17 October 2022 Afternoon Session Analysis

Pound gap up after huge U-turn announced.

The Pound Sterling, which was widely traded by global investors, jumped after the new prime minister Liz Truss reversed its tax-cut plan. Last Friday, Truss scrapped the pledge to reverse predecessor Boris Johnson’s hike of corporation tax from 19% to 25%, which could restore a huge amount of revenue to the UK government. Earlier this month, the UK government has scrapped its tax-cut plan after a substantial public backlash. Besides, Liz Truss also has decided to fire the finance minister Kwasi Kwarteng amid mounting political pressure and market chaos. For the replacement, a former health secretary and foreign secretary Jeremy Hunt will succeed the position as the next finance minister. Following the big U-turn in the fiscal monetary policy, market participants are seeing the effort of UK government and Bank of England (BoE) in tackling the sky-high inflation, aiming to cool down the overheating economy despite the risk of economic recession. As of writing, the pair of GBP/USD rose by 0.57% to 1.1234.

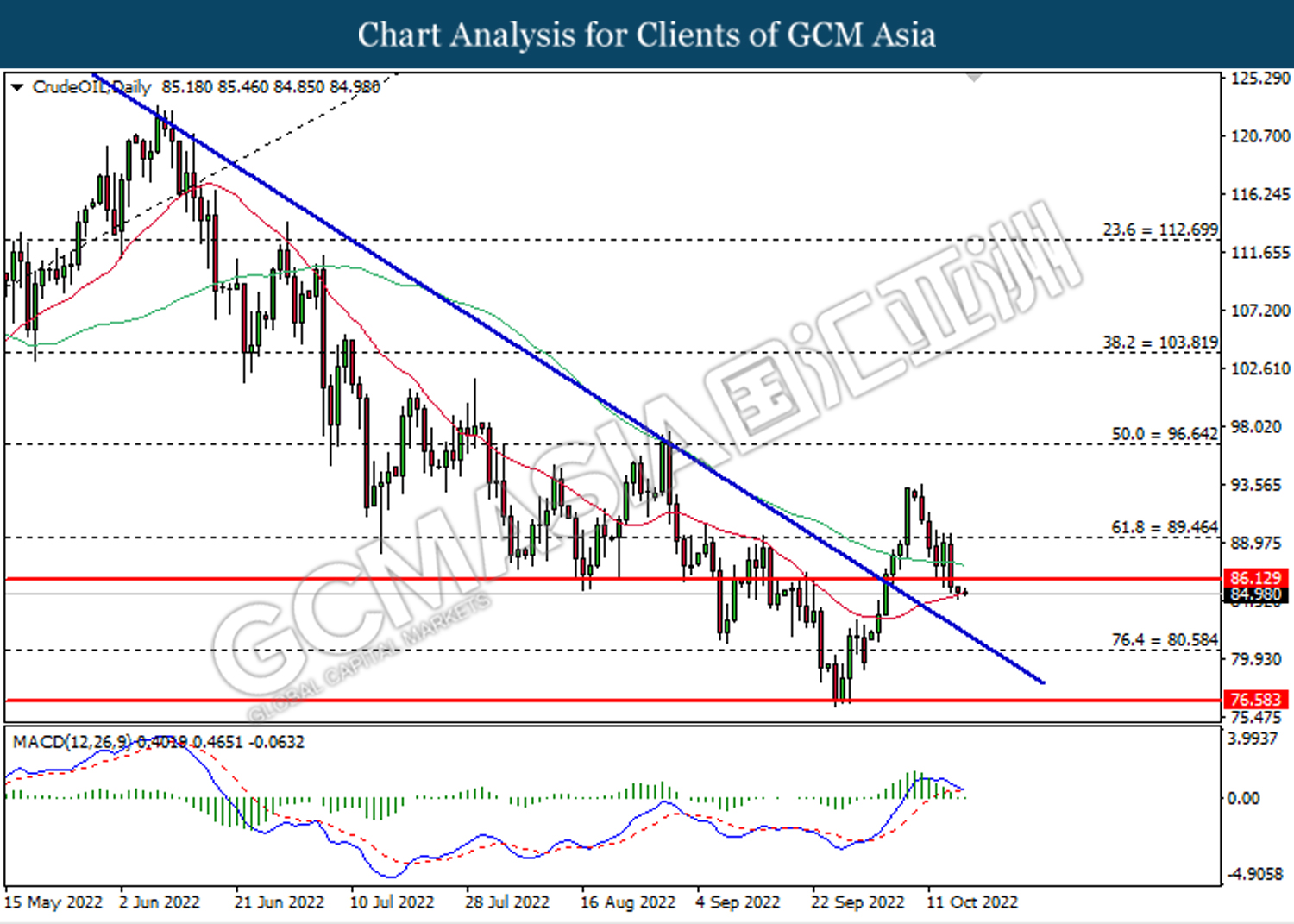

In the commodities market, the crude oil price edged up 0.38% to $86.15 per barrel but the overall trend remains bearish amid the mounting of China Covid-19 cases. Besides, the gold prices edged up 0.40% to $1650.50 per troy ounce amid a slight retracement in the dollar market.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

N/A

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded lower following the retracement from the resistance level at 113.30. MACD which illustrated bearish bias momentum suggests the index to extend its losses toward the support level at 111.25.

