16 December 2022 Afternoon Session Analysis

Pound plunged despite rate-hike plan remained.

The Pound Sterling, which was majorly traded by the global investors, plummeted significantly during the previous trading session after the Bank of England (BoE) raised the interest rate as widely expected. In the BoE Meeting, the Board of Committee lifted up the interest rate from 3.0% to 3.5%, in line with the consensus forecast. In further details, the BoE members is expecting the UK economy to be in recession for a prolonged period, while the inflationary pressure was expected to remain buoyed in the near-term future. Despite, the BoE agreed to continue its rate hike plan, whereby a 50-basis point is expected to be seen in the upcoming meeting. With that, it decremented the global demand over the pound market as the UK economy is trapped with prolonged recession. On top of that, the hawkish statement from the Federal Reserve Chairman Jerome Powell continues to be the main driven of the rising trend of dollar index, while pushing the pairing of GBP/USD lower yesterday. As of writing, the pair of GBP/USD rebounded slightly by 0.25% to 1.2205.

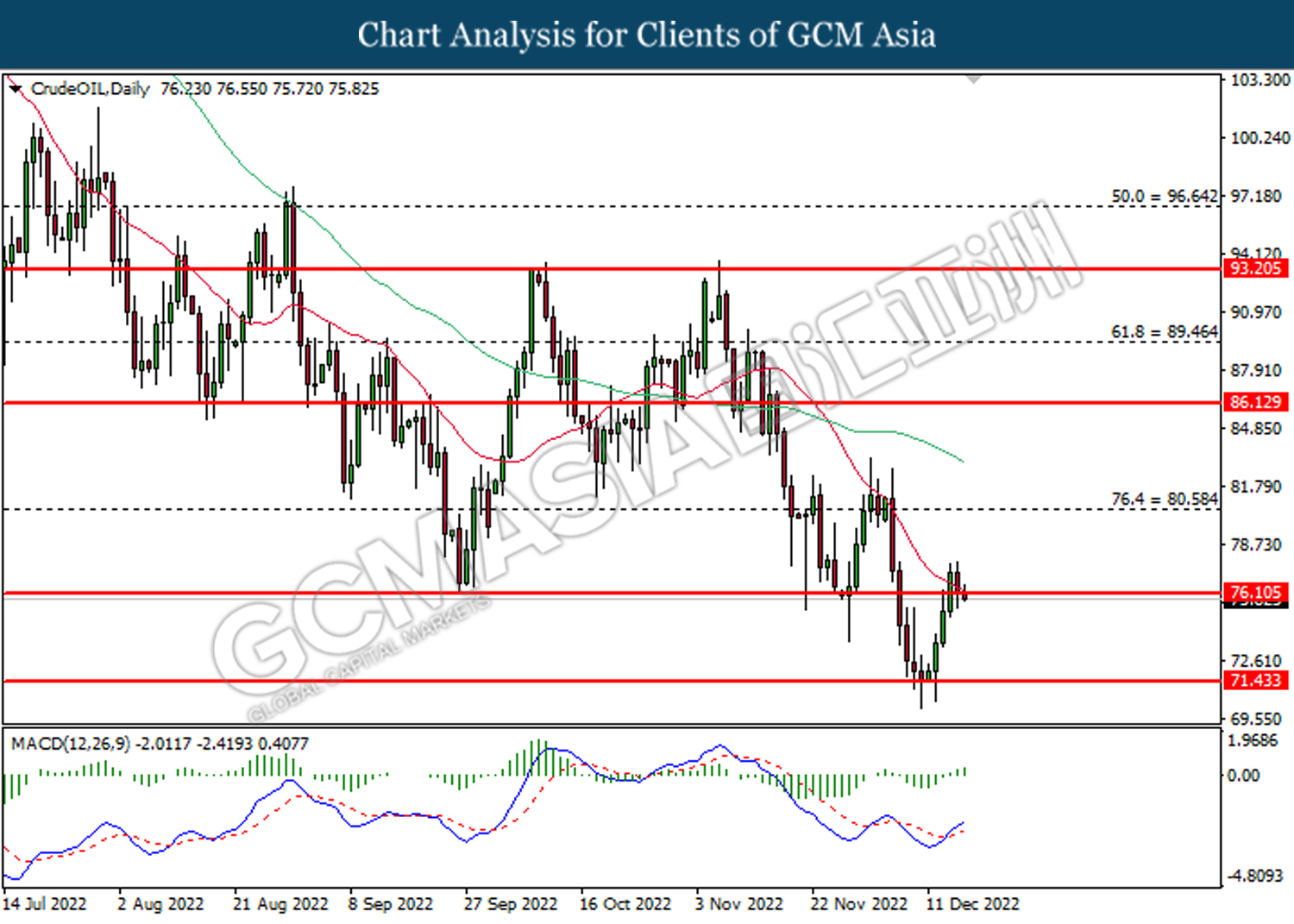

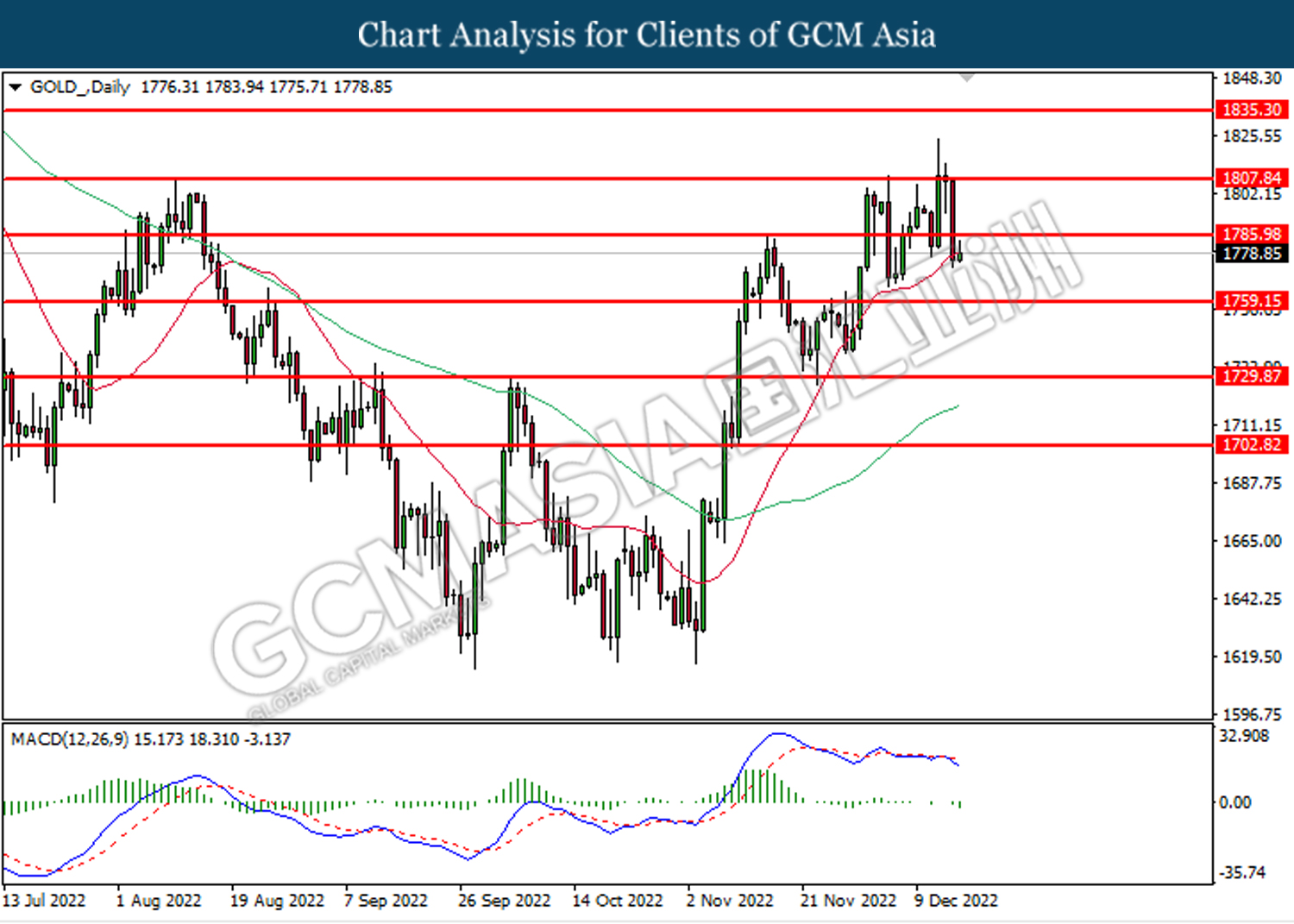

In the commodities market, the crude oil price slid by -0.45% to $76.00 per barrel as the strengthening of dollar index increased the cost of oil for non-US buyers. Besides, the gold prices dropped -0.05% to $1779.10 per troy ounce amid dollar strengthened.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 15:00 | GBP – Retail Sales (MoM) (Nov) | 0.6% | 0.3% | – |

