17 February 2023 Morning Session Analysis

Dollar Index surged amid another hot inflation report.

The dollar index, which is traded against a group of six major currencies, extended its gains for another consecutive trading session as the US released another hot inflation report, indicating that the Federal Reserve (Fed) has not succeeded in curbing high inflation rates. According to the US Bureau of Labor Statistics, the US Producer Price Index (PPI) decreased for the seventh consecutive month compared to the year before, reaching 6.0%, while the previous month’s reading was 6.5%. However, wholesale prices rose by 0.7% in January on a month-on-month basis, beating the consensus forecast of 0.4% and also the previous month’s reading of -0.2%. With that, it shows that price pressures are re-emerging in the US economy, where commodity prices remain on the rise even though the cash rate was raised to 4.75% in the last FOMC meeting. Therefore, rising inflationary pressures in the US may prompt the Fed to reconsider its more aggressive rate hike plans to moderate inflation in the US. Instead, the Greenback jumped more sharply amid tight labor market conditions, reflected by lower-than-expected unemployment claims over the past week. According to the Labor Department, US Initial Jobless Claims data reached 194K, missing the consensus forecast of 200K, reflecting the strength of the labor market. As of writing, the dollar index rose 0.08% to 104.00.

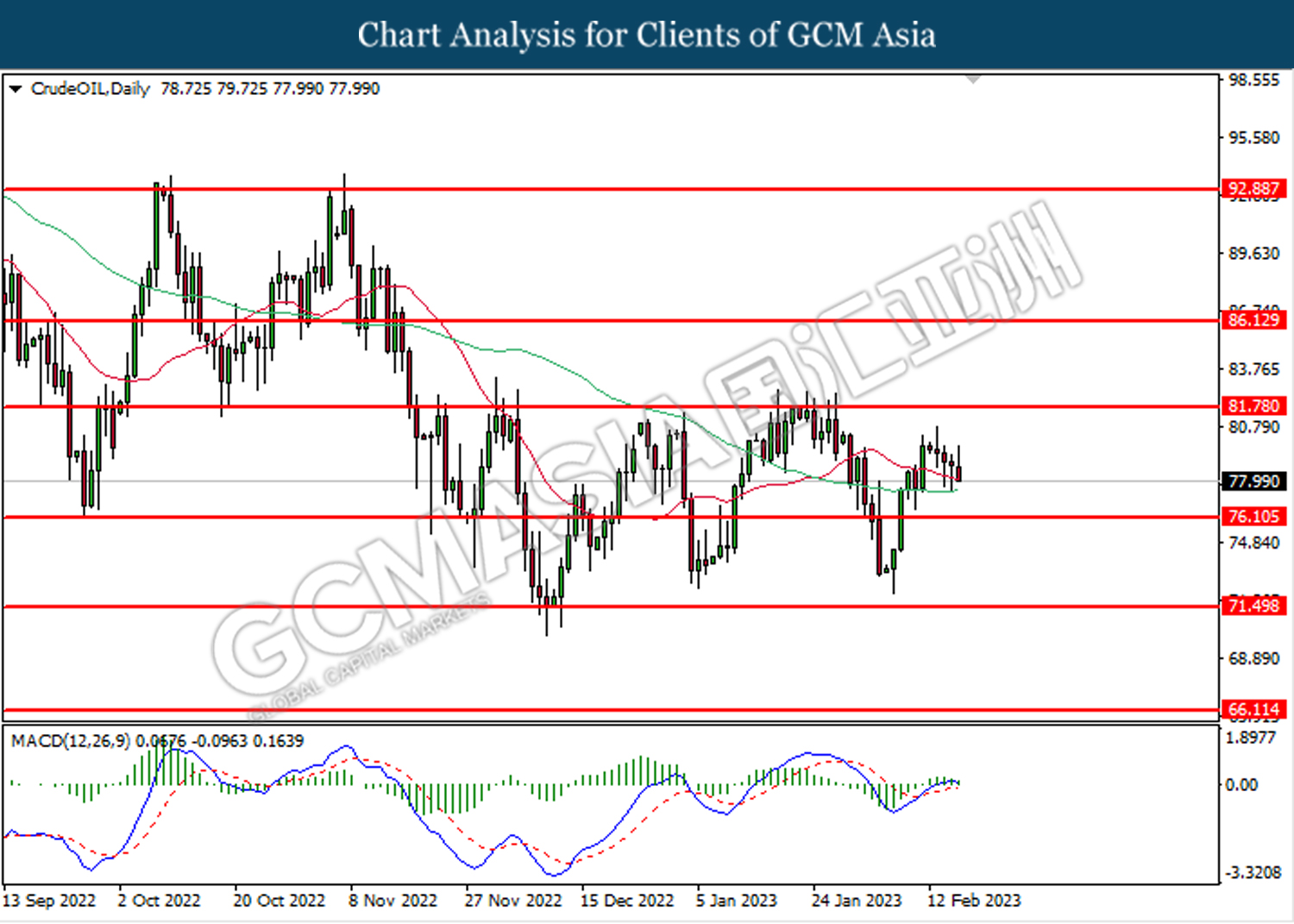

In the commodity market, the price of crude oil dropped by -0.47% to $78.15 a barrel as the black commodity weighed on a big increase in US crude inventories and hopes of a strong demand recovery in China. In addition, the price of gold edged up by 0.06% to $1837.10 per troy ounce as the US dollar rose significantly following the release of the PPI report.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 15:00 | GBP – Retail Sales (MoM) (Jan) | -1.0% | -0.3% | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded higher following a prior breakout above the previous resistance level at 103.15. MACD which illustrated bullish bias momentum suggests the index to extend its gains toward the resistance level at 105.00.

Resistance level: 105.00, 106.65

Support level: 103.15, 101.25

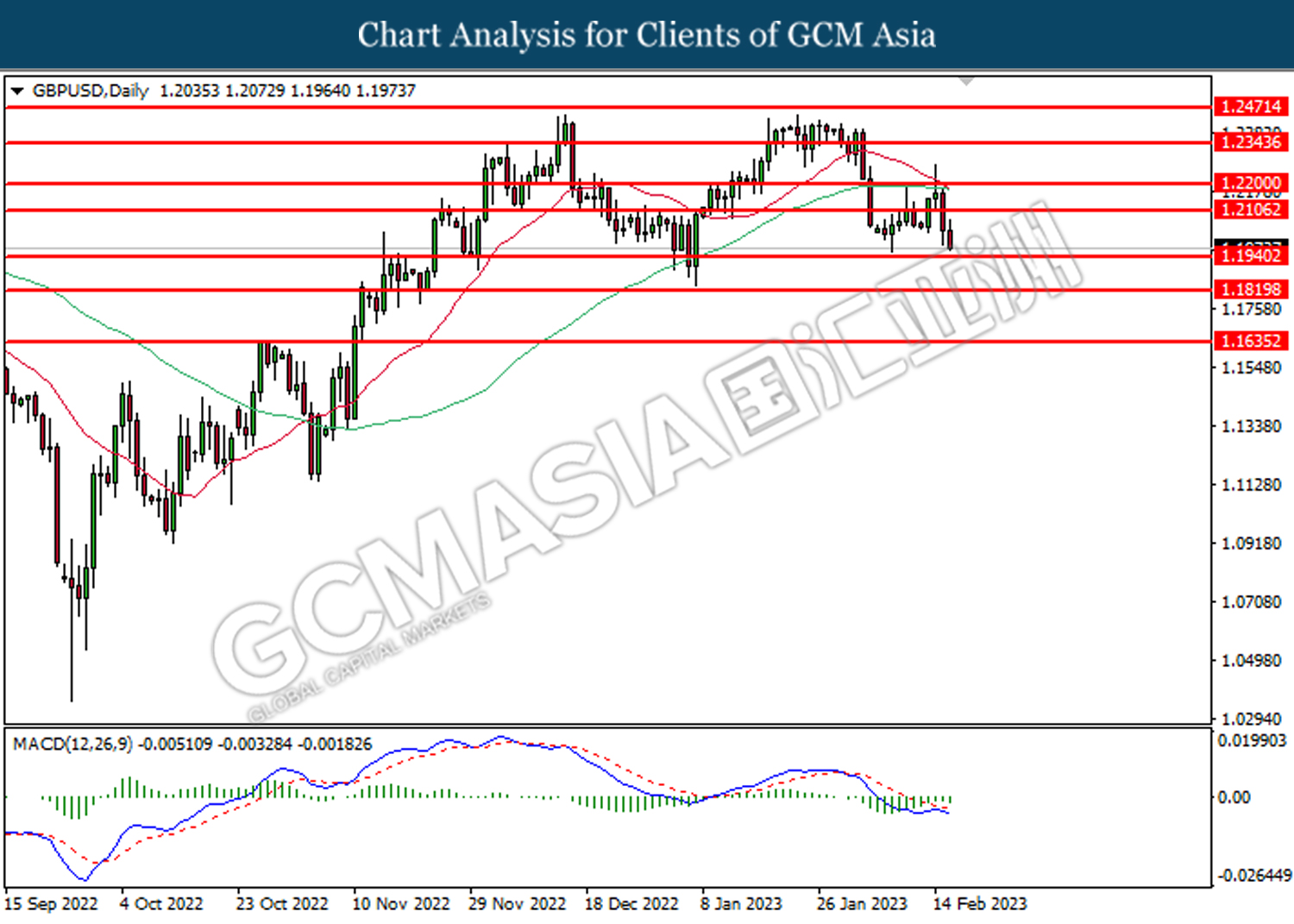

GBPUSD, Daily: GBPUSD was traded lower following the prior breakout below the previous support level at 1.2105. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 1.1940.

