18 February 2019 Morning Session Analysis

Dollar falls from high, risky assets gains.

Greenback measuring against a basket of six major currency pairs was falling by 0.06% to 96.60 amid investors’ optimism towards the trade war negotiations held in Beijing last week. Although the White House reported that much progress are still needed for changes in the Chinese trade behavior, investors hope remained high that both economy powerhouses will reach a trade deal that would benefit both countries and put an end to the trade war. The risk aversion led investors to sell safe-haven dollar and enter into riskier markets such as pound and kiwi. Focus will be placed on next week’s trade talks in Washington while market participants hope for an agreement to end the trade war before the 1st March deadline for further tariffs. In other news, pair of GBP/USD gained 0.15% to 1.2905, supported by higher than expected Retail Sales data last Friday and the sell-off for dollar. Amid Brexit political turmoil, UK was still able to maintain a high consumer spending and healthy inflation level. Prime Minister Theresa May will struggle to persuade the EU to agree with changes over the Irish backstop plan this week as the deadline marches closer.

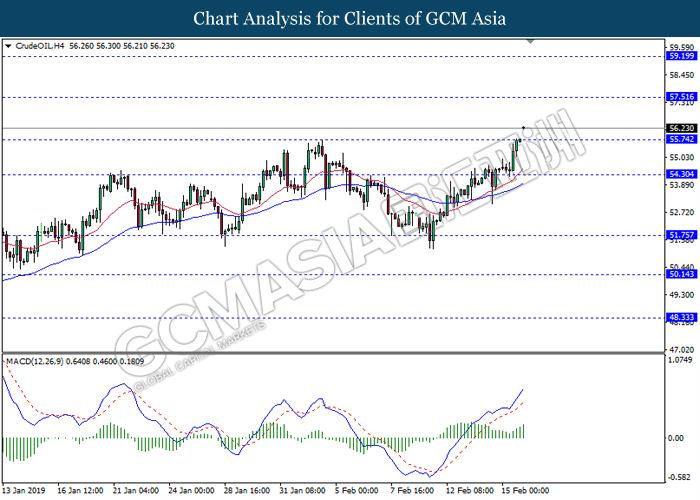

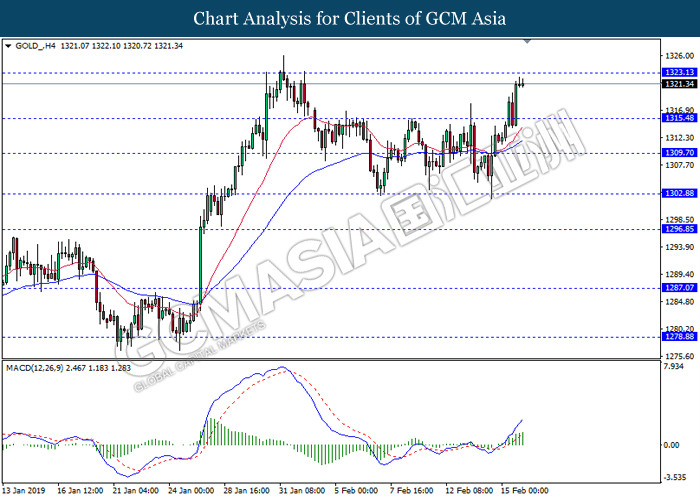

In the commodities market, crude oil price was traded higher by 0.39% to $56.35 per barrel due to changes in sentiment for the oil market. OPEC’s latest monthly oil market report indicated a fall in total production last month by 800K bpd to a low of 30.8 million bpd. As OPEC’s production cut effect starts to take place, the oil market was further supported by US sanctions on Venezuelan oil. Likewise, gold price increased by 0.14% to $1323.00 per troy ounce amid weakened dollar.

