17 December 2021 Afternoon Session Analysis

Euro rose following ECB rate decision.

The Euro which traded against the dollar and other currency pairs have rose after ECB anoounced its policy decision recently. The ECB have continue to maintain its monetary policy settings unchanged as widely expected with the interest rate at 0.00%. However, in the accompanying statement, the European Central Bank announced that it would end its 1.85 trillion euro emergency bond purchase program in March 2022. The members of the European Central Bank believe that the EU economy has continued to recover and is expected to move towards the medium-term goal next year. However, the central bank stated that the bond purchase program (APP) will serve as a transition and will continue to purchase a total of 20 billion euros per month. They stated that they need to continue to implement adequate easing policies to control the inflation level. The lack of fresh dovish signals from the ECB have help lifted the market sentiment. At the time of writing, EUR/USD rose 0.05% to 1.1322.

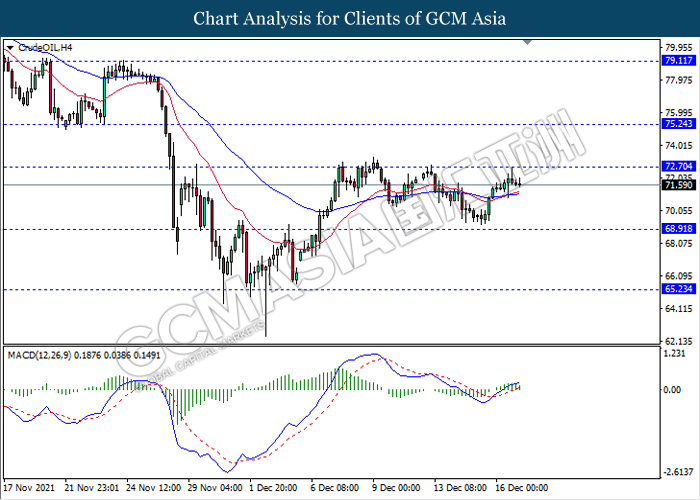

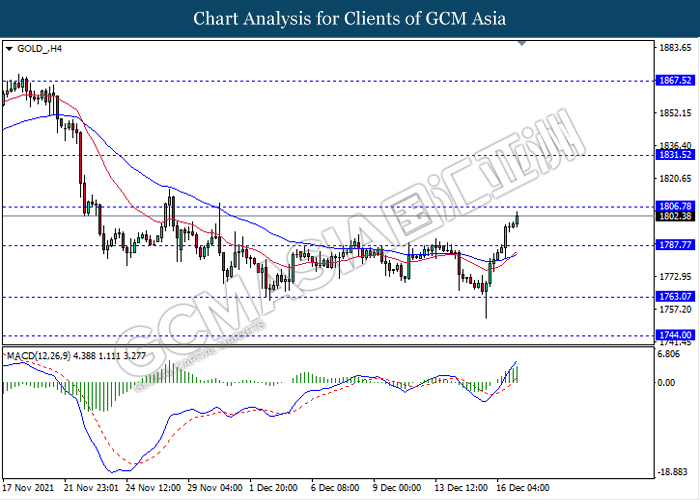

In the commodities market, crude oil price retreat 0.11% to $71.65 a troy ounce as of writing amid rising global Omicron cases. In Denmark, South Africa and the United Kingdom, the number of new Omicron cases has been doubling every two days. Denmark’s Prime Minister Mette Frederiksen on Thursday warned the government may impose further curbs to limit the spread of Omicron. On the other hand, gold price surge 0.20% to $1803.01 a troy ounce at the time of writing following dollar strength.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 15:00 | GBP – Retail Sales (MoM) (Nov) | 0.8% | 0.8% | – |

