17 October 2022 Morning Session Analysis

US Dollar surged, supported by upbeat data.

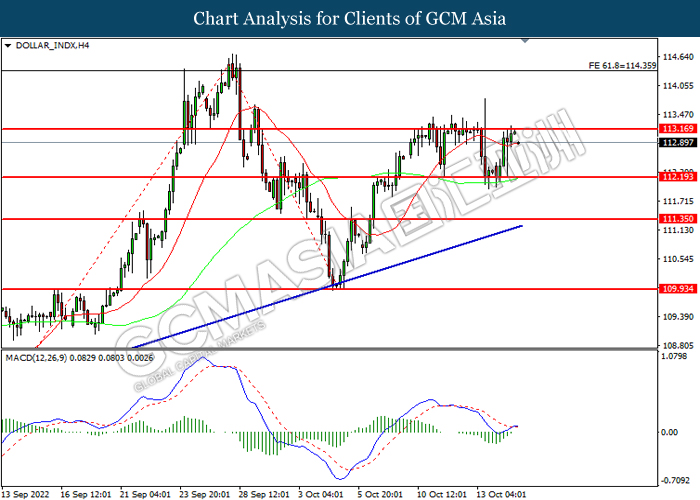

The Dollar Index which traded against a basket of six major currencies extend its gains over the backdrop of bullish economic data from US region last week. According to Census Bureau, US Core Retail Sales for last month notched up significantly from the preliminary reading of -0.1% to 0.1%, exceeding the market forecast at -0.1%. In addition, a survey from University of Michigan on Friday also indicated that US Michigan Consumer Sentiment had improved further in October, which increasing from the previous reading of 58.6 to 59.8, better than the market forecast at 59.0. Nonetheless, Investors would continue to scrutinize the US housing market this week, where the increase in interest rate has already jeopardized the housing demand. As of writing, the Dollar Index appreciated by 0.01% to 113.05.

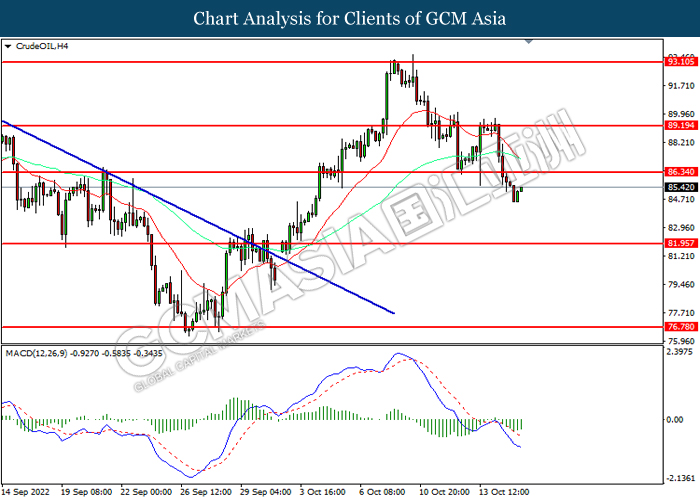

In the commodities market, the crude oil price retreated by 0.05% to 85.20 per barrel as of writing as the rising global recession risk continue to drag down the appeal for this black-commodity. On the other hand, the gold price depreciated by 0.05% to $1647.55 per troy ounces as of writing amid strengthening US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

N/A

Technical Analysis

DOLLAR_INDX, H4: Dollar index was traded higher while currently testing the resistance level. MACD which illustrated diminishing bearish momentum suggest the index to extend its gains after breakout.

Resistance level: 113.15, 114.35

Support level: 112.20, 111.35

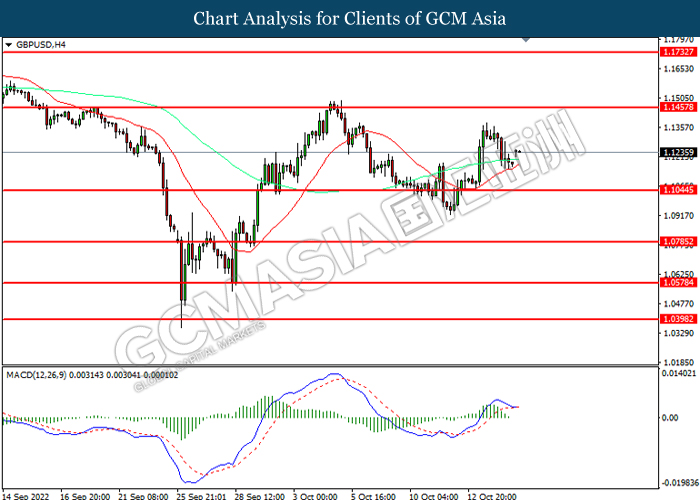

GBPUSD, H4: GBPUSD was traded lower while currently near the support level. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after breakout.

