16 May 2023 Morning Session Analysis

US dollar tumbled as debt ceiling issue remained unsolved.

The dollar index, which was traded against a basket of six major currencies, reverted its previous gains yesterday as the market participants are waiting for a clearer signals from the US on how they are going to avoid a first ever default before 1st June. At this point in time, the Joe Biden has scheduled a meeting to talk with the congressional leaders on tomorrow morning before he leaves for G7 meeting in Japan. Prior to that, the talk on last Sunday between the two sides have been “constructive, according to the Deputy Treasury Secretary Wally Adeyemo. The White House has not ruled out imposing annual spending caps, whereby the Republicans has been emphasizing that the annual spending caps are necessary for them to agree on raising the nation’s $31.4 trillion debt limit. However, the two parties do not appear close to a deal and it is seemingly that the stalemate would remain for a longer time as both parties maintain their own provincial hardline stance. Besides, the US Treasury secretary has repeatedly called on Congress to agree to raise the US $31.4tril federal borrowing limit to avoid the “economic and financial catastrophe” that would ensue if the US defaulted on its debt. As of writing, the dollar index dropped -0.25% to 102.40.

In the commodities market, crude oil prices edged up by 0.64% to $70.55 per barrel amid wildfires in Canada boosted the prospect of tightening supply. Besides, gold prices ticked up by 0.02% to $2016.10 per troy ounce as the dollar retreated from its recent high level.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

16:00 CrudeOIL IEA Monthly Report

22:00 EUR ECB President Lagarde Speaks

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 14:00 | GBP – Average Earnings Index +Bonus (Mar) | 5.9% | 5.8% | – |

