17 April 2023 Afternoon Session Analysis

Euro beaten down by dovish speech from ECB.

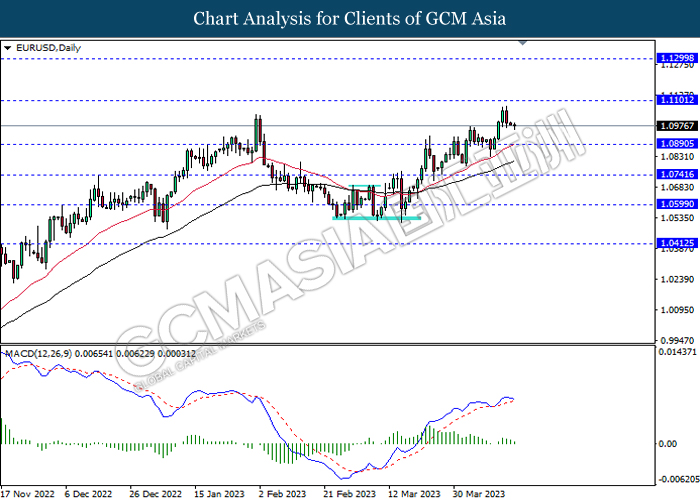

The EUR/USD, which traded by majority of global investors received significant bearish momentum on last Friday following the dovish statement has been presented by ECB officials. According to Bloomberg, the ECB Governing Council member Mario Centeno claimed on the International Monetary Fund (IMF) Spring Meetings that the central bank was suggested to slow down its rate hike pace due to the stress of high-price in the Eurozone was easing. He said there was no need for further aggressive rate rises, so he thought a rise of 0 or 25 basis points would be appropriate in the May meeting. Besides, another ECB member had also expressed similar views. ECB Governing Council member Francois Villeroy de Galha emphasized that the process of rate hike was coming to an end. With such background, the appeal of Euro was dragged down, while prompting investors to shift their capitals toward other currencies such as US Dollar. Though, it is note-worthy that some of the members still support the central bank to raise its rate by 50 basis point to dampen inflationary risk. Thus, the speech of ECB President Christine Lagarde that would be released today would likely to provide some clues about its interest rate decisions. As of writing, the EUR/USD depreciated by 0.19% to 1.0979.

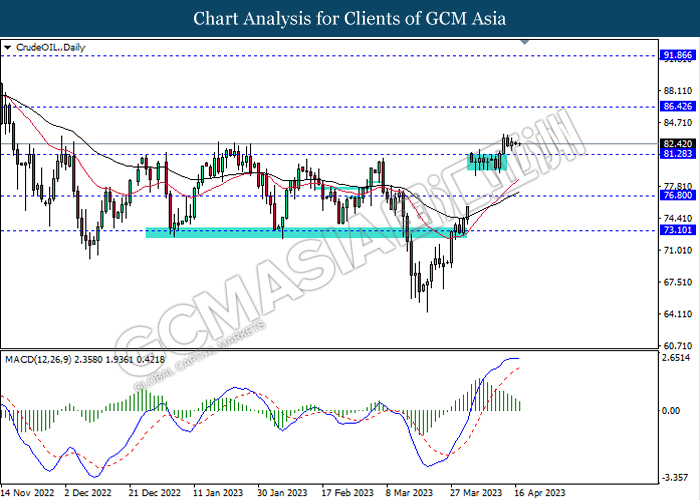

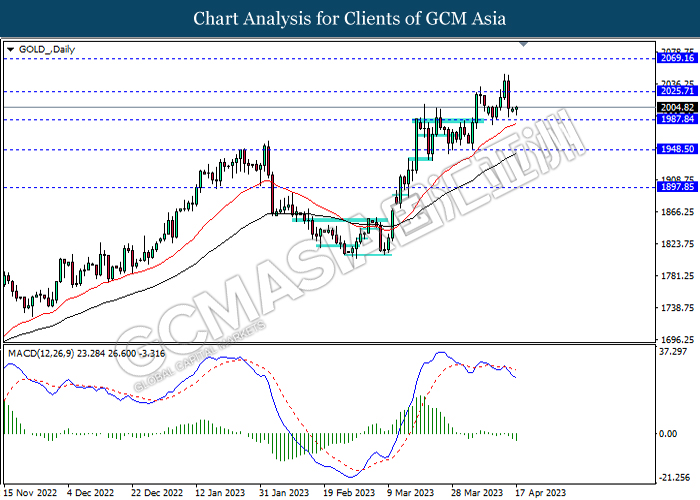

In the commodities market, the crude oil prices edged up by 0.01% to $82.44 per barrel as of writing following the IEA speculated the oil demand would rebound in the year of 2023. On the other hand, the gold price dropped by 0.01% to $2004.26 per troy ounce as of writing over the strengthening of US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

