17 November 2022 Afternoon Session Analysis

Pound Sterling rallied as data shown soaring inflation in UK.

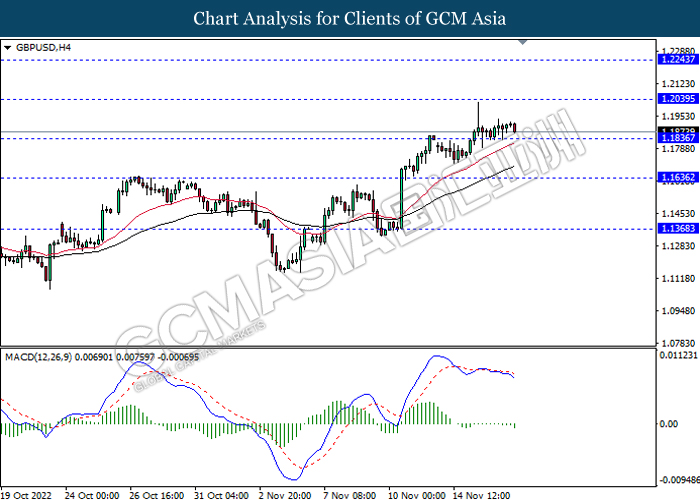

The GBP/USD, which widely traded by majority of investors rose significantly on yesterday amid the background of rising inflationary risk. According to Office for National Statistics, the UK Consumer Price Index (CPI) YoY jumped to a 41-year high of 11.1% in October, exceeding the market consensus forecast of 10.7%. The soaring of food, transport and energy price keep threatening household and business, which sparkling the hopes of aggressive rate hike from Bank of England (BoE). In addition, Pound Sterling’s gains has been extended following the hawkish statement form BoE. According to Reuters, BoE Governor Andrew Bailey claimed on Wednesday that the UK labor market is still ‘tight’, as well as more rate hikes are likely to be implemented in order to bring down sky-rocketed price. With that, it attracted the eye of investors and stoke a shift in sentiment toward UK currency. As of now, market participants would scrutinize on fiscal statement that delivered by UK Finance Minister Jeremy Hunt on Thursday night. As of writing, GBP/USD depreciated by 0.29% to 1.1874.

In the commodities market, the crude oil price slumped by 1.33% to $84.45 per barrel as of writing as the rising Covid-19 cases in China had weighed down the demand of this black commodity. On the other hand, the gold price eased by 0.51% to $1763.33 per troy ounce as of writing following the strengthening of US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

20:30 GBP Autumn Forecast Statement

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 18:00 | EUR – CPI (YoY) (Oct) | 10.7% | 10.7% | – |

| 21:30 | USD – Building Permits (Oct) | 1.564M | 1.512M | – |

| 21:30 | USD – Initial Jobless Claims | 225K | 225K | – |

| 21:30 | USD – Philadelphia Fed Manufacturing Index (Nov) | -8.7 | -6.2 | – |

Technical Analysis

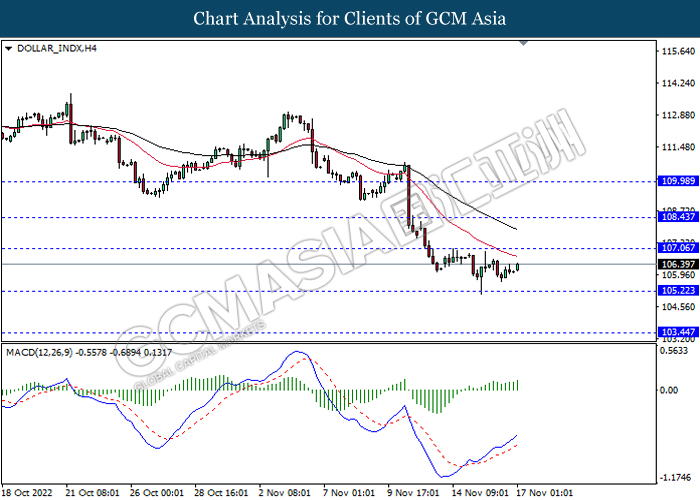

DOLLAR_INDX, H4: Dollar index was traded lower following prior breakout below the previous support level. However, MACD which illustrated increasing bullish momentum suggest the index to be traded higher as technical correction.

