17 May 2023 Afternoon Session Analysis

The Pound extended losses after weakening economic conditions.

The Pound Sterling, which was traded against the greenback, extended its losses after the weak economic conditions looms over the markets. In March, the employment average earning plus bonus showed 5.8% steadily at the same level as market expectation and prior readings. However, other key labor force data for March were softer, according to the Office for National Statistics (ONS). The 3 months employment change data showed an increase to 182 thousand while economists expect this reading to slip to 160 thousand from the prior reading of 169 thousand. Nonetheless, Britain’s unemployment rate unexpectedly rose to 3.9% as more labor returned to the jobs market. Employment and non-unemployment both rose again in the first 3 months of 2024, and the number of neither working nor looking for work continues to fall, despite the number of unemployed due to long-term sickness rising to new records, the director of economics in ONS said. Weak labor conditions were further supported by claims in March, which surged by 46,700, compared with forecasts for a rise of 31,200. As a result, the latest labor market suggested a less hawkish monetary position as labor market conditions deteriorates. It also increases the odds that the Bank of England (BoE) debate its further interest rate decision. As of writing, the GBP/USD traded down by -0.01% to $1.2486.

In the commodities market, crude oil prices appreciated by 0.08% to $70.92 per barrel as investors remained cautious after API crude oil inventory showed surplus readings. Besides, gold prices ticked up by 0.14% to $1991.60 per troy ounce following the prior debt ceiling talks remains uncertain.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

17:50 GBP BoE Gov Bailey Speaks

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 17:00 | EUR – CPI (YoY) (Apr) | 6.9% | 7.0% | – |

