17 August 2022 Morning Session Analysis

Dollar lingers ahead of Retail Sales and Fed meeting minutes.

The dollar index, which traded against a basket of six currencies, traded flat yesterday as the market participants are waiting for the data on retail sales in the US as well as the central bank’s meeting minutes of the July meeting. Since the beginning of this week, the dollar index has bounced back from the six-week low as the heightening of global recession risk triggered the market risk-off sentiment, prompting the investors’ demand for the safe haven currency. It is noteworthy to mention that the US delegation’s visit to Taiwan has further increased the uncertainty in the global outlook as China immediately announced a fresh military drill near Taiwan as a dissatisfying response to the issue. Besides, Russian President Vladimir Putin also accused the US is seeking to prolong the conflict in Ukraine as the nation is obviously trying to fuel the conflicts elsewhere in the world. On the other side, the greenback managed to regain its previous losses as investors ramped up the bets that the US would continue to hike rates aggressively as the Fed officials maintained their hawkish tone on the tightening path of the monetary policy. At this juncture, investors will eye the crucial economic data such as Retail Sales, as well as the Fed meeting minutes to scrutiny the aggressiveness of the rate hike going forward. As of writing, the dollar index dropped 0.06% to 106.50.

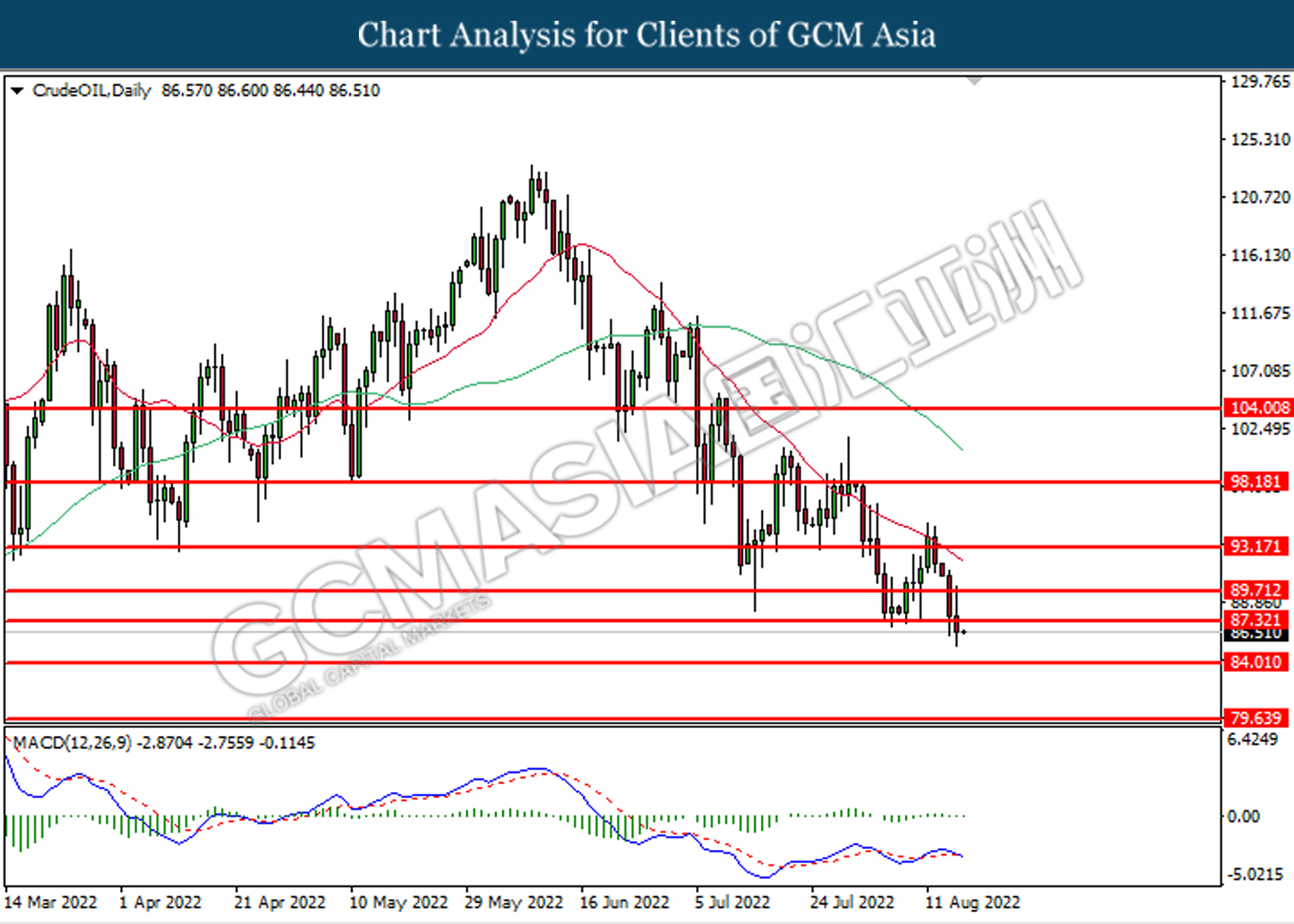

In the commodities market, the crude oil price is down 0.36% to $86.50 a barrel amid the uncertainty over the Iran nuclear deal, where the investors are not sure if the US and Iran will achieve a consensus on sealing a deal. Besides, the gold prices appreciated by 0.01% to $1775.35 a troy ounce amid the weakening of the dollar index.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

