17 August 2022 Afternoon Session Analysis

New Zealand Dollar surged as hawkish tone from RBNZ.

The New Zealand Dollar rebounded from its lower following the rate hike decision from Reserve Bank of New Zealand. According to the latest monetary policy statement, the Monetary Policy Committee (MPC) decided to raise its official cash rate (OCR) from 3% to 2.5%. Besides, the committee also vowed that they would likely to maintain the pace of contractionary monetary policy as the current price stability in the New Zealand still highly uncertain. Recently, the global consumer price inflation has continued to surged as global rising commodity prices. The war in Ukraine continues to underpin high commodity prices, with global production costs and constraints further exacerbated by supply-chain bottlenecks. In addition, the MPC also reiterated that the domestic spending in the country still remained resilient, along with robust employment level. As of writing, the pair of NZD/USD appreciated by 0.19% to 0.6355.

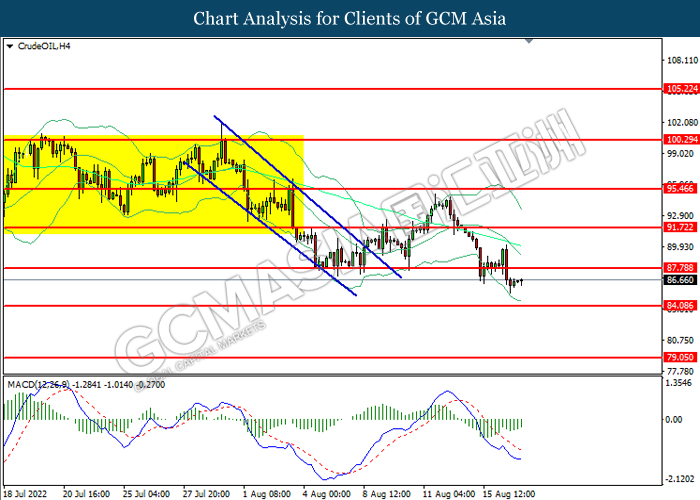

In the commodities market, the crude oil price slumped 0.21% to $87.55 per barrel as of writing. The oil market extends its losses amid rising recession risk as well as the possibility of making deal consensus on the Iran Nuclear continue to weigh down the crude oil price. On the other hand, the gold price depreciated by 0.01% to $1775.15 per troy ounces as of writing as further aggressive rate hike expectation continue to linger in the global financial market.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

02:00 USD FOMC Meeting Minutes

(18th)

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 14:00 | GBP – CPI (YoY) (Jul) | 9.4% | 9.8% | – |

| 20:30 | USD – Core Retail Sales (MoM) (Jul) | 1.0% | -0.1% | – |

| 20:30 | USD – Retail Sales (MoM) (Jul) | 1.0% | 0.1% | – |

| 22:30 | CrudeOIL – Crude Oil Inventories | 5.458M | -0.275M | – |

Technical Analysis

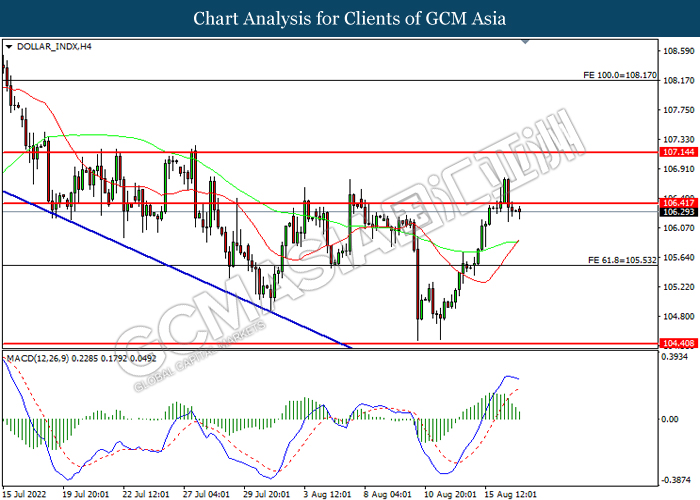

DOLLAR_INDX, H4: Dollar index was traded higher while currently testing the resistance level. However, MACD which illustrated diminishing bullish momentum suggest the index to be traded lower as technical correction.

