17 November 2022 Morning Session Analysis

Dollar revived following the release of solid retail sales data.

The dollar index, which gauges its value against a basket of six major currencies, managed to hold its ground yesterday as upbeat economic data sparked bullish momentum in the dollar market. According to the Census Bureau, US Retail Sales came in at 1.3%, stronger than the consensus forecast of 1.0%, showing households stepped up their spending throughout the month of October. On the other hand, the US Core Retail Sales data also rose solidly, from 0.1% to 1.3%, beating the consensus forecast of 0.4%. Following the upbeat data as well as the sign of a slowdown in inflation, actually adds to cautious optimism that the economy could avoid an expected recession next year or experience only a mild one. Besides, the Fed’s Waller also reiterated his point of view regarding the rate hike, whereby he is in favor of a 50-basis point of a rate hike. Similarly, he also emphasized that how high rates have to go hinges on the upcoming economic data. As of writing, the dollar index is up by 0.13% to 106.25.

In the commodities market, the crude oil price plunged by -1.77% to $85.60 per barrel as the oil supply to Hungary via the Druzhba pipeline resumed after being suspended temporarily in the past day. Besides, the gold prices edged down by -0.28% to $1773.90 per troy ounce amid the strengthening of the dollar index.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

20:30 GBP Autumn Forecast Statement

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 18:00 | EUR – CPI (YoY) (Oct) | 10.7% | 10.7% | – |

