16 May 2023 Afternoon Session Analysis

EUR lifted up after the economic outlook improved. consumer

The Euro which was traded against the greenback, was lifted yesterday after the European Commission delivered an optimistic spring 2023 economic forecast. The economic outlook for 2023 and 2024 was revised up to 1.0% and 1.7%, respectively, from 0.8% and 1.0%. The main factor attributed to the revised is the lower energy price allows governments to phrase out energy support measures. Falling in energy prices drove further government budget deficit reductions to 3.1% and 2.4% in 2023 and 2024 in accordingly. The headline inflations will further be cooling amid a sharp deceleration of energy prices. Moreover, the labor market remains resilient against economic slowdown since the EU unemployment rate hit a record low of 6.0% in March 2023. Wage growth has picked up since early 2020 but estimation of the upcoming unemployment rate will remain just above 6%. However, the expansion of the economy showed in slowing pace after the EU industrial production in March presented in negative -4.1% reading, lower than the previous reading and market estimations which is 1.5% and -2.5% respectively. The output of capital goods such as construction and equipment fell 15.4% in the month, while Irish output plunged 26.3% for the month, Eurostat said on Monday. Meanwhile, investors are await for Christine Lagarde, European Central Bank (ECB) Governor’s speech tonight to get a clue from it. As of writing, the EUR/USD edged up by 0.08% to 1.0883.