23:00 EUR ECB President Lagarde Speaks

Today’s Highlight Economic Data

N/A

Technical Analysis

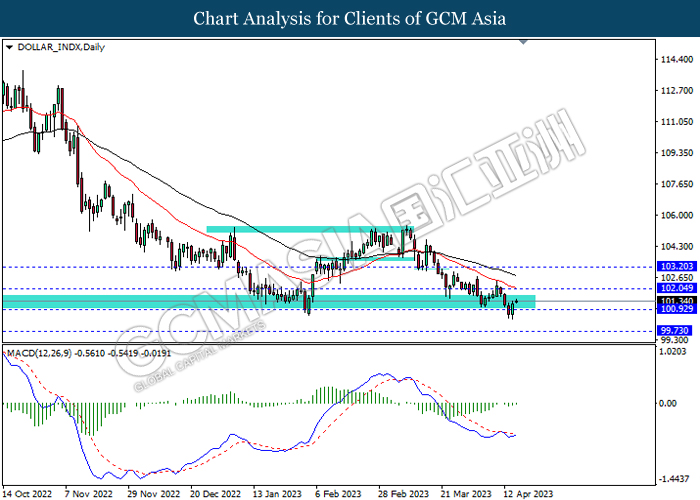

DOLLAR_INDX, Daily: Dollar index was traded higher following prior breakout above the previous resistance level. MACD which illustrated decreasing bearish momentum suggest the index to extend its gains.

Resistance level: 102.05, 103.20

Support level: 100.90, 99.75

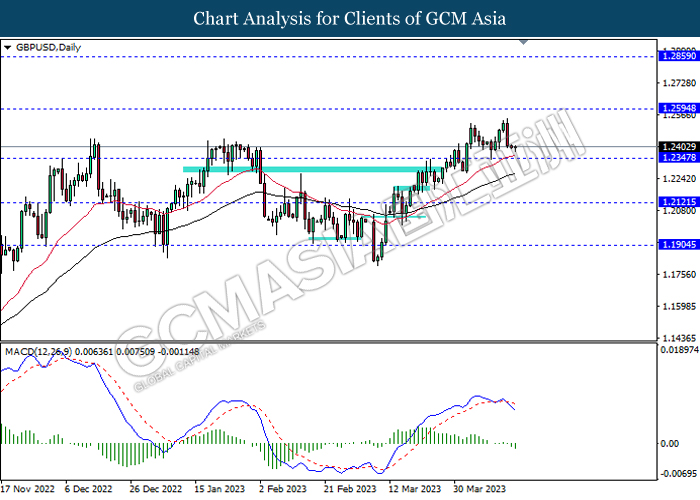

GBPUSD, Daily: GBPUSD was traded lower following prior retracement from the higher level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 1.2595, 1.2860

Support level: 1.2345, 1.2120

EURUSD, Daily: EURUSD was traded lower following prior retracement from the higher level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses.

Resistance level: 1.1100, 1.1300

Support level: 1.0890, 1.0740

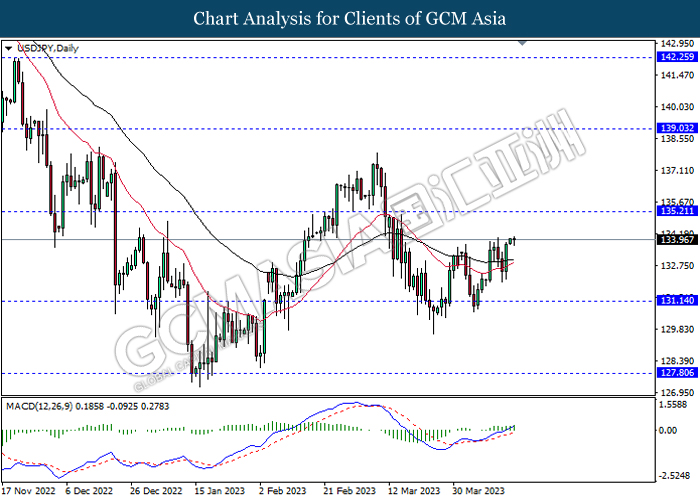

USDJPY, Daily: USDJPY was traded higher following prior rebound from the support level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 135.20, 139.05

Support level: 131.15, 127.80

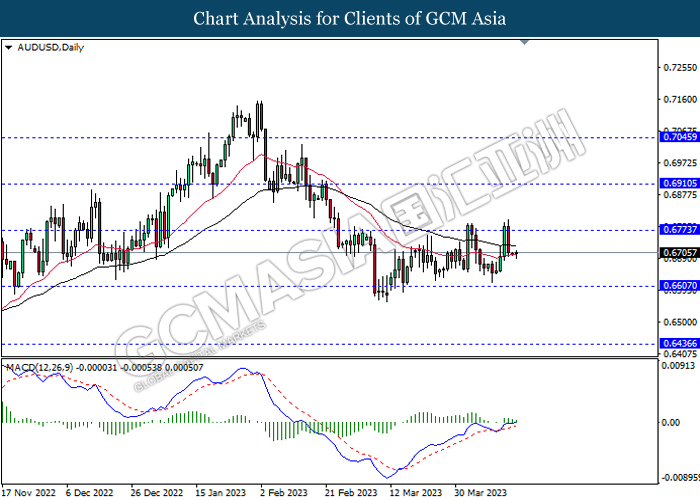

AUDUSD, Daily: AUDUSD was traded lower following prior retracement from the resistance level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses.