Resistance level: 113.30, 115.00

Support level: 111.25, 109.00

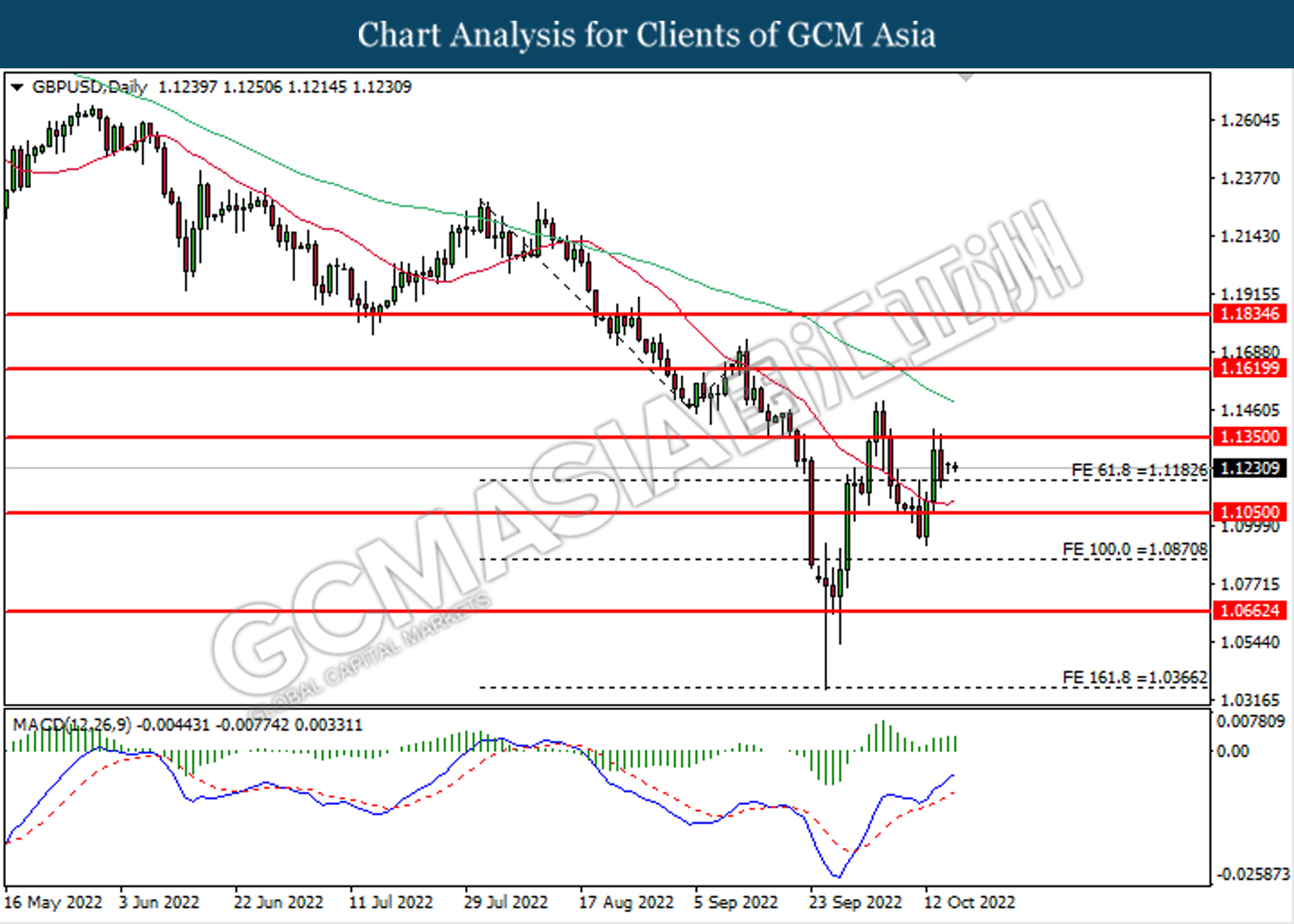

GBPUSD, Daily: GBPUSD was traded higher following prior rebound from the support level at 1.1185. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 1.1350.