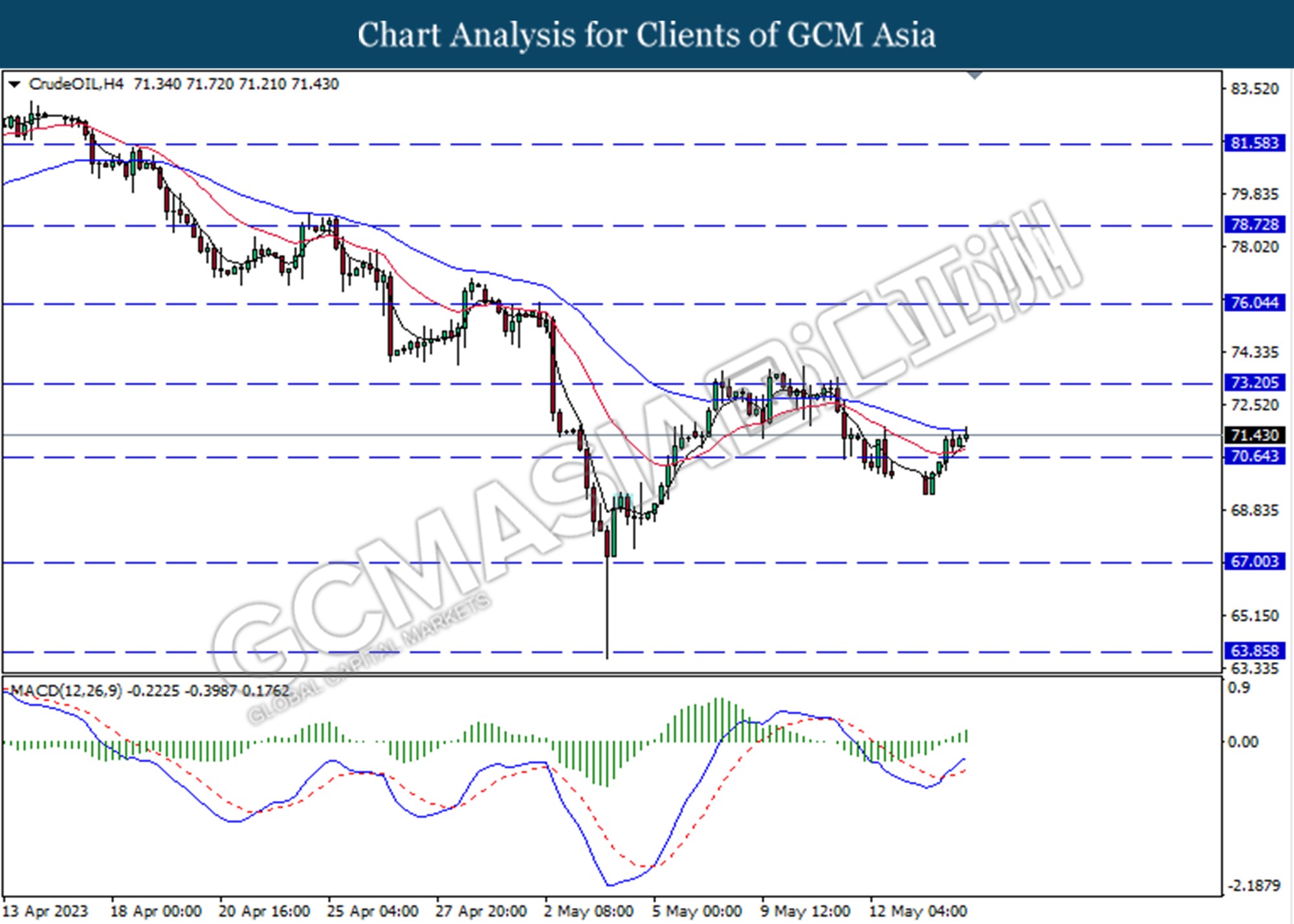

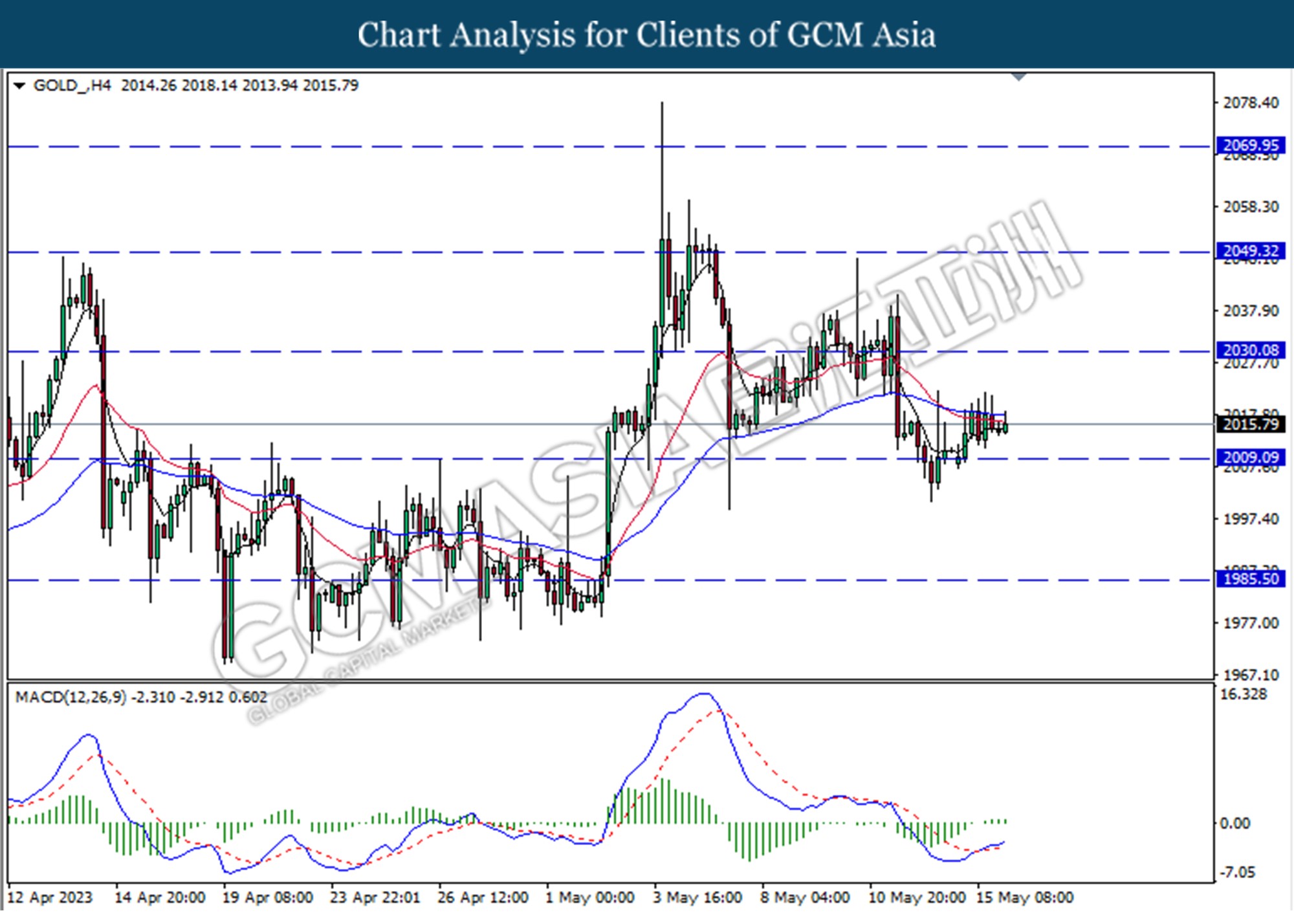

In the commodities market, crude oil prices are up by 0.48% to $71.45 per barrel amid the US Department of Energy’s plan to refill its Strategic Petroleum Reserve (SPR). Besides, gold prices gained by 0.01% to $2016.69 per troy ounce as the dollar weakened.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

16:00 CrudeOIL IEA Monthly Report

22:00 EUR ECB President Lagarde Speaks

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 17:00 | EUR – German ZEW Economic Sentiment (May) | 4.1 | -5.3 | – |