| 20:30 | USD – Building Permits (Apr) | 1.430M | 1.430M | – |

| 22:30 | CrudeOIL – Crude Oil Inventories | 2.951M | -0.917M | – |

Technical Analysis

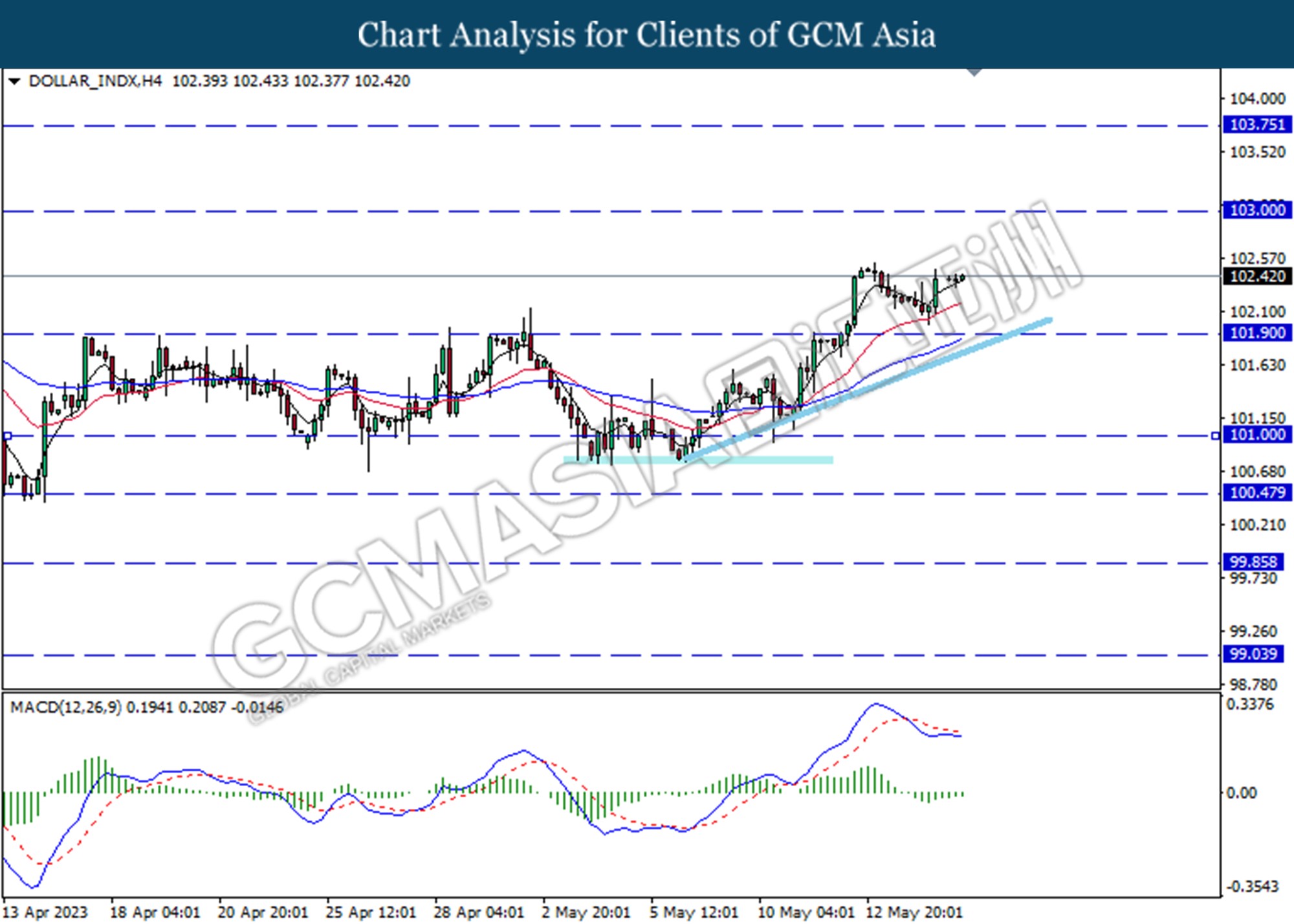

DOLLAR_INDX, H4: Dollar index was traded higher following the prior rebound from the lower level. MACD which illustrated diminishing bearish momentum suggests the index extended its gains toward the resistance level at 103.00.

Resistance level: 103.00, 103.75

Support level: 101.90, 101.00

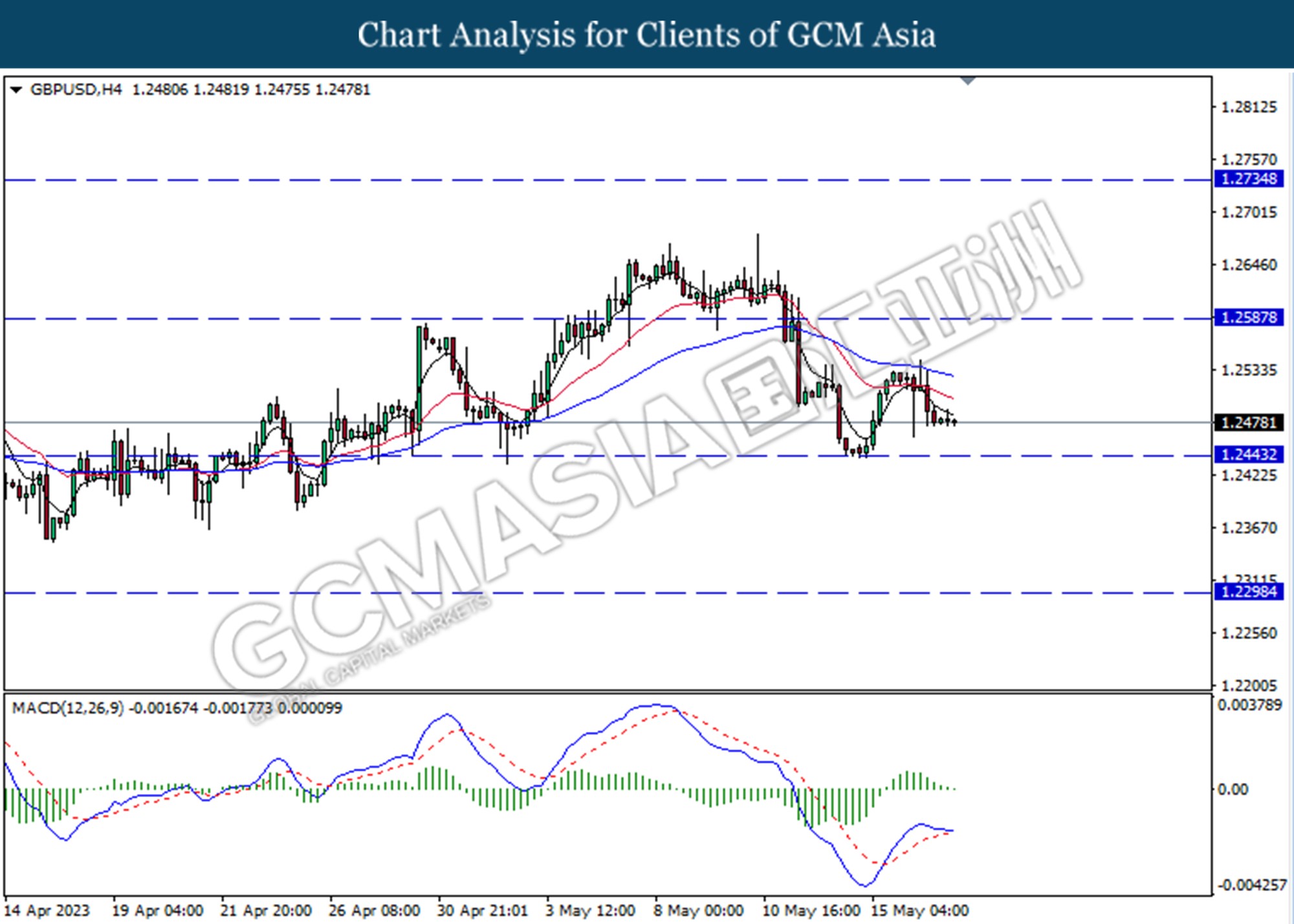

GBPUSD, H4: GBPUSD was traded lower following the prior retracement from the higher level. MACD which illustrated diminishing bearish momentum suggests the pair extended its losses toward the support level at 1.2445.

