17 February 2022 Morning Session Analysis

Lack of hawkishness in Fed minutes.

Investors began to reassess their sentiment towards the US dollar following a more dovish meeting minutes from the Federal Reserve. Within the minutes, Fed officials reemphasized that US inflation which lingers at its highest since 1982 may pose a threat towards the economy and jobs market. They also emphasized that keeping monetary policy loose at a longer period of time may jeopardize overall economic momentum. Thus, Fed suggested that they will initiate an interest rate hike which is currently speculated to be done on March meeting. However, Fed reiterates that the decision to initiate a rate hike depends on their analysis of current economic situation which will be done on a meeting basis. The signal suggests that Federal Reserve will still require justification from future economic data, contradicts with market speculation that they will tighten the monetary policy at a faster pace. As of writing, the dollar index is down by 0.01% to 95.75.

For commodities, crude oil price was down by 0.38% to $89.33 per barrel following possibility of US and Iran in reaching a denuclearization deal. On the other hand, gold price was up 0.01% to $1,869.40 a troy ounce due to weaker US dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 21:30 | USD – Building Permits (Jan) | 223K | 220K | – |

| 21:30 | USD – Initial Jobless Claims | 23.2 | 20 | – |

| 21:30 | USD – Philadelphia Fed Manufacturing Index (Feb) | 64.8K | -15.0K | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded higher following prior rebound from lower levels. However, MACD which illustrate bearish signal suggests the index to be traded lower in short-term.