| 20:30 | USD – Core Retail Sales (MoM) (Apr) | -0.4% | 0.4% | – |

| 20:30 | USD – Retail Sales (MoM) (Apr) | -0.6% | 0.8% | – |

| 20:30 | CAD – Core CPI (MoM) (Apr) | 0.6% | – | – |

Technical Analysis

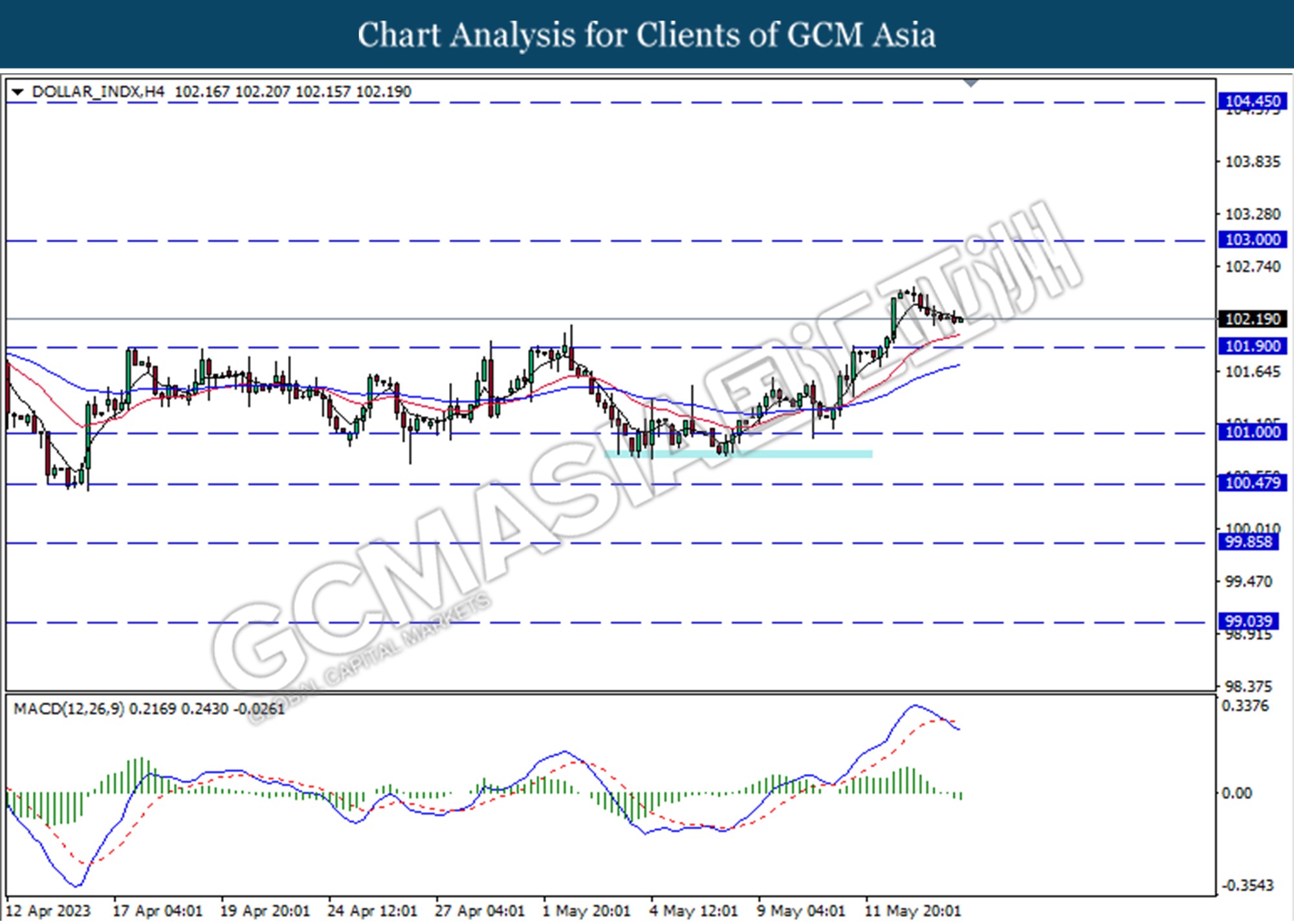

DOLLAR_INDX, H4: Dollar index was traded lower prior retracement from the higher level. MACD which illustrated increasing bearish momentum suggests the index extended its losses toward the support level at 101.90.