Resistance level: 1.2590, 1.2735

Support level: 1.2445, 1.2300

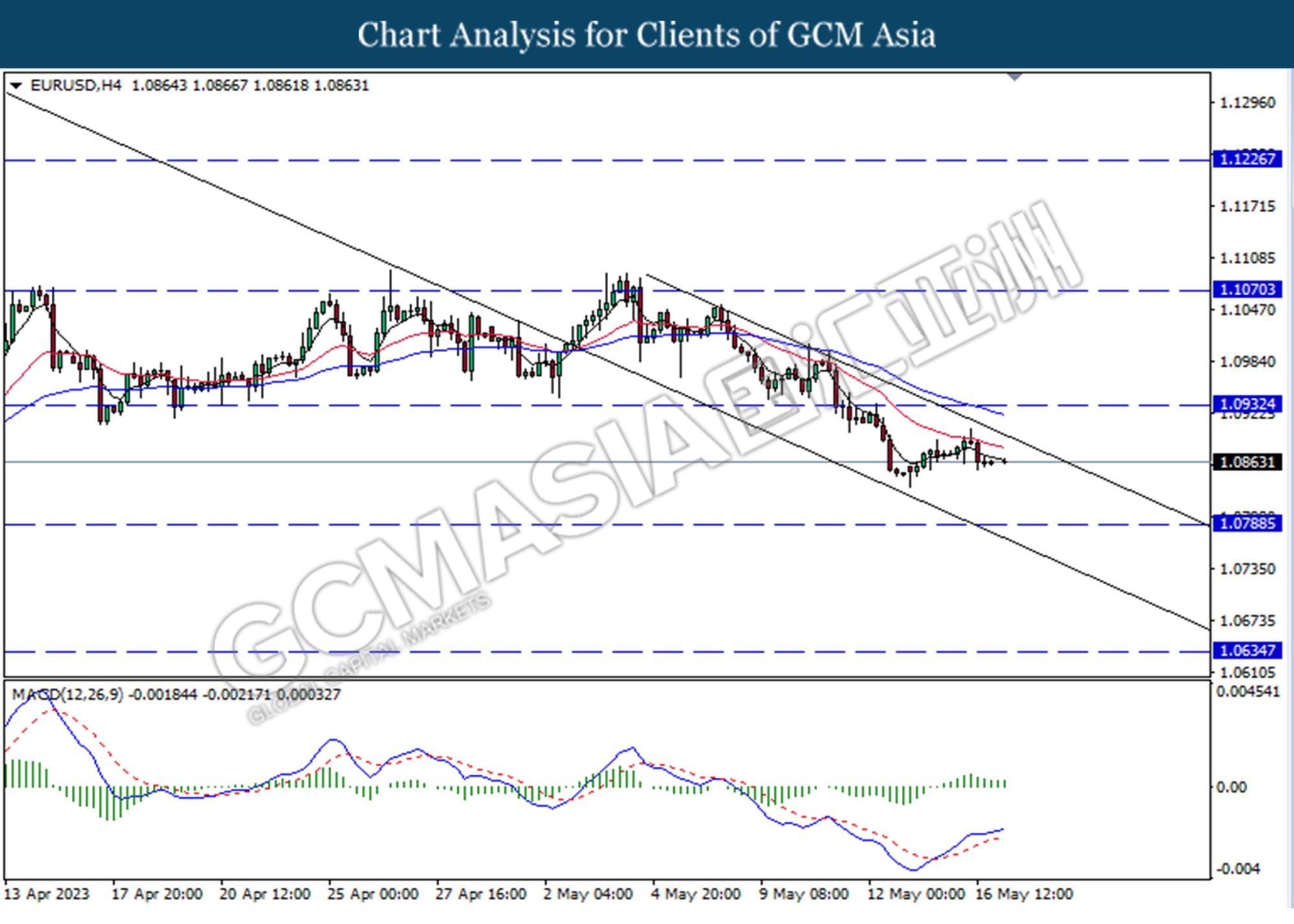

EURUSD, H4: EURUSD was traded lower following the prior retracement from the higher level. MACD which illustrated diminishing bullish momentum suggests the pair extended its losses toward the support level.