| 14:00 | GBP – Claimant Count Change (Apr) | 28.2K | 31.2K | – |

| 17:00 | EUR – German ZEW Economic Sentiment (May) | 4.1 | -5.3 | – |

| 20:30 | USD – Core Retail Sales (MoM) (Apr) | -0.4% | 0.4% | – |

| 20:30 | USD – Retail Sales (MoM) (Apr) | -0.6% | 0.8% | – |

| 20:30 | CAD – Core CPI (MoM) (Apr) | 0.6% | – | – |

Technical Analysis

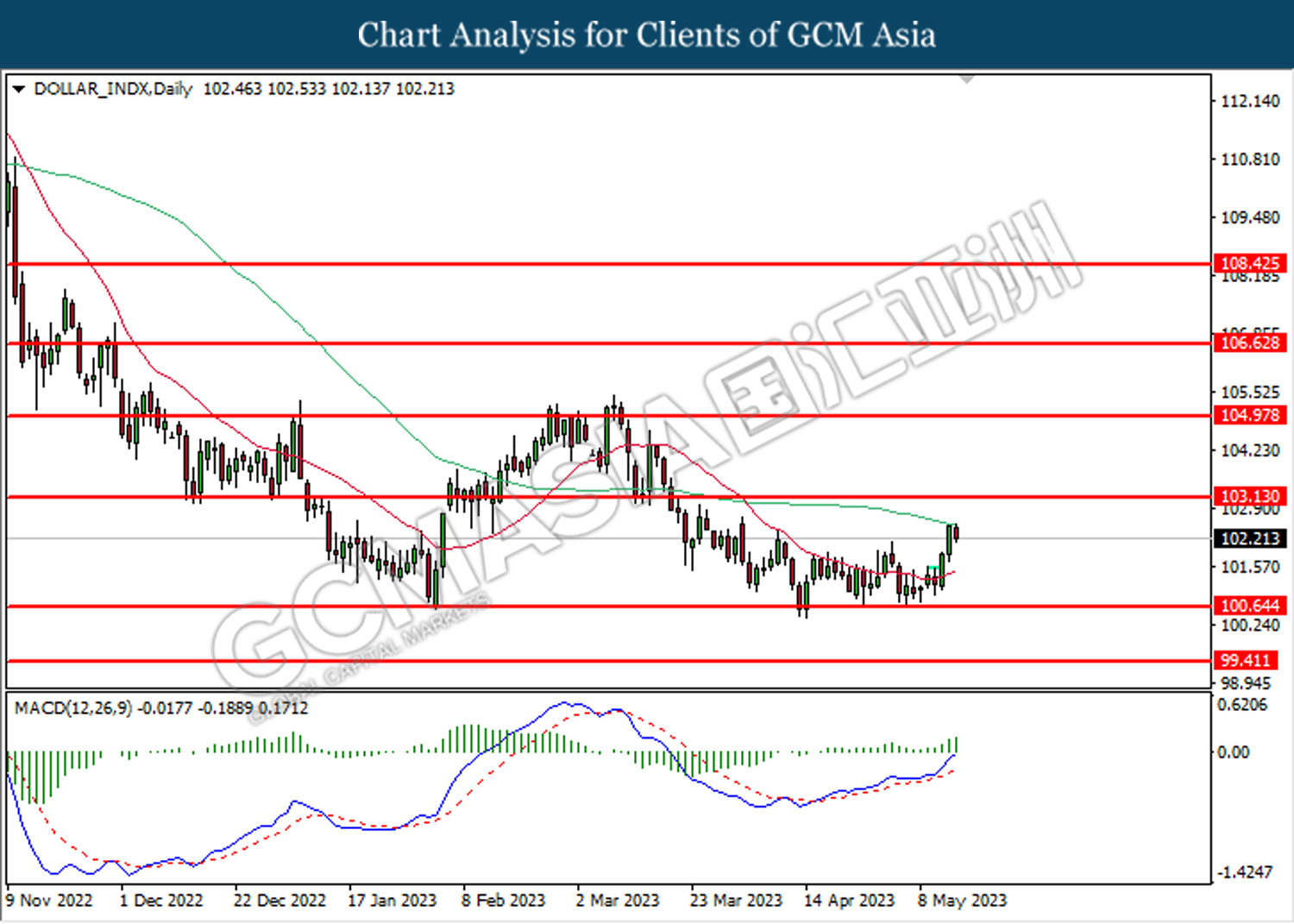

DOLLAR_INDX, Daily: Dollar index was traded higher following the prior rebound from the support level at 100.65. MACD which illustrated bullish bias momentum suggests the index to extend its gains toward the resistance level at 103.15.

Resistance level: 103.15, 104.95

Support level: 100.65, 99.40

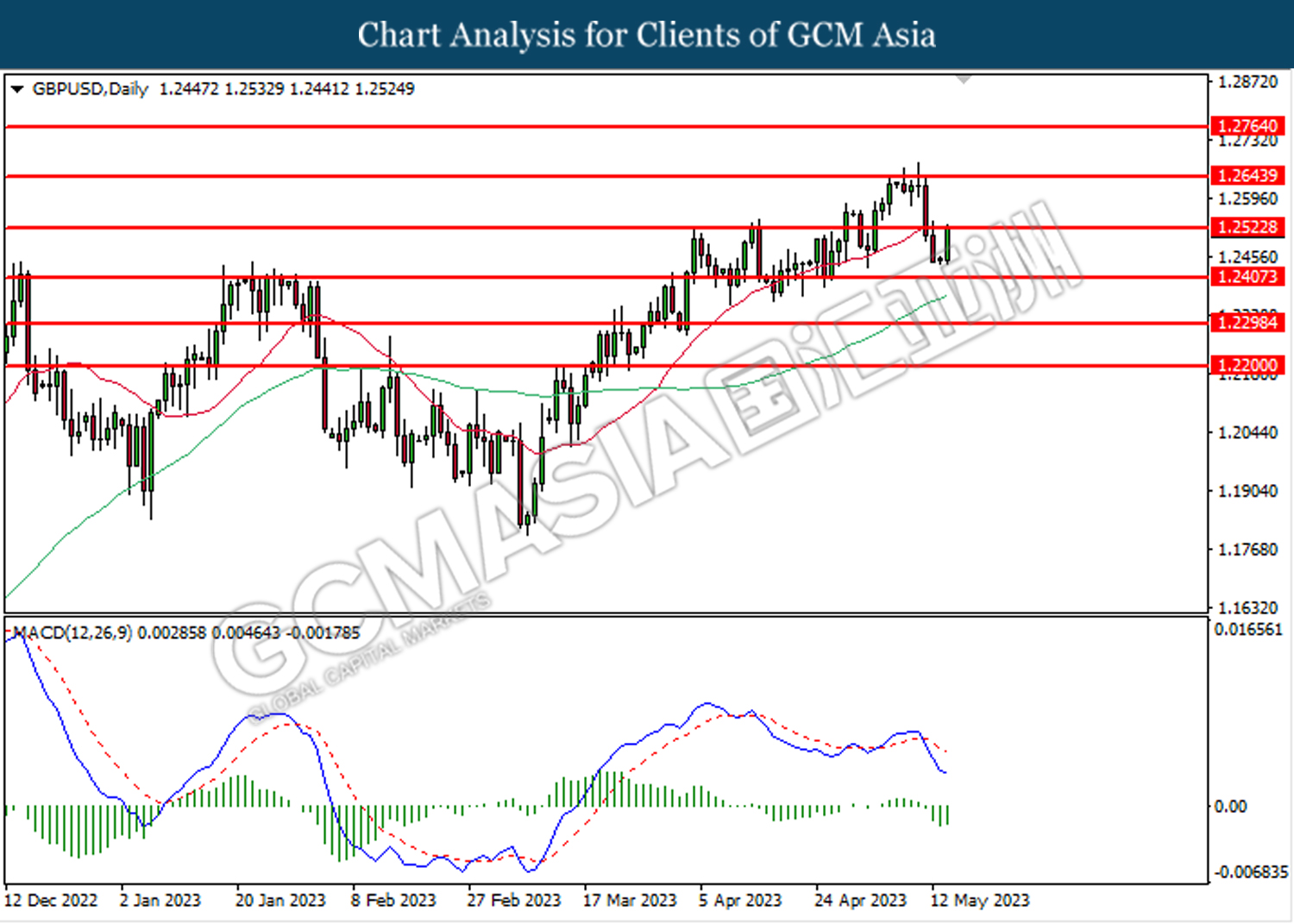

GBPUSD, Daily: GBPUSD was traded higher while currently testing the resistance level at 1.2525. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.2525, 1.2645

