18 July 2022 Morning Session Analysis

Investors lowered Fed’s rate hike forecast, US Dollar beaten down.

The Dollar Index which traded against a basket of six major currencies retreated from its recent high on Friday over the diminishing odds of aggressive rate hikes from Federal Reserve. According to Fed Rate Monitor Tool, the possibility of 100 basis point increase was notched down from the previous day’s reading of 48.2% to 29.1%. Last week, the CPI and PPI data had given a higher-than-expected reading, which are 9.1% and 1.1% respectively. These inflation data which over the market forecast had hinted that the risk of increasing price keep lingering in the US market while the market participants started to ponder a full-percentage point of rate hike. Nonetheless, two of the Federal Reserve’s most hawkish policymakers on 14 July said they favored another 75-basis-point interest rate increase at the US central bank’s policy meeting this month, which spurred bearish momentum on the US Dollar. As of writing, the Dollar Index depreciated by 0.14% to 107.76.

In the commodities market, crude oil price edged down by 0.13% to $94.44 per barrel as of writing. However, the oil price rebounded on the last Friday trading session as the immediate Saudi oil output boost was not expected, according to Reuters. On the other hand, gold price appreciated by 0.27% to $1708.25 per troy ounce as of writing amid the weakening of US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

N/A

Technical Analysis

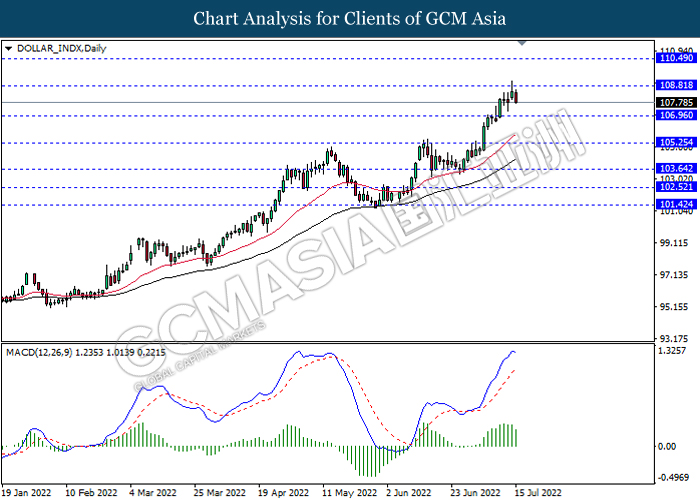

DOLLAR_INDX, Daily: Dollar index was traded lower following prior retracement from the resistance level. MACD which illustrated decreasing bullish momentum suggest the index to extend its losses.

Resistance level: 108.80, 110.50

Support level: 106.95, 105.25

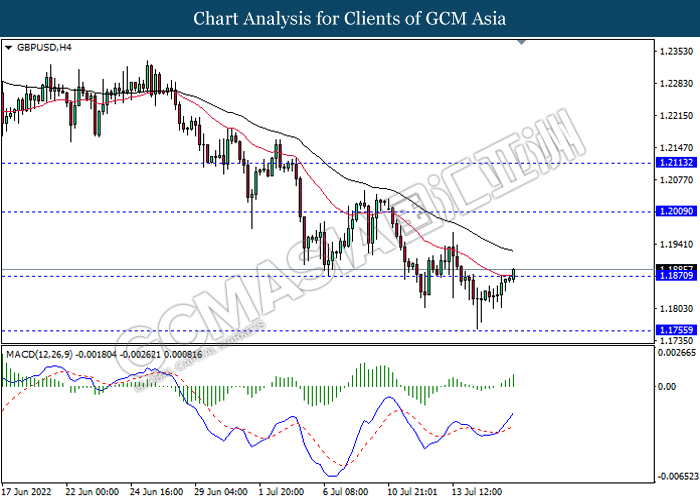

GBPUSD, H4: GBPUSD was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 1.2010, 1.2115

