18 March 2022 Morning Session Analysis

Euro surged following the released of inflation data.

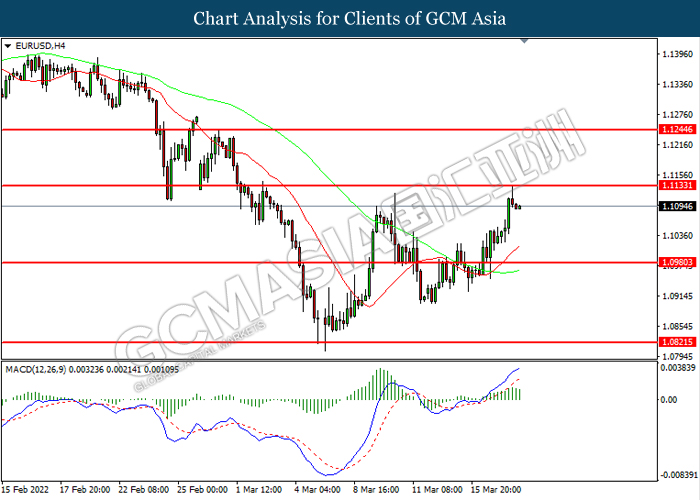

The Euro surged on yesterday over the backdrop of upbeat inflation data, which increasing the odds for the European Central Bank to be tightening the monetary policy in order to combat such high inflation risk. According to Eurostat, Eurozone Consumer Price Index (CPI) YoY notched up from the previous reading of 5.8% to 5.9% on year in February, exceeding the market forecast. The acceleration in the Eurozone’s annual inflation rate had adds further evidence to a build-up in price pressures globally that is lasting longer than initially expected. High inflation risk would likely to prompt the European Central Bank to implement contractionary monetary policy as well as increase their interest rate, which diminishing the money circulation in the Europe market while spurring bullish momentum on Euro. As of writing, EUR/USD surged 0.05% to 1.1095.

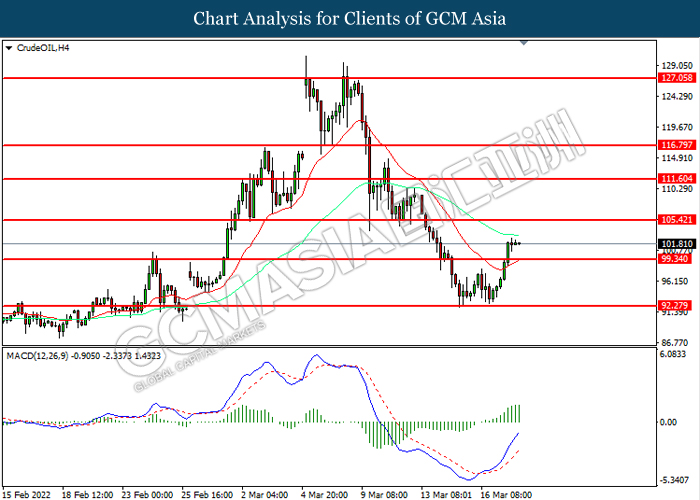

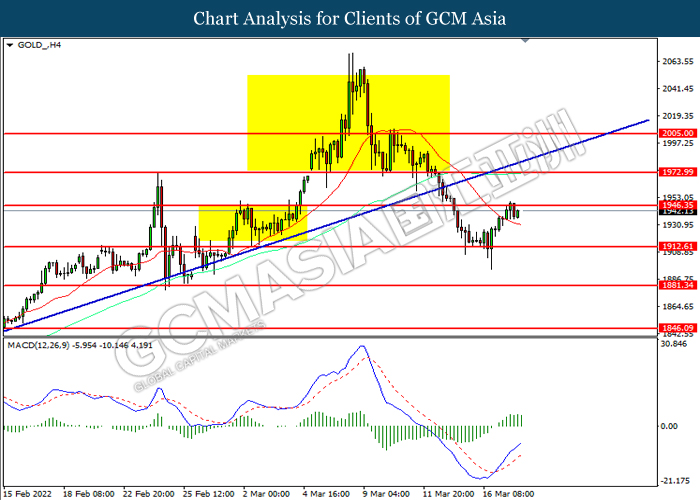

In the commodities market, the crude oil price rebounded 0.15% to $103.85 per barrel as of writing amid the rising tension between Russia-Ukraine had spurred fears upon the oil supply disruption. According to Azjazeera, Ukraine accused Russian forces of bombing a theatre sheltering civilians in the besieged southern city of Mariupol. On the other hand, the gold price appreciated by 0.04% to $1941.95 per troy ounces as of writing amid risk-off sentiment in the global financial market.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