Support level: 1.2405, 1.2300

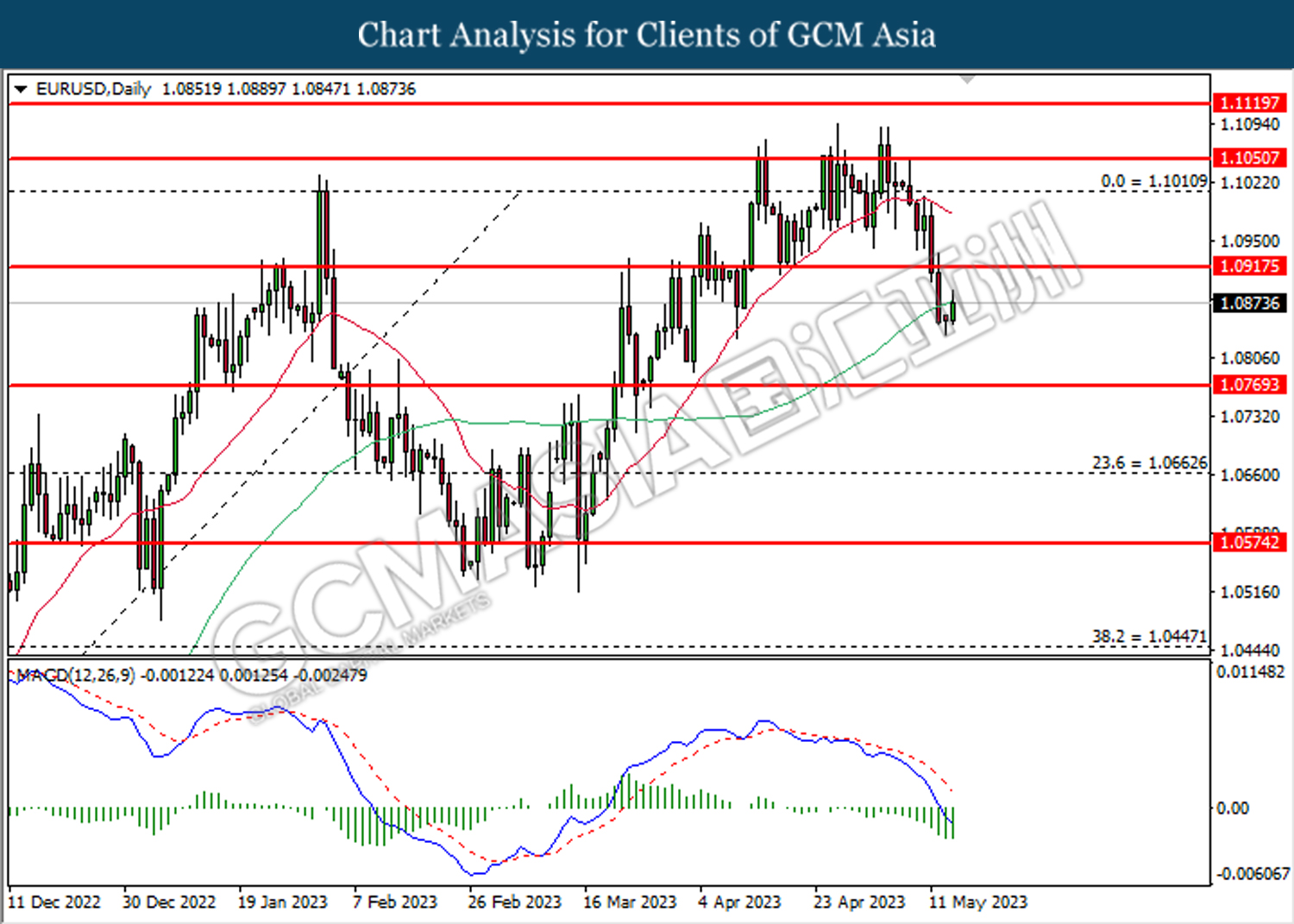

EURUSD, Daily: EURUSD was traded higher following the prior rebound from the lower level. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward the resistance level at 1.0915.

