18 January 2019 Afternoon Session Analysis

Dollar remain steady following upbeat data.

Dollar index remains firm against a basket of six major currencies following upbeat Jobless claims data. According to US Department of Labor, initial jobless claims at 5-week low, dropped by 3000 to 213,000 which exceed economists’ forecast for a drop to 216,000 which proved that the government shutdown has yet affected on jobs market. Besides that, Philadelphia Fed manufacturing index also rose to 17.00 which also beat expectation of 9.7, further boosted the dollar sentiment. Dollar index rose 0.02% to 95.68 as of writing. Meanwhile, USDJPY climb 0.15% to 109.38 at the time of writing following inflation rate at low levels. According to reports, Japanese core inflations remains trapped at seven month lows with Bank of Japan does not near anywhere closer to their 2% inflation target.

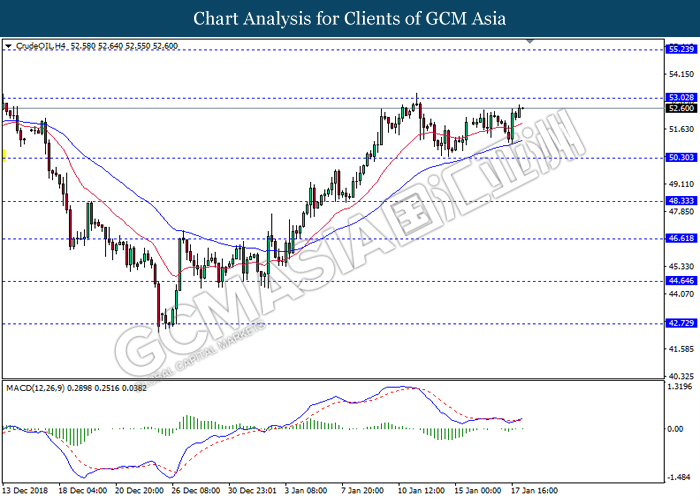

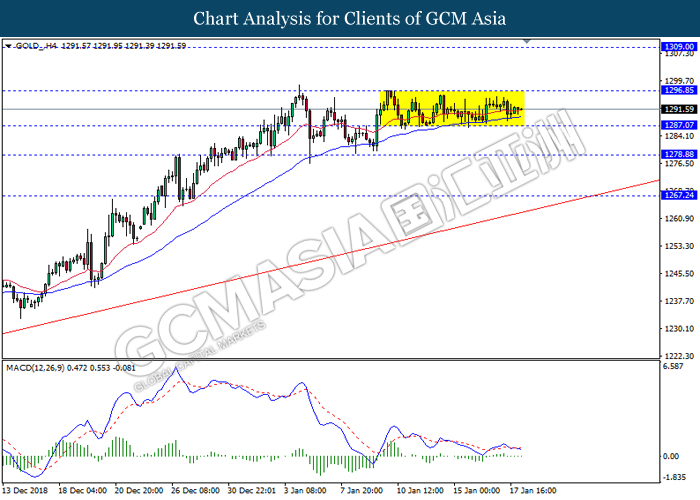

In the commodities market, crude oil price skyrocketed 0.81% to $52.60 per barrel as markets scatters to bid on oil market following US have plans to reconsider for harsher sanctions on Venezuela that could further decrease imports of country oil, boosting positive sentiment towards the oil markets. On the other hand, gold price struggled following increasing dollar strength and global tension ease.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