Resistance level: 96.60, 97.65

Support level: 95.80, 94.75

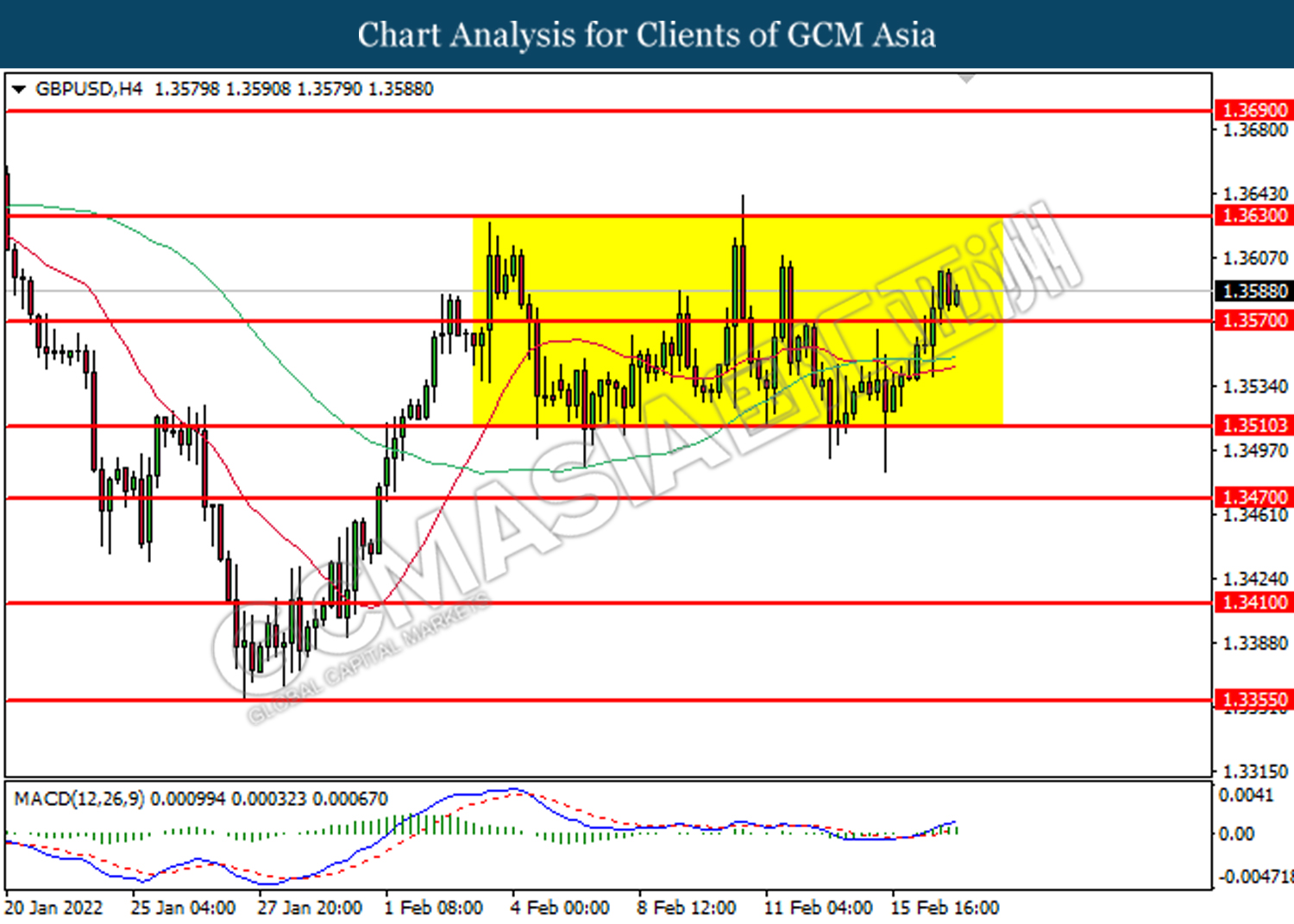

GBPUSD, H4: GBPUSD was traded higher following prior rebound from lower level. MACD which illustrate bullish signal suggests the pair to be traded higher in short-term.

Resistance level: 1.3630, 1.3690

Support level: 1.3570, 1.3510

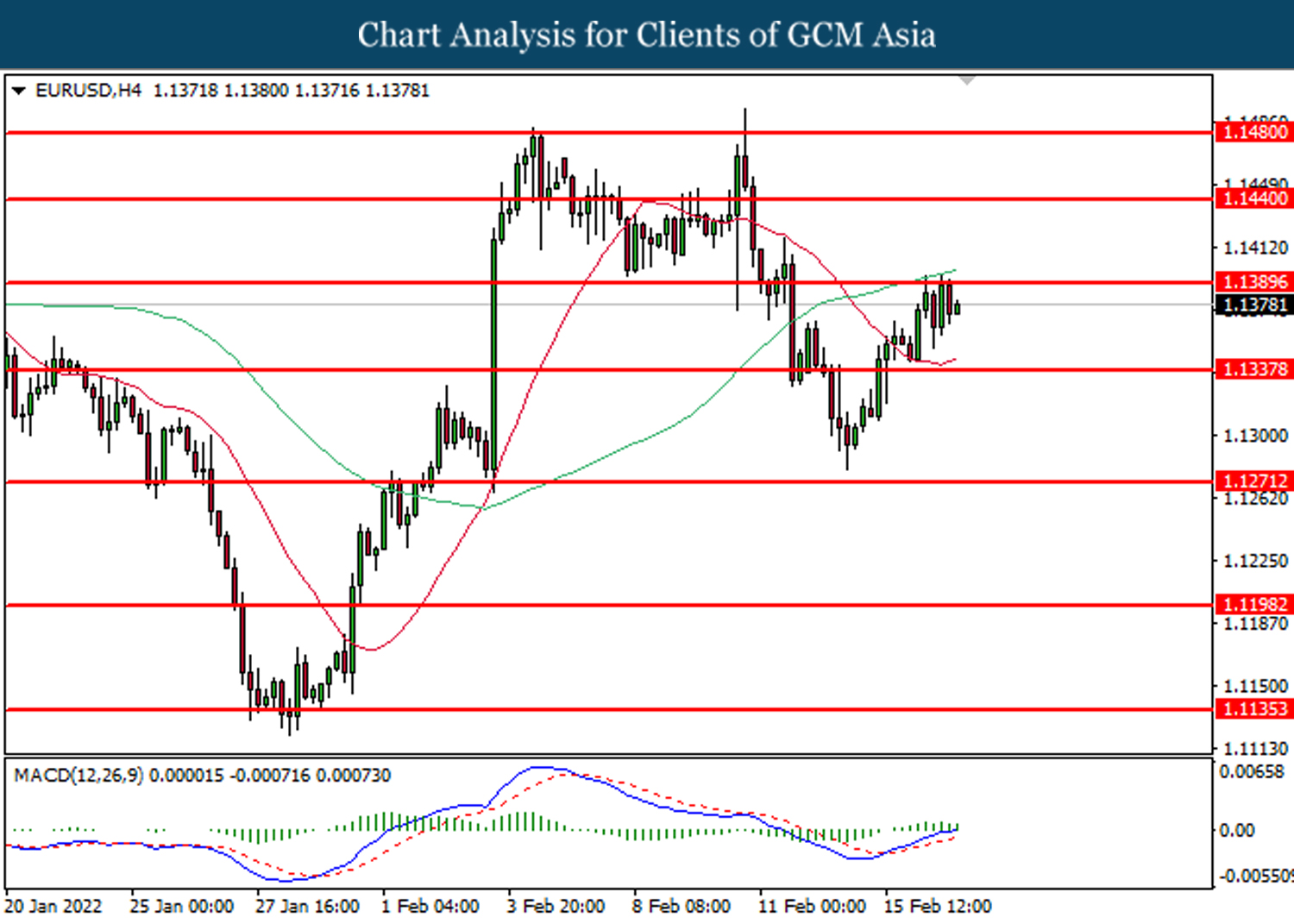

EURUSD, H4: EURUSD was traded higher following prior rebound from lower level. MACD which illustrate bullish signal suggests the pair to be traded higher in short-term.