Resistance level: 1.0915, 1.1010

Support level: 1.0770, 1.0665

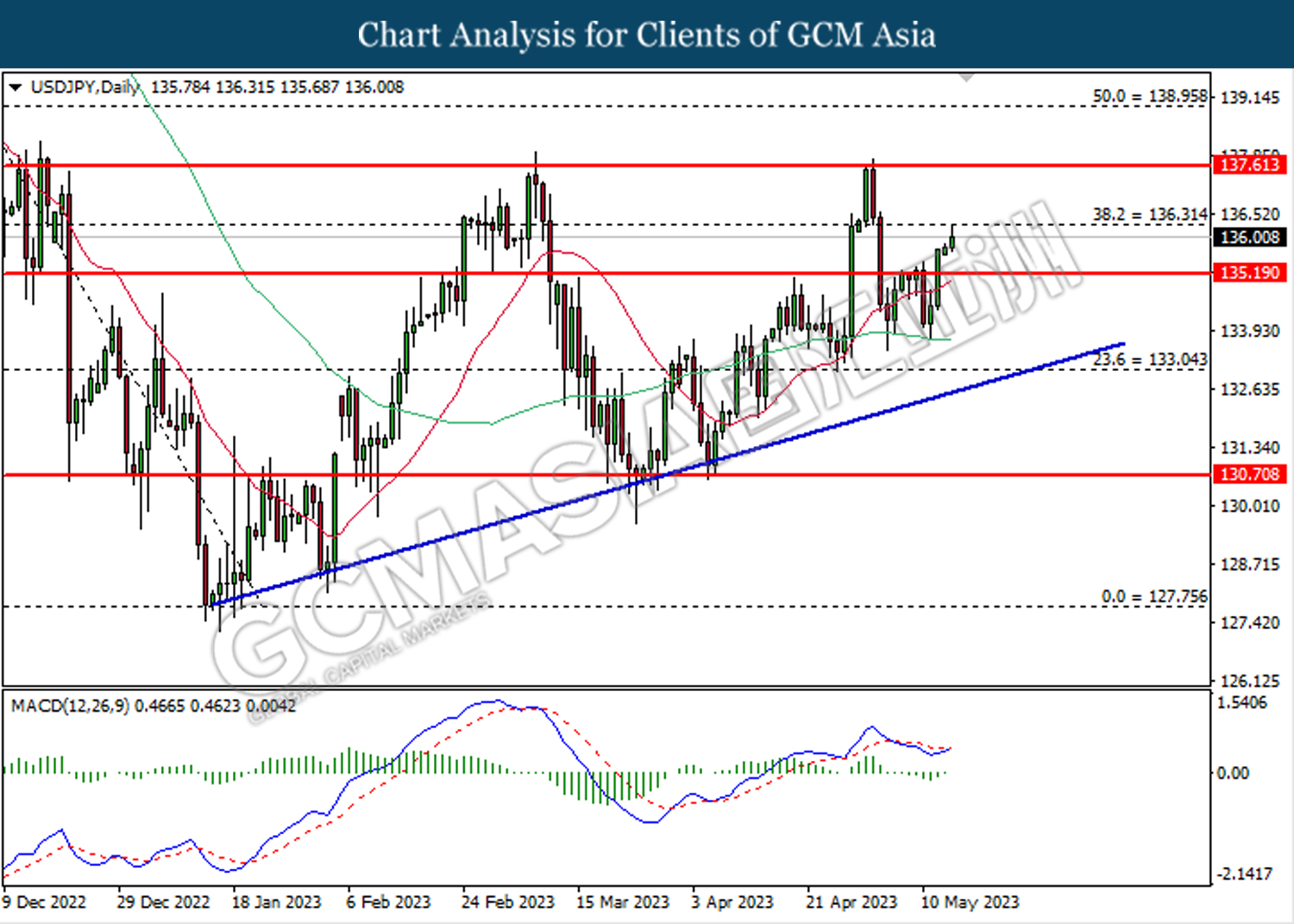

USDJPY, Daily: USDJPY was traded higher following the prior above the previous resistance level at 135.20. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward the resistance level at 136.30.

