17 February 2023 Afternoon Session Analysis

Lowe hints inflation around the peak, Aussie slip afterward.

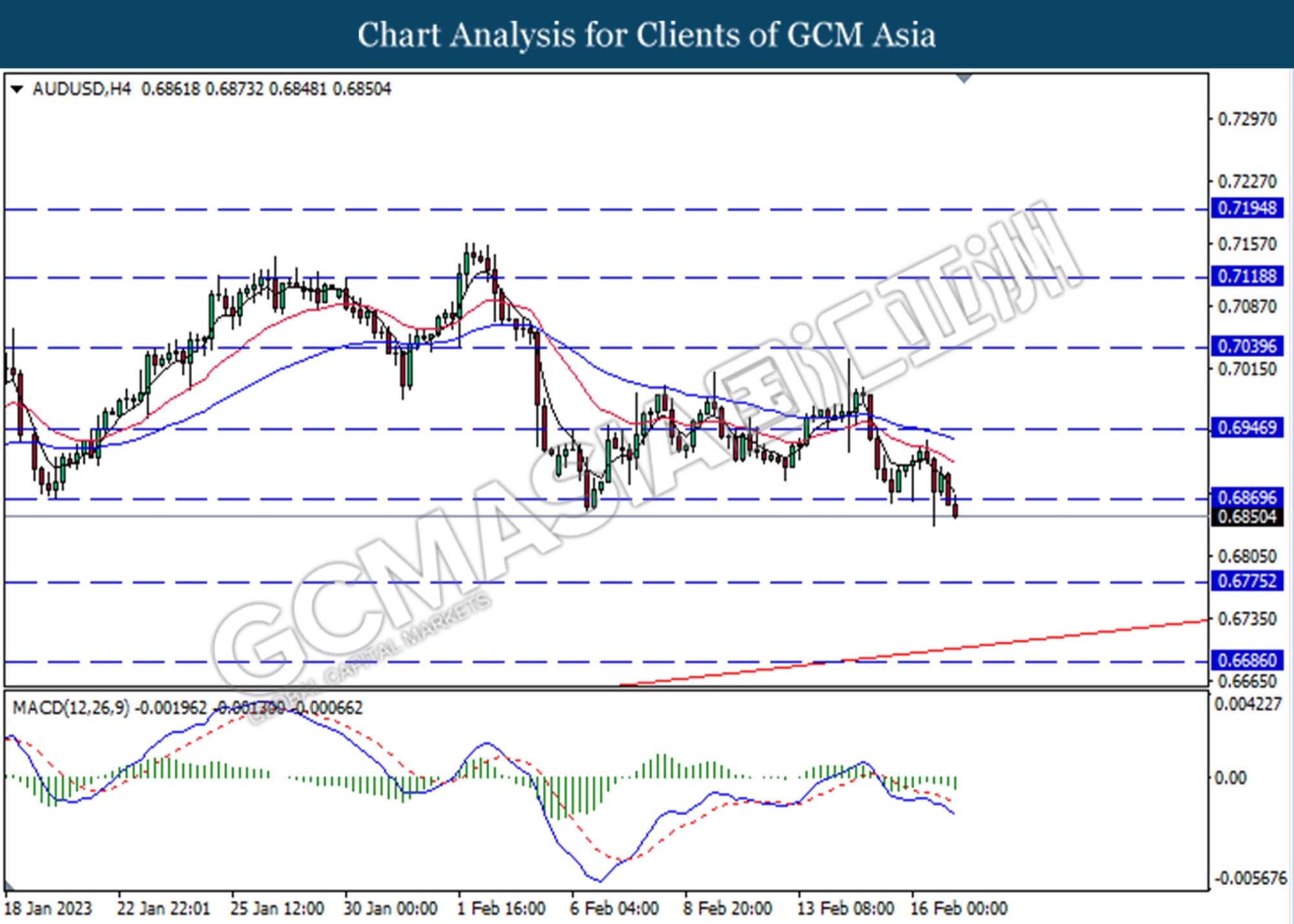

The Aussie, one of the major currencies traded by global investors, continued its downward trend for 3 consecutive days amid Lowe’s hint for inflation around the peak. The Reserve Bank of Australia (RBA) Governor mentioned in the statement that the consumer price index was in line with the forecast, it will decline to 4.75% over 2023 and to around 3% in the mid of 2025. With the global supply chain problems that have been relieved, shipping expenses, and oil prices off their peaks, the problem of high inflationary pressures is easing at the moment. Those remarks increased the investor’s expectation for a shift in RBA’s stance over the path of monetary policy. Moreover, Australia showed that its labor market remained fragile, which would stop the RBA from adopting an aggressive tightening move. According to the Australian Bureau of Statics, the employment change of Jan posted a negative reading at -11.5K, and unemployment rose by 0.2% to 3.7%. As of writing, AUD/USD slipped -0.49% to $0.6843.

