18 May 2022 Afternoon Session Analysis

Pound Sterling surged amid optimism upon the economic momentum.

Pound Sterling surged over the backdrop of the string of upbeat economic data from UK region yesterday. According to Office for National Statistics, UK Claimant Count Change came in at only -56.9K, better than the market forecast at -42.5K. Meanwhile, UK Average Earning Index + Bonus notched up significantly from the previous reading of 5.6% to 7.0%, exceeding the market forecast at 5.4%. As both crucial economic data fared much better than market expectation, which spurring further bets by investors on further rate hike decision from Bank of England in future. On the other hand, the Euro extend its gains following the European Central Bank unleashed their hawkish tone toward the economic progression. According to Reuters, Dutch Central Bank Chief Klass Knot claimed that the ECB should increase its benchmark interest rate by at least 25 basis point in July but should not yet rule out a bigger increase. As of writing, EUR/USD appreciated by 0.02% to 1.0540 while GBP/USD surged 0.03% to 1.2489.

In the commodities market, the crude oil price eased by 0.47% to $112.05 per barrel as of writing. The oil market retreated from its higher level following United States claimed that they could ease some restrictions on Venezuela’s government, raising upbeat hopes toward the additional oil supplies in future. On the other hand, the gold price slumped 0.11% to $1813.05 per troy ounces as of writing amid the rate hike expectation from the global central bank continue to drag down the appeal for the inflation-hedging commodity such as gold.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 14:00 | GBP – CPI (YoY) (Apr) | 7.0% | 9.1% | – |

| 17:00 | EUR – CPI (YoY) (Apr) | 7.5% | 7.5% | – |

| 20:30 | USD – Building Permits (Apr) | 1.870M | 1.810M | – |

| 20:30 | CAD – Core CPI (MoM) (Apr) | 1.4% | 0.5% | – |

| 22:30 | USD – Crude Oil Inventories | 8.487M | -0.457M | – |

Technical Analysis

DOLLAR_INDX, H4: Dollar index was traded lower following prior breakout below the previous support level. However, MACD which illustrated diminishing bearish momentum suggest the index to be traded higher as technical correction.

Resistance level: 103.90, 104.95

Support level: 102.45, 100.85

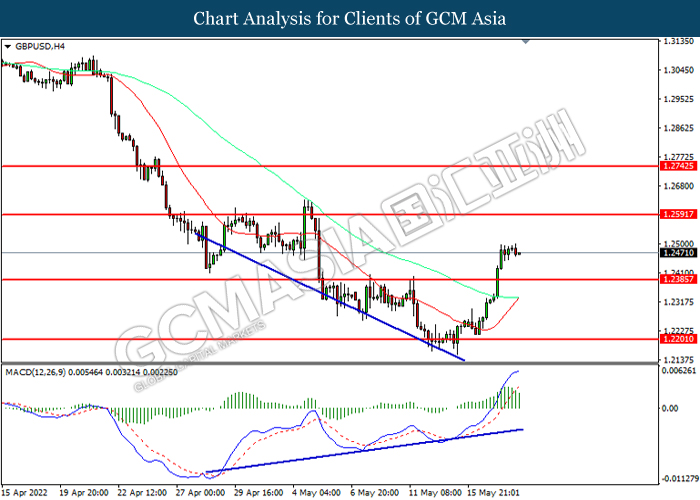

GBPUSD, H4: GBPUSD was traded higher following prior breakout above the previous resistance level. MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.2590, 1.2745

Support level: 1.2385, 1.2200

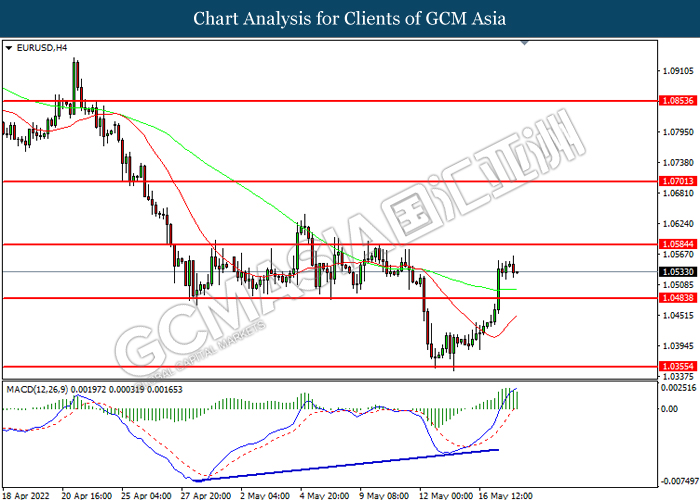

EURUSD, H4: EURUSD was traded higher while currently near the resistance level. However, MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.0585, 1.0700