Resistance level: 1.1390, 1.1440

Support level: 1.1340, 1.1270

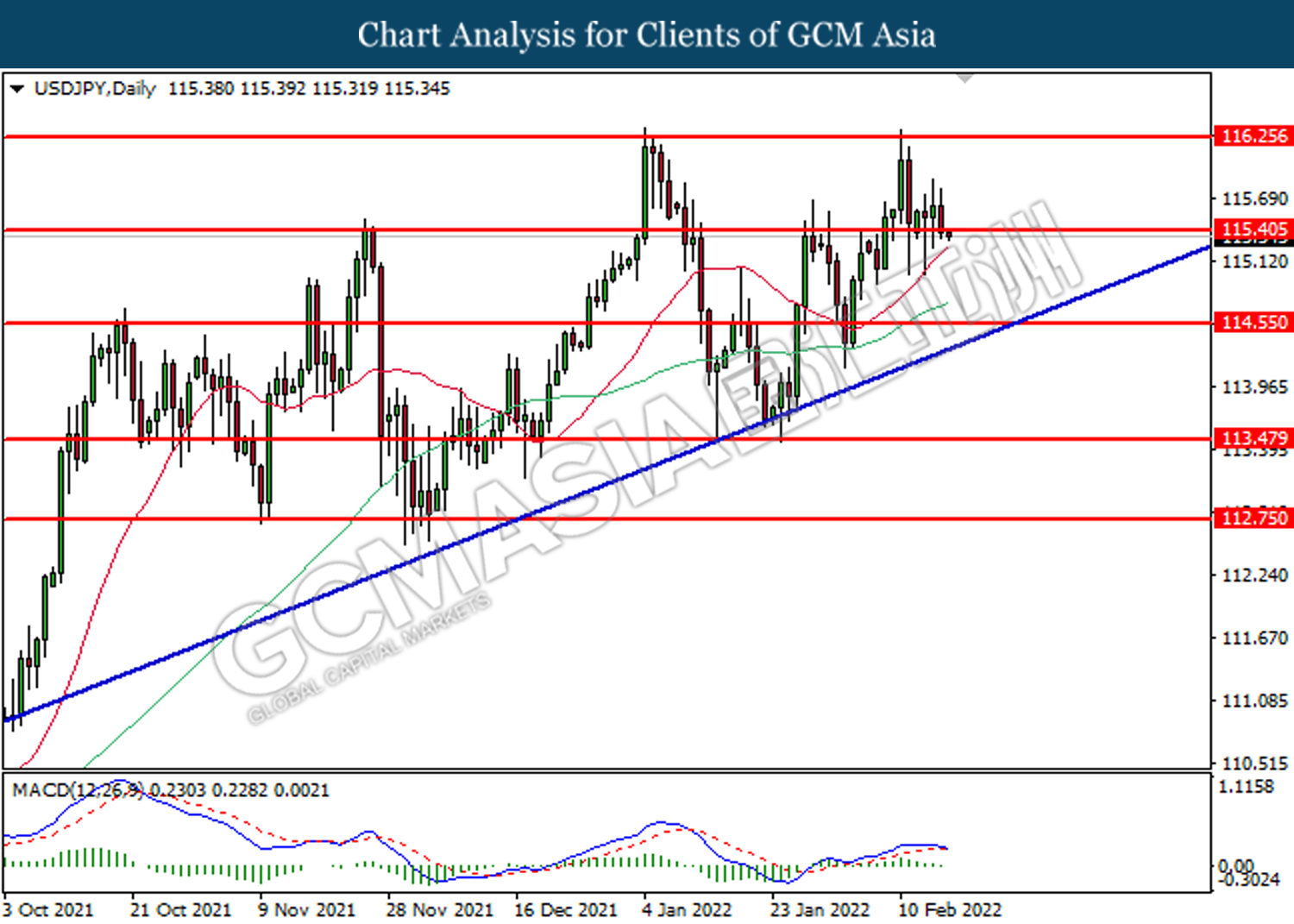

USDJPY, Daily: USDJPY was traded lower following prior retracement from higher level. MACD which illustrate bearish momentum suggests the pair to be traded lower in short-term.

