16 August 2022 Afternoon Session Analysis

Aussie revived following the release of RBA meeting minutes.

The Australian dollar, which is widely known as Aussie, rebounded after falling significantly yesterday amid the announcement of the Reserve Bank of Australia (RBA) meeting minutes. In the meeting minutes, the RBA officials had discussed the inflation level in Australia, where they actually noted that the inflation in the nation is high now and well above the target. The main factors that caused the sky-high inflation were due to the Covid-19 relation disruption to supply chains and the war in Ukraine. However, the members revealed that they reckon the inflation to peak later in 2022 and will start to decline back to the range between 2% – 3% by the end of 2024. On the labour market front, Australia’s employment market was growing strongly and the unemployment rate was at its lowest level in almost 50 years. Nonetheless, the path of the monetary policy would still be guided by the upcoming data as well as the economic outlook. The board is still committed to bringing down inflation to the long-term target of 2% to 3% over time. As of writing, the pair of AUD/USD is up by 0.17% to 0.7035.

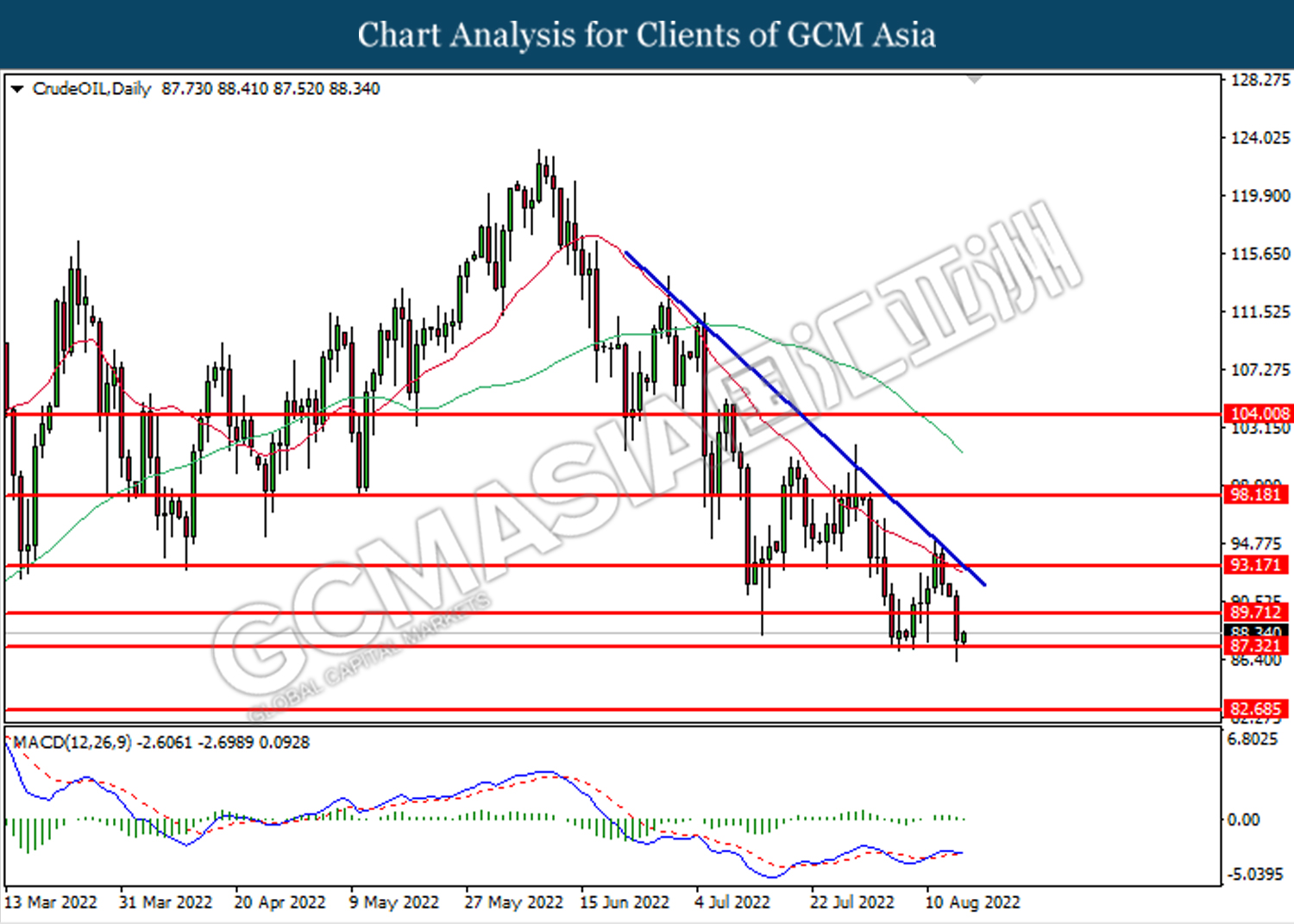

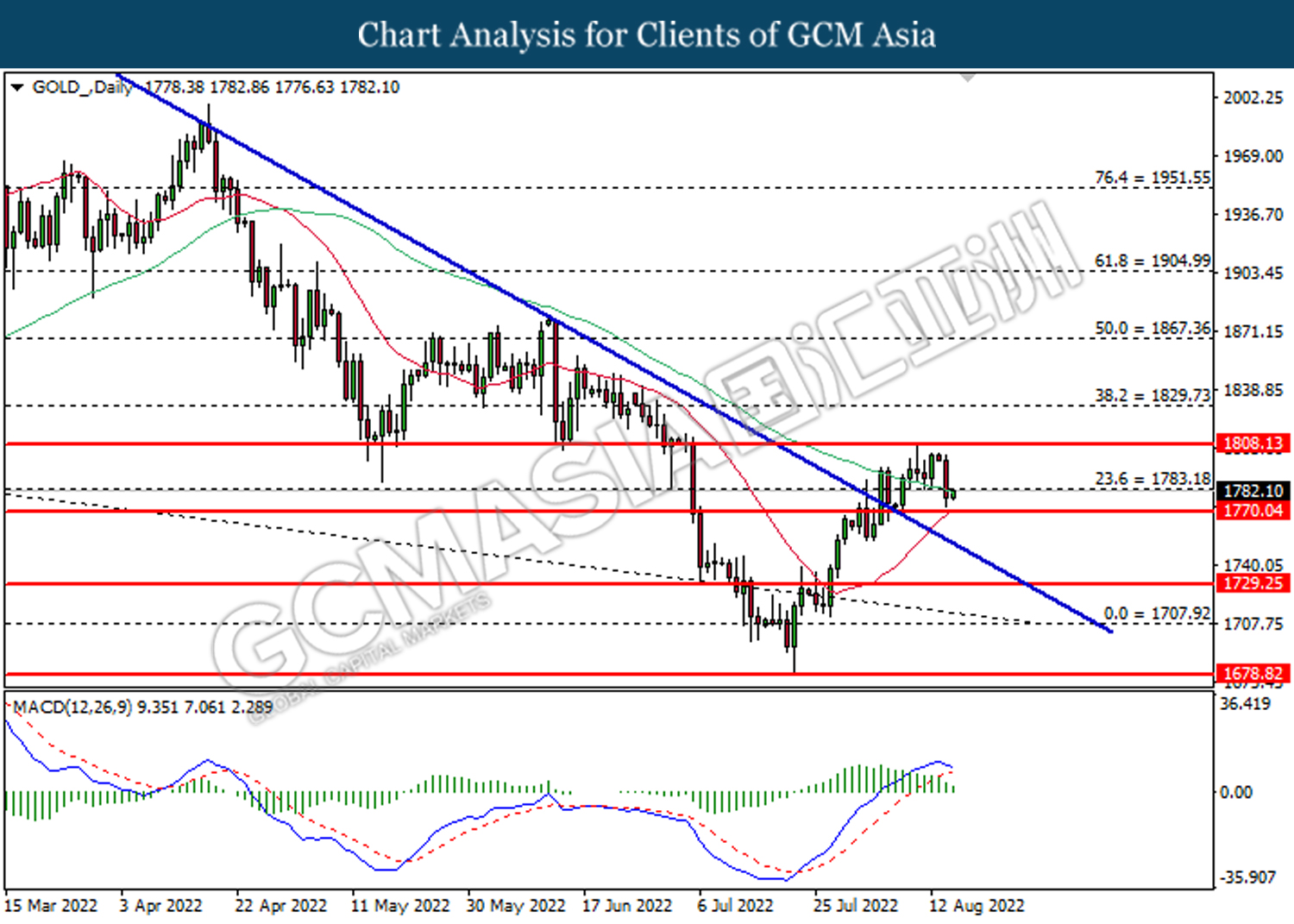

In the commodities market, the crude oil price climbed 1.14% to $89.40 a barrel, but still lingered near the recent low level amid the heightening of market concern over Chinese demand. Besides, the gold prices appreciated by 0.15% to $1782.00 per troy ounce as the dollar strengthened.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 14:00 | GBP – Average Earnings Index +Bonus (Jun) | 6.20% | 4.50% | – |