Support level: 1.0485, 1.0355

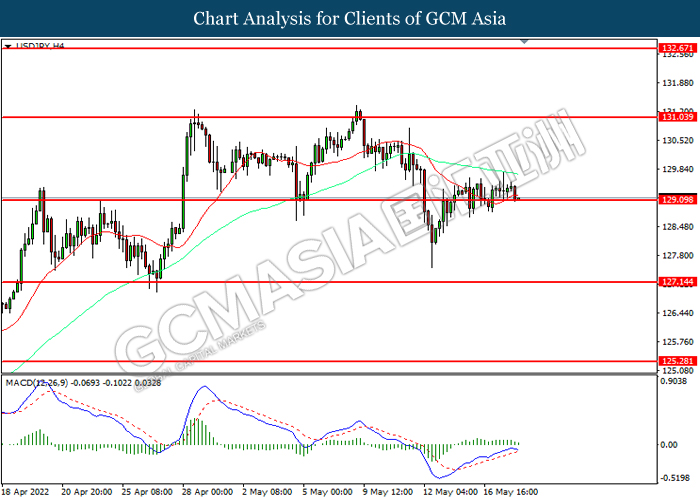

USDJPY, H4: USDJPY was traded within a range while currently testing the support level. However, MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after breakout.

Resistance level: 131.05, 132.65

Support level: 129.10, 127.15

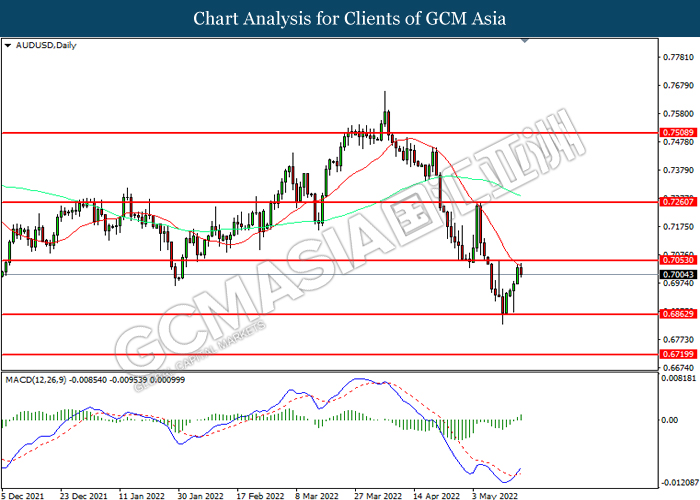

AUDUSD, Daily: AUDUSD was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its after breakout.

Resistance level: 0.7055, 0.7260

Support level: 0.6865, 0.6720

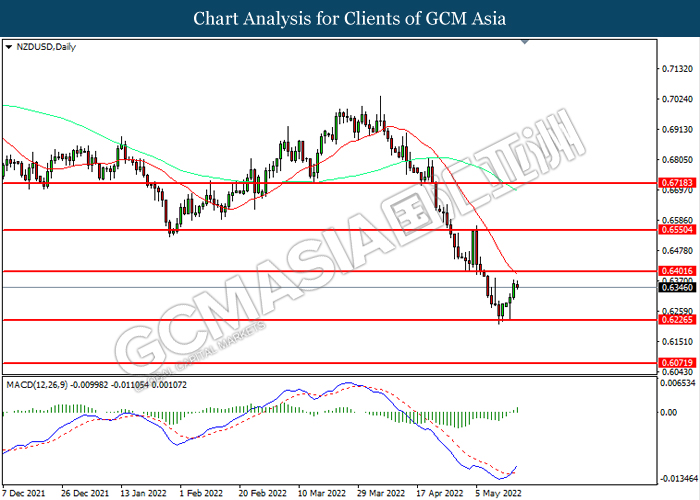

NZDUSD, Daily: NZDUSD was traded higher following prior rebound from the support level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 0.6400, 0.6550

Support level: 0.6225, 0.6070

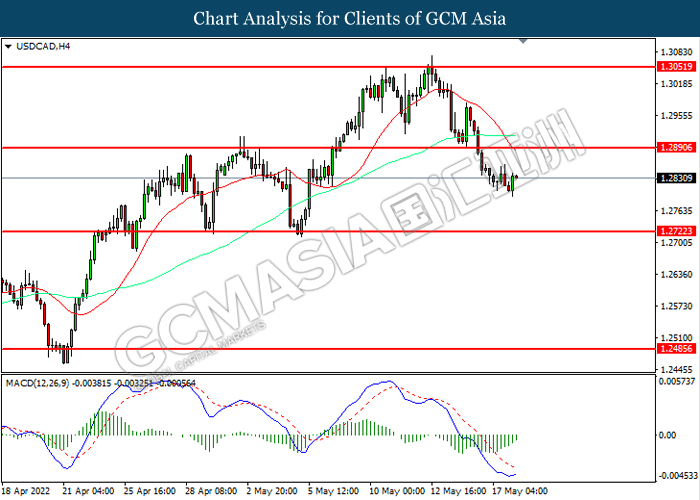

USDCAD, H4: USDCAD was traded lower following prior breakout below the previous support level. MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.2890, 1.3050

