16 November 2022 Morning Session Analysis

Greenback plummeted amid lighter-than-expected inflation report.

The dollar index, which gauges its value against a basket of six major currencies, lost its stance while slumping more than 1% during the previous trading session as another inflation report showed further slowdown in price increases. According to the US Bureau of Labor Statistics, US PPI for the month of October came in at 0.2%, far weaker than the consensus forecast at 0.4%, showing some sign that inflationary pressures in the nation had been abating over the past 1 month. Following the announcement of the data, the probability of a 50-basis point rate hike in the upcoming Dec meeting ticked up from 80.6% to 83.0%, while the probability of a 75-basis point dropped from 19.4% to 17.0%, according to the CME FedWatch Tool. With such a backdrop, the dollar index was sold off by the investors, while shifting their capital toward other riskier asset. As of writing, the dollar index dropped -0.09% to 106.55.

In the commodities market, the crude oil price surged by 1.91% to $87.15 per barrel following a significant draw in crude inventories. According to the API, the US crude oil inventories fell by -5.835M, recording a larger drop compared to the consensus forecast of -0.400M. Besides, the gold prices up by 0.04% to $1778.10 per troy ounce amid the weakening of dollar index.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

22:15 GBP BoE Gov Bailey Speaks

22:15 GBP Inflation Report Hearings

23:00 EUR ECB President Lagarde Speaks

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 15:00 | GBP – CPI (YoY) (Oct) | 10.1% | 10.7% | – |

| 21:30 | USD – Core Retail Sales (MoM) (Oct) | 0.1% | 0.4% | – |

| 21:30 | USD – Retail Sales (MoM) (Oct) | 0.0% | 1.0% | – |

| 21:30 | CAD – Core CPI (MoM) (Oct) | 0.4% | – | – |

| 23:30 | CrudeOIL – Crude Oil Inventories | 3.925M | -0.440M | – |

Technical Analysis

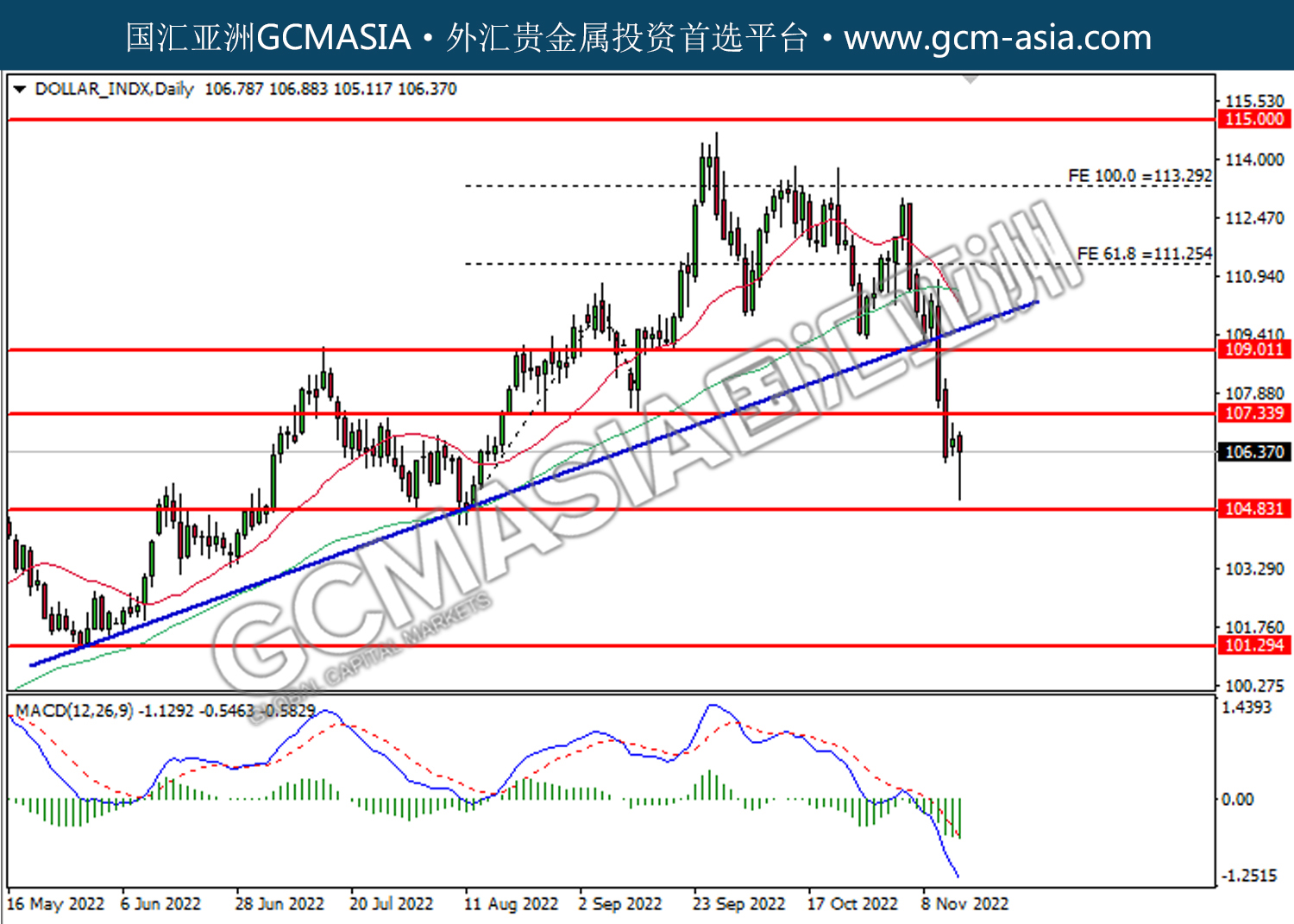

DOLLAR_INDX, Daily: Dollar index was traded lower following prior breakout below the support level at 107.35. MACD which illustrated bearish bias momentum suggests the index to extend its losses toward the support level at 104.85