Resistance level: 1.1350, 1.1620

Support level: 1.1185, 1.1050

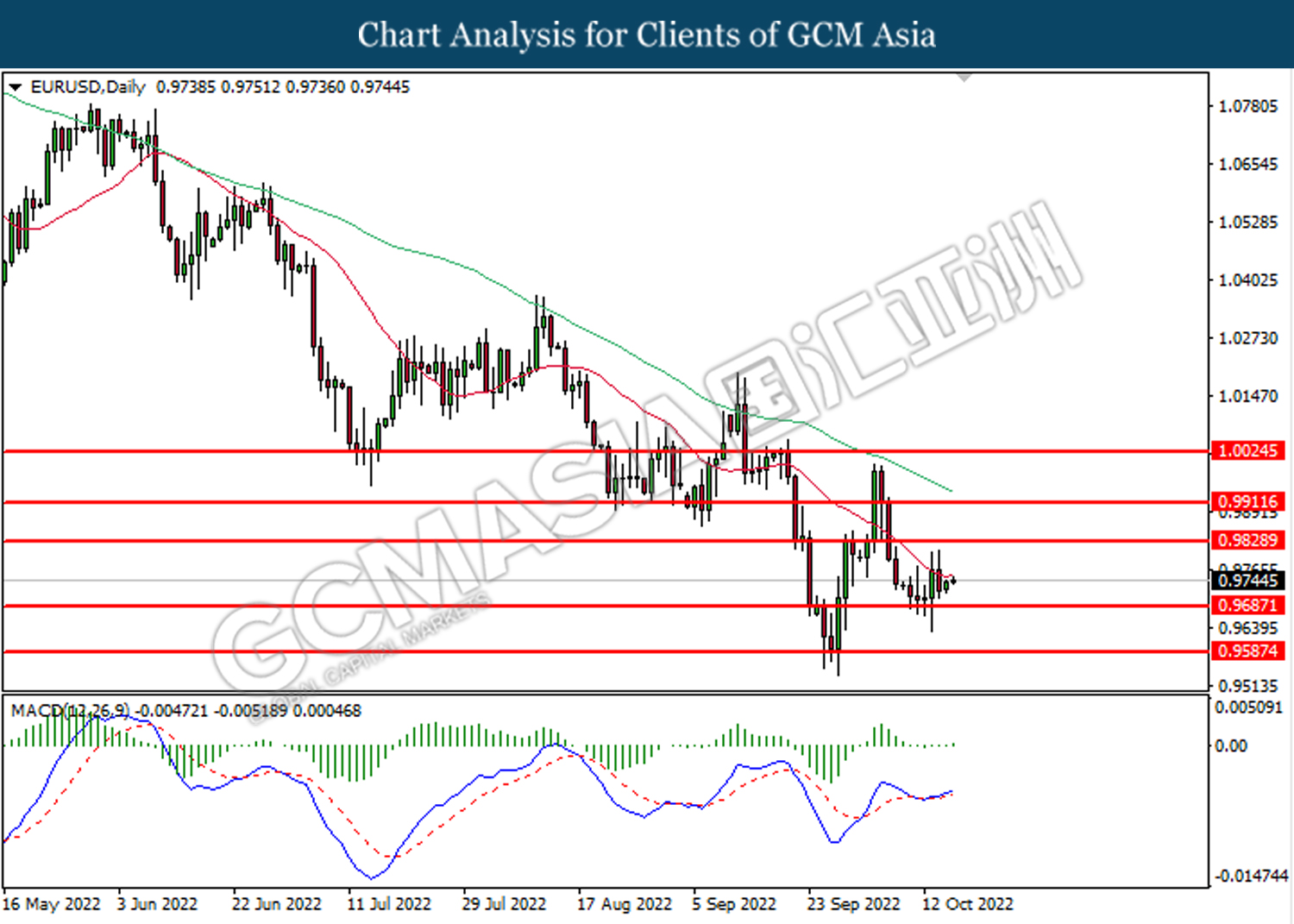

EURUSD, Daily: EURUSD was traded higher following prior rebound from the support level at 0.9685. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 0.9830.