| 16:30 | EUR – German Manufacturing PMI (Dec) | 46.2 | 46.3 | – |

| 17:30 | GBP – Composite PMI | 48.2 | – | – |

| 17:30 | GBP – Manufacturing PMI | 46.5 | 46.5 | – |

| 17:30 | GBP – Services PMI | 48.8 | 49.2 | – |

| 18:00 | EUR – CPI (YoY) (Nov) | 10.0% | 10.0% | – |

Technical Analysis

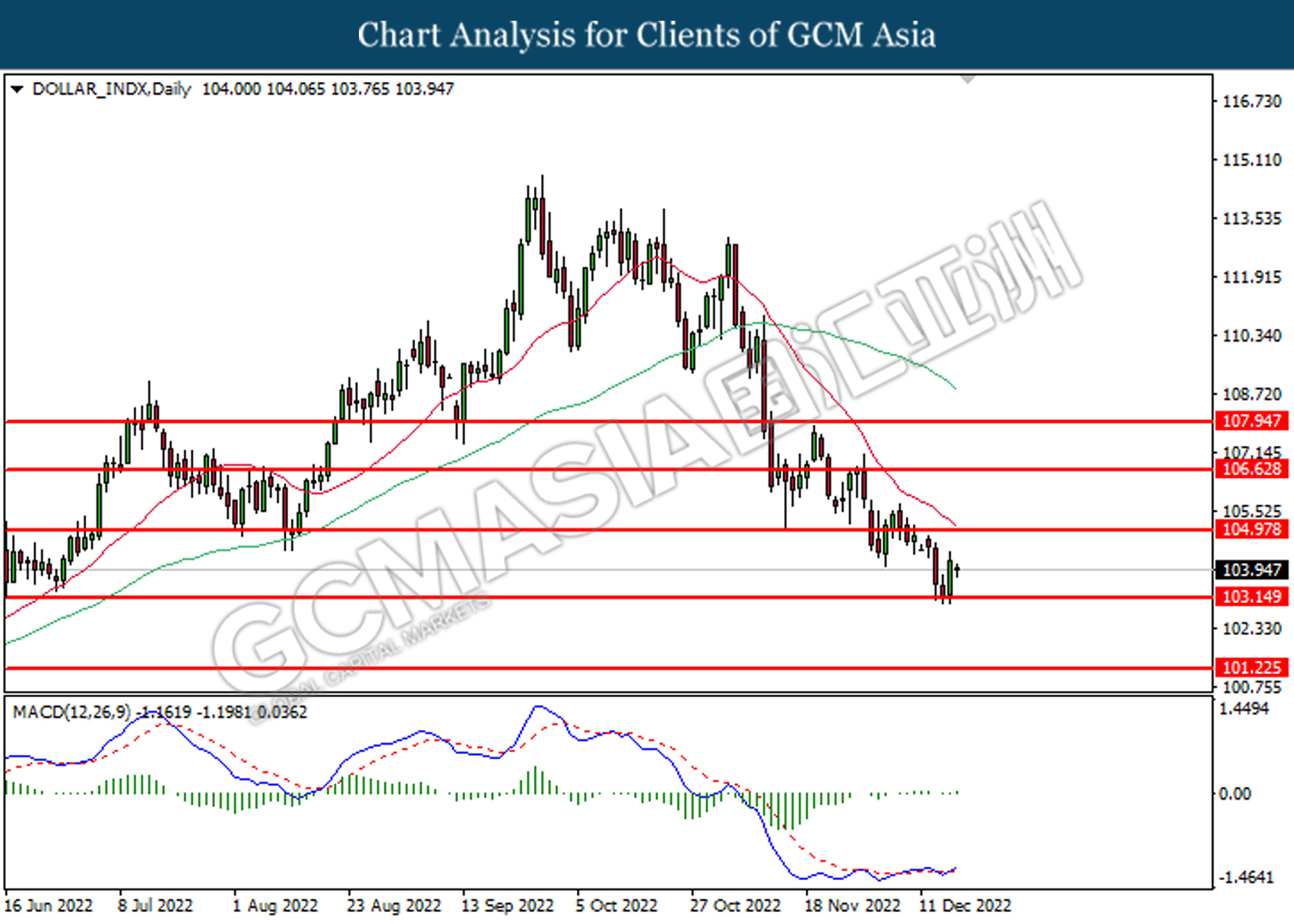

DOLLAR_INDX, Daily: Dollar index was traded higher following prior rebound from the support level at 103.15. MACD which illustrated bullish bias momentum suggests the index to extend its gains toward the resistance level at 105.00.