Resistance level: 107.35, 109.00

Support level: 104.85, 101.30

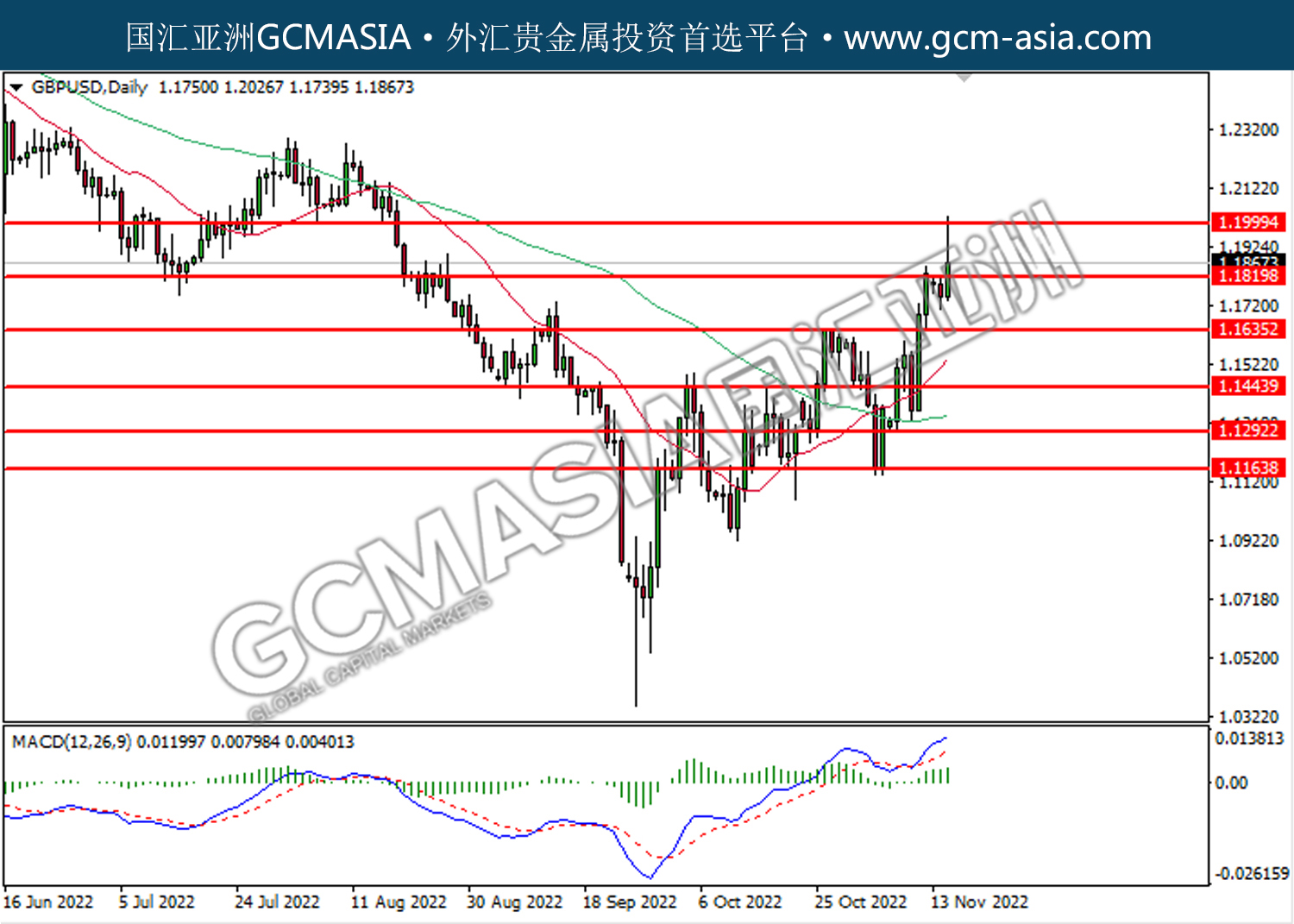

GBPUSD, Daily: GBPUSD was traded higher while currently testing the resistance level at 1.1820. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.1820, 1.2000

