18 April 2022 Morning Session Analysis

US Dollar surged as rate hike expectation.

The Dollar Index which traded against a basket of six major currencies hovered at recent peak as more hawkish statement form Federal Reserve officials continue to enforce the rate hike expectation. According to Reuters, New York Fed President John Williams claimed on Thursday that a 50-basis point of rate hike in next month was a reasonable option, signaling a faster tightening monetary policy in future. Contractionary monetary policy would likely to diminish the money circulation in the currencies market, spurring bullish momentum on the US Dollar. Currently, investors will be closely monitoring remarks on Thursday by Federal Reserve. The Fed Chair Jerome Powell would speak at the spring meeting of the International Monetary Fund (IMF) on Thursday to discuss about the monetary policy decision. As of writing, the Dollar Index appreciated by 0.16% to 100.50.

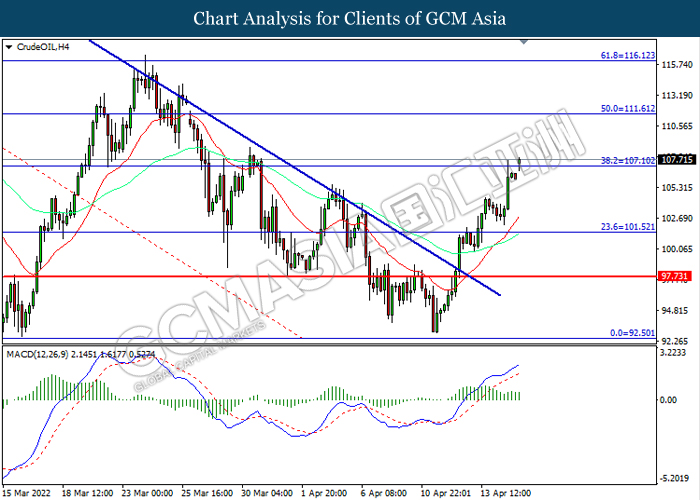

In the commodities market, the crude oil price appreciated by 1.33% to $107.43 per barrel as of writing. The oil price traded higher following Shanghai reported a record number of symptomatic Covid-19 cases on Saturday and other areas across China had tightened controls in order to combat the highly transmissible Omicron variant. On the other hand, the gold price appreciated by 0.32% to $1979.78 per troy ounces as of writing amid rising tensions between Russian-Ukraine continue to insinuate risk-off sentiment in the global financial market.

Today’s Holiday Market Close

Time Market Event

All Day GBP United Kingdom – Easter

All Day EUR Germany – Easter

All Day CHF Switzerland – Easter

All Day EUR Italy – Easter

All Day EUR France – Easter

All Day EUR Spain – Easter

All Day AUD Australia – Easter

All Day HKD Hong Kong – Easter

All Day NZD New Zealand – Easter

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

N/A

Technical Analysis

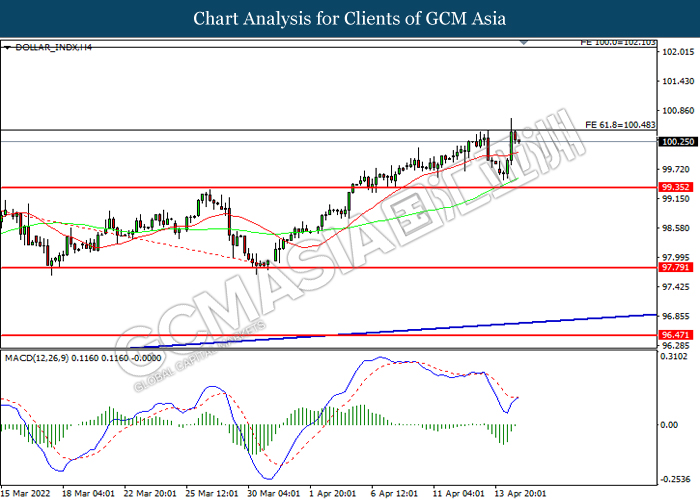

DOLLAR_INDX, H4: Dollar index was traded higher while currently testing the resistance level. MACD which illustrated diminishing bearish momentum suggest the index to extend its gains after breakout.

