18 August 2022 Morning Session Analysis

Rate hike expectation from Fed, spurred bullish momentum on the Greenback.

The Dollar Index which traded against a basket of six major currencies extend its gains over the backdrop of hawkish tone from the Federal Reserve. According to the latest monetary policy meeting minutes, the Federal Reserve officials indicated that they would likely to maintain their rate hike decision until inflation rate calm down substantially. “With the inflation rate remaining well exceed to the Monetary Policy Committee (MPC) objective, they claimed that the restrictive stance of monetary policy was still required to meet the Committee’s inflation target to promote maximum employment and price stability”, according to the FOMC meeting minutes. Though, they did not provide specific guidance for future rate hike decision while reiterating that they would be scrutinizing the economic data closely before making that decision. As of writing, the Dollar Index appreciated by 0.16% to 106.70.

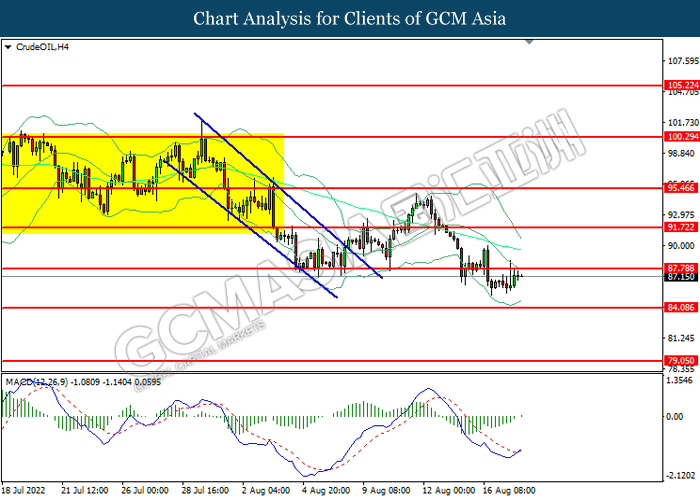

In the commodities market, the crude oil price rebounded by 0.35% to $87.25 per barrel as of writing following the upbeat inventory data was released. According to Energy Information Administration (EIA), the US Crude Oil Inventories came in at -7.056M, well below the market expectation at -0.275M. On the other hand, the gold price slumped 0.01% to $1762.90 per troy ounces as of writing amid strengthening US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 17:00 | EUR – CPI (YoY) (Jul) | 8.90% | 8.90% | – |

| 20:30 | USD – Initial Jobless Claims | 262K | 265K | – |

| 20:30 | USD – Philadelphia Fed Manufacturing Index (Aug) | -12.3 | -5 | – |

| 22:00 | USD – Existing Home Sales (Jul) | 5.12M | 4.88M | – |

Technical Analysis

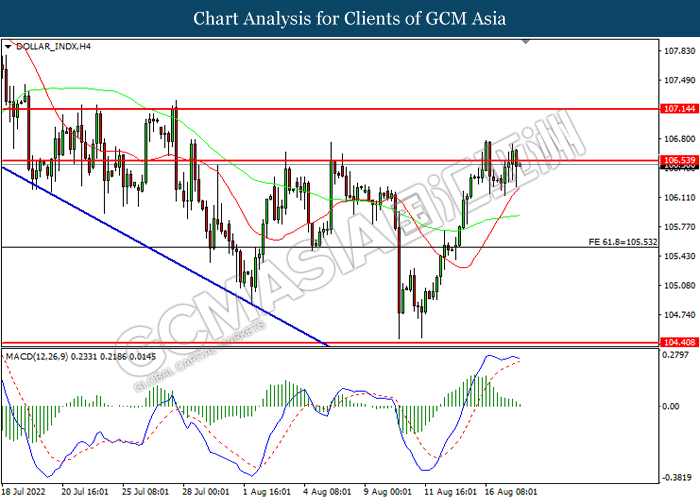

DOLLAR_INDX, H4: Dollar index was traded higher while currently testing the resistance level. However, MACD which illustrated diminishing bullish momentum suggest the index to be traded lower as technical correction.