| 17:00 | EUR – German Ifo Business Climate Index (Dec) | 96.5 | 95.3 | – |

| 18:00 | EUR – CPI (YoY) (Nov) | 4.9% | 4.8% | – |

Technical Analysis

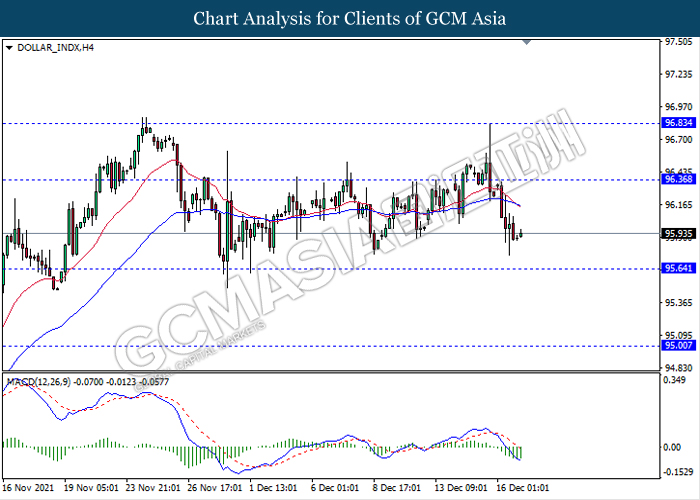

DOLLAR_INDX, H4: Dollar index was traded lower while currently testing near the support level 95.65. MACD which illustrate bearish momentum signal suggest the dollar to extend its losses after it breaks below the support level.

Resistance level: 96.35, 96.85

Support level: 95.65, 95.00

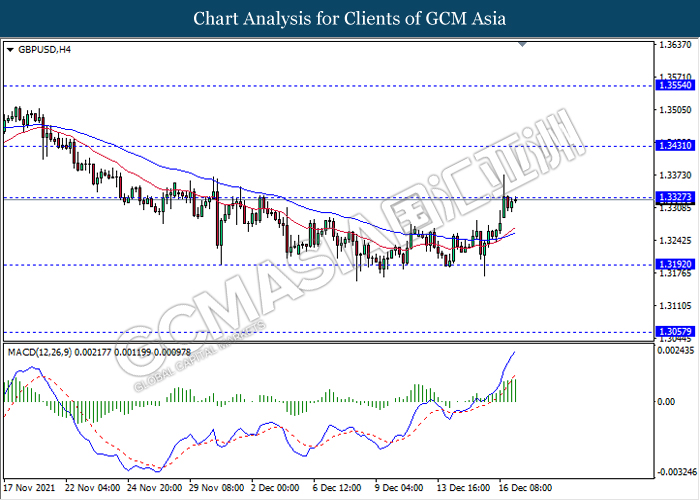

GBPUSD, H4: GBPUSD was traded higher while currently testing the resistance level 1.3325. MACD which illustrate ongoing bullish momentum signal suggest the pair to extend its gains after it breaks above the resistance level 1.3325.

Resistance level: 1.3325, 1.3430

Support level: 1.3190, 1.3055

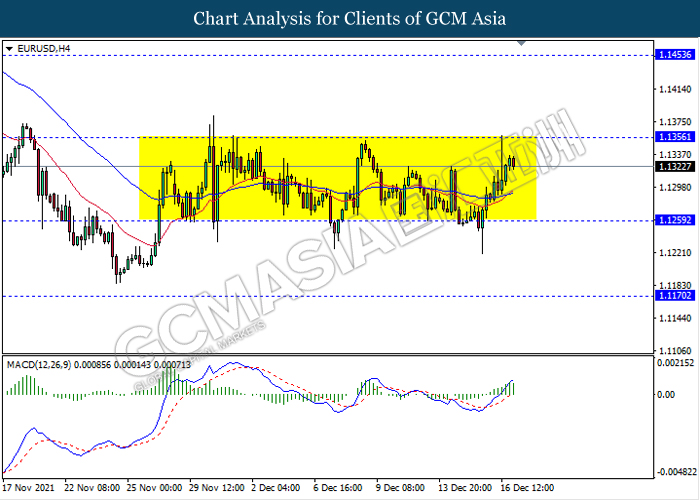

EURUSD, H4: EURUSD remain traded in a sideway channel while currently testing near the resistance level 1.1355. However, MACD which illustrate ongoing bullish momentum signal suggest the pair to extend its gains after it breaks above the resistance level.