Resistance level: 1.0930, 1.1070

Support level: 1.0790, 1.0635

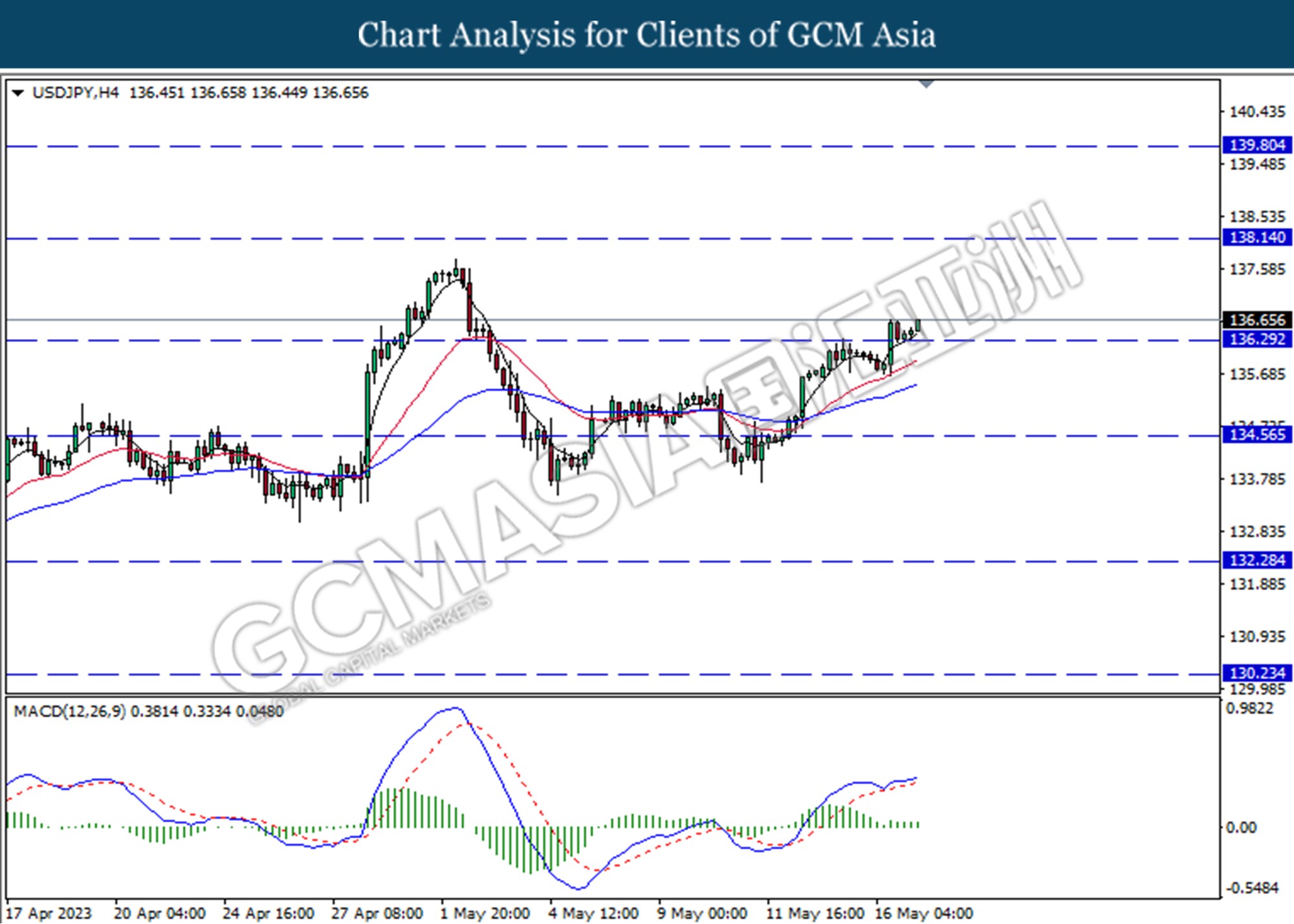

USDJPY, H4: USDJPY was traded higher following the prior breaks above the previous resistance level at 136.30. However, MACD which illustrated diminishing bullish momentum suggests the pair undergo technical correction in the short term.

Resistance level: 136.30, 138.15

Support level: 134.55, 132.30

AUDUSD, H4: AUDUSD was traded lower following the prior breaks below from the previous support level at 0.6685. MACD which illustrated diminishing bullish momentum suggests the pair extended its losses toward the support level.

