17 May 2023 Morning Session Analysis

US dollar surged while the debt ceiling in spotlight.

The dollar index, which was traded against a basket of six major currencies, regained its luster after a technical correction in the previous trading session amid constructive progress in the recent talk and both parties showed their strong-willingness on sealing a deal in the talks. According to the a communique, US President Joe Biden said the hour-long meeting with the congressional members on Tuesday was “good and productive” and that he was optimistic about the prospects for a deal. Besides, Mr McCarthy, who has been pessimistic throughout the negotiations, told reporters he believed a deal was possible by the end of this week. In order to avoid the US entering a calamitous default on its $31.4 trillion, Biden has canceled a trip to Australia and Papua New Guinea and will return to Washington after the end of G7 summit in Japan to focus on the debt ceiling. However, it is noteworthy to highlight that there is no official deal on raising the debt limit has been sealed at this point in time. The republicans are still demanding a spending cuts, while Joe Biden repeatedly said that a potential debt default and budget spending should be separate. As of writing, the dollar index rose 0.17% to 102.60.

In the commodities market, crude oil prices edged down by -0.55% to $70.95 per barrel amid a weaker demand from China and US oil inventory increased. Besides, gold prices ticked up by 0.05% to $1990.10 per troy ounce following a tremendous sell-off yesterday’s night amid the rise in US treasury yield.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

17:50 GBP BoE Gov Bailey Speaks

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 17:00 | EUR – CPI (YoY) (Apr) | 6.9% | 7.0% | – |