Resistance level: 106.40, 107.15

Support level: 105.55, 104.40

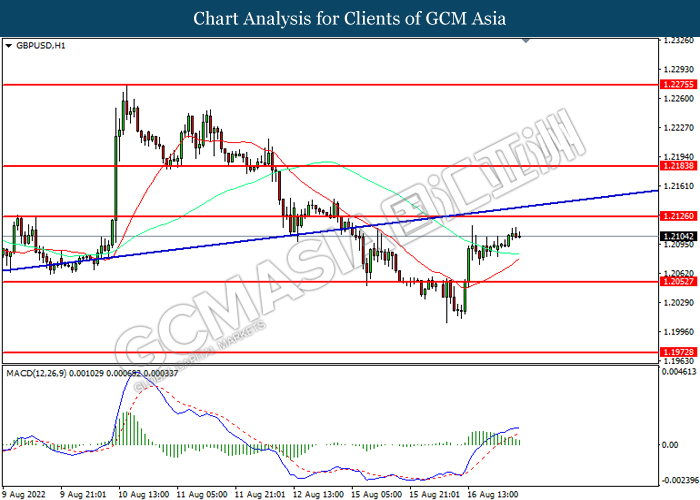

GBPUSD, H1: GBPUSD was traded higher while currently testing the resistance level. However, MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.2125, 1.2185

Support level: 1.2055, 1.1975

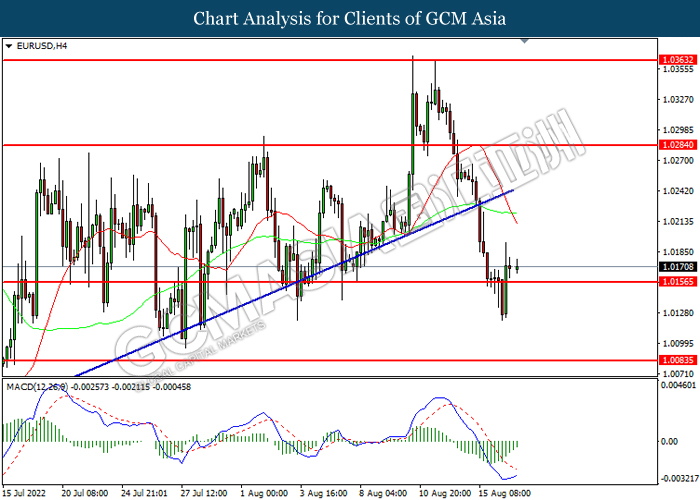

EURUSD, H4: EURUSD was traded lower while currently testing the support level. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.0285, 1.0365

Support level: 1.0155, 1.0085

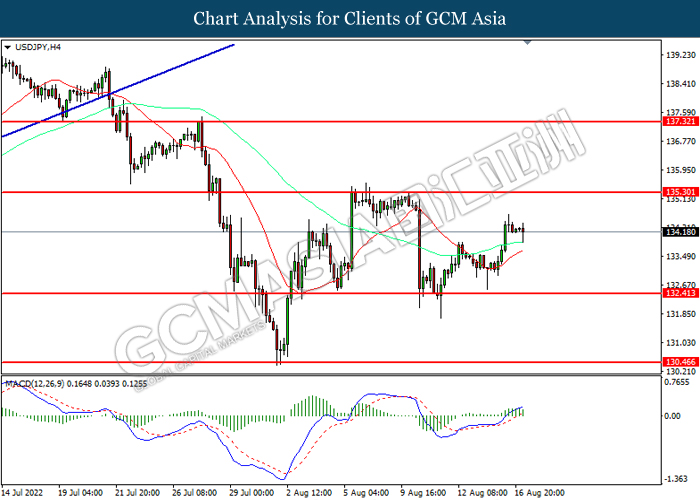

USDJPY, H4: USDJPY was traded higher following prior rebounded from the support level. MACD which illustrated increasing bullish momentum suggest the pair to extend tis gains toward resistance level.

Resistance level: 135.30, 137.30

Support level: 132.40, 130.45

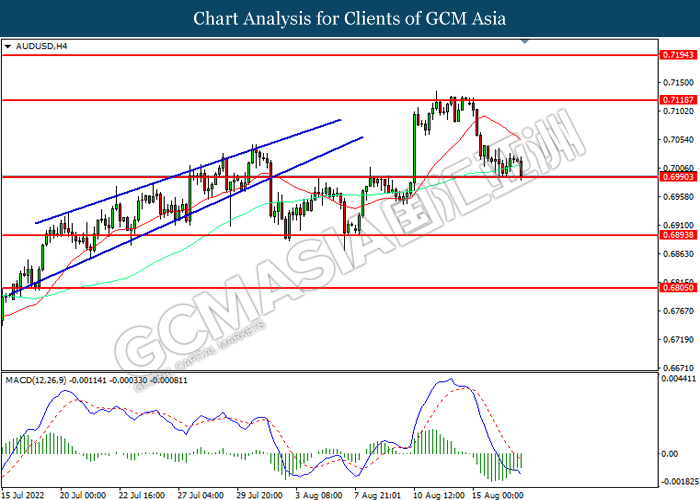

AUDUSD, H4: AUDUSD was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after breakout.