Today’s Holiday Market Close

Time Market Event

All Day CAD Family Day

All Day USD Washington’s Birthday

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

N/A

Technical Analysis

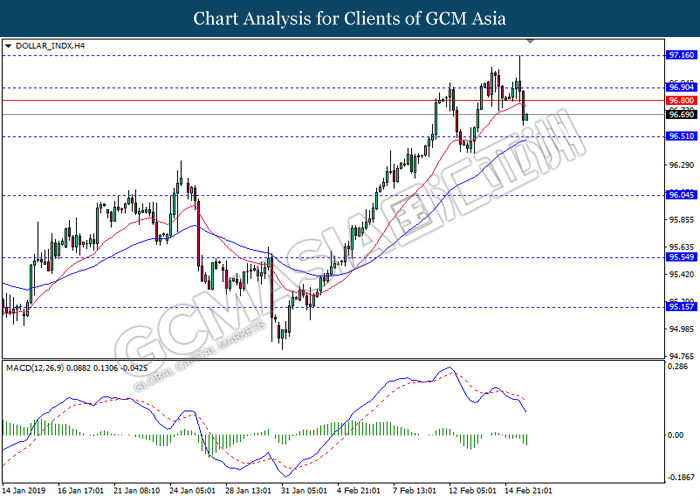

DOLLAR_INDX, H4: Dollar index was traded lower following prior breakout below the previous support level 96.90. MACD which iluustrate bearish momentum with the formation of death cross suggest the dollar to extend its losses towards the support level 96.50.

Resistance level: 96.90, 97.15

Support level: 96.50, 96.05

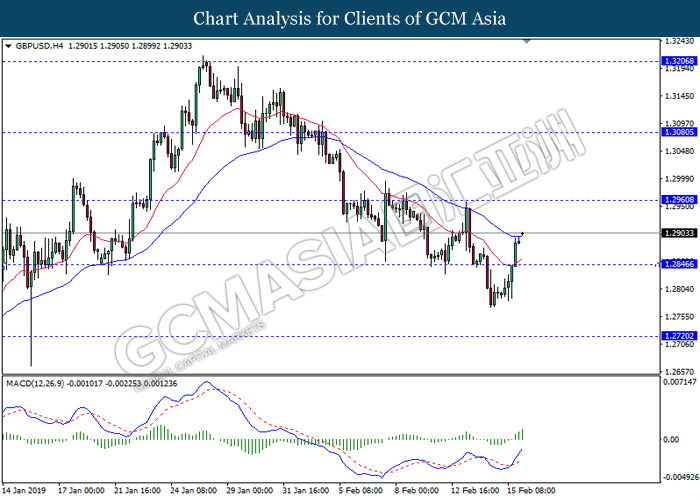

GBPUSD, H4: GBPUSD was traded higher following prior breakout above the previous resistance level 1.2845. MACD which illustrate bullish bias with the formation of golden cross suggest the pair to extend its gains towards the resistance level 1.2960.

Resistance level: 1.2960, 1.3080

Support level: 1.2845, 1.2720

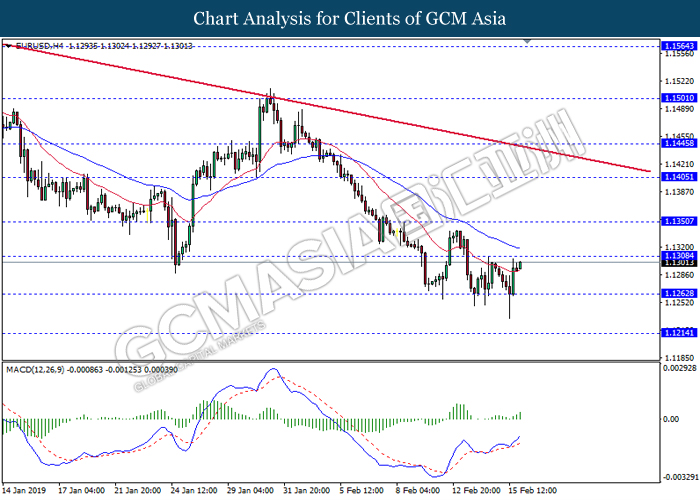

EURUSD, H4: EURUSD was traded higher while currently testing near the resistance level 1.1310. MACD which illustrate bullish momentum with golden cross formation suggest the pair to extend its rebound after it breaks above the resistance level 1.1310.