| 20:30 | USD – Building Permits (Apr) | 1.430M | 1.430M | – |

| 22:30 | CrudeOIL – Crude Oil Inventories | 2.951M | -0.917M | – |

Technical Analysis

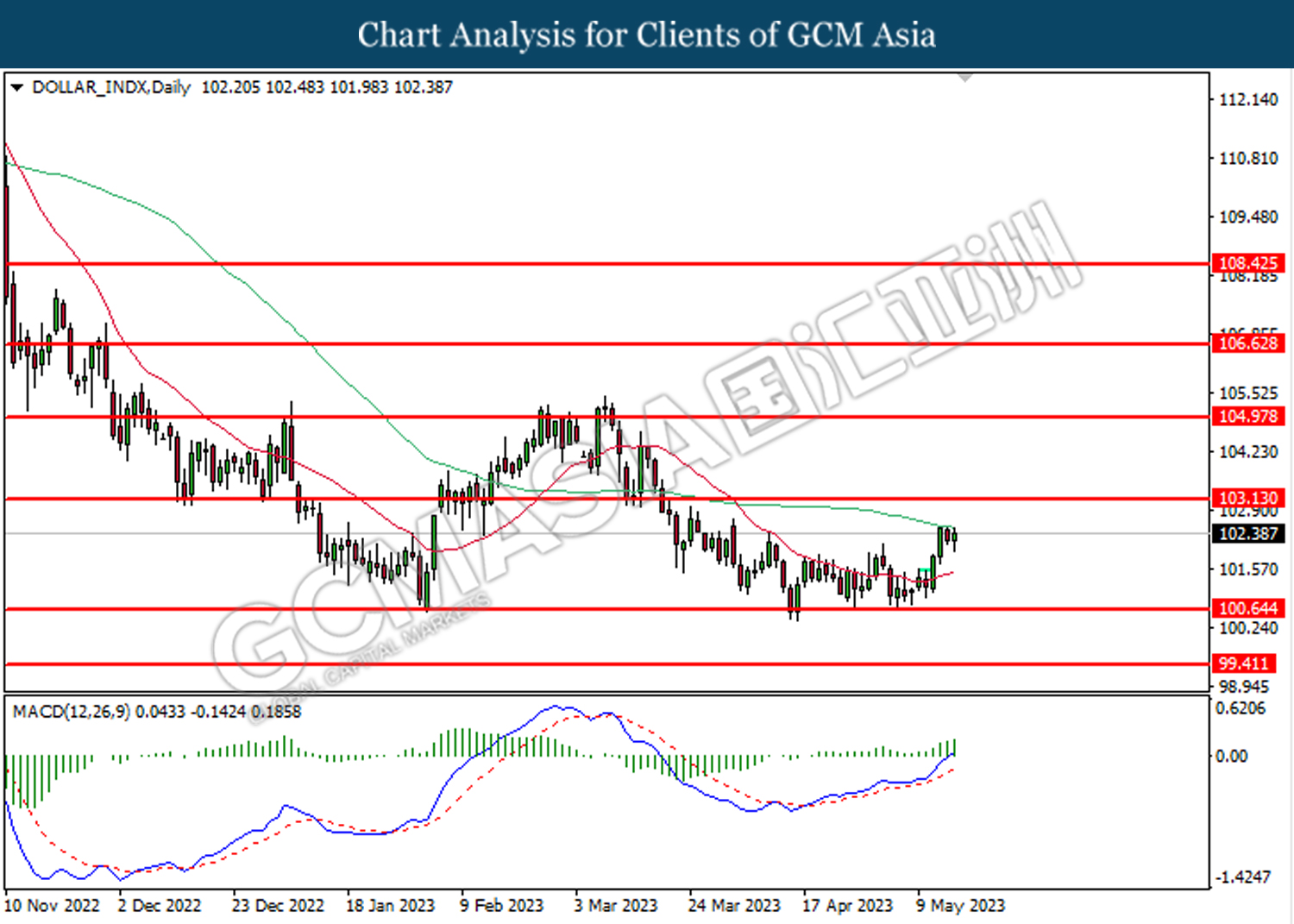

DOLLAR_INDX, Daily: Dollar index was traded higher following the prior rebound from the support level at 100.65. MACD which illustrated bullish bias momentum suggests the index to extend its gains toward the resistance level at 103.15.

Resistance level: 103.15, 104.95

Support level: 100.65, 99.40

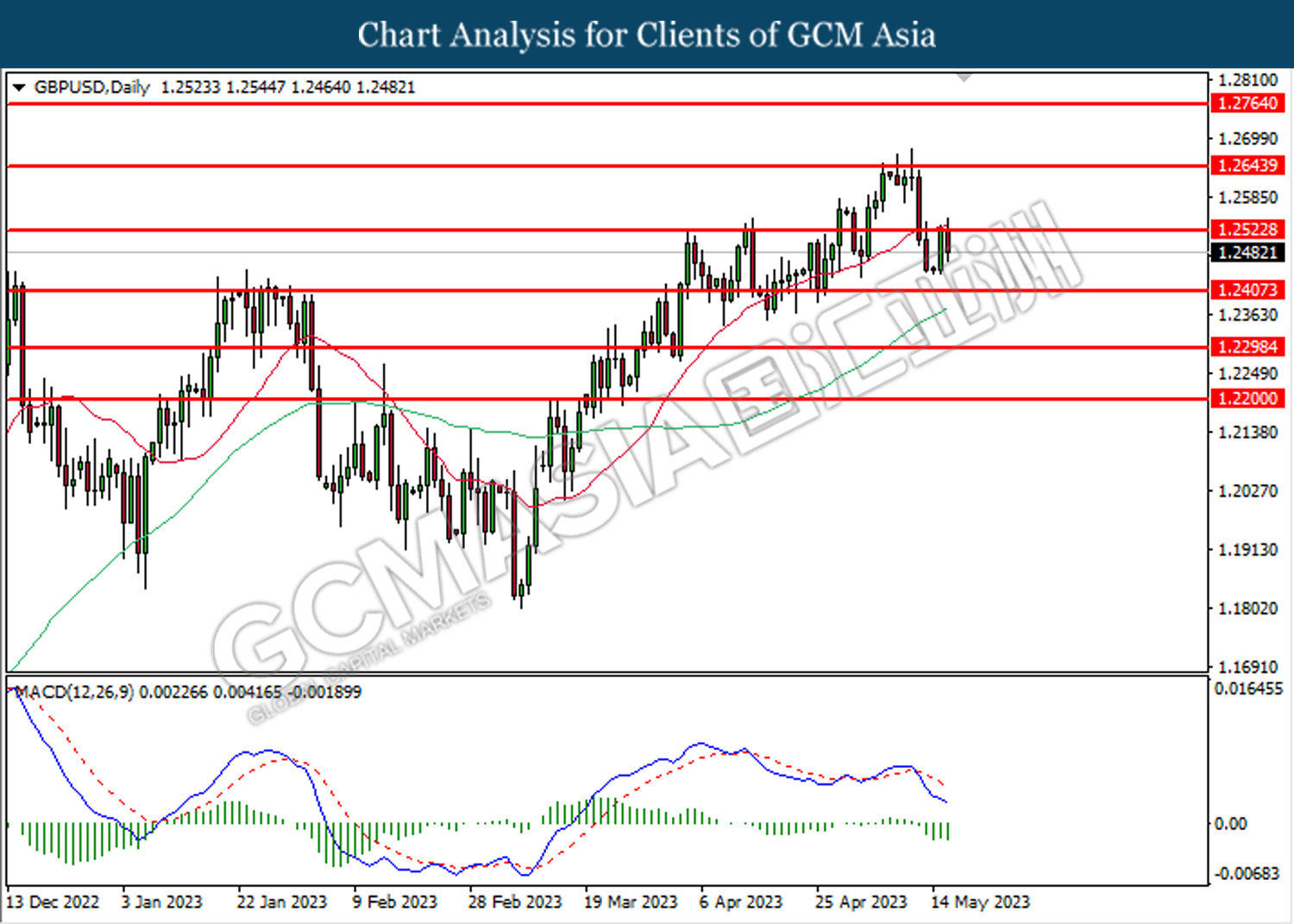

GBPUSD, Daily: GBPUSD was traded lower following the prior retracement from the resistance level at 1.2525. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 1.2405.

