18 May 2022 Morning Session Analysis

China plan to ease lockdown, US Dollar slumped.

The Dollar Index which traded against a basket of six major currencies slumped since yesterday over the rising of risk-sentiment toward stock market. According to Reuters, Shanghai set out plans on Monday for the end of a painful COVID-19 lockdown that has lasted more than six weeks, heavily bruising China’s economy, and for the return of more normal life from June 1. The loosing of lockdown in China would likely to boost up the economic activities in China region, dialing up the market optimism toward China economic progression and prompting investors to shift their capitals toward China shares. Nonetheless, the overall trend for Dollar Index remained bullish following hawkish speech from Federal Reserve. According to CNBC, Federal Reserve Chairman Jerome Powell reiterated on Tuesday that he will back interest rate increases until prices start falling back toward a healthy level to get inflation down. Investors would continue to scrutinize the latest updates with regards of rate hike decision from Fed in order to gauge the likelihood movement of Dollar Index. As of writing, the Dollar Index depreciated by 0.83% to 103.34.

In commodities market, crude oil price appreciated by 1.09% to $110.83 per barrel as of writing amid China plan to loose its lockdown on June 1, which led to the surging demand on oil. Besides, gold price depreciated by 0.30% to $1813.43 per troy ounce as of writing following the rising demand on risk-appetite assets.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 14:00 | GBP – CPI (YoY) (Apr) | 7.0% | 9.1% | – |

| 17:00 | EUR – CPI (YoY) (Apr) | 7.5% | 7.5% | – |

| 20:30 | USD – Building Permits (Apr) | 1.870M | 1.810M | – |

| 20:30 | CAD – Core CPI (MoM) (Apr) | 1.4% | 0.5% | – |

| 22:30 | USD – Crude Oil Inventories | 8.487M | -0.457M | – |

Technical Analysis

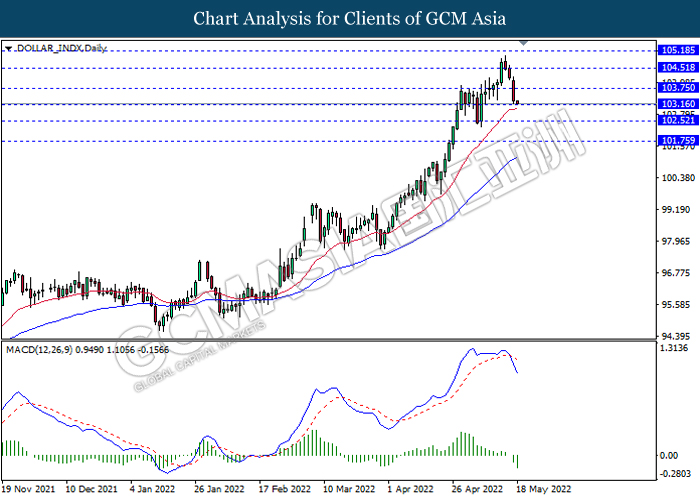

DOLLAR_INDX, Daily: Dollar index was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the index to extend its losses if successfully breakout the support level.

Resistance level: 103.75, 104.50

Support level: 103.15, 102.50

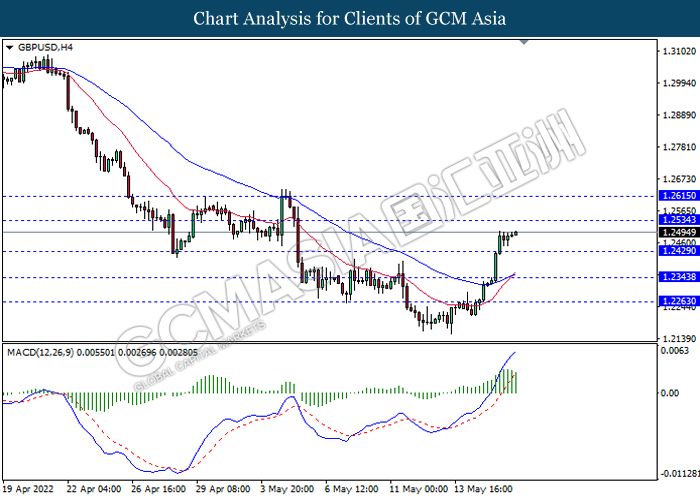

GBPUSD, H4: GBPUSD was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.2535, 1.2615

Support level: 1.2430, 1.2345

EURUSD, H4: EURUSD was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.0605, 1.0685

