17 May 2022 Morning Session Analysis

US Dollar slumped amid downbeat China economic data.

The Dollar Index which traded against a basket of six major currencies slumped since yesterday amid the backdrop of negative China economic data. According to National Bureau of Statistics of China, China Industrial Production YoY notched down from the previous reading of 5.0% to -2.9%, missing the market forecast of 0.4%. Industrial Production is used to measure the real output in manufacturers, mines, and utilities within a country. A lower than expected reading indicated that the recession economic growth in China, which would likely to bring negative prospects toward economic progression in US as China was one of the largest economy in the world. It prompted investors to shift their capitals from US Dollar into other assets. Besides, amid swelling prices, most Americans see inflation as the biggest issue facing the country, according to a survey from Pew Research. The war-driven inflation would intensify the economy recession in US, spurring further bearish momentum on US Dollar. As of writing, the Dollar Index depreciated by 0.36% to 104.24.

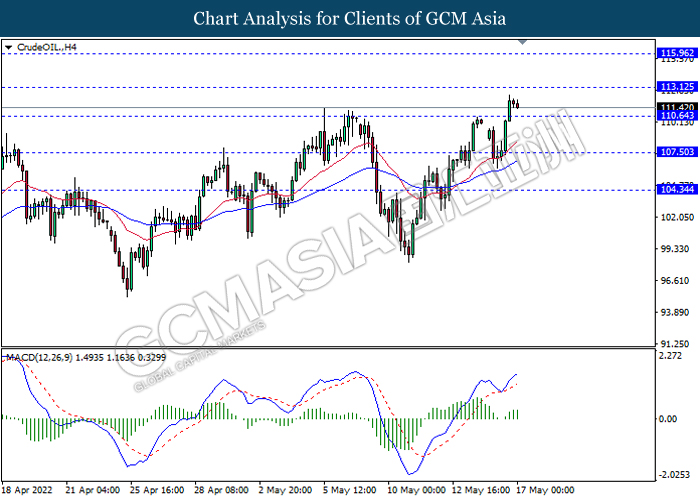

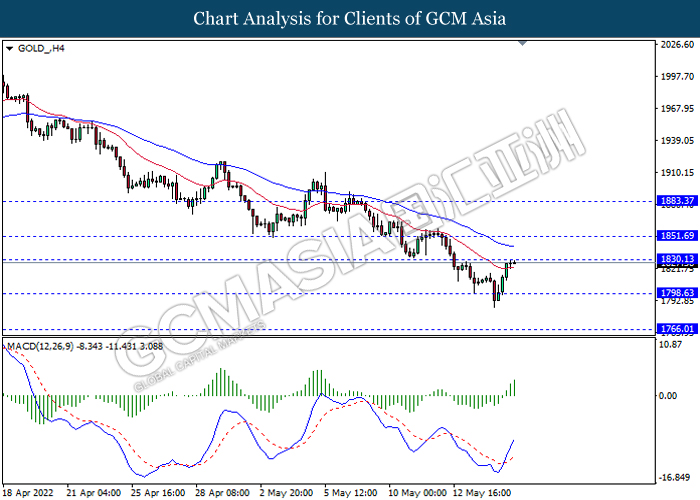

In commodities market, crude oil price depreciated by 0.06% to $111.75 per barrel as of writing. Nonetheless, the overall trend for crude oil price remained bullish following China’s coronavirus pandemic was receding in the hardest-hit areas, which would see the significant demand recovery on oil. On the other hand, gold price rose by 0.70% to $1826.32 per troy ounce as of writing over the easing of US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 14:00 | GBP – Average Earnings Index +Bonus (Mar) | 5.4% | 5.4% | – |