Resistance level: 0.6685, 0.6775

Support level: 0.6600, 0.6525

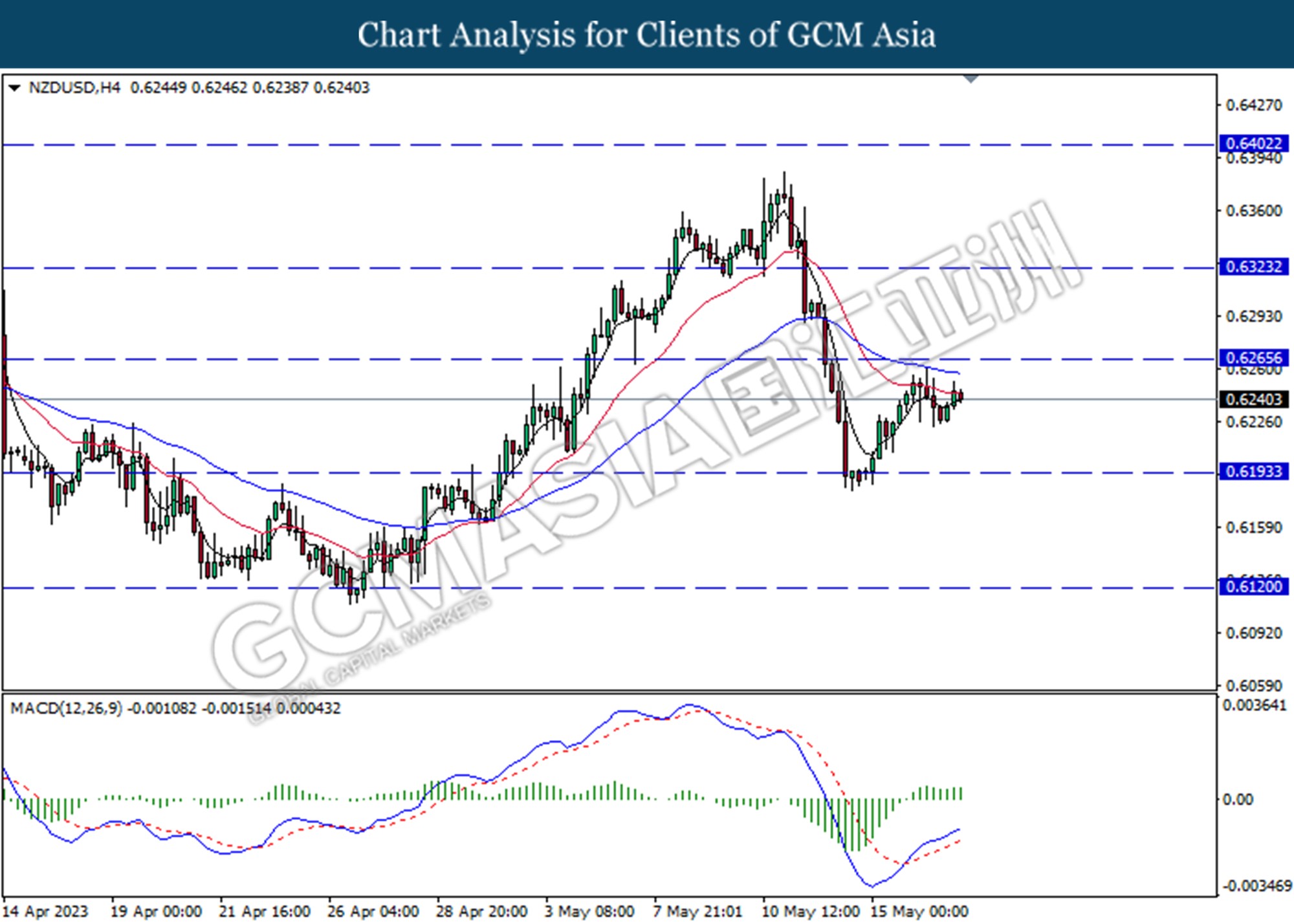

NZDUSD, H4: NZDUSD was traded higher following the prior rebound from the lower level. MACD which illustrated bullish momentum suggests the pair extended its gains toward the resistance level at 0.6265.