11:00 NZD RBNZ Press Conference

02:00 USD FOMC Meeting Minutes

(18th)

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 10:00 | NZD – RBNZ Interest Rate Decision | 2.50% | 3.00% | – |

| 14:00 | GBP – CPI (YoY) (Jul) | 9.4% | 9.8% | – |

| 20:30 | USD – Core Retail Sales (MoM) (Jul) | 1.0% | -0.1% | – |

| 20:30 | USD – Retail Sales (MoM) (Jul) | 1.0% | 0.1% | – |

| 22:30 | CrudeOIL – Crude Oil Inventories | 5.458M | -0.275M | – |

Technical Analysis

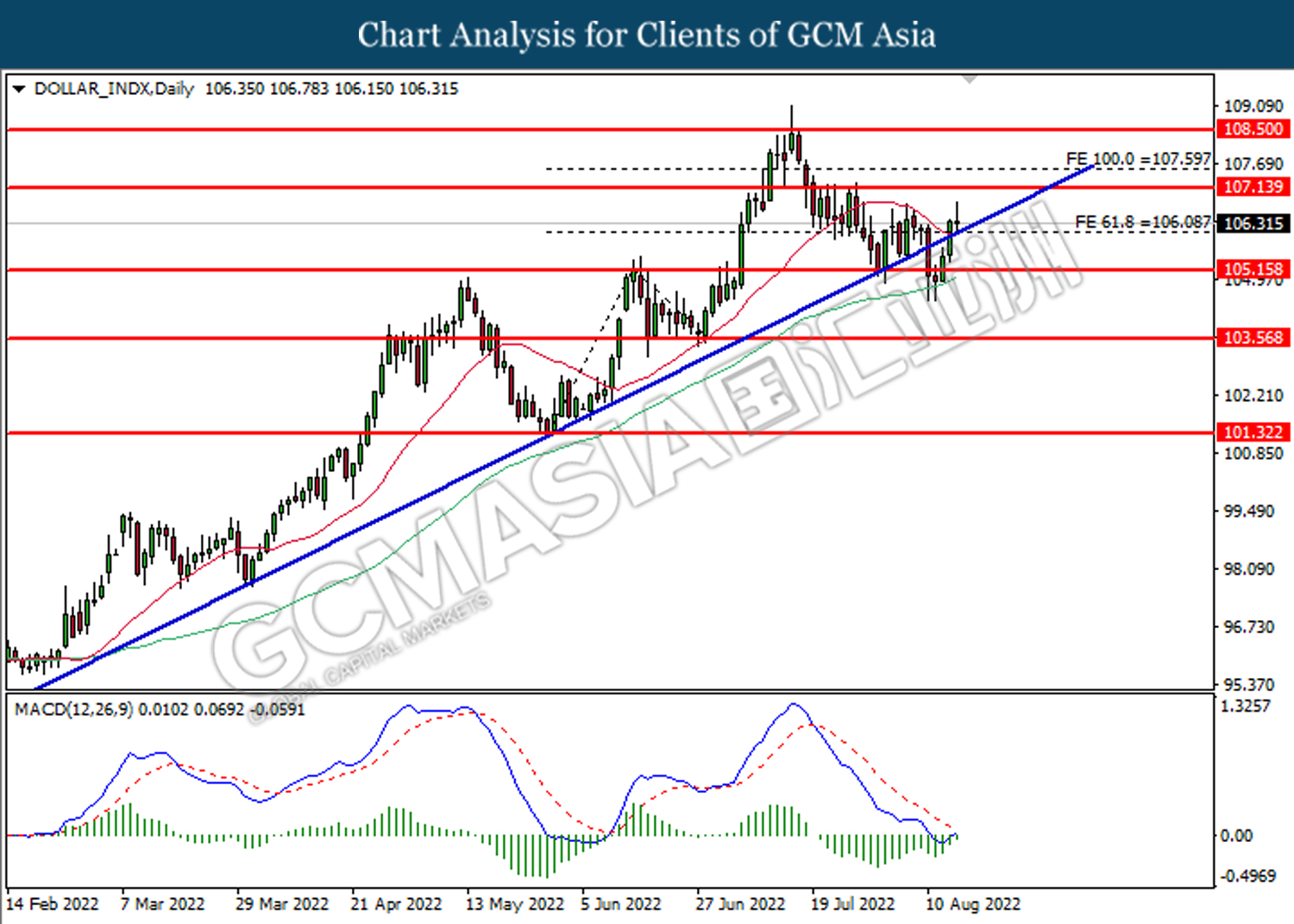

DOLLAR_INDX, Daily: Dollar index was traded higher following prior breakout above the previous upward trendline. MACD which illustrated diminishing bearish momentum suggests the index to extend its gains toward the resistance level at 107.15.