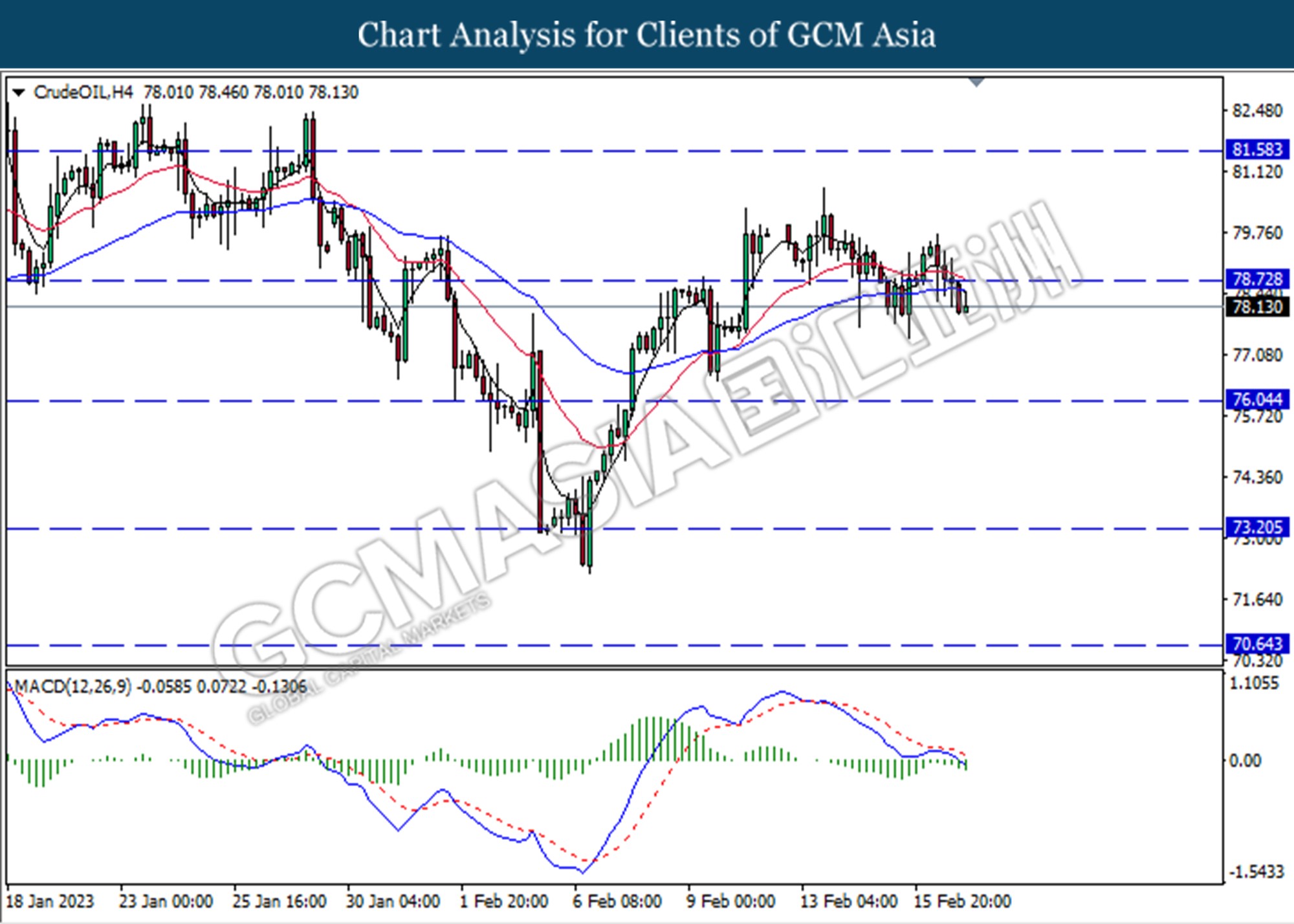

In the commodity market, the price of crude oil edged lower by -0.92% to $77.77 a barrel amid investor-heightened concerns that the Fed would further tighten monetary policy and hit the oil demand. In addition, the price of gold edged down by -0.84% to $1836.20 per troy ounce amid hawkish comments over the interest rate hike from Fed officials.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