Resistance level: 136.30, 137.60

Support level: 135.20, 133.05

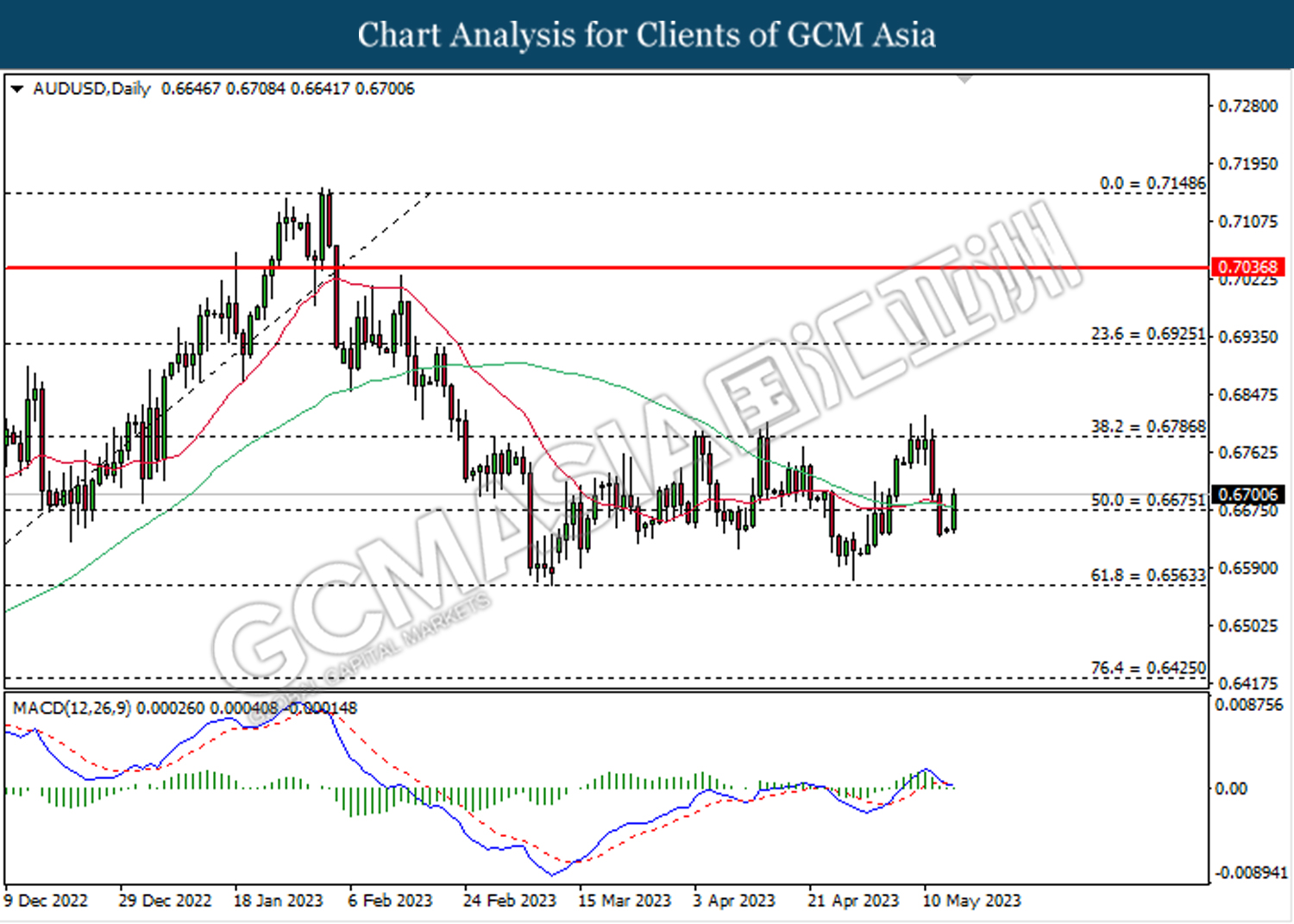

AUDUSD, Daily: AUDUSD was traded higher while currently testing the resistance level at 0.6675. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 0.6675, 0.6785

