18 July 2022 Afternoon Session Analysis

Inflation risk continue to spur hawks’ sentiment in NZD.

The New Zealand Dollar surged significant following the released of spiking inflation data, which spurring further expectation upon the rate hike policy from the Reserve Bank of New Zealand. According to Statistics New Zealand, New Zealand Consumer Price Index (CPI) quarter-on-quarter came in at 1.7%, exceeding the market forecast at 1.5% and annual rate increment by 7.1%. Recently, the Reserve Bank of New Zealand (RBNZ) has increased their interest rate to 2.50% from a record low 0.25% in October last year. Besides, the Monetary Policy Committee (MPC) also signaled that further rate hikes would be needed in order to combat the high inflation risk. Nonetheless, the gains experienced by the Chinese proxy currency such as New Zealand Dollar was limited following cities across China had implement partial Covid-19 lockdown. In total, China reported another 450 new Covid-19 cases on Friday, according to the National Health Commission. As of writing, NZD/USD appreciated by 0.49% to 0.6190.

In the commodities market, the crude oil price retreated by 0.85% to $93.90 per barrel as of writing. The crude oil price edged higher amid market participants concerned that the implementation of lockdown in China would weigh down the market demand on this black commodity. On the other hand, the gold price appreciated by 0.36% to $1713.45 per troy ounces as of writing amid weakening US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

N/A

Technical Analysis

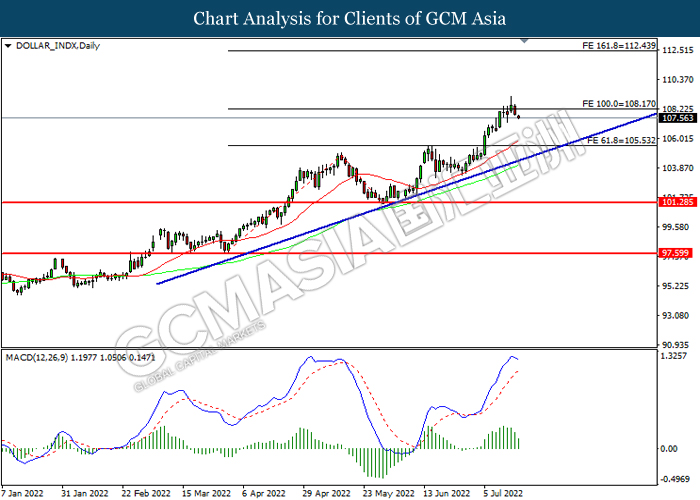

DOLLAR_INDX, Daily: Dollar index was traded higher while currently testing the resistance level. However, MACD which illustrated diminishing bullish momentum suggest the index to be traded lower as technical correction.

Resistance level: 108.15, 112.45

Support level: 105.55, 101.30

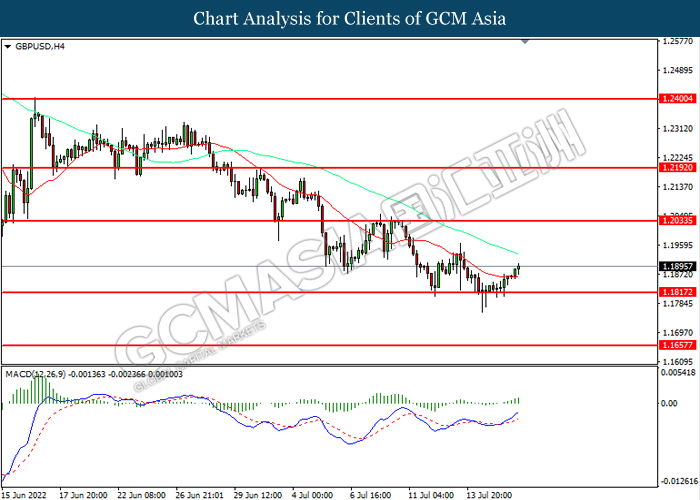

GBPUSD, H4: GBPUSD was traded higher following prior rebounded from the support level. MACD which illustrated increasing bullish momentum suggest the pair to extend tis gains toward resistance level.

Resistance level: 1.2035, 1.2190

Support level: 1.1815, 1.1655

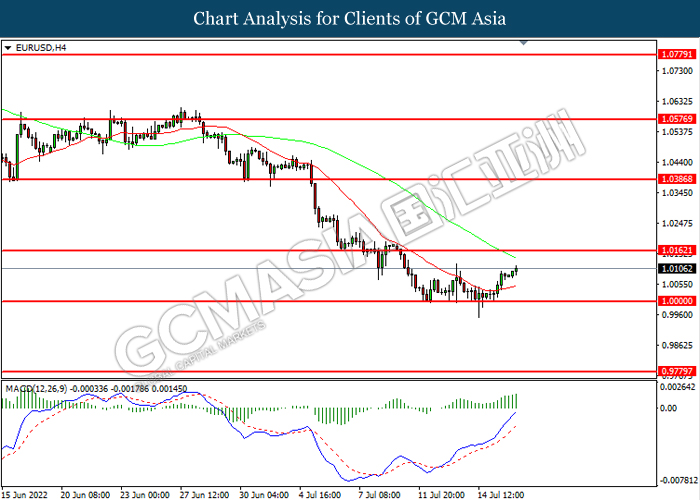

EURUSD, H4: EURUSD was traded higher following prior rebounded from the support level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains toward the resistance level.