Resistance level: 105.00, 106.65

Support level: 103.15, 101.25

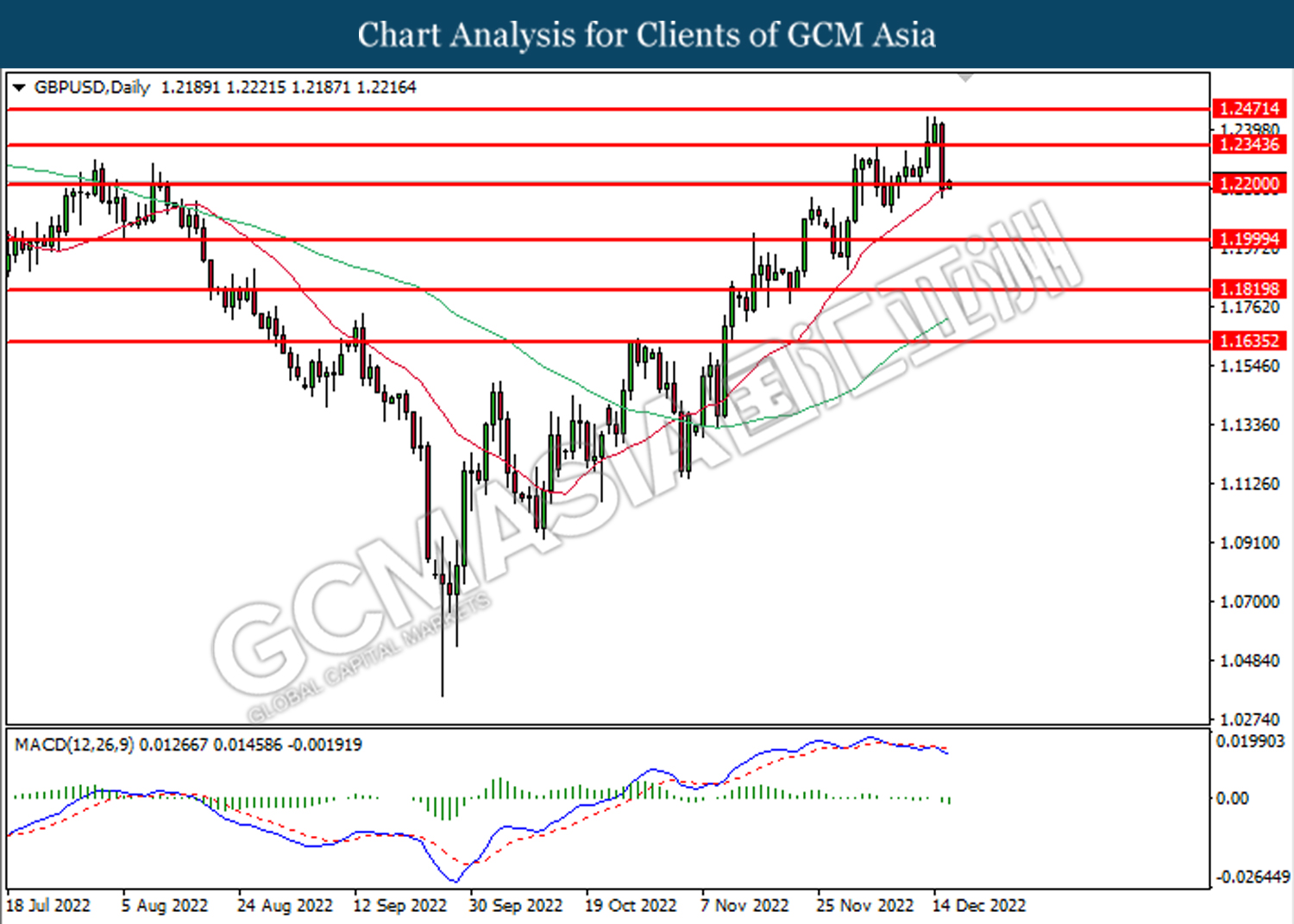

GBPUSD, Daily: GBPUSD was traded lower while currently testing the support level at 1.2200. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.2345, 1.2470

Support level: 1.2200, 1.2000

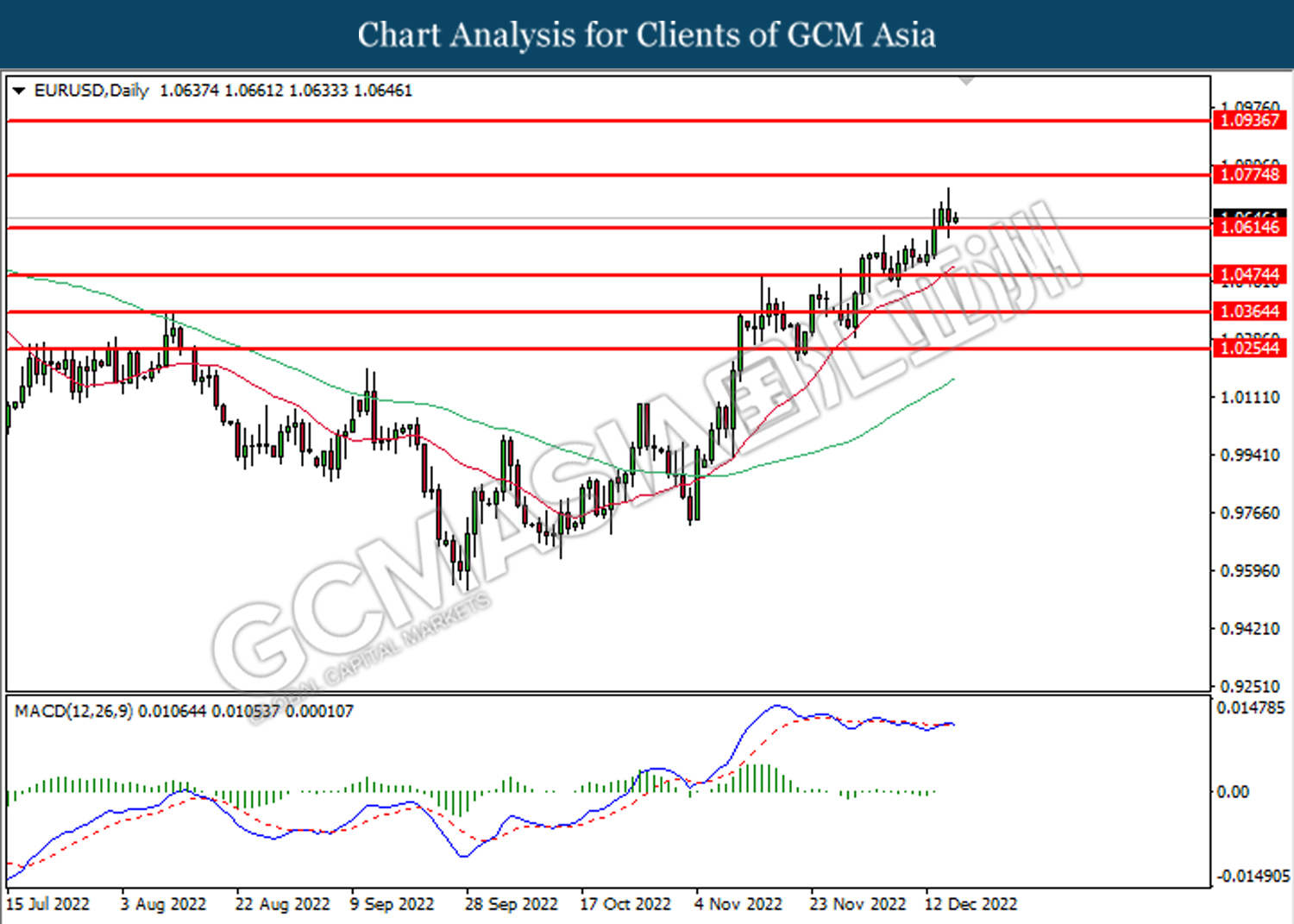

EURUSD, Daily: EURUSD was traded higher following prior breakout above the previous resistance level at 1.0615. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward the resistance level at 1.0775.