Resistance level: 107.05, 108.45

Support level: 105.20, 103.45

GBPUSD, H4: GBPUSD was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated increasing bearish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.2040, 1.2245

Support level: 1.1835, 1.1635

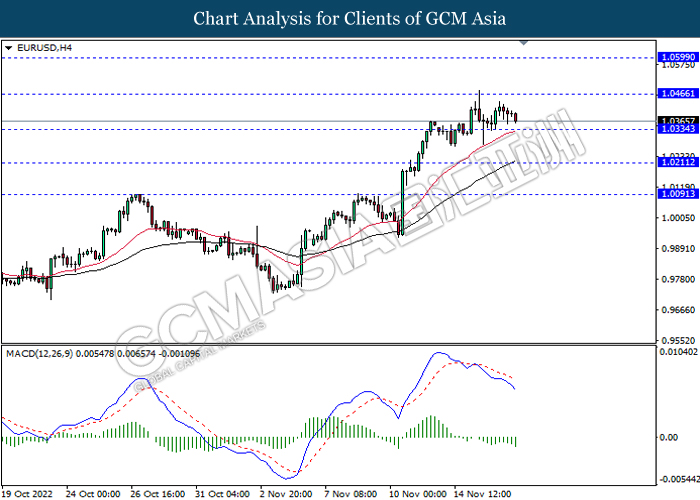

EURUSD, H4: EURUSD was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated increasing bearish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.0465, 1.0600

Support level: 1.0335, 1.0210

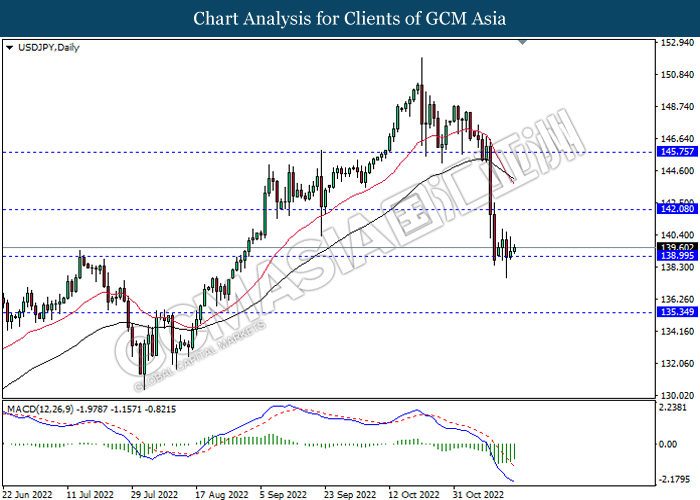

USDJPY, Daily: USDJPY was traded higher following prior rebound form the support level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 142.10, 145.75

Support level: 139.00, 135.35

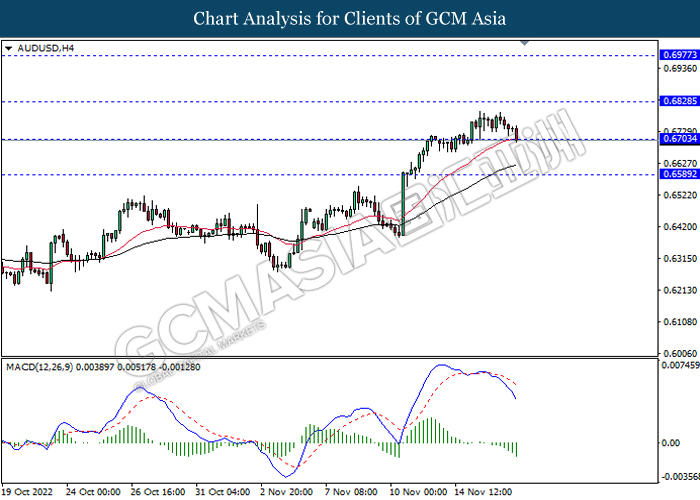

AUDUSD, H4: AUDUSD was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses if successfully breakout the support level.

Resistance level: 0.6830, 0.6975

Support level: 0.6705, 0.6590

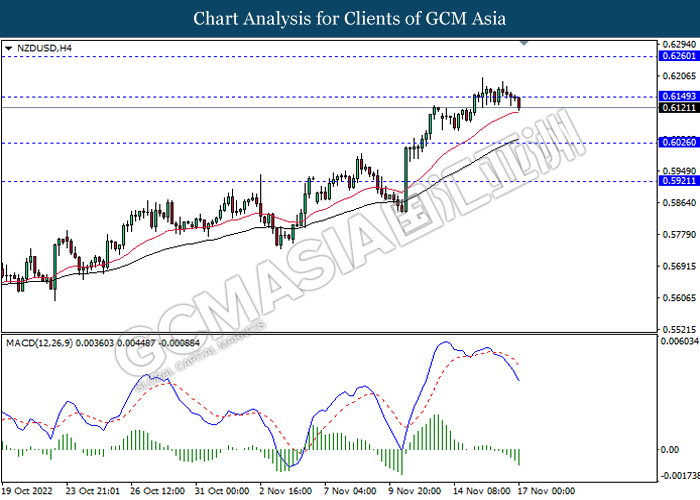

NZDUSD, H4: NZDUSD was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 0.6150, 0.6260