Resistance level: 1.2525, 1.2645

Support level: 1.2405, 1.2300

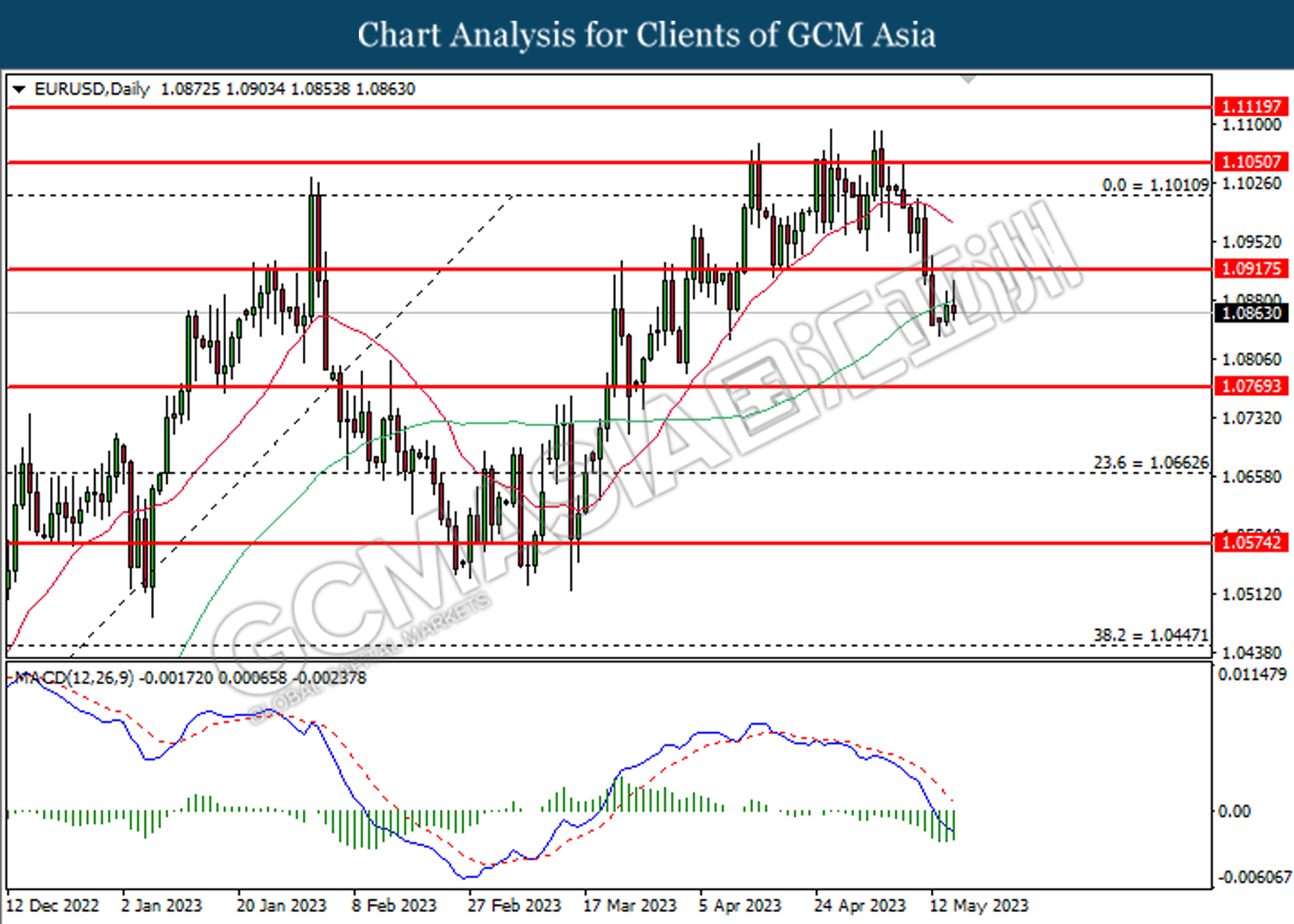

EURUSD, Daily: EURUSD was traded lower following the prior retracement from the resistance level at 1.0915. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 1.0770.