Resistance level: 115.40, 116.25

Support level: 114.55, 113.50

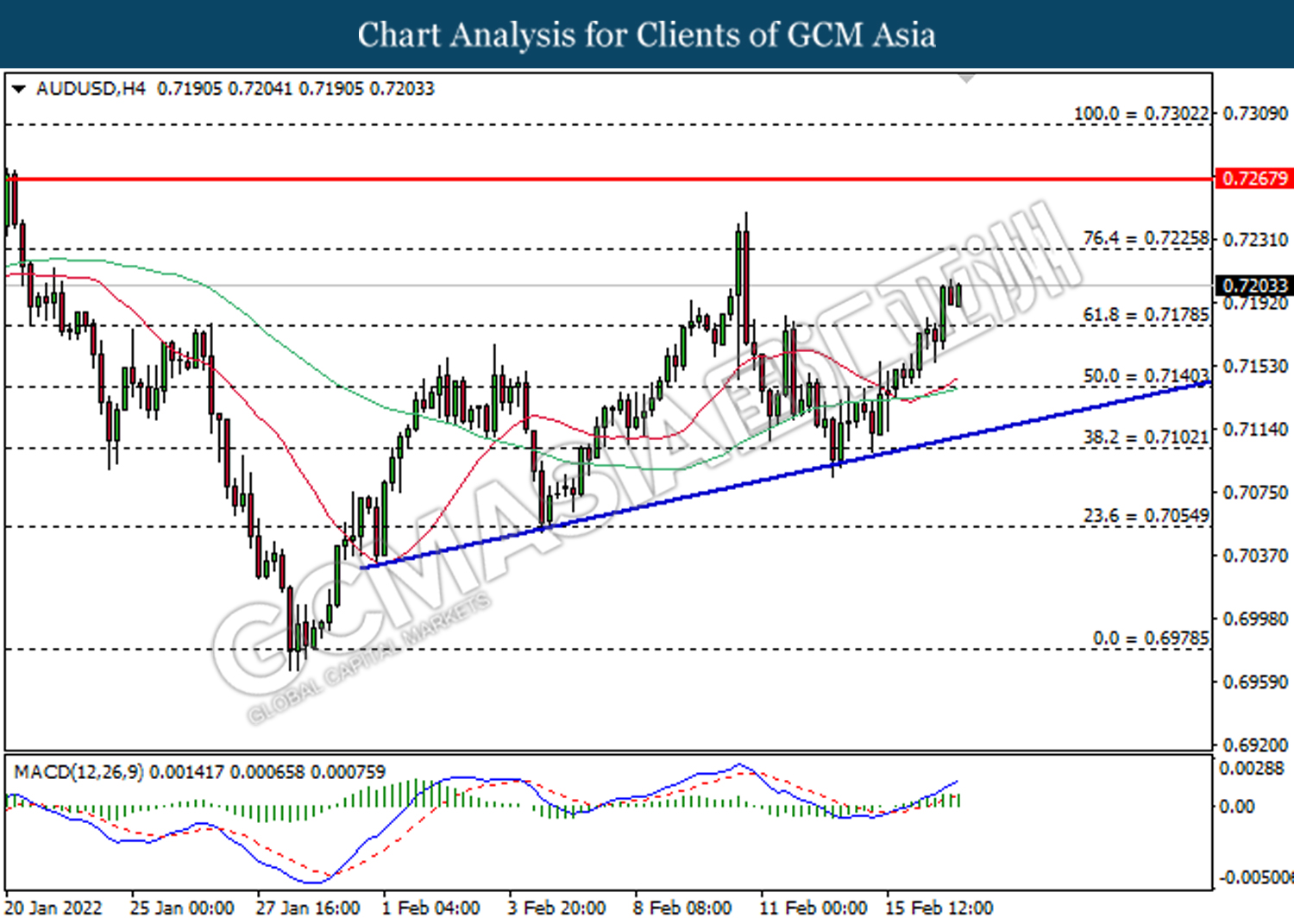

AUDUSD, H4: AUDUSD was traded higher following prior rebound from lower level. MACD which illustrate bullish signal suggests the pair to be traded higher in short-term.