Resistance level: 1.0775, 1.0935

Support level: 1.0615, 1.0475

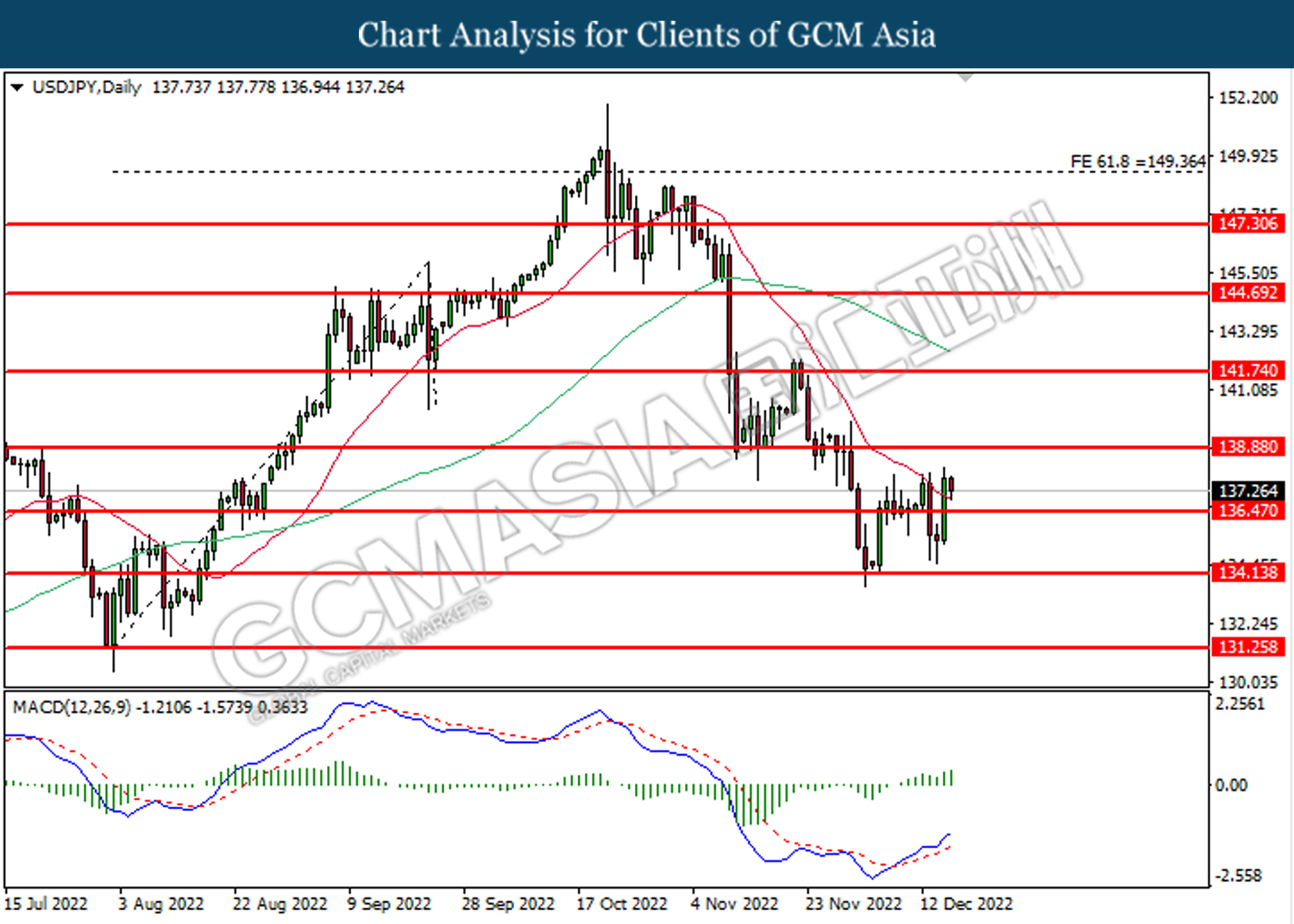

USDJPY, Daily: USDJPY was traded higher following prior breakout above the previous resistance level at 136.45. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 138.90.