N/A

Technical Analysis

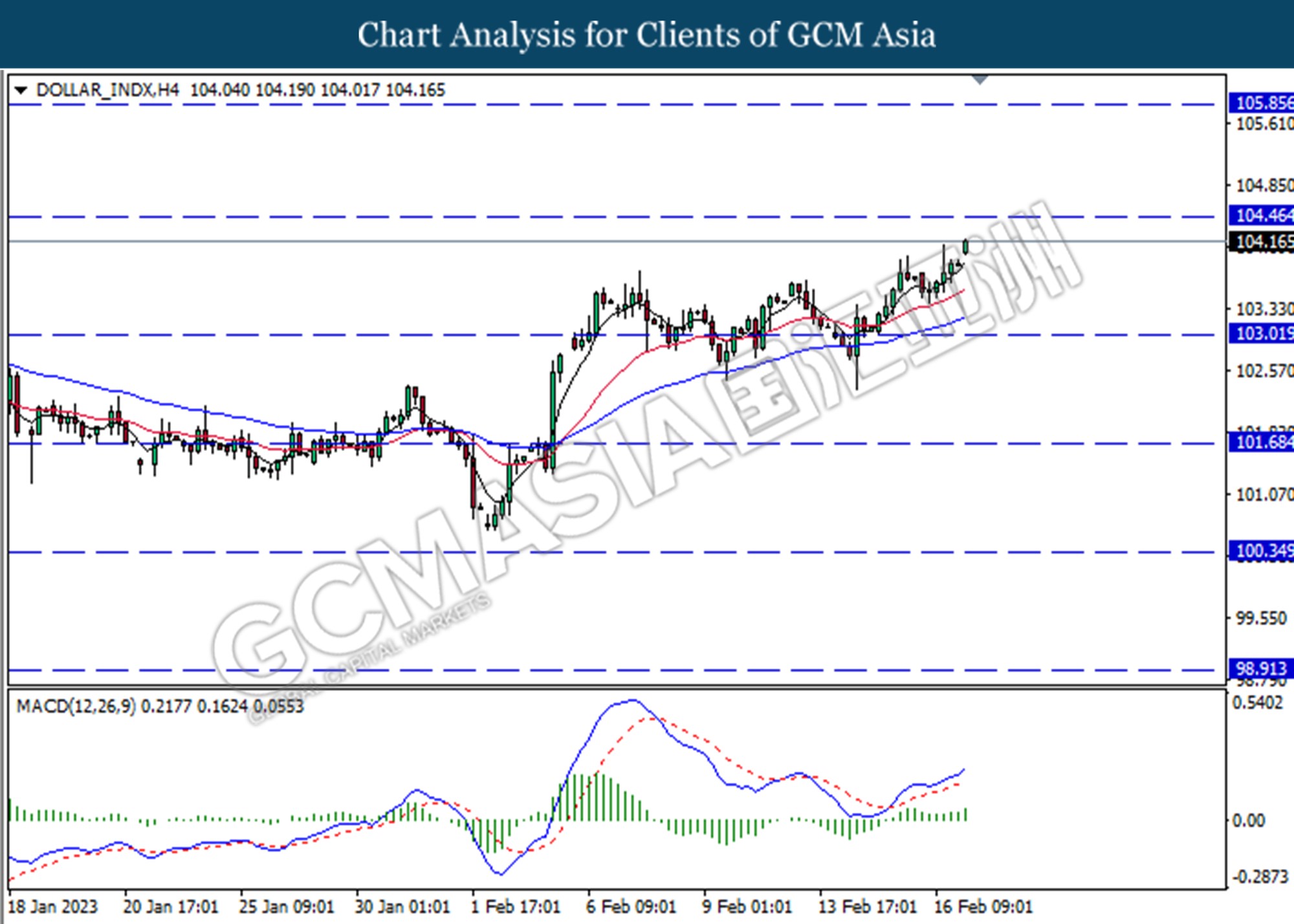

DOLLAR_INDX, H4: Dollar index was traded higher following a prior rebound from the lower level. MACD which illustrated bullish bias momentum suggests the index to extend its gains toward the resistance level at 104.45.