| 14:00 | GBP – Claimant Count Change (Jul) | -20.0K | – | – |

| 17:00 | EUR – German ZEW Economic Sentiment (Aug) | -53.8 | -52.7 | – |

| 20:30 | USD – Building Permits (Jul) | 1.696M | 1.640M | – |

| 20:30 | CAD – Core CPI (MoM) (Jul) | 0.30% | – | – |

Technical Analysis

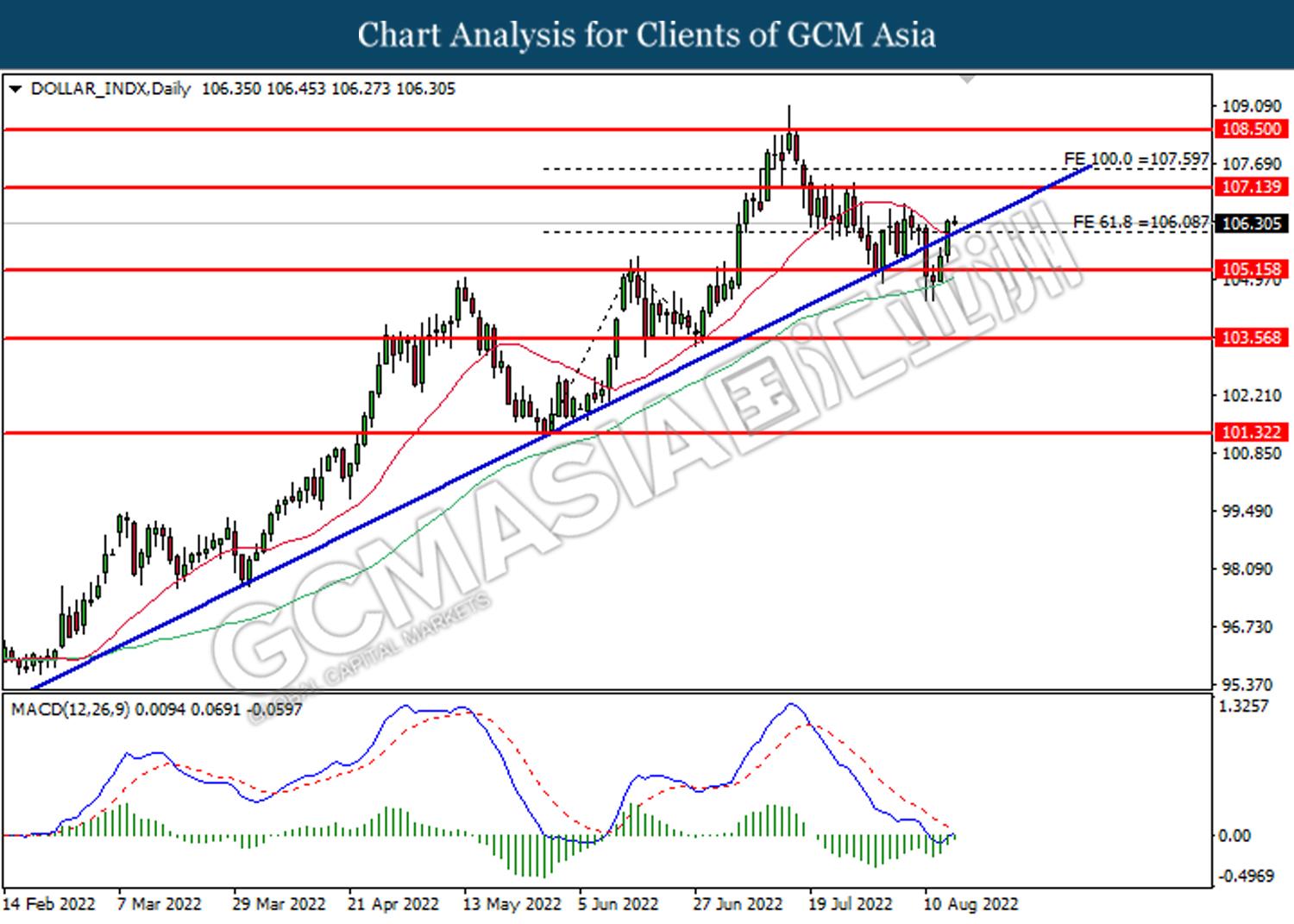

DOLLAR_INDX, Daily: Dollar index was traded higher following prior breakout above the previous upward trendline. MACD which illustrated diminishing bearish momentum suggests the index to extend its gains toward the resistance level at 107.15.