| 14:00 | GBP – Claimant Count Change (Apr) | -46.9K | -38.8K | – |

| 20:30 | USD – Core Retail Sales (MoM) (Apr) | 1.4% | 0.3% | – |

| 20:30 | USD – Retail Sales (MoM) (Apr) | 0.7% | 0.8% | – |

Technical Analysis

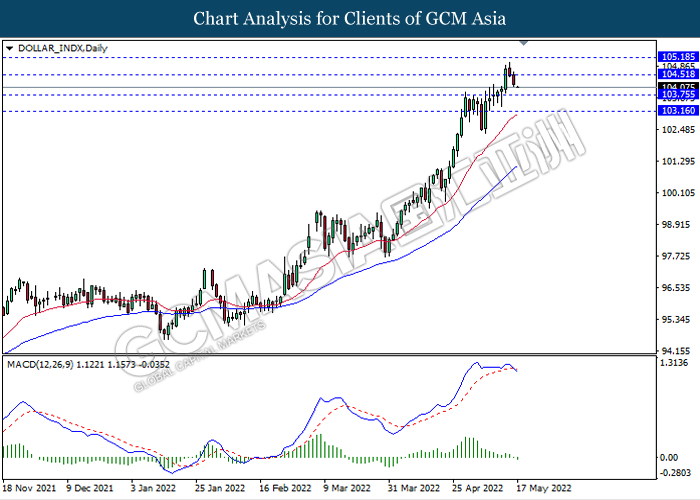

DOLLAR_INDX, Daily: Dollar index was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the index to extend its losses.

Resistance level: 104.50, 105.20

Support level: 103.75, 103.15

GBPUSD, H4: GBPUSD was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains if successfully breakout the resistance level.

Resistance level: 1.2345, 1.2430

Support level: 1.2265, 1.2165

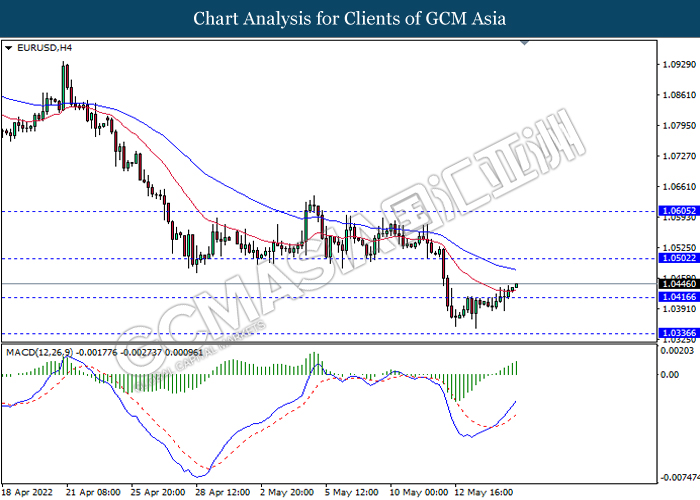

EURUSD, H4: EURUSD was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 1.0500, 1.0605

Support level: 1.0415, 1.0335

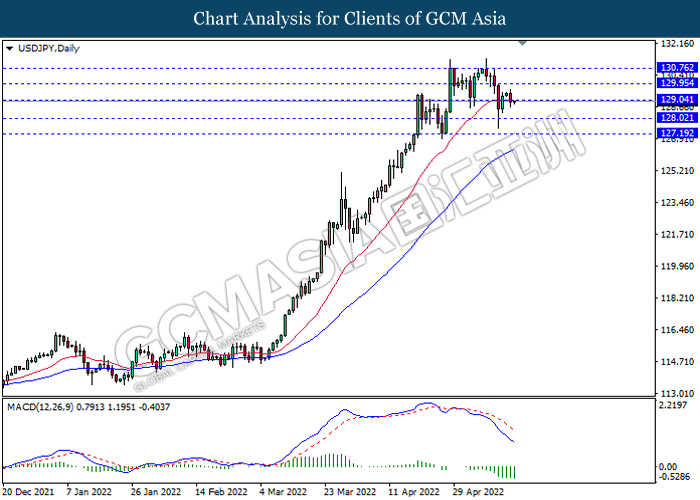

USDJPY, Daily: USDJPY was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to be extend its losses.

