18 May 2023 Afternoon Session Analysis

The Aussie slipped on weakened labour conditions.

The Aussie dollar, which was traded against the greenback, extended its losses after the weak labor conditions in Australia. The labor data unexpectedly showed a contraction in April, while the unemployment data rose amid a cooling in economic activities. The number of employment changes was recorded at -4.3k data from the Australia Bureau of Statistics (ABS). This data surprised the market as the market expected the reading to fall to 25k from 61.1k in the previous month. The unemployment reading increased to 3.7% from 3.5% higher than prior readings. A fewer number of people worked on account of the Easter holidays, and it also indicates the Australian labor shortage is being met by people working longer hours, ABS said in the release. The data showed some weakening in the labor market following a post-Covid boon over the past year and it also reflects the high interest rate decision by the Reserve Bank of Australia. As a result, the weakened labor conditions suggested that RBA consider pausing its tightening moves. As of writing, the pair of AUD/USD, extended its losses by -0.24% to $0.6644.

In the commodities market, crude oil prices ticked down by -0.56% to $72.44 per barrel following a prior rebound after investors regain confidence in US debt ceiling talks. Besides, gold prices slipped by -0.14% to $81978.81 per troy ounce as the dollar index

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

17:00 EUR ECB President Lagarde Speaks

17:15 GBP BoE MPC Treasury Committee Hearings

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 20:30 | USD – Initial Jobless Claims | 264K | 254K | – |

| 20:30 | USD – Philadelphia Fed Manufacturing Index (May) | -31.3 | -19.0 | – |

| 22:00 | USD – Existing Home Sales (Apr) | 4.44M | 4.30M | – |

Technical Analysis

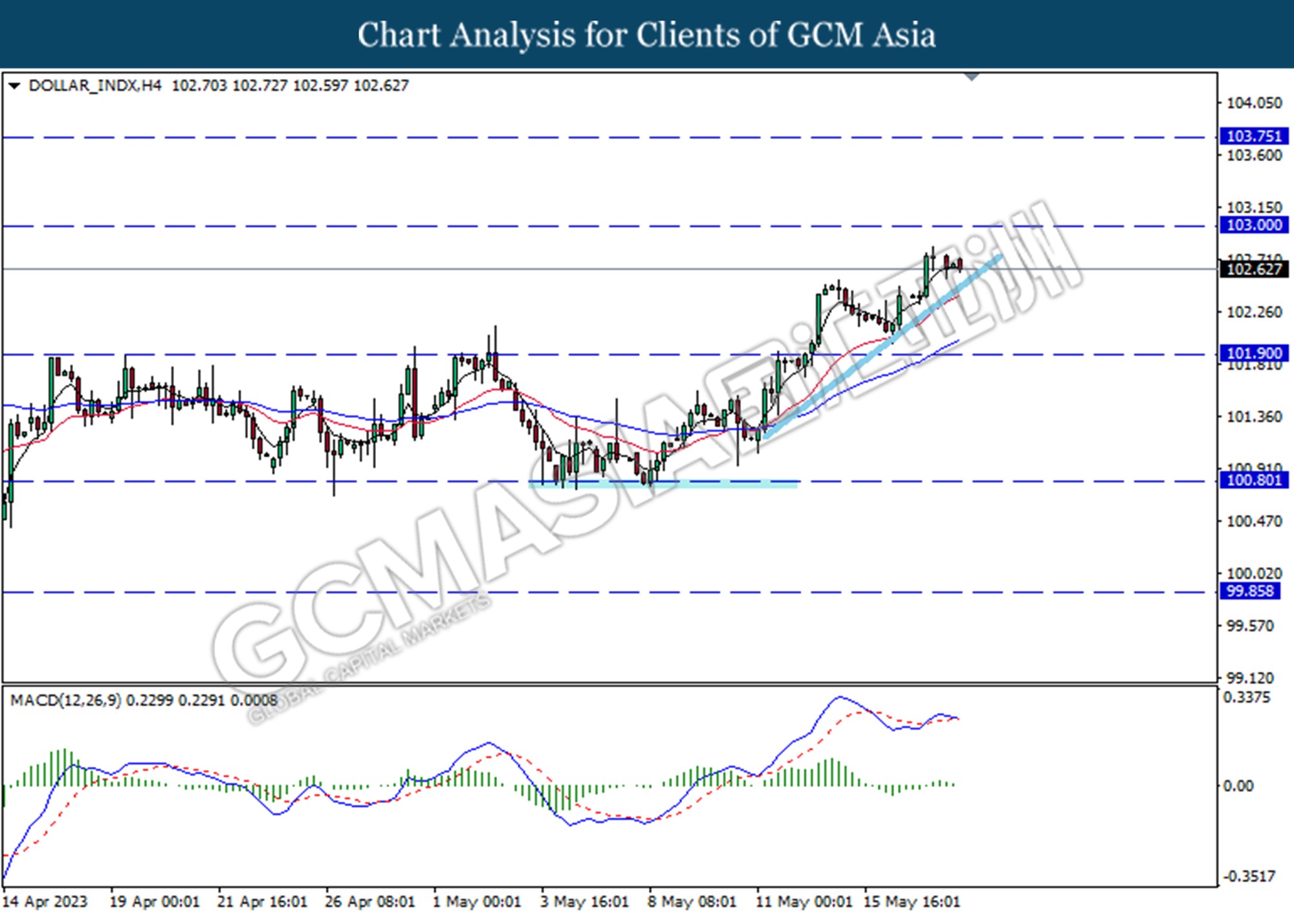

DOLLAR_INDX, H4: Dollar index was traded lower following the prior retracement from the higher level. MACD which illustrated diminishing bullish momentum suggests the index to extend its losses toward the upward trend line.