Resistance level: 107.15, 107.60

Support level: 106.10, 105.15

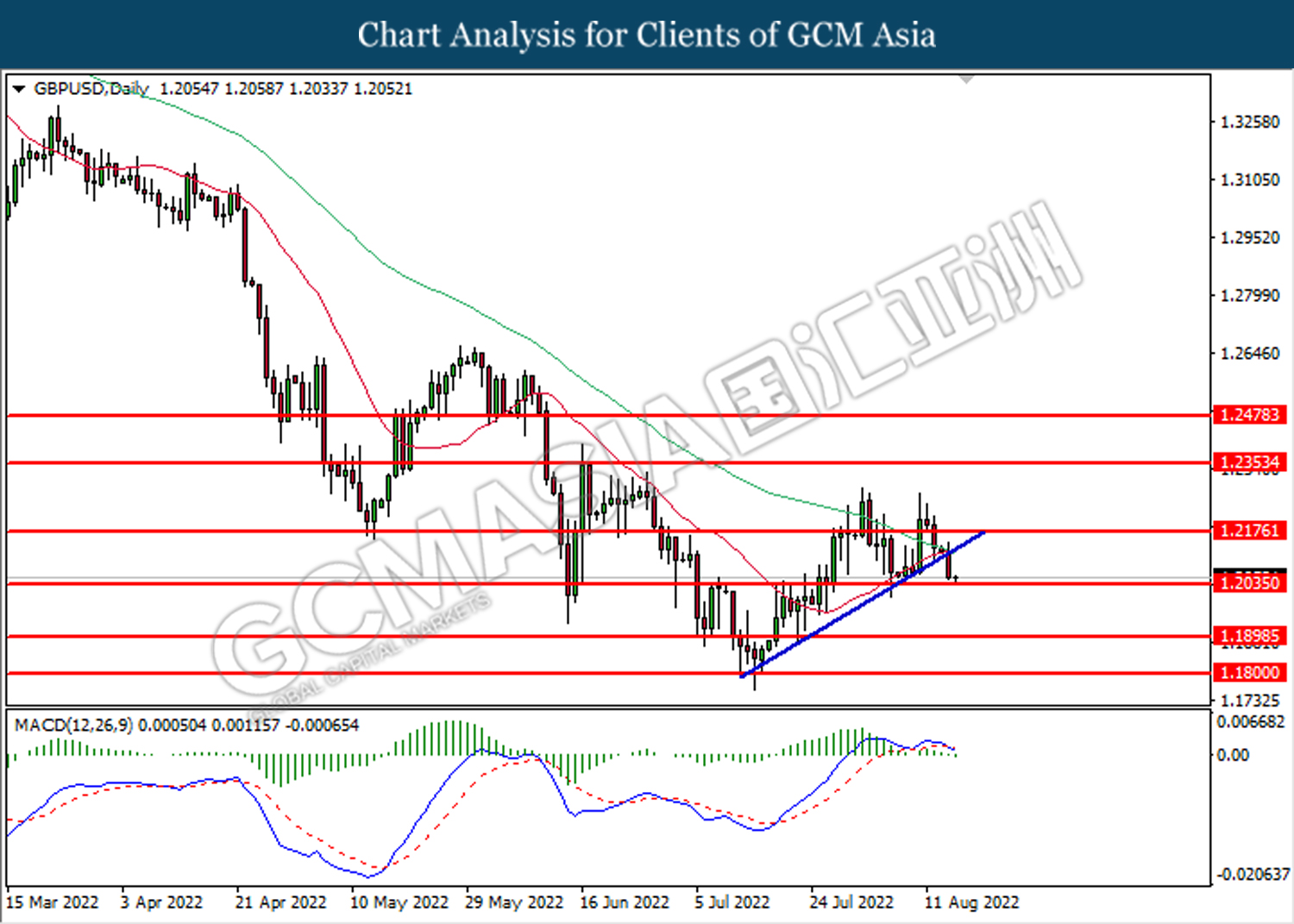

GBPUSD, Daily: GBPUSD was traded lower while currently testing the support level at 1.2035. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.2175, 1.2355