Resistance level: 0.6265, 0.6325

Support level: 0.6195, 0.6120

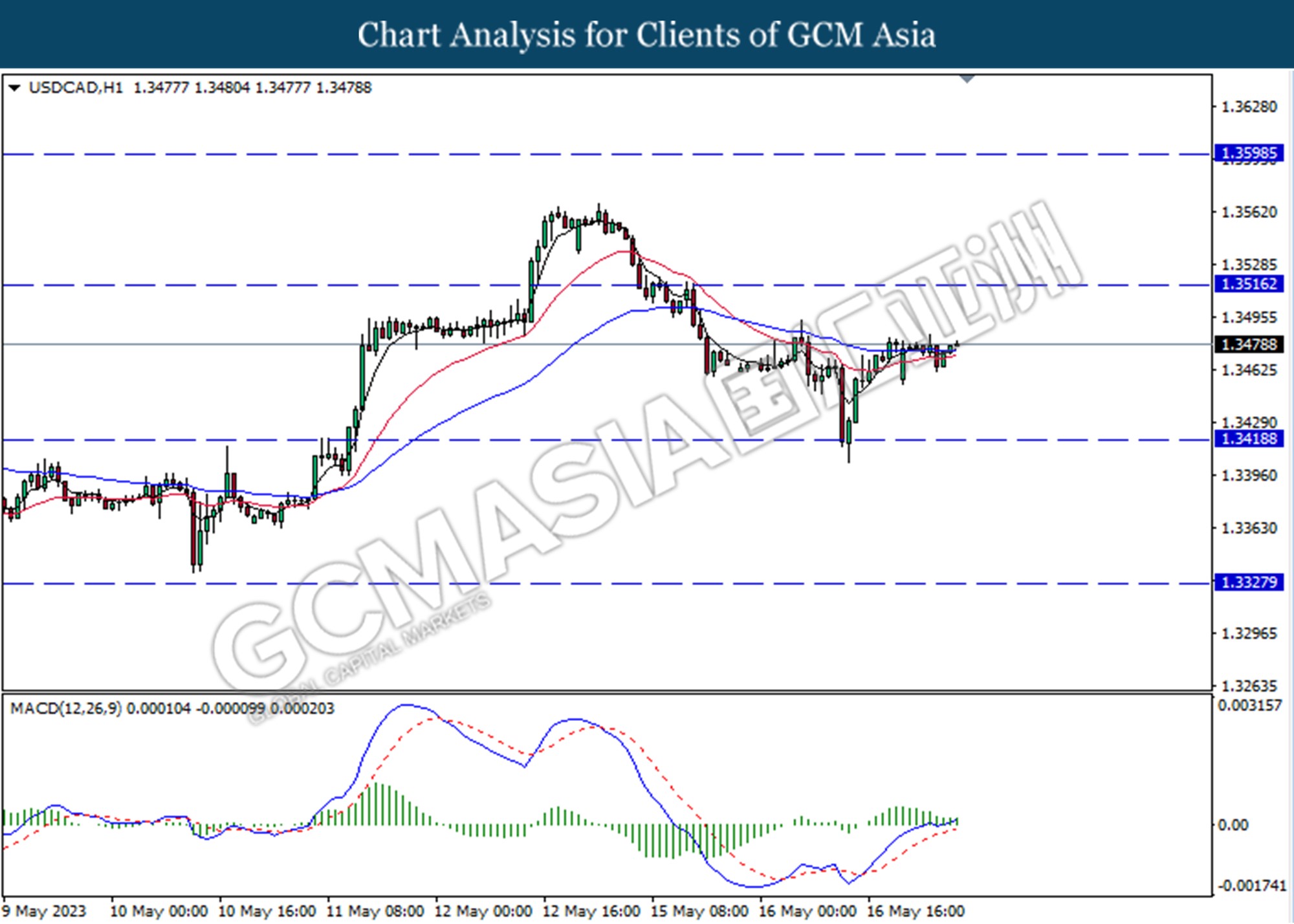

USDCAD, H4: USDCAD was traded higher following the prior rebound from the lower level. However, MACD which illustrated diminishing bullish momentum suggests the pair undergo a technical correction in the short term.