Resistance level: 103.00, 103.75

Support level: 101.90, 100.80

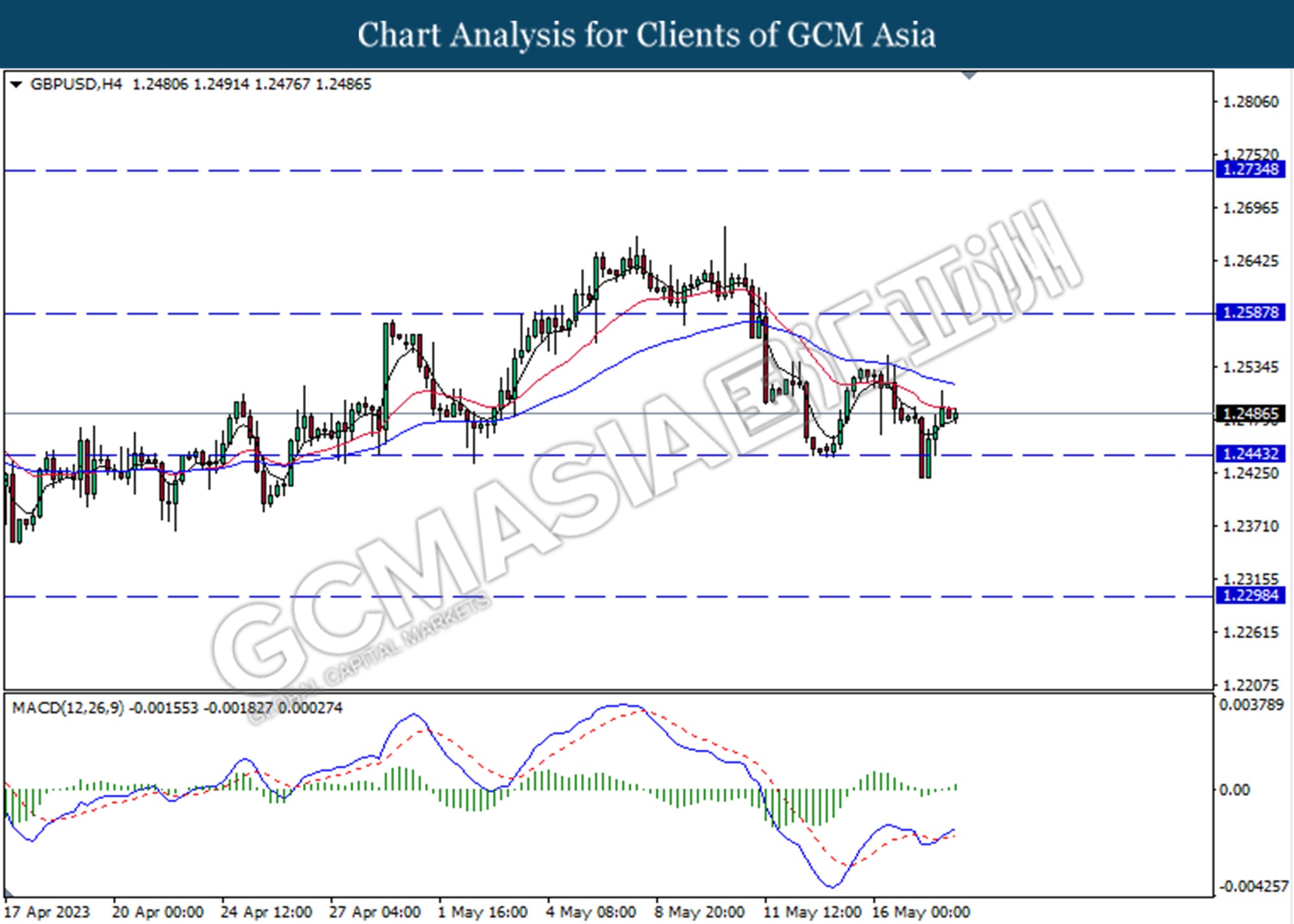

GBPUSD, H4: GBPUSD was traded higher following the prior rebound from the support level at 1.2445. MACD which illustrated increasing bullish momentum suggests the pair to extend its gains toward the resistance level.