Resistance level: 1.0915, 1.1010

Support level: 1.0770, 1.0665

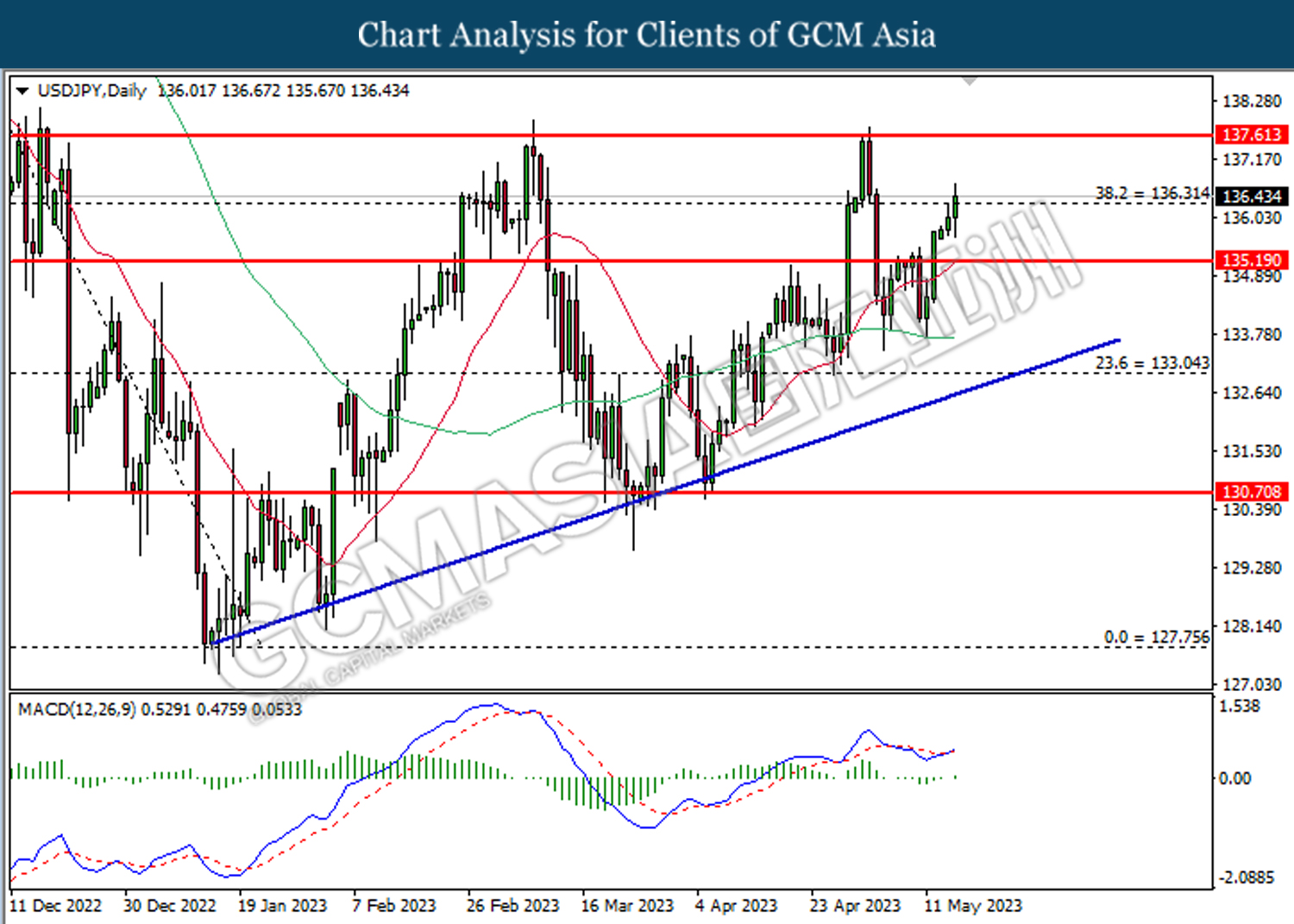

USDJPY, Daily: USDJPY was traded higher while currently testing the resistance level at 136.30. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 136.30, 137.60

Support level: 135.20, 133.05

AUDUSD, Daily: AUDUSD was traded lower while currently retesting the support level at 0.6675. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 0.6785, 0.6925