Support level: 1.1635, 1.1445

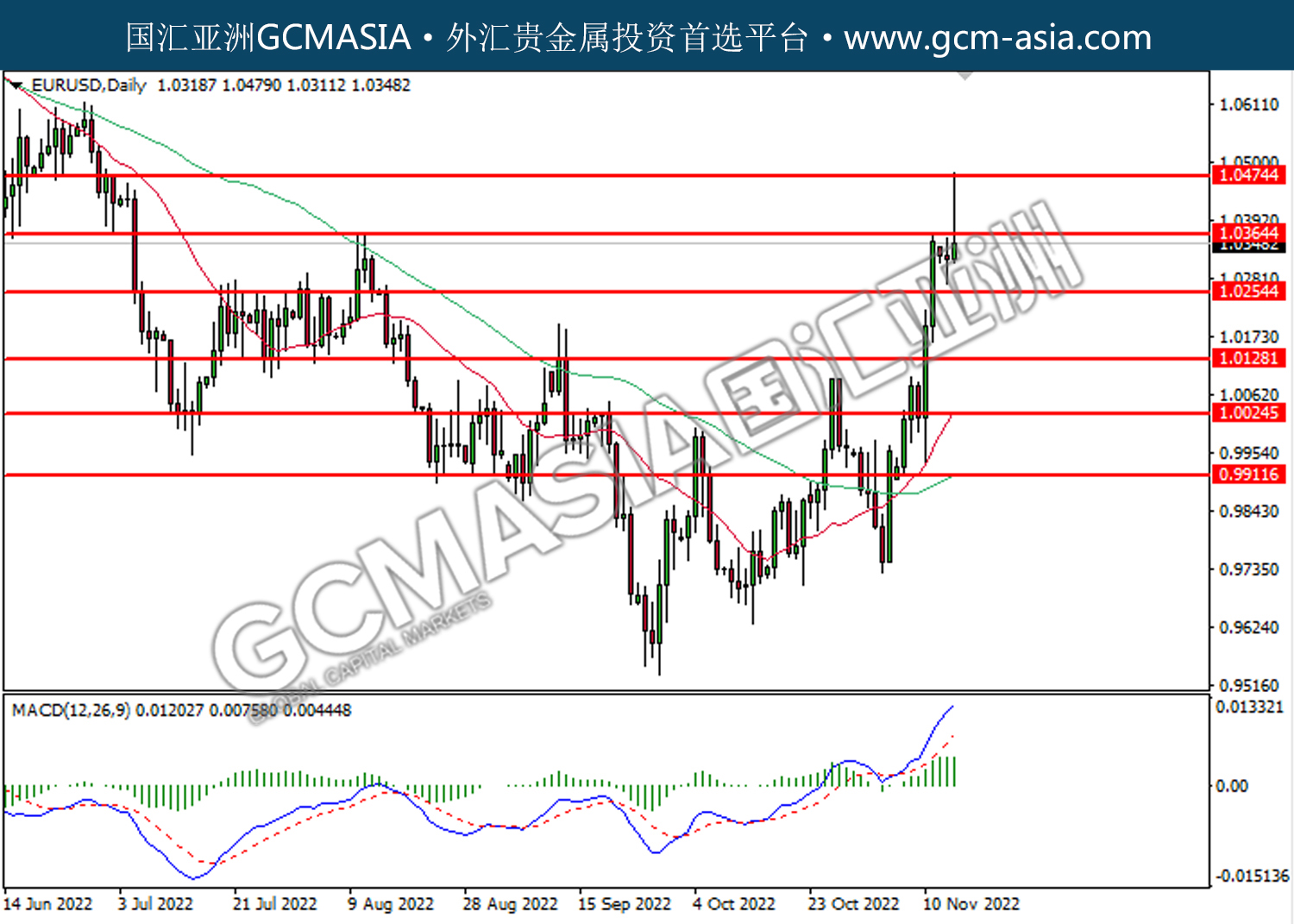

EURUSD, Daily: EURUSD was traded higher while currently testing the resistance level at 1.0365. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.0365, 1.0475