Resistance level: 1.2590, 1.2735

Support level: 1.2445, 1.2300

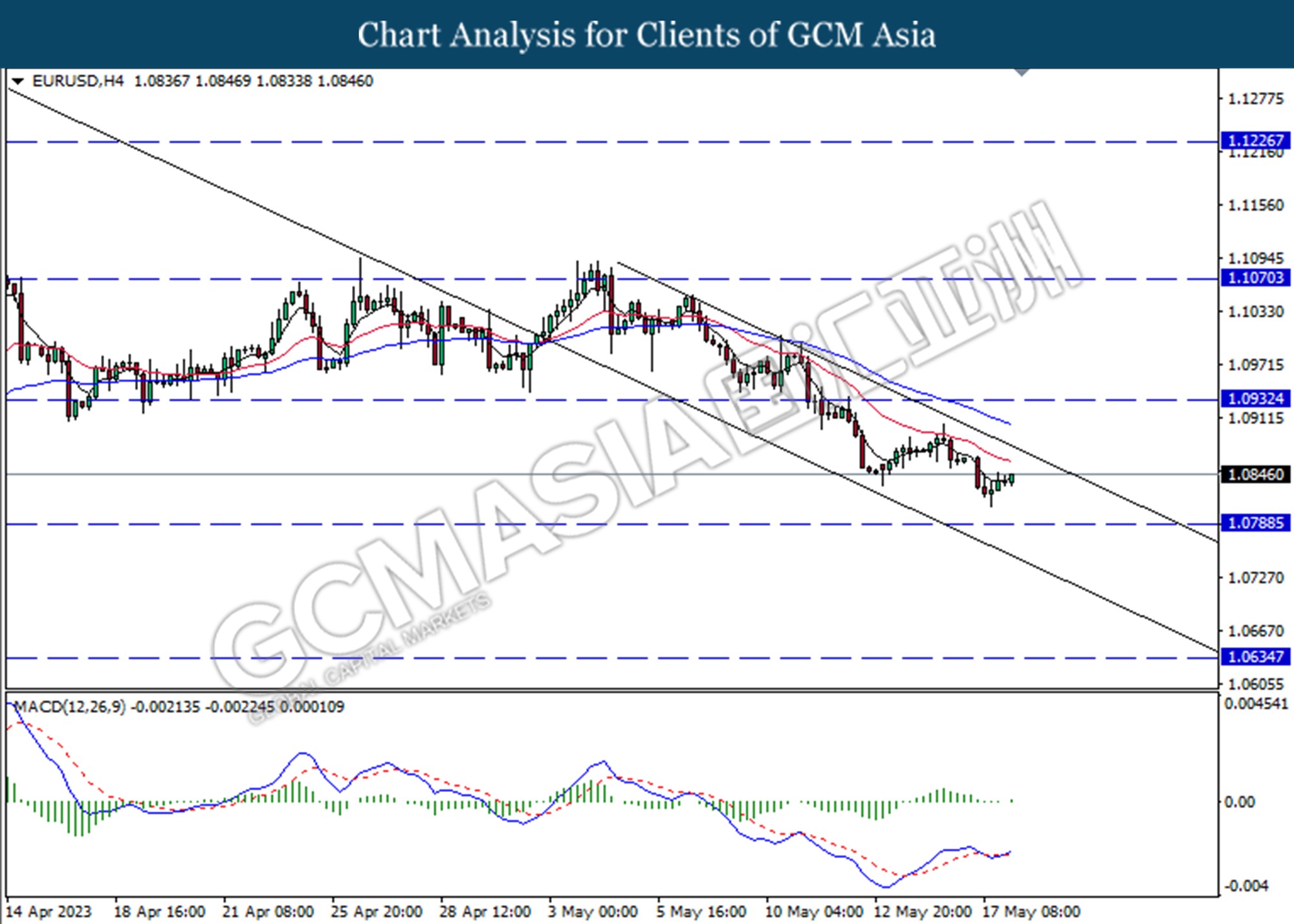

EURUSD, H4: EURUSD was traded higher following the prior rebound from the lower level. MACD which illustrated increasing bullish momentum suggests the pair to extend its gains toward the resistance level.