| 21:30 | USD – Building Permits (Oct) | 1.564M | 1.512M | – |

| 21:30 | USD – Initial Jobless Claims | 225K | 225K | – |

| 21:30 | USD – Philadelphia Fed Manufacturing Index (Nov) | -8.7 | -6.2 | – |

Technical Analysis

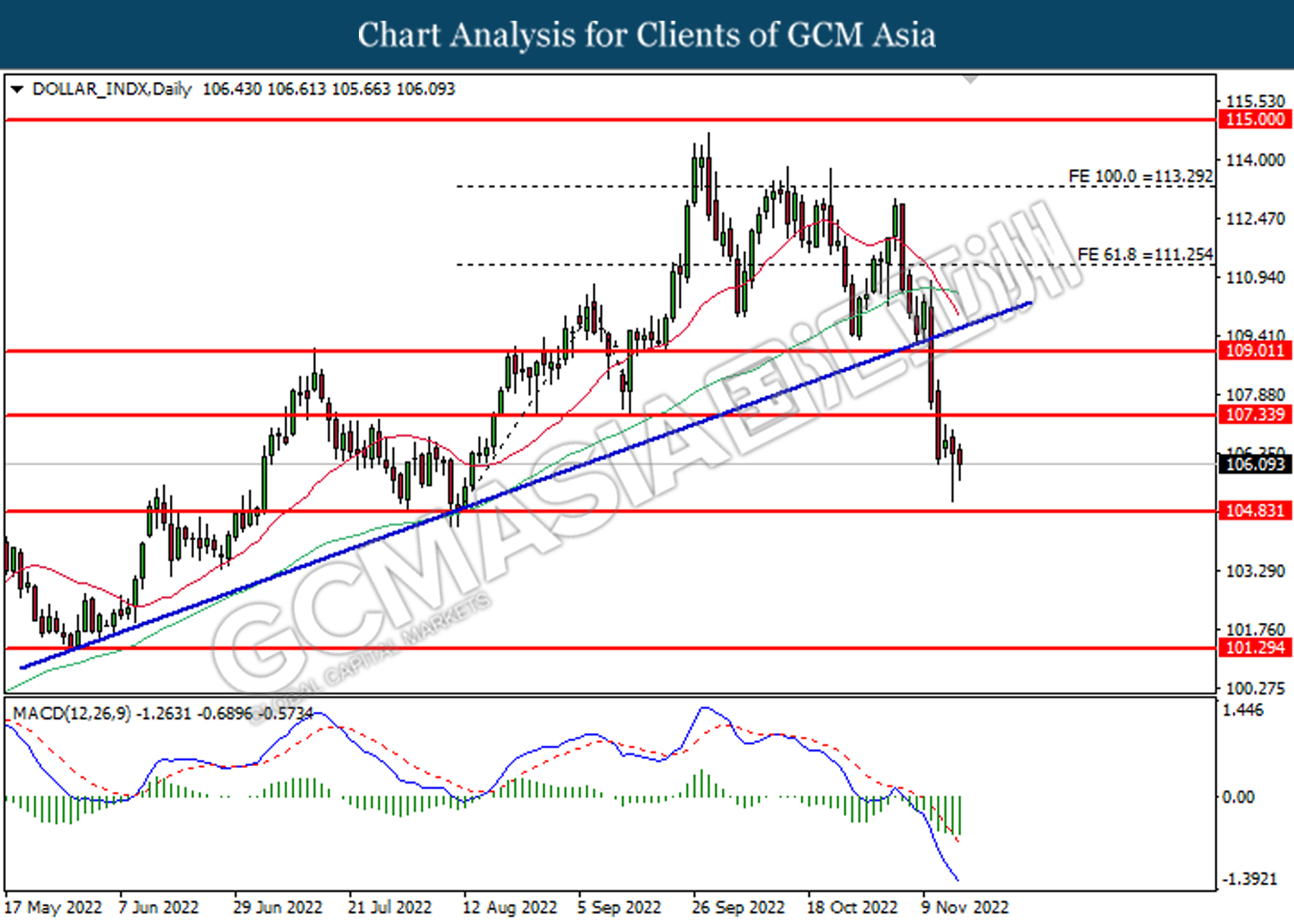

DOLLAR_INDX, Daily: Dollar index was traded lower following prior breakout below the support level at 107.35. MACD which illustrated bearish bias momentum suggests the index to extend its losses toward the support level at 104.85

Resistance level: 107.35, 109.00

Support level: 104.85, 101.30

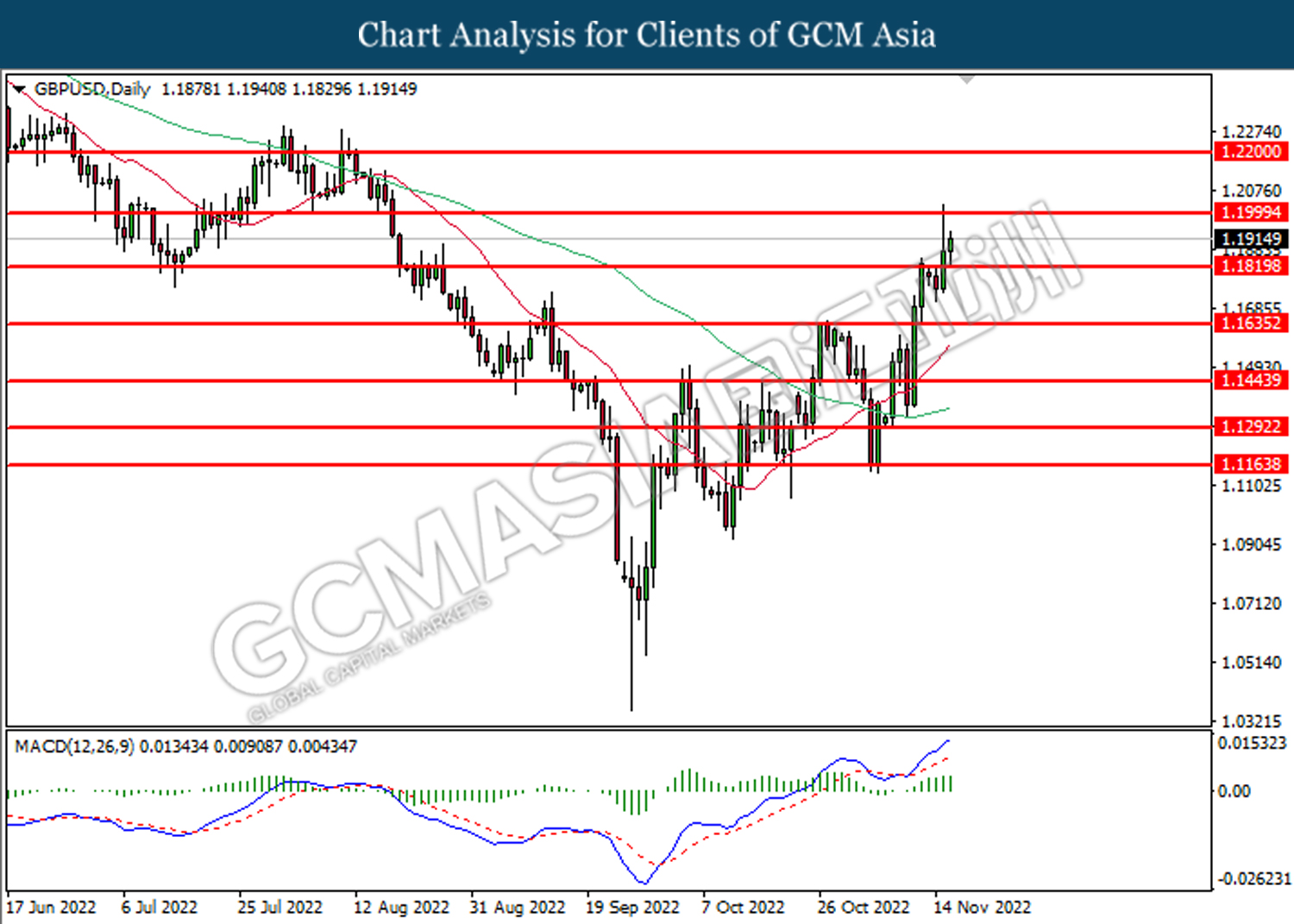

GBPUSD, Daily: GBPUSD was traded higher following prior breakout above the previous resistance level at 1.1820. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 1.2000.