Support level: 1.0255, 1.0130

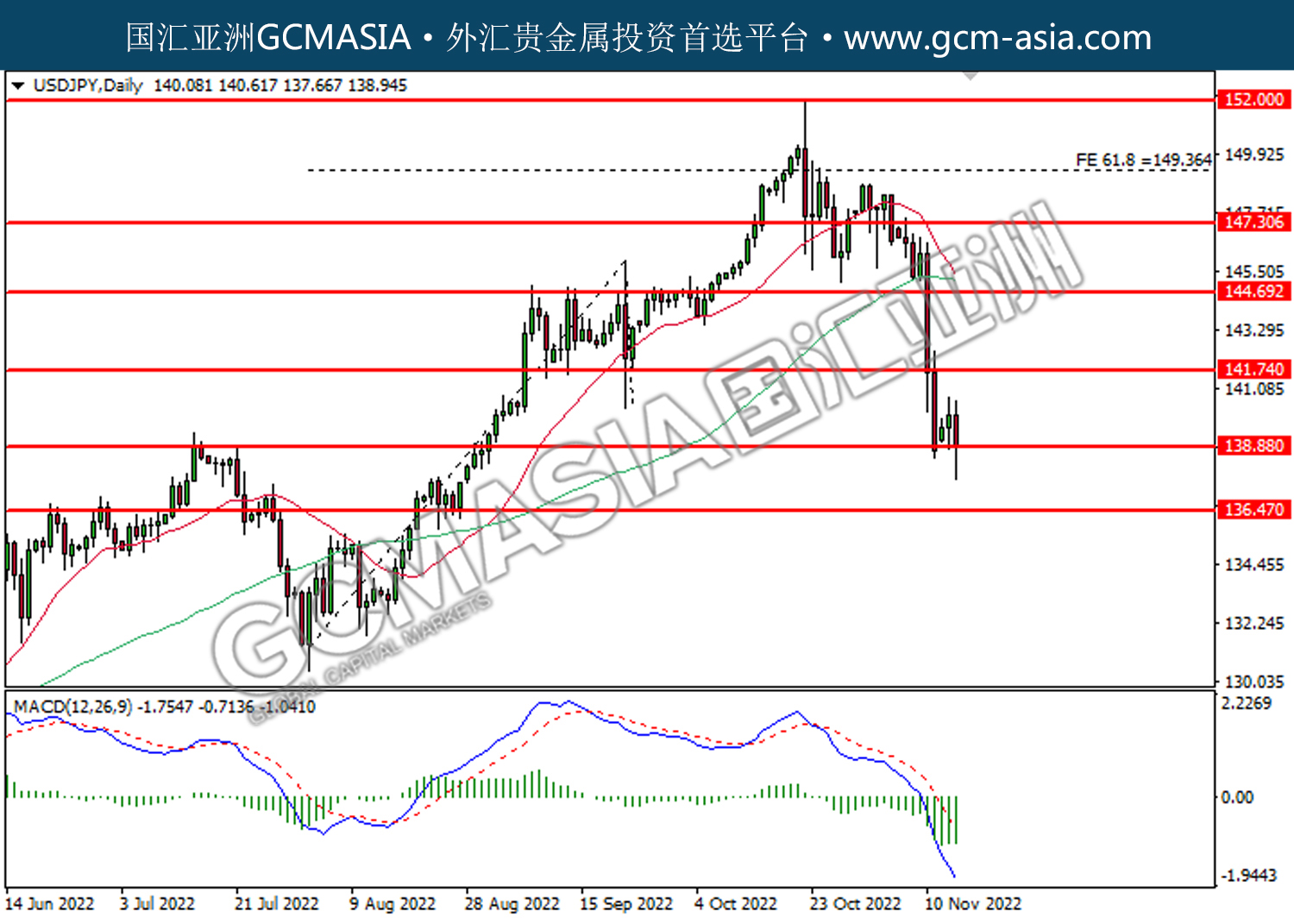

USDJPY, Daily: USDJPY was traded lower while currently testing the support level ta 138.90. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 141.75, 144.70

Support level: 138.90, 136.45

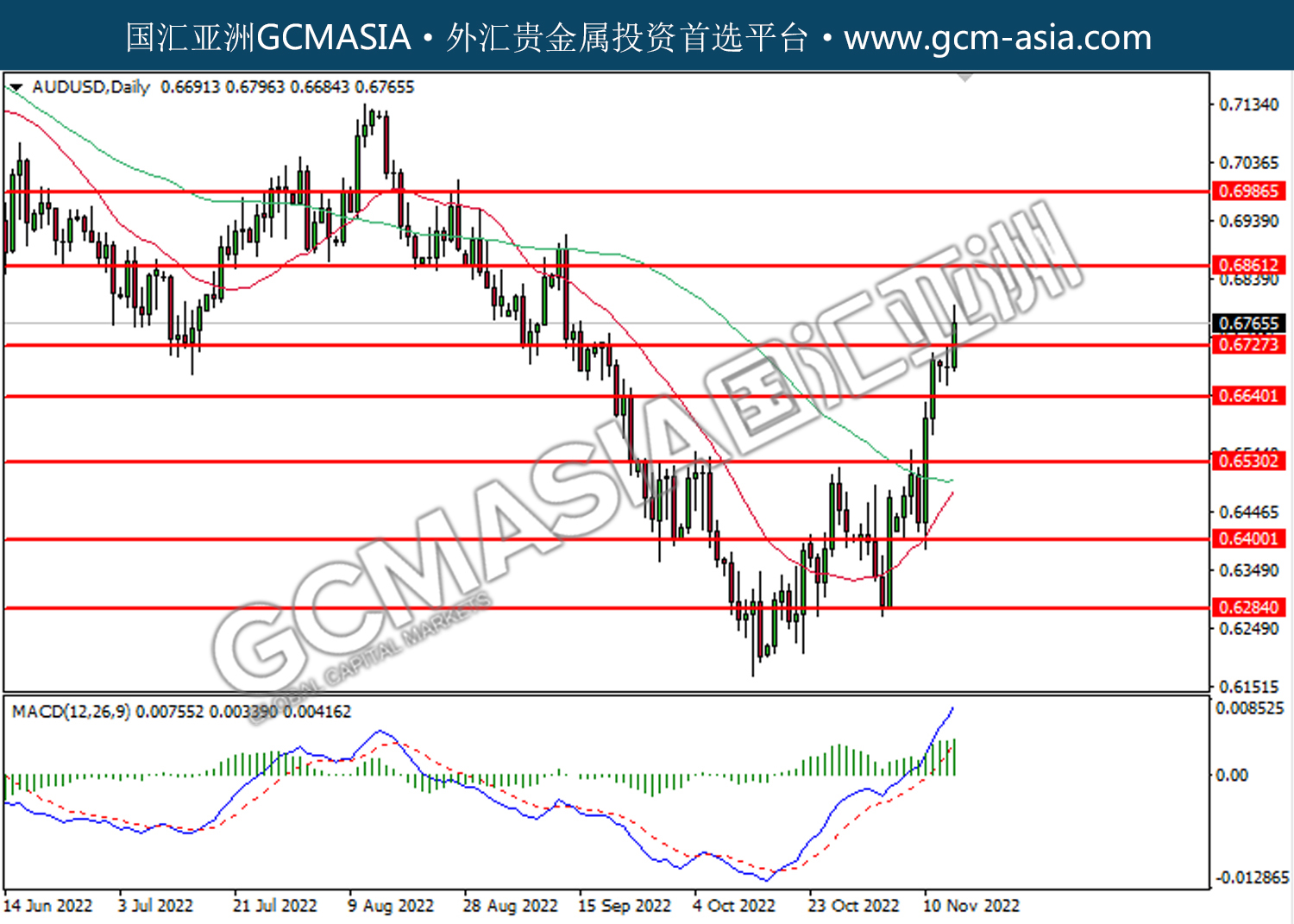

AUDUSD, Daily: AUDUSD was traded higher following prior breakout above the previous resistance level at 0.6725. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 0.6860.