Resistance level: 0.9830, 0.9910

Support level: 0.9685, 0.9585

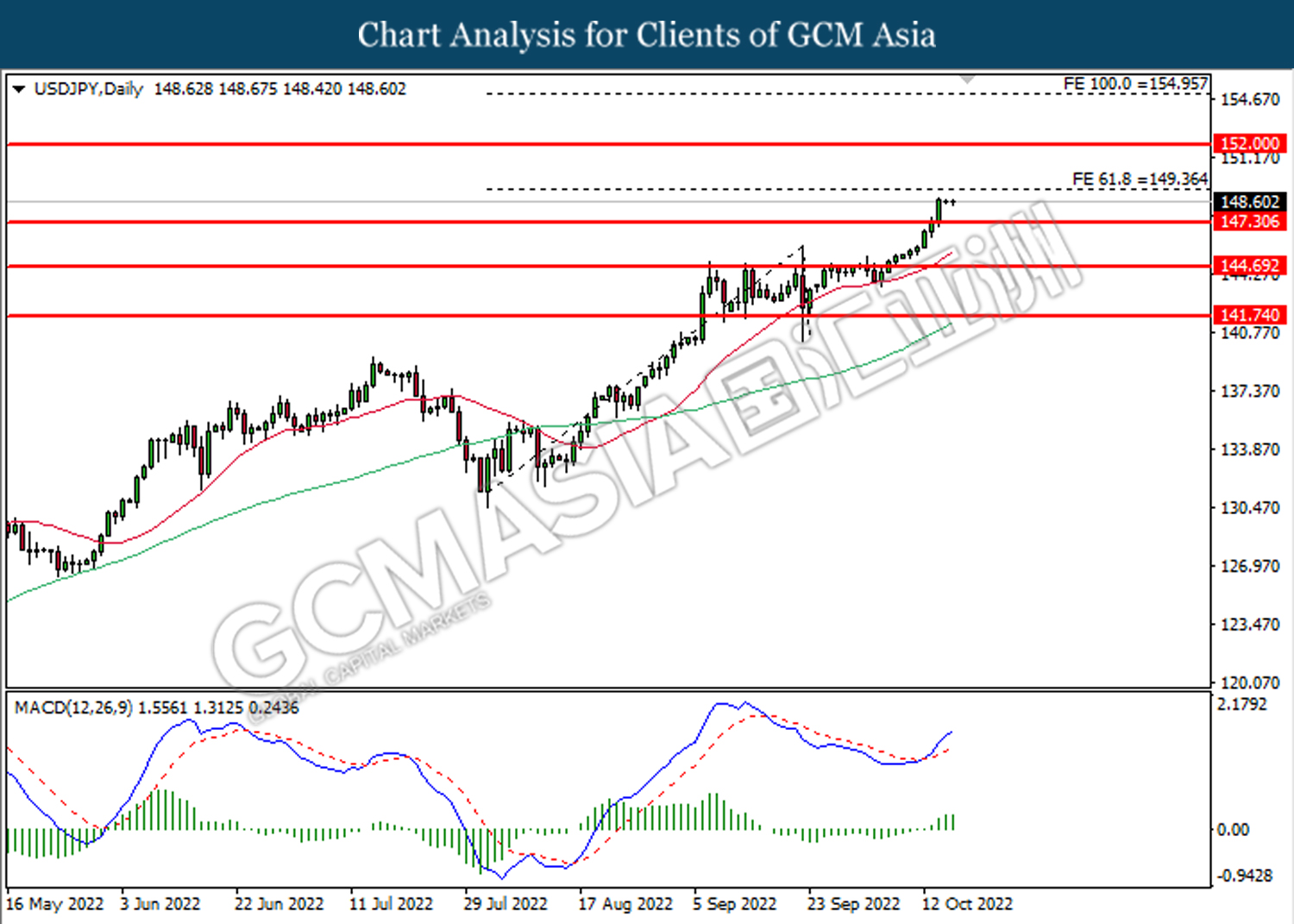

USDJPY, Daily: USDJPY was traded higher following prior breakout above the previous resistance level at 147.30. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 149.35.