Resistance level: 0.7225, 0.7270

Support level: 0.7180, 0.7140

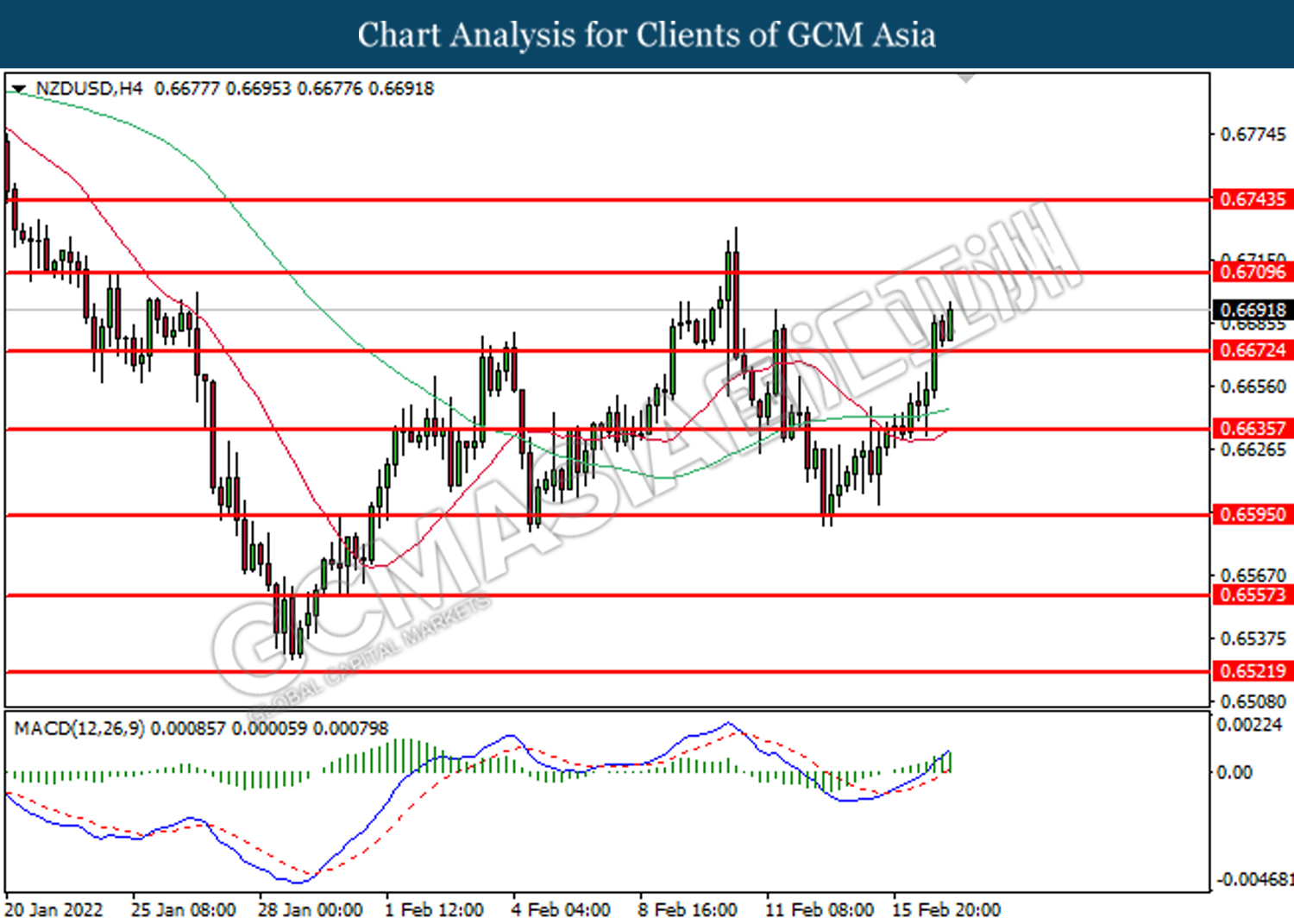

NZDUSD, H4: NZDUSD was traded higher following prior rebound from lower levels. MACD which illustrate bullish signal suggests the pair to be traded higher in short-term.