Resistance level: 104.45, 105.85

Support level: 103.00,101.70

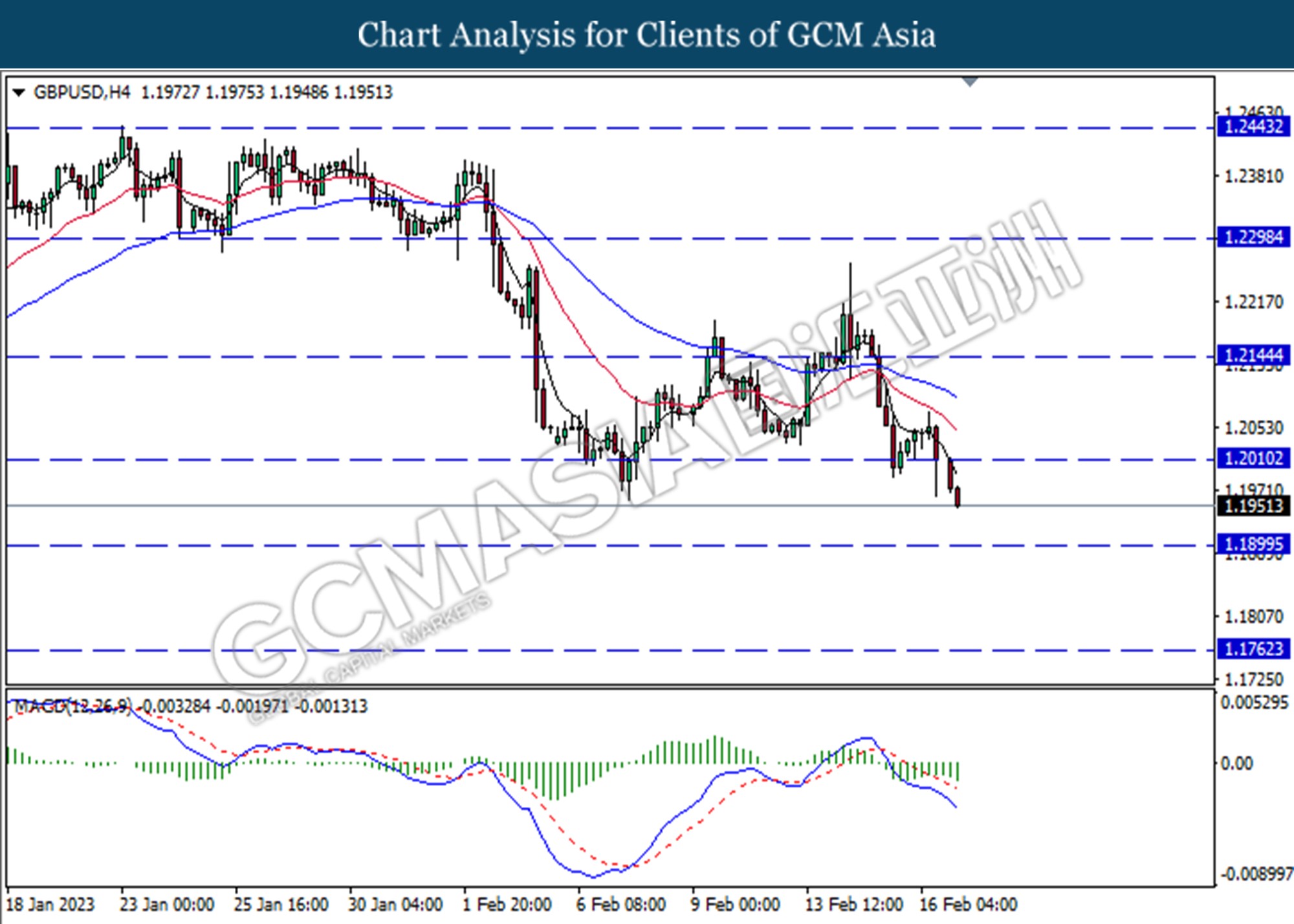

GBPUSD, H4: GBPUSD was traded lower following the prior breakout below the previous support level at 1.2010. MACD which illustrated bearish bias momentum suggests the pair to extend its losses toward the support level at 1.1900.

Resistance level: 1.2010, 1.2145

Support level: 1.1900, 1.1765

EURUSD, H4: EURUSD was traded lower following a prior retracement from a higher level. MACD which illustrated increasing bearish momentum suggests the pair to extend its losses toward the support level at 1.6035.