Resistance level: 1.3515, 1.3600

Support level: 1.3420, 1.3330

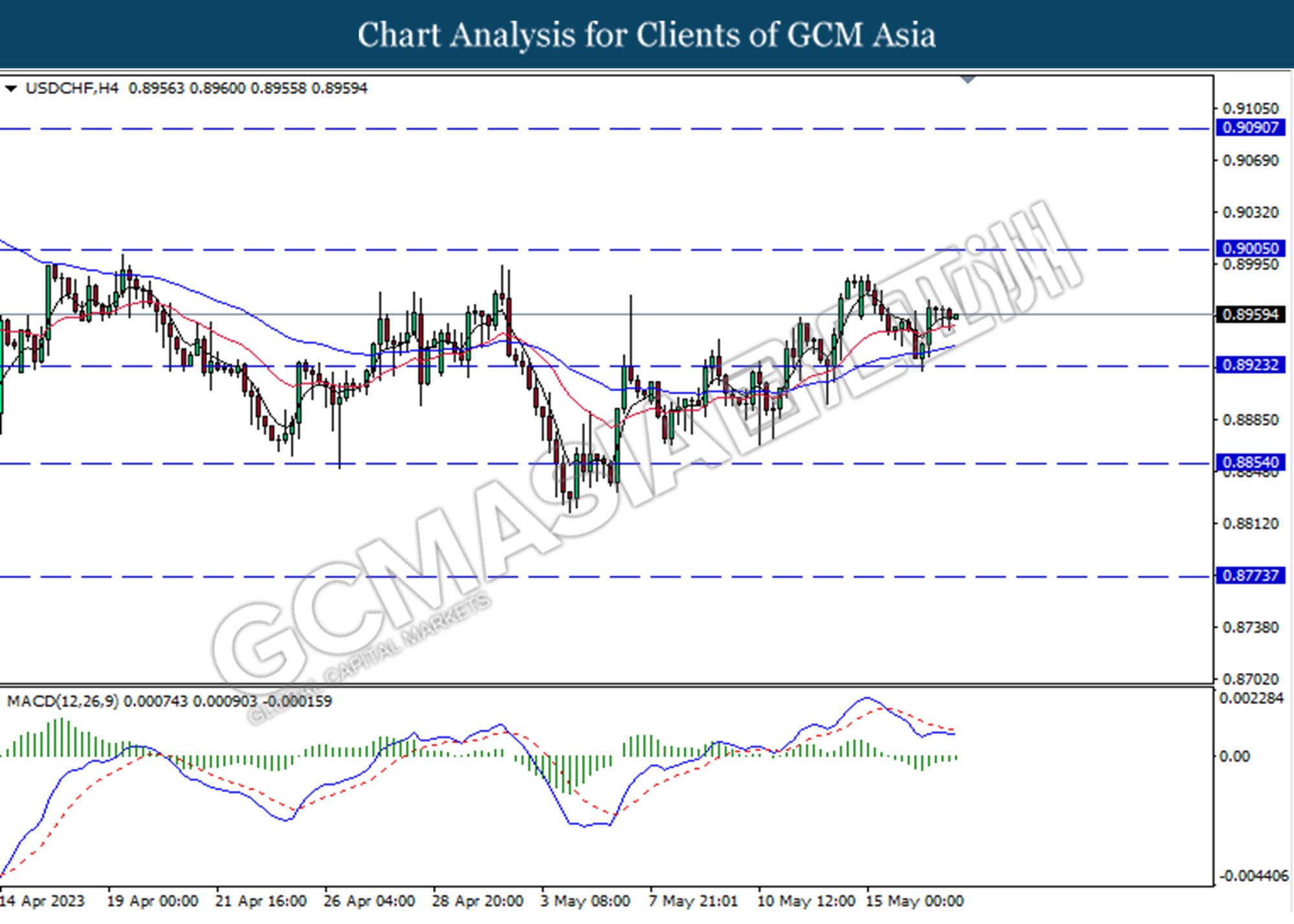

USDCHF, H4: USDCHF was traded lower following the prior retracement from the higher level. However, MACD which illustrated diminishing bearish momentum suggests the pair undergo a technical correction in the short term.

Resistance level: 0.9000, 0.9075

Support level: 0.8865, 0.8780

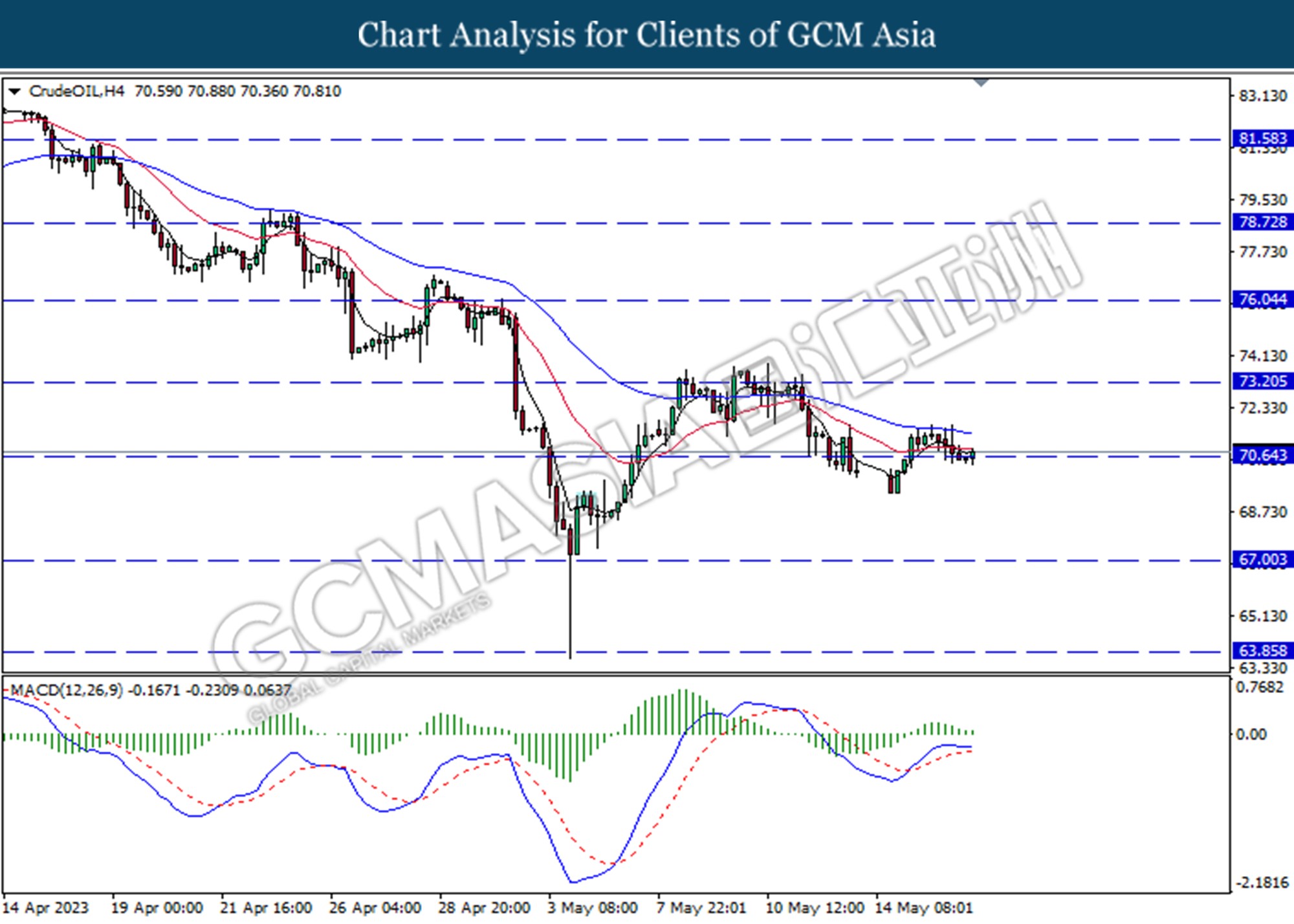

CrudeOIL, H4: Crude oil price was traded higher following the prior rebound from the support level at 70.65. However, MACD which illustrated diminishing bullish momentum suggests the commodity undergo a technical correction in the short term.