Support level: 0.6675, 0.6565

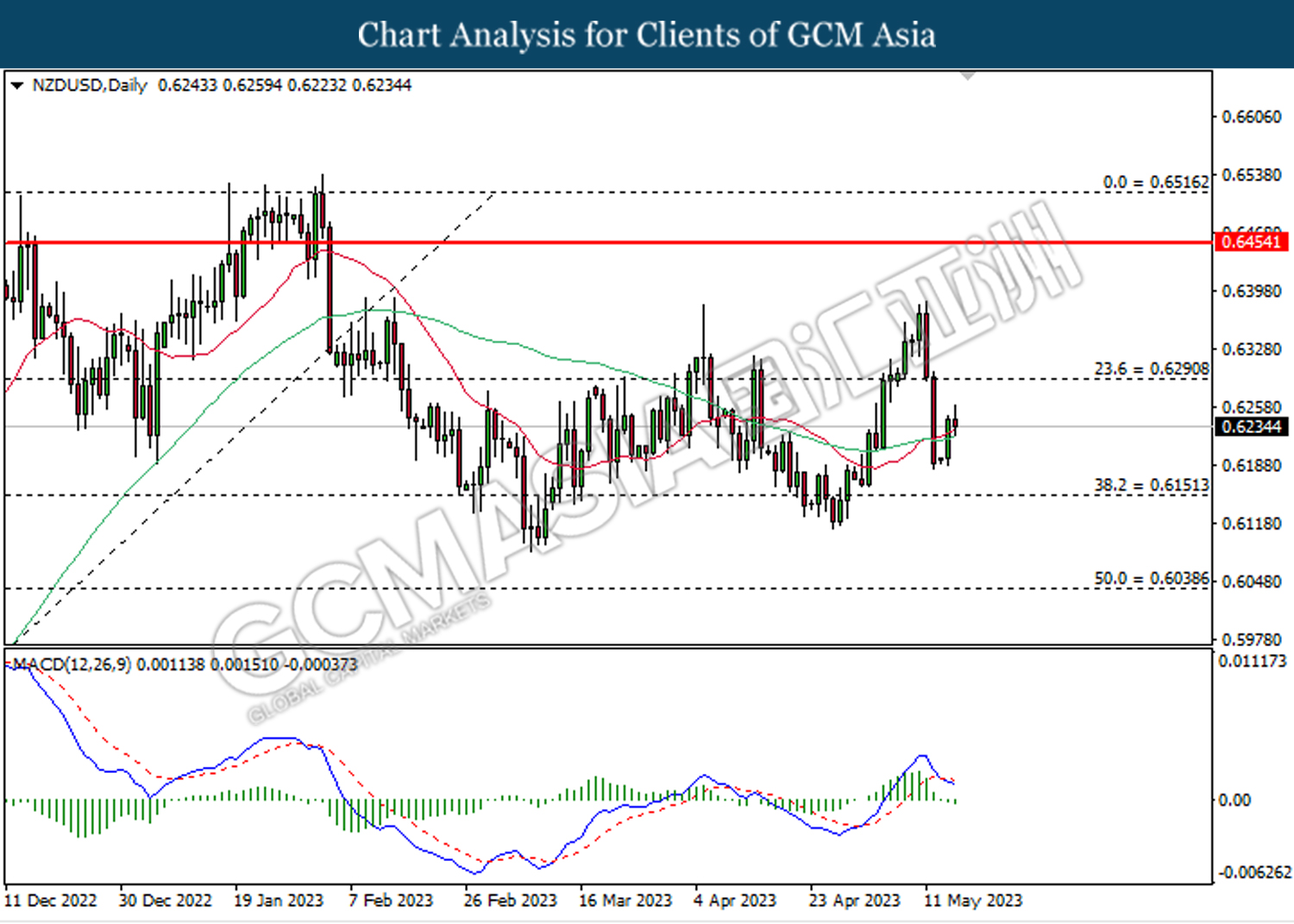

NZDUSD, Daily: NZDUSD was traded higher following the prior rebound from the lower level. However, MACD which illustrated bearish bias momentum suggest the pair to undergo technical correction in short term.