Resistance level: 1.3010, 1.1350

Support level: 1.1260, 1.1215

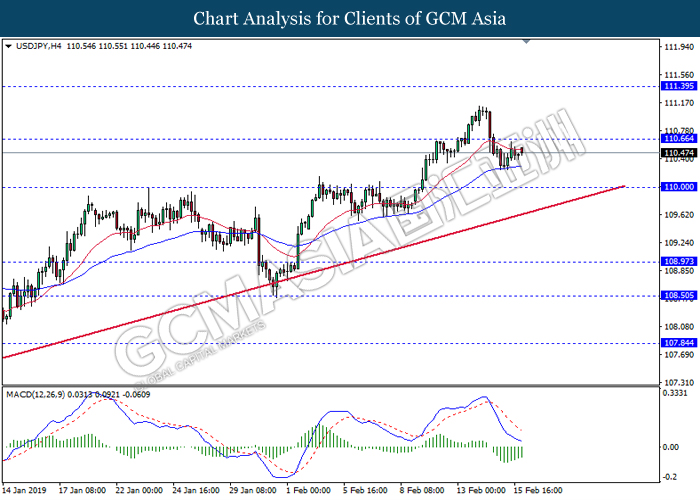

USDJPY, H4: USDJPY was traded flat after it breaks below the previous support level 110.65 recently. However, MACD which illustrate diminishing bearish momentum suggest the pair to be traded higher after it breaks back above the previous support level.

Resistance level: 110.65, 111.40

Support level: 110.00, 108.95

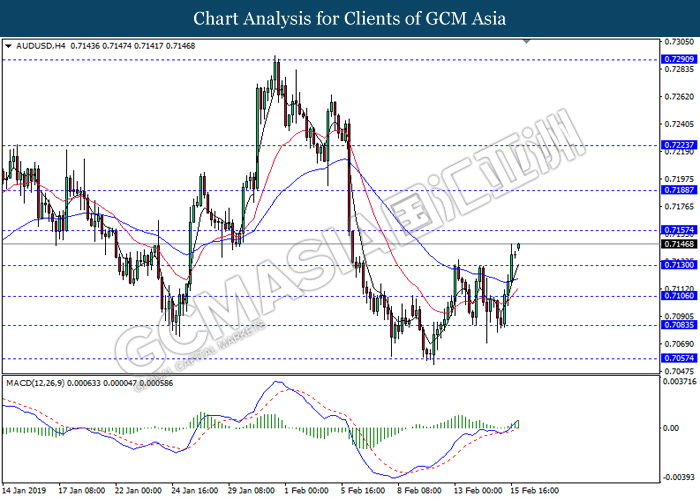

AUDUSD, H4: AUDUSD was traded higher following prior breakout above the previous resistance level 0.7155. MACD which illustrate bearish bias with the formation of golden cross suggest the pair to extend its gains towards the resistance level 0.7155.

Resistance level: 0.7155, 0.7190

Support level: 0.7130, 0.7105

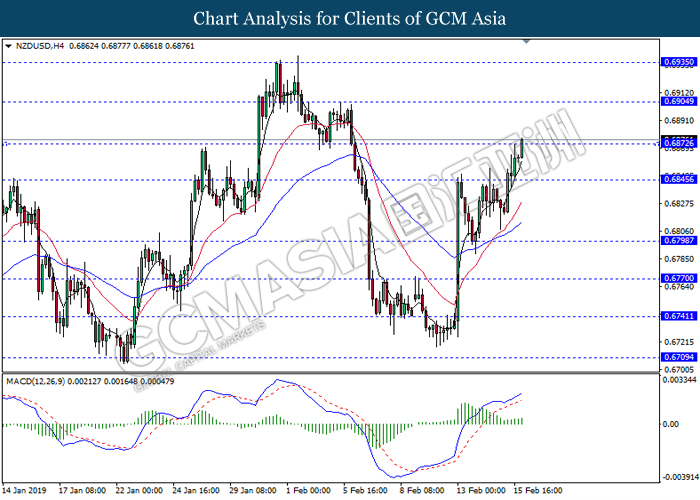

NZDUSD, H4: NZDUSD was traded higher following prior breakout above the previous resistance level 0.6905. MACD which illustrate bearish momentum signal suggest the pair to extend its gains towards the resistance level 0.6905.