Support level: 1.1870, 1.1755

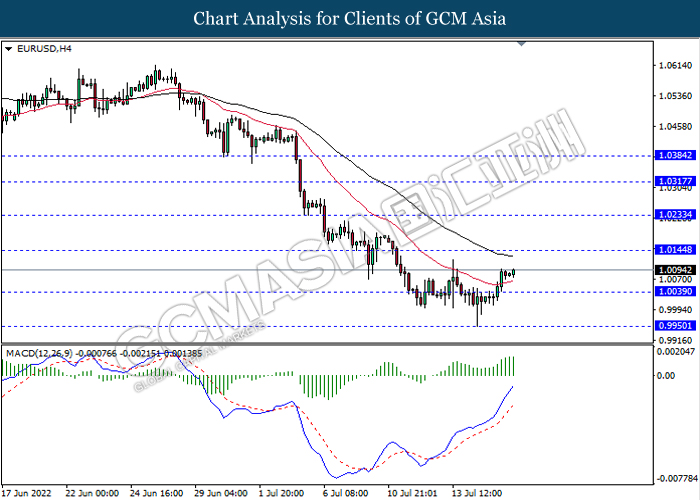

EURUSD, H4: EURUSD was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.0145, 1.0235

Support level: 1.0040, 0.9950

USDJPY, H4: USDJPY was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 138.60, 139.90

Support level: 137.35, 136.65

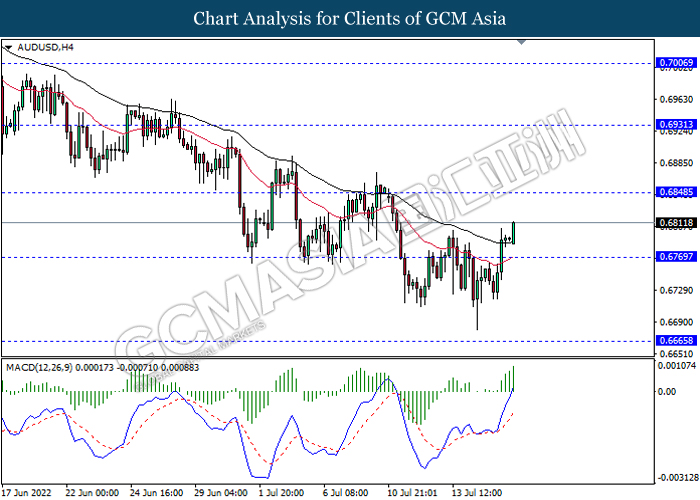

AUDUSD, H4: AUDUSD was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 0.6850, 0.6930

Support level: 0.6770, 0.6665

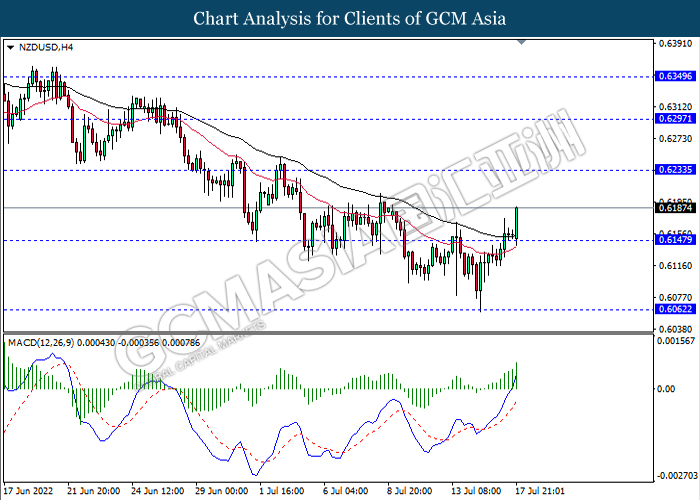

NZDUSD, H4: NZDUSD was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 0.6235, 0.6295

Support level: 0.6145, 0.6060

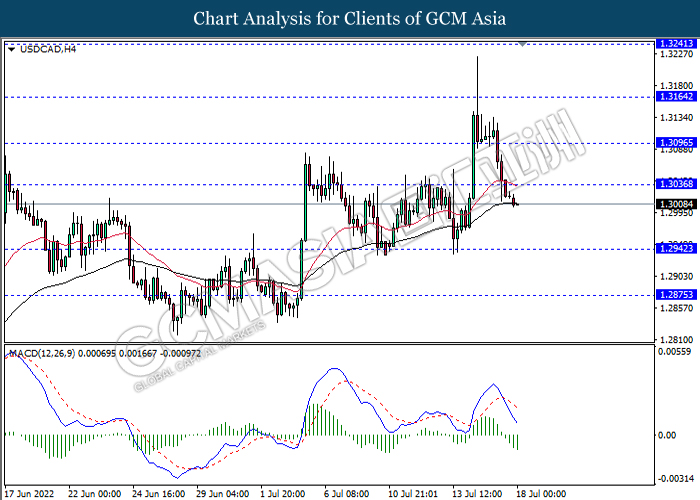

USDCAD, H4: USDCAD was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 1.3035, 1.3095