Support level: 1.0500, 1.0415

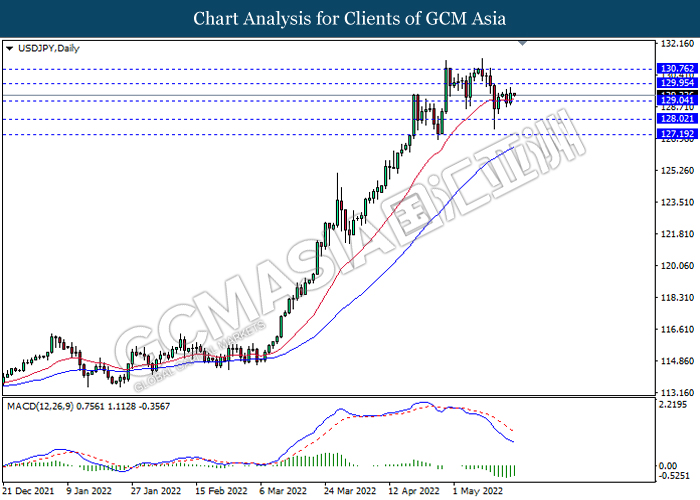

USDJPY, Daily: USDJPY was traded higher following prior rebound from the support level. MACD which illustrated decreasing bearish momentum suggest the pair to be extend its gains.

Resistance level: 129.95, 130.75

Support level: 129.05, 128.00

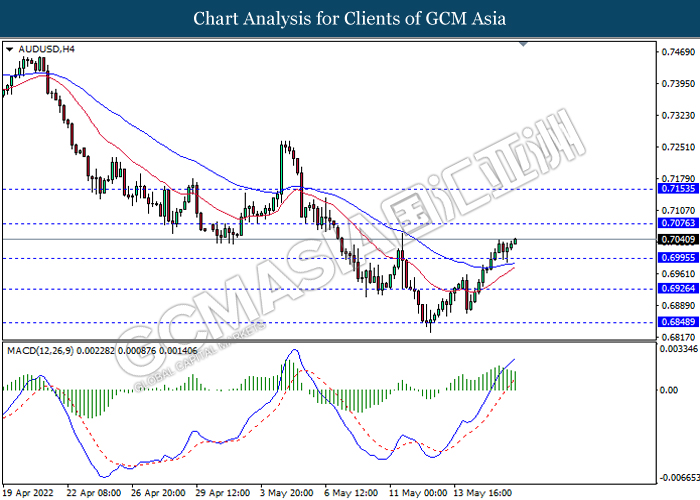

AUDUSD, H4: AUDUSD was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 0.7075, 0.7155

Support level: 0.6995, 0.6925

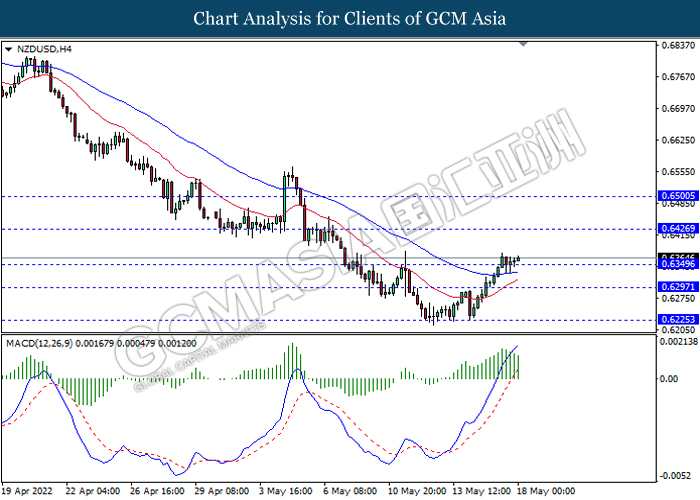

NZDUSD, H4: NZDUSD was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 0.6425, 0.6500

Support level: 0.6350, 0.6295

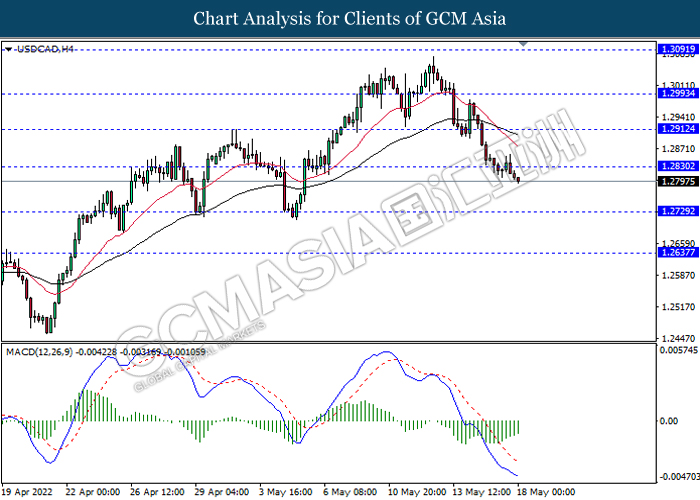

USDCAD, H4: USDCAD was traded lower following prior breakout below the previous support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.2830, 1.2910