Resistance level: 1.0935, 1.1070

Support level: 1.0790, 1.0635

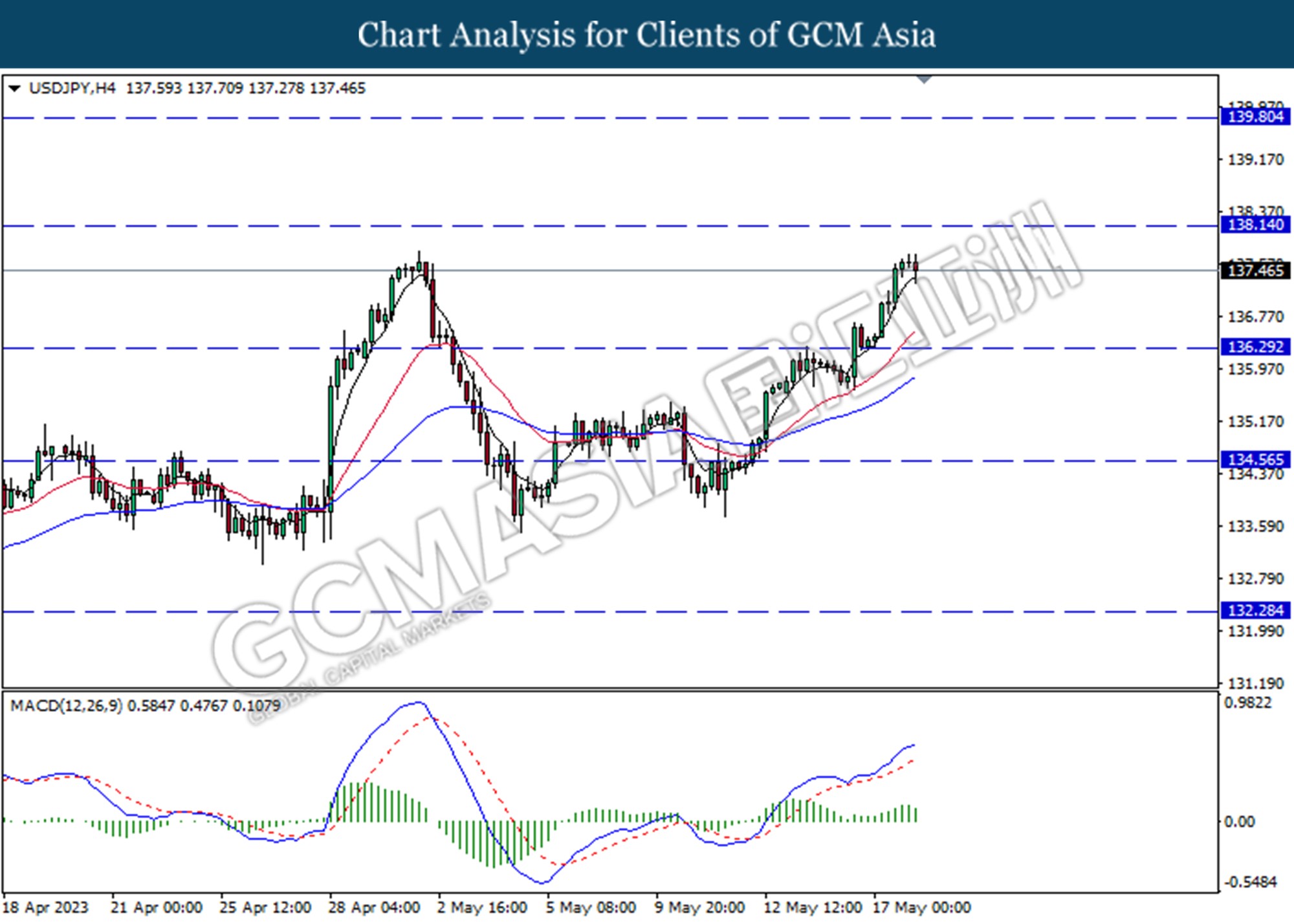

USDJPY, H4: USDJPY was traded lower following the prior retracement from the higher level. MACD which illustrated diminishing bullish momentum suggests the pair to extend its losses toward the support level at 136.30.

Resistance level: 138.15, 139.80

Support level: 136.30, 134.55

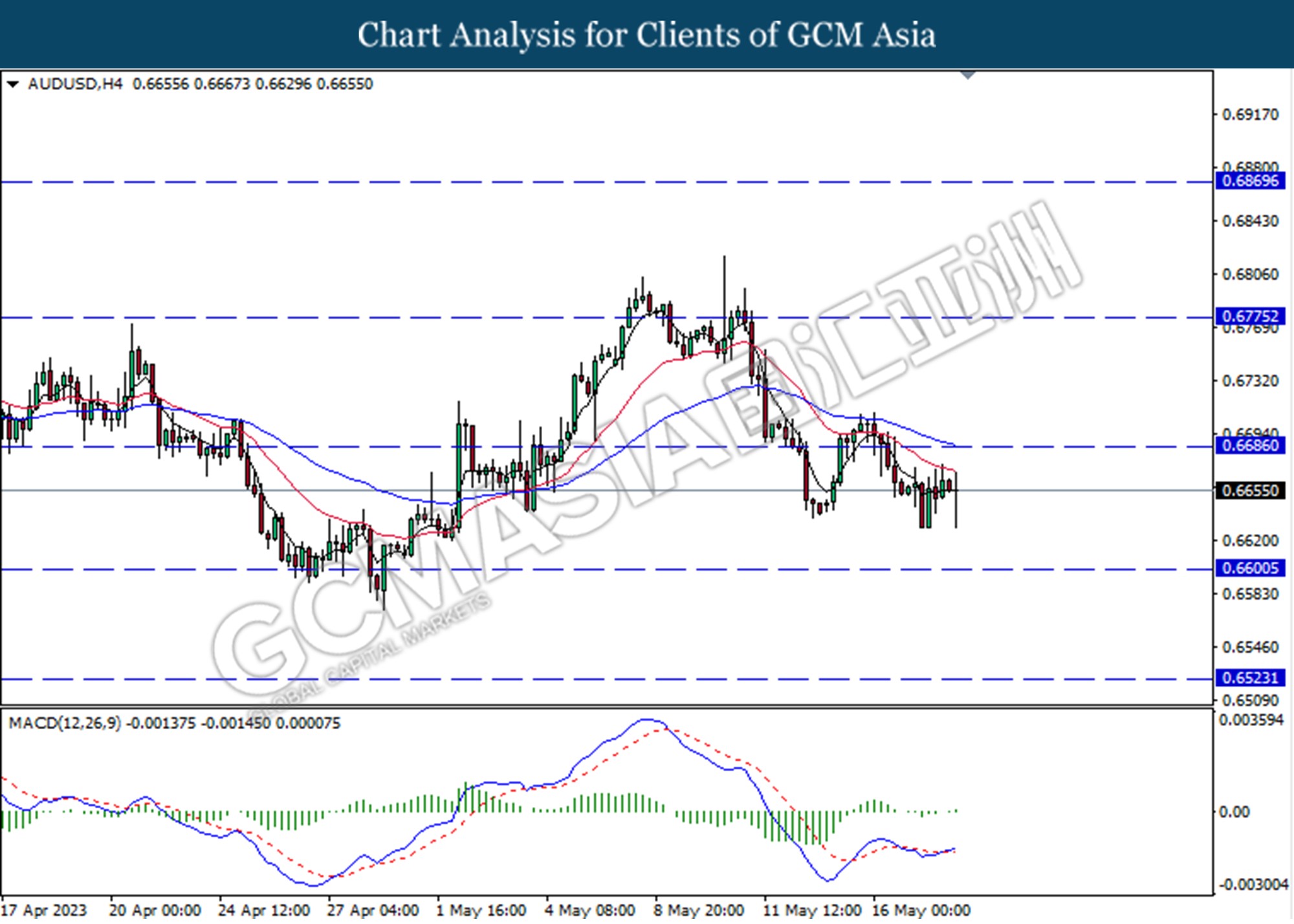

AUDUSD, H4: AUDUSD was traded lower following the prior retracement from the higher level. However, MACD which illustrated bullish momentum suggests the pair to undergo technical correction in the short-term.