Resistance level: 0.6860, 0.6985

Support level: 0.6725, 0.6640

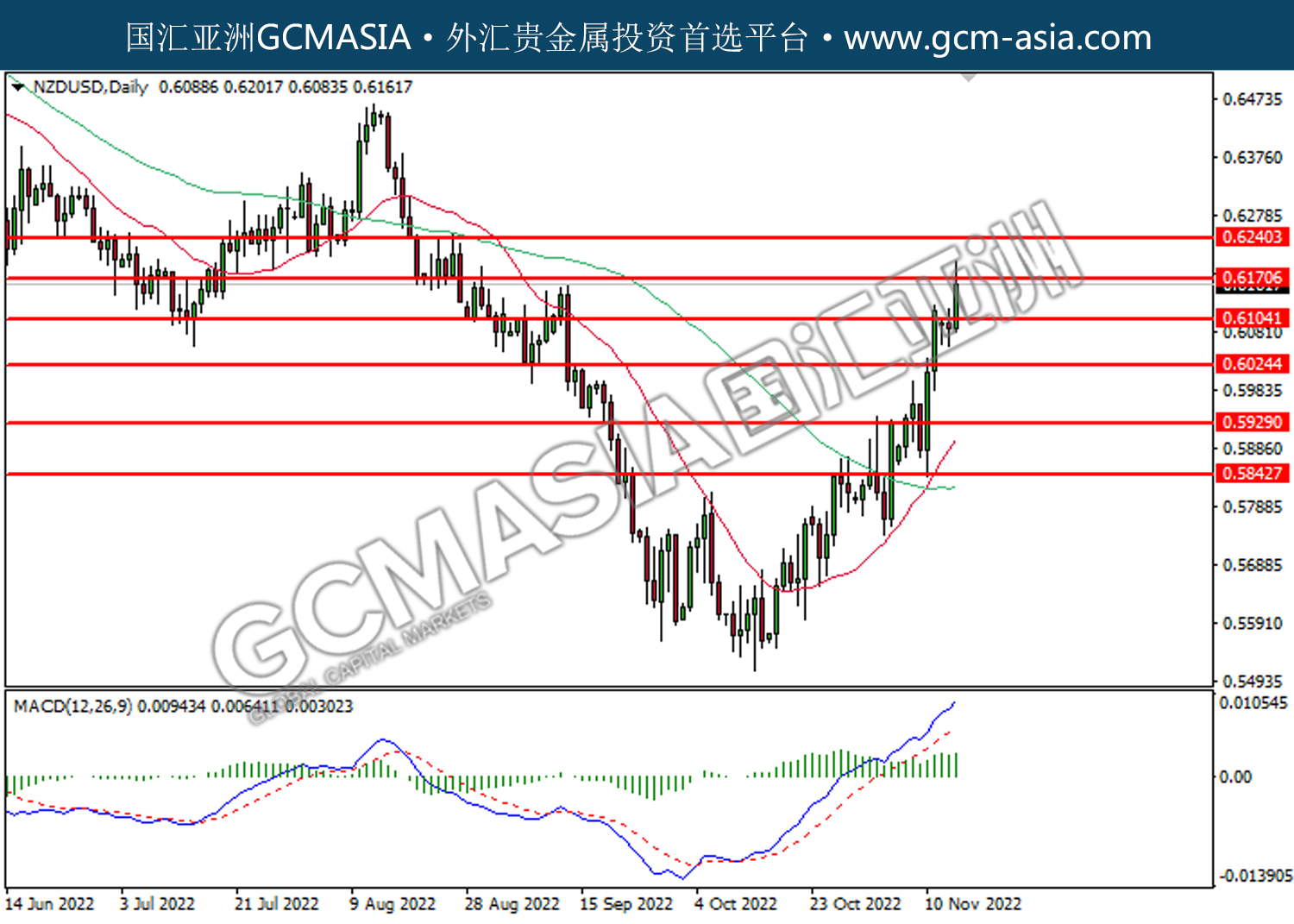

NZDUSD, Daily: NZDUSD was traded higher while currently testing the resistance level at 0.6170. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 0.6170, 0.6240