Resistance level: 107.15, 107.60

Support level: 106.10, 105.15

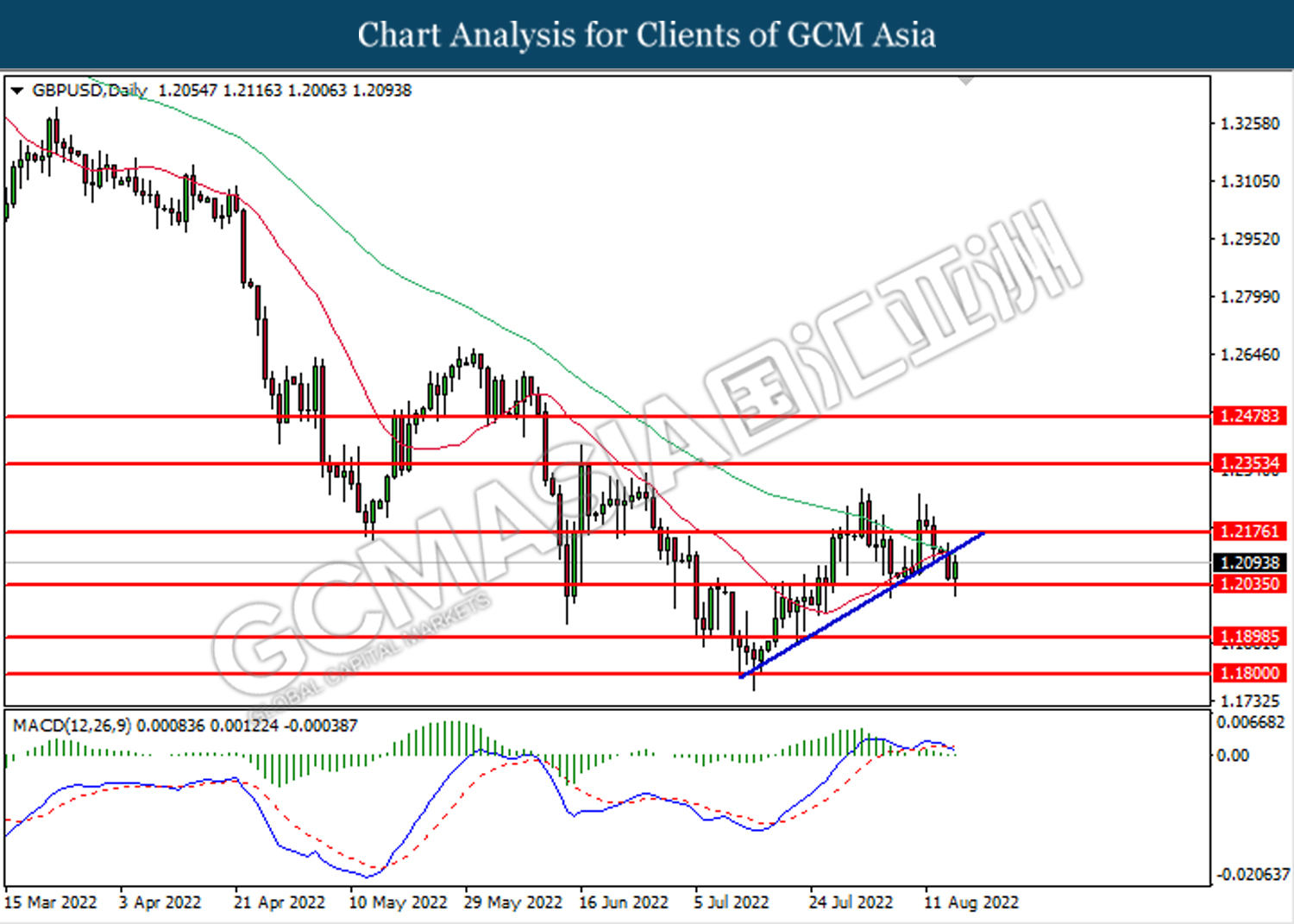

GBPUSD, Daily: GBPUSD was traded lower while currently testing the support level at 1.2035. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.2175, 1.2355