Resistance level: 73.20, 76.05

Support level: 70.65, 67.00

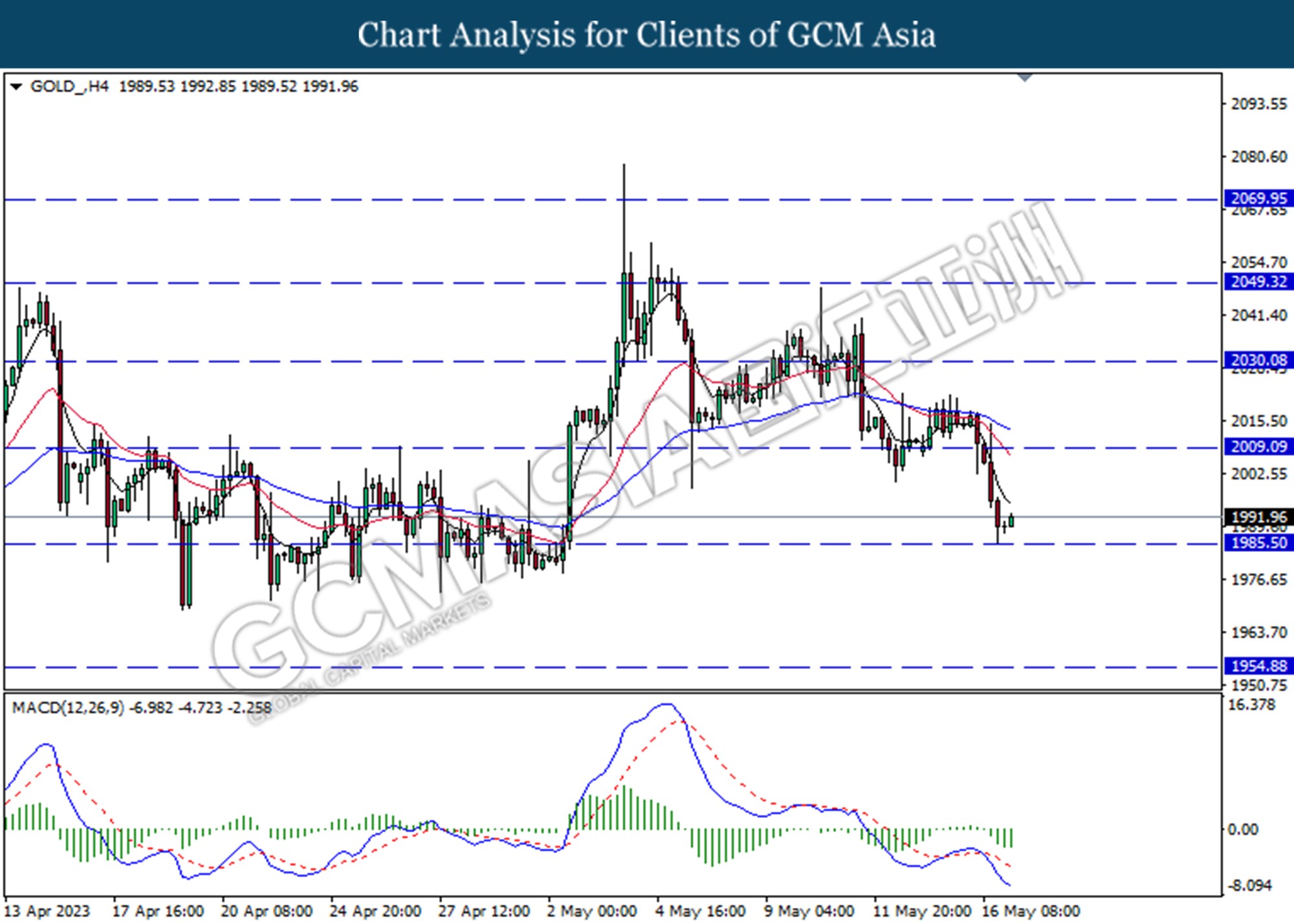

GOLD_, H4: Gold price was traded higher following a prior rebound from the support level at 1985.50. However, MACD which illustrated bearish momentum the commodity undergoes a technical correction in the short term.

Resistance level: 2009.10, 2030.10

Support level: 1985.50, 1954.90