Resistance level: 1.2105, 1.2200

Support level: 1.1940, 1.1820

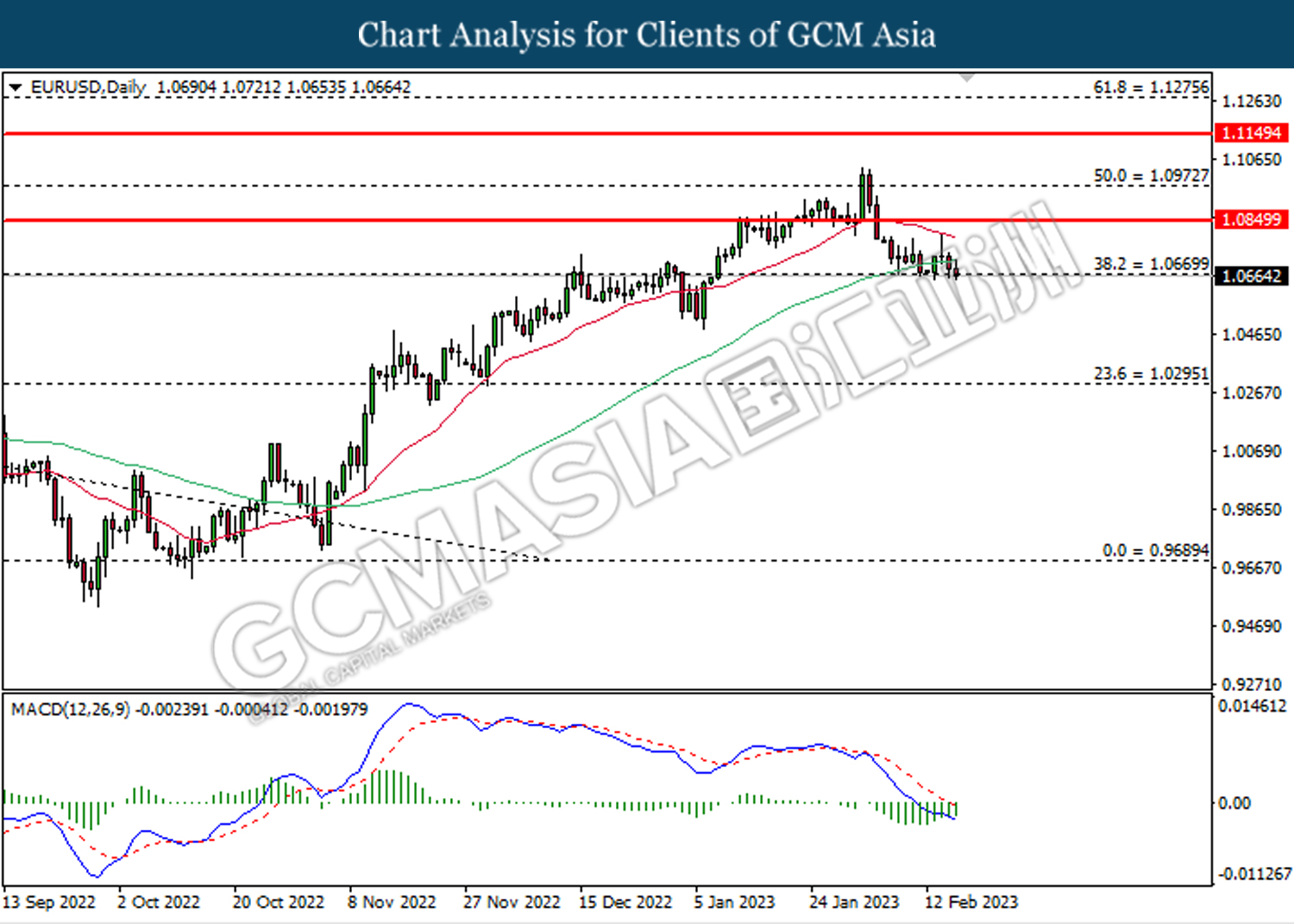

EURUSD, Daily: EURUSD was traded lower while currently testing the support level at 1.0670. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.0850, 1.0975