Resistance level: 100.50, 102.10

Support level: 99.35, 97.80

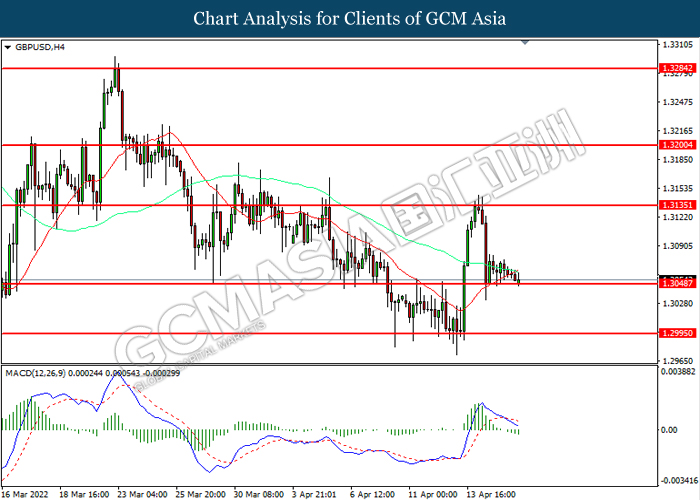

GBPUSD, H4: GBPUSD was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after breakout.

Resistance level: 1.3135, 1.3200

Support level: 1.3050, 1.2995

EURUSD, H4: EURUSD was traded lower while currently testing the support level. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.0910, 1.0975

Support level: 1.0805, 1.0690

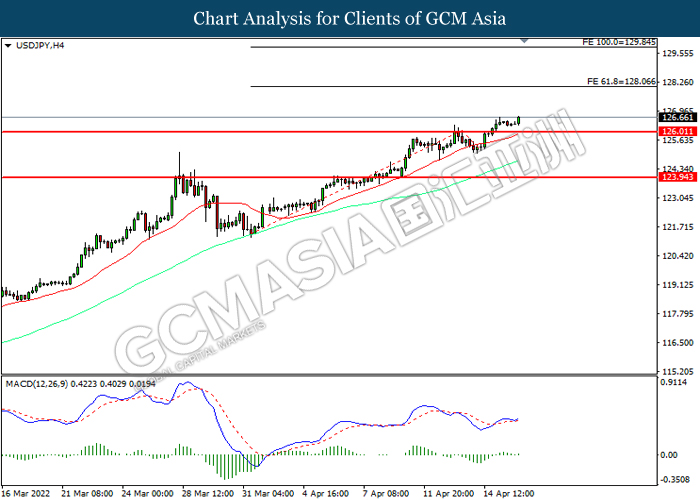

USDJPY, H4: USDJPY was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend tis gains toward resistance level at 128.05.

Resistance level: 128.05, 129.85

Support level: 126.00, 123.95

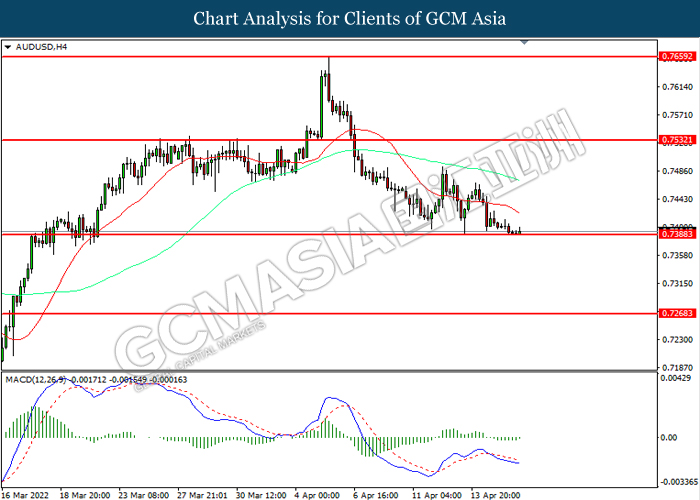

AUDUSD, H4: AUDUSD was traded lower while currently testing the support level. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.7530, 0.7660

Support level: 0.7390, 0.7270

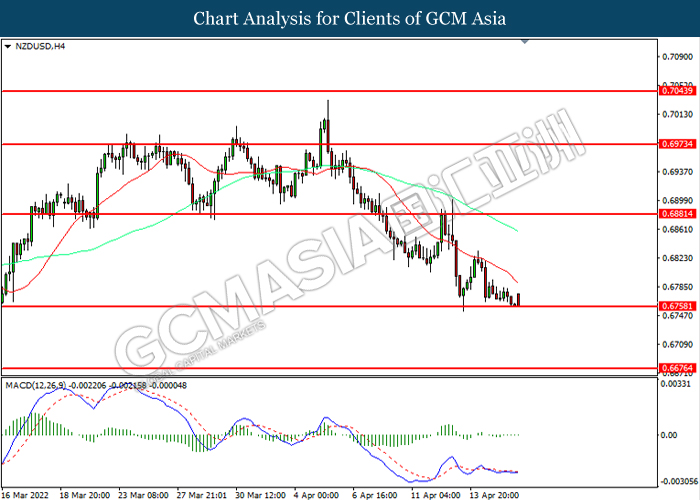

NZDUSD, H4: NZDUSD was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after breakout.

