18 May 2023 Morning Session Analysis

Greenback buoyed by debt ceiling optimism.

The dollar index, which was traded against a basket of six major currencies, hovered near the highest level in seven weeks as the recent progress in the debt ceiling talks boosted the sentiment in dollar market. Yesterday, before the US President Joe Biden prepared to travel to Japan for the G7 leader summit, he revealed that his meeting with the congressional members had been “civil and respectful” as both parties noticed the consequences of no deal on raising the debt ceiling. Biden also said that he is confident that they will eventually seal a deal and US will not default before 1st of June. With such a backdrop, the investors regained their confidence that a debt ceiling crisis would see a resolution sooner or later. However, a deal is unforeseeable within the next few days as Joe Biden will only be back in Washington on Sunday. Prior to that, Biden has shortened his Asia trip where he has canceled to visit Papua New Guinea and Australia, in order to continue the debt ceiling talk. As of writing, the dollar index rose 0.28% to 102.85.

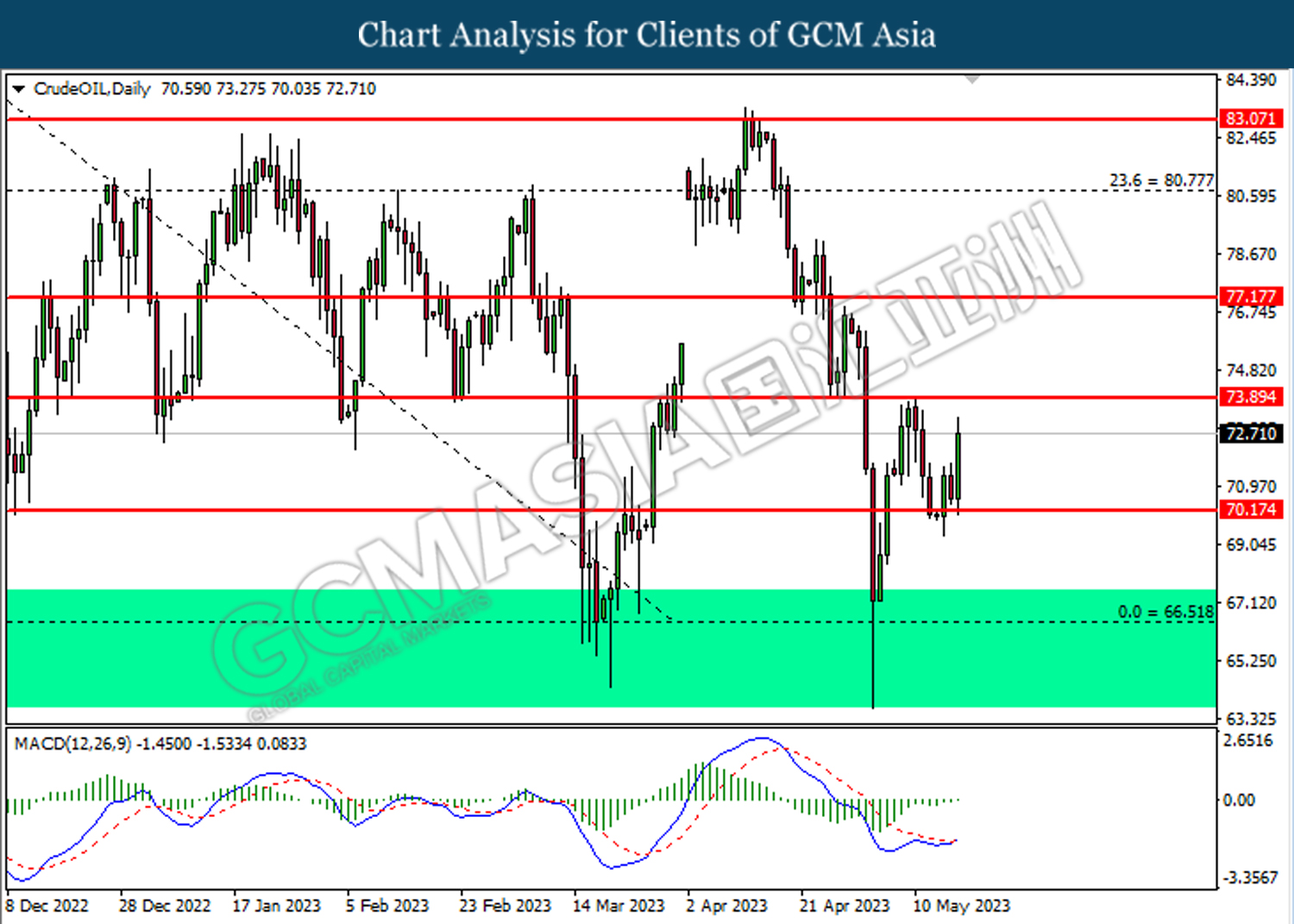

In the commodities market, crude oil prices edged up by 3.12% to $72.80 per barrel amid the optimism on U.S. debt ceiling negotiations boosted the prospect of oil market. Besides, gold prices ticked down by -0.09% to $1983.40 per troy ounce as the optimism on debt ceiling talk outweighed the market worries over banking crisis.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