Resistance level: 1.2000, 1.2200

Support level: 1.1820, 1.1635

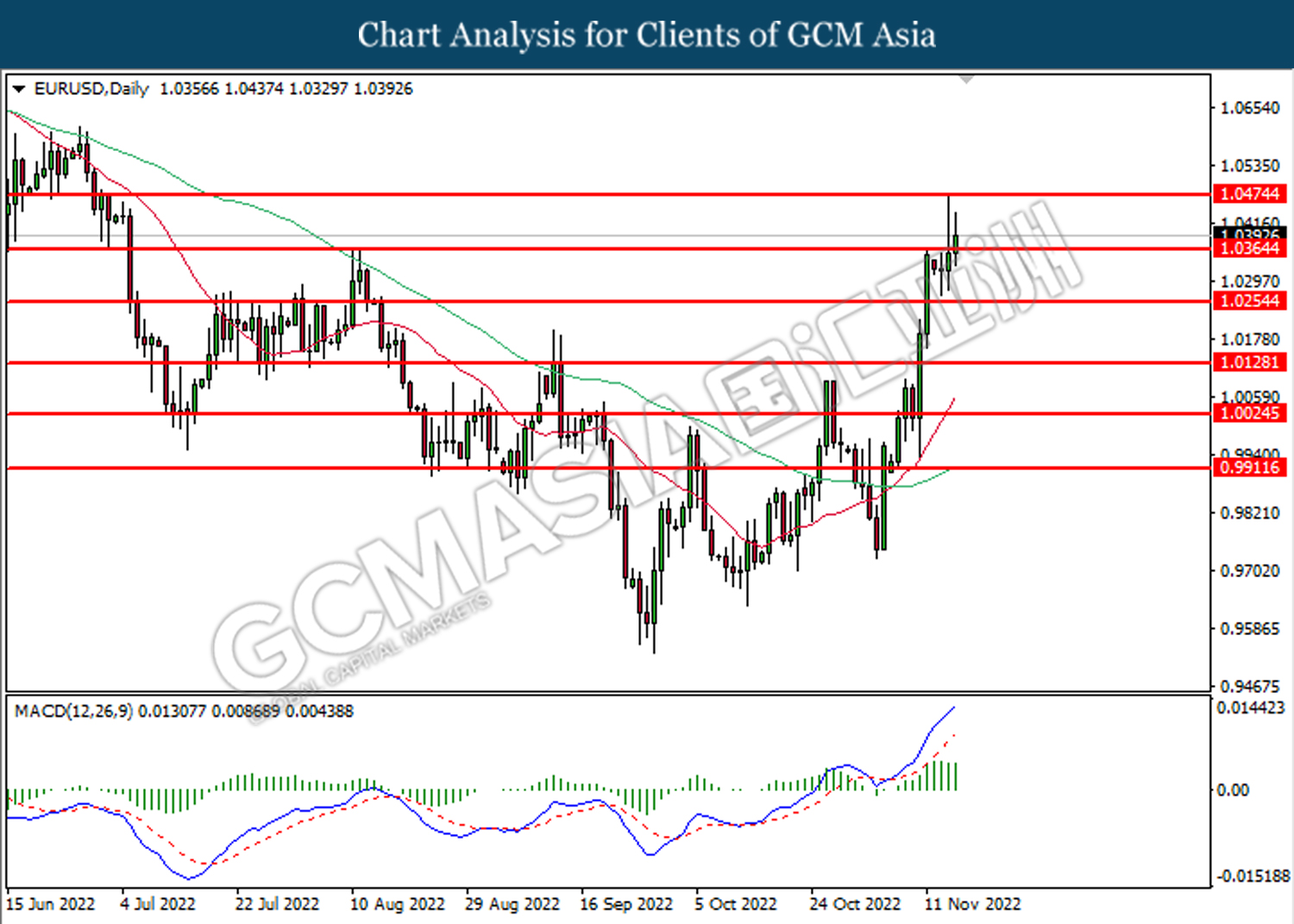

EURUSD, Daily: EURUSD was traded higher while currently testing the resistance level at 1.0365. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.0365, 1.0475