Support level: 1.2035, 1.1900

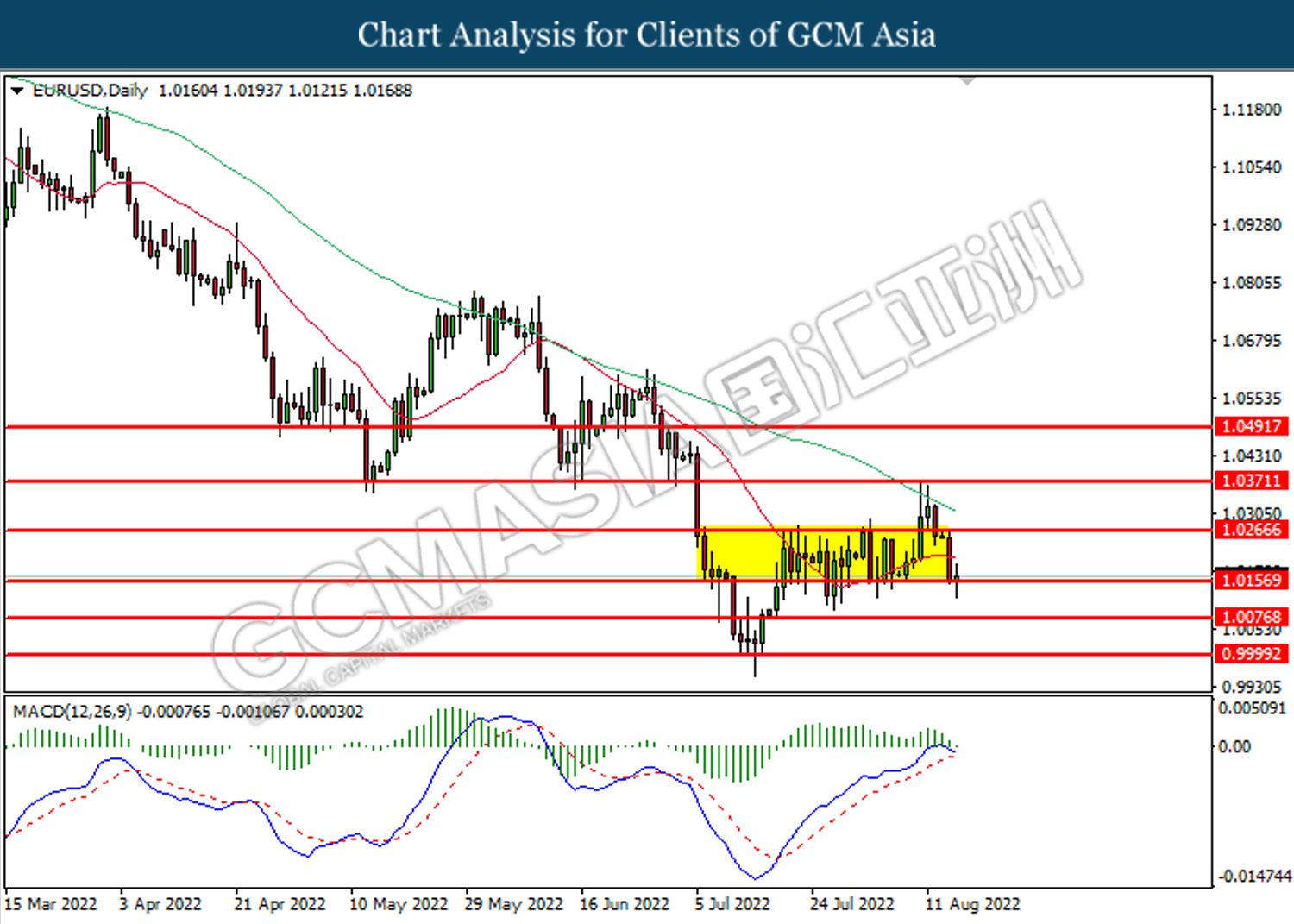

EURUSD, Daily: EURUSD was traded lower while currently testing the support level at 1.0155. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.0265, 1.0370

