16 December 2022 Morning Session Analysis

US Dollar skyrocketed as hawkish stance implied.

The Dollar index which traded against a basket of six major currencies surged on yesterday as Fed emphasized its aggressive rate hike stance. The US central bank raised its interest rate by 50 basis point to 4.50% in early Thursday, after four consecutive 75 basis point hikes. In the Press Conference, the Federal Reserve Chairman Jerome Powell reiterated that the current inflation data was not enough to convince Fed to turn its stance, even economy slips toward a possible recession, which hinted that further rate hike might be implemented. The Fed projected continued rate hikes to above 5% in 2023, a level not seen since a steep economic downturn in 2007. On the economic data front, a series of downbeat data has limited the gains of US Dollar. According to Census Bureau, the US retail sales fell more than expected in November, while the US Philadelphia Fed Manufacturing Index was also disappointed most of market participants. The pessimistic economy outlook has stoked a shift in sentiment toward other currencies which provided a better return. As of writing, the Dollar Index rose by 0.77% to 104.21.

In the commodities market, the crude oil price edged up by 0.11% to $76.20 per barrel as of writing after the sharp decline throughout overnight trading session following the Canada’s TC Energy Corp was resuming operations in a section of its Keystone pipeline. In addition, the gold price dropped by 0.05% to $1776.62 per troy ounce as of writing over the strengthening of US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 15:00 | GBP – Retail Sales (MoM) (Nov) | 0.6% | 0.3% | – |

| 16:30 | EUR – German Manufacturing PMI (Dec) | 46.2 | 46.3 | – |

| 17:30 | GBP – Composite PMI | 48.2 | – | – |

| 17:30 | GBP – Manufacturing PMI | 46.5 | 46.5 | – |

| 17:30 | GBP – Services PMI | 48.8 | 49.2 | – |

| 18:00 | EUR – CPI (YoY) (Nov) | 10.0% | 10.0% | – |

Technical Analysis

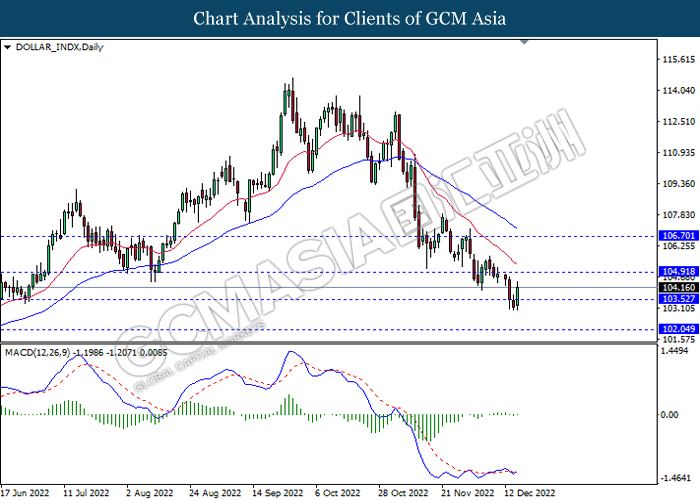

DOLLAR_INDX, Daily: Dollar index was traded higher following prior breakout above the previous resistance level. MACD which illustrated decreasing bearish momentum suggest the index to extend its gains.