Support level: 1.0255, 1.0130

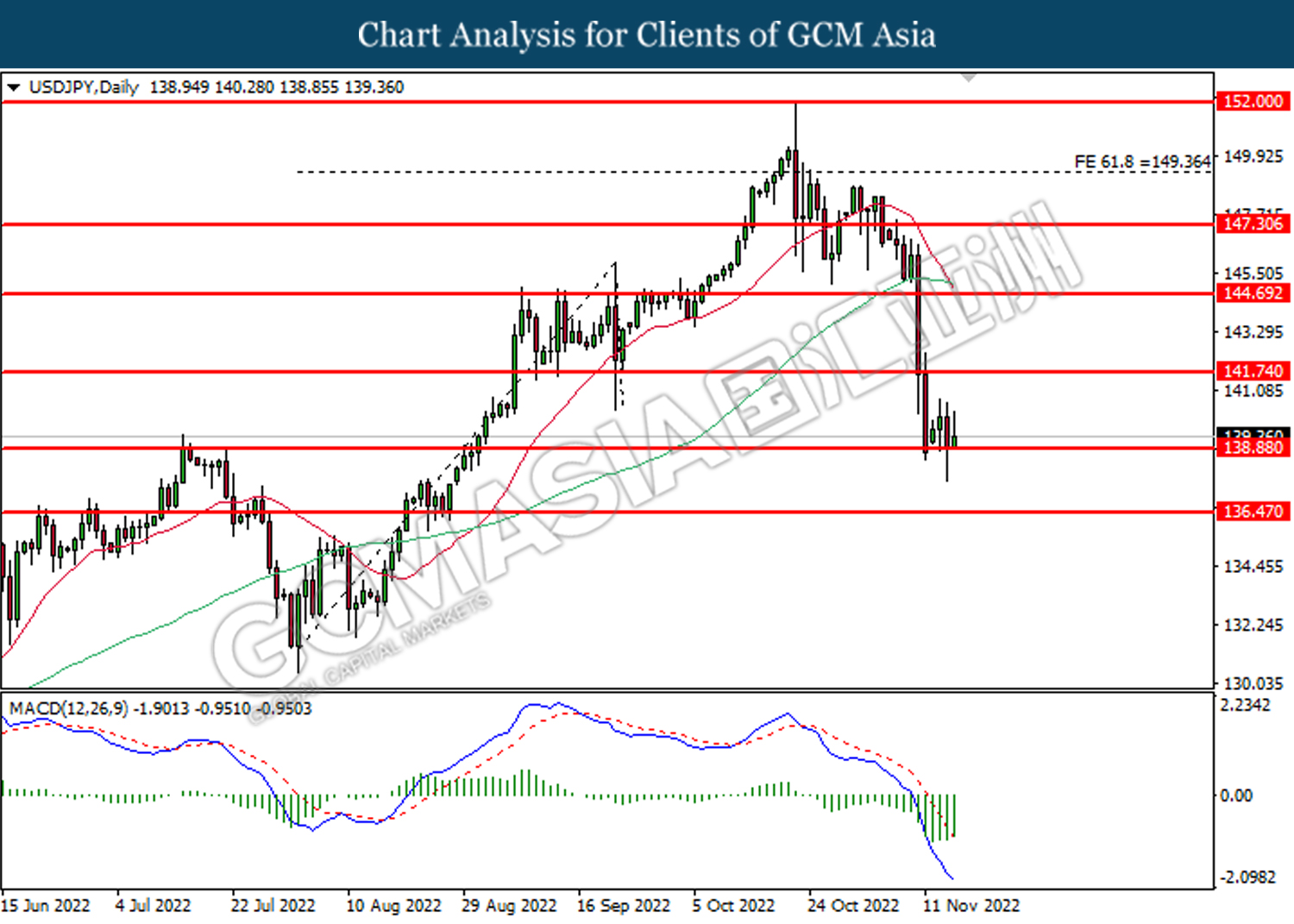

USDJPY, Daily: USDJPY was traded lower while currently testing the support level ta 138.90. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 141.75, 144.70