Resistance level: 0.6685, 0.6775

Support level: 0.6600, 0.6525

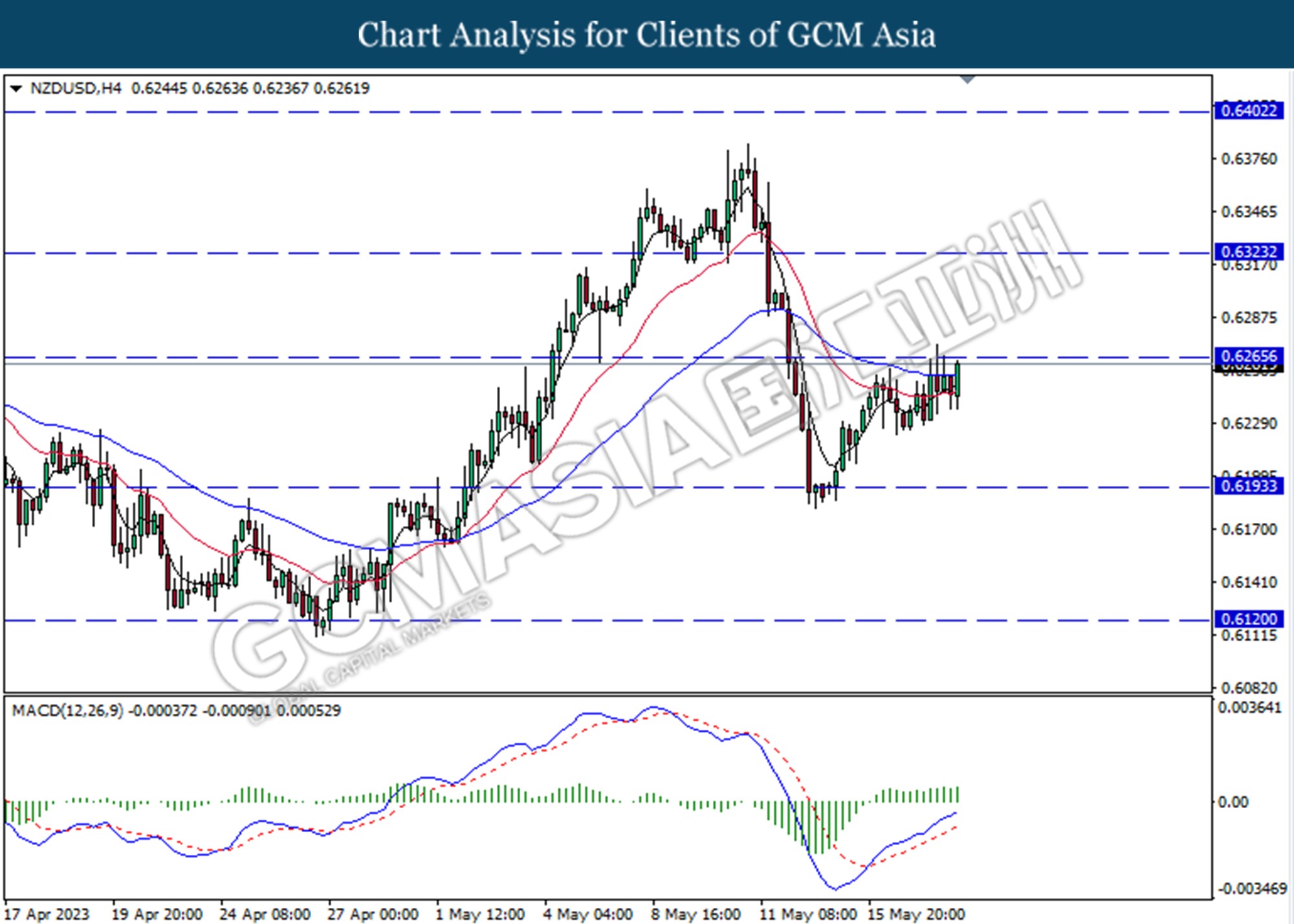

NZDUSD, H4: NZDUSD was traded higher while currently testing for the resistance level at 0.6265. MACD which illustrated increasing bullish momentum suggests the pair extended its gains after it successfully break above the resistance level.