Resistance level: 1.0160, 1.0385

Support level: 1.0000, 0.9780

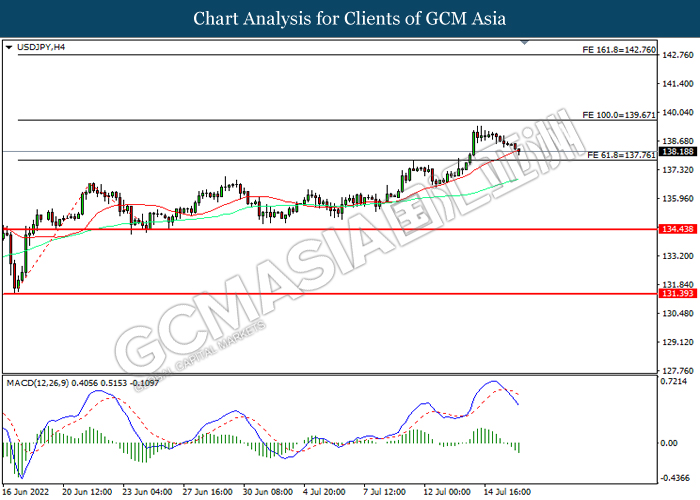

USDJPY, H4: USDJPY was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after breakout.

Resistance level: 139.65, 142.75

Support level: 137.75, 134.45

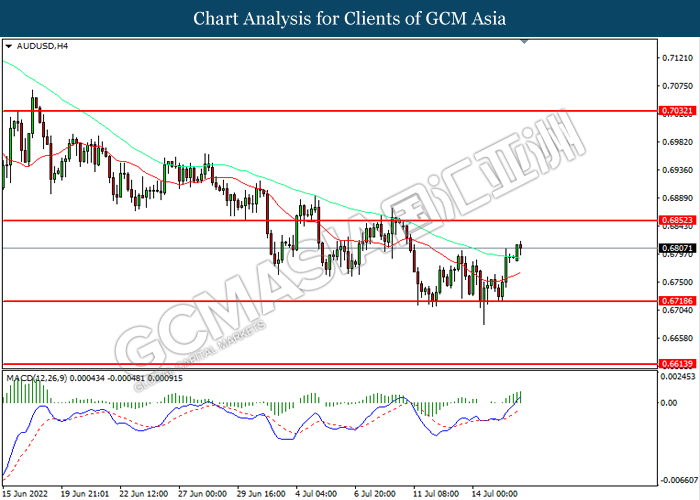

AUDUSD, H4: AUDUSD was traded higher while currently near the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains after breakout.

Resistance level: 0.6850, 0.7030

Support level: 0.6720, 0.6615

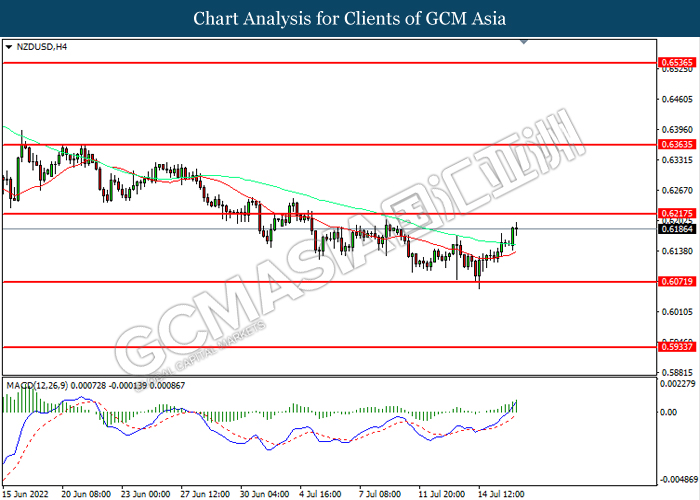

NZDUSD, H4: NZDUSD was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains after breakout.

Resistance level: 0.6215, 0.6365

Support level: 0.6070, 0.5935

USDCAD, H4: USDCAD was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 1.3050, 1.3185

Support level: 1.2925, 1.2840

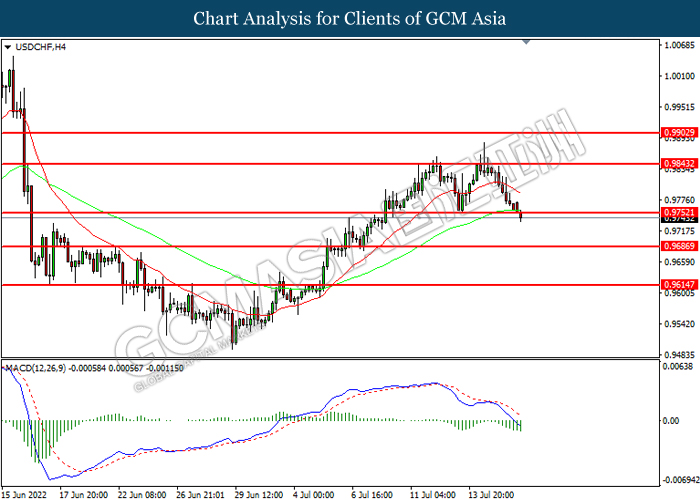

USDCHF, H4: USDCHF was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses toward support level.

Resistance level: 0.9750, 0.9845

Support level: 0.9685, 0.9615

CrudeOIL, H4: Crude oil price was traded within a range while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the commodity to extend its gains after it breakout the resistance level.

Resistance level: 95.15, 103.40

Support level: 89.50, 84.05

GOLD_, H1: Gold price was traded higher following prior rebounded from the support level. MACD which illustrated increasing bullish momentum suggest the commodity to extend its gains toward resistance level.

Resistance level: 1724.95, 1745.65

Support level: 1702.60, 1679.25