17:00 EUR ECB President Lagarde Speaks

17:15 GBP BoE MPC Treasury Committee Hearings

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 20:30 | USD – Initial Jobless Claims | 264K | 254K | – |

| 20:30 | USD – Philadelphia Fed Manufacturing Index (May) | -31.3 | -19.0 | – |

| 22:00 | USD – Existing Home Sales (Apr) | 4.44M | 4.30M | – |

Technical Analysis

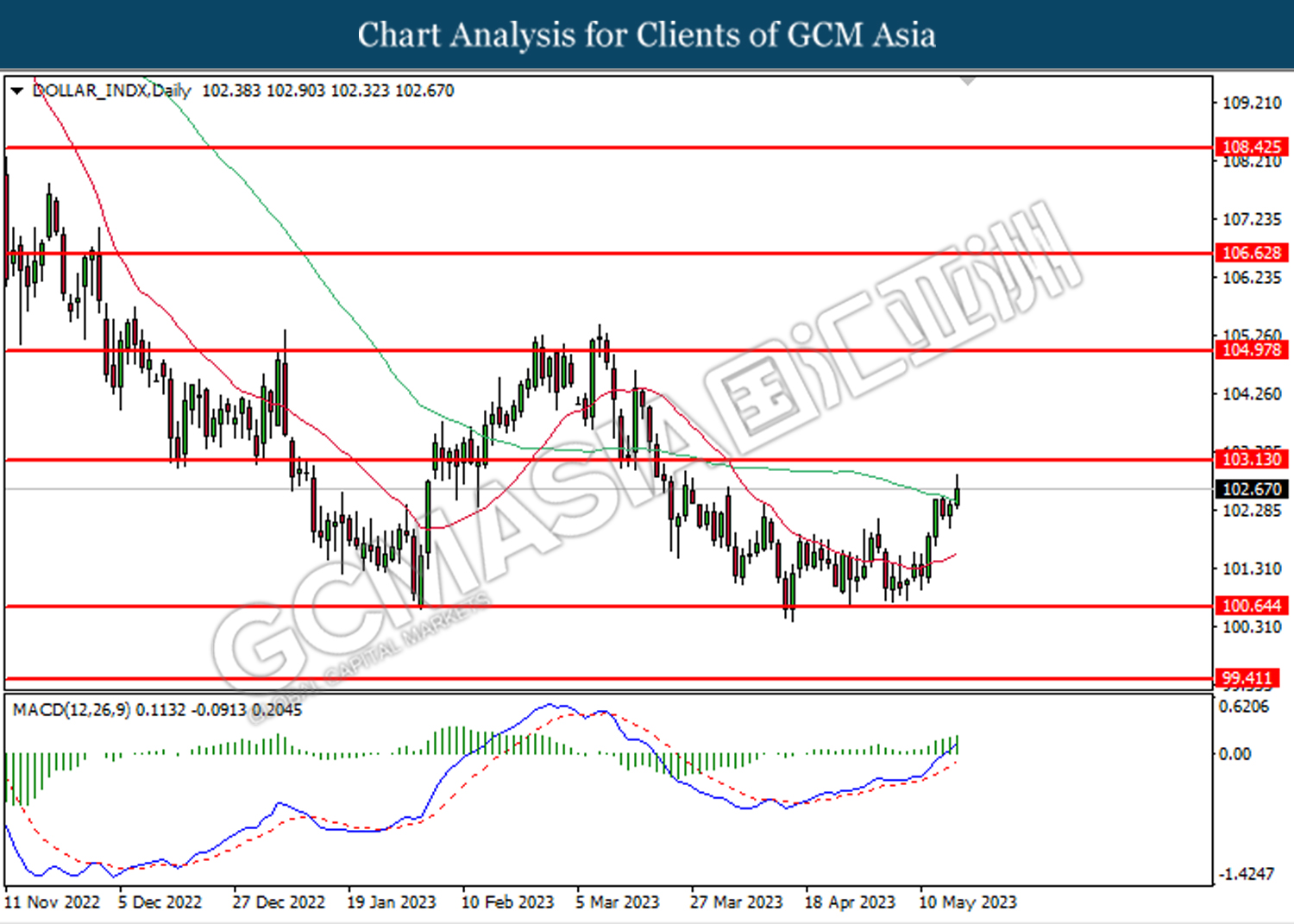

DOLLAR_INDX, Daily: Dollar index was traded higher following the prior rebound from the support level at 100.65. MACD which illustrated bullish bias momentum suggests the index to extend its gains toward the resistance level at 103.15.