Resistance level: 0.6905, 0.6935

Support level: 0.6870, 0.6845

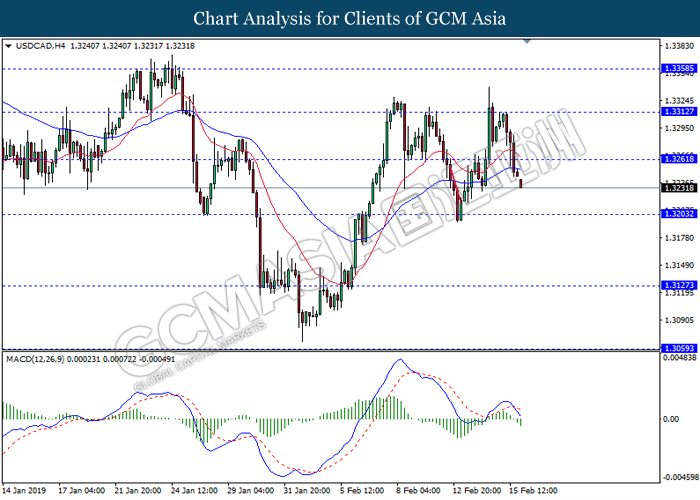

USDCAD, H4: USDCAD was traded lower following recent breakout below the previous support level 1.3260. MACD which illustrate bearish momentum with the formation of death cross suggest the pair to extend its losses towards the support level 1.3205.

Resistance level: 1.3260, 1.3310

Support level: 1.3205, 1.3125

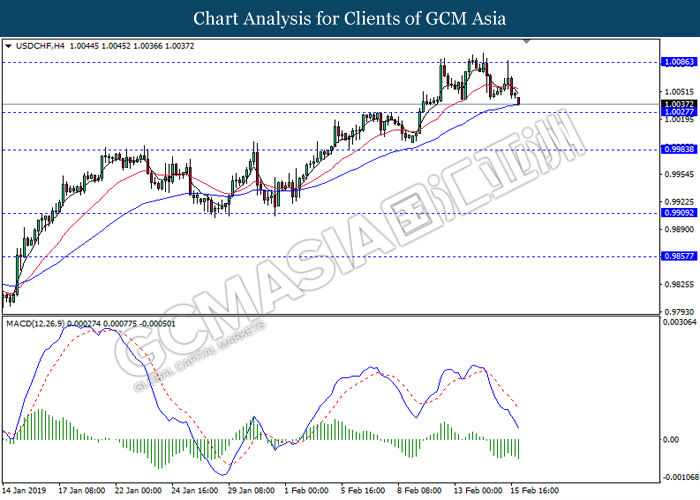

USDCHF, H4: USDCHF was traded lower following prior retracement from the resistance level 1.0085. MACD which illustrate persistent bearish momentum suggest the pair to extend its losses towards the support level 1.0025.

Resistance level: 1.0085, 1.0115

Support level: 1.0025, 0.9985

CrudeOIL, H4: Crude oil price was traded higher following prior breakout above the previous resistance level 55.75. MACD which illustrate bullish momentum suggest the commodity to extend its gains towards the resistance level 57.50.

Resistance level: 57.50, 59.20

Support level: 55.75, 54.30

GOLD_, H4: Gold price was traded higher while currently testing near the resistance level 1323.10. MACD which illustrate bullish momentum suggest the commodity to extend its gains after it breaks above the resistance level.

Resistance level: 1323.10, 1329.10

Support level: 1315.50, 1309.70