17:00 CrudeOIL IEA Monthly Report

Tentative CrudeOIL OPEC Meeting

22:05 USD FOMC Member Williams Speaks

00:00 (19th) USD FOMC Member Harker Speaks

Today’s Highlight Economic Data

| Time | Market & Data | Previous | Forecast | Actual |

| 17:30 | GBP – Retail Sales (MoM) (Dec) | 1.4% | -0.8% | – |

| 21:30 | CAD – Core CPI (MoM) (Dec) | -0.2% | – | – |

| 22:15 | USD – Industrial Production (MoM) (Dec) | 0.6% | 0.2% | – |

| 23:00 | USD – Michigan Consumer Sentiment (Jan) | 98.3 | 97.0 | – |

| 02:00

(19th) |

CrudeOIL – US Baker Hughes Oil Rig Count | 873 | – | – |

Technical Analysis

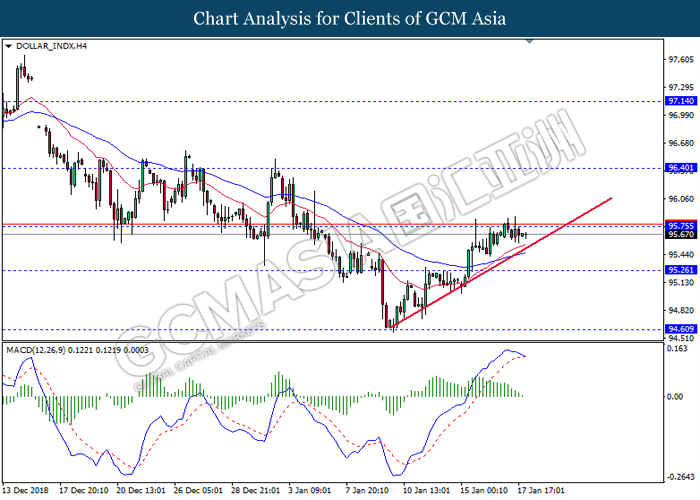

DOLLAR_INDX, H4: Dollar index was traded higher following prior retracement from the resistance level 95.75. MACD which illustrate bearish momentum with the formation of death cross suggest the pair to extend its retracement towards the support level 95.25.

Resistance level: 95.75, 96.40

Support level: 95.25, 94.60

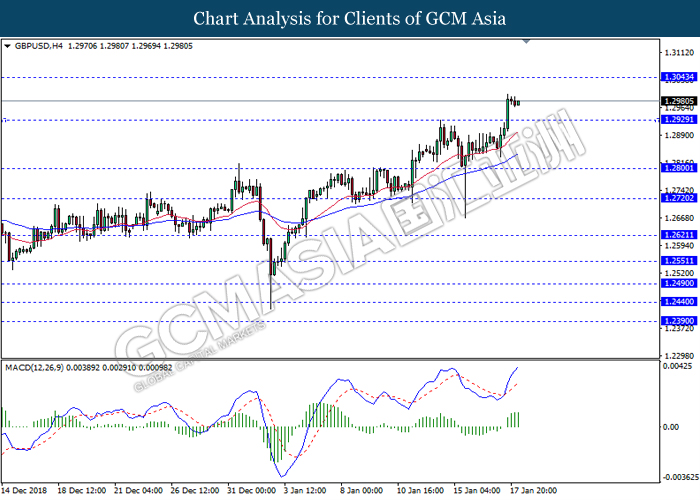

GBPUSD, H4: GBPUSD was traded higher following prior breakout above the previous resistance level 1.2930. MACD which illustrate bullish momentum with the formation of golden cross suggest the pair to extend its gains towards the resistance level 1.3045

Resistance level: 1.3045, 1.3165

Support level: 1.2930, 1.2800

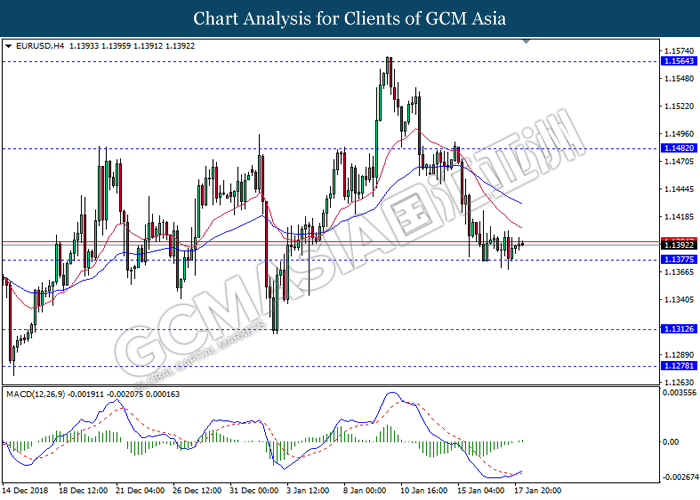

EURUSD, H4: EURUSD was traded higher following prior rebound from the support level 1.1375. MACD which illustrate bullish bias signal with the formation of golden cross suggest the pair to extend its rebound towards the support level 1.1375.