Resistance level: 1.1455, 1.1735

Support level: 1.1045, 1.0785

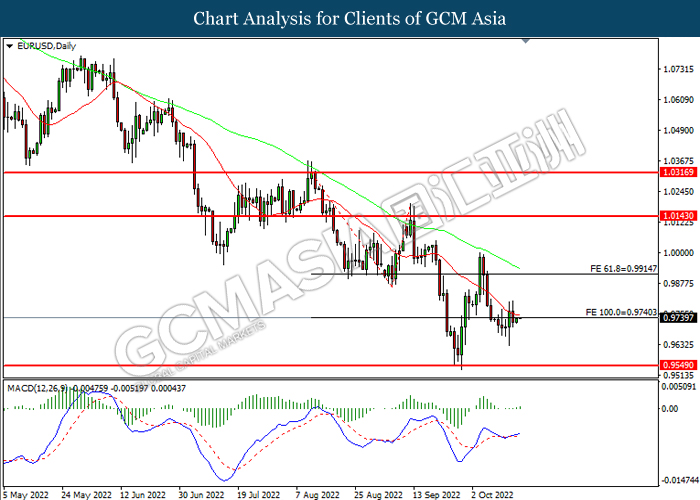

EURUSD, Daily: EURUSD was traded lower while currently testing the support level. However, MACD which illustrated increasing bullish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.9915, 1.0145

Support level: 0.9740, 0.9550

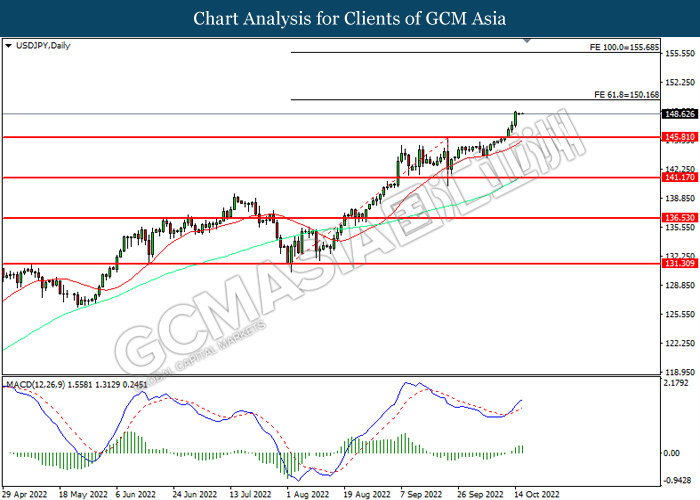

USDJPY, Daily: USDJPY was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains toward resistance level.

Resistance level: 150.15, 155.70

Support level: 145.80, 141.15

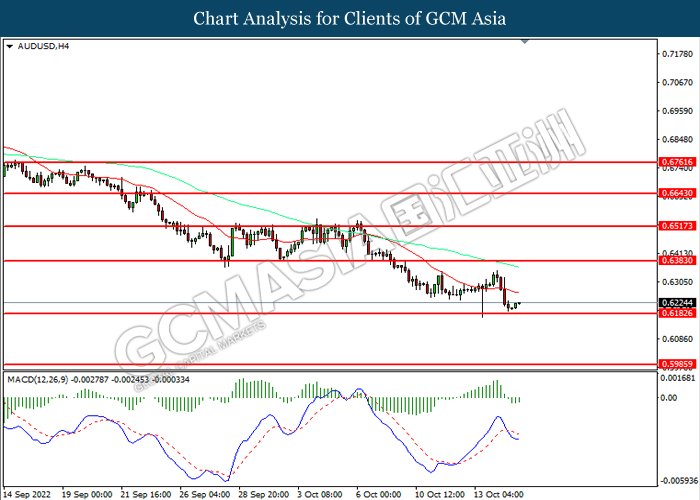

AUDUSD, H4: AUDUSD was traded lower while currently testing the support level. MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.6385, 0.6515