Resistance level: 149.35, 152.00

Support level: 147.30, 144.70

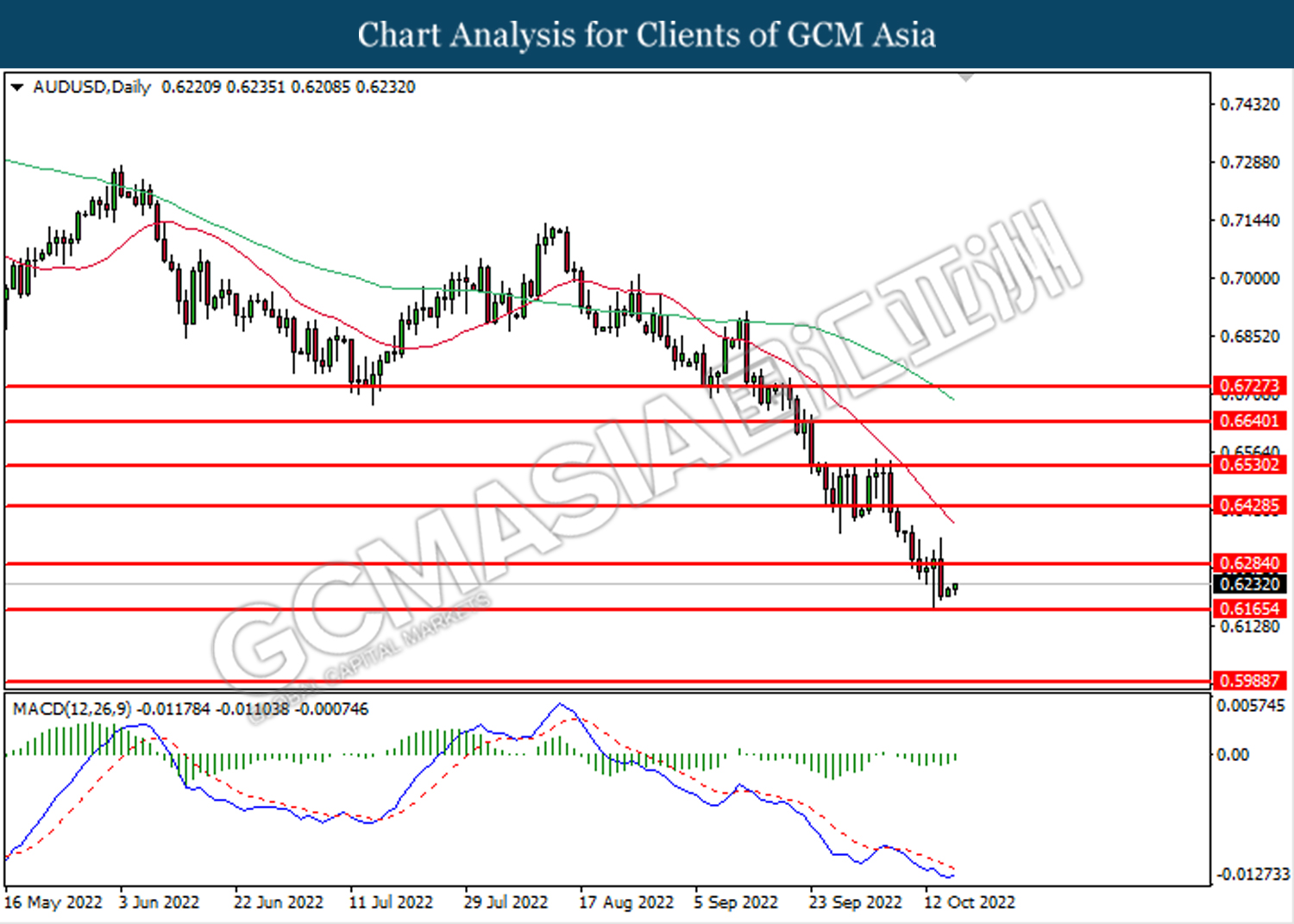

AUDUSD, Daily: AUDUSD was traded higher following prior rebound from the support level at 0.6165. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward the resistance level at 0.6285.

