17 July 2017 Weekly Analysis

GCMAsia Weekly Report: July 17 – 21

Market Review (Forex): July 10 – 14

U.S. Dollar

Greenback fell to its lowest level since October against other major peers last Friday following weak US inflation and retail sales data which has added more doubts on Federal Reserve’s plan to raise interest rates again this year. The dollar index fell 0.69% to 94.90, its lowest since October 5th.

According to the Labor Department, US consumer price inflation slowed down to 1.6% in June as compared to 1.9% in May. Consumer spending were also weaker-than-expected with retail sales tumbling 0.2% last month as compared to expected rise of 0.1%. The Fed hiked its rates last month which sticking to their forecast for one more rate hike this year. However, overall sluggish outlook for inflation has raised questions over their ability to follow through such plans.

In a testimony before the US Congress on Wednesday, Fed Chair Janet Yellen postulate that the economy is strong enough for the Fed to raise interest rates again and wind down its massive bond portfolio. However, she reiterated that the current inflation pressure is still below its target and noted particular uncertainty that could affect their monetary policy in the future.

US Inflation Rate

—– Forecast

US inflation rate for year-over-year comparison came in at 1.6% for the month of June, less than economist expectation of 1.7%.

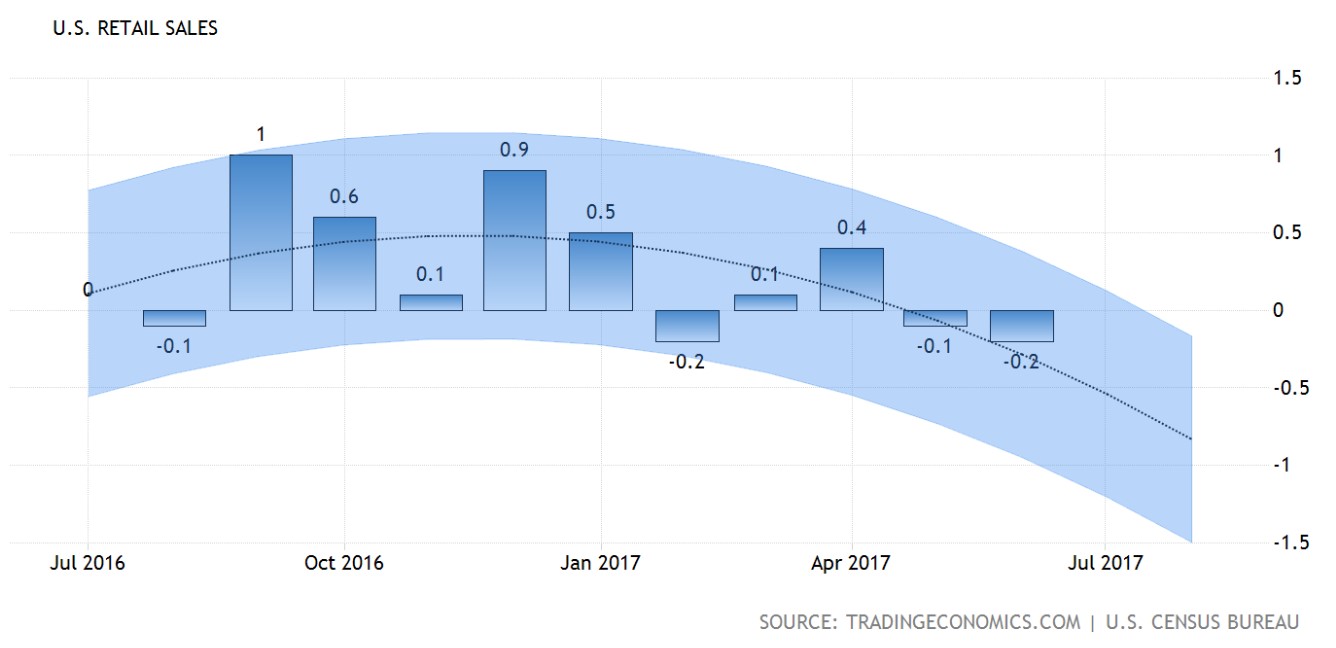

US Retail Sales

—– Forecast

US retail sales shrank by 0.2% for last month, indicating a slowdown in personal consumption.

USD/JPY

Pairing of USD/JPY was down 0.65% to 112.53 on Friday.

EUR/USD

Euro added up 0.62% to $1.1469, closing in near 14-months high of $1.1488.

GBP/USD

Pound sterling skyrocketed 1.24% to $1.3099, its highest level since September 2016.