Support level: 0.6185, 0.5985

NZDUSD, Daily: NZDUSD was traded lower while currently testing the support level. However, MACD which illustrated increasing bullish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.5925, 0.6170

Support level: 0.5570, 0.5315

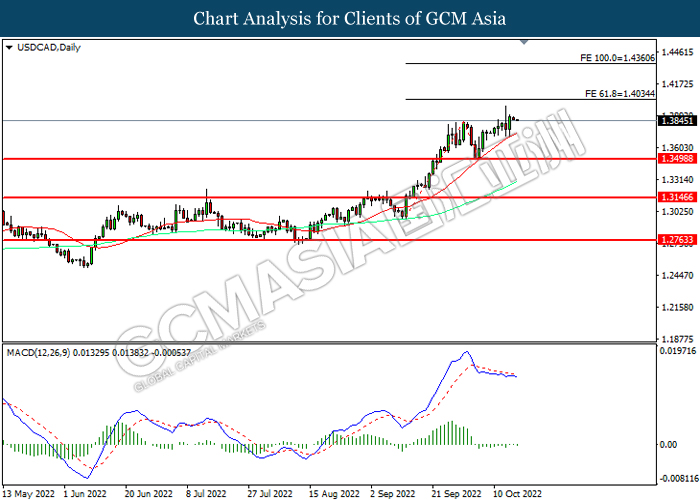

USDCAD, Daily: USDCAD was traded higher while currently near the resistance level. However, MACD which illustrated increasing bearish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.4035, 1.4360

Support level: 1.3500, 1.3145

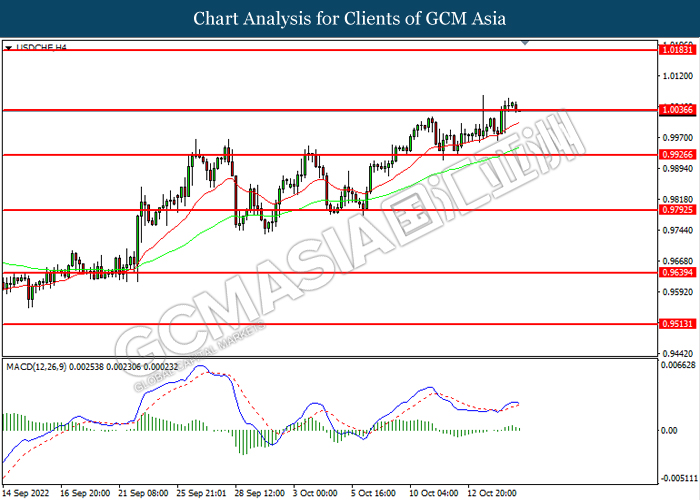

USDCHF, H4: USDCHF was traded higher while currently testing the resistance level. However, MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.0035, 1.0185

Support level: 0.9925, 0.9795

CrudeOIL, H4: Crude oil price was traded lower following prior breakout below the previous support level. However, MACD which illustrated diminishing bearish momentum suggest the commodity to be traded higher as technical correction.

Resistance level: 86.35, 89.20

Support level: 81.95, 76.80

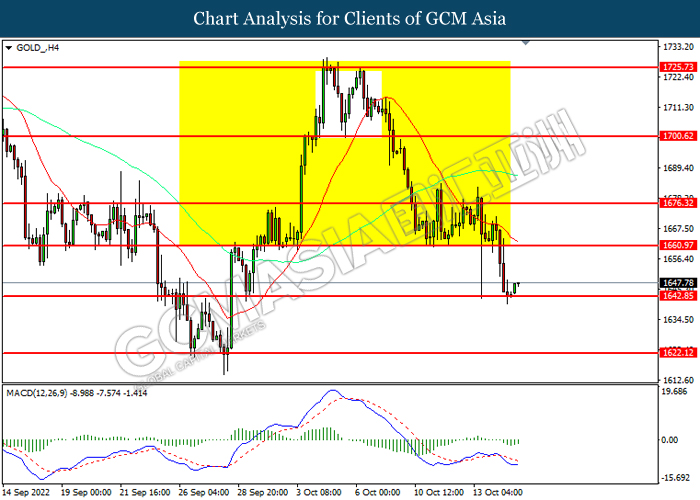

GOLD_, H4: Gold price was traded lower while currently testing the support level. However, MACD which illustrated diminishing bearish momentum suggest the commodity to be traded higher as technical correction.

Resistance level: 1660.95, 1676.30

Support level: 1642.85, 1622.10