Resistance level: 138.90, 141.75

Support level: 136.45, 134.15

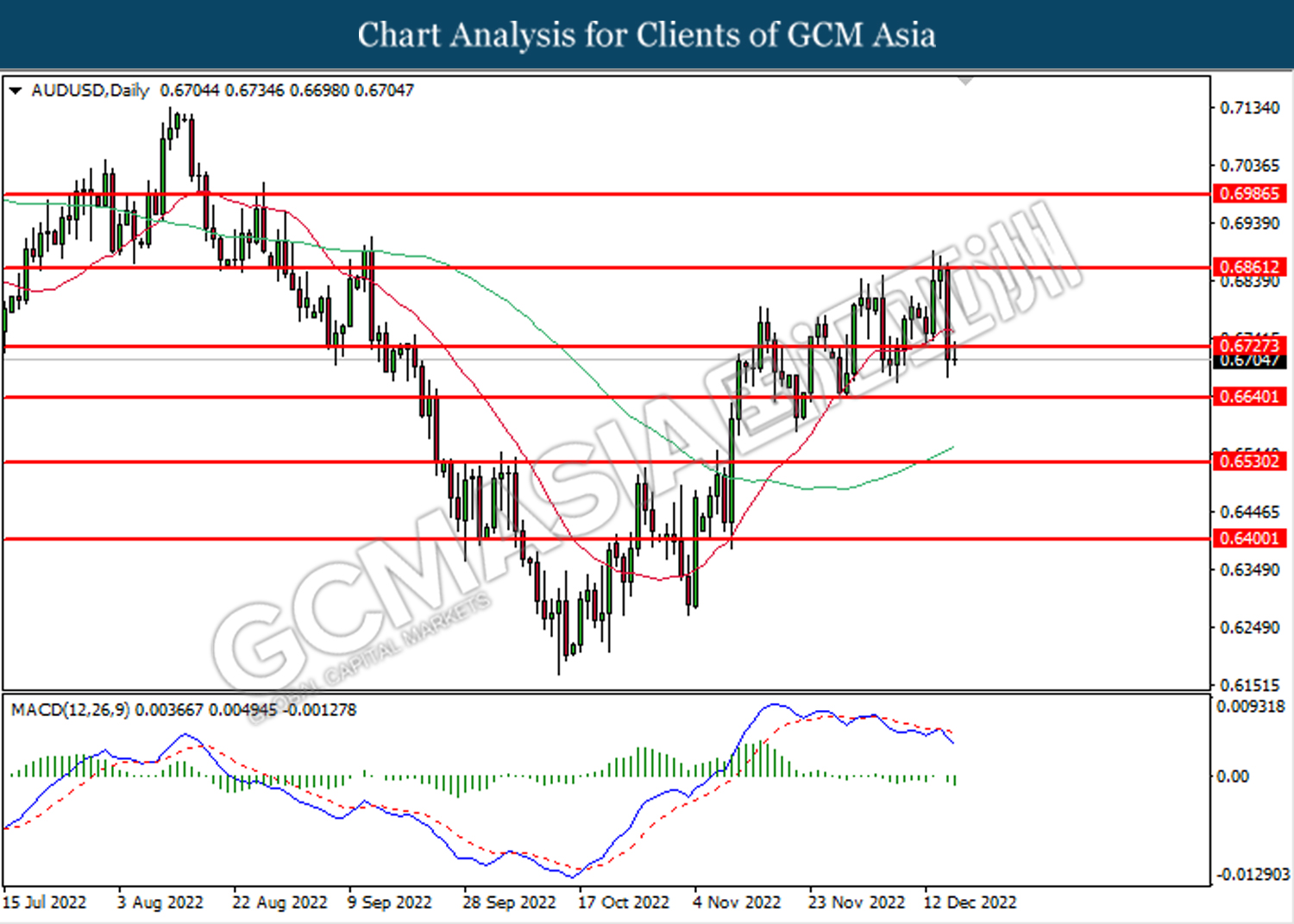

AUDUSD, Daily: AUDUSD was traded lower following prior breakout below the previous support level at 0.6725. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 0.6640.