Support level: 1.0155, 1.0075

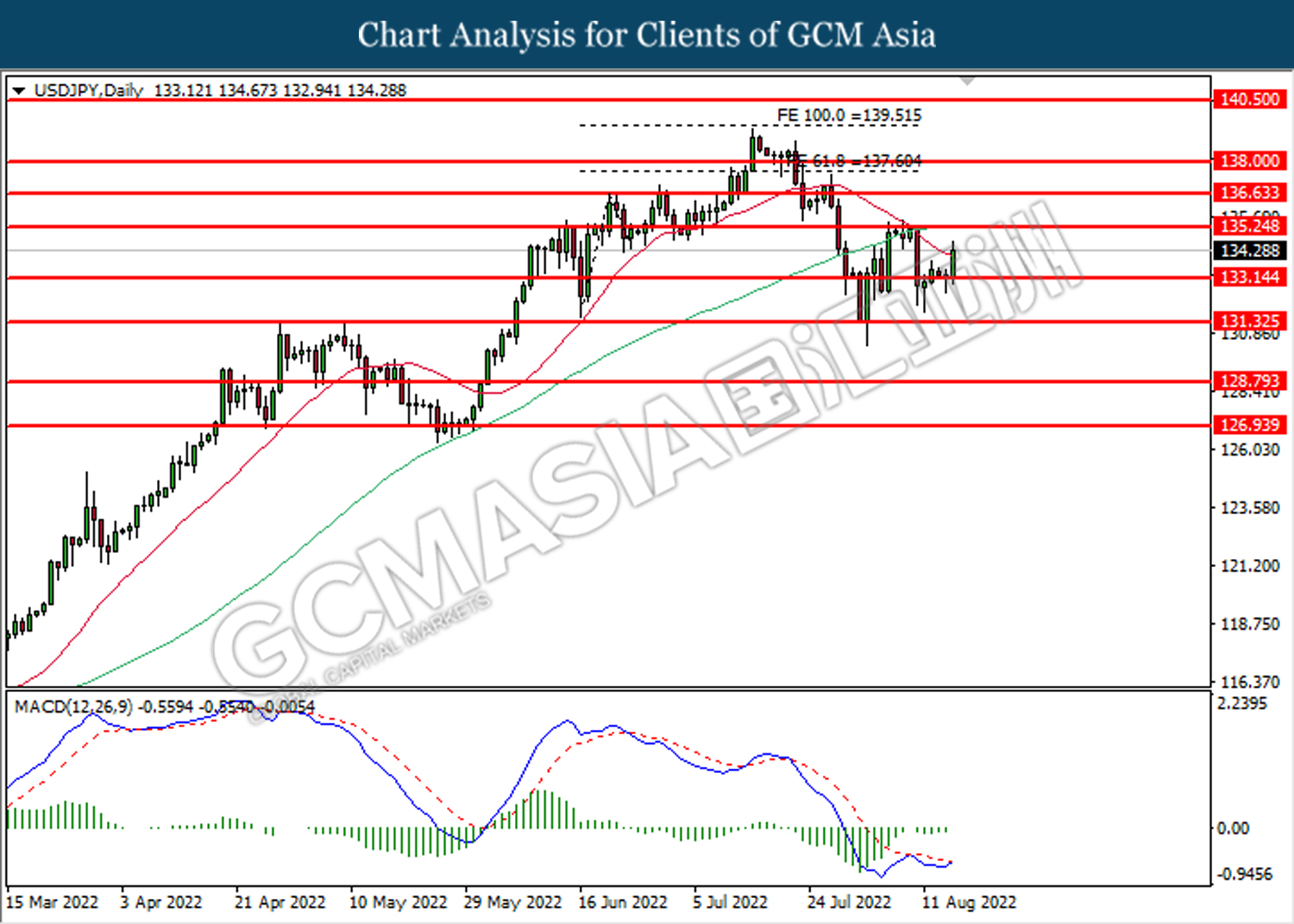

USDJPY, Daily: USDJPY was traded higher following prior rebound from the support level at 133.15. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward the resistance level at 135.25.