Resistance level: 0.6265, 0.6325

Support level: 0.6195, 0.6120

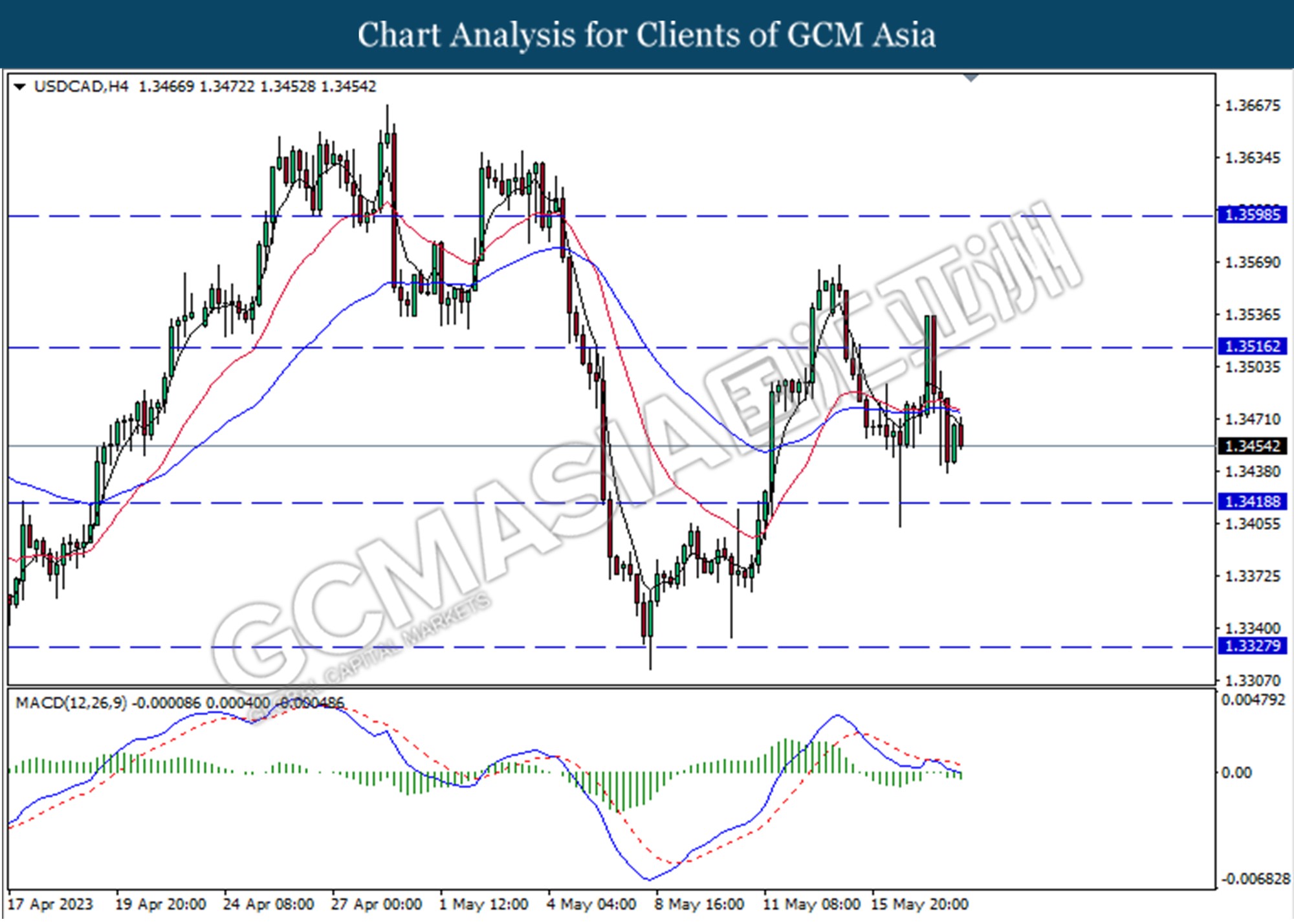

USDCAD, H4: USDCAD was traded lower following the prior breakout below the previous support level at 1.3515. MACD which illustrated increasing bearish momentum suggests the pair to extend its losses toward the support level at 1.3515.