Support level: 138.90, 136.45

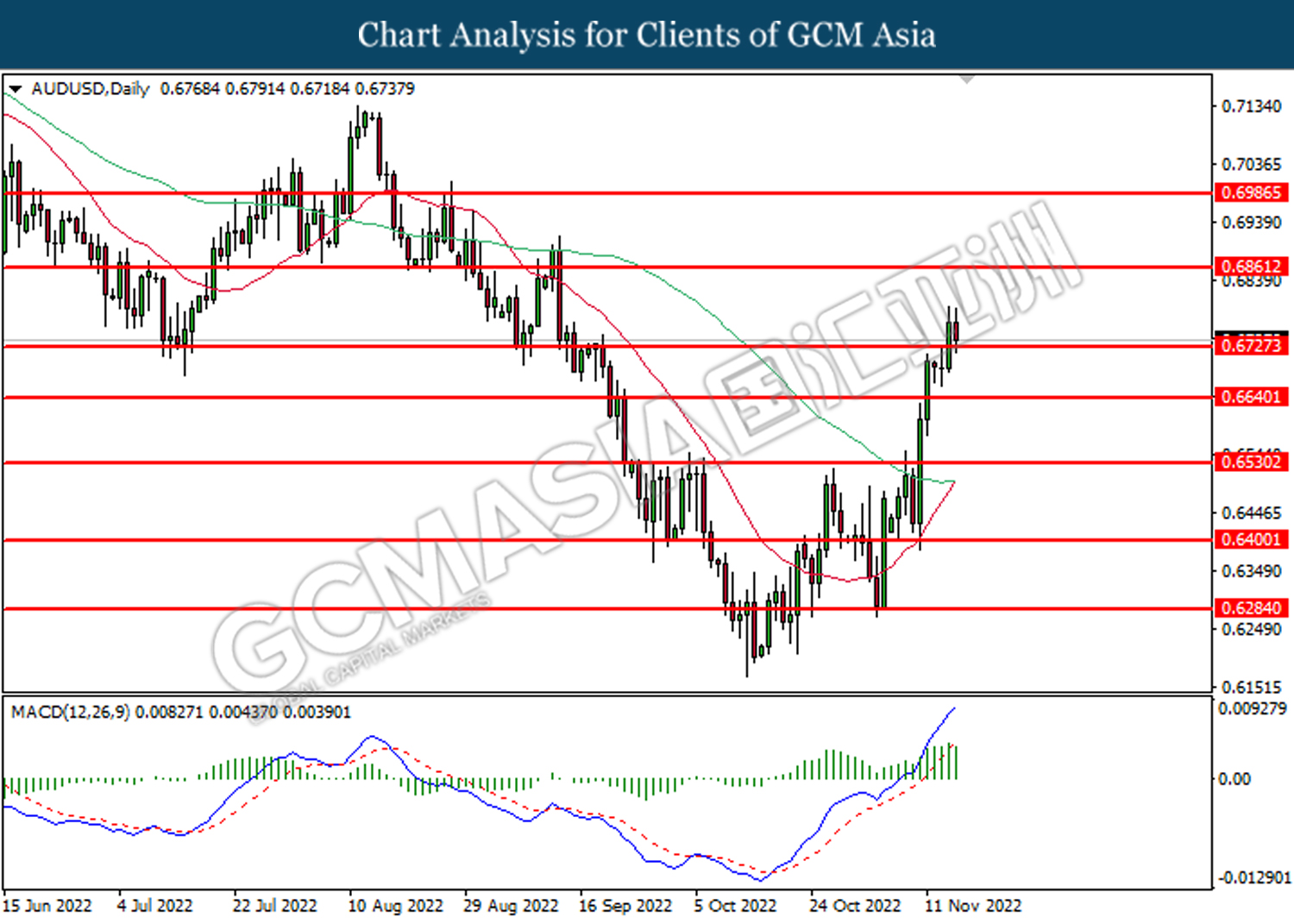

AUDUSD, Daily: AUDUSD was traded higher following prior breakout above the previous resistance level at 0.6725. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 0.6860.

