16 June 2022 Morning Session Analysis

US Dollar eased despite the hawkish move of Fed.

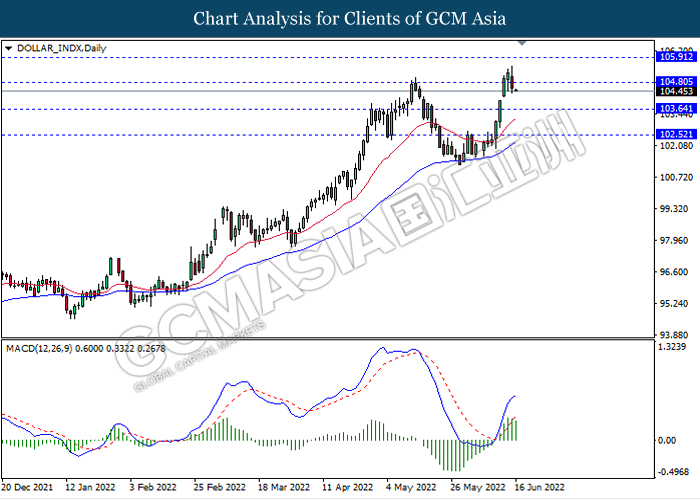

The Dollar Index which traded against a basket of six major currencies slumped after the FOMC meetings. According to Reuters, Federal Reserve had implement a 75 basic point rate hike in the meetings, which exceeding the market forecast of 50 basic point. Nonetheless, the US Dollar retraced from its recent highs amid the economic forecast from Fed. According to its own economic projections, the Fed expects growth to be weaker and the unemployment rate to be higher after the aggressive rate hike. The growth forecast lowered to 1.7% for 2022 from 2.8%, and the unemployment rate forecast raised to 3.7% for 2022 from 3.5%. Despite the rate hike implementation would likely to combat inflation risk, it might also increase the borrowing cost of consumer too. Consequences, it would likely to diminish the consumer spending in US, which brought negative prospects toward economic progression in US region. Besides, the bearish retails sales data spurred further bearish momentum on the Dollar Index. The US Core Retail Sales MoM and US Retail Sales MoM for May had given a downbeat reading, which are 0.5% and -0.3%, lower than the market forecast of 0.8% and 0.2% respectively. It prompted investors to shift their capitals toward other assets which having better prospects. As of writing, the Dollar Index depreciated by 0.69% to 104.61.

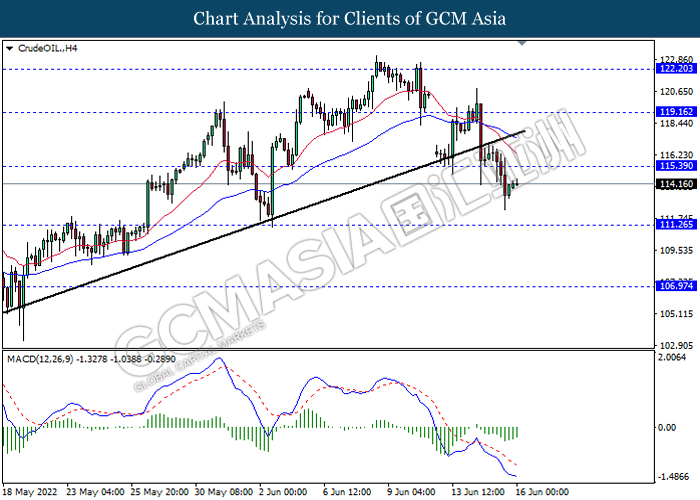

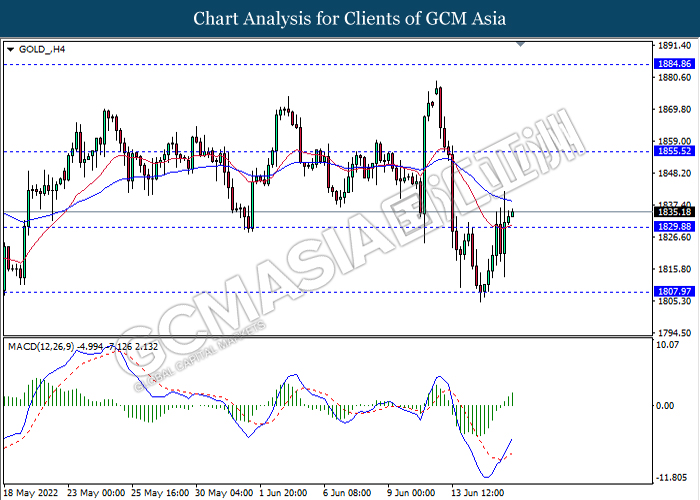

In the commodities market, crude oil price appreciated by 0.94% to $116.39 per barrel as of writing. However, the overall trend for oil price remained bearish following the higher-than-expected oil inventories. On the other hand, gold price rallied by 0.84% to $1834.75 per troy ounce as of writing over the economic recession forecast from Fed.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

15:30 CHF SNB Monetary Policy Assessment

16:30 CHF SNB Press Conference

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 15:30 | CHF – SNB Interest Rate Decision (Q2) | -0.75% | – | – |

| 19:00 | GBP – BoE Interest Rate Decision (Jun) | 1.00% | 1.25% | – |

| 20:30 | USD – Building Permits (May) | 1.823M | 1.787M | – |

| 20:30 | USD – Initial Jobless Claims | 229K | 215K | – |

| 20:30 | USD – Philadelphia Fed Manufacturing Index (Jun) | 2.6 | 5.3 | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded lower following prior breakout below the previous support level. MACD which illustrated decreasing bullish momentum suggest the index to extend its losses.