Support level: 0.6565, 0.6425

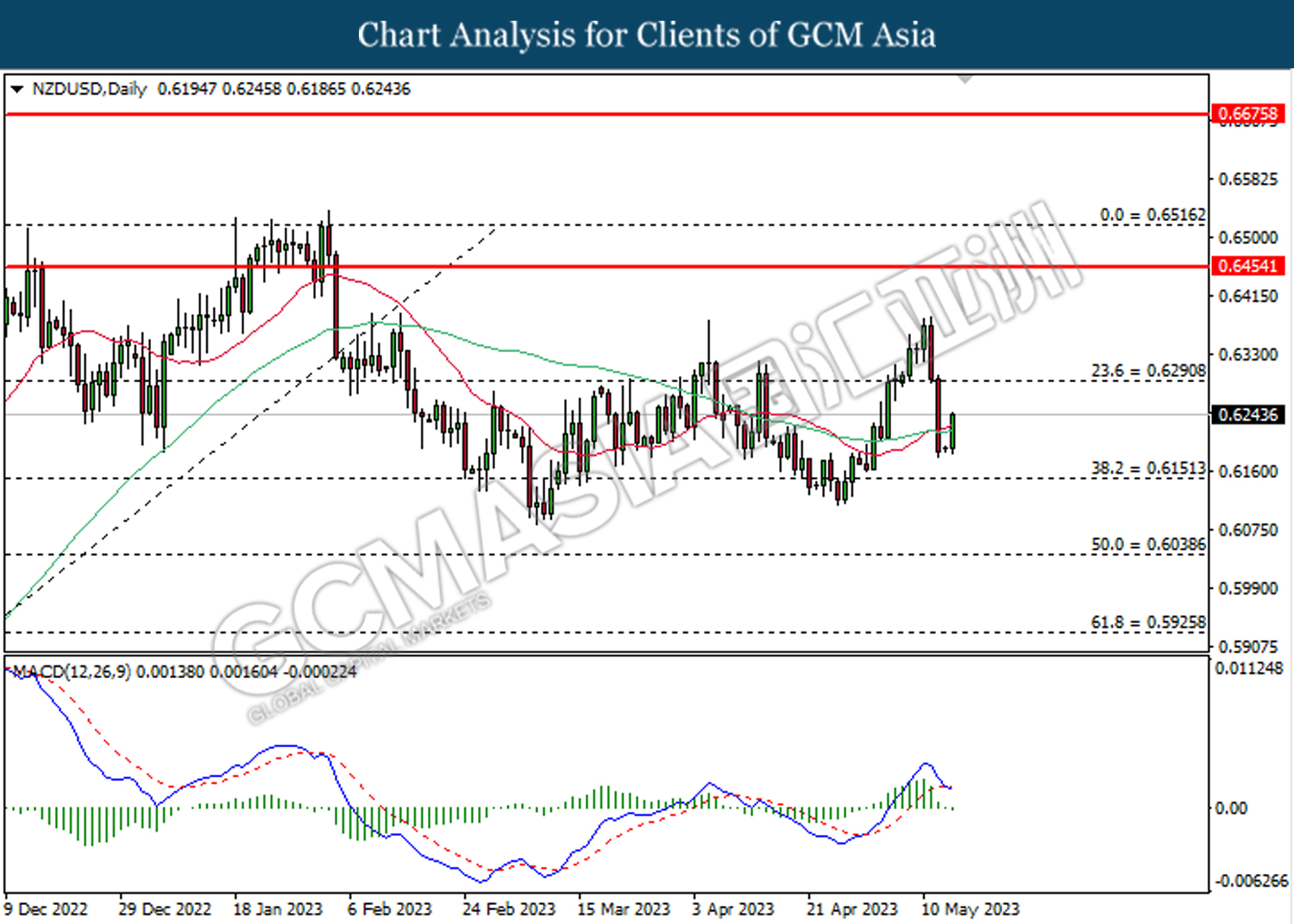

NZDUSD, Daily: NZDUSD was traded higher following the prior rebound from the lower level. However, MACD which illustrated diminishing bullish momentum suggest the pair to undergo technical correction in short term.