Resistance level: 103.00, 104.45

Support level: 101.90, 101.00

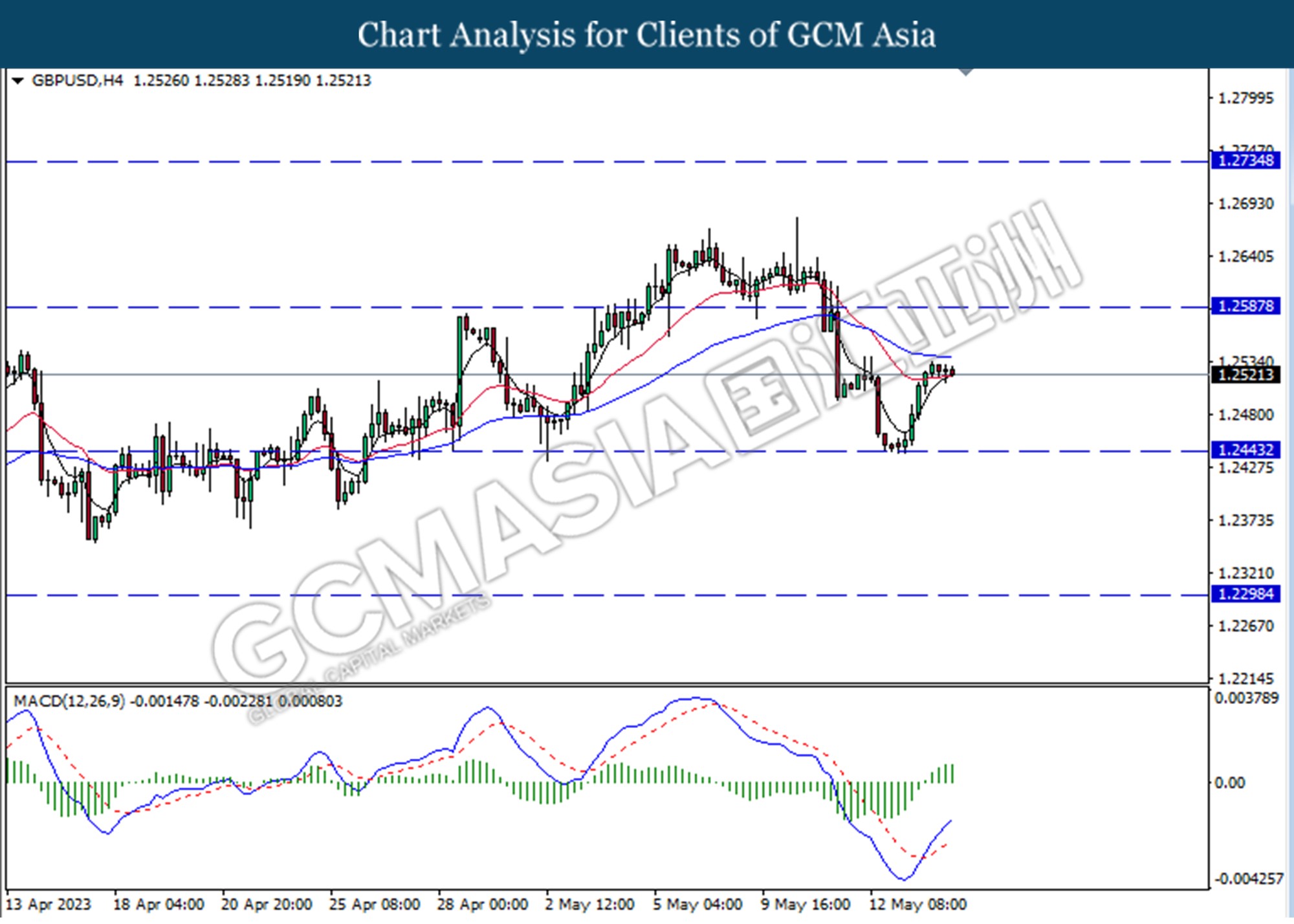

GBPUSD, H4: GBPUSD was traded higher following the prior rebound from the support level at 1.2445. MACD which illustrated increasing bullish momentum suggests the pair extended its gains toward the resistance level.

Resistance level: 1.2590, 1.2735

Support level: 1.2445, 1.2300

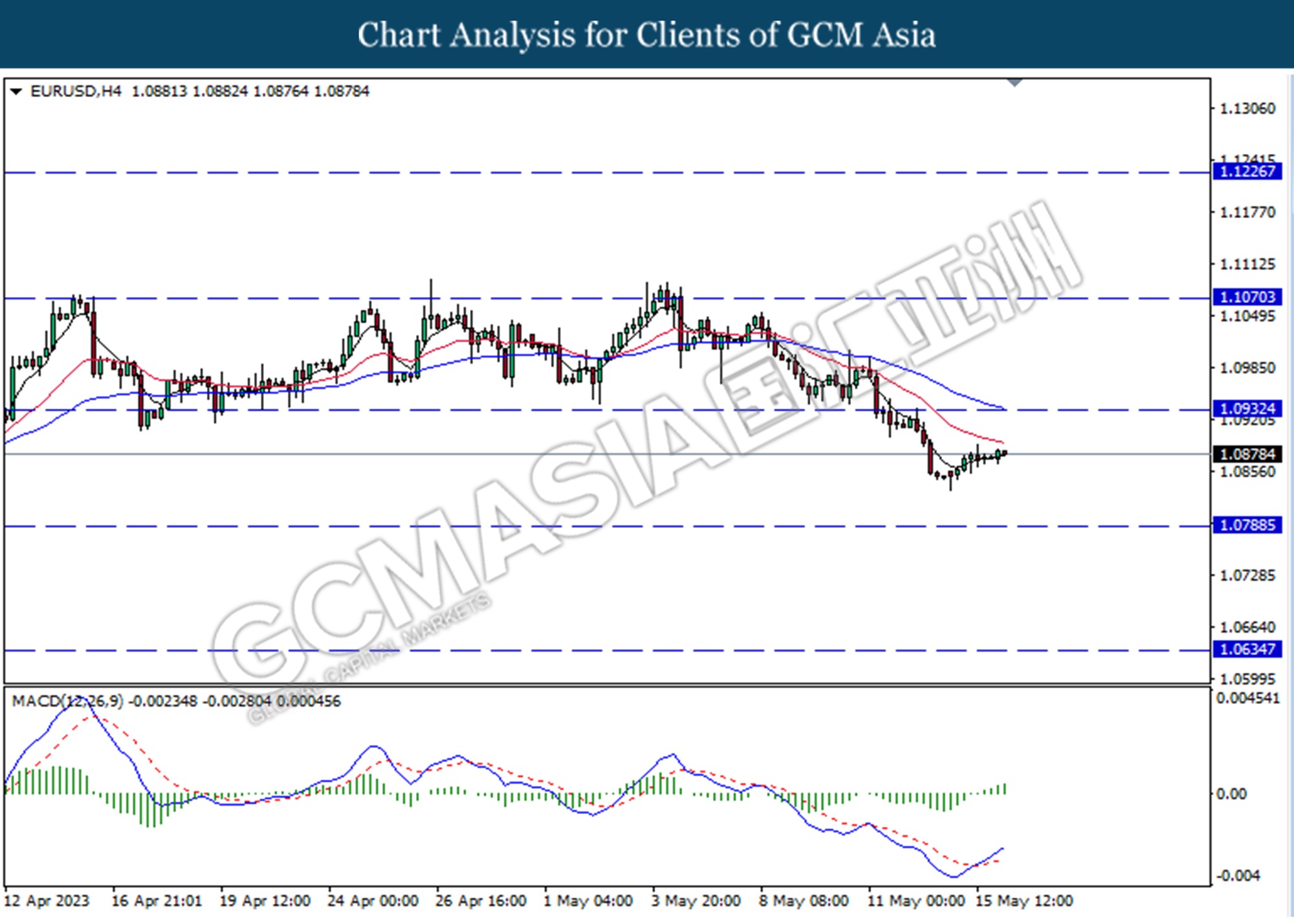

EURUSD, H4: EURUSD was traded higher following the prior rebound from the lower level. MACD which illustrated increasing bullish momentum suggests the pair extended its gains toward the resistance level at 1.0930.