Support level: 1.2035, 1.1900

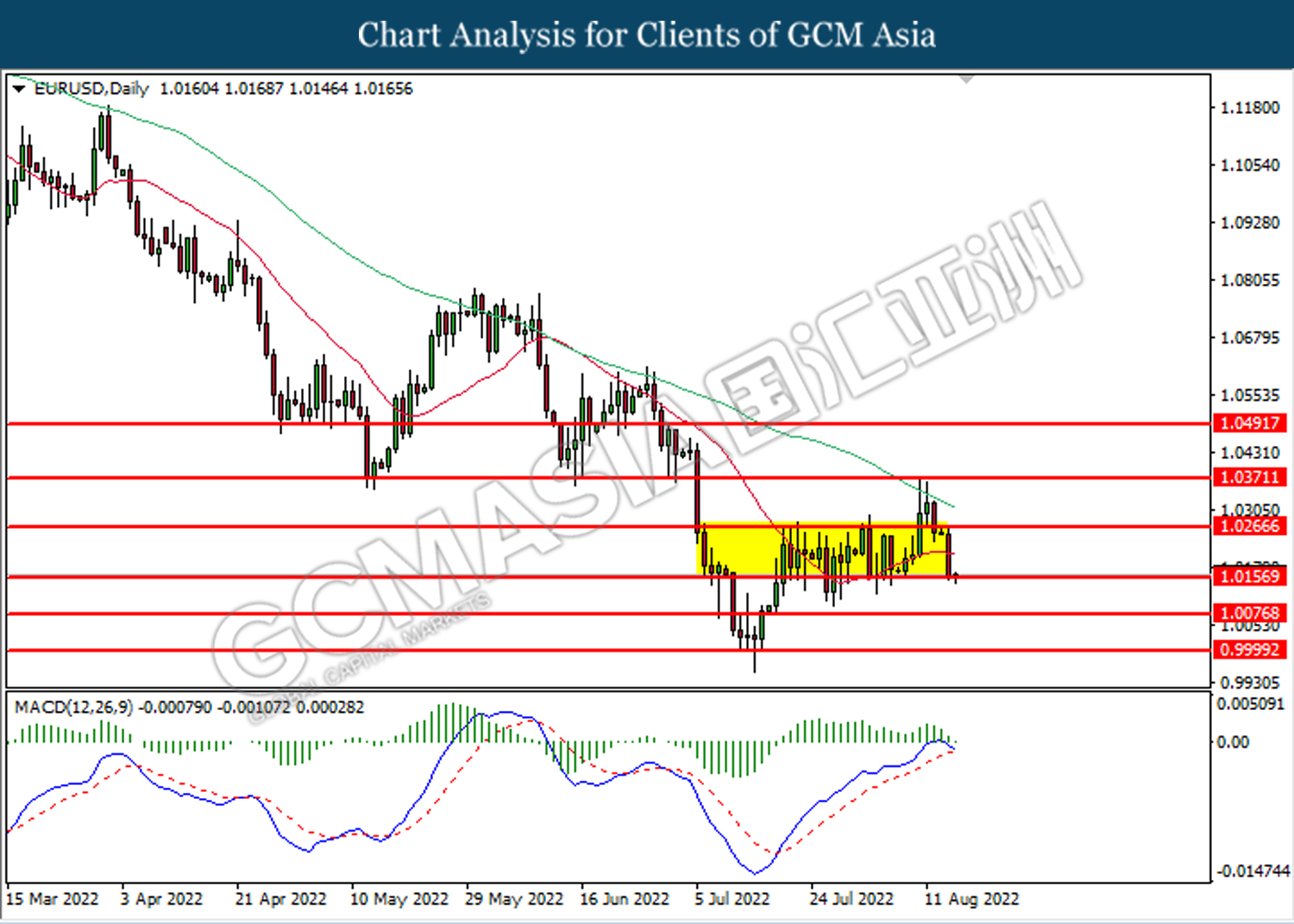

EURUSD, Daily: EURUSD was traded lower while currently testing the support level at 1.0155. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.0265, 1.0370