Support level: 1.2940, 1.2875

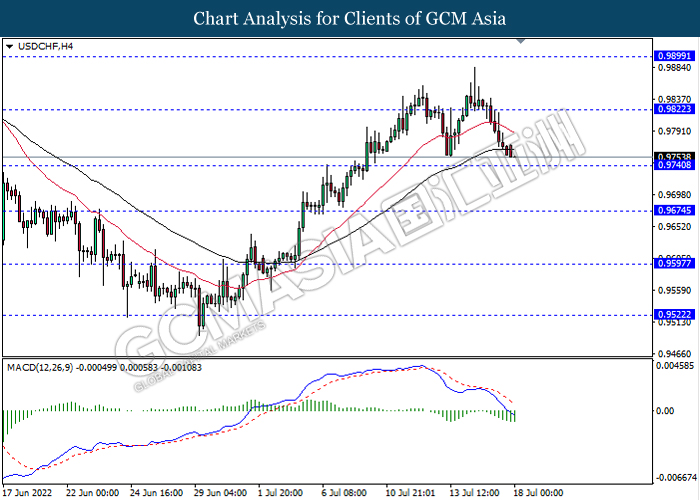

USDCHF, H4: USDCHF was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses if successfully breakout the support level.

Resistance level: 0.9820, 0.9900

Support level: 0.9740, 0.9675

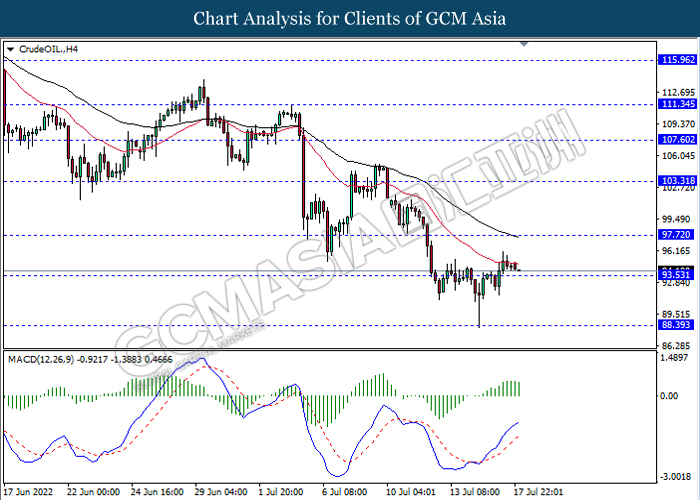

CrudeOIL, H4: Crude oil price was traded lower while currently testing the support level. MACD which illustrated decreasing bullish momentum suggest the commodity to extend its losses if successfully breakout the support level.

Resistance level: 97.70, 103.30

Support level: 93.55, 88.40

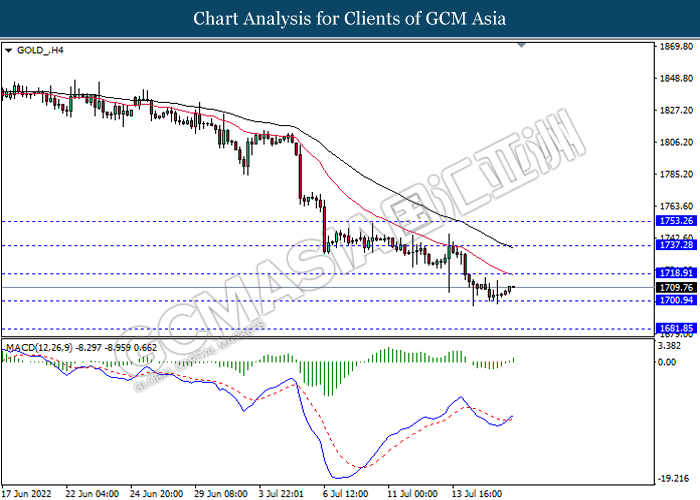

GOLD_, H4: Gold price was traded higher following prior rebound from the support level. MACD which illustrated increasing bullish momentum suggest the commodity to extend its gains.

Resistance level: 1718.90, 1737.30

Support level: 1700.95, 1681.85