Resistance level: 135.25, 136.65

Support level: 133.15, 131.30

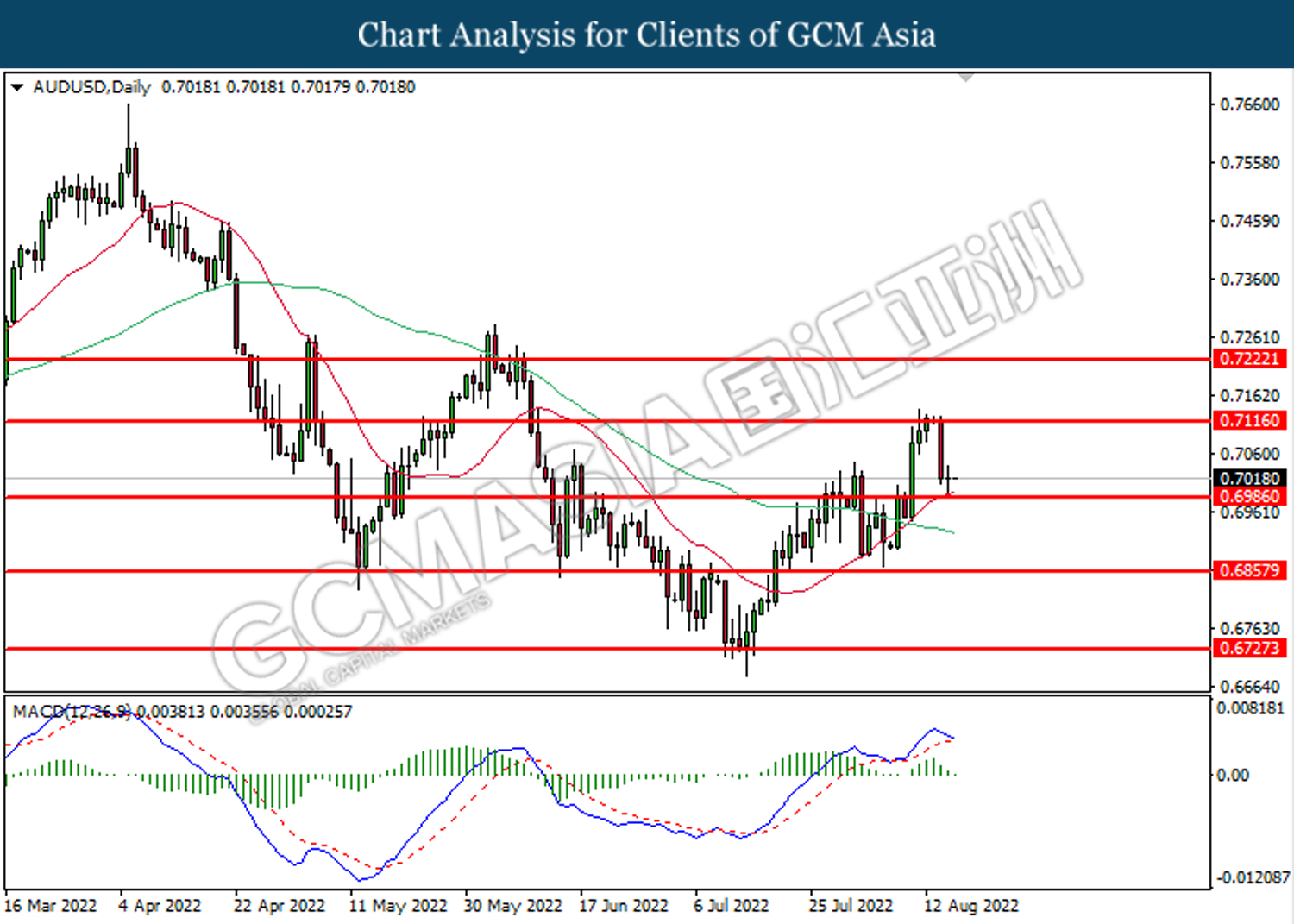

AUDUSD, Daily: AUDUSD was traded lower following prior retracement from the resistance level at 0.7115. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward the support level at 0.6985.