Resistance level: 104.80, 105.90

Support level: 103.65, 102.50

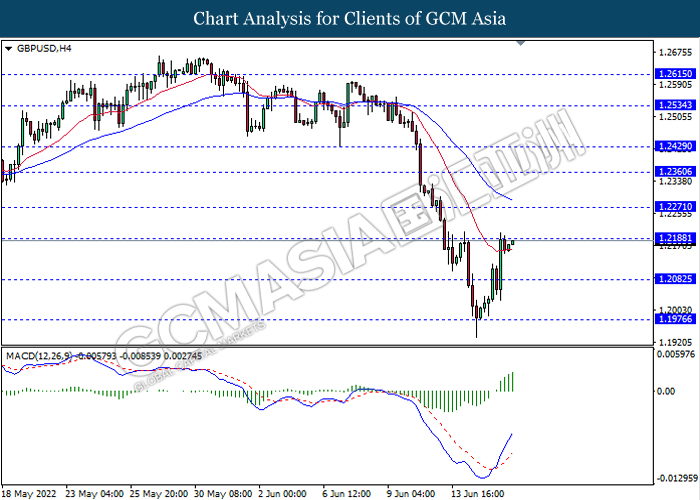

GBPUSD, H4: GBPUSD was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains if successfully breakout the resistance level.

Resistance level: 1.2190, 1.2270

Support level: 1.2080, 1.1975

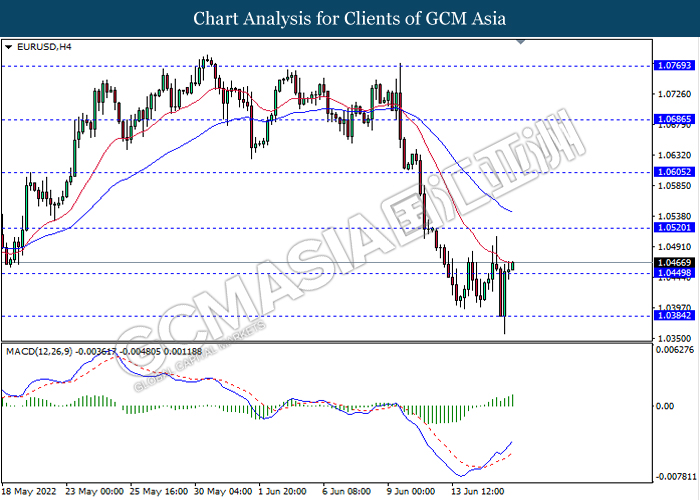

EURUSD, H4: EURUSD was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 1.0520, 1.0605

Support level: 1.0450, 1.0385

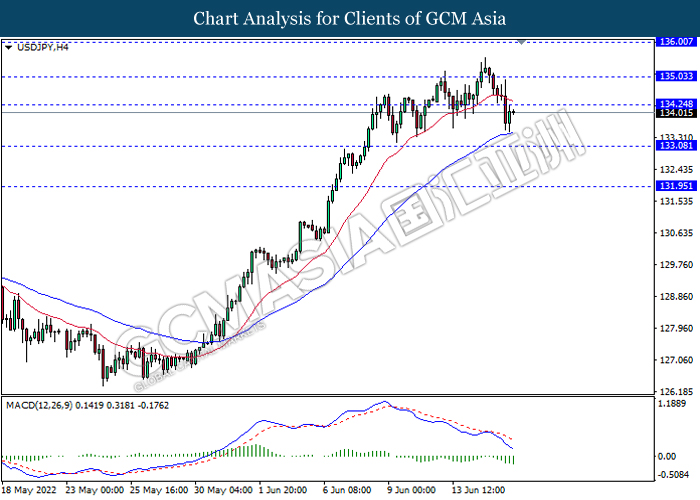

USDJPY, H4: USDJPY was traded higher while currently testing the resistance level. However, MACD which illustrated increasing bearish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 134.25, 135.05