Resistance level: 1.0850, 1.0975

Support level: 1.0635, 1.0465

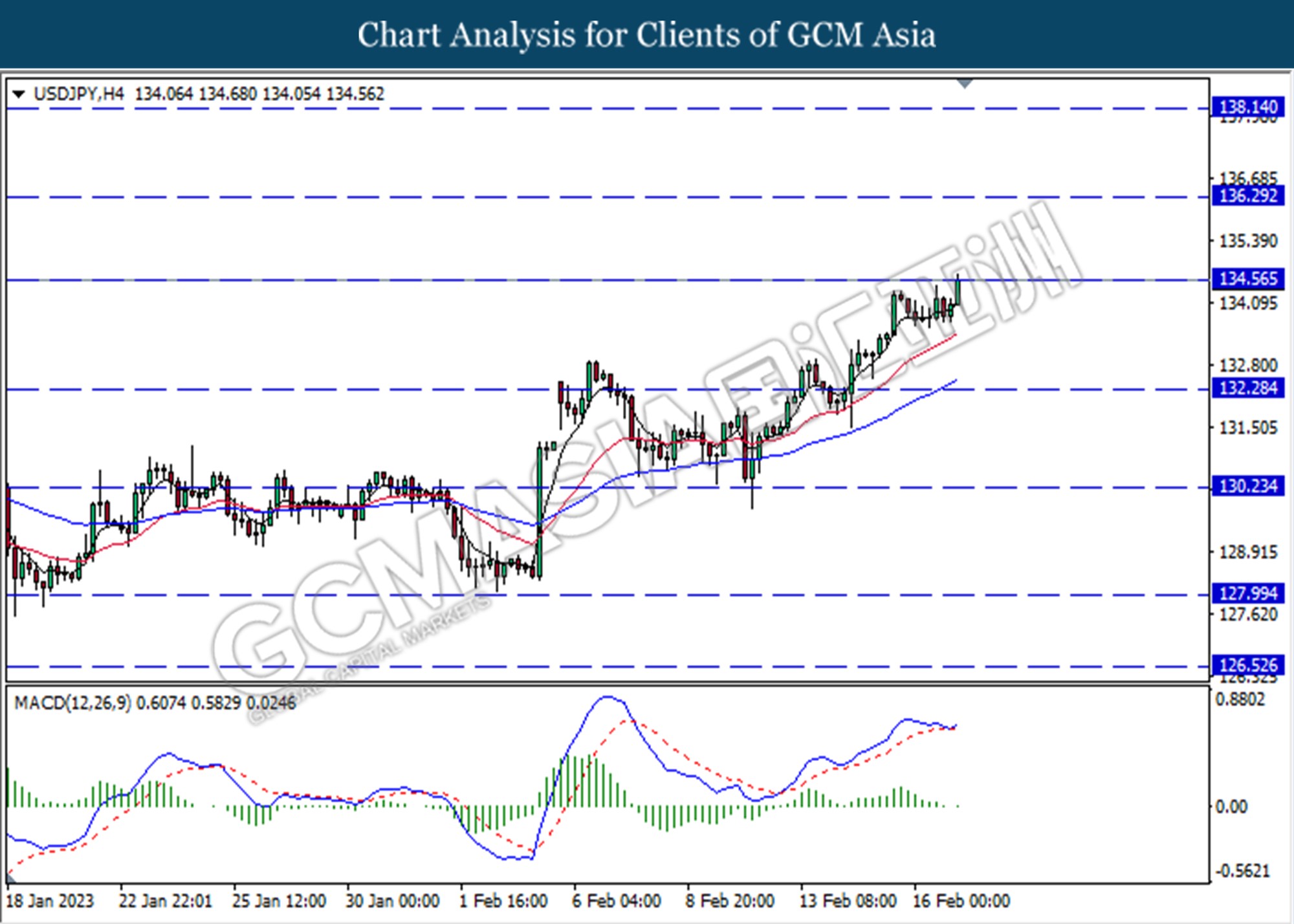

USDJPY, H4: USDJPY was traded higher while currently testing for the resistance level at 134.55. However, MACD which illustrated diminishing bullish momentum suggests the pair undergo a technical correction in the short-term.

Resistance level: 134.55, 136.30

Support level: 132.30, 130.25

AUDUSD, H4: AUDUSD was traded lower following a prior break below the previous support level at 0.6870. MACD which illustrated bearish momentum suggests the pair to extend its losses toward the support level at 0.6775.