Resistance level: 0.7115, 0.7220

Support level: 0.6985, 0.6860

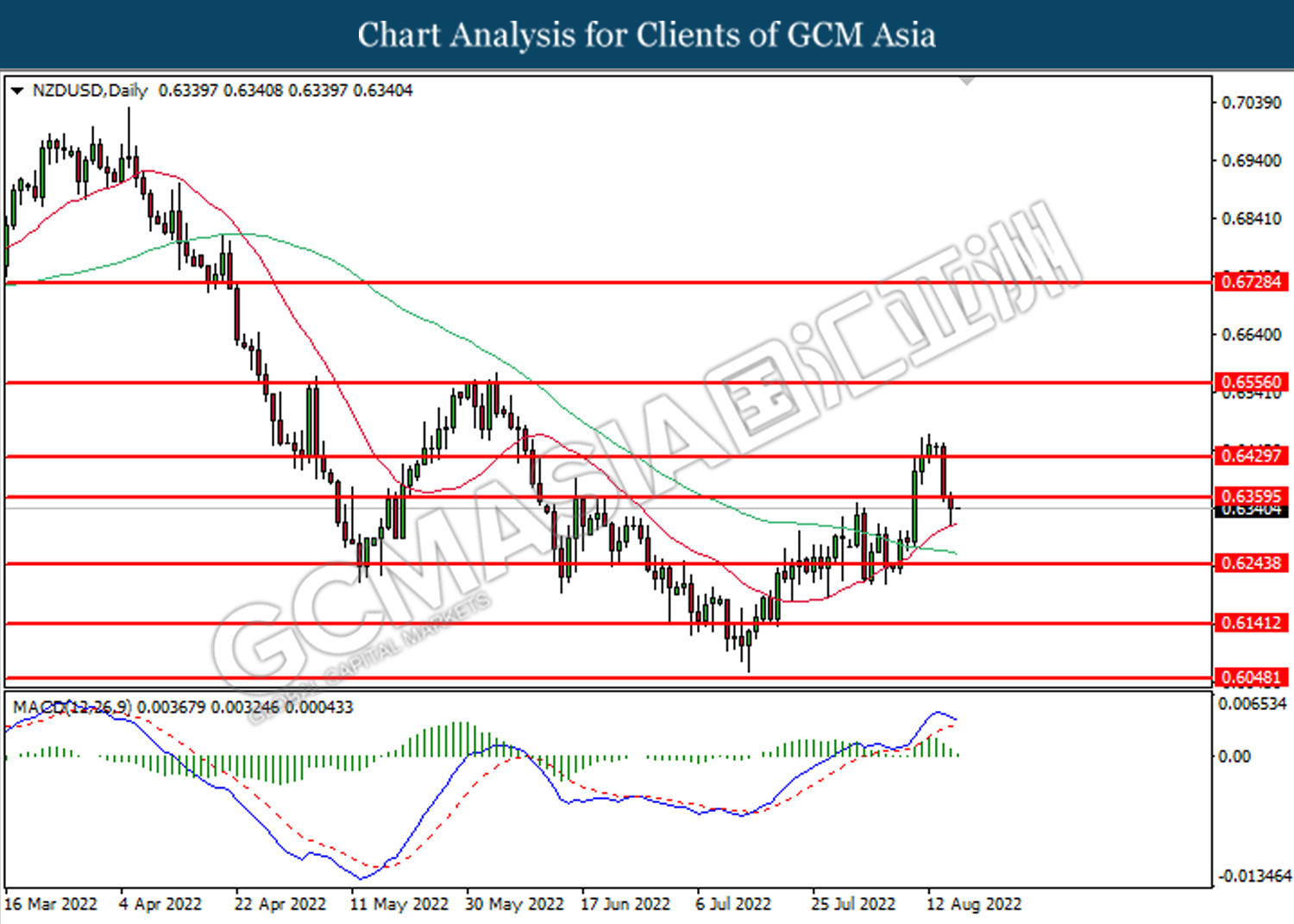

NZDUSD, Daily: NZDUSD was traded lower following prior breakout below the previous support level at 0.6360. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward the support level at 0.6245.

Resistance level: 0.6360, 0.6430

Support level: 0.6245, 0.6140

USDCAD, Daily: USDCAD was traded lower following prior retracement from the resistance level at 1.2925. MACD which illustrated diminishing bearish momentum suggests the pair to undergo technical correction in short term.

Resistance level: 1.2925, 1.2985

Support level: 1.2805, 1.2730

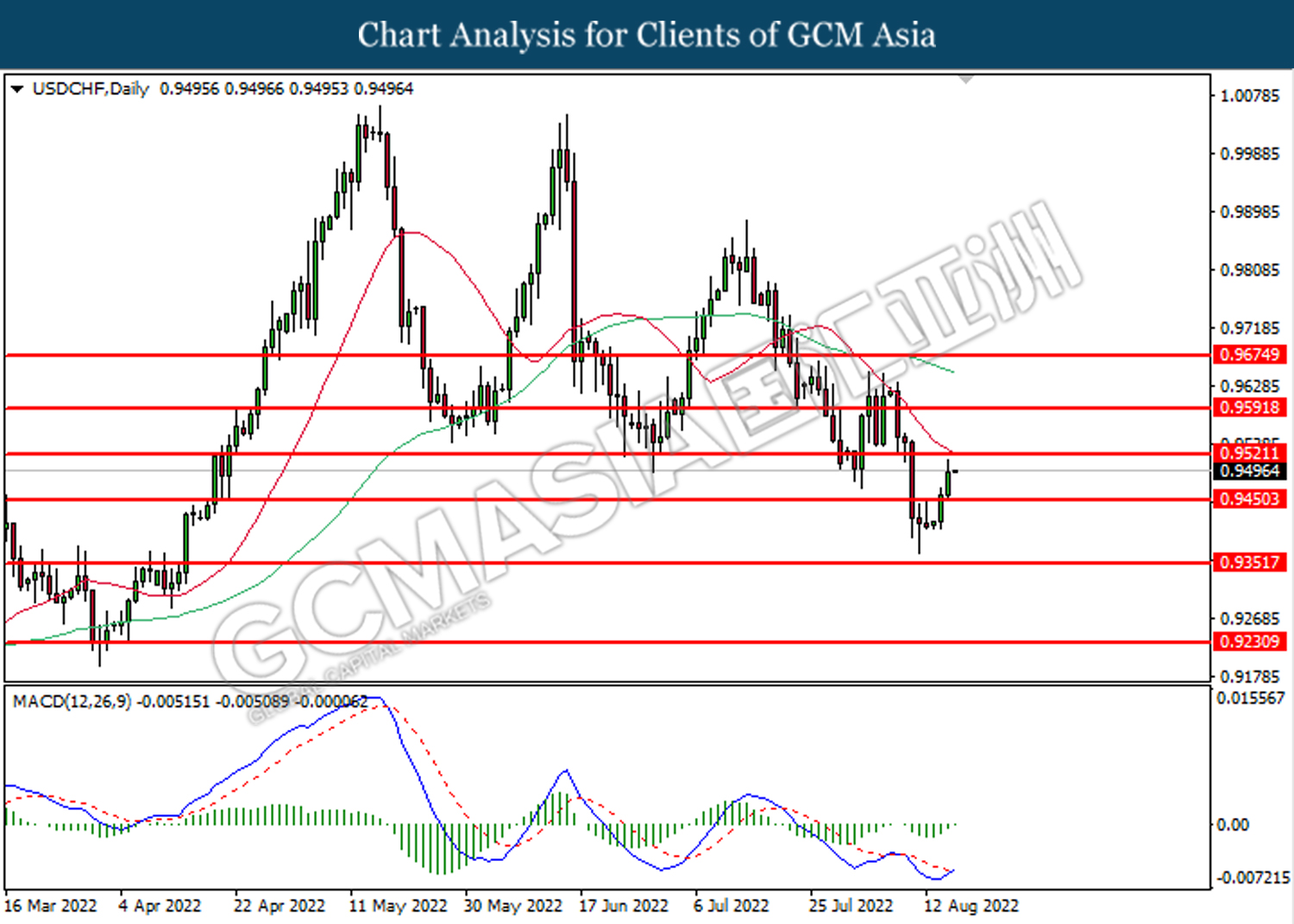

USDCHF, Daily: USDCHF was traded higher following prior breakout above the previous resistance level at 0.9450. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward the resistance level at 0.9520.