Resistance level: 0.6725, 0.6860

Support level: 0.6640, 0.6530

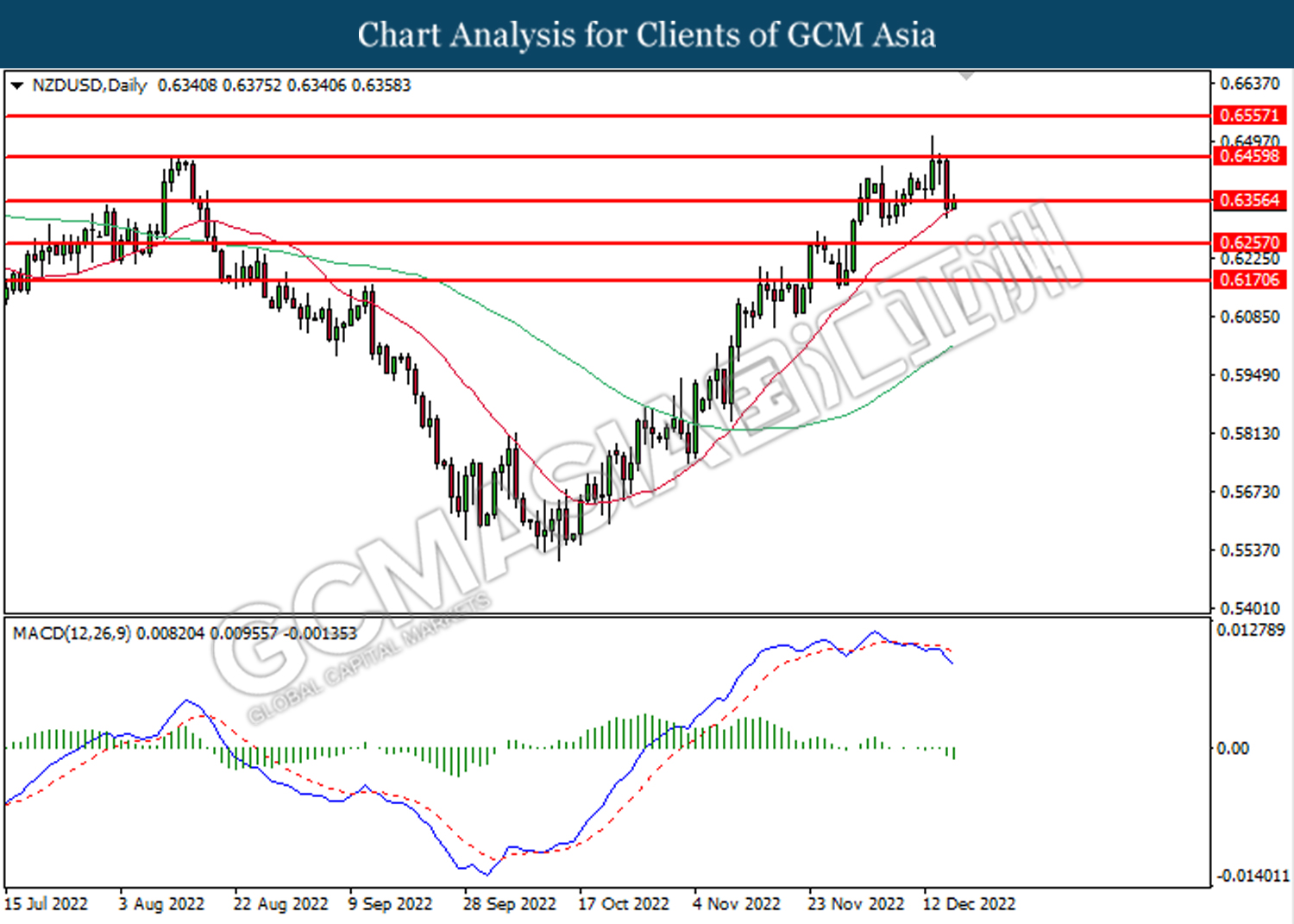

NZDUSD, Daily: NZDUSD was traded higher while currently testing the resistance level at 0.6355. MACD which illustrated bearish bias momentum suggest the pair to undergo technical correction in short term.

Resistance level: 0.6355, 0.6460

Support level: 0.6255, 0.6170

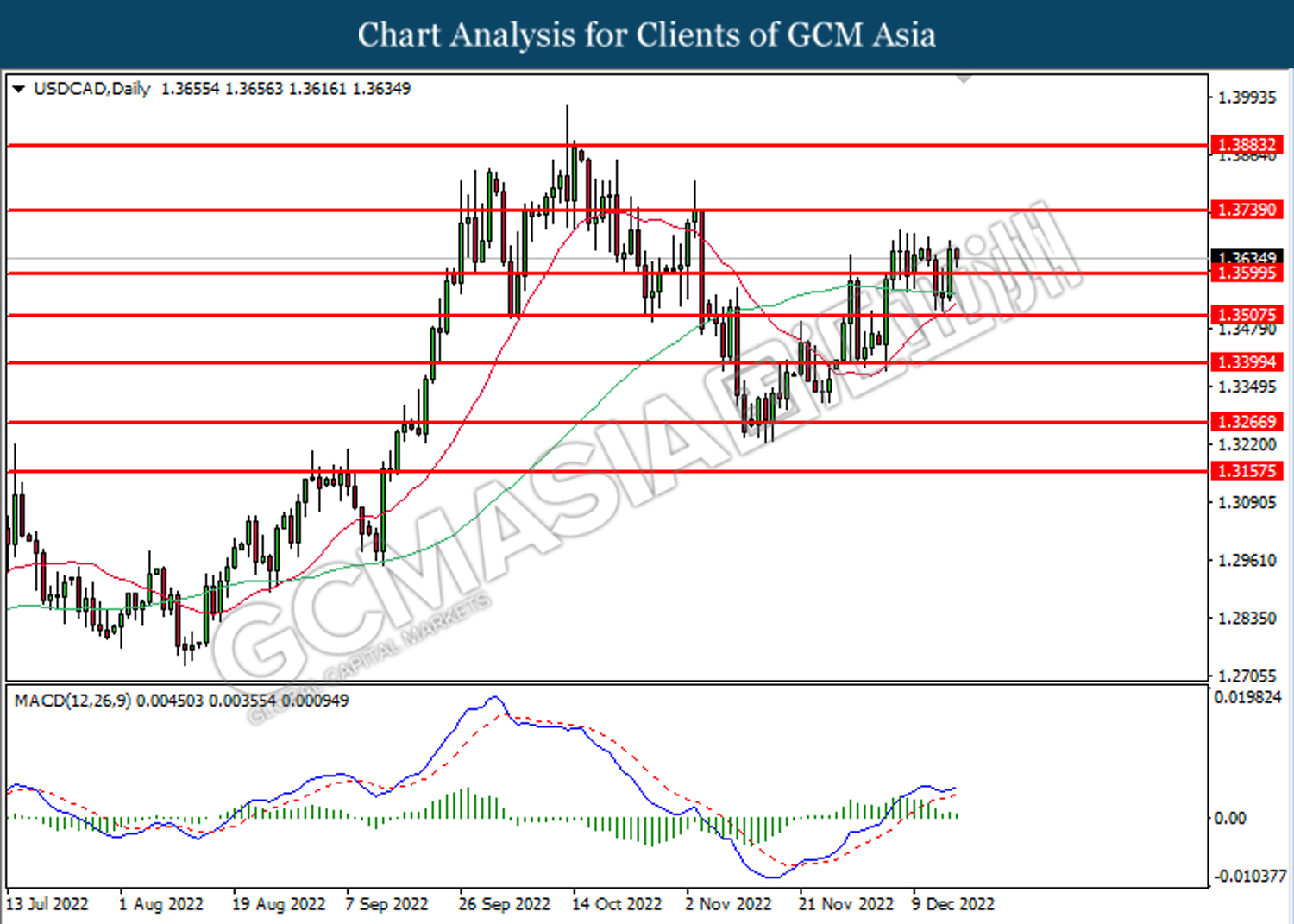

USDCAD, Daily: USDCAD was traded higher following prior breakout above the previous resistance level at 1.3600. MACD which illustrated bullish bias momentum suggests the pair to extend its gains toward the resistance level at 1.3740.