Support level: 1.2730, 1.2635

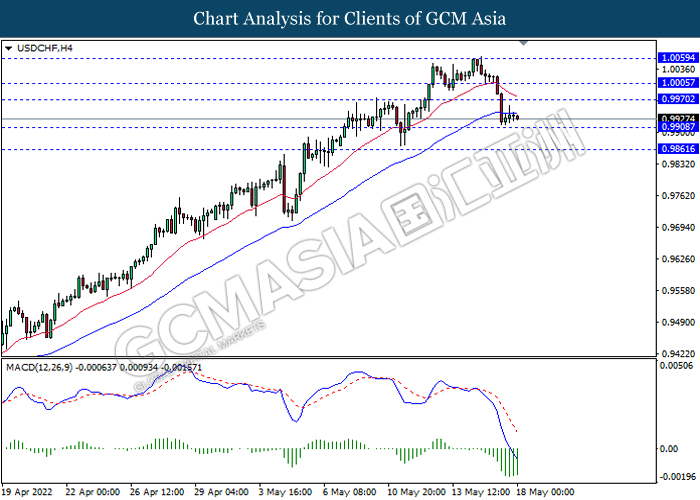

USDCHF, H4: USDCHF was traded lower while currently testing the support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.9970, 1.0005

Support level: 0.9910, 0.9860

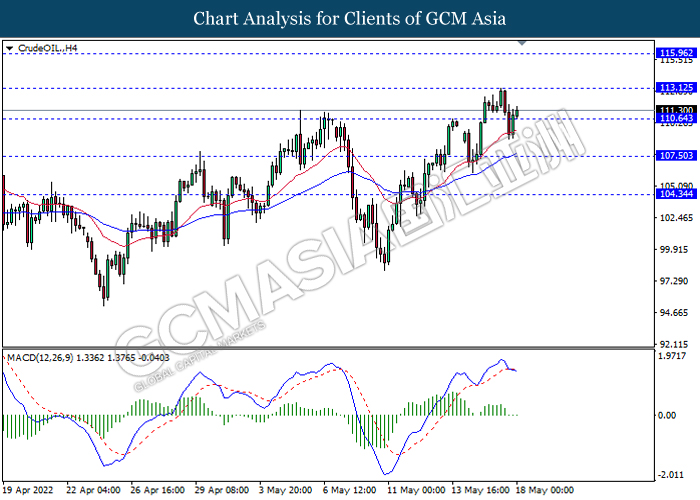

CrudeOIL, H4: Crude oil price was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated increasing bearish momentum suggest the commodity to be traded lower as technical correction.

Resistance level: 113.10, 115.95

Support level: 110.65, 107.50

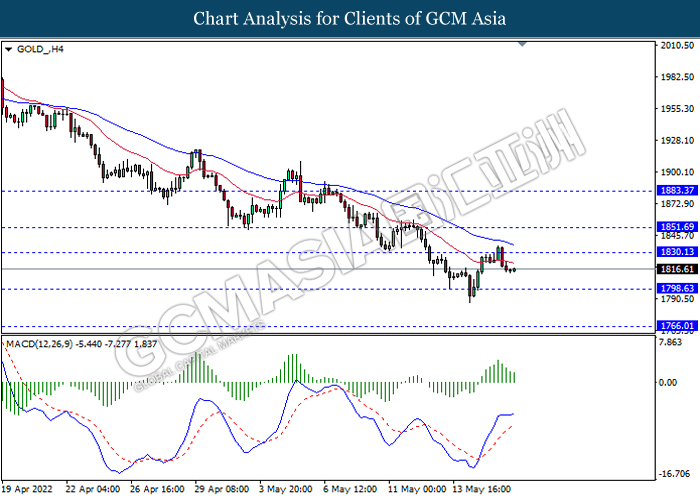

GOLD_, H4: Gold price was traded lower following prior retracement from the resistance level. However, MACD which illustrated increasing bullish momentum suggest the commodity to be traded higher as technical correction.

Resistance level: 1830.15, 1851.70

Support level: 1798.65, 1766.00