Resistance level: 103.15, 104.95

Support level: 100.65, 99.40

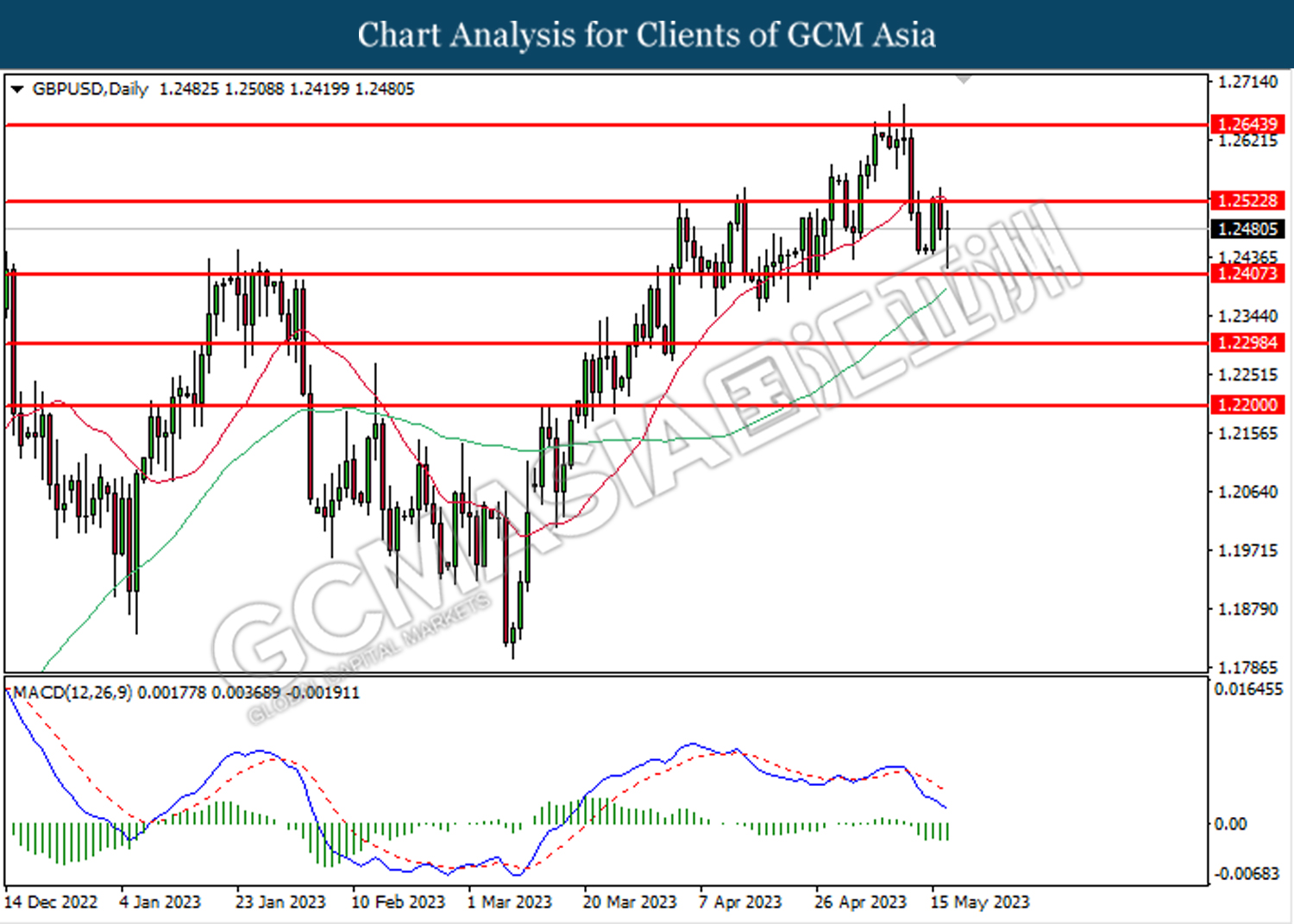

GBPUSD, Daily: GBPUSD was traded lower following the prior retracement from the resistance level at 1.2525. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 1.2405.