Resistance level: 1.1480, 1.1565

Support level: 1.1375, 1.1310

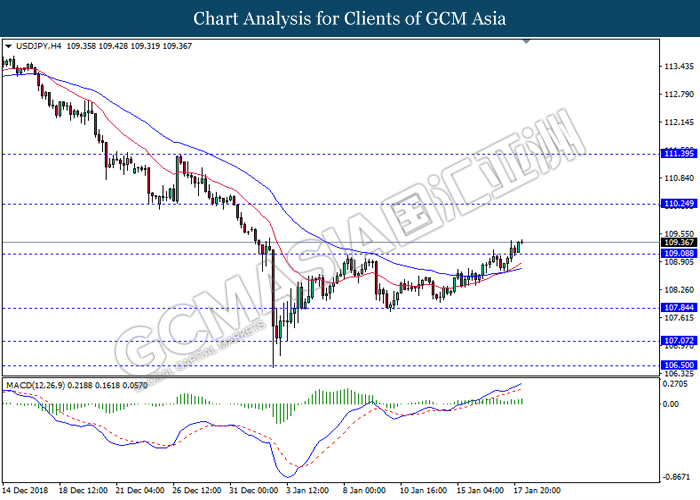

USDJPY, H4: USDJPY was traded higher following recent breakout above the previous resistance level 109.10. MACD which illustrate bullish bias suggest the pair to extend its gains towards the resistance level 110.25

Resistance level: 110.25, 111.40

Support level: 109.10, 107.85

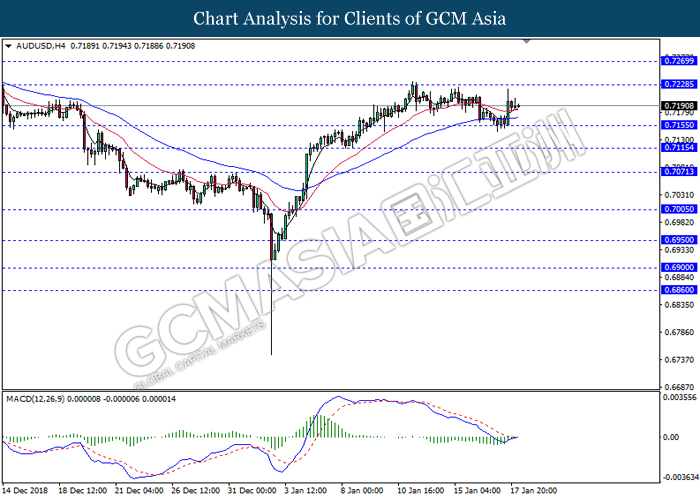

AUDUSD, H4: AUDUSD was traded higher following prior rebound from the support level 0.7155. MACD which illustrate bullish momentum signal with the starting formation of golden cross suggest the pair to extend its rebound towards the resistance level 0.7230

Resistance level: 0.7230, 0.7270

Support level: 0.7155, 0.7115

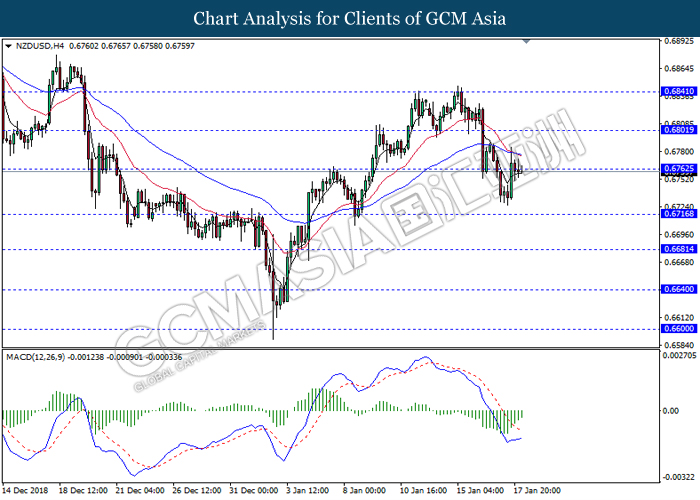

NZDUSD, H4: NZDUSD was traded higher while currently retest the resistance level 0.6760. MACD which illustrate bullish momentum suggest the pair to extend its momentum after it breaks above the resistance level.