11:00 JPY BoJ Monetary Policy Statement

14:30 JPY BoJ Press Conference

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 21:30 | CAD – Core Retail Sales (MoM) (Jan) | -2.50% | -2.00% | – |

| 23:00 | USD – Existing Home Sales (Feb) | 6.50M | 6.16M | – |

Technical Analysis

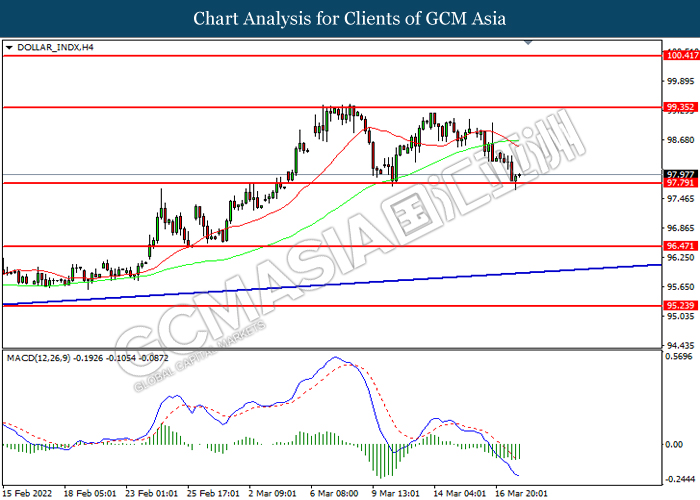

DOLLAR_INDX, H4: Dollar index was traded lower following prior retracement from the resistance level. MACD which illustrated increasing bearish momentum suggest the index to extend its losses.

Resistance level: 99.35, 100.40

Support level: 97.80, 96.45

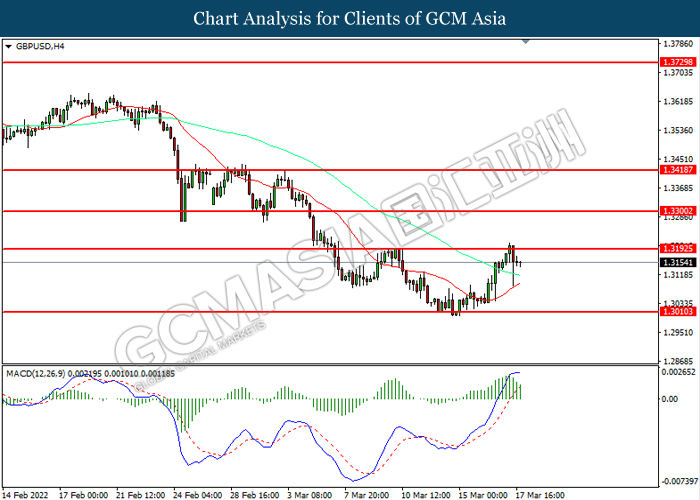

GBPUSD, Daily: GBPUSD was traded higher while currently testing resistance level. MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.3190, 1.3420

Support level: 1.2915, 1.2755

EURUSD, H4: EURUSD was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 1.1135, 1.1245

Support level: 1.0980, 1.0820

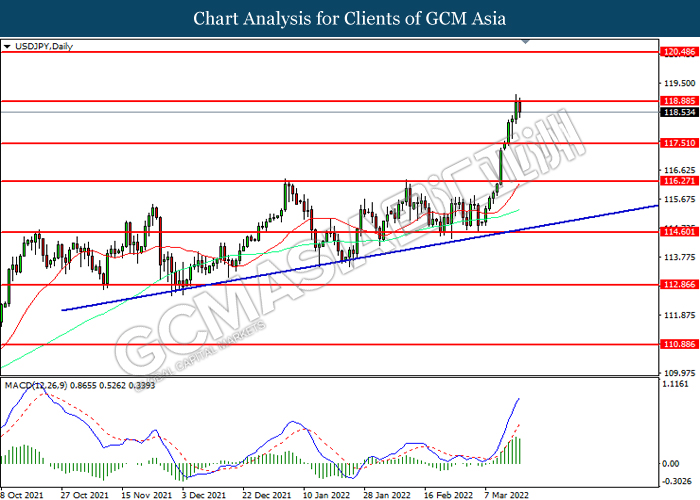

USDJPY, Daily: USDJPY was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains after breakout.

Resistance level: 118.90, 120.50

Support level: 117.50, 116.25

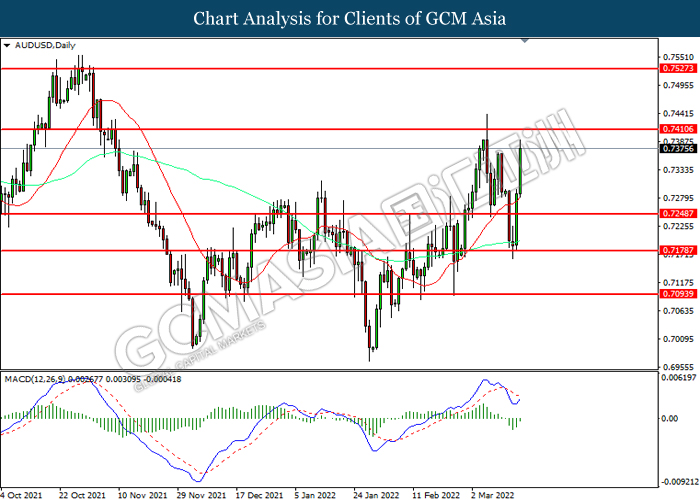

AUDUSD, H4: AUDUSD was traded higher following prior breakout above previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 0.7410, 0.7525