Support level: 1.0155, 1.0075

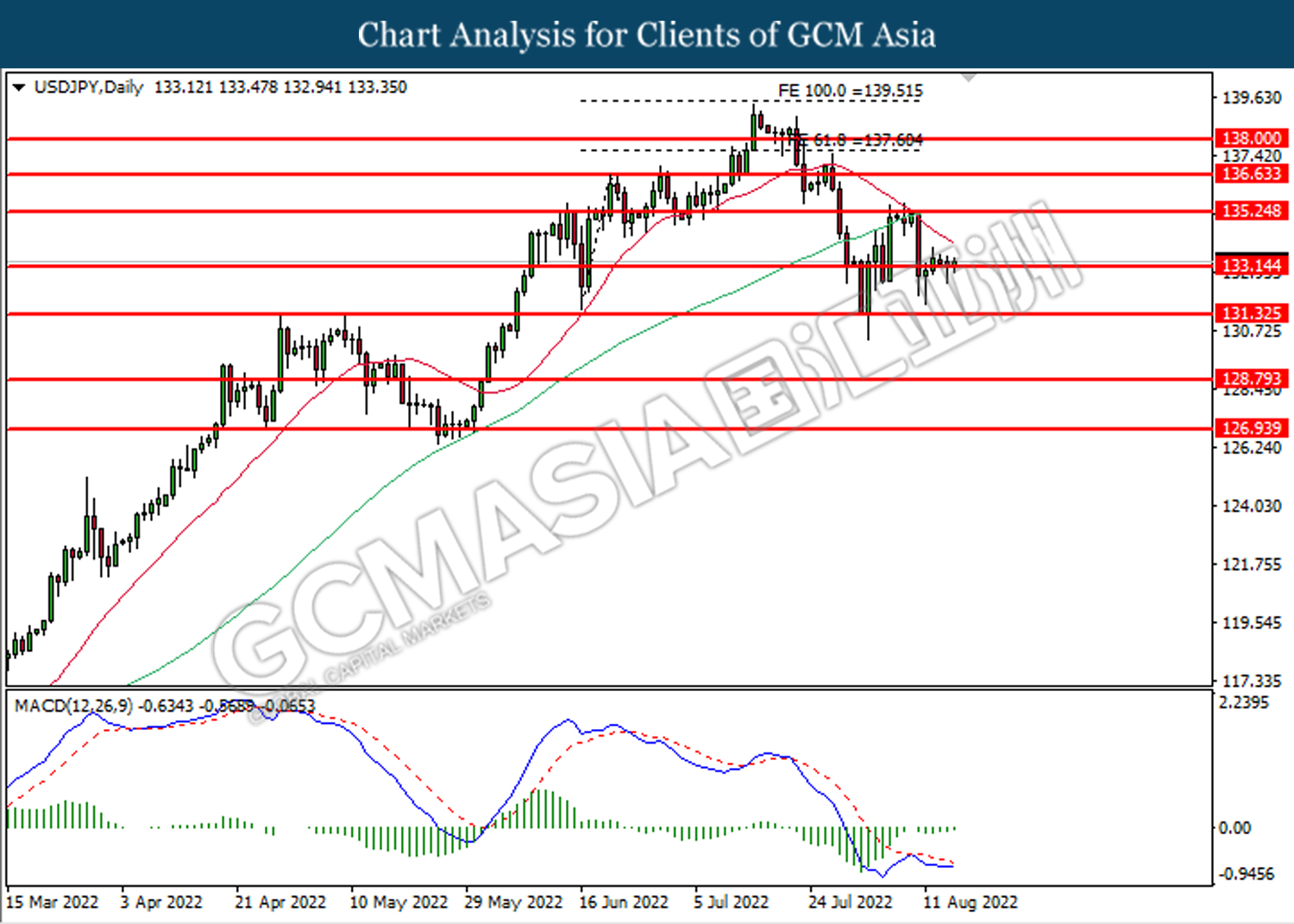

USDJPY, Daily: USDJPY was traded lower while currently testing the support level at 133.15. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 135.25, 136.65