Support level: 1.0670, 1.0295

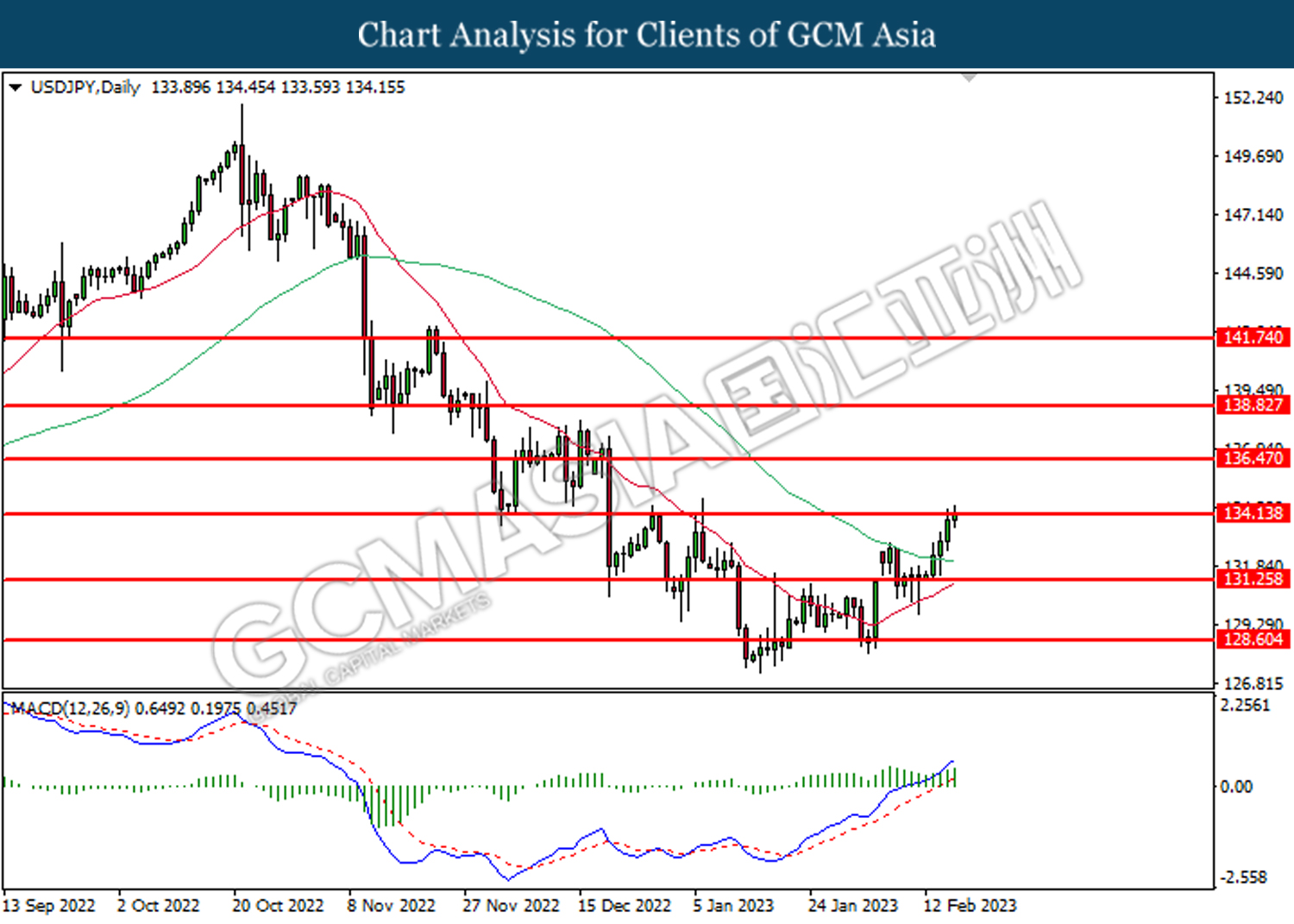

USDJPY, Daily: USDJPY was traded higher while currently testing the resistance level at 134.15. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 134.15, 136.45