Resistance level: 0.6290. 0.6455

Support level: 0.6150, 0.6040

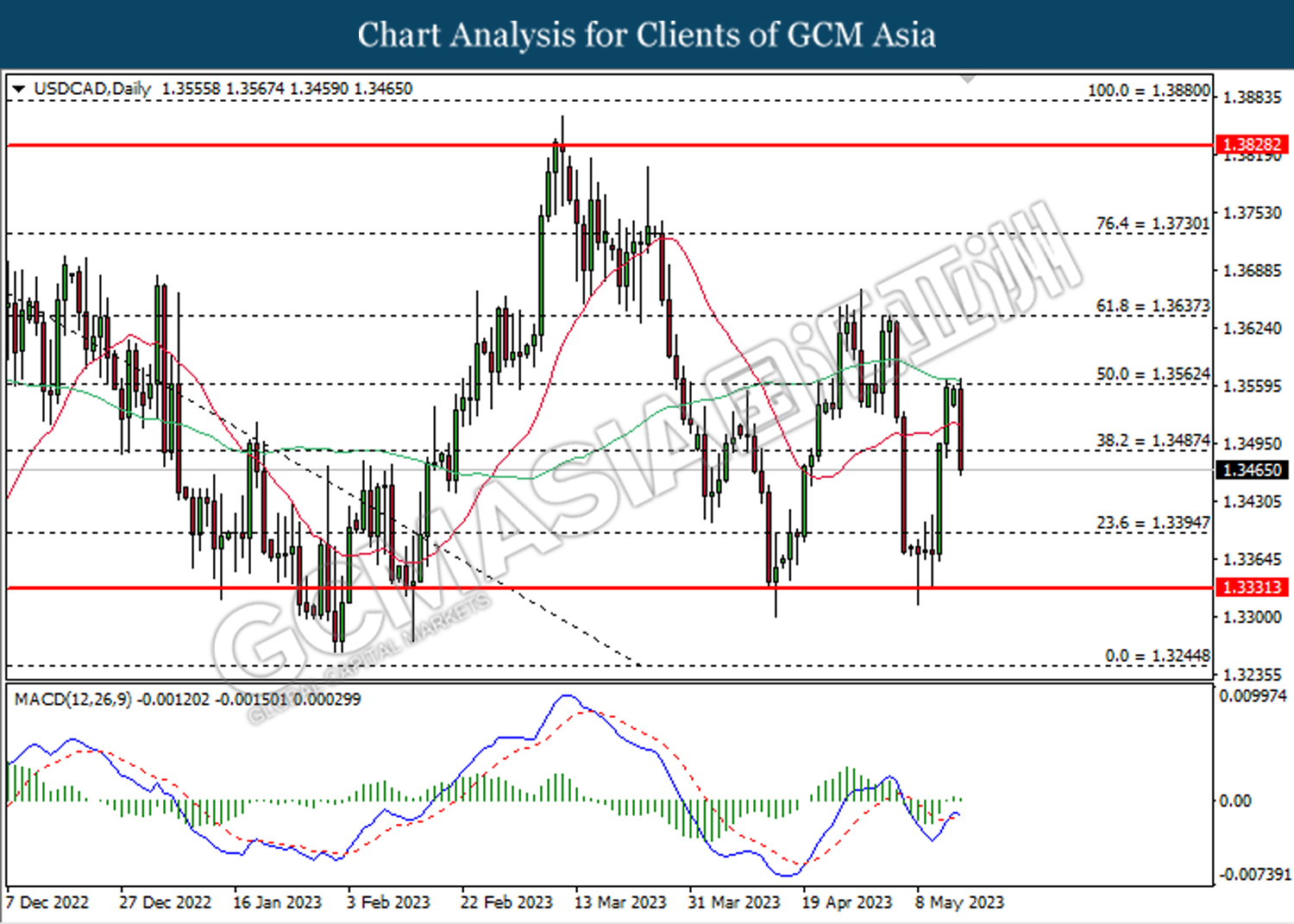

USDCAD, Daily: USDCAD was traded lower while currently testing the support level at 1.3485. MACD which illustrated diminishing bearish momentum suggests the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.3565, 1.3635

Support level: 1.3485, 1.3395

USDCHF, Daily: USDCHF was traded higher following the prior rebound from the support level at 0.8865. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 0.9000.

Resistance level: 0.9000, 0.9075

Support level: 0.8865, 0.8780

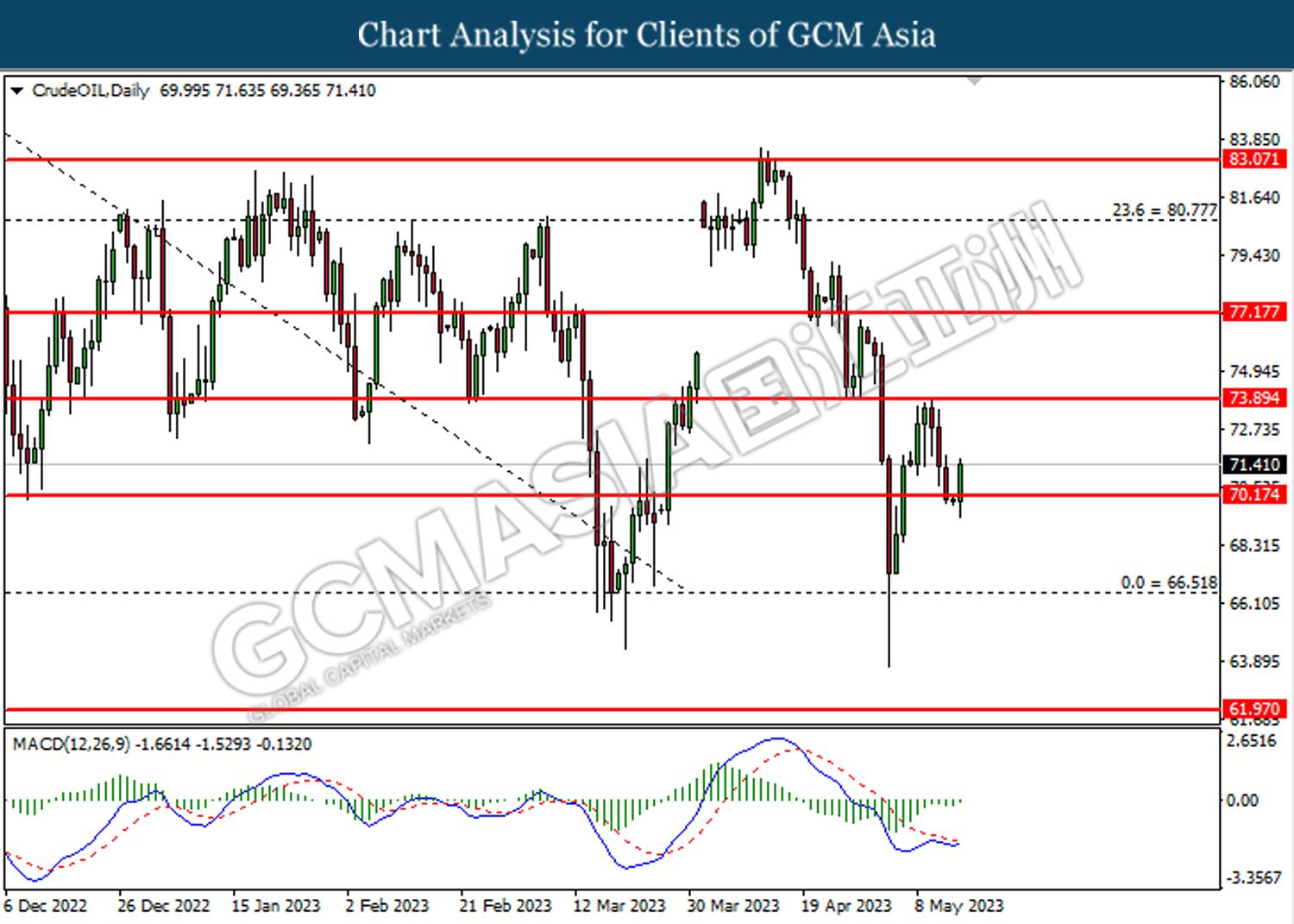

CrudeOIL, Daily: Crude oil price was traded higher following the prior rebound from the support level at 70.15. MACD which illustrated diminishing bearish momentum suggest the commodity to extend its gains toward the resistance level at 73.90.