Resistance level: 0.6775, 0.6910

Support level: 0.6605, 0.6435

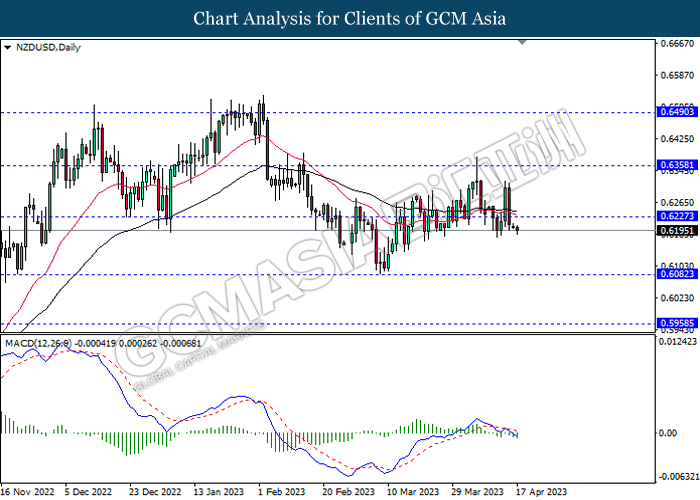

NZDUSD, Daily: NZDUSD was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 0.6225, 0.6360

Support level: 0.6080, 0.5960

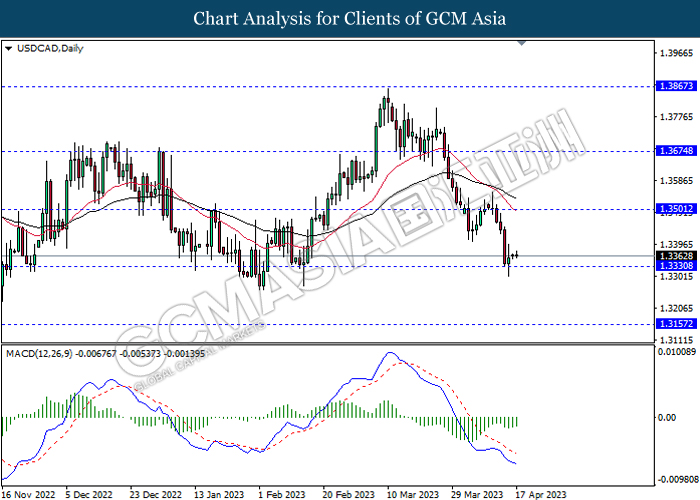

USDCAD, Daily: USDCAD was traded higher following prior rebound from the support level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 1.3500, 1.3675

Support level: 1.3330, 1.3155

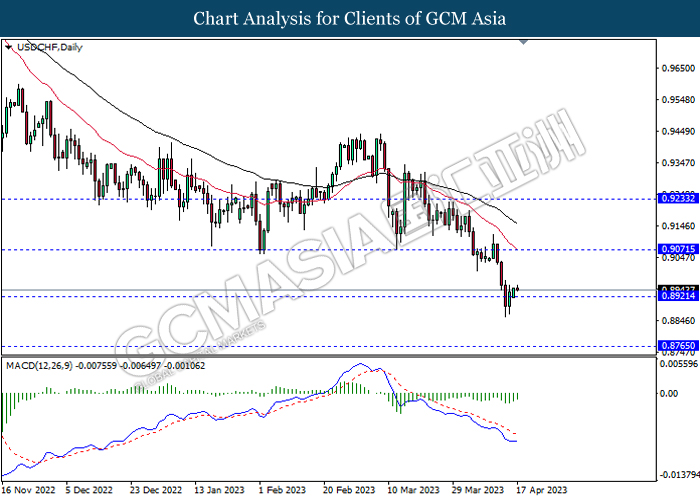

USDCHF, Daily: USDCHF was traded higher following prior breakout above the previous resistance level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 0.9070, 0.9235

Support level: 0.8920, 0.8765

CrudeOIL, Daily: Crude oil price was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the commodity to be traded lower as technical correction.

Resistance level: 86.40, 91.85

Support level: 81.30, 76.80

GOLD_, Daily: Gold price was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses.

Resistance level: 2025.70, 2069.15

Support level: 1987.85, 1948.50