17 June 2022 Afternoon Session Analysis

Swiss Franc surged following Switzerland implement first rate hike in 15 years.

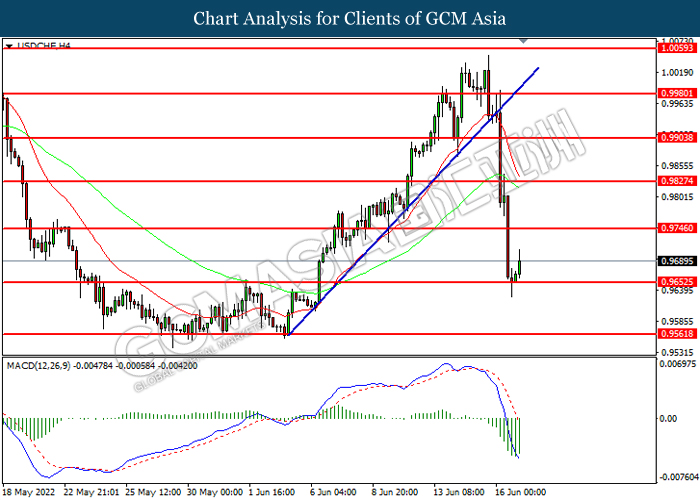

The Swiss Franc surged significantly following the Swiss National Bank increased its benchmark interest rate for the first time in 15 years in an unexpected move on Thursday, while reiterating that they will continue to rate hike further, aligning with other central banks in contractionary monetary policy to combat the spiking number of inflation. According to Swiss National Bank, the Switzerland Interest Rate Decision increased from the previous reading of -0.75% to -0.25%, exceeding the market expectation at -0.75%. It was the first-rate hike by the SNB since September 2007. Besides that, the other central banks are also implementing contractionary monetary policy in attempt to cool inflation. Yesterday, the Bank of England also increased the UK interest rate by a quarter point, which also spurring further bullish market demand on the Pound Sterling. Recently, the fresh data has shown that UK inflation soared to 40-yer high of 9% annually in April as rising food and energy prices, and the country faces a major cost of living crisis. As of writing, USD/CHF depreciated by 0.10% to 0.9680 while GBP/USD retreated by 0.34% to 1.2309.

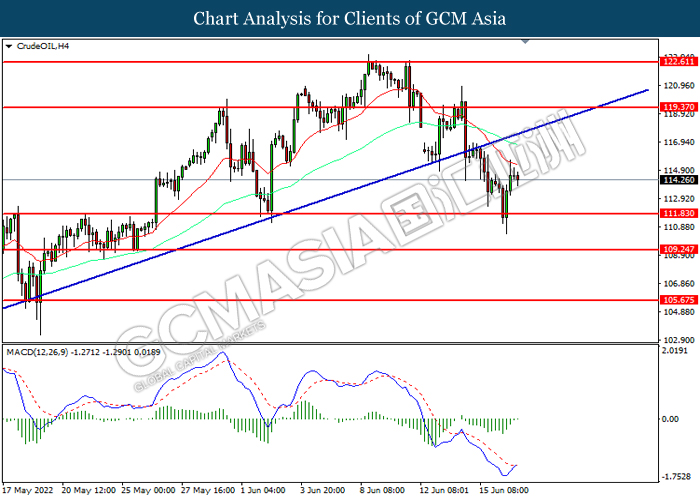

In the commodities, the crude oil price depreciated by 0.38% to $117.00 per barrel as of writing. The oil market retraced from its higher level amid the fears upon the recession risk in future continue to weigh down the appeal for this black-commodity. On the other hand, the gold price slumped 0.69% to $1843.90 per troy ounces amid strengthening US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

20:45 USD Fed Chair Powell Speaks

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 17:00 | EUR – CPI (YoY) (May) | 8.1% | 8.1% | – |

Technical Analysis

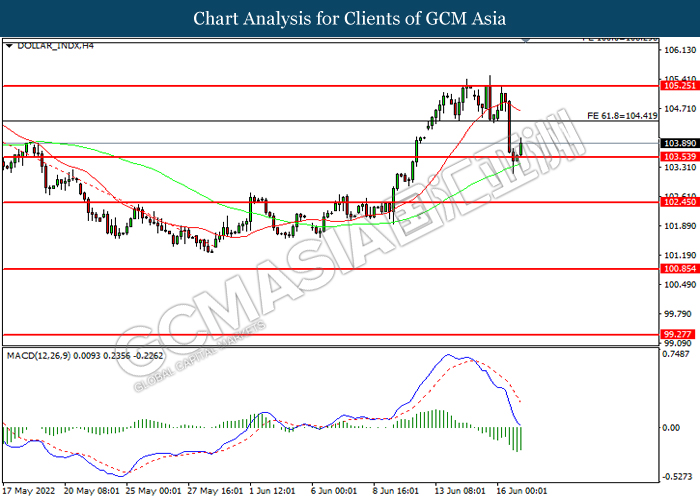

DOLLAR_INDX, H4: Dollar index was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the index to extend its losses after breakout.