Resistance level: 129.05, 129.95

Support level: 128.00, 127.20

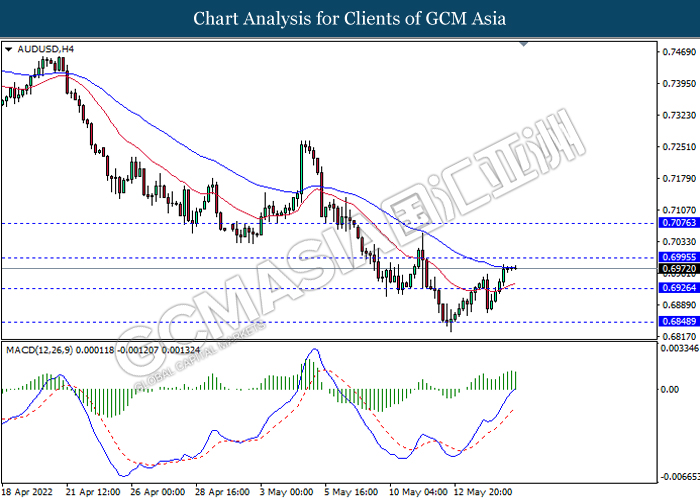

AUDUSD, H4: AUDUSD was traded higher while currently testing the resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 0.6995, 0.7075

Support level: 0.6925, 0.6850

NZDUSD, H4: NZDUSD was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 0.6350, 0.6425

Support level: 0.6295, 0.6225

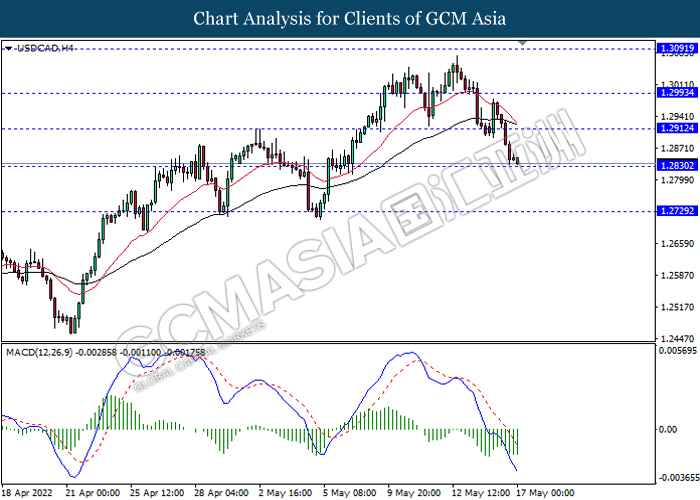

USDCAD, H4: USDCAD was traded lower while currently testing the support level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its losses if successfully breakout the support level.

Resistance level: 1.2910, 1.2995

Support level: 1.2830, 1.2730

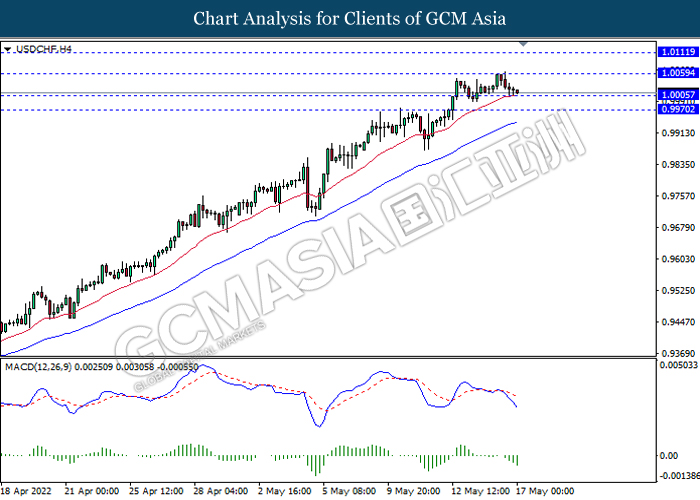

USDCHF, H4: USDCHF was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses if successfully breakout the support level.

Resistance level: 1.0060, 1.0110

Support level: 1.0005, 0.9970

CrudeOIL, H4: Crude oil price was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the commodity to be traded lower as technical correction.

Resistance level: 113.10, 115.95

Support level: 110.65, 107.50

GOLD_, H4: Gold price was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the commodity to extend its gains if successfully breakout the resistance level.

Resistance level: 1830.15, 1851.70

Support level: 1798.65, 1766.00