Resistance level: 1.0930, 1.1070

Support level: 1.0790, 1.0635

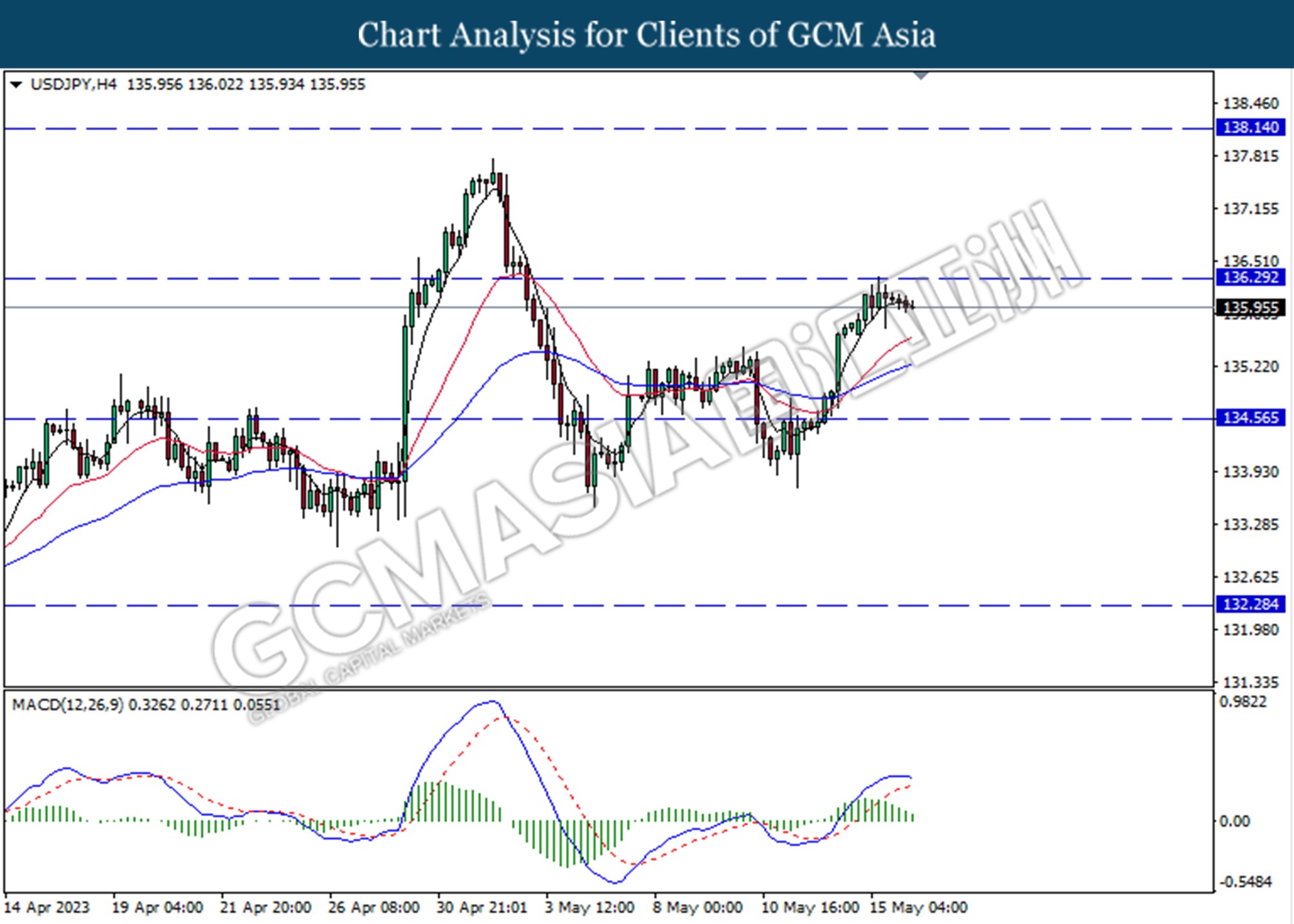

USDJPY, H4: USDJPY was traded lower following the prior retracement from resistance level at 136.30. MACD which illustrated diminishing bearish momentum suggests the pair extended its gains toward the resistance level at 136.30.