Resistance level: 1.2525, 1.2645

Support level: 1.2405, 1.2300

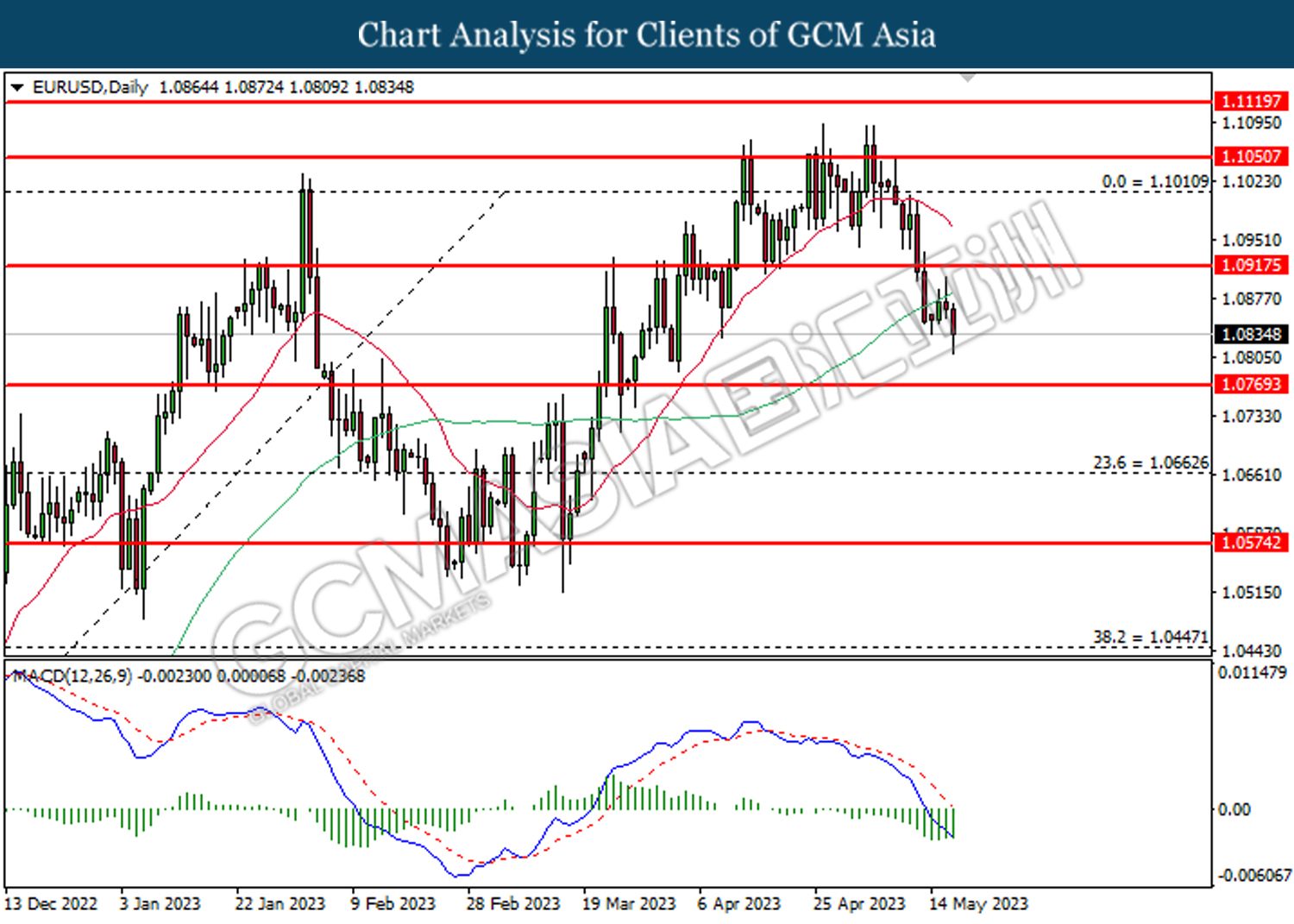

EURUSD, Daily: EURUSD was traded lower following the prior retracement from the resistance level at 1.0915. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 1.0770.