Resistance level: 0.6870, 0.6945

Support level: 0.6775, 0.6685

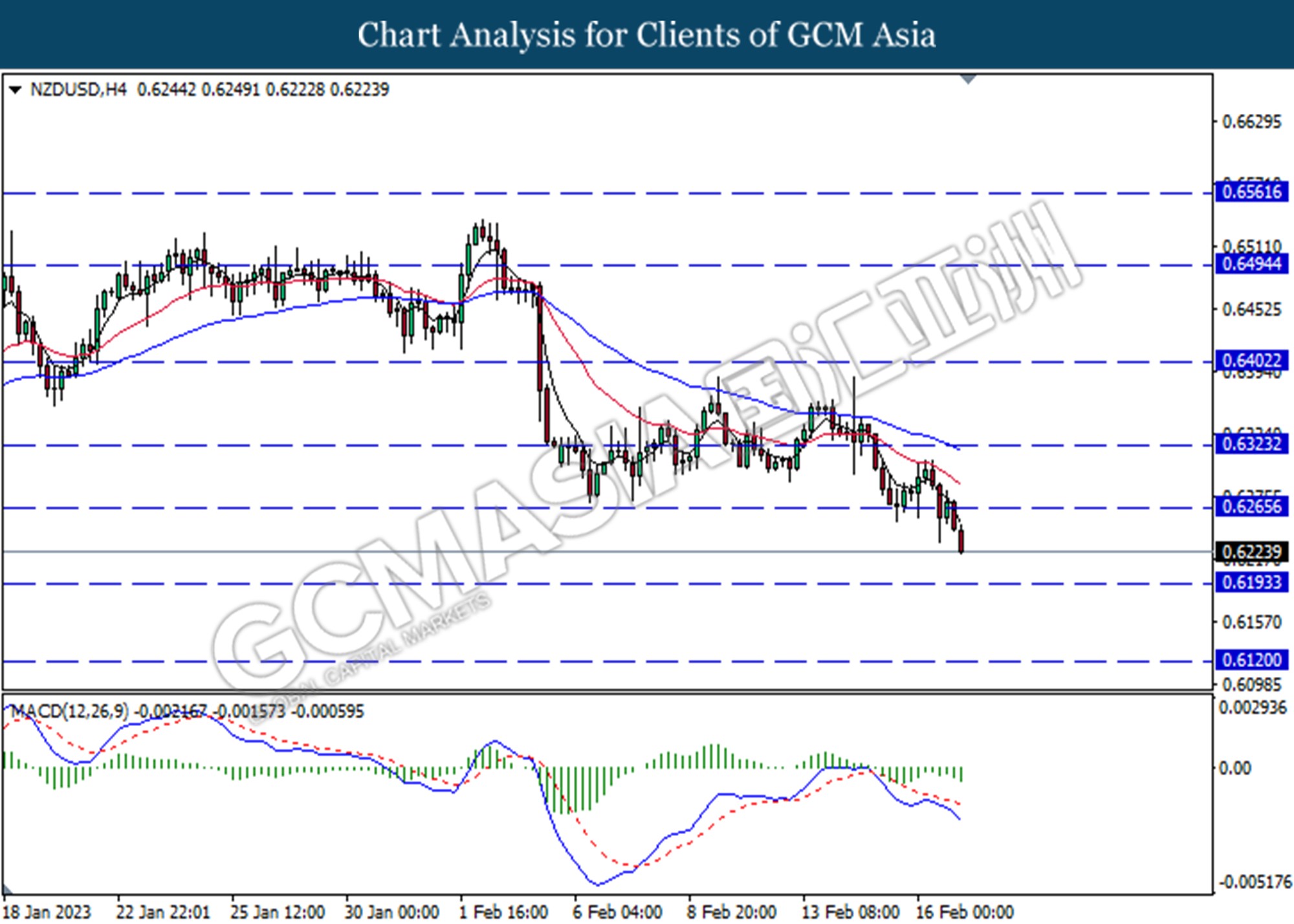

NZDUSD, H4: NZDUSD was traded lower following a prior break below the previous support level at 0.6195. MACD which illustrated bearish momentum suggests the pair to extend its losses toward the support level at 0.6195.