Support level: 133.15, 131.30

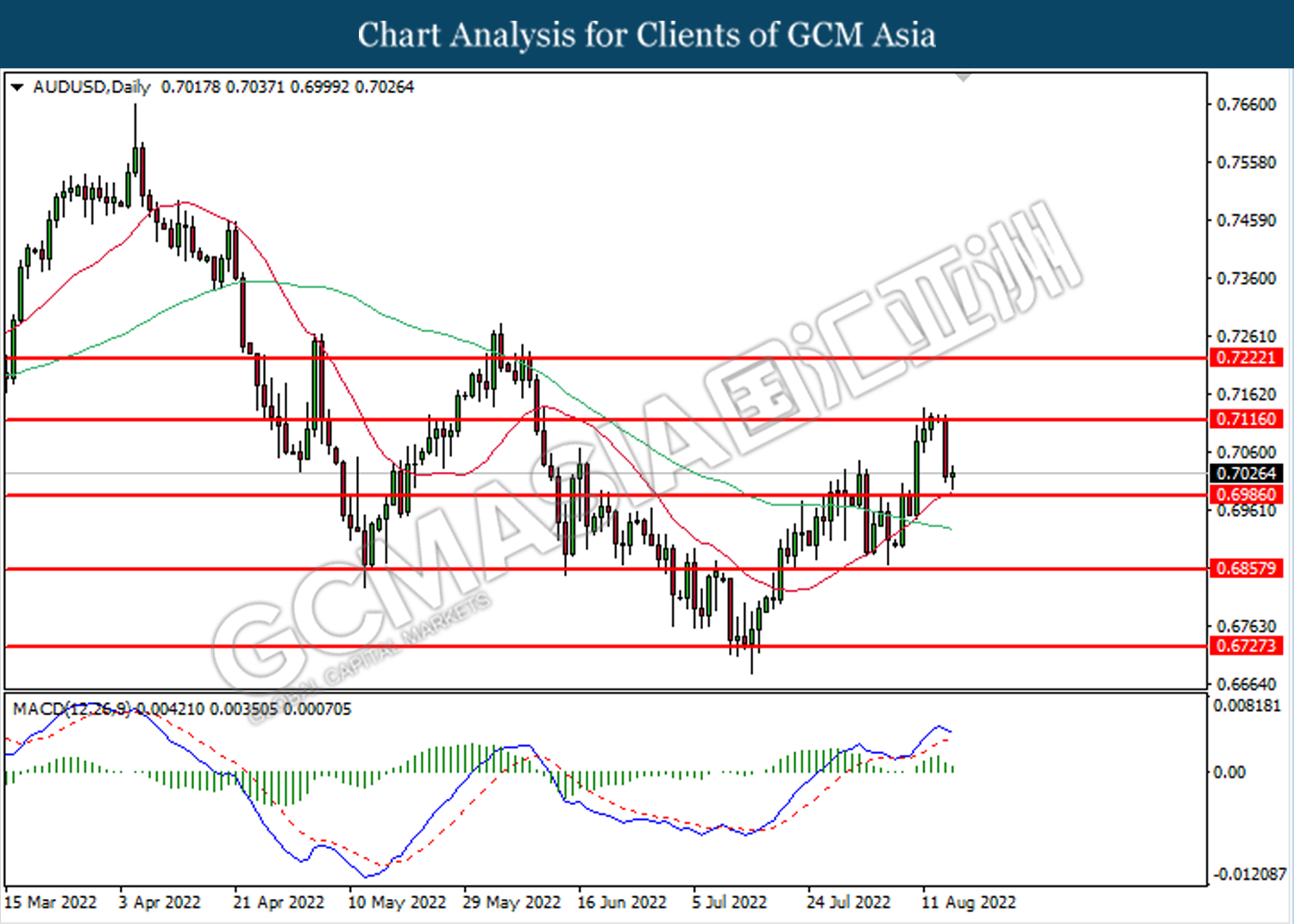

AUDUSD, Daily: AUDUSD was traded lower following prior retracement from the resistance level at 0.7115. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward the support level at 0.6985.

Resistance level: 0.7115, 0.7220

Support level: 0.6985, 0.6860

NZDUSD, Daily: NZDUSD was traded lower while currently retesting the support level at 0.6360. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 0.6430, 6555

Support level: 0.6360, 0.6245

USDCAD, Daily: USDCAD was traded higher while currently testing the resistance level at 1.2925. MACD which illustrated increasing bullish momentum suggests the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.2925, 1.2985