Support level: 131.25, 128.60

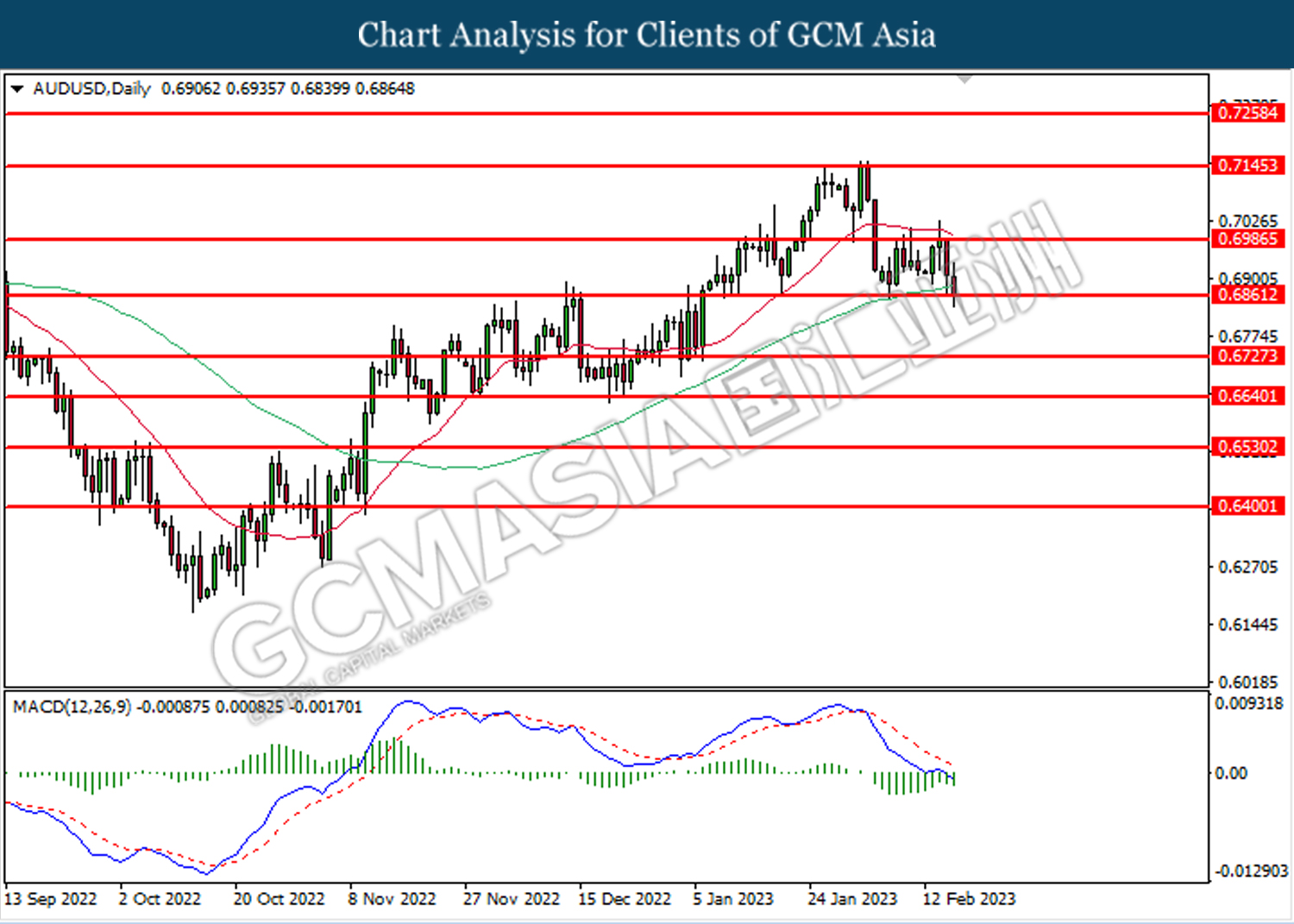

AUDUSD, Daily: AUDUSD was traded lower while currently testing the support level at 0.6860. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 0.6985, 0.7145