Resistance level: 0.6880, 0.6975

Support level: 0.6760, 0.6675

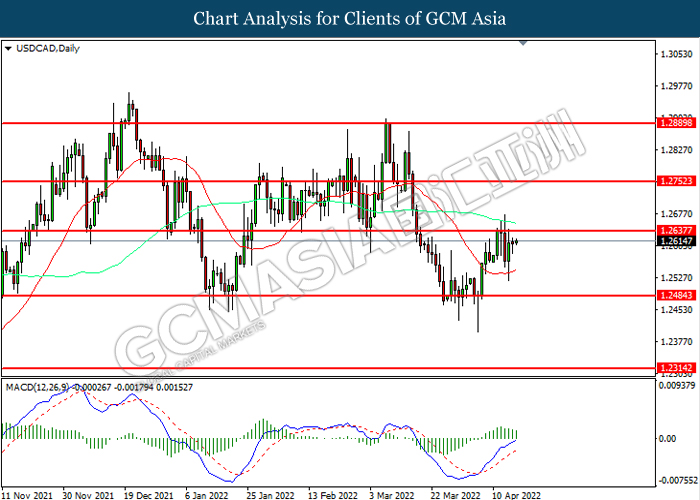

USDCAD, Daily: USDCAD was traded higher while currently testing the resistance level. However, MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.2635, 1.2750

Support level: 1.2485, 1.2315

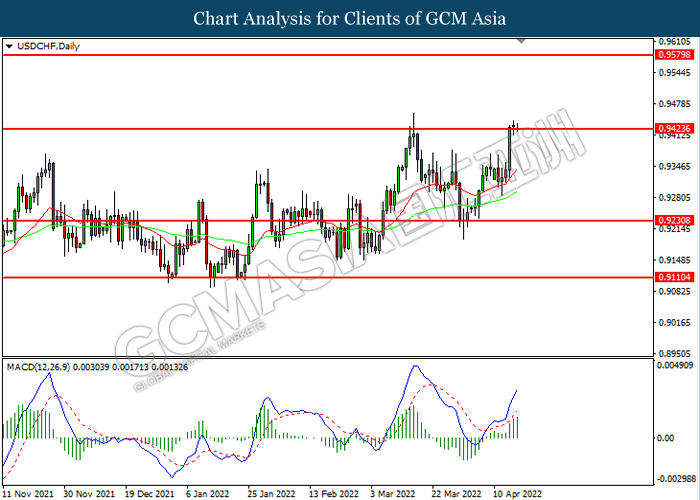

USDCHF, Daily: USDCHF was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains after breakout.

Resistance level: 0.9425, 0.9580

Support level: 0.9230, 0.9110

CrudeOIL, H4: Crude oil price was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated diminishing bullish momentum suggest the commodity to be traded lower as technical correction.

Resistance level: 111.60, 116.10

Support level: 107.10, 101.50

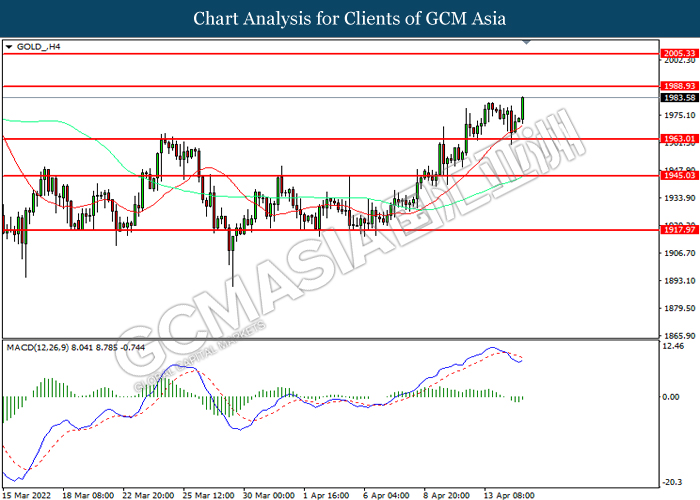

GOLD_, H4: Gold price was traded higher while currently testing the resistance level. MACD which illustrated diminishing bearish momentum suggest the commodity to extend its gains after breakout the resistance level.

Resistance level: 1988.95, 2005.35

Support level: 1963.00, 1945.05