Resistance level: 0.6290. 0.6455

Support level: 0.6150, 0.6040

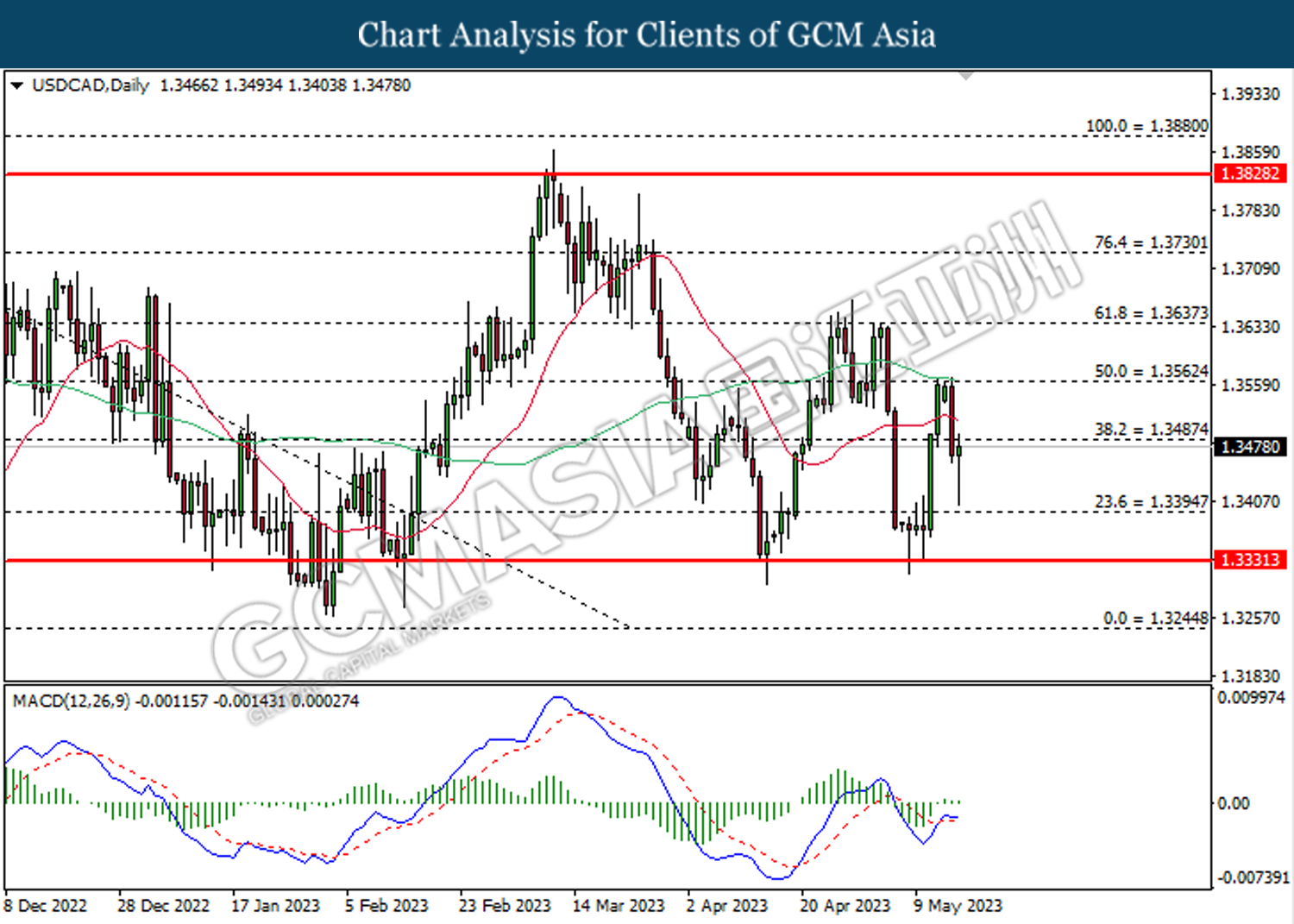

USDCAD, Daily: USDCAD was traded lower while currently testing the support level at 1.3395. MACD which illustrated diminishing bullish momentum suggests the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.3485, 1.3565

