16 November 2022 Afternoon Session Analysis

Pound Sterling spiked after bullish economic data announced.

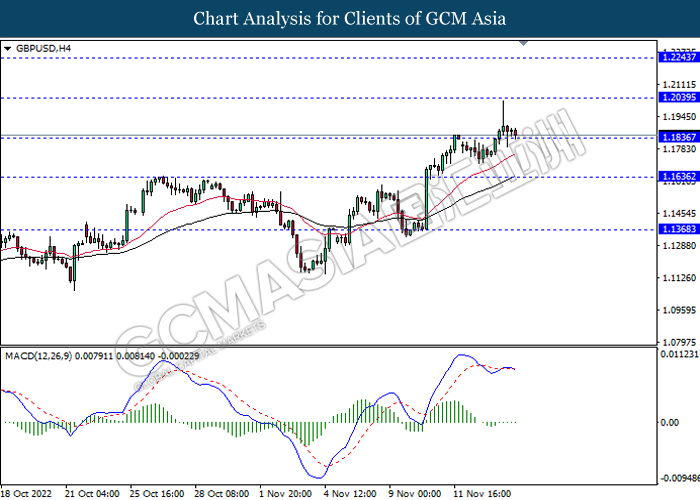

The GBP/USD, which widely traded by majority of investors rose significantly on yesterday as the upbeat economic data has been unleashed. According to Office for National Statistics, the UK Average Earnings Index +Bonus came in at the reading of 6.0%, exceeding the market forecast of 5.9%. Besides, the UK Claimant Count Change notched down from the previous reading of 3.9K to 3.3K, far lower than the consensus expectation of 17.3K. These two data that higher-than-expected figures had brought positive prospects toward economic progression in the UK, while it attracted the market participants to invest in UK market. In addition, Pound Sterling extended its gains following the depreciation of US Dollar, which leaded by the easing inflationary pressure in the US. As of now, investors would highly scrutinize on the announcement of CPI data in UK, which it could provide a clearer rate hike path for BoE. Currently, economist are anticipating the CPI reading would reach 10.7%, which higher than the previous reading of 10.1%. As of writing, GBP/USD edged down by 0.03% to 1.1855.

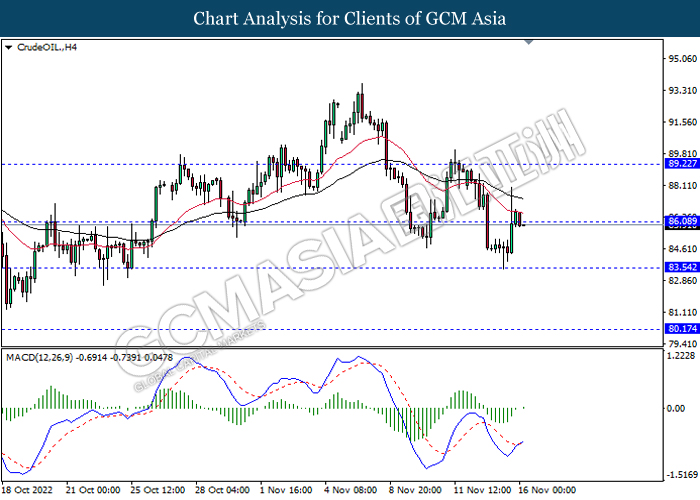

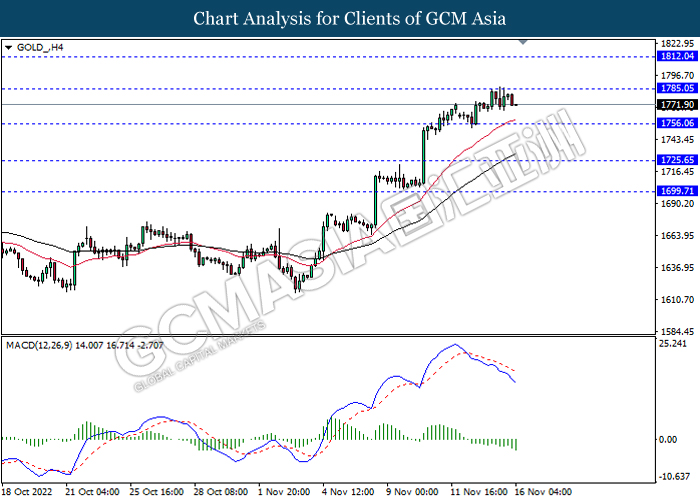

In the commodities market, the crude oil price dropped by 0.41% to $86.56 per barrel as of writing as the rising fears of lower oil demand that caused by exacerbating pandemic Covid-19 in China. On the other hand, the gold price depreciated by 0.01% to $1773.45 per troy ounce as of writing following prior rebound of US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