Support level: 1.2805, 1.2730

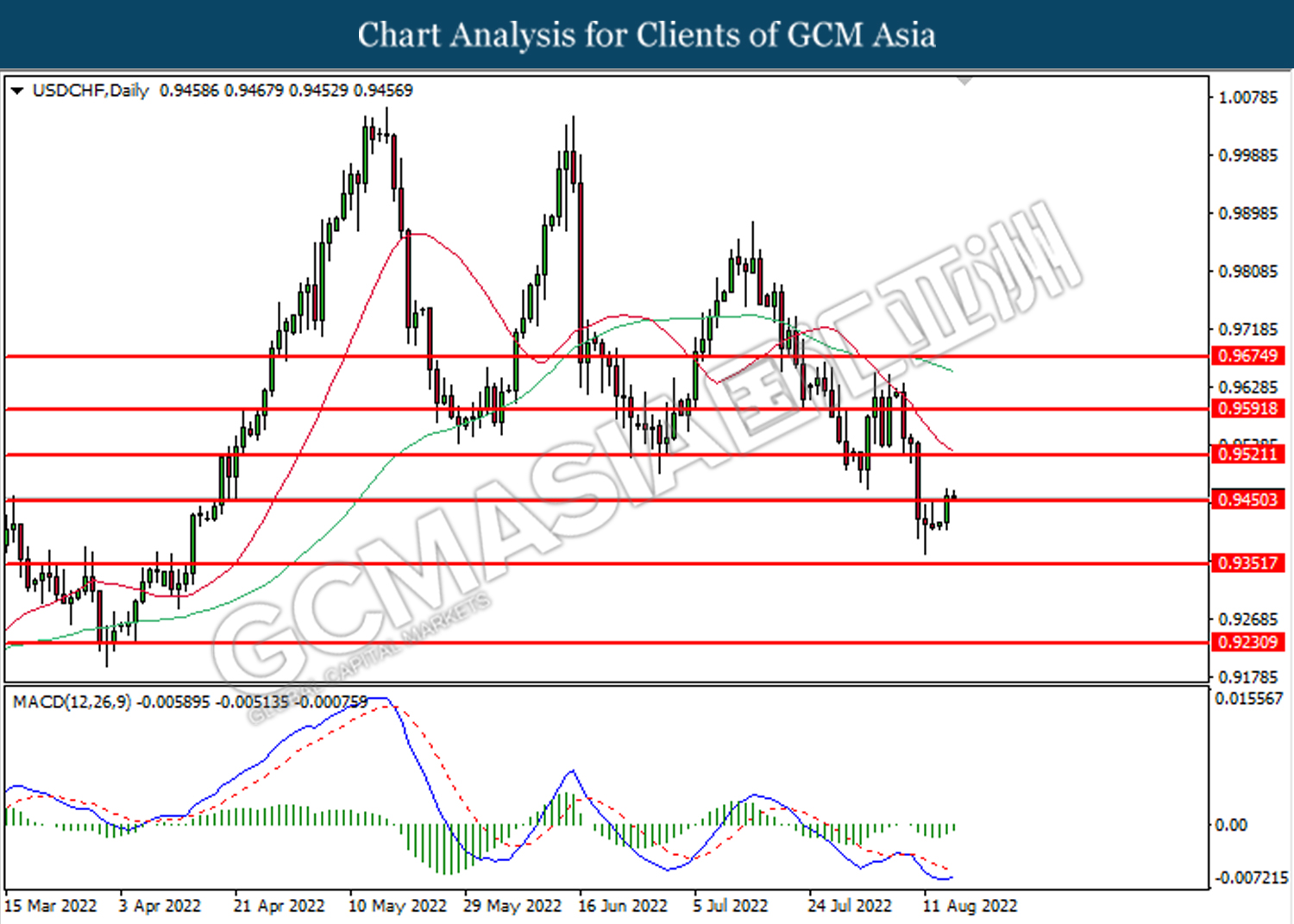

USDCHF, Daily: USDCHF was traded higher following prior breakout above the previous resistance level at 0.9450. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward the resistance level at 0.9520.

Resistance level: 0.9520, 0.9590

Support level: 0.9450, 0.9350

CrudeOIL, Daily: Crude oil price was traded higher following prior rebound from the support level at 87.30. However, MACD which illustrated diminishing bullish momentum suggests the commodity to undergo technical retracement in short term.

Resistance level: 89.70, 93.15

Support level: 87.30, 82.70

GOLD_, Daily: Gold price was traded higher following prior rebound near the support level at 1770.05. However, MACD which illustrated diminishing bullish momentum suggest the commodity to undergo technical retracement in short term.

Resistance level: 1783.20, 1808.15

Support level: 1770.05, 1729.25