Resistance level: 0.9520, 0.9590

Support level: 0.9450, 0.9350

CrudeOIL, Daily: Crude oil price was traded lower following prior breakout below the previous support level at 87.30. MACD which illustrated diminishing bullish momentum suggests the commodity to extend its losses toward the support level at 84.00.

Resistance level: 87.30, 89.70

Support level: 84.00, 79.65

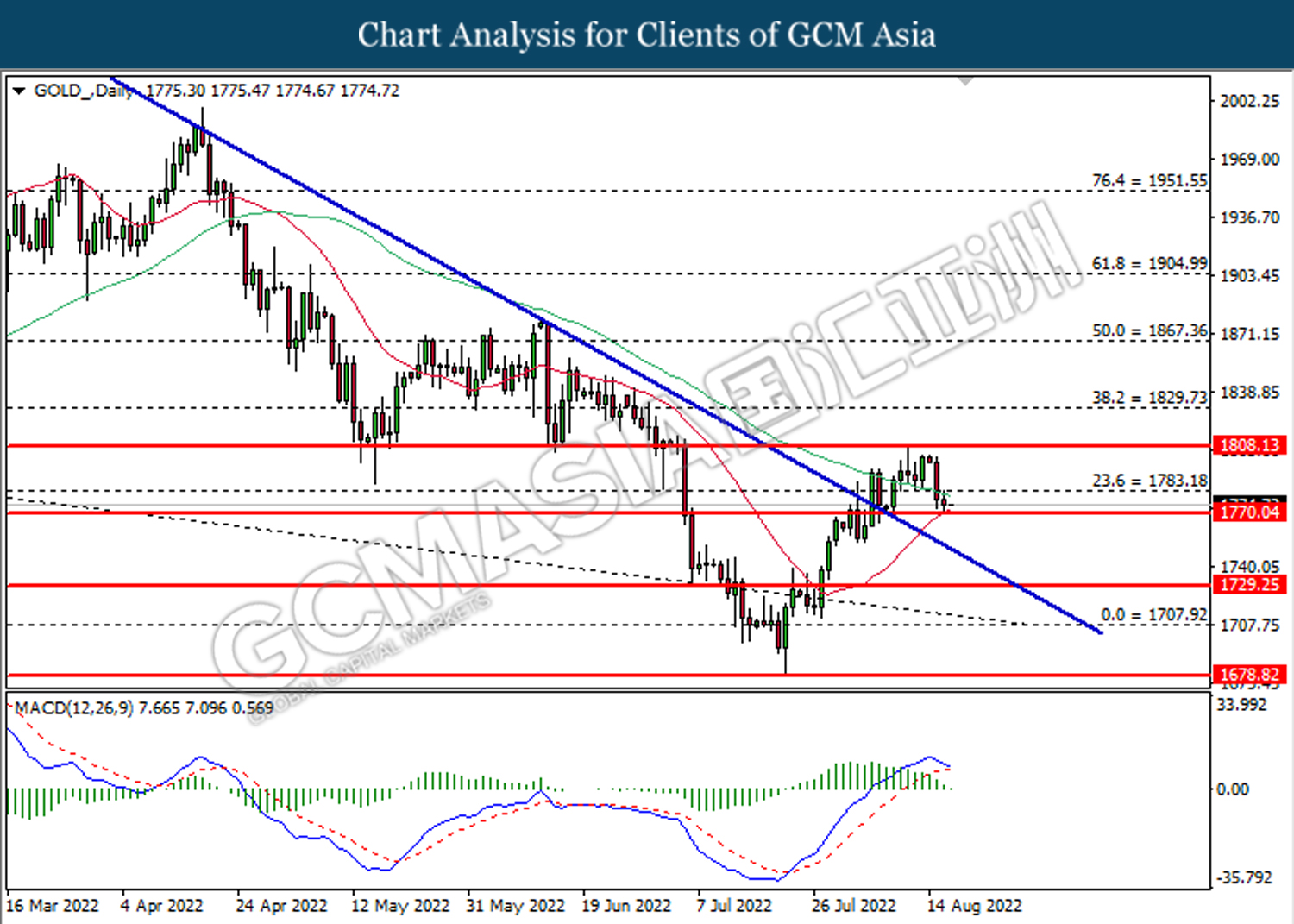

GOLD_, Daily: Gold price was traded lower while currently testing the support level at 1770.05. MACD which illustrated diminishing bullish momentum suggest the commodity to extend its losses after it successfully breakout below the support level.

Resistance level: 1783.20, 1808.15

Support level: 1770.05, 1729.25