Resistance level: 1.1355, 1.1455

Support level: 1.1260, 1.1170

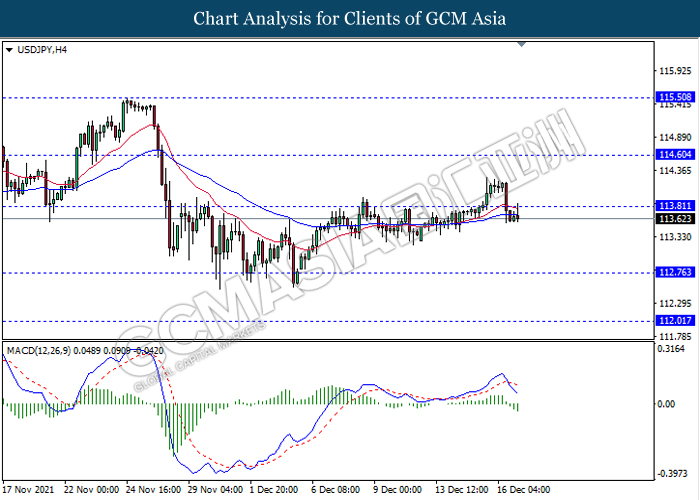

USDJPY, H4: USDJPY was traded lower following prior breakout below the previous support level 113.80. MACD which illustrate bearish bias signal with the formation of death cross suggest the pair to extend its losses towards the support level 112.75.

Resistance level: 113.80, 114.60

Support level: 112.75, 112.00

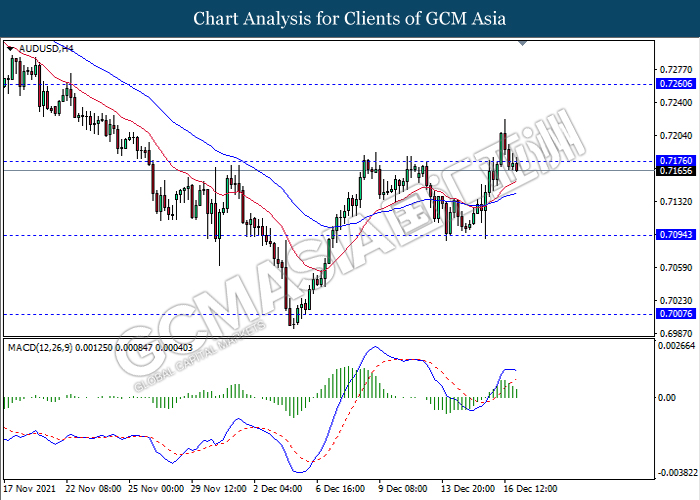

AUDUSD, H4: AUDUSD was traded lower following prior breakout below the previous support level 0.7175. MACD which illustrate diminishing bullish momentum signal suggest the pair to extend its losses towards the support level 0.7095.

Resistance level: 0.7175, 0.7260

Support level: 0.7095, 0.7005

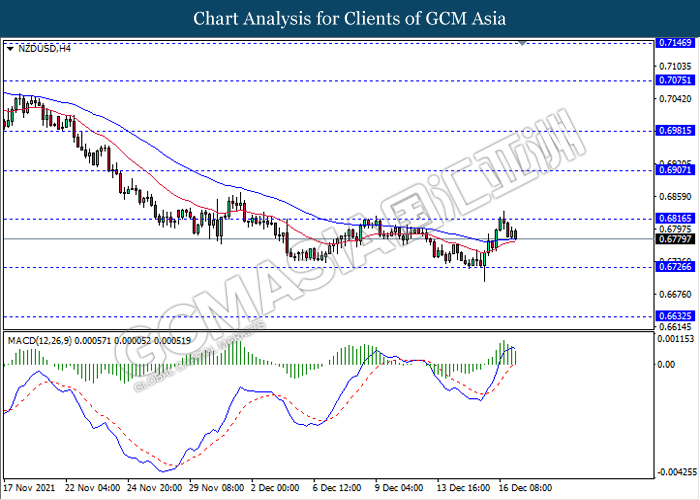

NZDUSD, H4: NZDUSD was traded lower following prior retracement from the resistance level 0.6815. MACD which illustrate diminishing bullish momentum signal suggest the pair to extend its retracement towards the support level 0.6725.