Resistance level: 106.55, 107.15

Support level: 105.55, 104.40

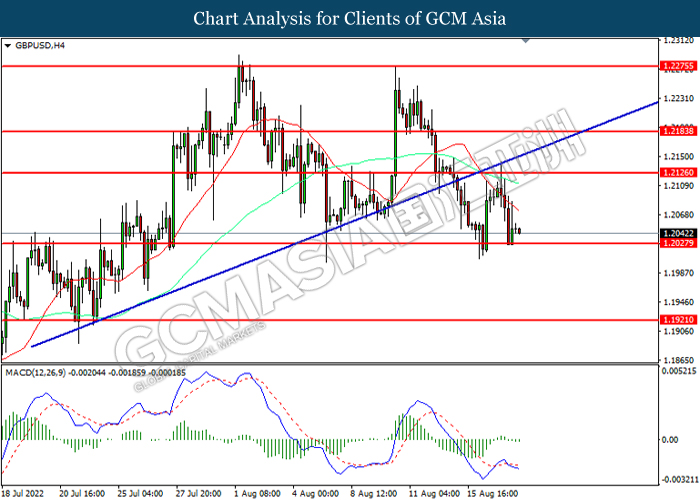

GBPUSD, H4: GBPUSD was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after breakout.

Resistance level: 1.2125, 1.2185

Support level: 1.2055, 1.1975

EURUSD, H4: EURUSD was traded lower while currently testing the support level. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.0285, 1.0365

Support level: 1.0155, 1.0085

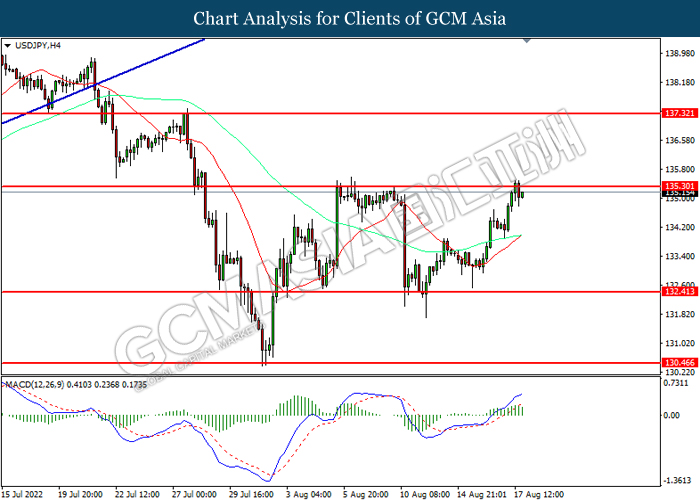

USDJPY, H4: USDJPY was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains after breakout.

Resistance level: 135.30, 137.30

Support level: 132.40, 130.45

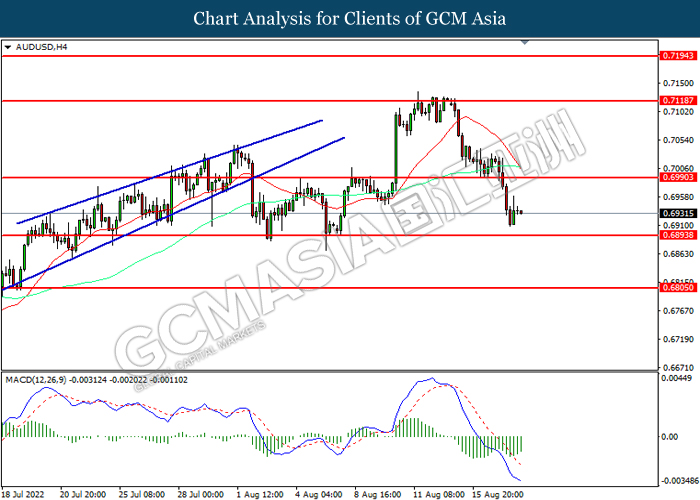

AUDUSD, H4: AUDUSD was traded lower while currently testing the support level. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.6990, 0.7120

Support level: 0.6895, 0.6805

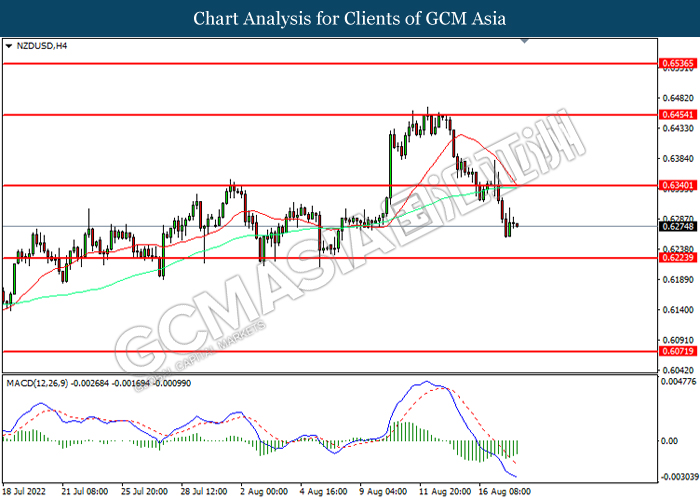

NZDUSD, H4: NZDUSD was traded lower following prior breakout below the previous support level. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.6340, 0.6455