Resistance level: 104.40, 105.25

Support level: 103.55, 102.45

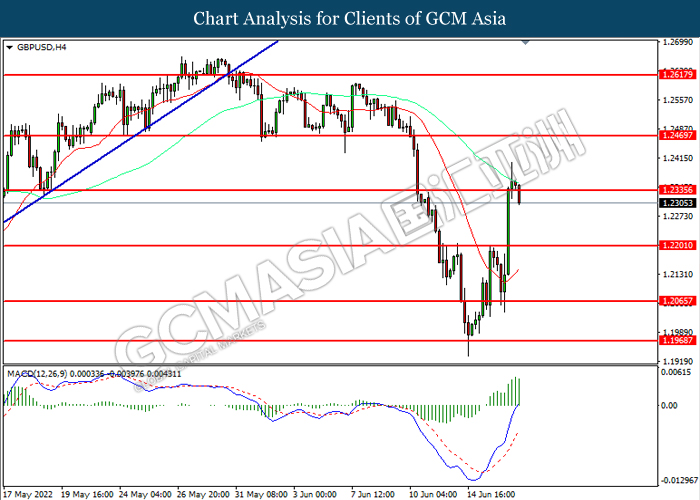

GBPUSD, H4: GBPUSD was traded lower following prior retracement from the resistance level. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses.

Resistance level: 1.2335, 1.2470

Support level: 1.2200, 1.2065

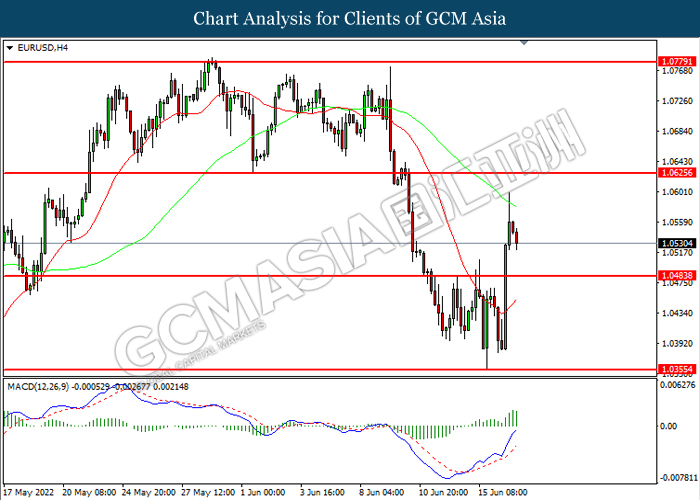

EURUSD, H4: EURUSD was traded higher following prior breakout the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 1.0625, 1.0780

Support level: 1.0485, 1.0355

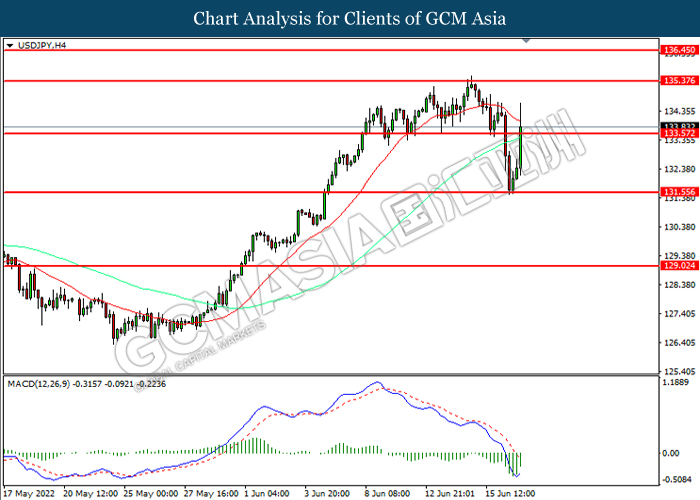

USDJPY, H4: USDJPY was traded higher following prior breakout above the previous resistance level. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains.

