17 June 2020 Afternoon Session Analysis

Dollar revived amid upbeat economic data.

Dollar index which gauge its value against a basket of six major currencies managed to extend its rebound after hitting its recent low level amid recent economic data showed a crucial recovery sign after US lifted up its lockdown restriction one month ago. According to the Census Bureau, U.S. Retail Sales data was came in at 17.7%, unexpectedly far better than economist forecast at 8.0%, indicating that American shopping activity has powered significantly, recorded the biggest monthly jump despite the economy is still being haunted by the fallout of Covid-19. Other than that, Jerome Powell neutral statement which released on yesterday has eventually put the entire market sentiment unclear. In details, Jerome Powell revealed that economy are now facing unprecedented significant long term damage which can been obviously seen from high unemployment rate and increasing cases number of business failure in US. However, US economy has entered into stabilization stage after removing its lockdown measures where business and factory are allowed to reopen during this period. As of now, dollar index rose by 0.04% to 97.00.

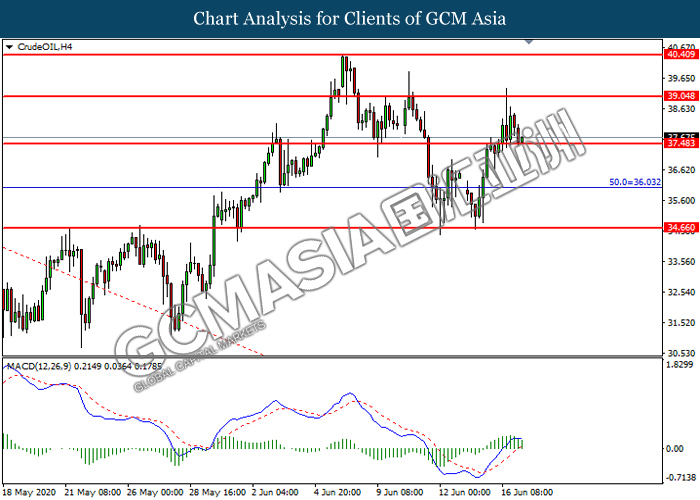

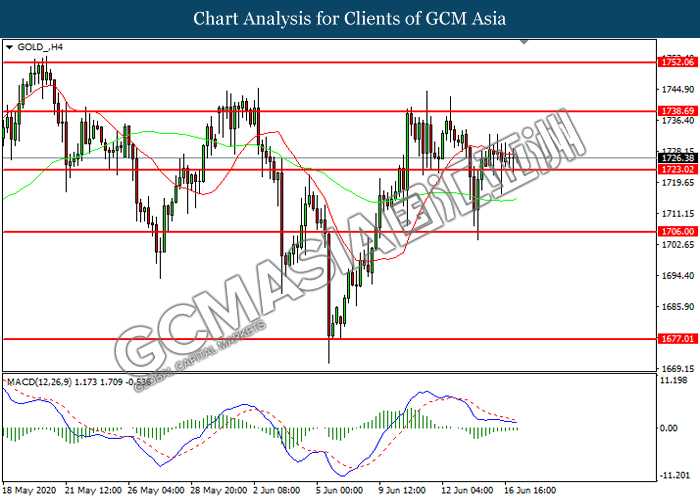

In the commodities market, crude oil price plunged 2.06% to $37.59 per barrel amid continuous sign of crude oil build in US. According to the API, US API Weekly Crude Oil Stock data has increased by 3.900M while the previous reading was 8.400M. The reported build in crude oil inventories level has dragged down the appeal of oil market. Besides, gold price rose by 0.02% to $1726.75 a troy ounce amid heightening of virus’s pandemic.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 17.00 | EUR – CPI (YoY) (May) | 0.1% | 0.1% | – |

| 20.30 | USD – Building Permits (May) | 1.228M | 1.066M | – |

| 20.30 | CAD – Core CPI (MoM) (May) | 0.4% | – | – |

| 22.30 | CrudeOIL – Crude Oil Inventories | 5.720M | -0.152M | – |

Technical Analysis

DOLLAR_INDX, H1: Dollar index was traded within a range while currently testing the resistance level at 97.15. MACD which illustrated diminishing bullish momentum suggest the index to be traded lower in short-term as technical correction.

Resistance level: 97.15, 98.15

Support level: 96.30, 95.40

GBPUSD, H1: GBPUSD was traded lower while currently testing the support level at 1.2540. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher in short-term as technical correction.

Resistance level: 1.2640, 1.2710

Support level: 1.2540, 1.2465

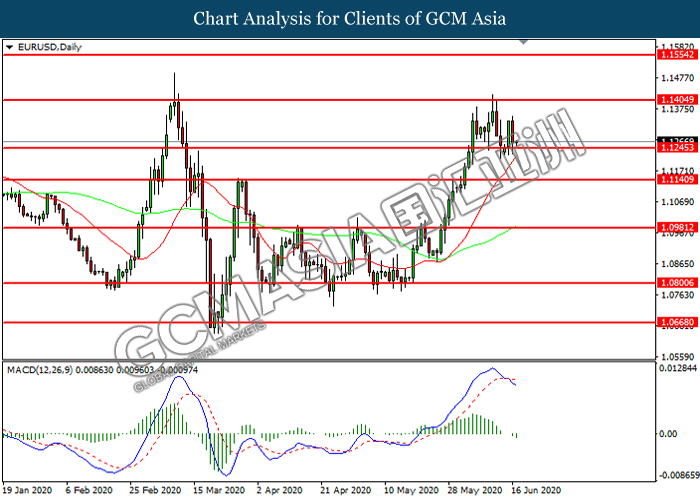

EURUSD, Daily: EURUSD was traded lower while currently testing the support level at 1.1245. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.1405, 1.1555

Support level: 1.1245, 1.1140

USDJPY, H1: USDJPY was traded lower while currently near the support level at 107.15. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher in short-term as technical correction.