Market Review (Commodities): July 10 – 14

GOLD

Gold price rose to two-weeks high on Friday as weak US inflation data spurs higher doubts on Federal Reserve’s ability to raise its interest rates for the third time by year end. The price of the yellow metal rose 0.95% while closing the week at $1,228.88. For the week, the precious metal has gained 1.32%. Expectations that rates will stay low tend to boost gold price, which struggles to compete with yield bearing assets once borrowing cost rises.

Crude Oil

Oil prices settled higher for fifth consecutive session on Friday while scoring a weekly gain of 5% as investors cheered data that suggests a pick up in oil demand for second half of 2017. Its prices were up 46 cents or 1% and ended the week at $46.54 a barrel. For the week, it has gained $2.31 or 5%, propped up by reports of accelerating demand growth from the International Energy Agency and crude oil import growth in China while coupled with falling crude stocks in the US.

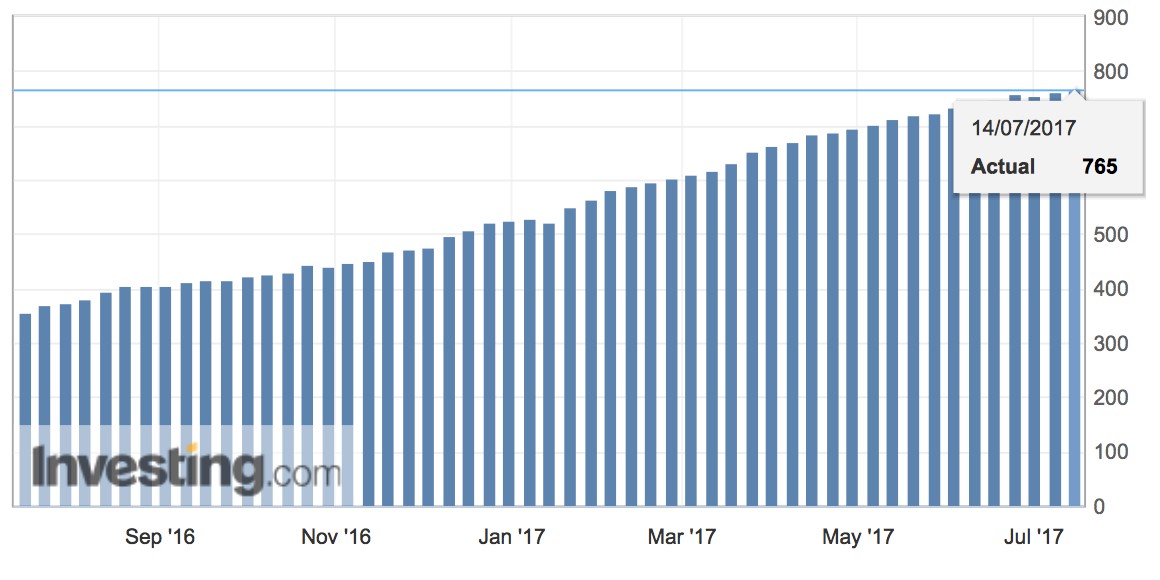

Despite recent gains, concerns over rising global supplies continues to surround the oil market and capping its gains. According to US oilfield service provider Baker Hughes, the number of active oil drilling rig was up by 2 to a total count of 765, its highest since April 2015. Such addition underlined the concern that ongoing rebound of US shale production may derail other producer’s effort to rebalance the oil market.

Previously, OPEC and some non-OPEC members had extended a deal to cut 1.8 million barrels per day until March 2018. However, the production-cut agreement has yet to yield any impact on global inventory levels due to rising supply from non-participating countries such as Libya, Nigeria and United States.

U.S. Baker Hughes Oil Rig Count

US drillers has added 2 oil rigs last week, bringing in to a total of 765.

Weekly Outlook: July 17 – 21

For the week ahead, investors will be turning their focus to the outcome of Thursday’s European Central Bank meeting for fresh clues on when it will reduce its ultra-easy monetary policy. Likewise, China’s data on second quarter growth alongside with UK’s inflation data will be closely watched as well.

As for oil traders, they will keep an eye on fresh weekly information regarding US stockpiles of crude and refined products on Tuesday and Wednesday to gauge the strength of demand in the US. Likewise, comments from global oil producers will be sidelined to gain further evidence of their compliance towards the agreement to reduce its daily output levels.