Resistance level: 0.6710, 0.6745

Support level: 0.6670, 0.6635

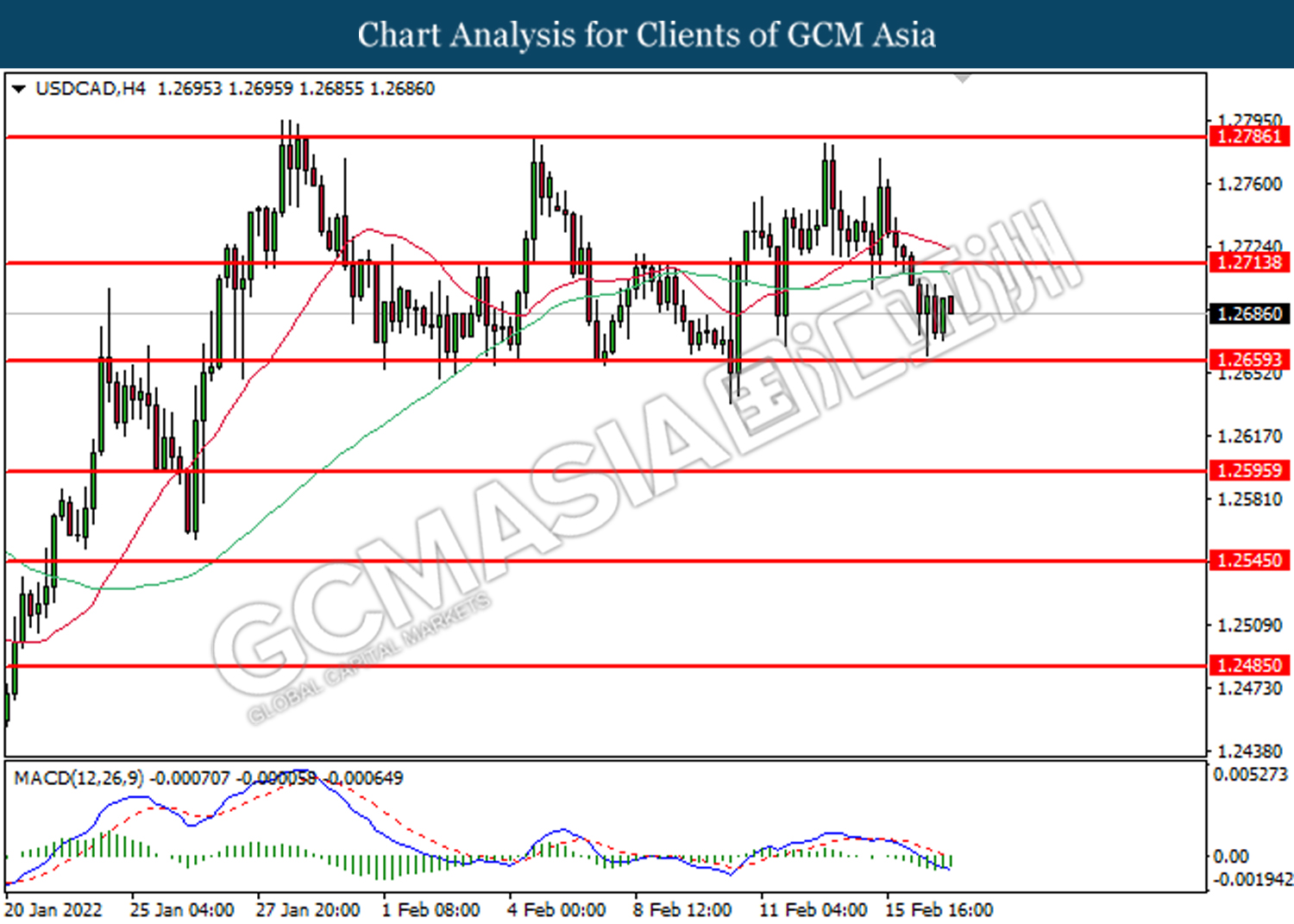

USDCAD, H4: USDCAD was traded lower following prior retracement from higher levels. MACD which illustrate bearish momentum suggests the pair to be traded lower in short-term.