Resistance level: 0.6860, 0.6985

Support level: 0.6725, 0.6640

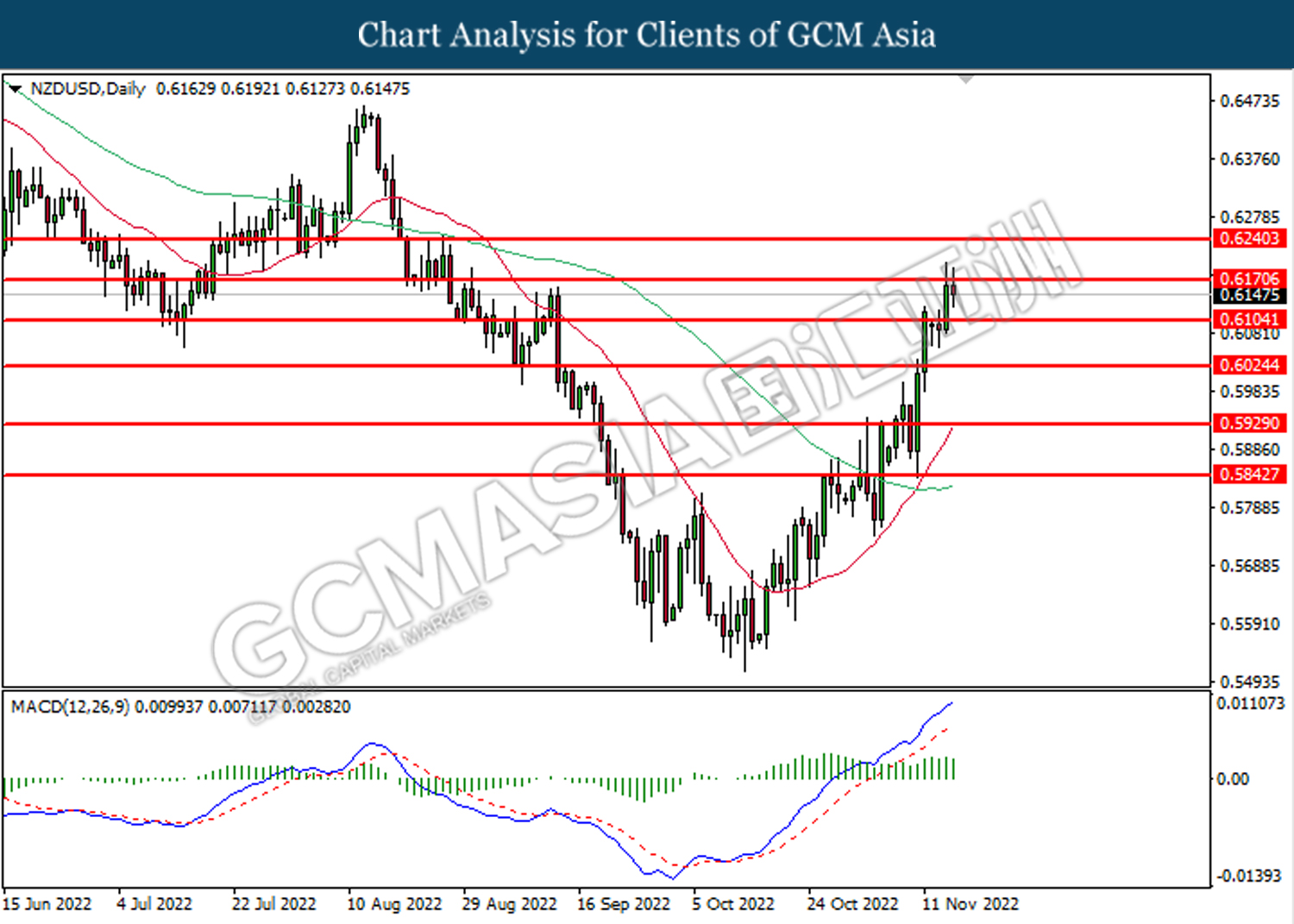

NZDUSD, Daily: NZDUSD was traded higher while currently testing the resistance level at 0.6170. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 0.6170, 0.6240