Resistance level: 1.0915, 1.1010

Support level: 1.0770, 1.0665

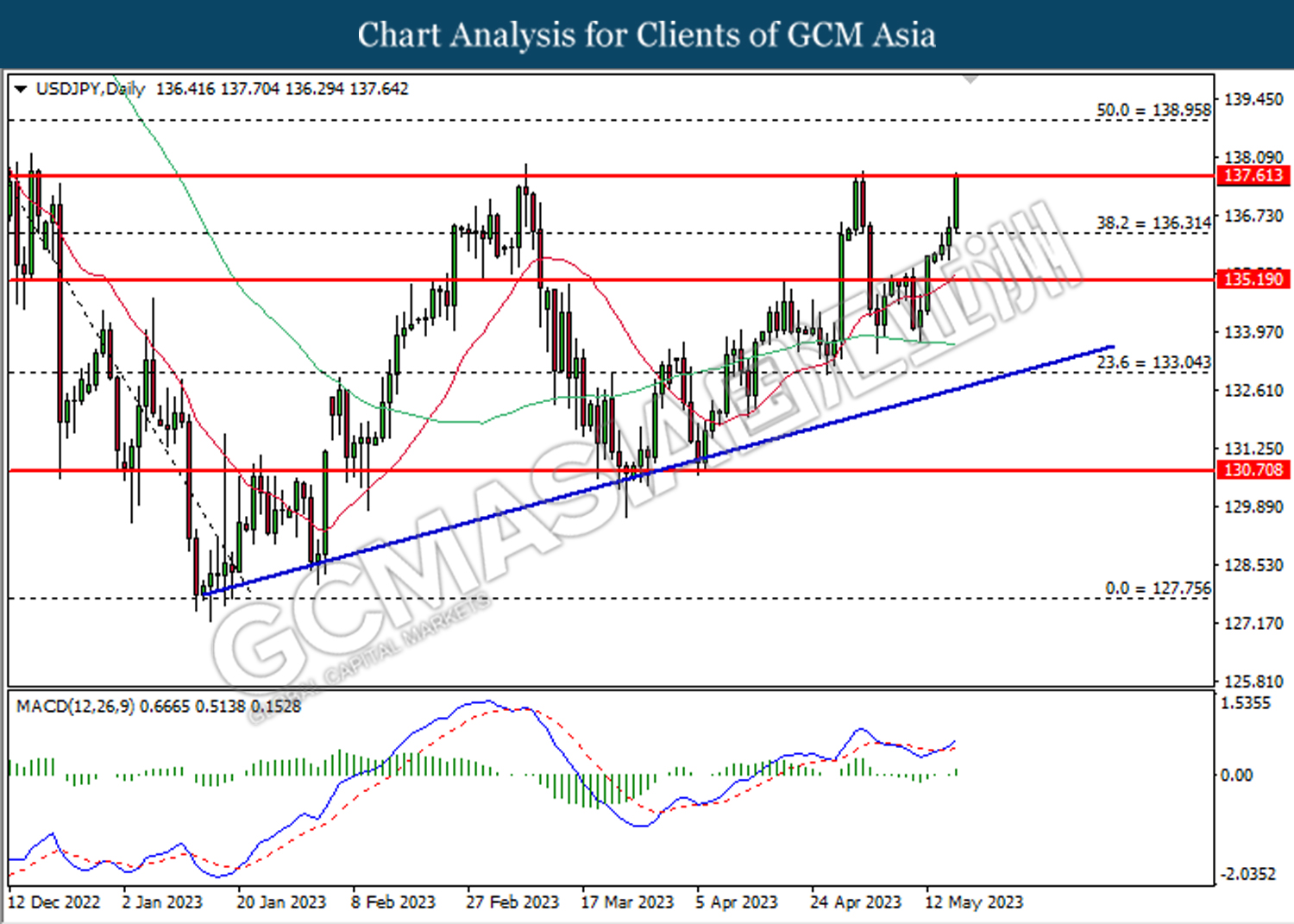

USDJPY, Daily: USDJPY was traded higher while currently testing the resistance level at 137.60. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 137.60, 138.95

Support level: 136.30, 135.20

AUDUSD, Daily: AUDUSD was traded lower following the prior breakout below the previous support level at 0.6675. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 0.6565.