Support level: 1.3395, 1.3330

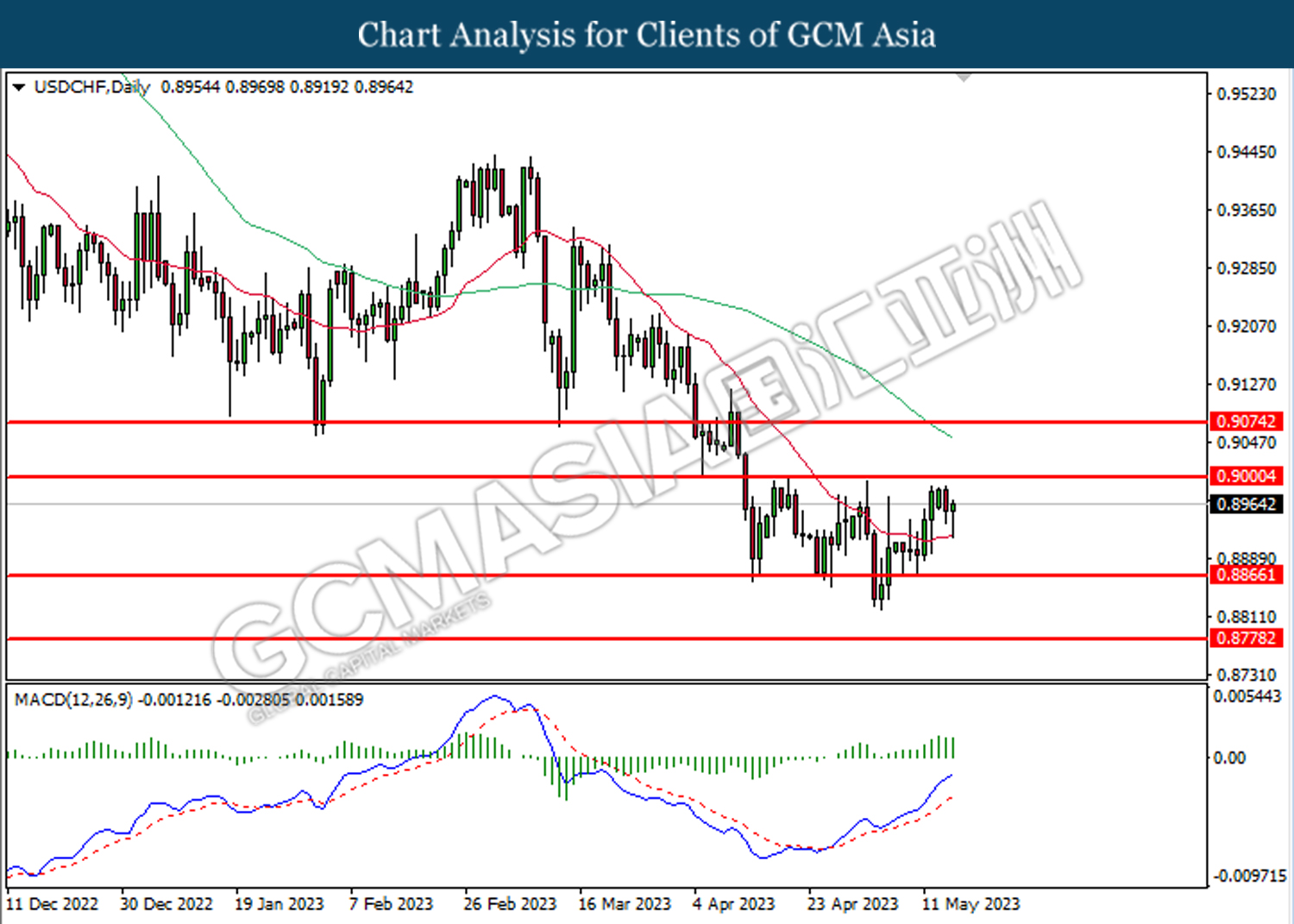

USDCHF, Daily: USDCHF was traded higher following the prior rebound from the support level at 0.8865. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 0.9000.

Resistance level: 0.9000, 0.9075

Support level: 0.8865, 0.8780

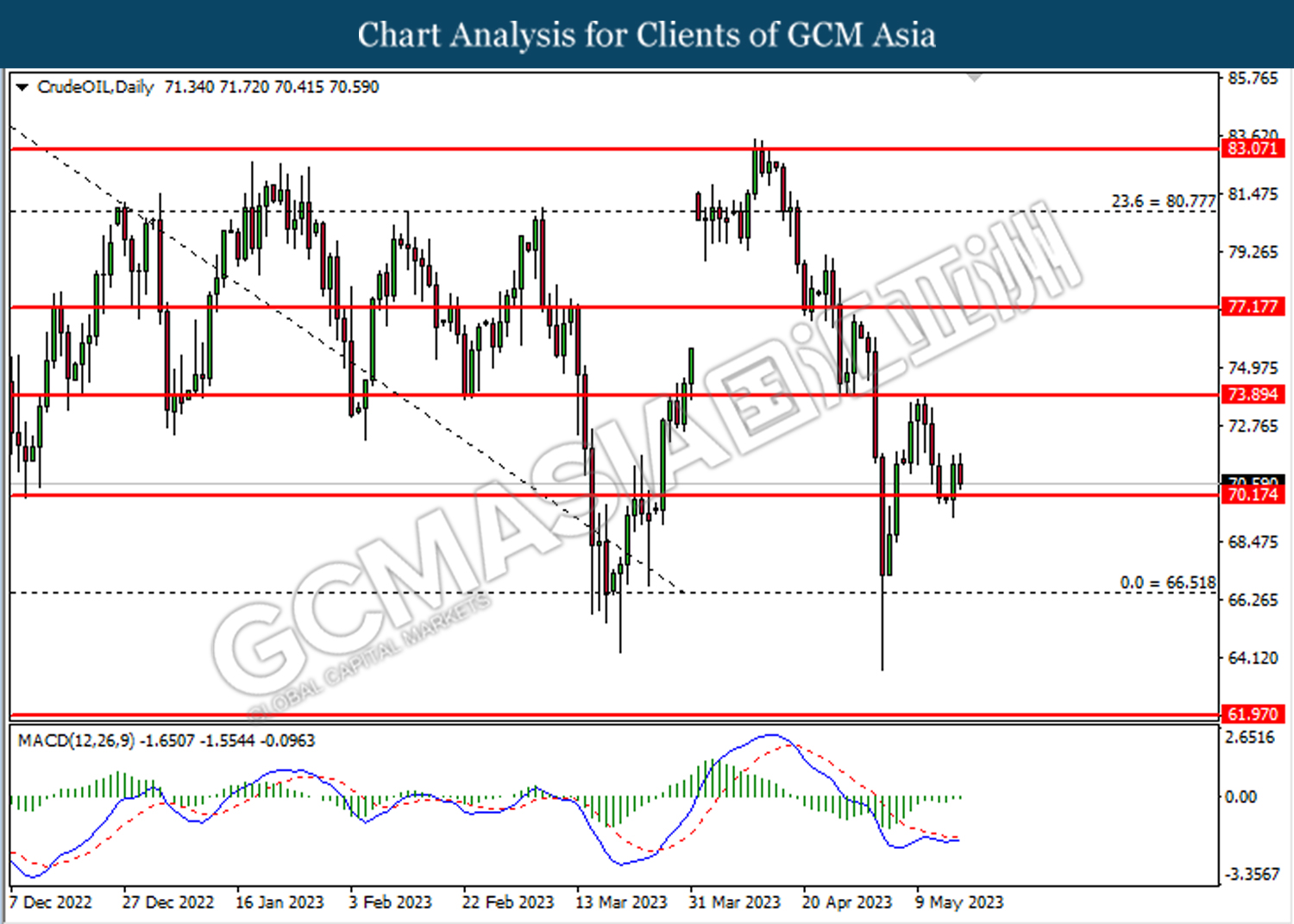

CrudeOIL, Daily: Crude oil price was traded higher following the prior rebound from the support level at 70.15. MACD which illustrated diminishing bearish momentum suggest the commodity to extend its gains toward the resistance level at 73.90.