Support level: 0.6860, 0.6725

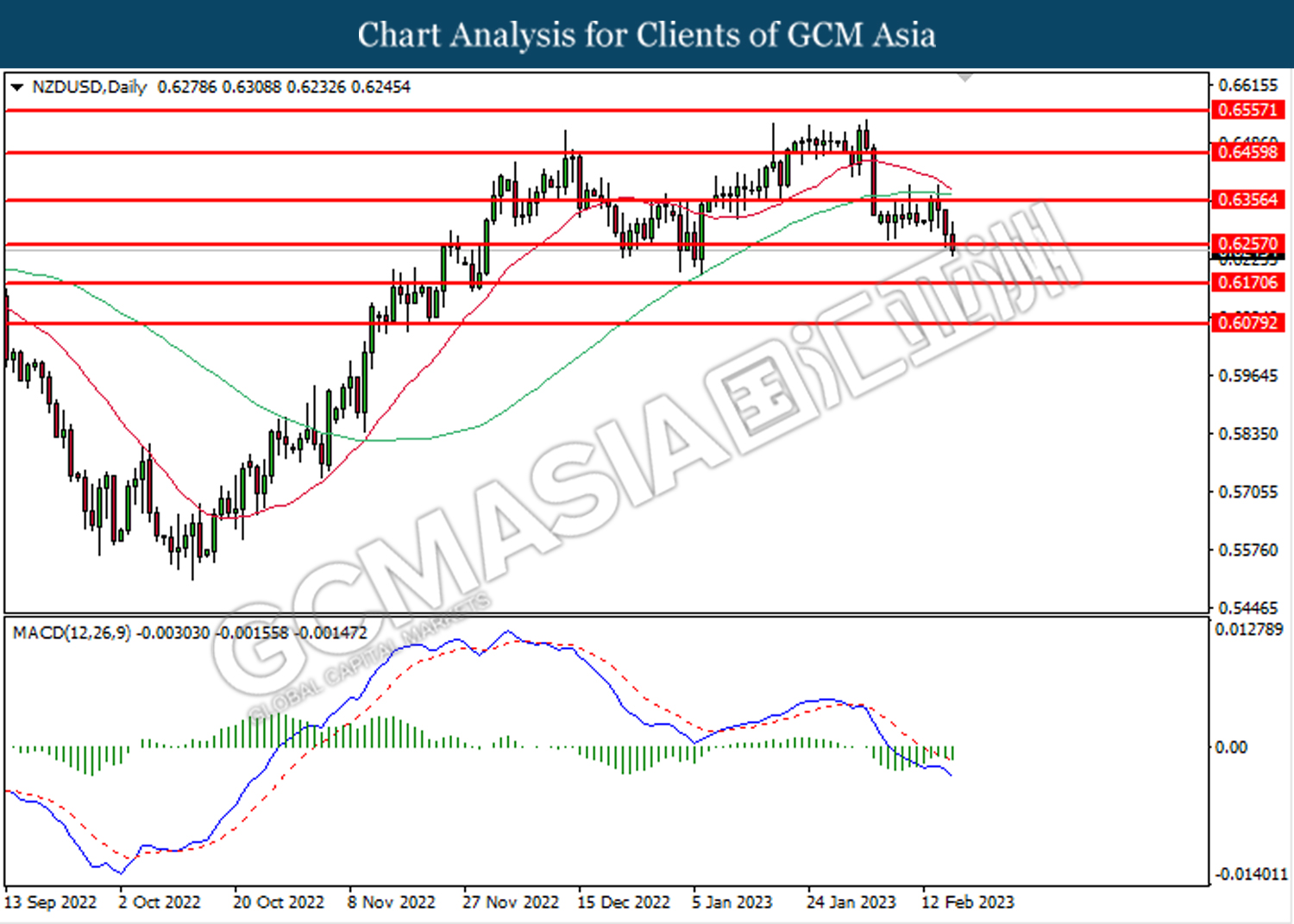

NZDUSD, Daily: NZDUSD was traded lower while currently testing the support level at 0.6255. MACD which illustrated bearish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 0.6355, 0.6460