Resistance level: 0.6675, 0.6785

Support level: 0.6565, 0.6425

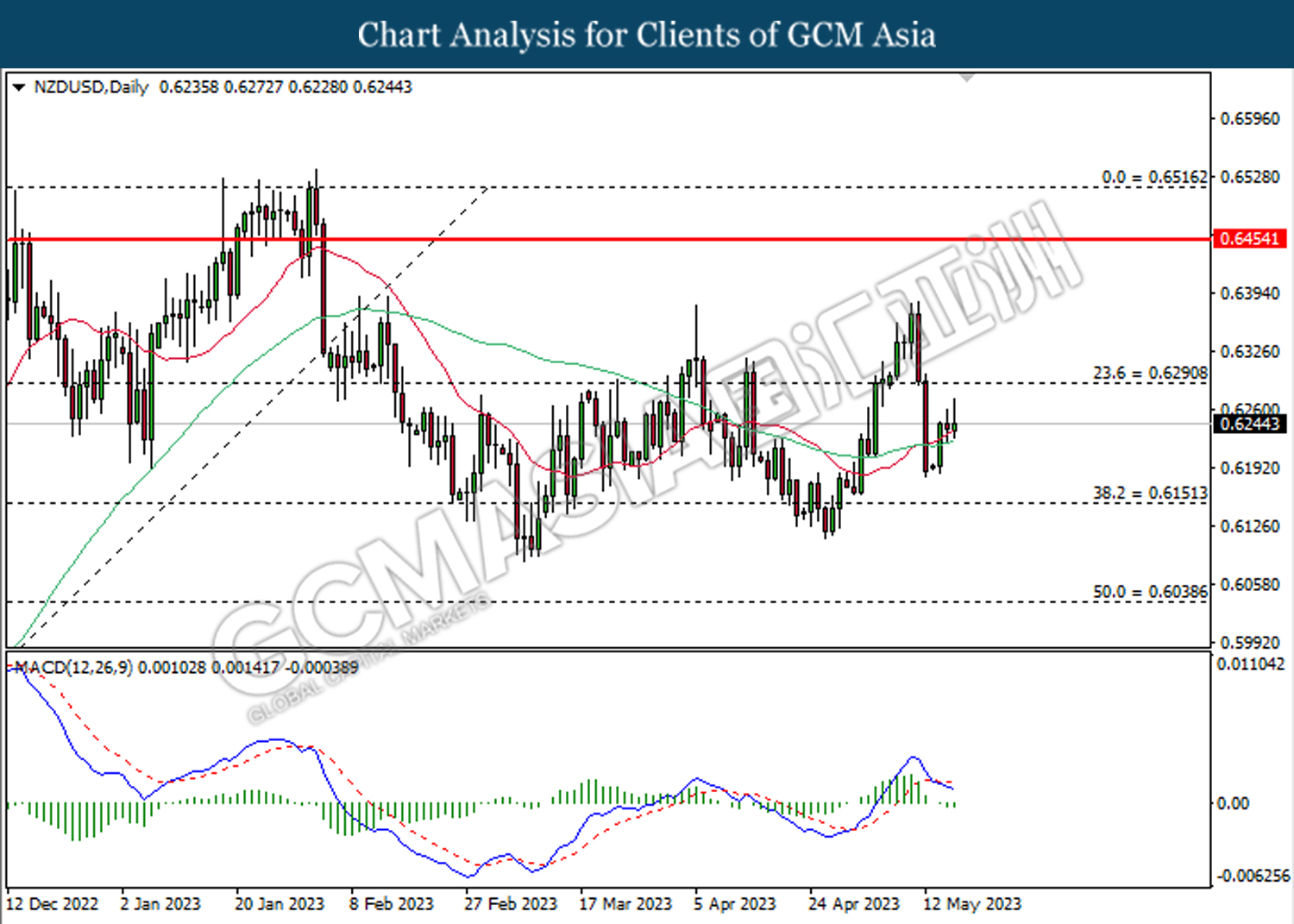

NZDUSD, Daily: NZDUSD was traded higher following the prior rebound from the lower level. However, MACD which illustrated bearish bias momentum suggest the pair to undergo technical correction in short term.