Resistance level: 107.45, 107.80

Support level: 107.15, 106.70

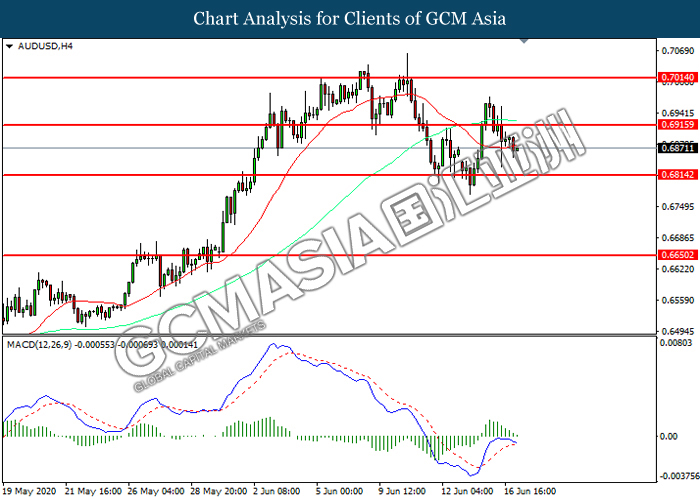

AUDUSD, H4: AUDUSD was traded lower following prior breakout below the previous support level at 0.6915. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward support level at 0.6815.

Resistance level: 0.6915, 0.7015

Support level: 0.6815, 0.6650

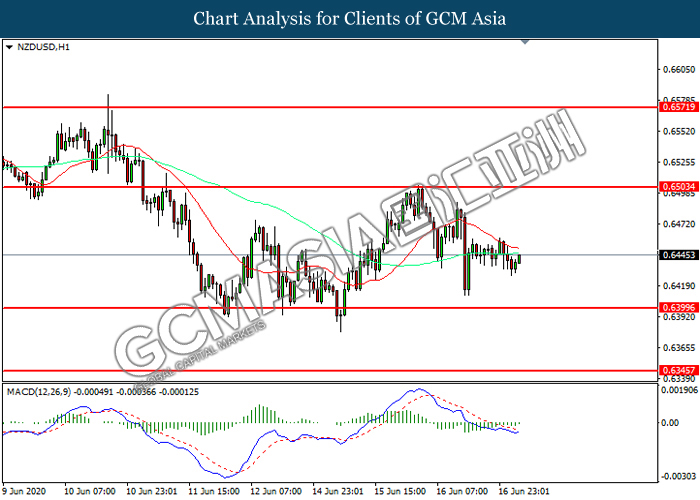

NZDUSD, H1: NZDUSD was traded lower following prior retracement from the resistance level at 0.6505. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher in short-term as technical correction.

Resistance level: 0.6505, 0.6570

Support level: 0.6400, 0.6345

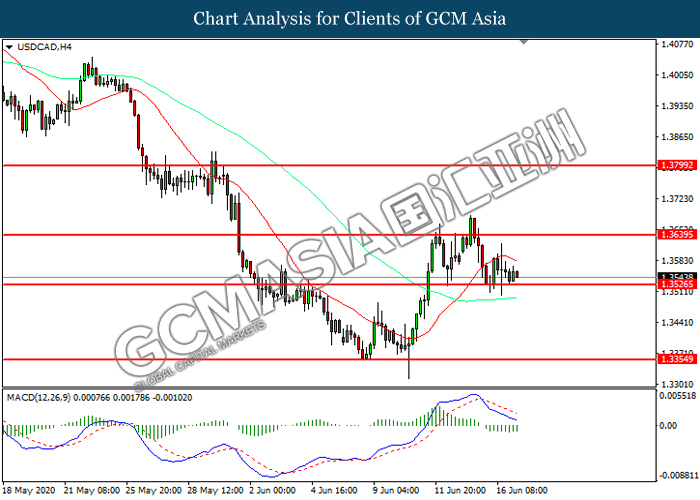

USDCAD, H4: USDCAD was traded lower while currently testing the support level at 1.3525. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher in short-term as technical correction.

Resistance level: 1.3640, 1.3800

Support level: 1.3525, 1.3355

USDCHF, H1: USDCHF was traded lower following prior retracement from the resistance level at 0.9615. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward support level at 0.9485.

Resistance level: 0.9515, 0.9545

Support level: 0.9485, 0.9460

CrudeOIL, H4: Crude oil price was traded lower while currently testing the support level at 37.50. MACD which illustrated diminishing bullish momentum suggest the commodity to extend its losses after it successfully breakout below the support level.

Resistance level: 39.05,40.40

Support level: 36.05, 34.65

GOLD_, H4: Gold price was traded within a range while currently testing the support level at 1723.00. However, MACD which illustrated diminishing bearish momentum suggest the commodity to be traded higher in short-term as technical correction.

Resistance level: 1738.70, 1752.05

Support level: 1723.00, 1706.00