Resistance level: 0.6265, 0.6325

Support level: 0.6195, 0.6120

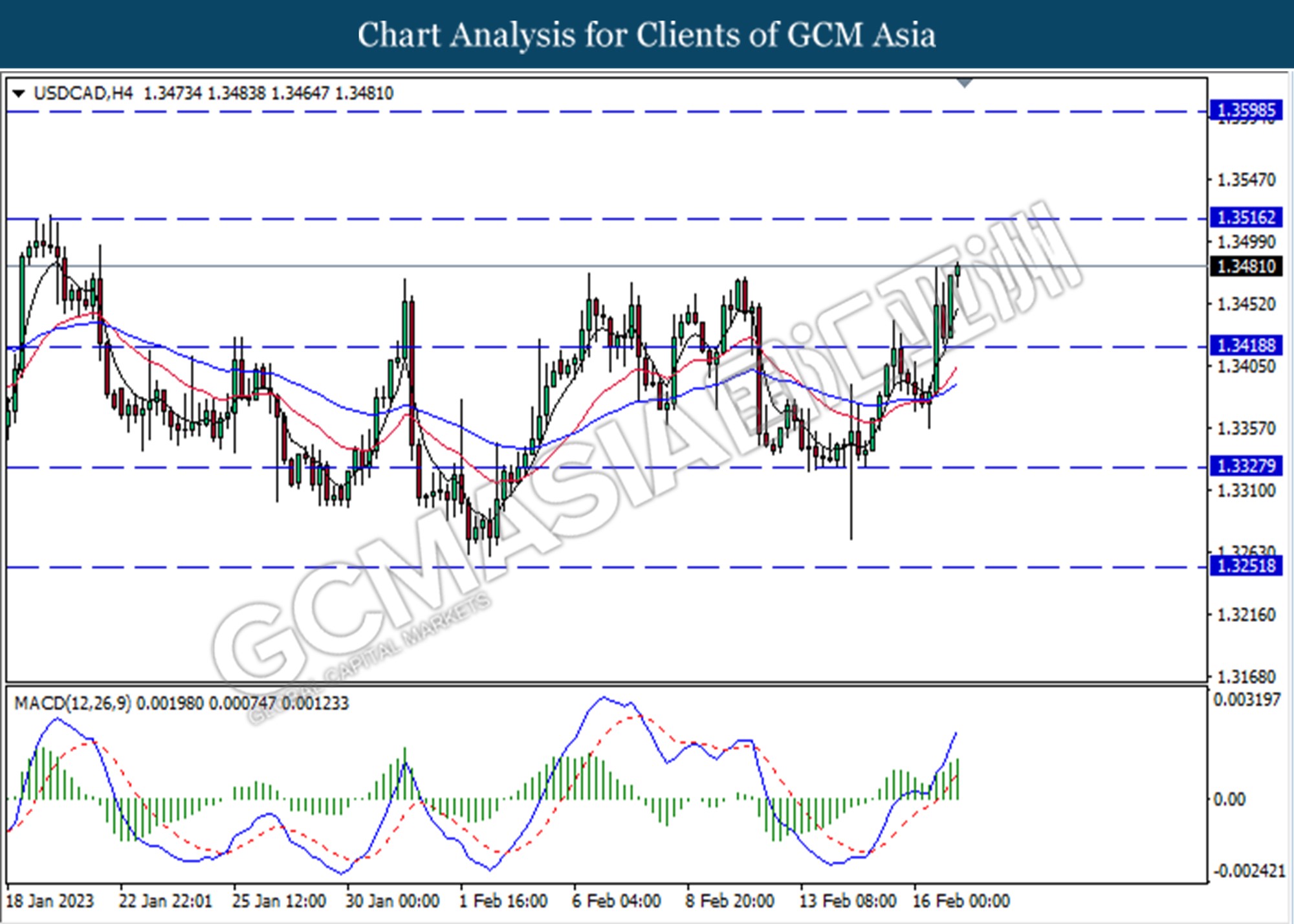

USDCAD, H4: USDCAD was traded higher following a prior break above the previous resistance level at 1.3420. MACD which illustrated bullish momentum suggests the pair to extend its gains toward the resistance level at 1.3515.

Resistance level: 1.3515, 1.3600

Support level: 1.3420, 1.3330

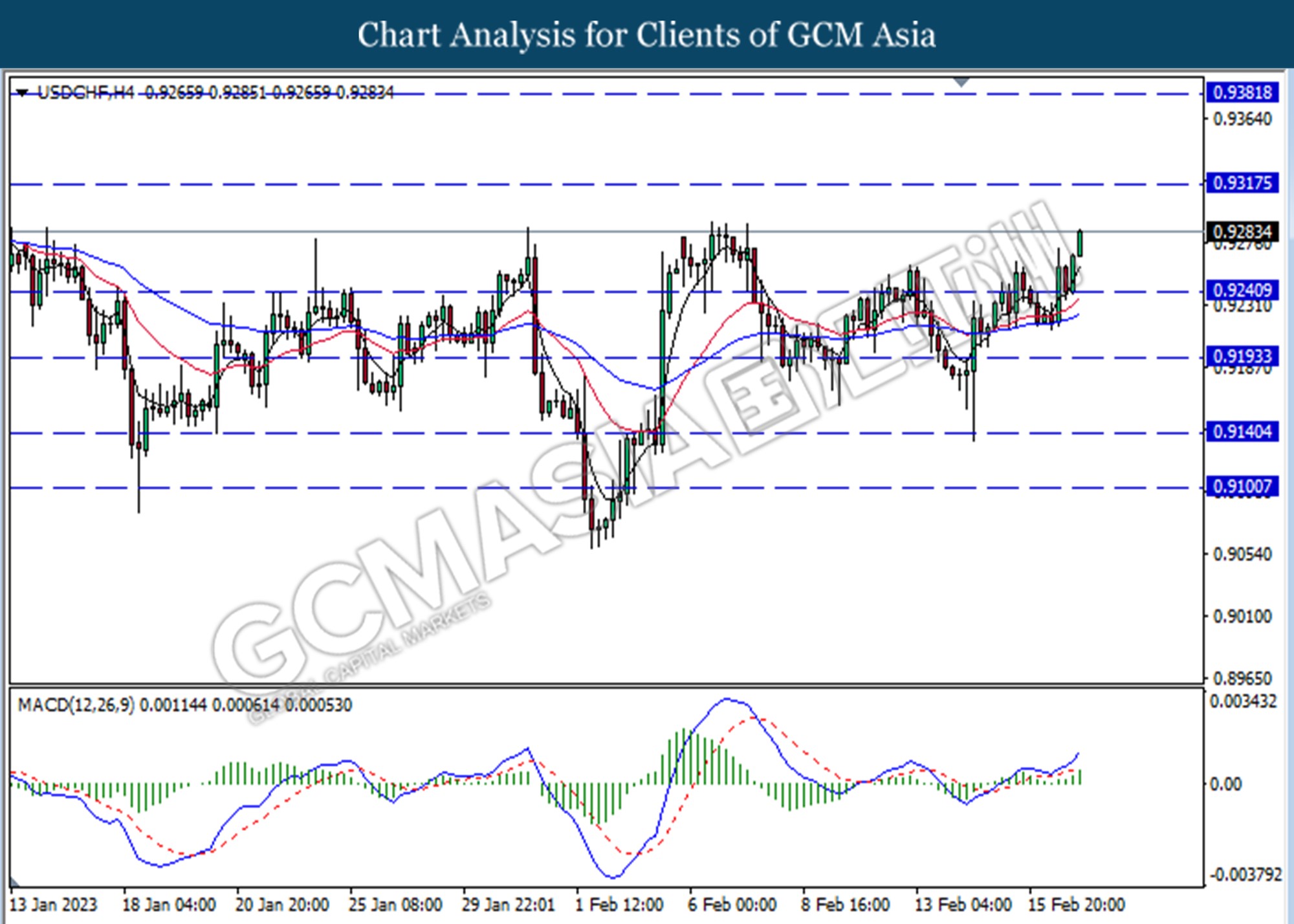

USDCHF, H4: USDCHF was traded higher following a prior break above the previous resistance level at 0.9240. MACD which illustrated bullish momentum suggests the pair to extend its gains toward the resistance level at 0.9320.