Resistance level: 1.2715, 1.2785

Support level: 1.2660, 1.2600

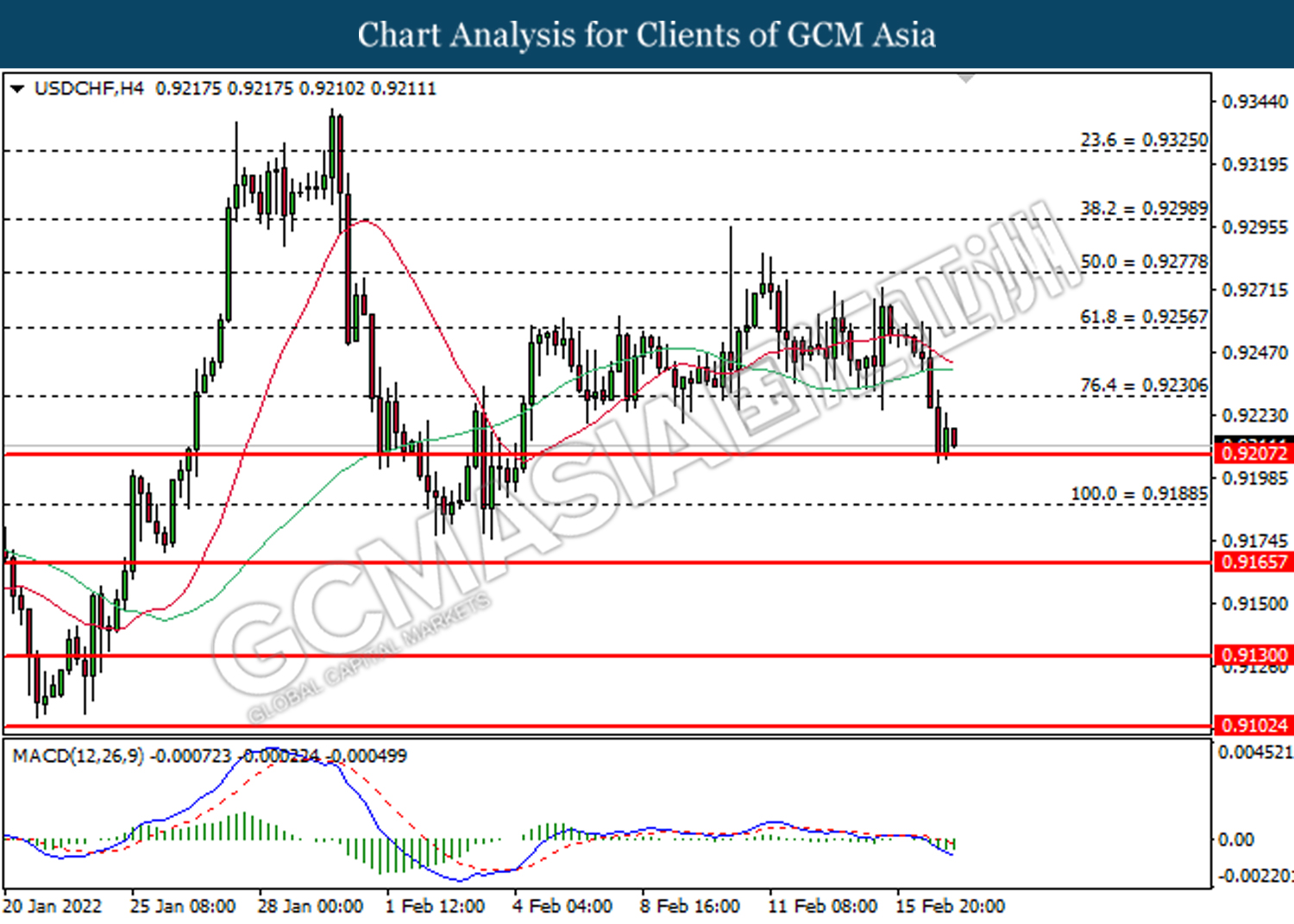

USDCHF, H4: USDCHF was traded lower following prior retracement from higher levels. MACD which illustrate bearish signal suggests the pair to be traded lower in short-term.

Resistance level: 0.9230, 0.9255

Support level: 0.9210, 0.9190

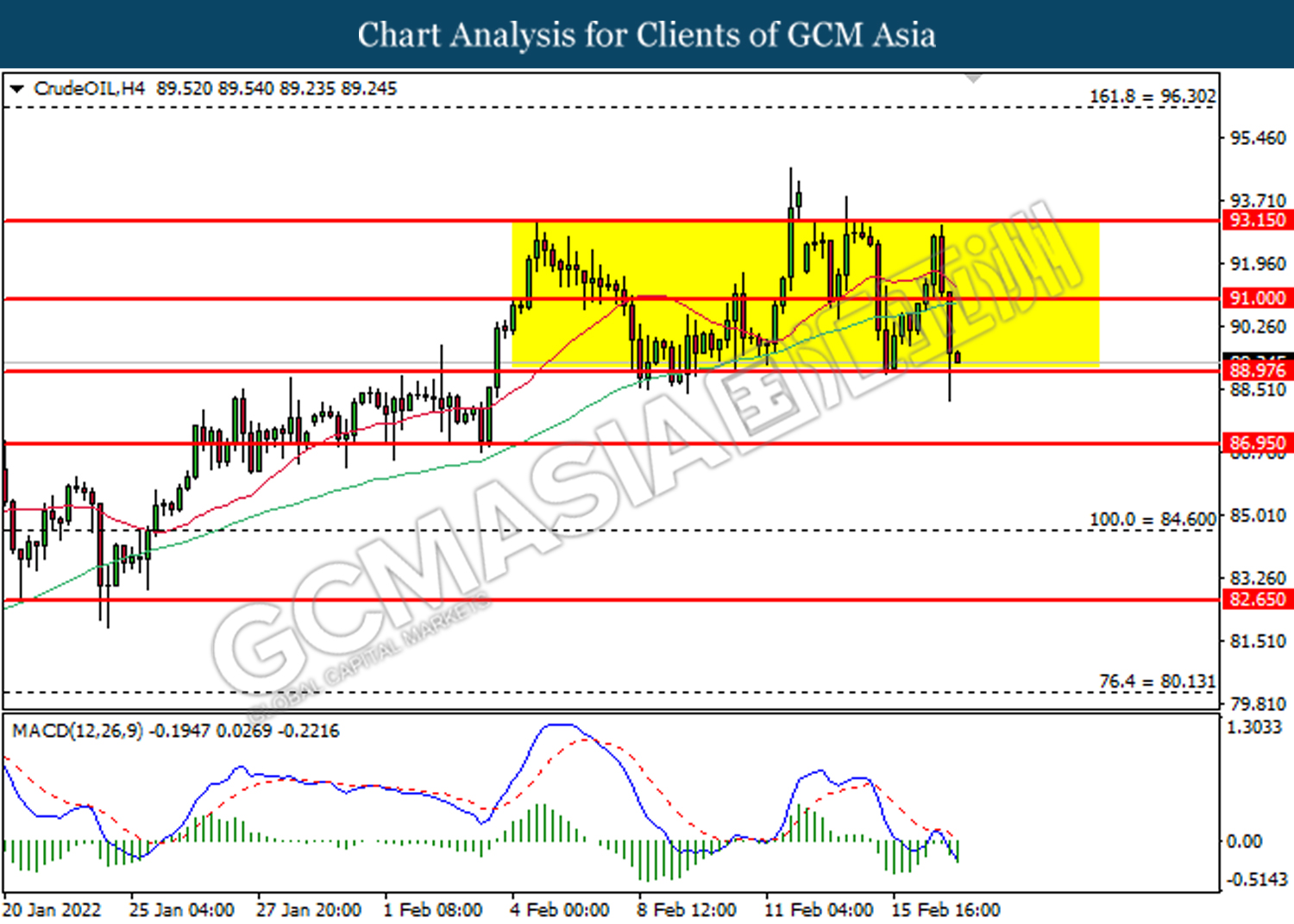

CrudeOIL, H4: Crude oil price was traded lower following prior retracement from higher levels. MACD which illustrate bearish signal suggests its price to be traded lower after breaking the support level.