Highlighted economy data and events for the week: July 17 – 21

| Monday, July 17 |

Data CNY – GDP (YoY) (Q2) CNY – Industrial Production (YoY) (Jun) EUR – CPI (YoY) (Jun) USD – NY Empire State Manufacturing Index (Jul)

Events N/A

|

| Tuesday, July 18 |

Data NZD – CPI (QoQ) (Q2) GBP – CPI (YoY) (Jun) EUR – German ZEW Economic Sentiment (Jul) USD – Import Price Index (MoM) (Jun)

Events AUD – RBA Meeting Minutes GBP – BoE Gov Carney Speaks

|

| Wednesday, July 19 |

Data Crude Oil – API Weekly Crude Oil Stock USD – Building Permits (Jun) USD – Housing Starts (Jun) CAD – Manufacturing Sales (MoM) (May) Crude Oil – Crude Oil Inventories

Events N/A

|

| Thursday, July 20 |

Data AUD – Employment Change (Jun) JPY – BoJ Interest Rate Decision GBP – Retail Sales (MoM) (Jun) EUR – Deposit Facility Rate EUR – ECB Interest Rate Decision (Jul) USD – Initial Jobless Claims USD – Philadelphia Fed Manufacturing Index (Jul)

Events JPY – BoJ Monetary Policy Statement (YoY) JPY – BoJ Outlook Report (YoY) JPY – BoJ Press Conference EUR – ECB Press Conference

|

|

Friday, July 21

|

Data GBP – Public Sector Net Borrowing (Jun) CAD – Core CPI (MoM) (Jun) CAD – Core Retail Sales (MoM) (May) Crude Oil – U.S. Baker Hughes Oil Rig Count

Events N/A

|

Technical weekly outlook: July 17 – 21

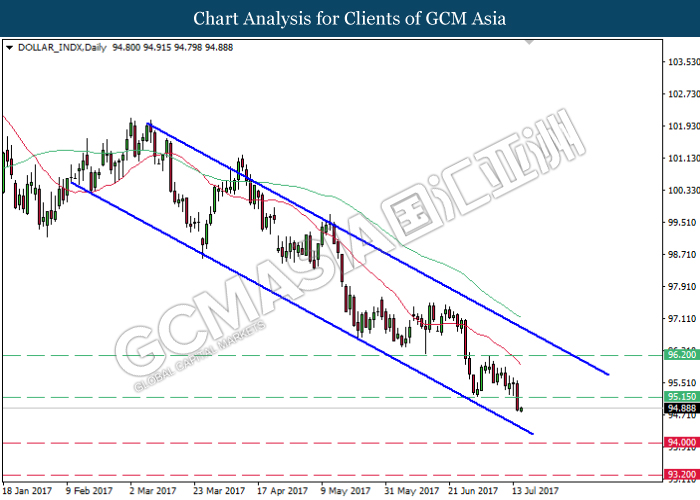

Dollar Index

DOLLAR_INDX, Daily: Dollar index remained traded within a downward channel while recently closed below the strong support of 95.15. Such price action suggests dollar index to extend its downside bias towards the bottom level of the channel in short-term.

Resistance level: 95.15, 96.20

Support level: 94.00, 93.20

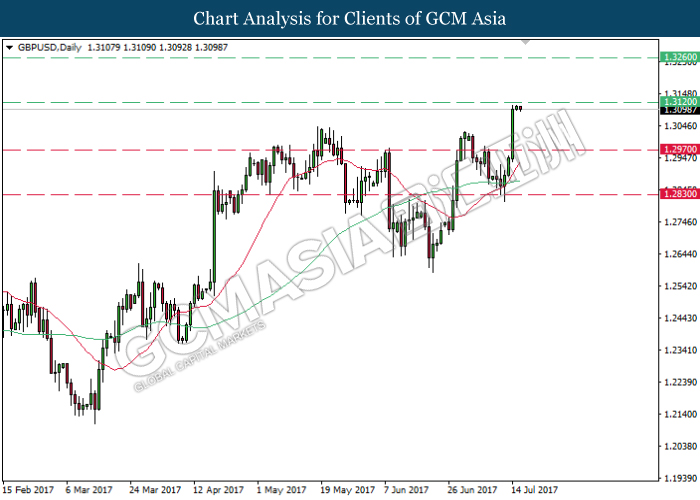

GBPUSD

GBPUSD, Daily: GBPUSD extended gains following prior rebound near the support level of 1.2830. Both MA lines which has formed a golden cross suggests GBPUSD to extend its upward momentum after successfully closing above the resistance level of 1.3120.