Resistance level: 0.6285, 0.6430

Support level: 0.6165, 0.5990

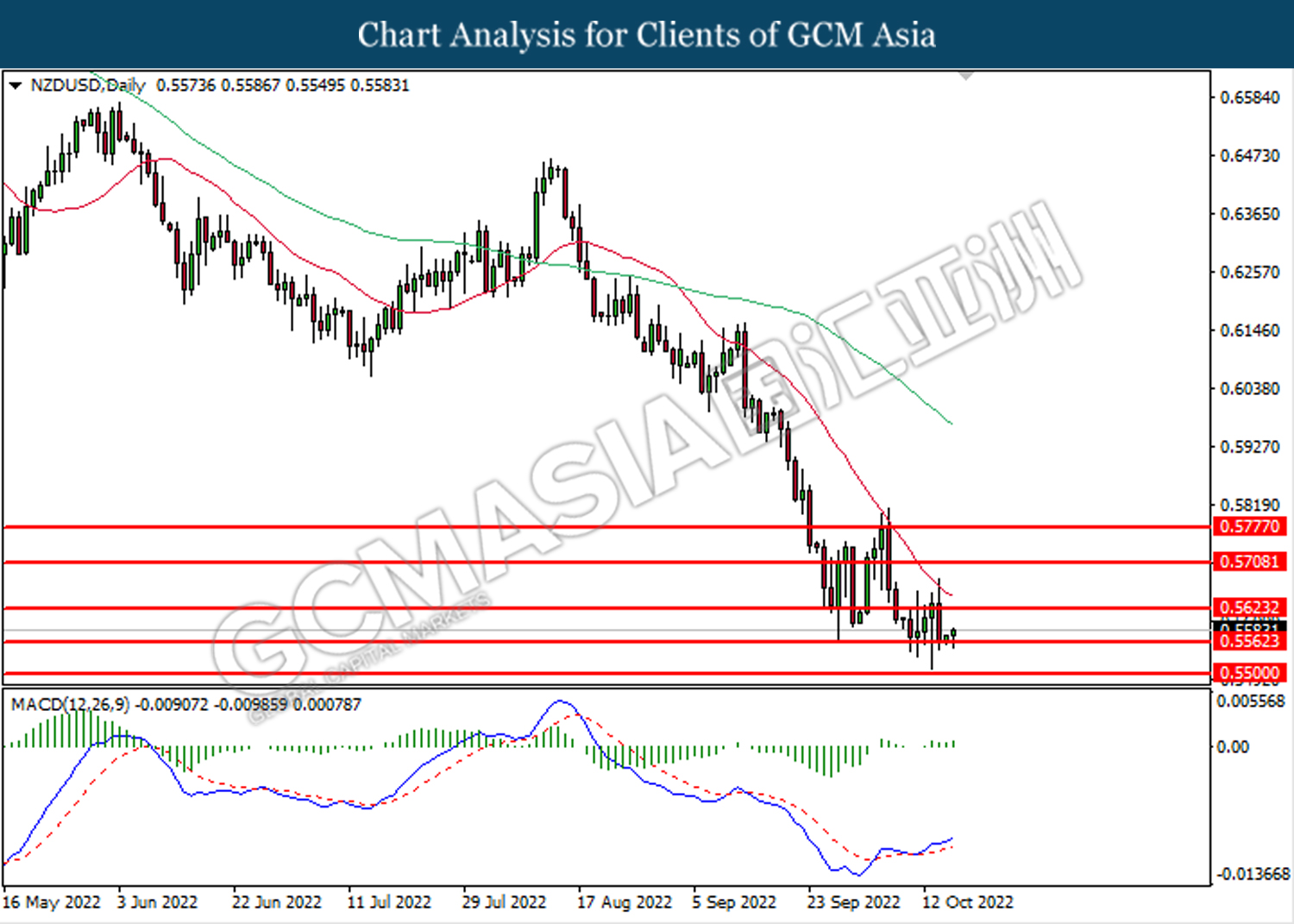

NZDUSD, Daily: NZDUSD was traded higher following prior rebound from the support level at 0.5565. MACD which illustrated bullish bias momentum suggest the pair to extend gains toward the resistance level at 0.5625.