Resistance level: 0.6290. 0.6455

Support level: 0.6150, 0.6040

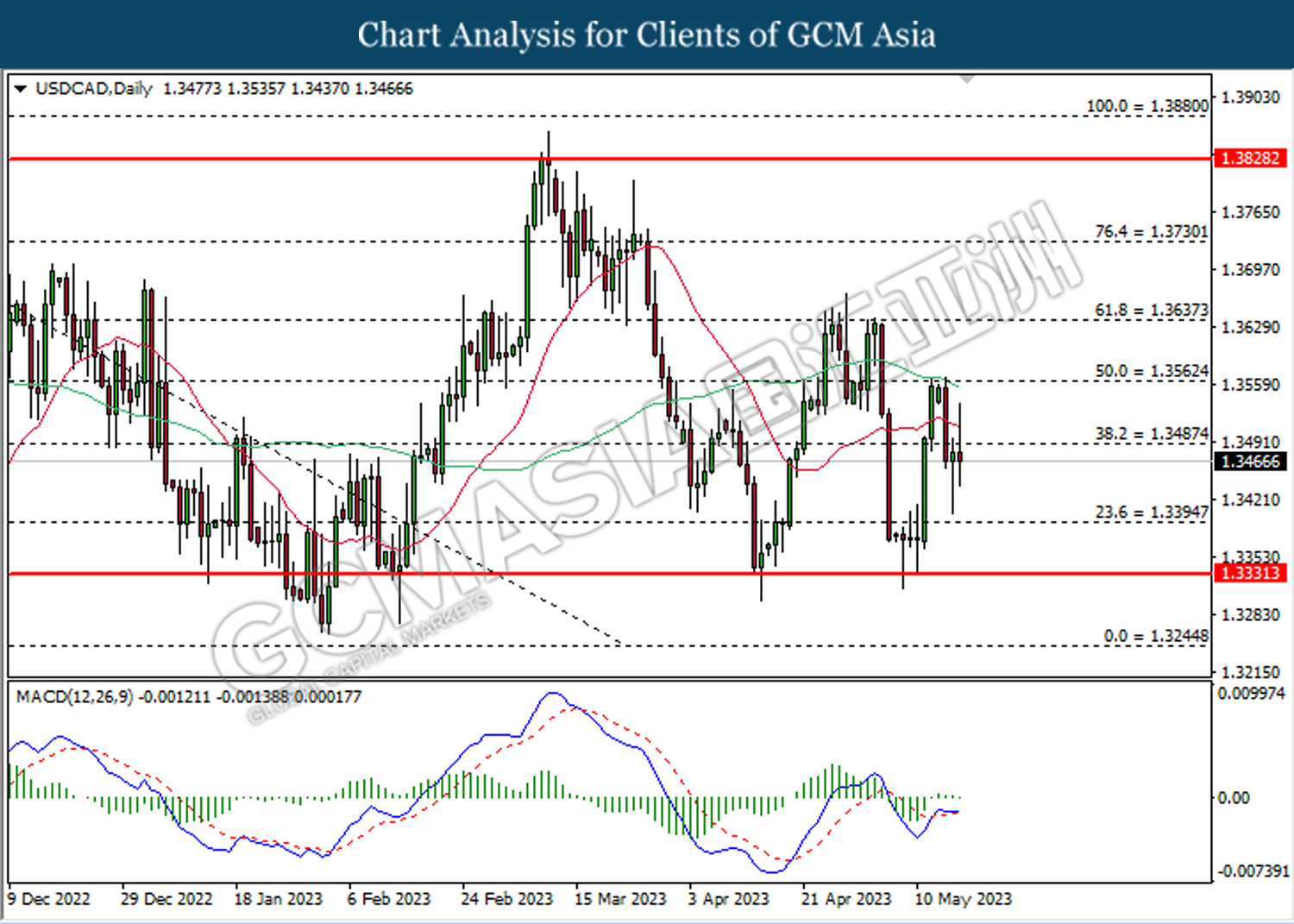

USDCAD, Daily: USDCAD was traded lower following the prior breakout below the previous support level at 1.3485. MACD which illustrated diminishing bullish momentum suggests the pair to extend its losses toward the support level at 1.3395.

Resistance level: 1.3485, 1.3565

Support level: 1.3395, 1.3330

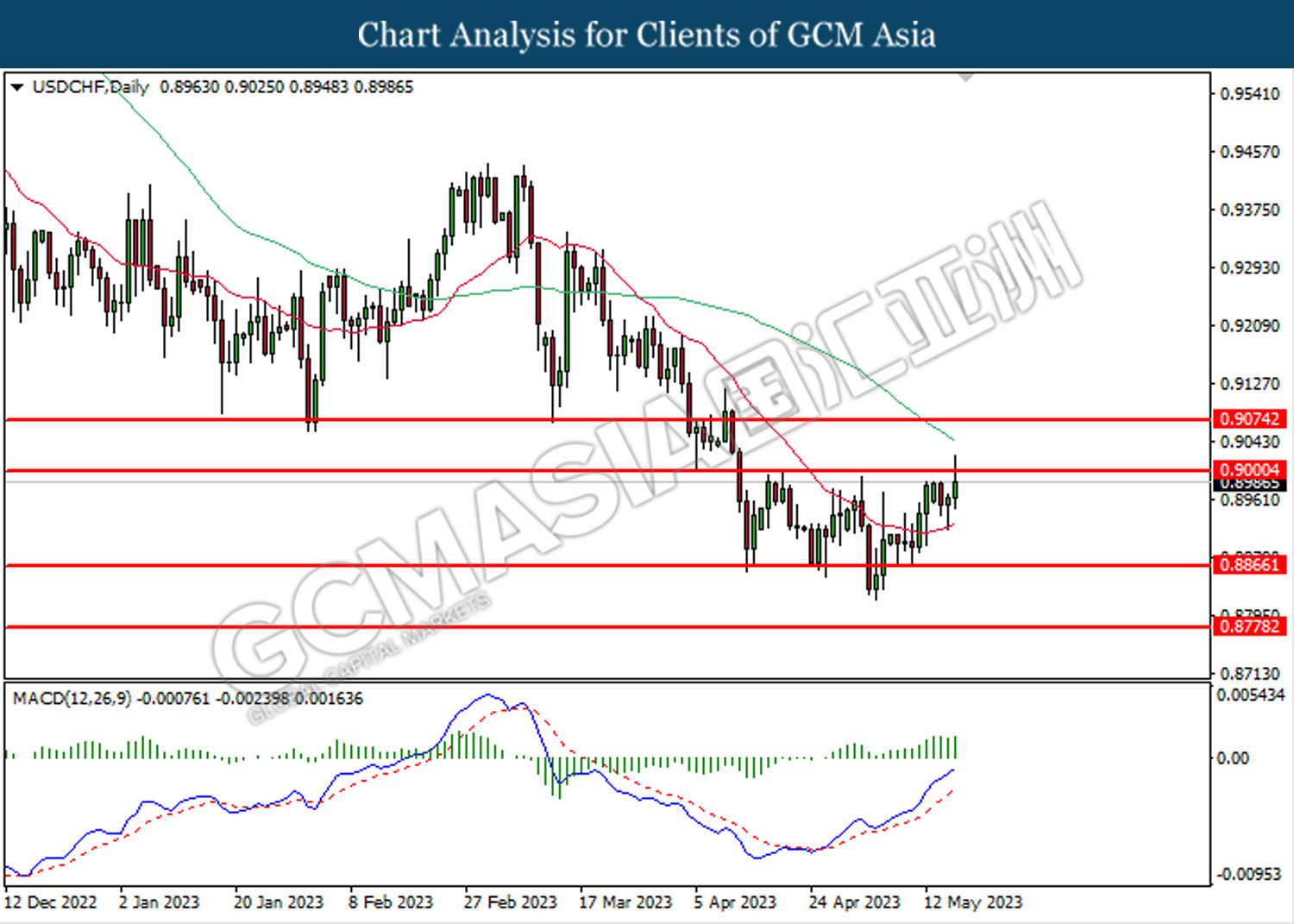

USDCHF, Daily: USDCHF was traded higher following the prior rebound from the support level at 0.8865. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 0.9000.