Resistance level: 91.00, 93.15

Support level: 88.95, 86.95

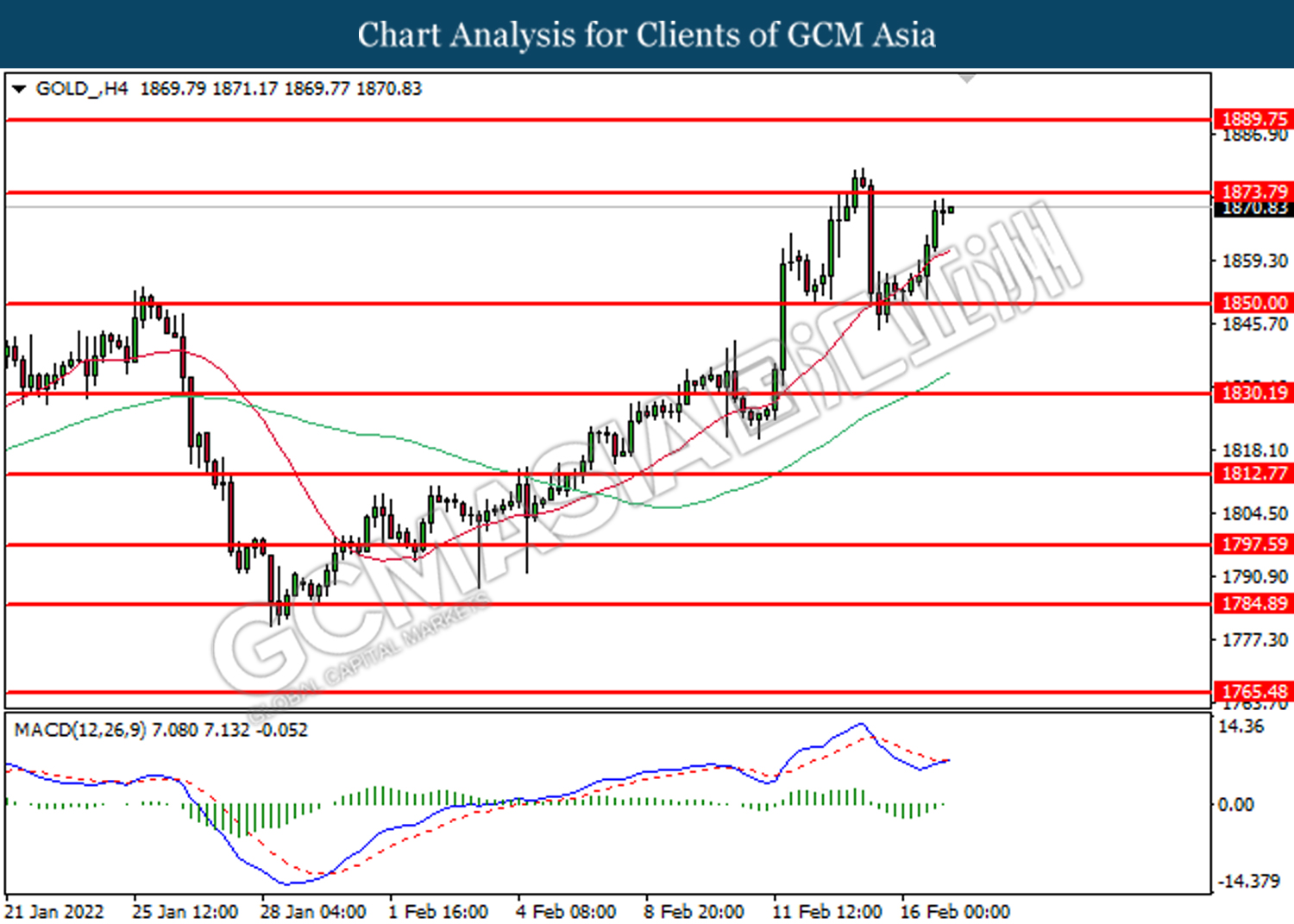

GOLD_, H4: Gold price was traded higher following prior rebound from lower levels. MACD which illustrate bullish signal suggests its price to be traded higher after breaking the resistance level.

Resistance level: 1873.80, 1889.75

Support level: 1850.00, 1830.20