Resistance level: 0.5625, 0.5710

Support level: 0.5560, 0.5500

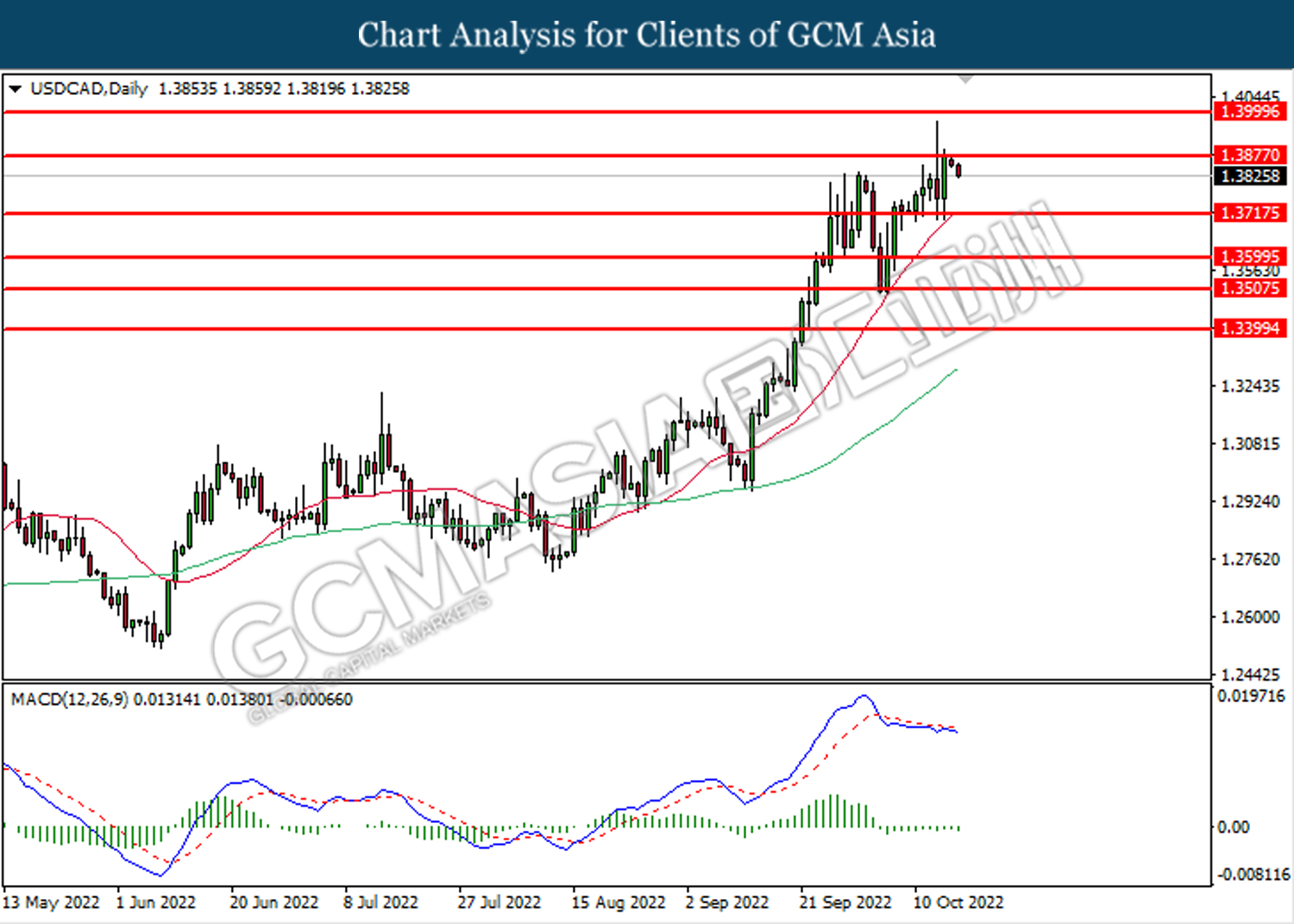

USDCAD, Daily: USDCAD was traded lower following prior retracement from the resistance level at 1.3875. MACD which illustrated bearish bias momentum suggests the pair to extend its losses toward the support level at 1.3715.