Support level: 0.6105, 0.6025

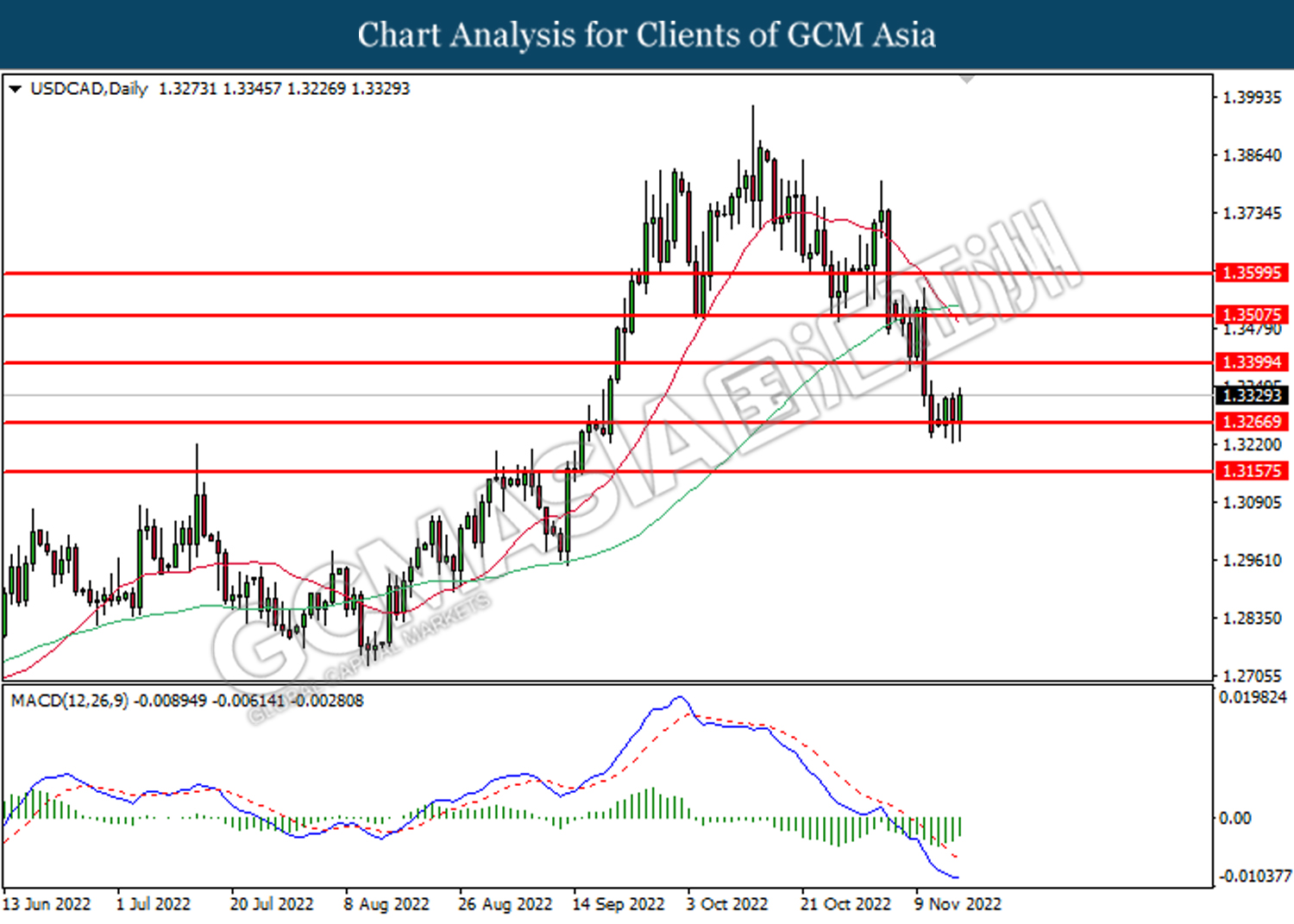

USDCAD, Daily: USDCAD was traded higher following prior rebound from the support level at 1.3265. MACD which illustrated diminishing bearish momentum suggests the pair to extend its gains toward the resistance level at 1.3400.

Resistance level: 1.3400, 1.3505

Support level: 1.3265, 1.3155

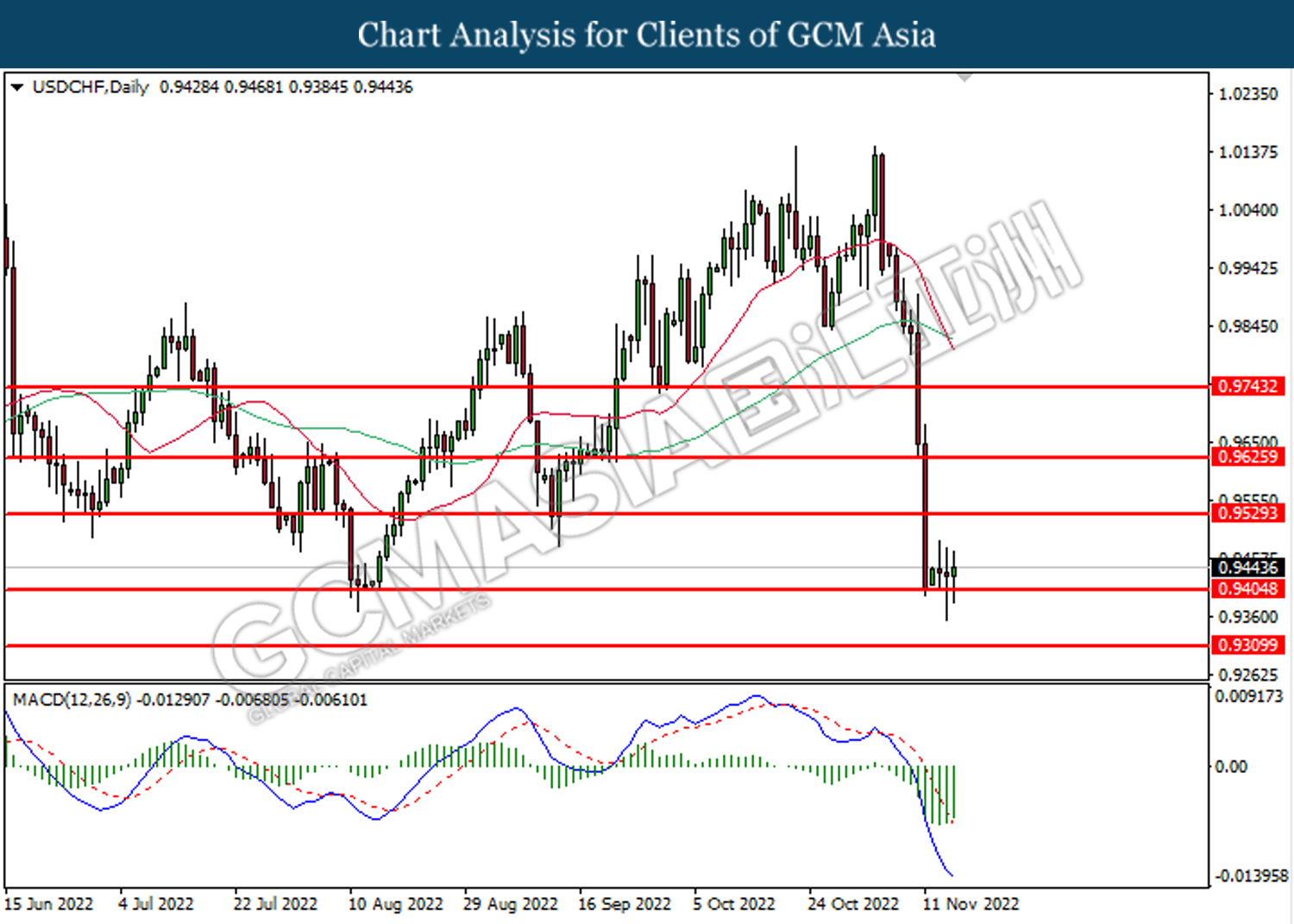

USDCHF, Daily: USDCHF was traded higher following prior rebound from the support level at 0.9405. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward the resistance level at 0.9530.