Resistance level: 0.7120, 0.7195

Support level: 0.6990, 0.6895

NZDUSD, H4: NZDUSD was traded lower while currently testing the support level. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.6455, 0.6535

Support level: 0.6340, 0.6225

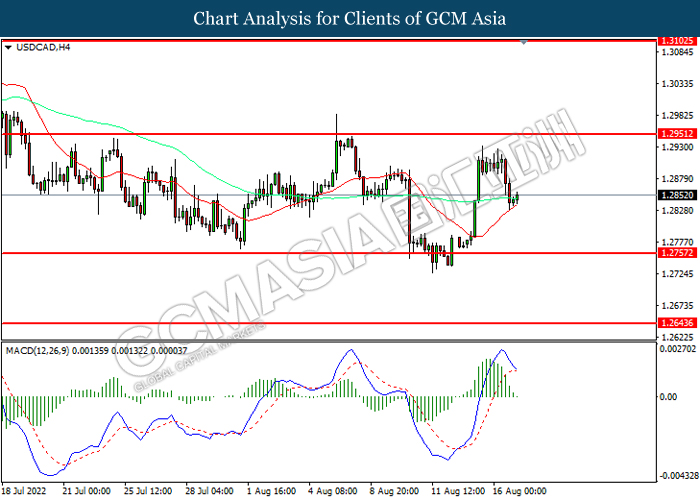

USDCAD, H4: USDCAD was traded lower following prior retracement from the resistance level. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward support level.

Resistance level: 1.2950, 1.3105

Support level: 1.2755, 1.2645

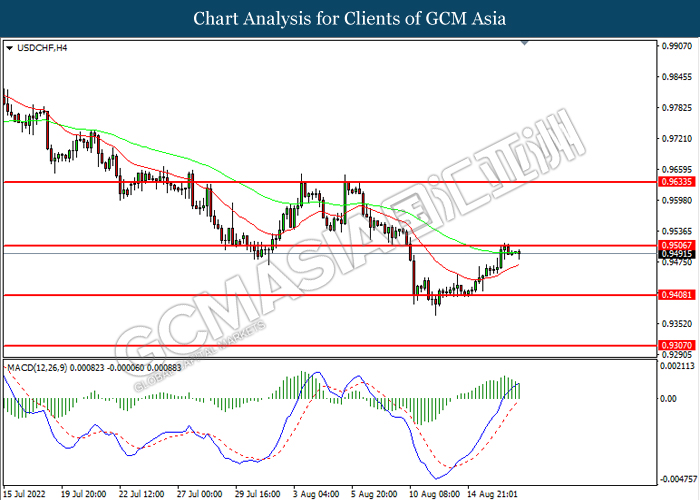

USDCHF, H4: USDCHF was traded higher while currently testing the resistance level. MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 0.9505, 0.9635

Support level: 0.9410, 0.9305

CrudeOIL, H4: Crude oil price was traded lower following prior breakout below the previous support level. However, MACD which illustrated diminishing bearish momentum suggest the commodity to be traded higher as technical correction.

Resistance level: 87.80, 91.70

Support level: 84.10, 79.05

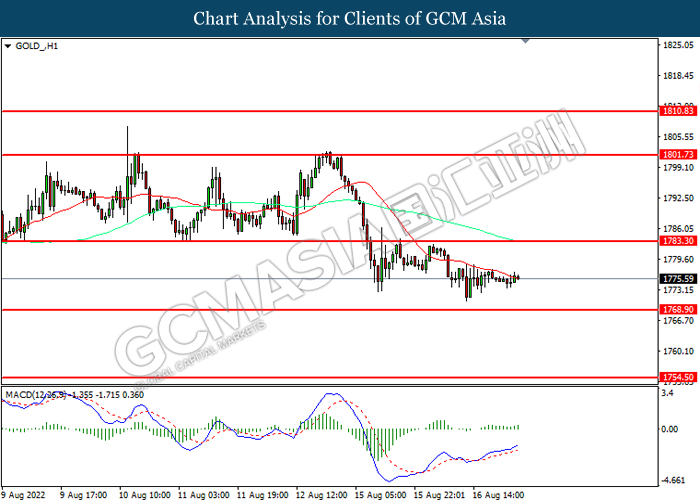

GOLD_, H1: Gold price was traded lower following prior breakout below the previous support level. However, MACD which illustrated increasing bullish momentum suggest the commodity to be traded higher as technical correction.

Resistance level: 1783.30, 1801.75

Support level: 1768.90, 1754.50