Resistance level: 136.30, 138.15

Support level: 134.55, 132.30

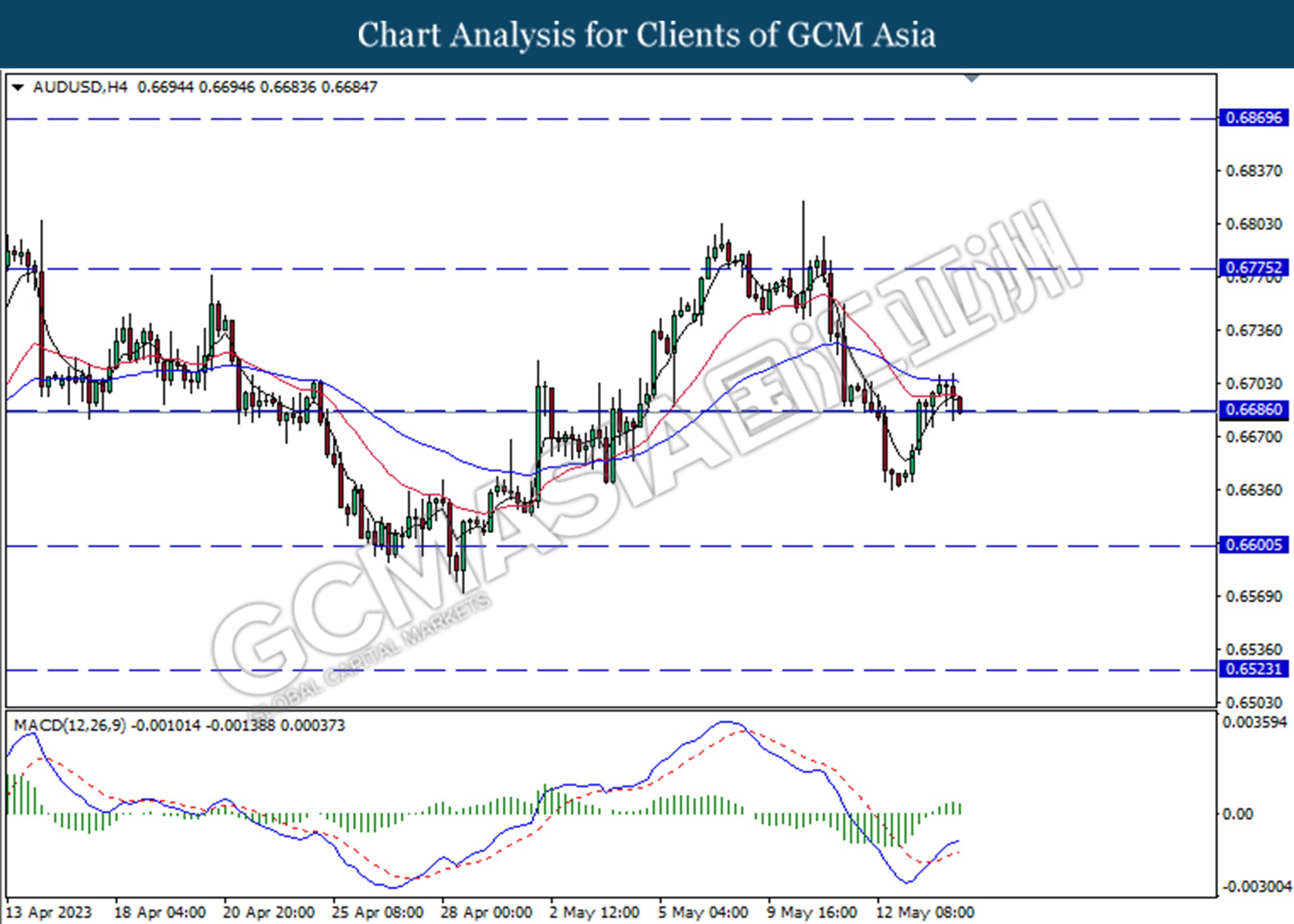

AUDUSD, H4: AUDUSD was traded lower while currently testing the support level at 0.6685. However, MACD which illustrated bullish momentum suggests the pair to undergo technical correction in the short term.