Support level: 0.7250, 0.7180

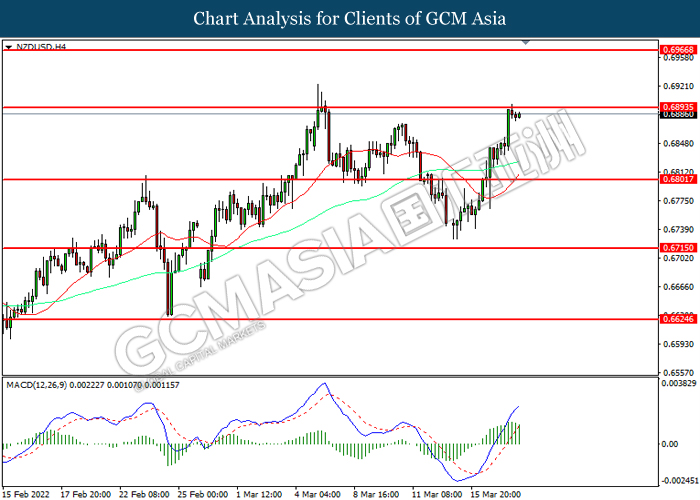

NZDUSD, H4: NZDUSD was traded higher while currently testing the resistance level at 0.6895. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains after it successfully breakout.

Resistance level: 0.6895, 0.6965

Support level: 0.6800, 0.6715

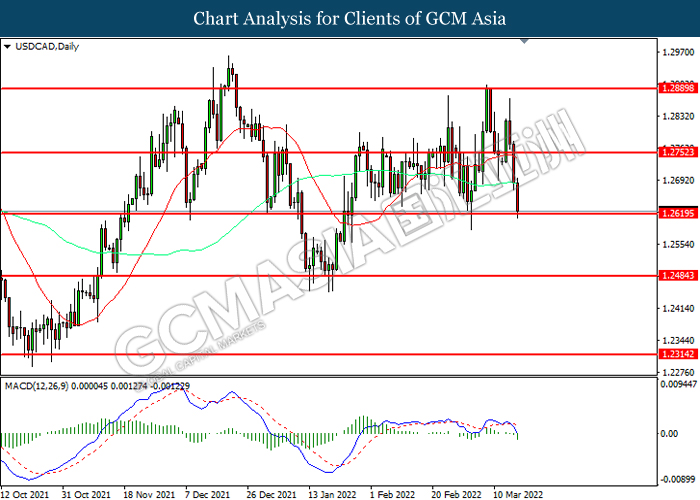

USDCAD, H4: USDCAD was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 1.2755, 1.2890

Support level: 1.2620, 1.2485

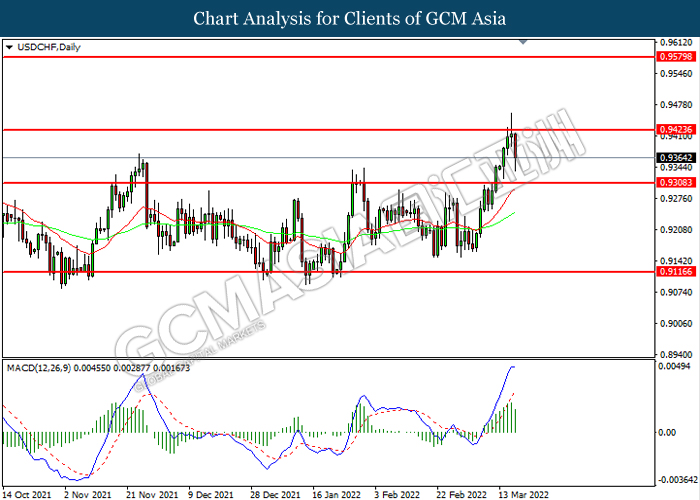

USDCHF, Daily: USDCHF was traded lower following prior retracement from the resistance level. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses.

Resistance level: 0.9425, 0.9580

Support level: 0.9310, 0.9115

CrudeOIL, H4: Crude oil price was traded higher following prior breakout above the previous resistance level at 99.35. MACD which illustrated increasing bullish momentum suggest the commodity to extend its gains toward resistance level at 105.40.

Resistance level: 105.40, 111.60

Support level: 99.35, 92.30

GOLD_, H4: Gold price was traded higher following prior rebound from the support level at 1912.60. MACD which illustrated increasing bullish momentum suggest the commodity to extend its gains.

Resistance level: 1946.35, 1973.00

Support level: 1912.60, 1881.35