Support level: 0.6105, 0.6025

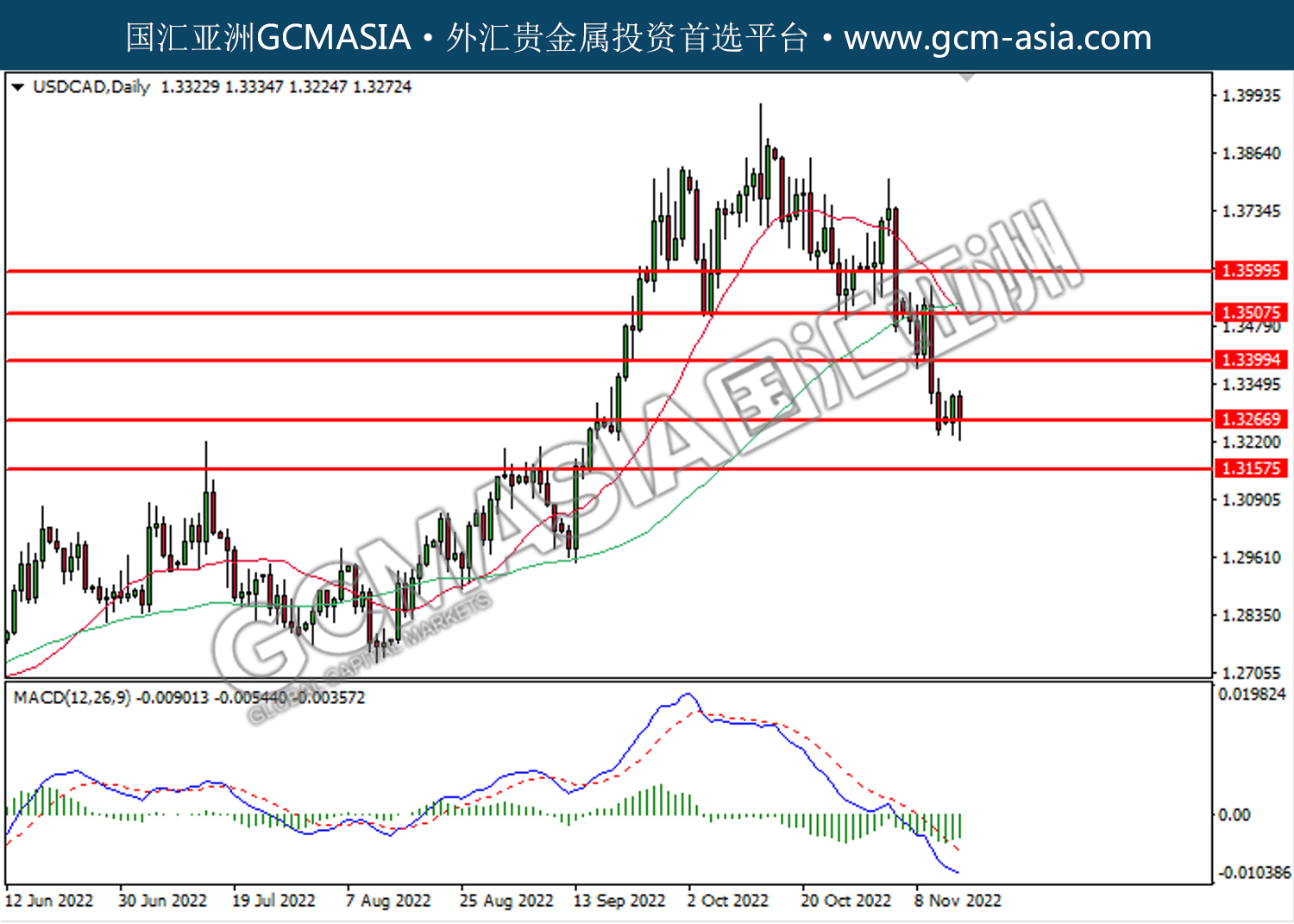

USDCAD, Daily: USDCAD was traded lower while currently testing the support level at 1.3265. MACD which illustrated bearish bias momentum suggests the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.3400, 1.3505