Support level: 0.6025, 0.5920

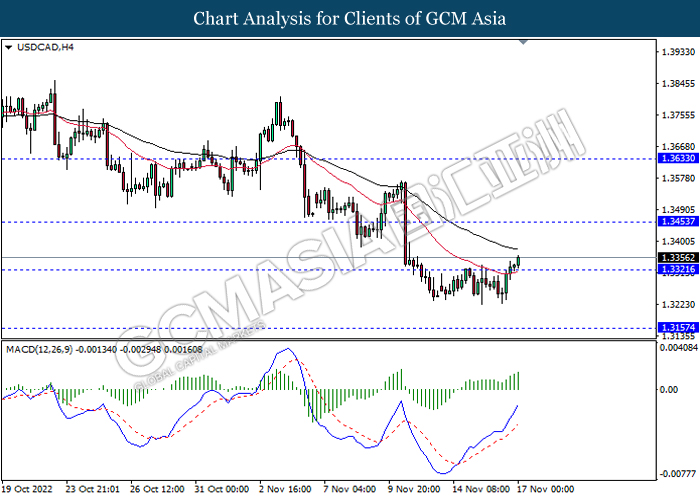

USDCAD, H4: USDCAD was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 1.3455, 1.3635

Support level: 1.3320, 1.3155

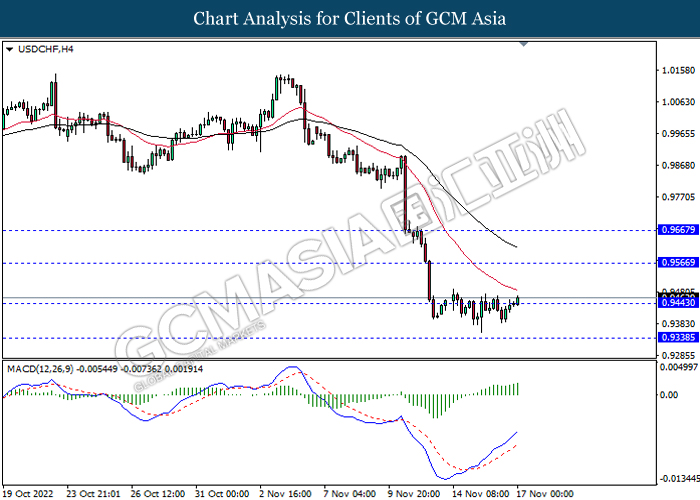

USDCHF, H4: USDCHF was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 0.9565, 0.9665

Support level: 0.9445, 0.9340

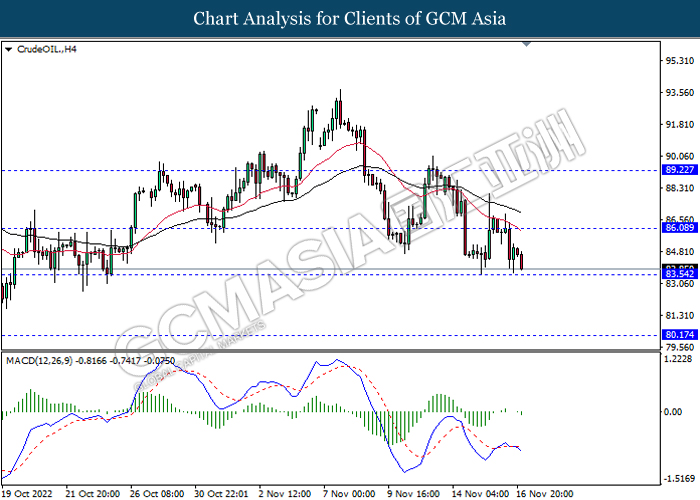

CrudeOIL, H4: Crude oil price was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses if successfully breakout the support level.

Resistance level: 86.10, 89.20

Support level: 83.55, 80.15

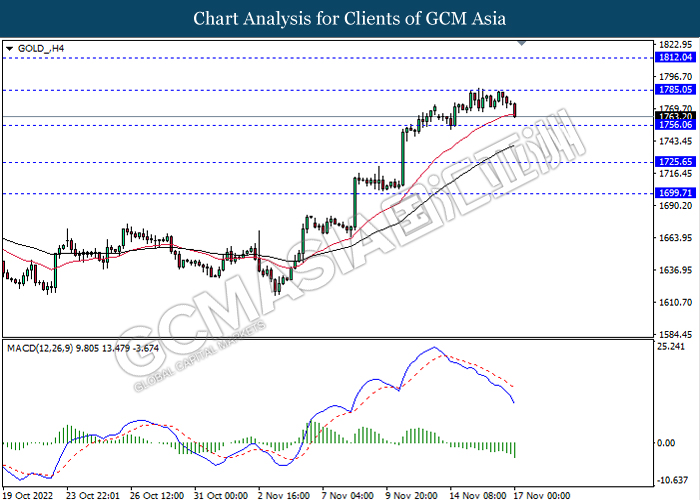

GOLD_, H4: Gold price was traded lower following prior retracement from the resistance level. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses.

Resistance level: 1785.05, 1812.05

Support level: 1756.05, 1725.65