Support level: 0.6255, 0.6170

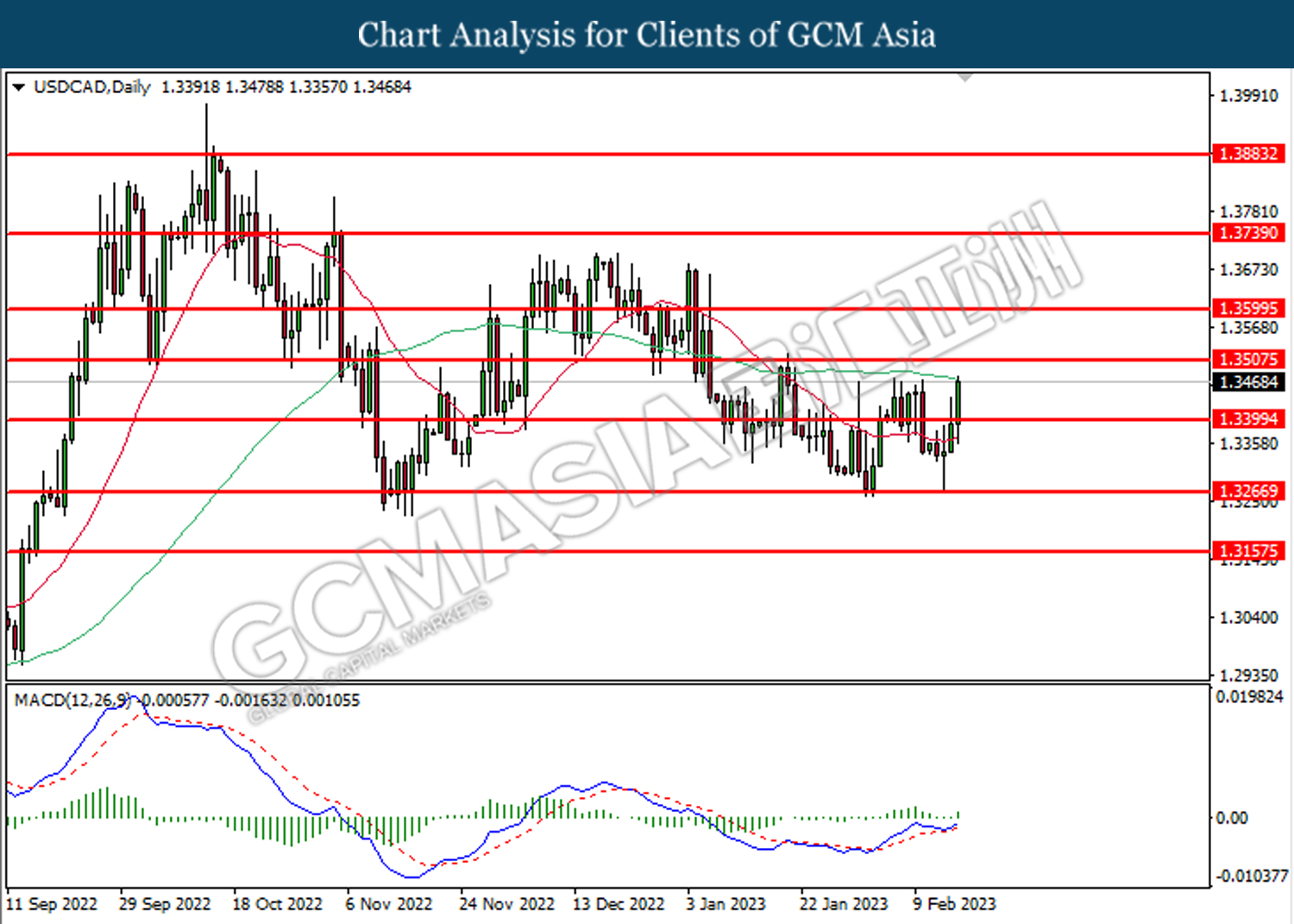

USDCAD, Daily: USDCAD was traded higher while currently testing the resistance level at 1.3400. MACD which illustrated bullish bias momentum suggests the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.3400, 1.3505

Support level: 1.3265, 1.3155

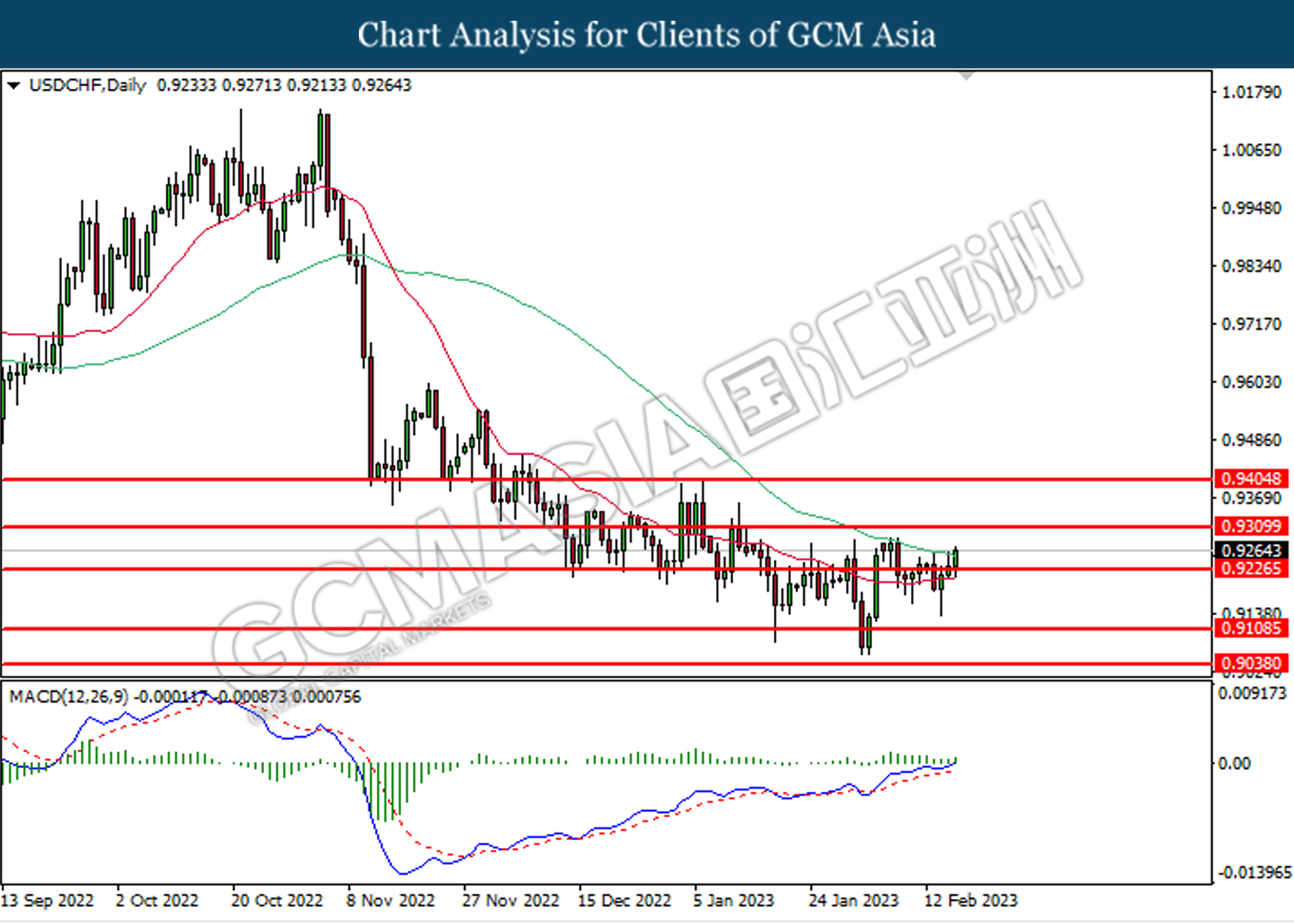

USDCHF, Daily: USDCHF was traded higher while currently testing the resistance level at 0.9225. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 0.9225, 0.9310

Support level: 0.9110, 0.9040

CrudeOIL, Daily: Crude oil price was traded lower following the prior retracement from the higher level. MACD which illustrated diminishing bullish momentum suggest the commodity to extend its losses toward the support level at 76.10.