Resistance level: 73.90, 77.15

Support level: 70.15, 66.50

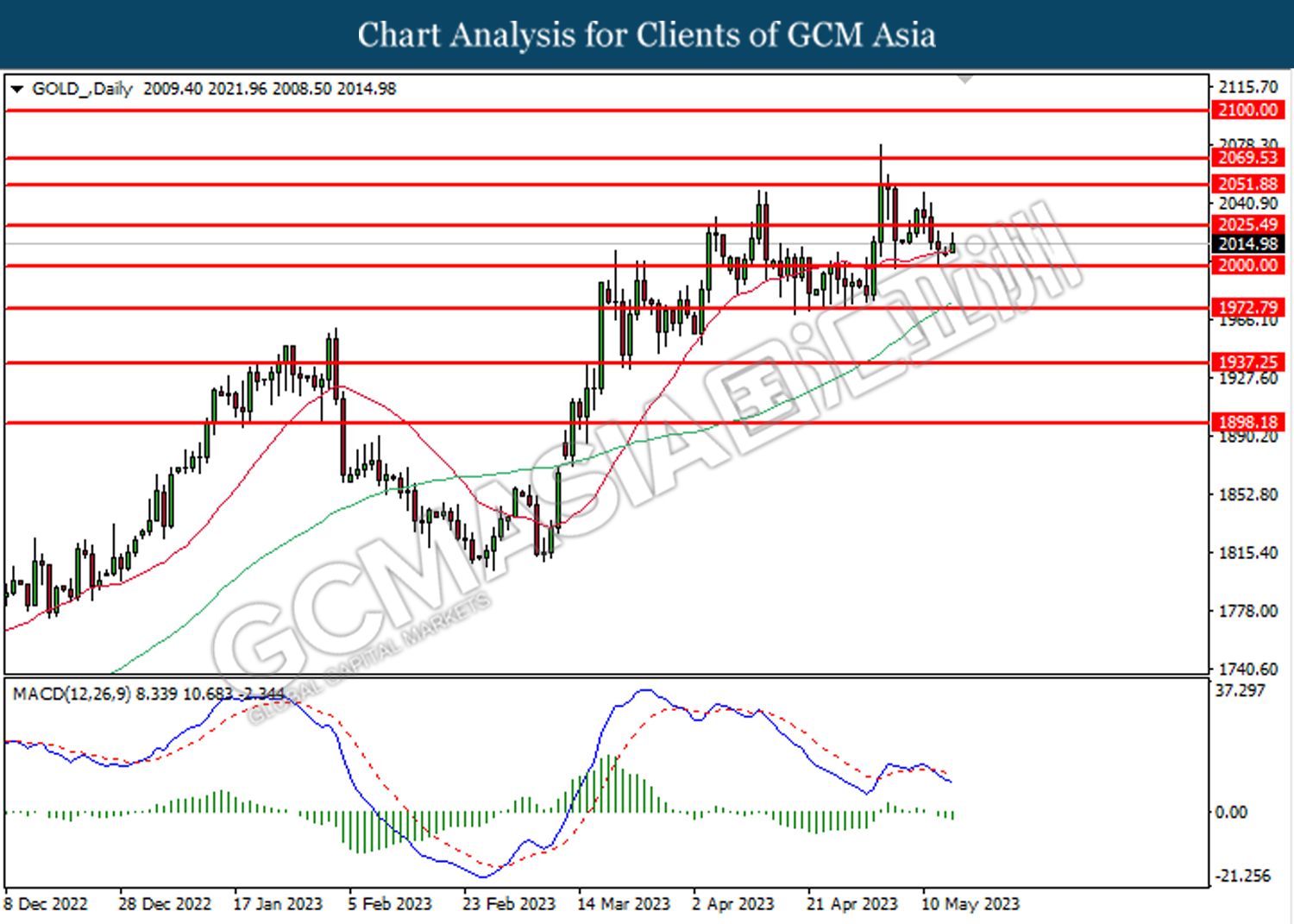

GOLD_, Daily: Gold price was traded higher following the prior rebound from the lower level. MACD which illustrated bearish bias momentum suggests the commodity to extend its losses toward the support level at 2000.00.

Resistance level: 2025.50, 2051.90

Support level: 2000.00, 1972.80