Support level: 1.3265, 1.3155

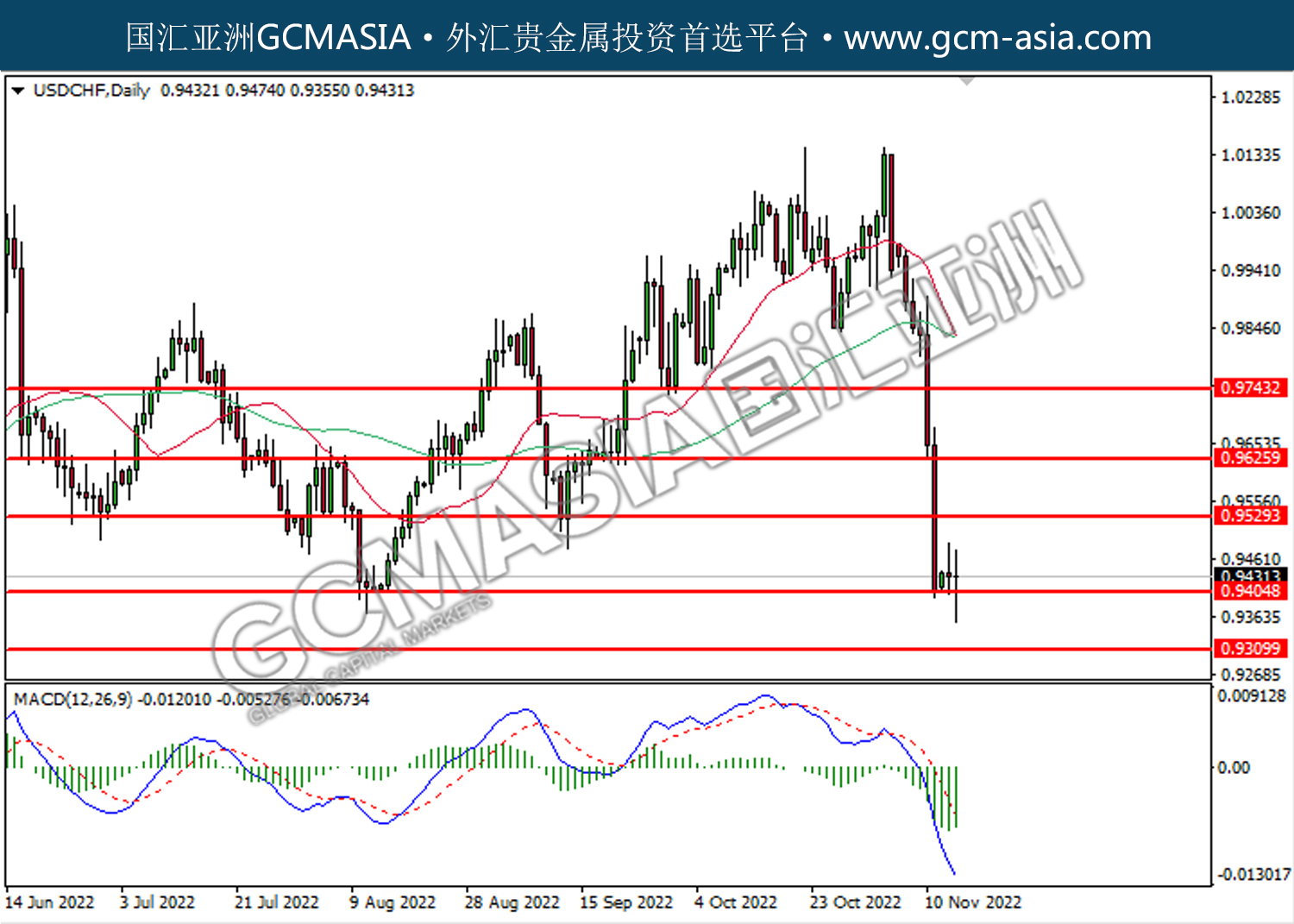

USDCHF, Daily: USDCHF was traded higher following prior rebound from the support level at 0.9405. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward the resistance level at 0.9530.