Resistance level: 0.9530, 0.9625

Support level: 0.9405, 0.9310

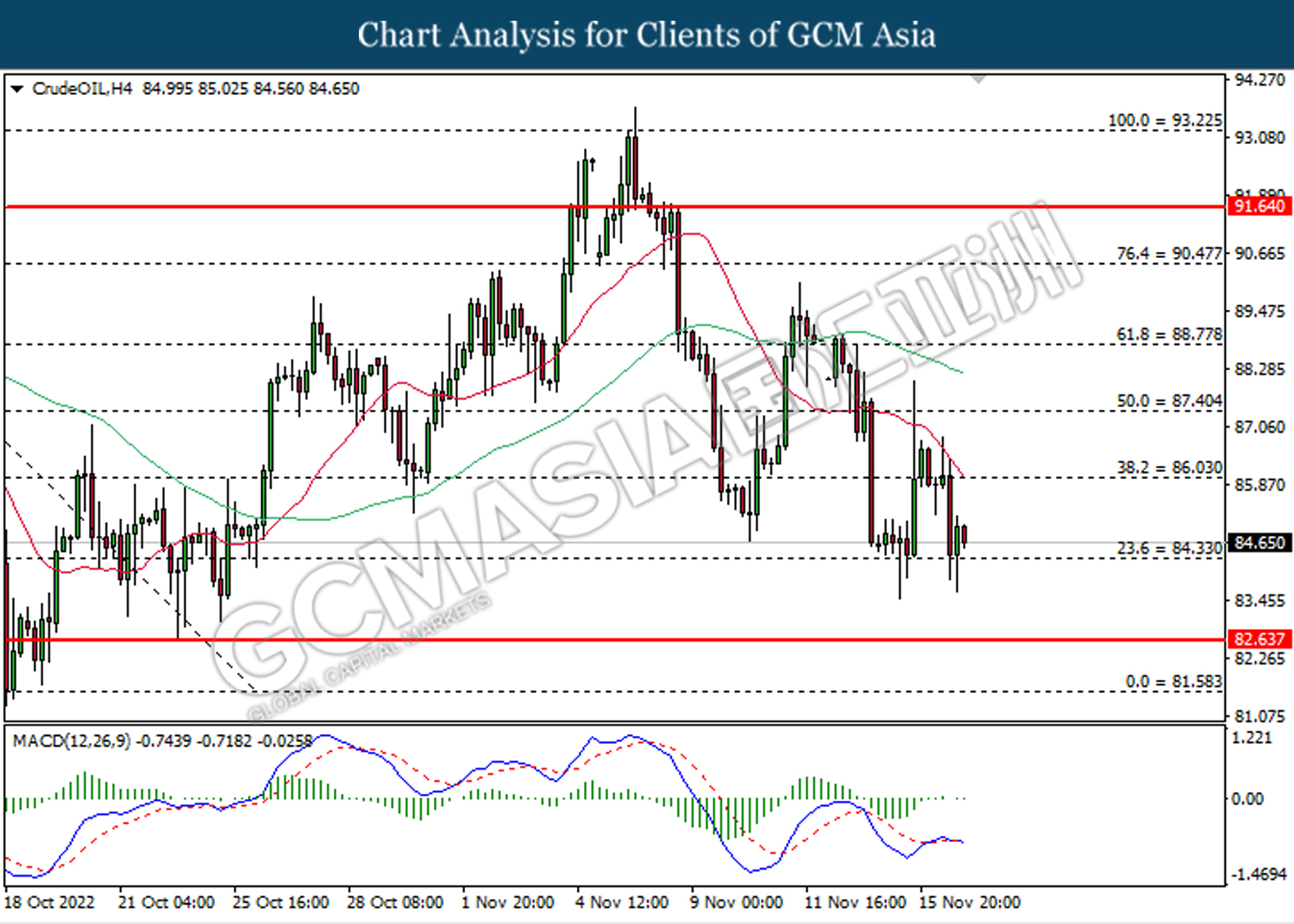

CrudeOIL, H4: Crude oil price was traded higher following prior rebound from support level at 84.35. Due to lack of signal from MACD, it is suggested to wait for further confirmation before entering into market.

Resistance level: 86.05, 87.40

Support level: 84.35, 82.65

GOLD_, Daily: Gold price was traded higher following prior breakout above the previous resistance level at 1766.50. MACD which illustrated bullish bias momentum suggests the commodity to extend its gains toward the resistance level at 1805.90.

Resistance level: 1805.90, 1850.95

Support level: 1766.50, 1726.15