Resistance level: 1.3420, 1.3330

Support level: 1.3515, 1.3600

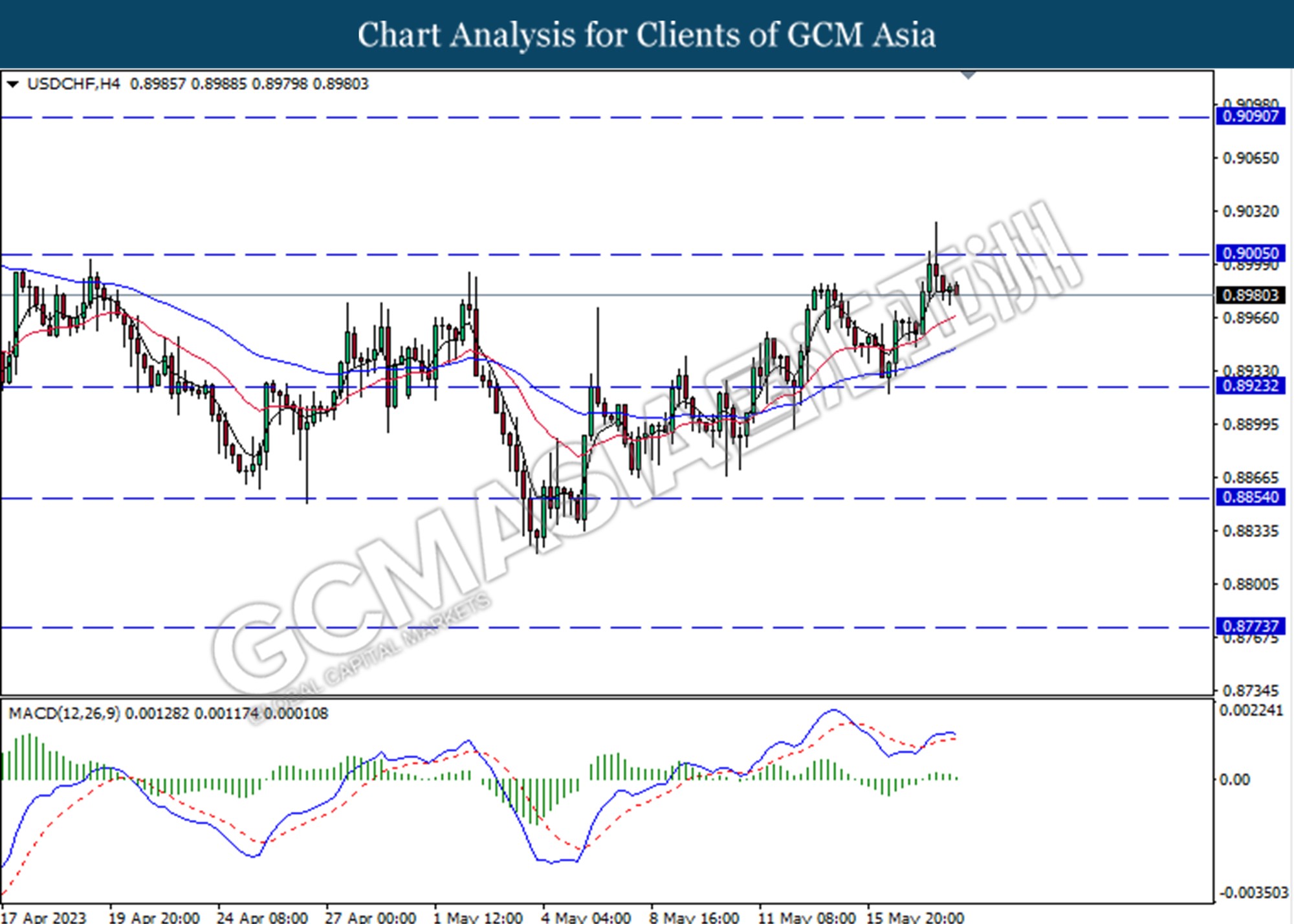

USDCHF, H4: USDCHF was traded lower following the prior breakout below the previous support level at 0.9005. MACD which illustrated diminishing bullish momentum suggests the pair to extend its losses toward the support level.