Resistance level: 73.90, 77.15

Support level: 70.15, 66.50

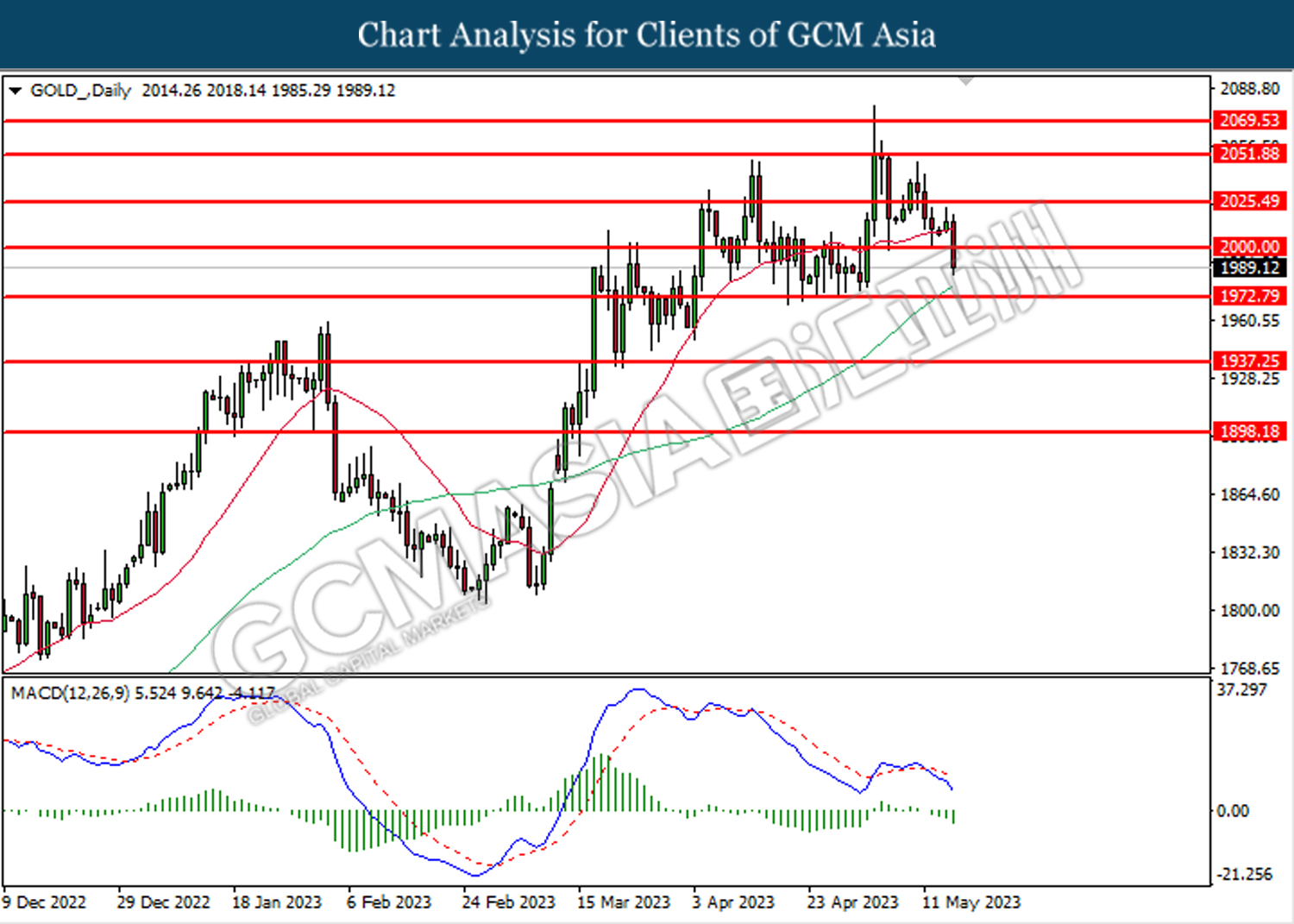

GOLD_, Daily: Gold price was traded lower while currently testing the support level at 2000.00. MACD which illustrated bearish bias momentum suggests the commodity to extend its losses after it successfully breakout below the support level.

Resistance level: 2025.50, 2051.90

Support level: 2000.00, 1972.80