22:15 GBP BoE Gov Bailey Speaks

22:15 GBP Inflation Report Hearings

23:00 EUR ECB President Lagarde Speaks

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 15:00 | GBP – CPI (YoY) (Oct) | 10.1% | 10.7% | – |

| 21:30 | USD – Core Retail Sales (MoM) (Oct) | 0.1% | 0.4% | – |

| 21:30 | USD – Retail Sales (MoM) (Oct) | 0.0% | 1.0% | – |

| 21:30 | CAD – Core CPI (MoM) (Oct) | 0.4% | – | – |

| 23:30 | CrudeOIL – Crude Oil Inventories | 3.925M | -0.440M | – |

Technical Analysis

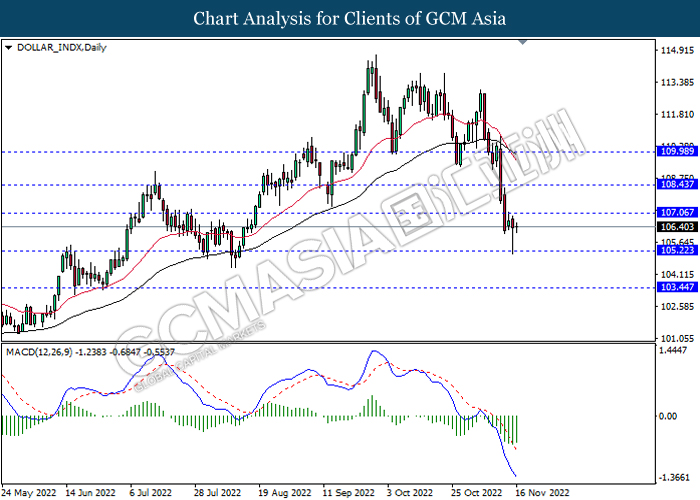

DOLLAR_INDX, Daily: Dollar index was traded lower following prior breakout below the previous support level. However, MACD which illustrated decreasing bearish momentum suggest the index to be traded higher as technical correction.

Resistance level: 107.05, 108.45

Support level: 105.20, 103.45

GBPUSD, H4: GBPUSD was traded lower while currently testing the support level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses if successfully breakout the support level.

Resistance level: 1.2040, 1.2245

Support level: 1.1835, 1.1635

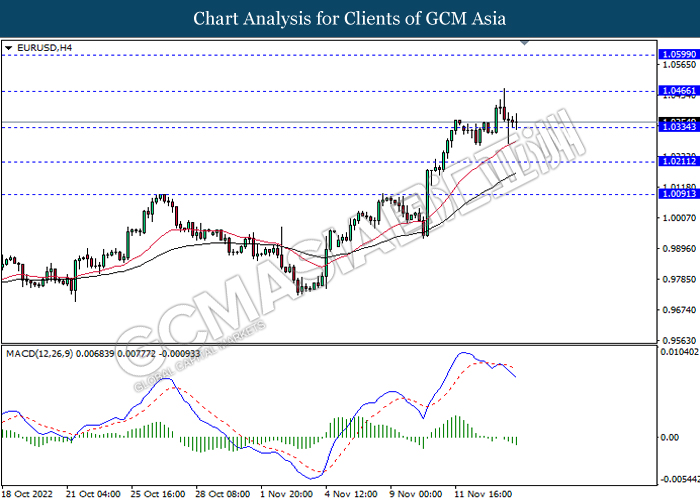

EURUSD, H4: EURUSD was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses if successfully breakout the support level.

Resistance level: 1.0465, 1.0600

Support level: 1.0335, 1.0210

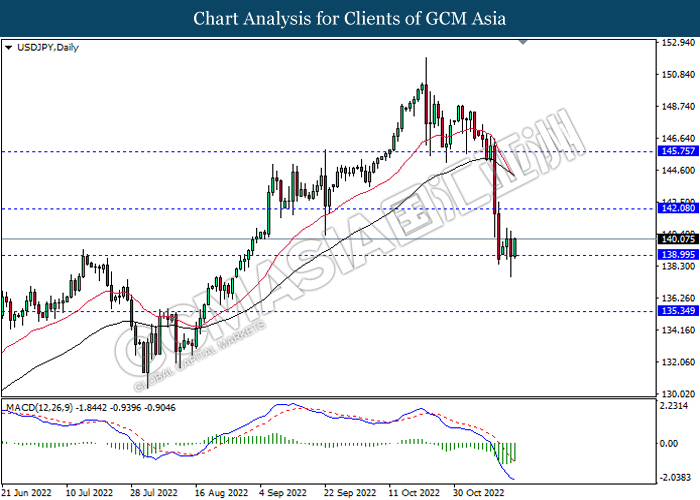

USDJPY, Daily: USDJPY was traded higher following prior rebound form the support level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 142.10, 145.75