Resistance level: 0.6775, 0.6870

Support level: 0.6685, 0.6600

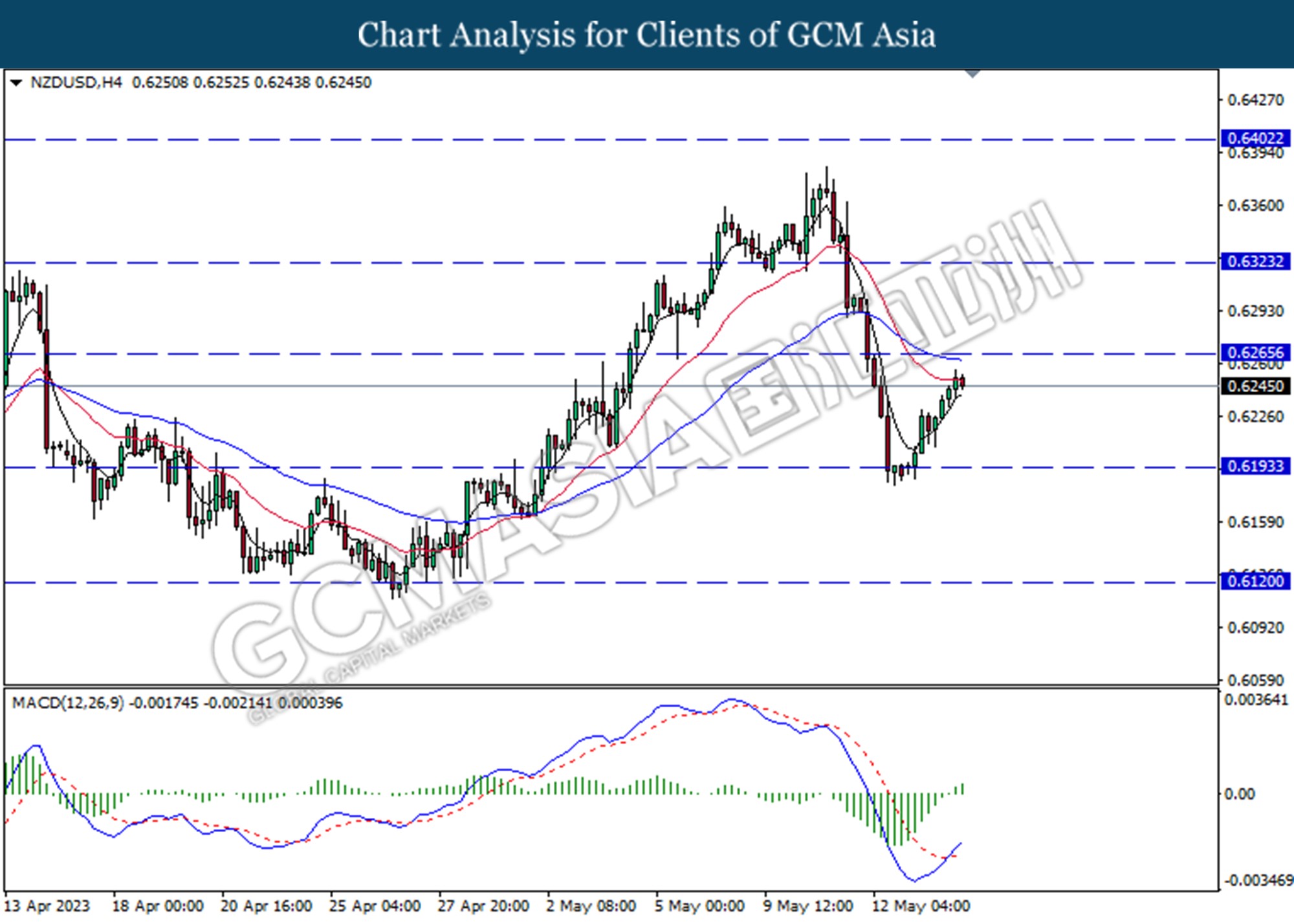

NZDUSD, H4: NZDUSD was traded higher following the prior rebound from the lower level. MACD which illustrated increasing bullish momentum suggests the pair to extend its gains toward the resistance level at 0.6265

Resistance level: 0.6265, 0.6325

Support level: 0.6195, 0.6120

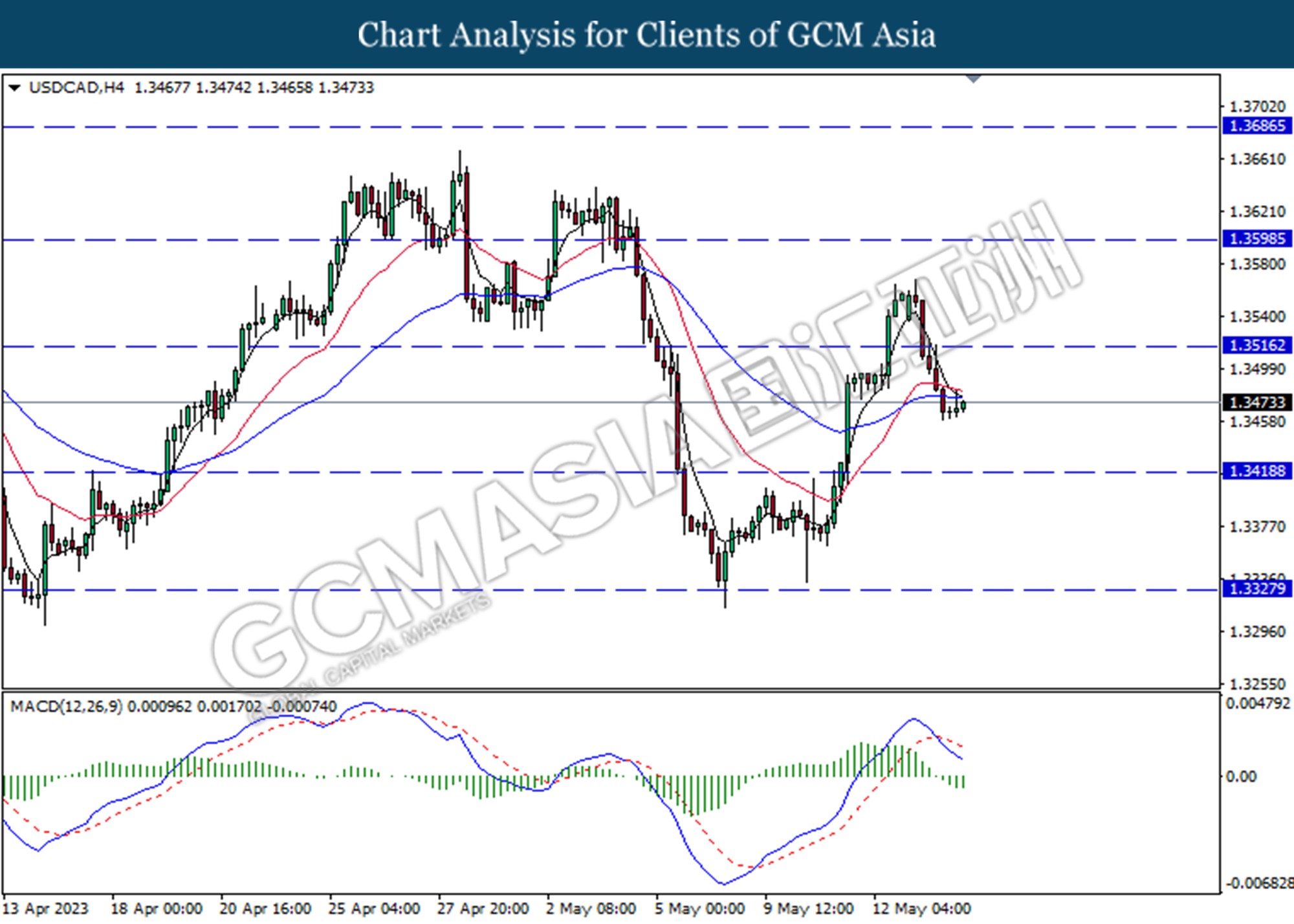

USDCAD, H4: USDCAD was traded lower following the prior break below from the previous support level at 1.3515. MACD which illustrated increasing bearish momentum suggests the pair extended its losses toward the support level.