Support level: 1.2720, 1.2485

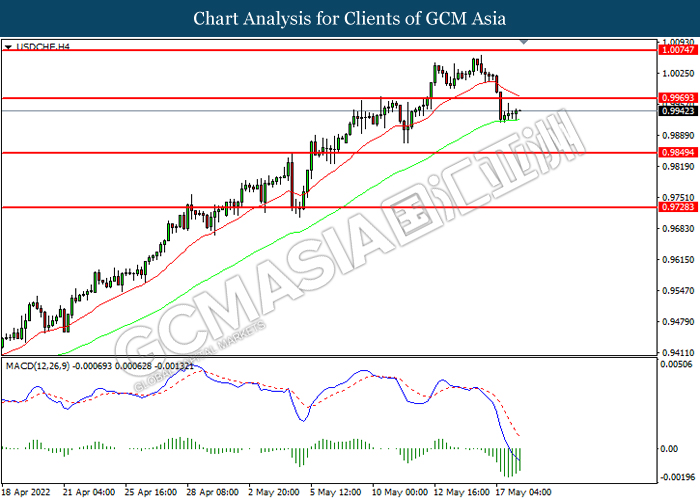

USDCHF, H4: USDCHF was traded lower following breakout below the previous support level. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.9970, 1.0075

Support level: 0.9850, 0.9730

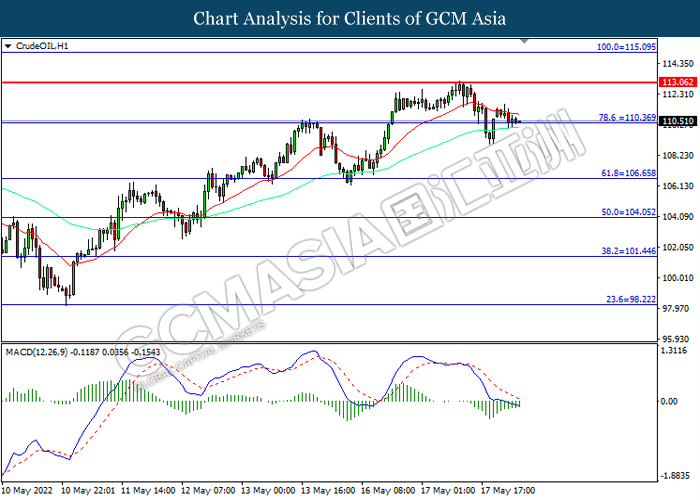

CrudeOIL, H1: Crude oil price was traded lower while currently testing the support level. However, MACD which illustrated diminishing bearish momentum suggest the commodity to be traded higher as technical correction.

Resistance level: 113.05, 115.10

Support level: 110.35, 106.65

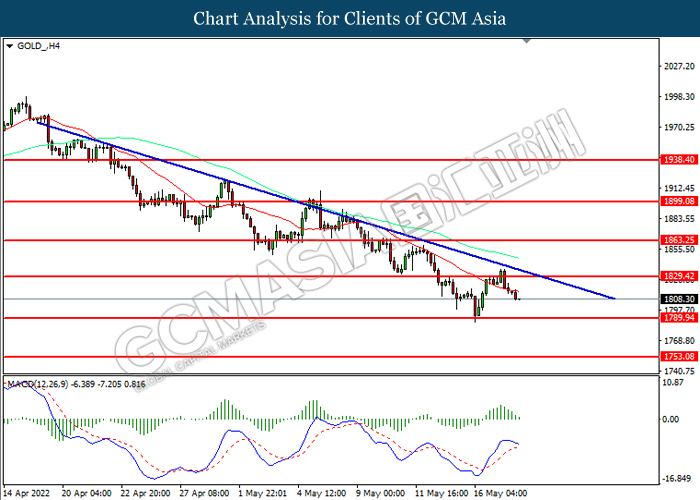

GOLD_, H4: Gold price was traded lower following prior retracement from the resistance level. MACD which illustrated diminishing bullish momentum suggest the commodity to extend its losses toward support level.

Resistance level: 1829.40, 1863.25

Support level: 1789.95, 1753.10