Support level: 133.10, 131.95

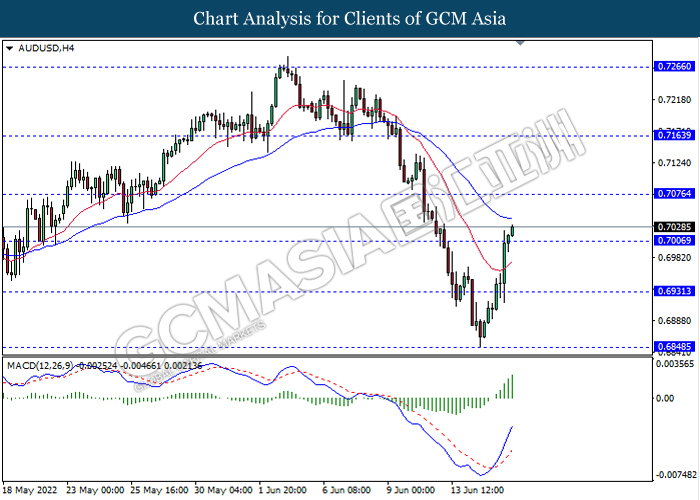

AUDUSD, H4: AUDUSD was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 0.7075, 0.7165

Support level: 0.7005, 0.6915

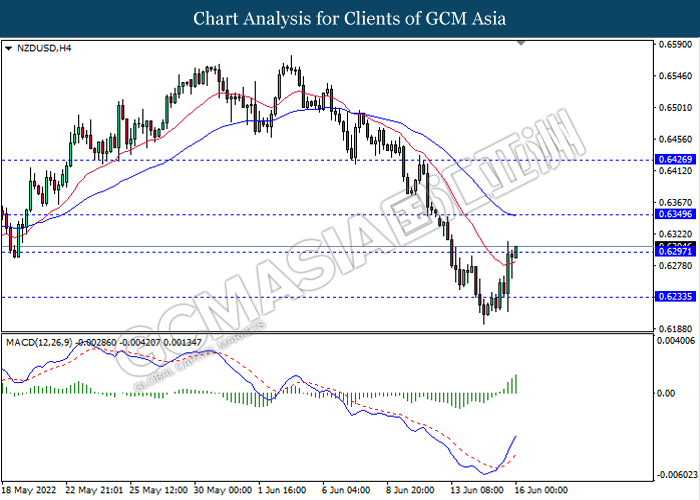

NZDUSD, H4: NZDUSD was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 0.6350, 0.6425

Support level: 0.6295, 0.6235

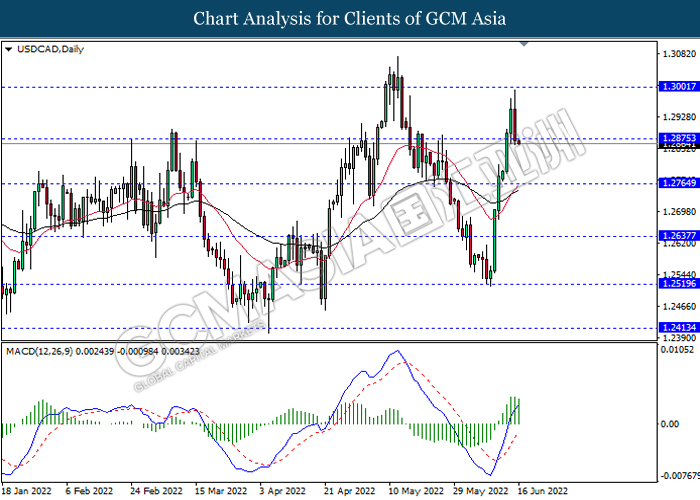

USDCAD, Daily: USDCAD was traded lower following prior breakout below the previous support level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses.

Resistance level: 1.2875, 1.3000

Support level: 1.2765, 1.2635

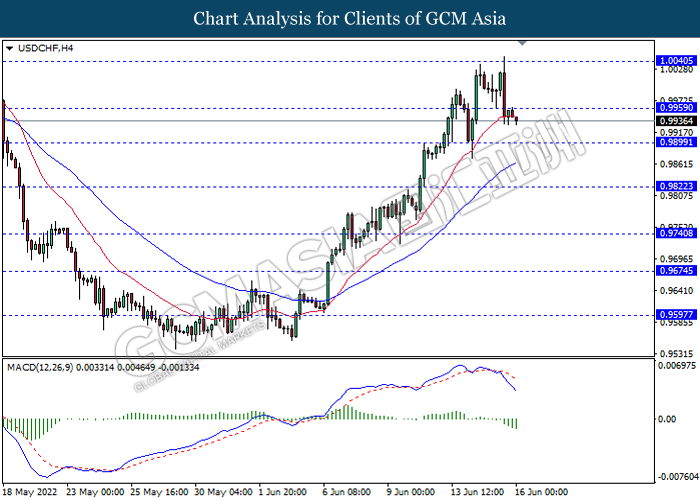

USDCHF, H4: USDCHF was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 0.9960, 1.0040

Support level: 0.9900, 0.9820

CrudeOIL, H4: Crude oil price was traded lower following prior breakout below the previous support level. However, MACD which illustrated decreasing bearish momentum suggest the commodity to be traded higher as technical correction.

Resistance level: 115.40, 119.15

Support level: 111.25, 106.95

GOLD_, H4: Gold price was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the commodity to extend its gains.

Resistance level: 1855.50, 1884.85

Support level: 1829.90, 1807.95