Resistance level: 104.90, 106.70

Support level: 103.50, 102.05

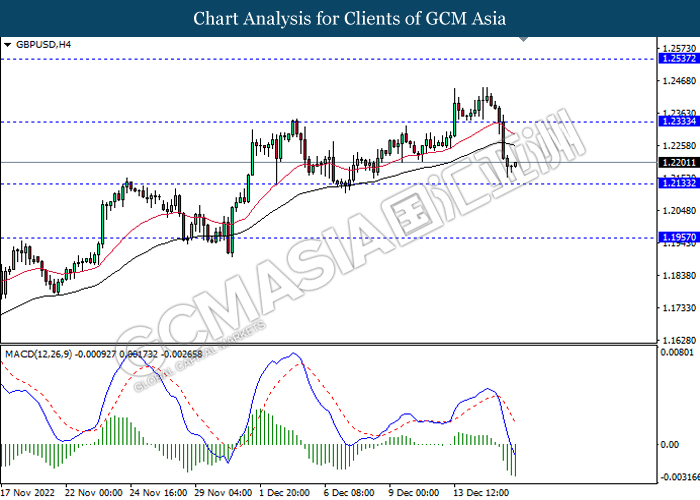

GBPUSD, H4: GBPUSD was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 1.2335, 1.2535

Support level: 1.2135, 1.1955

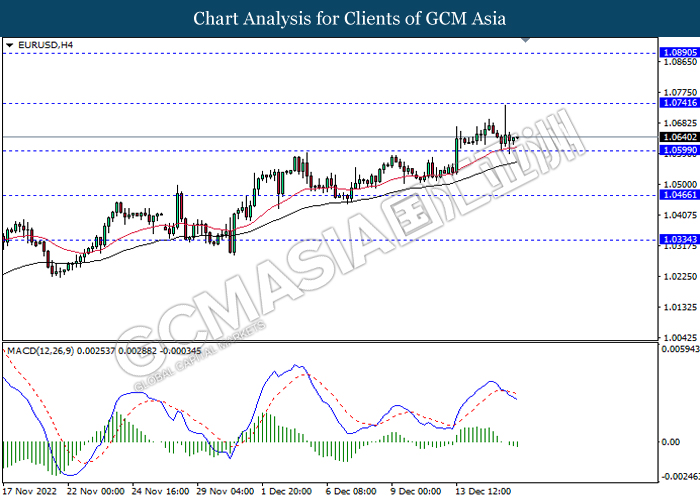

EURUSD, H4: EURUSD was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated increasing bearish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.0740, 1.0890

Support level: 1.0600, 1.0465

USDJPY, Daily: USDJPY was traded higher following prior rebound from the support level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 139.00, 142.10

Support level: 135.35, 131.30

AUDUSD, Daily: AUDUSD was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses if successfully breakout the support level.

Resistance level: 0.6830, 0.6960

Support level: 0.6705, 0.6590

NZDUSD, H4: NZDUSD was traded lower following prior breakout below the previous support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.6360, 0.6460

Support level: 0.6260, 0.6150

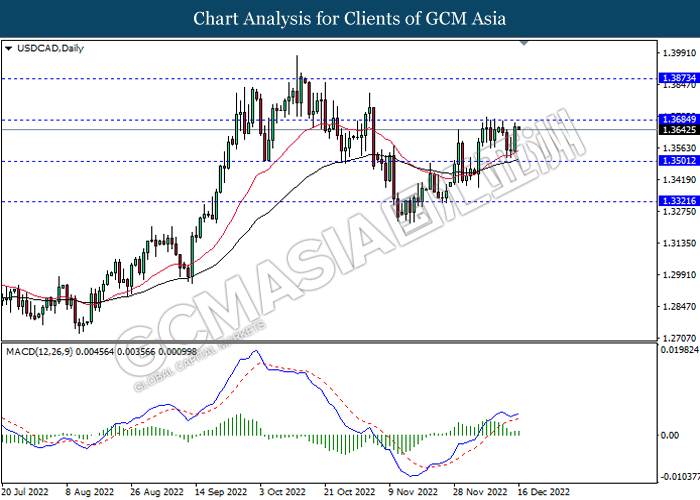

USDCAD, Daily: USDCAD was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains if successfully breakout the resistance level.