Resistance level: 1.3515, 1.3600

Support level: 1.3420, 1.3330

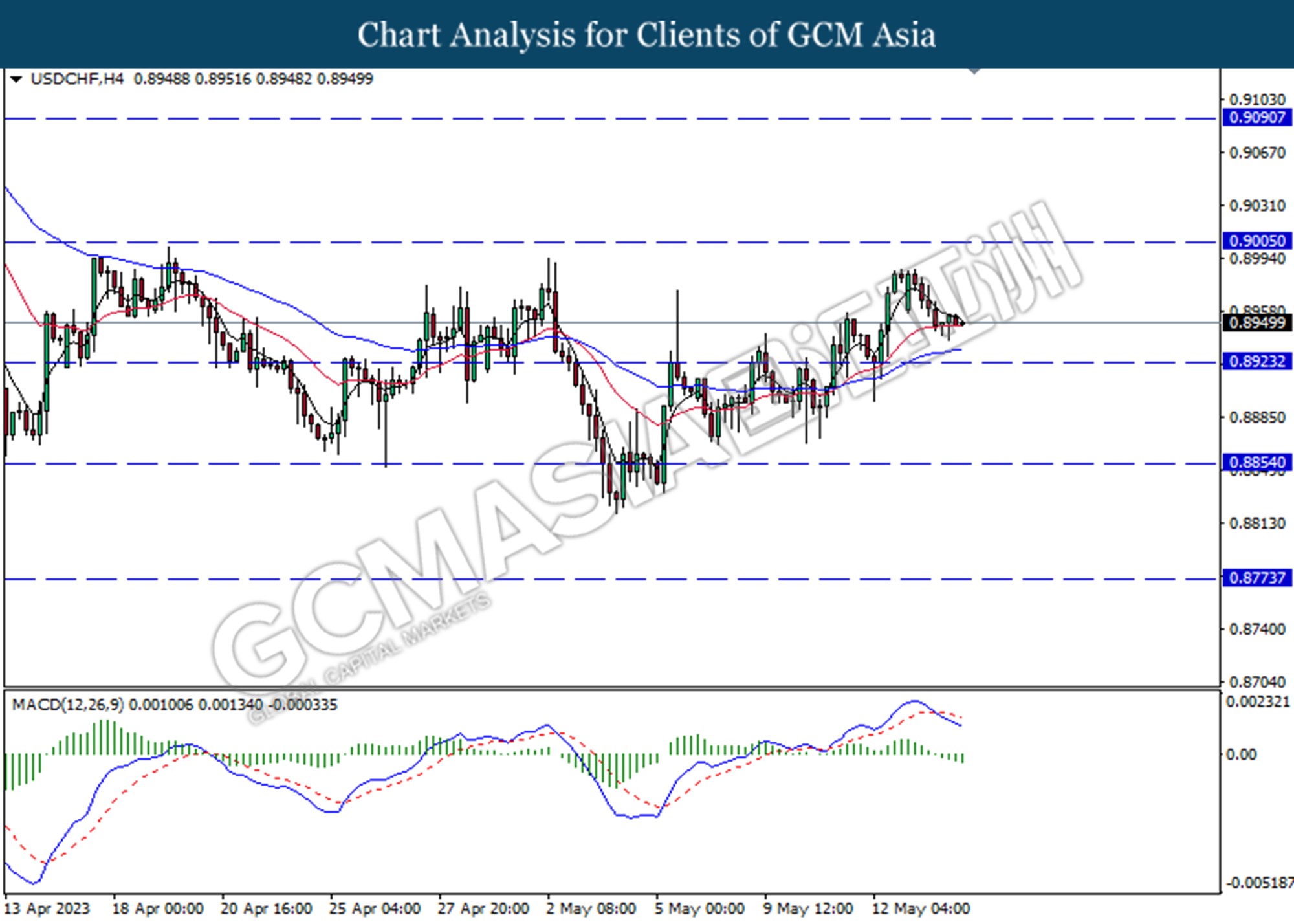

USDCHF, H4: USDCHF traded lower following a prior retracement from the higher level. MACD which illustrated increasing bearish momentum suggests the pair extended its losses toward the support level.

Resistance level: 0.9005, 0.9090

Support level: 0.8925, 0.8855

CrudeOIL, H4: Crude oil price was traded higher following the prior break above from the previous resistance level at 70.65. MACD which illustrated increasing bullish momentum suggests the commodity extended its gains toward the resistance level.

Resistance level: 73.20, 76.05

Support level: 70.65, 67.00

GOLD_, H4: Gold price was traded higher following the prior rebound from the lower level. MACD which illustrated bullish momentum suggests the commodity extended its gains toward the resistance level.

Resistance level: 2030.10, 2049.30

Support level: 2009.10, 1985.50