Resistance level: 81.80, 86.15

Support level: 76.10, 71.50

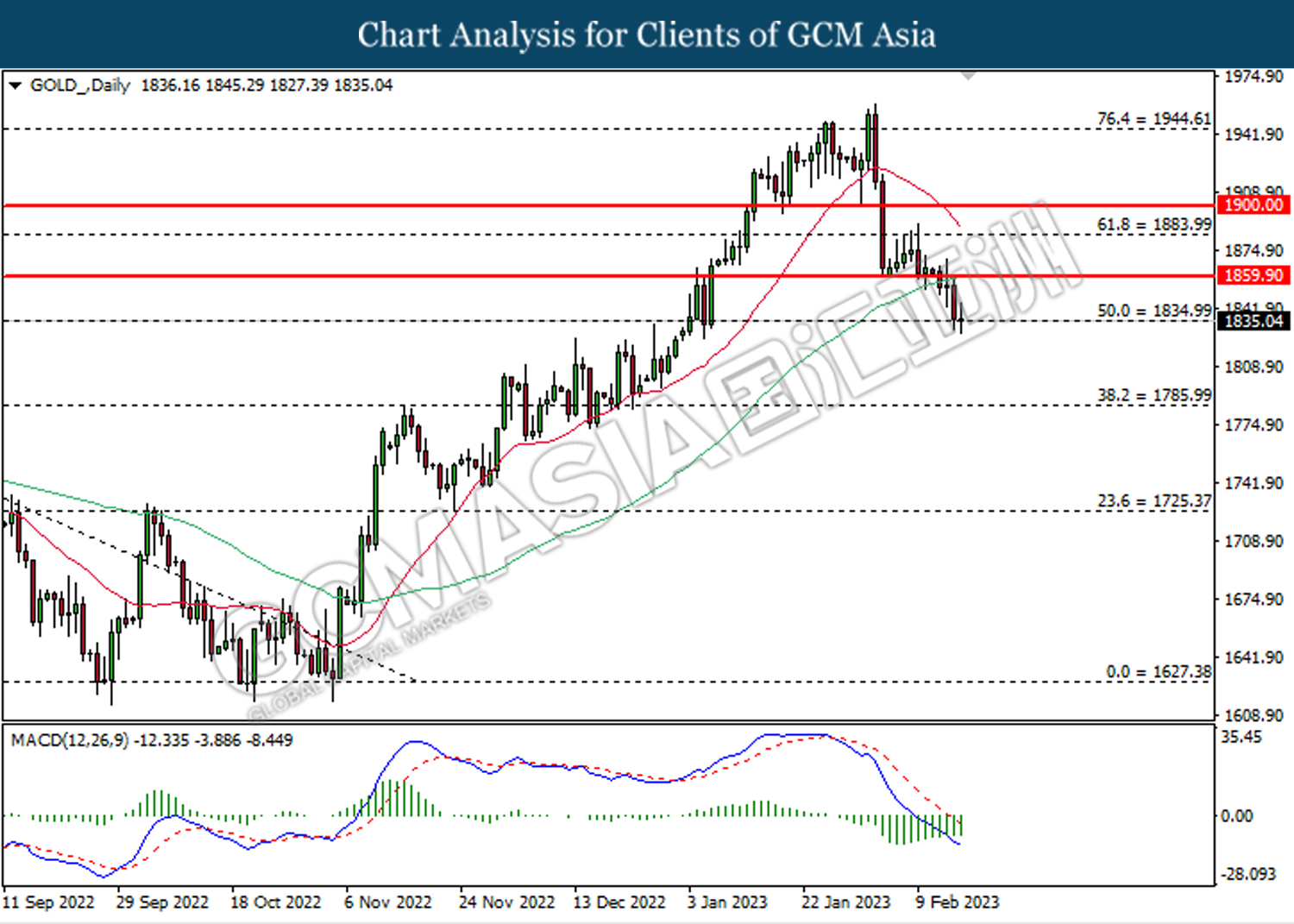

GOLD_, Daily: Gold price was traded lower while currently testing the support level at 1835.00 MACD which illustrated bearish bias momentum suggests the commodity to extend its losses after it successfully breakout below the support level.

Resistance level: 1859.90, 1884.00

Support level: 1835.00, 1786.00