Resistance level: 1.3685, 1.3875

Support level: 1.3500, 1.3320

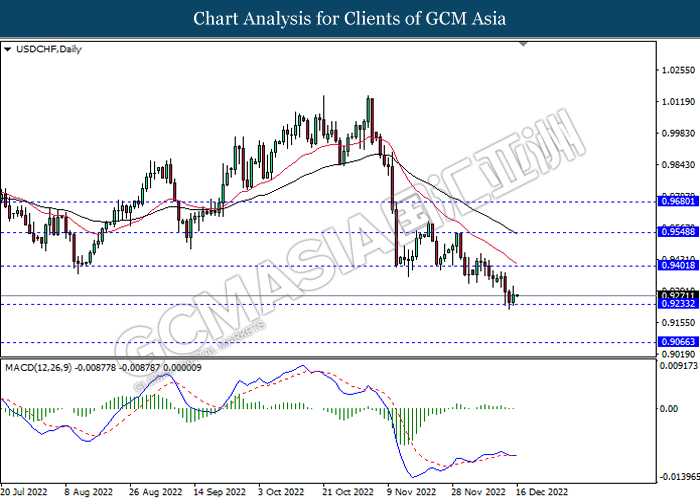

USDCHF, Daily: USDCHF was traded lower while currently testing the support level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses if successfully breakout the support level.

Resistance level: 0.9400, 0.9550

Support level: 0.9235, 0.9065

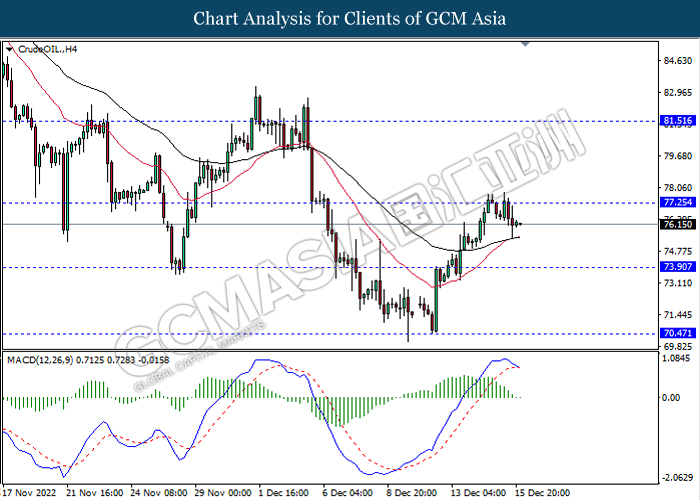

CrudeOIL, H4: Crude oil price was traded lower following prior retracement from the resistance level. MACD which illustrated decreasing bullish momentum suggest the commodity to extend its losses.

Resistance level: 77.25, 81.50

Support level: 73.90, 70.45

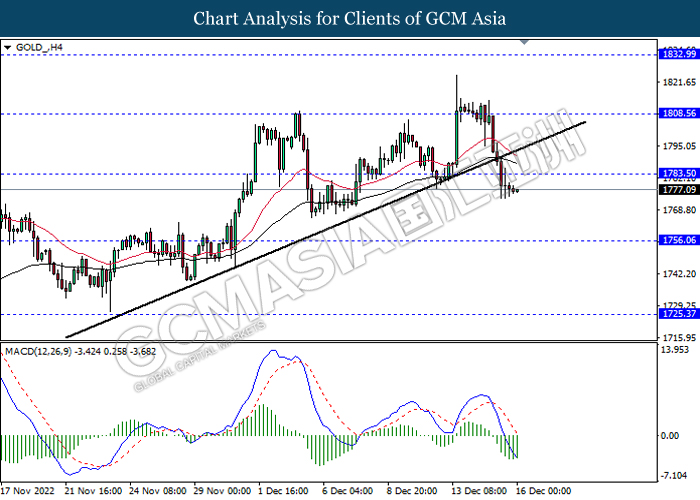

GOLD_, H4: Gold price was traded lower following prior breakout below the support level. However, MACD which illustrated decreasing bearish momentum suggest the commodity to be traded higher as technical correction.

Resistance level: 1783.50, 1808.55

Support level: 1756.05, 1725.35