Resistance level: 1.3120, 1.3260

Support level: 1.2970, 1.2830

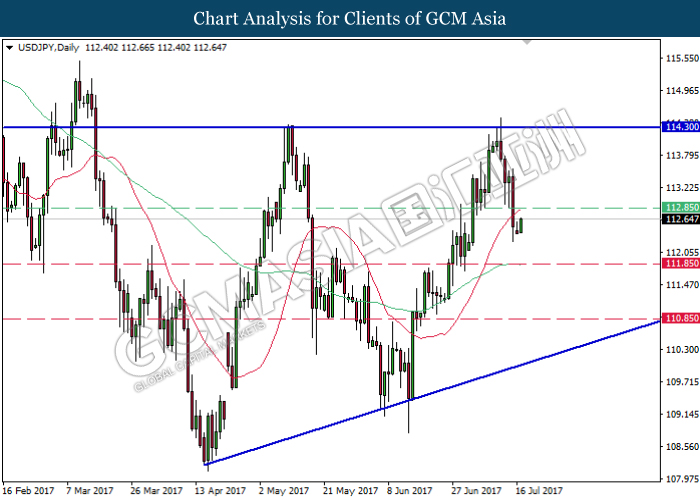

USDJPY

USDJPY, Daily: USDJPY remained traded within an ascending triangle following prior retracement from the top level. Recent closure below the 20-MA line (red) suggests USDJPY to be traded lower in short-term, towards the support level 111.85.

Resistance level: 112.85, 114.30

Support level: 111.85, 110.85

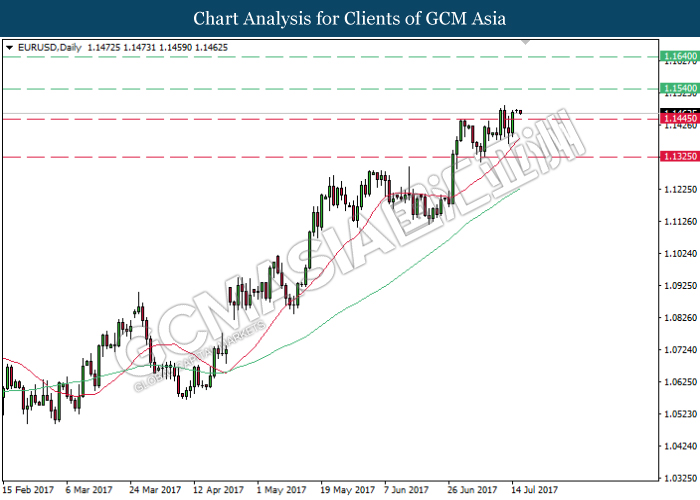

EURUSD

EURUSD, Daily: EURUSD extended its uptrend following recent rebound near the 20-MA line (red). Both MA lines which continues to expand upwards suggests EURUSD to advance further up, towards the target of resistance level at 1.1540.

Resistance level: 1.1540, 1.1640

Support level: 1.1445, 1.1325

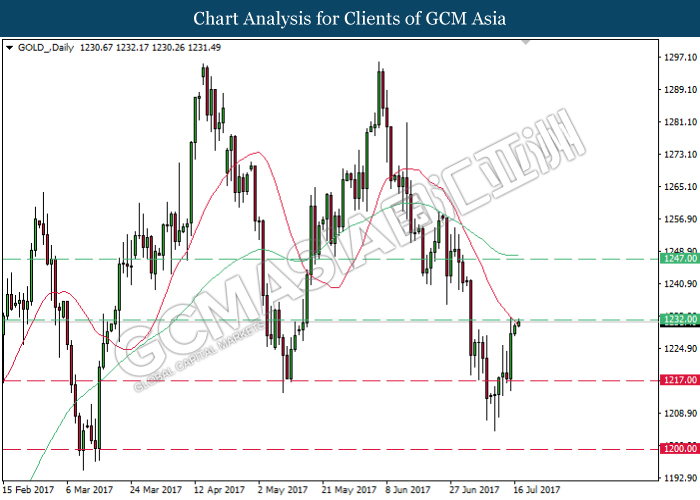

GOLD

GOLD_, Daily: Gold price extended its gains following prior rebound near the support level of 1217.00. Recent closure above the 20-MA line (red) suggests gold price to extend its upward momentum after successfully closing above the resistance level of 1232.00.

Resistance level: 1232.00, 1247.00

Support level: 1217.00, 1200.00

Crude Oil

CrudeOIL, Daily: Crude oil price were traded higher following prior rebound near the support level of 45.25. A closure above the strong resistance level of 47.00 would suggest crude oil price to extend its upward momentum towards the upper level of downward channel thereafter.

Resistance level: 47.00, 48.50

Support level: 45.25, 43.70