Resistance level: 0.6815, 0.6905

Support level: 0.6725, 0.6830

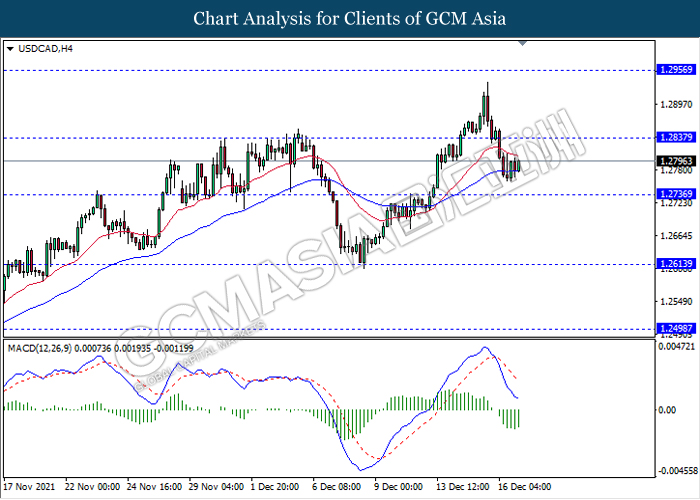

USDCAD, H4: USDCAD was traded higher following prior rebound from its low level. MACD which illustrate diminishing bearish momentum signal suggest the pair to extend its rebound towards the resistance level 1.2835.

Resistance level: 1.2835, 1.2955

Support level: 1.2735, 1.2615

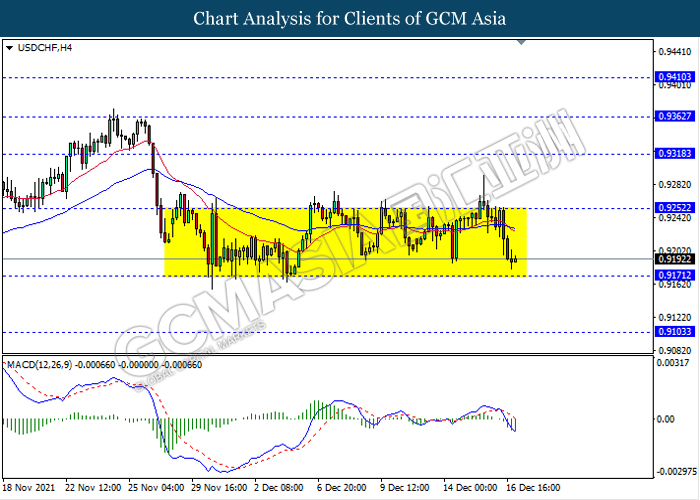

USDCHF, H4: USDCHF remain traded in a sideway channel while currently testing near the support level 0.9170. However, MACD which illustrate bearish bias signal suggest the pair to extend its losses after it breaks below the support level.

Resistance level: 0.9250, 0.9320

Support level: 0.9170, 0.9105

CrudeOIL, H4: Crude oil price was traded higher while currently testing near the resistance level 72.70. MACD which illustrate bullish bias signal suggest the commodity to extend its gains after it breaks above the resistance level 72.70.

Resistance level: 72.70, 75.25

Support level: 68.90, 65.25

GOLD_, H4: Gold price was traded higher while currently testing near the resistance level 1806.80. MACD which illustrate bullish bias signal suggest the commodity to extend its gains after it breaks above the resistance level.

Resistance level: 1806.80, 1831.50

Support level: 1787.75, 1763.05