Resistance level: 0.6760, 0.6800

Support level: 0.6715, 0.6680

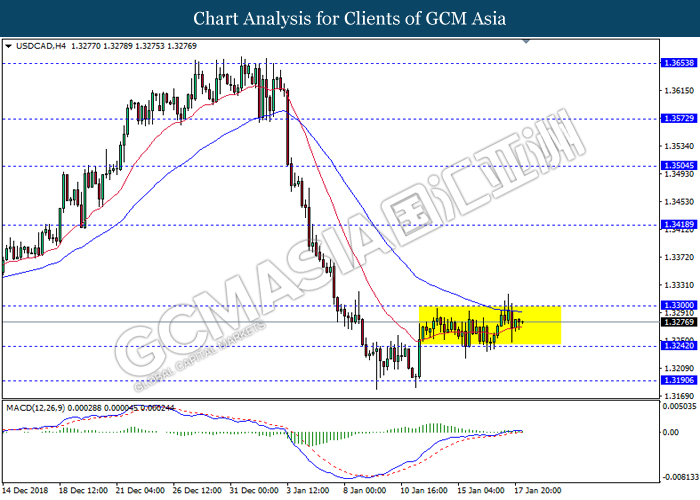

USDCAD, H4: USDCAD remains traded in a sideway channel following recent retracement from the resistance level 1.3300. Due to lack of signal from MACD, it is suggested to wait until further signal appears such as breakout above or below the nearest resistance or support level before entering the market.

Resistance level: 1.3300, 1.3420

Support level: 1.3190, 1.3060

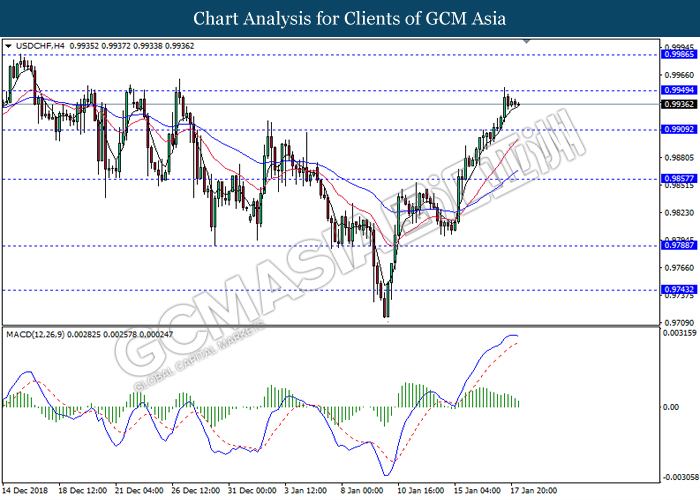

USDCHF, H4: USDCHF was traded lwoer following prior retracement from the resistance level 0.9950. MACD which illustrate bearish bias signal suggest the pair to extend it retracement towards the support level 0.9910.

Resistance level: 0.9950, 0.9985

Support level: 0.9910, 0.9855

CrudeOIL, H4: Crude oil price was traded higher following prior rebound from the support level 50.30. MACD which display bullish momentum suggest the commodity to extend its gains towards the resistance level 53.00

Resistance level: 53.00, 55.25

Support level: 50.30, 48.30

GOLD_, H4: Gold price remain traded in a sideway channel. Due to lack of clear signal from MACD, it is suggested to wait until further signal appears such as breakout above resistance level 1298.50 or support level 1286.90 before entering the market.

Resistance level: 1296.85, 1309.00

Support level: 1287.00, 1278.90