Resistance level: 1.3740, 1.3885

Support level: 1.3600, 1.3505

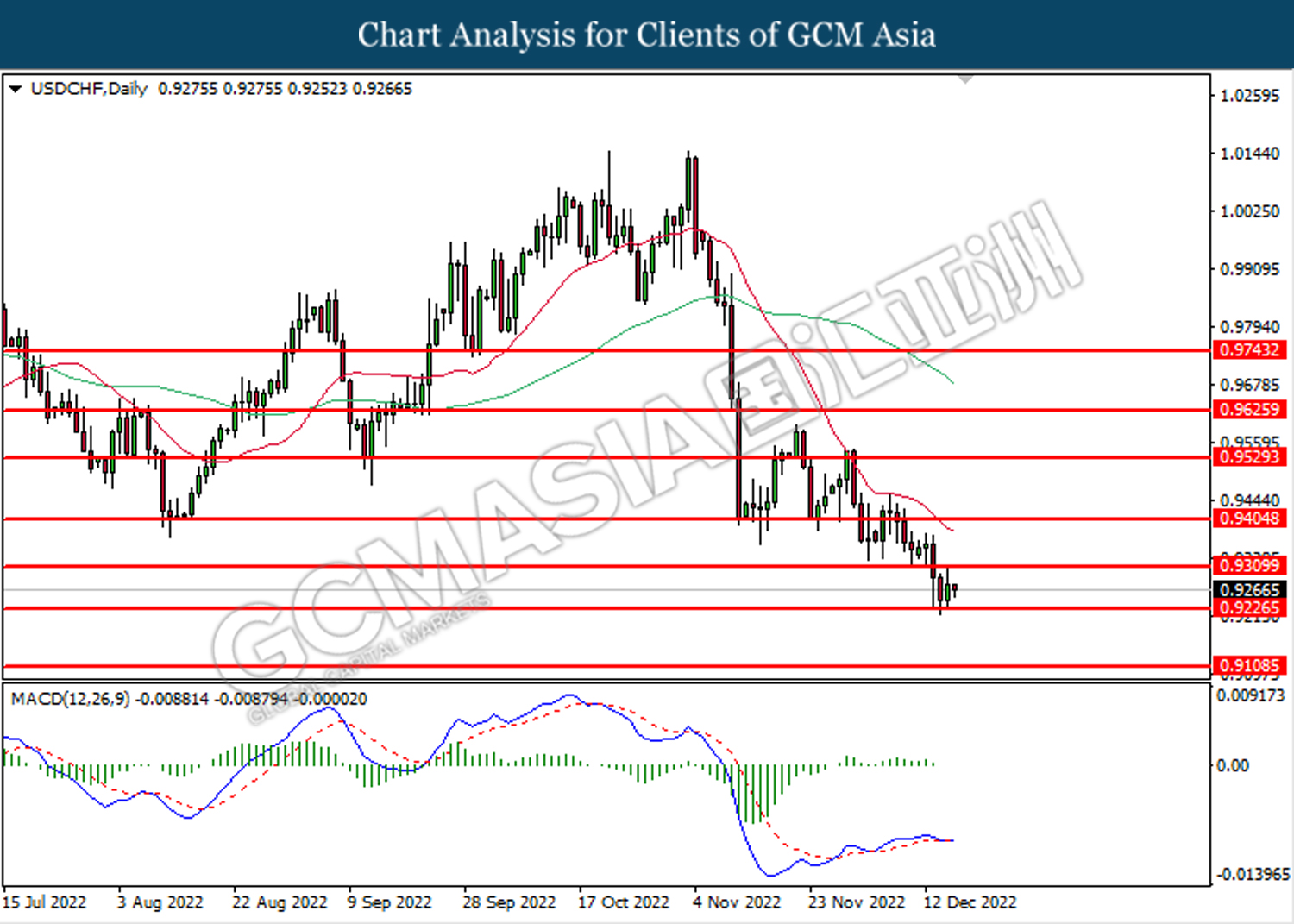

USDCHF, Daily: USDCHF was traded higher following prior rebound from the support level at 0.9225. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward resistance level at 0.9310.

Resistance level: 0.9310, 0.9405

Support level: 0.9225, 0.9110

CrudeOIL, Daily: Crude oil price was traded lower while currently testing the support level at 76.10. However, MACD which illustrated bullish bias momentum suggest the commodity to undergo technical correction in short term.

Resistance level: 80.60, 86.15

Support level: 76.10, 71.45

GOLD_, Daily: Gold price was traded lower following prior breakout below the previous support level at 1786.00. MACD which illustrated bearish bias momentum suggests the commodity to extend its losses toward the support level at 1759.15.

Resistance level: 1786.00, 1807.85

Support level: 1759.15, 1729.85