Resistance level: 0.9000, 0.9075

Support level: 0.8865, 0.8780

CrudeOIL, Daily: Crude oil price was traded higher following the prior rebound from the support level at 70.15. MACD which illustrated diminishing bearish momentum suggest the commodity to extend its gains toward the resistance level at 73.90.

Resistance level: 73.90, 77.15

Support level: 70.15, 66.50

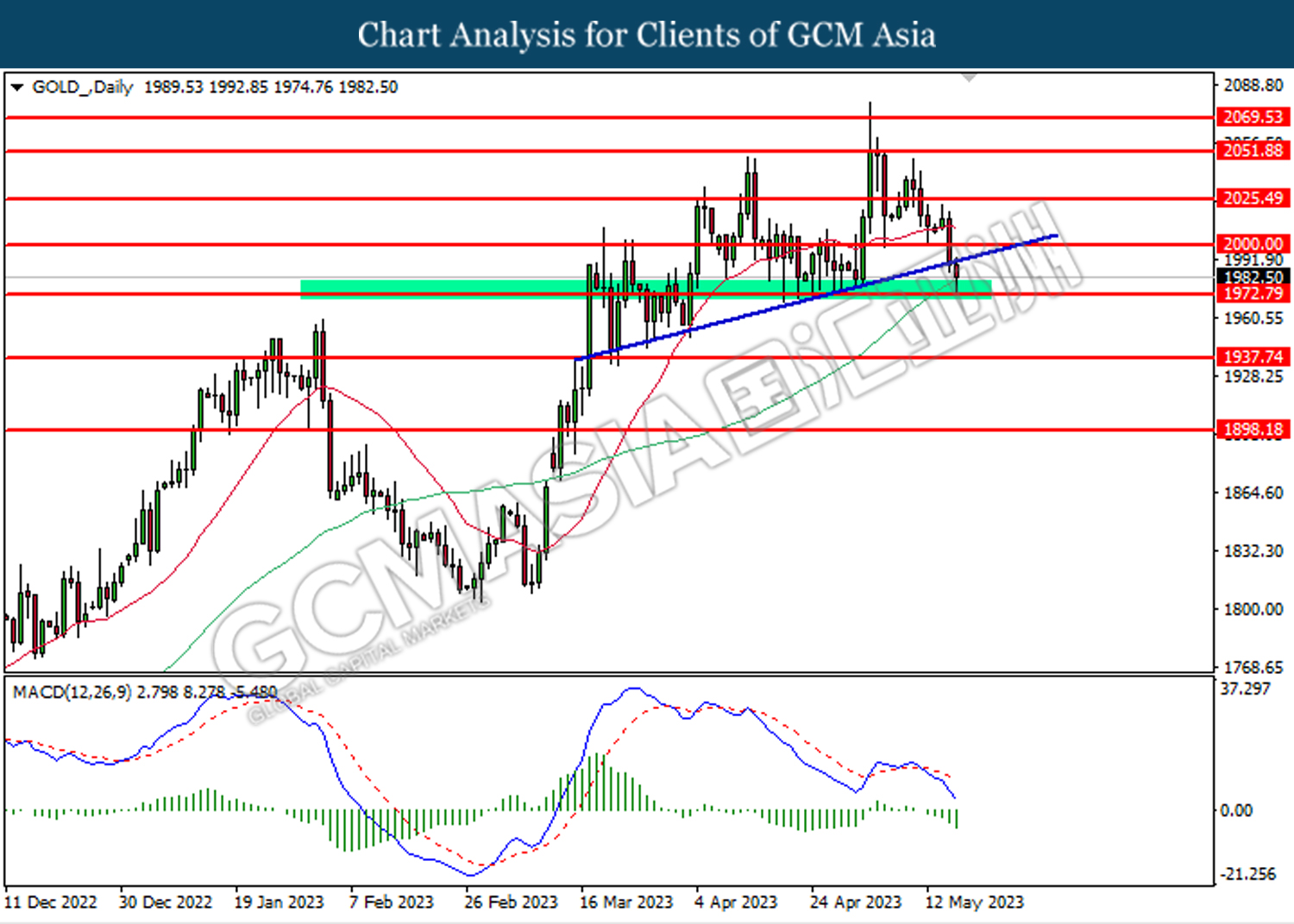

GOLD_, Daily: Gold price was traded lower while currently testing the support level at 1972.80. MACD which illustrated bearish bias momentum suggests the commodity to extend its losses after it successfully breakout below the support level.

Resistance level: 2000.00, 2025.50

Support level: 1972.80, 1937.75