Resistance level: 1.3875, 1.4000

Support level: 1.3715, 1.3600

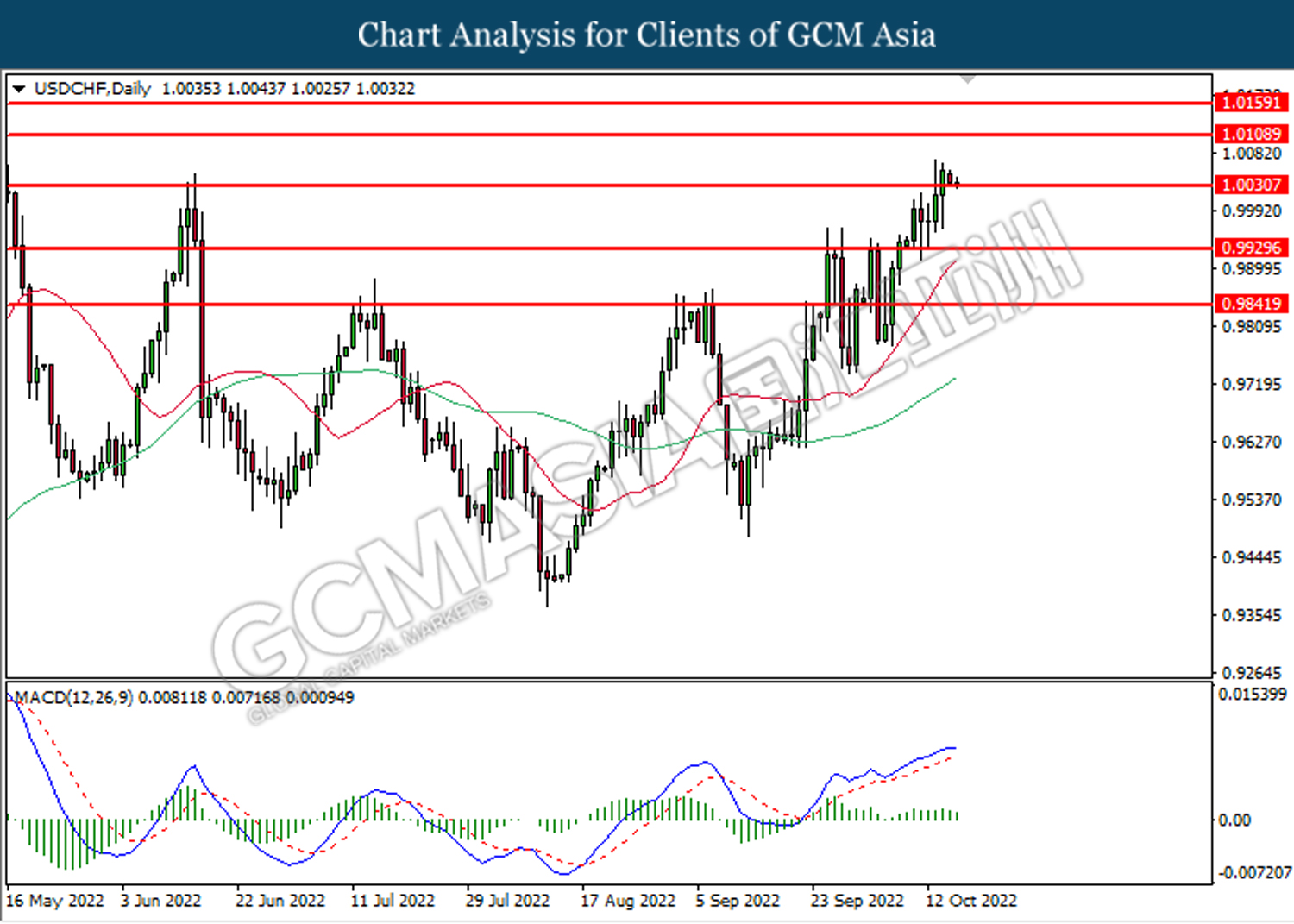

USDCHF, Daily: USDCHF was traded lower while currently testing the support level at 1.0030. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.0110, 1.0160

Support level: 1.0030, 0.9930

CrudeOIL, Daily: Crude oil price was traded lower following prior breakout below the previous support level at 86.15. MACD which illustrated diminishing bullish momentum suggests the commodity to extend its losses toward the support level at 80.60.

Resistance level: 86.15, 89.45

Support level: 80.60, 76.60

GOLD_, Daily: Gold price was traded higher following prior rebound from the lower level. MACD which illustrated diminishing bearish momentum suggest the commodity to extend its rebound toward the resistance level at 1661.40.

Resistance level: 1661.40, 1693.35

Support level: 1627.40, 1600.00