Support level: 0.6225, 0.6070

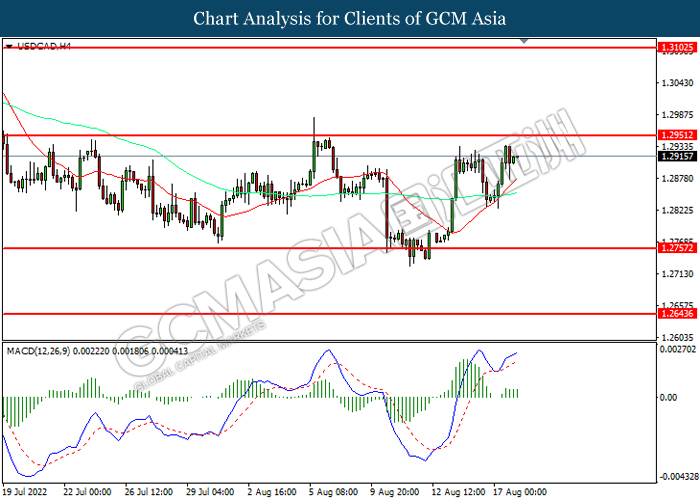

USDCAD, H4: USDCAD was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains after breakout.

Resistance level: 1.2950, 1.3105

Support level: 1.2755, 1.2645

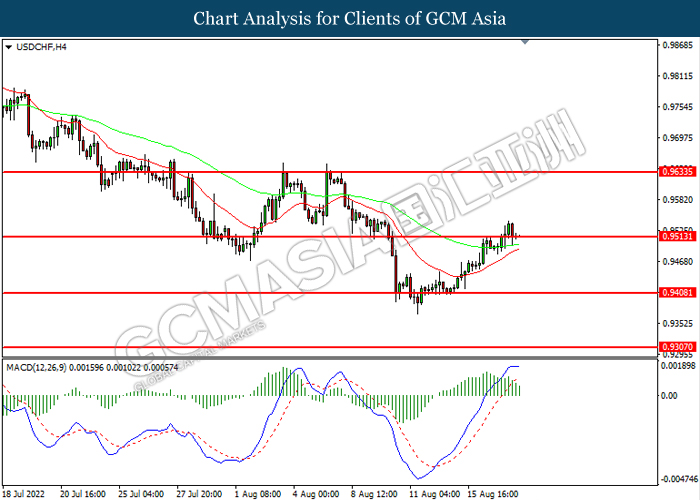

USDCHF, H4: USDCHF was traded higher while currently testing the resistance level. However, MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 0.9515, 0.9635

Support level: 0.9410, 0.9305

CrudeOIL, H4: Crude oil price was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the commodity to extend its gains after breakout.

Resistance level: 87.80, 91.70

Support level: 84.10, 79.05

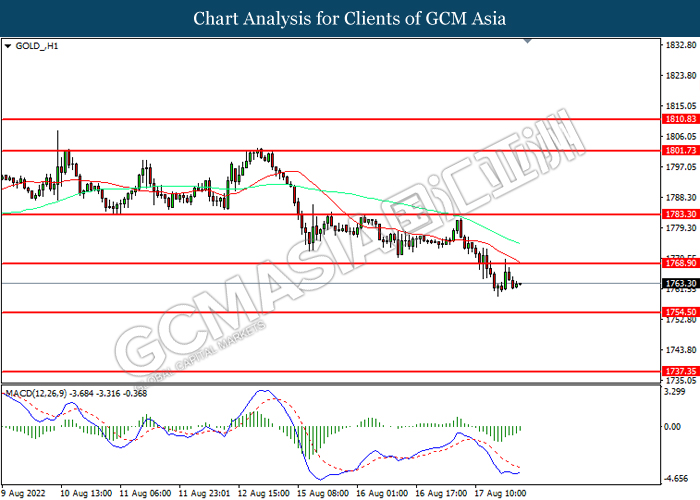

GOLD_, H1: Gold price was traded lower following prior breakout below the previous support level. However, MACD which illustrated diminishing bearish momentum suggest the commodity to be traded higher as technical correction.

Resistance level: 1768.90, 1783.30

Support level: 1754.50, 1737.35