Resistance level: 0.9530, 0.9625

Support level: 0.9405, 0.9310

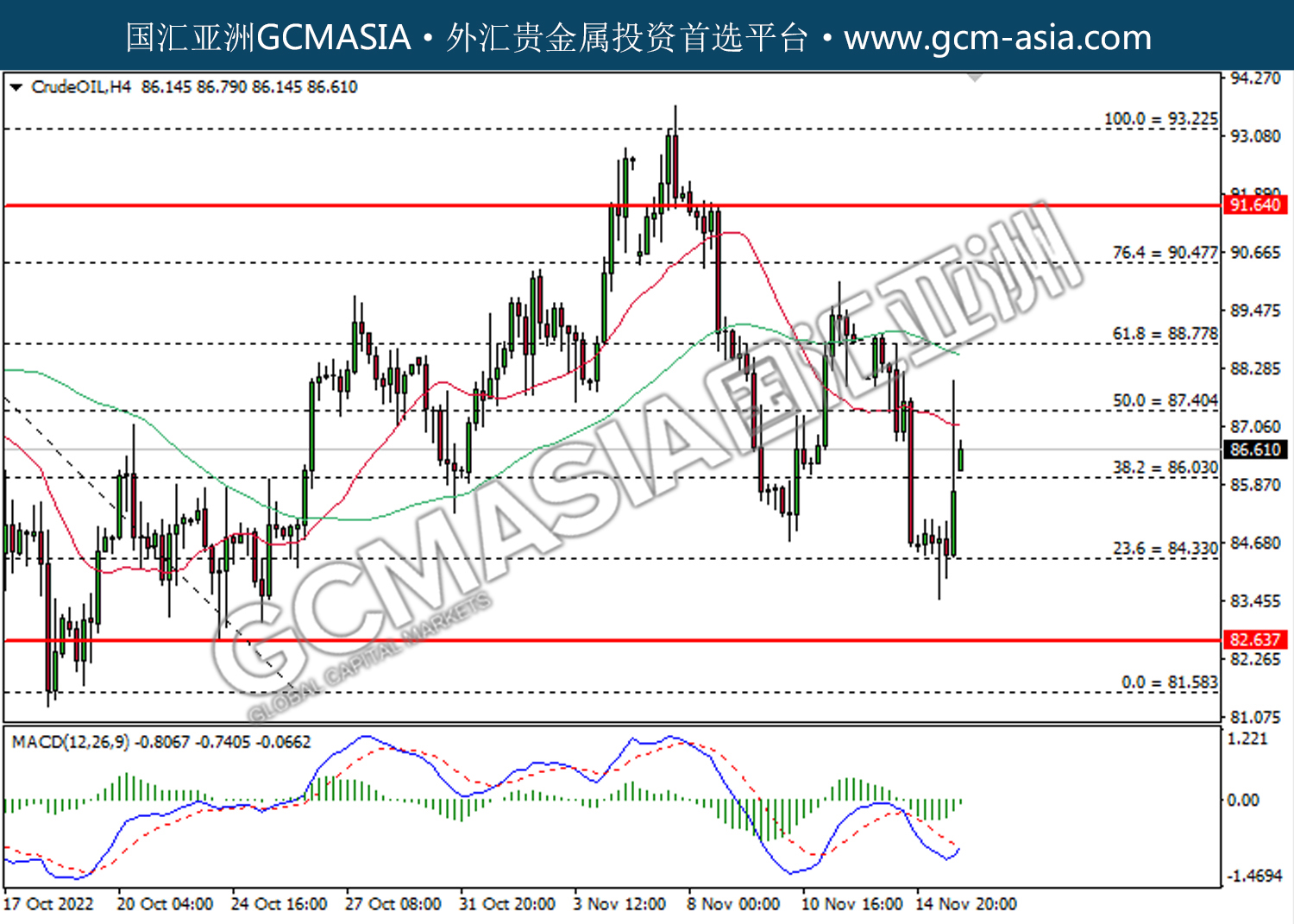

CrudeOIL, H4: Crude oil price was traded higher following prior breakout above the previous resistance level at 86.05. MACD which illustrated diminishing bearish momentum suggests the commodity to extend its gains toward the resistance level at 87.40.

Resistance level: 87.40, 88.80

Support level: 86.05, 84.35

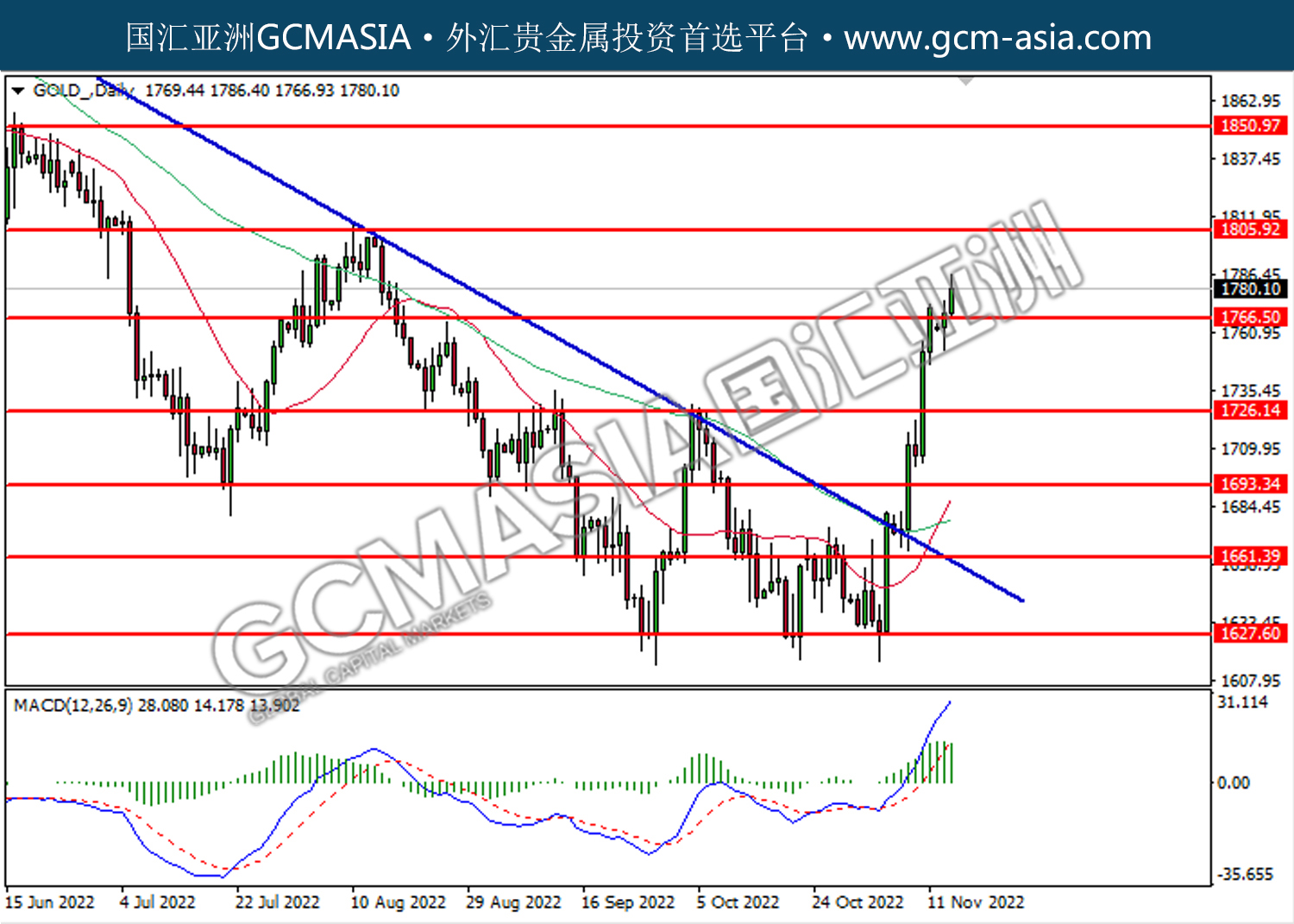

GOLD_, Daily: Gold price was traded higher following prior breakout above the previous resistance level at 1766.50. MACD which illustrated bullish bias momentum suggests the commodity to extend its gains toward the resistance level at 1805.90.

Resistance level: 1805.90, 1850.95

Support level: 1766.50, 1726.15