Support level: 139.00, 135.35

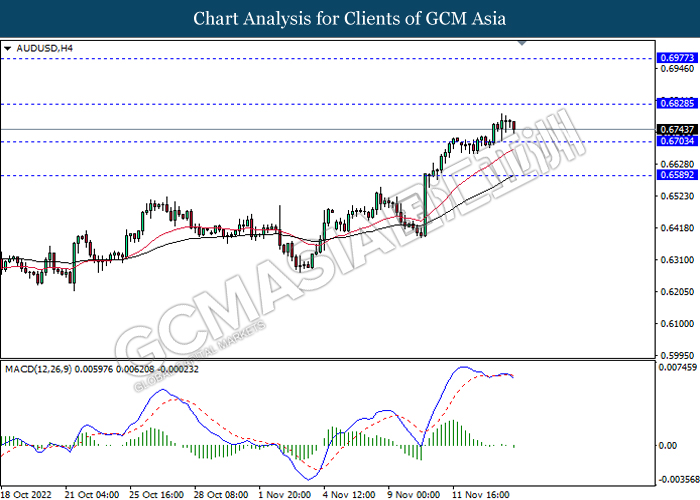

AUDUSD, H4: AUDUSD was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 0.6830, 0.6975

Support level: 0.6705, 0.6590

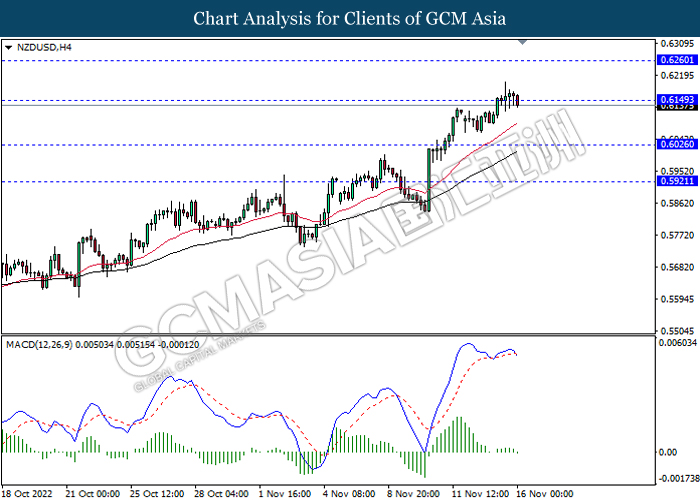

NZDUSD, H4: NZDUSD was traded lower following prior breakout below the previous support level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses.

Resistance level: 0.6150, 0.6260

Support level: 0.6025, 0.5920

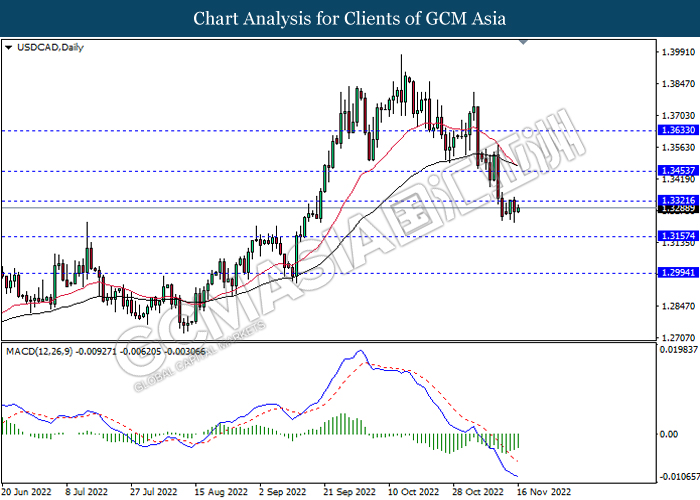

USDCAD, Daily: USDCAD was traded lower following prior breakout below the previous support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.3320, 1.3455

Support level: 1.3155, 1.2995

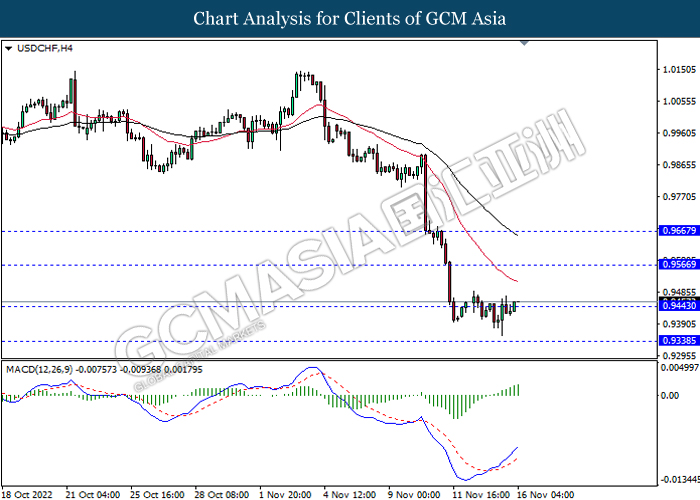

USDCHF, H4: USDCHF was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 0.9565, 0.9665

Support level: 0.9445, 0.9340

CrudeOIL, H4: Crude oil price was traded lower following prior breakout below the previous support level. However, MACD which illustrated decreasing bearish momentum suggest the commodity to be traded higher as technical correction.

Resistance level: 86.10, 89.20

Support level: 83.55, 80.15

GOLD_, H4: Gold price was traded lower following prior retracement from the resistance level. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses.

Resistance level: 1785.05, 1812.05

Support level: 1756.05, 1725.65