Resistance level: 0.9005, 0.9090

Support level: 0.8925, 0.8855

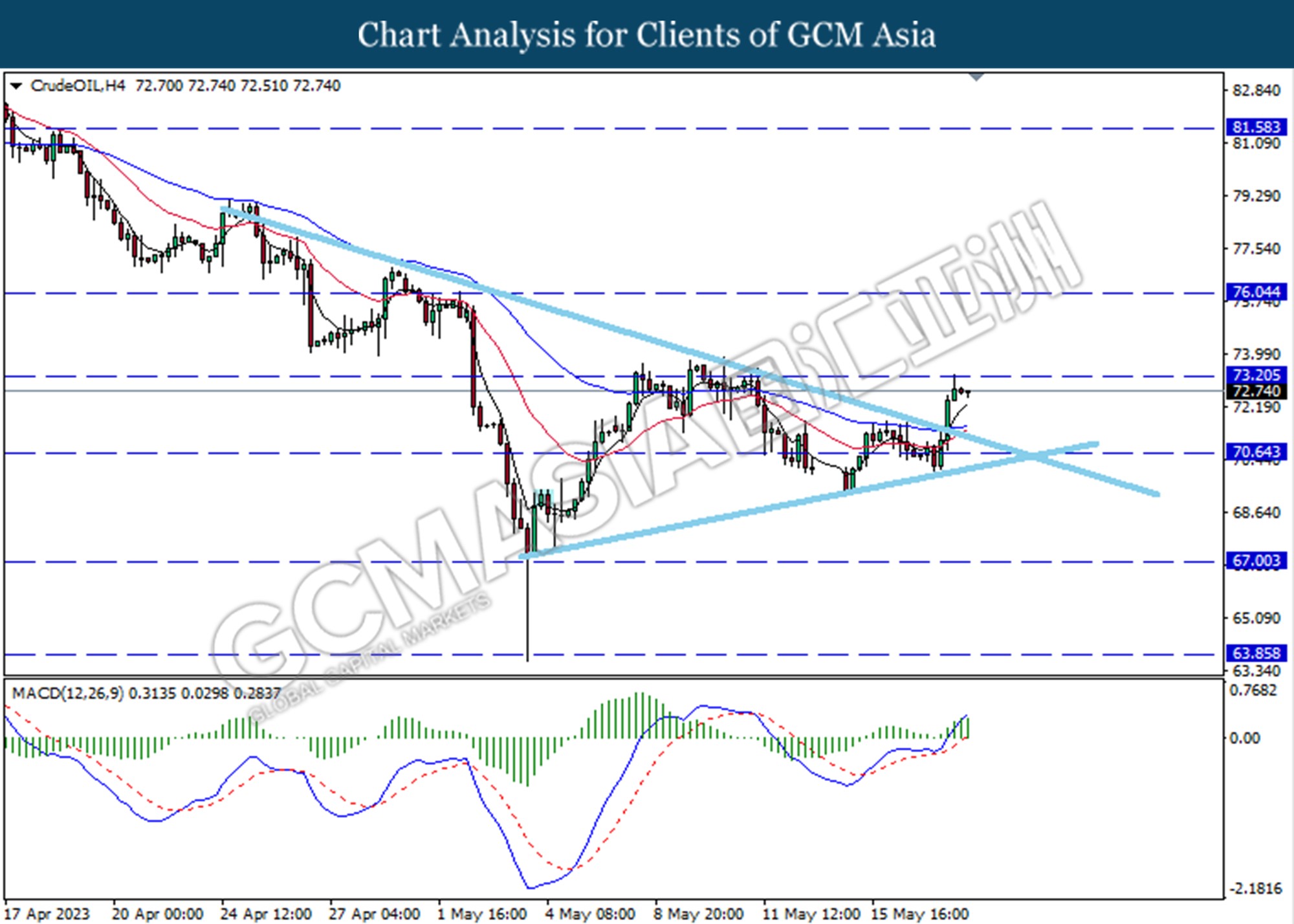

CrudeOIL, H4: Crude oil price was traded higher following the prior rebound from the support level at 70.65. MACD which illustrated increasing bullish momentum suggests the commodity to extend its gains toward the resistance level at 73.20.

Resistance level: 73.20, 76.05

Support level: 70.65, 67.00

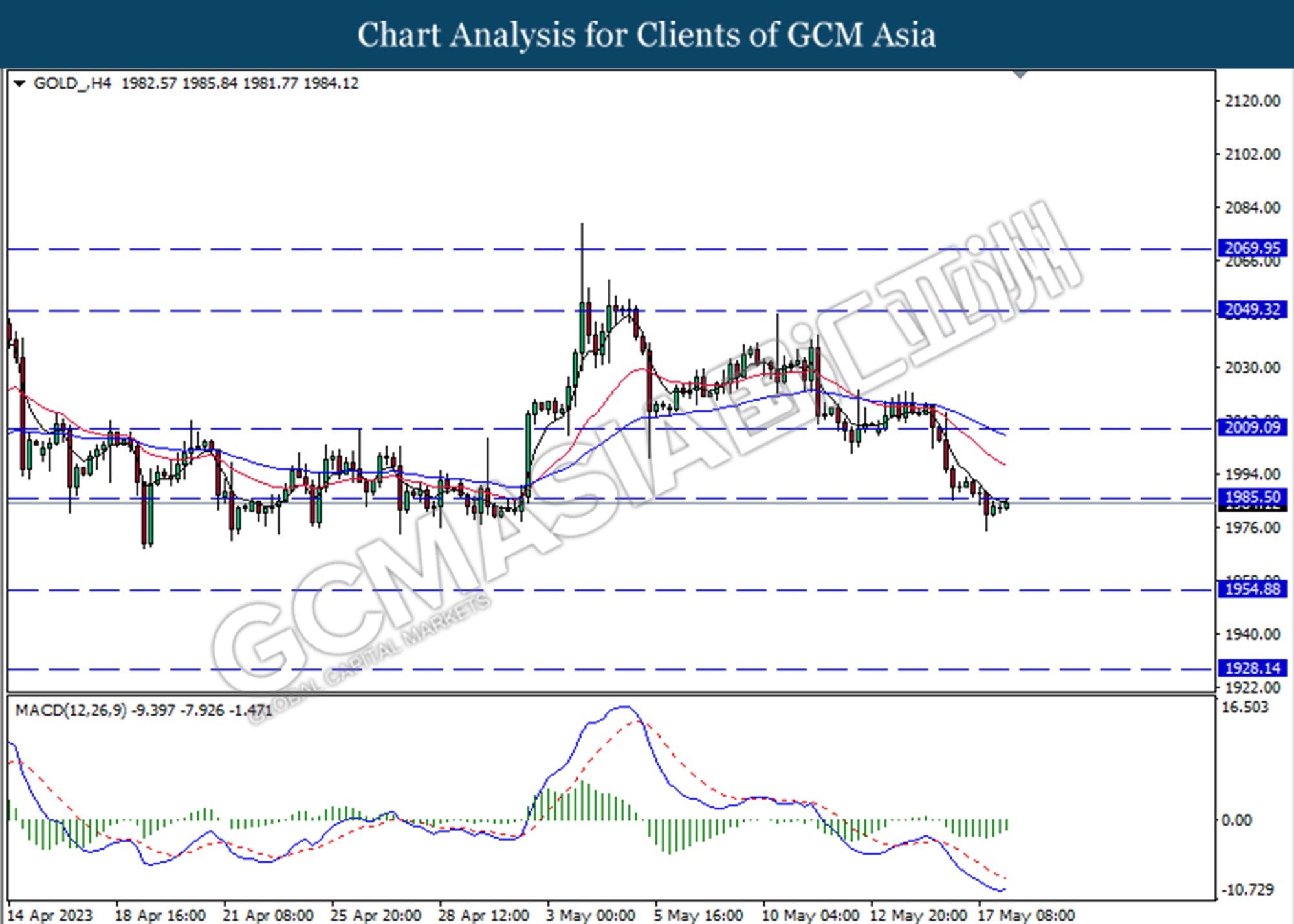

GOLD_, H4: Gold price was traded higher while currently testing the resistance level at 1985.50. MACD which illustrated diminishing bearish momentum suggests the commodity to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1985.50, 2009.10

Support level: 1954.90, 1928.15