Resistance level: 135.40, 136.45

Support level: 133.55, 131.25

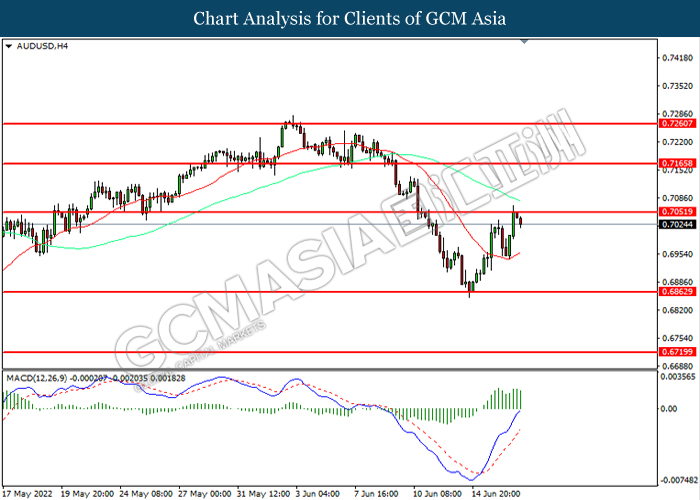

AUDUSD, H4: AUDUSD was traded higher while currently testing the resistance level. However, MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 0.7050, 0.7165

Support level: 0.6865, 0.6720

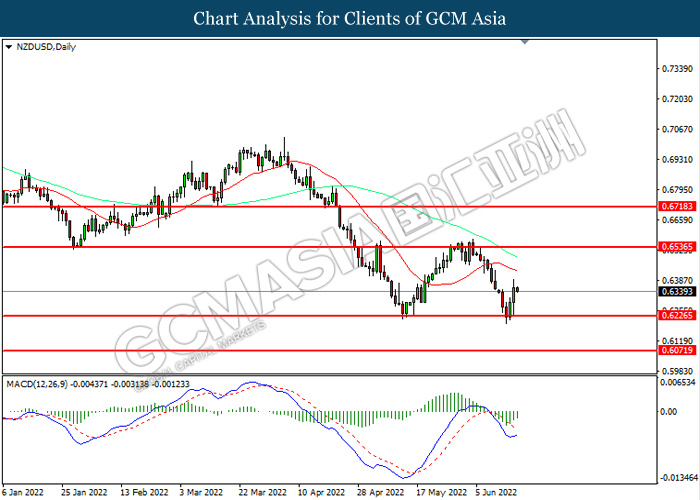

NZDUSD, Daily: NZDUSD was traded higher following prior rebounded from the support level. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward resistance level.

Resistance level: 0.6535, 0.6720

Support level: 0.6225, 0.6070

USDCAD, H4: USDCAD was traded higher while currently testing the resistance level. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after breakout.

Resistance level: 1.2975, 1.3050

Support level: 1.2860, 1.2765

USDCHF, H4: USDCHF was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after breakout.

Resistance level: 0.9745, 0.9825

Support level: 0.9655, 0.9560

CrudeOIL, H4: Crude oil price was traded higher following prior rebounded from the support level. MACD which illustrated diminishing bearish momentum suggest the commodity to extend its gains.

Resistance level: 119.35, 112.60

Support level: 111.85, 109.25

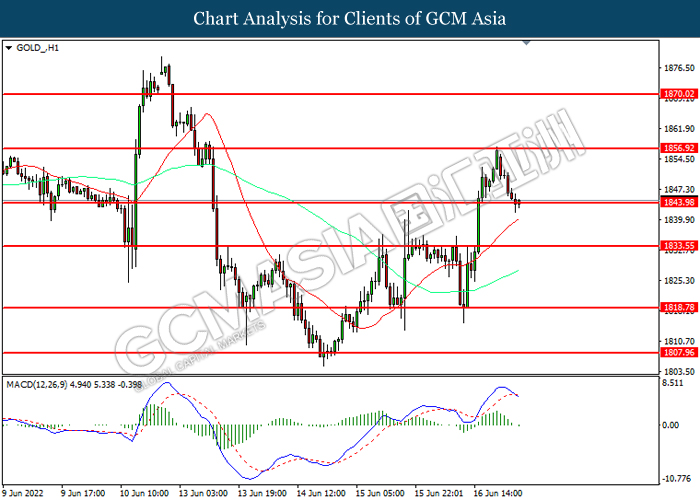

GOLD_, H1: Gold price was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses after breakout.

Resistance level: 1856.90, 1870.00

Support level: 1844.00, 1833.55