Resistance level: 0.9320, 0.9380

Support level: 0.9240, 0.9195

CrudeOIL, H4: Crude oil price was traded lower following the prior break below the previous support level at 78.70. MACD which illustrated bearish momentum suggest the commodity to extend its losses toward the support level at 76.05.

Resistance level: 78.70,81.60

Support level: 76.05, 72.20

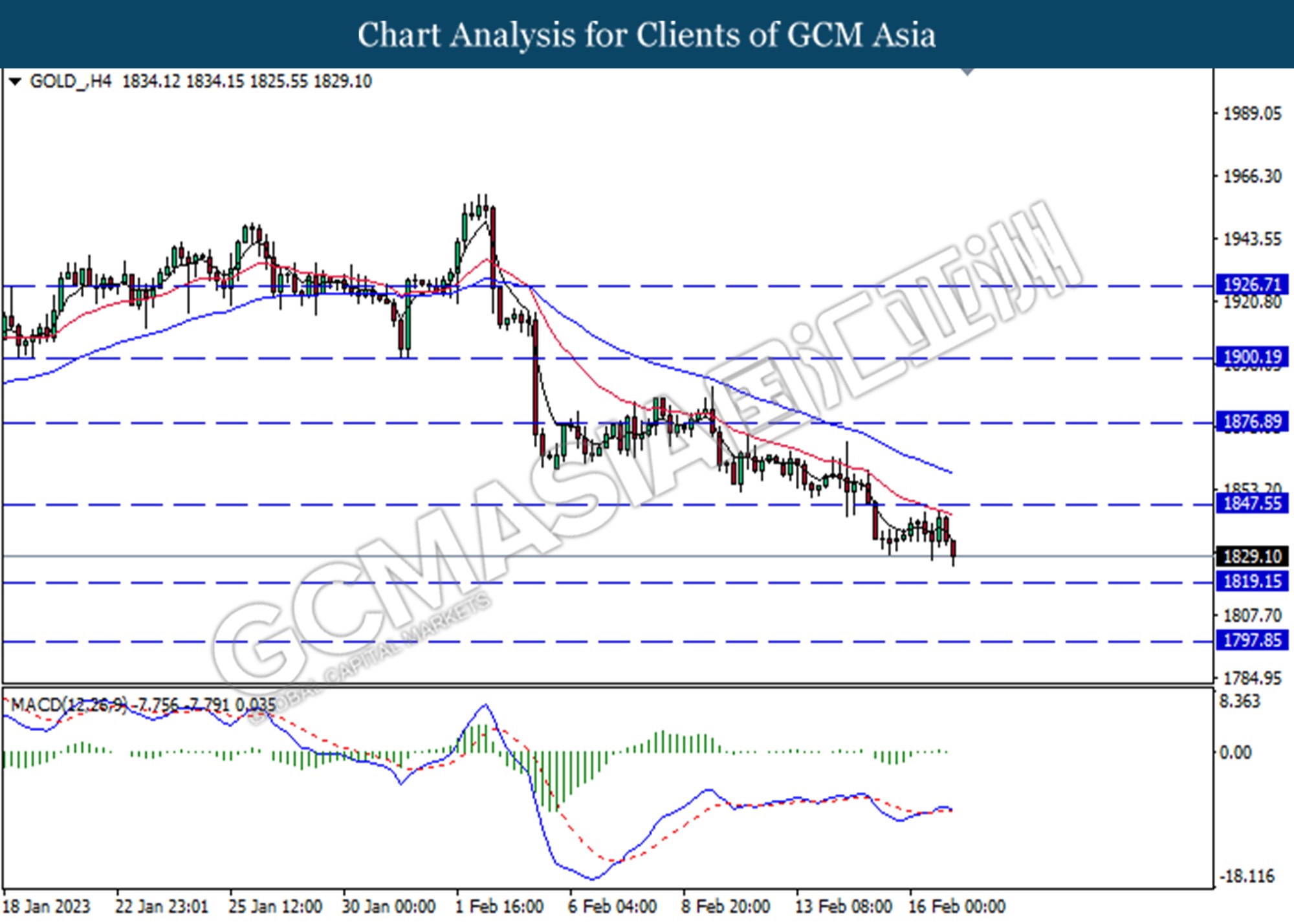

GOLD_, H4: Gold price was traded lower following a prior retracement from the higher level. MACD which illustrated diminishing bullish momentum suggests the commodity to extend its losses toward the support level.

Resistance level: 1847.55, 1876.90

Support level: 1819.15, 1797.85