18 October 2022 Afternoon Session Analysis

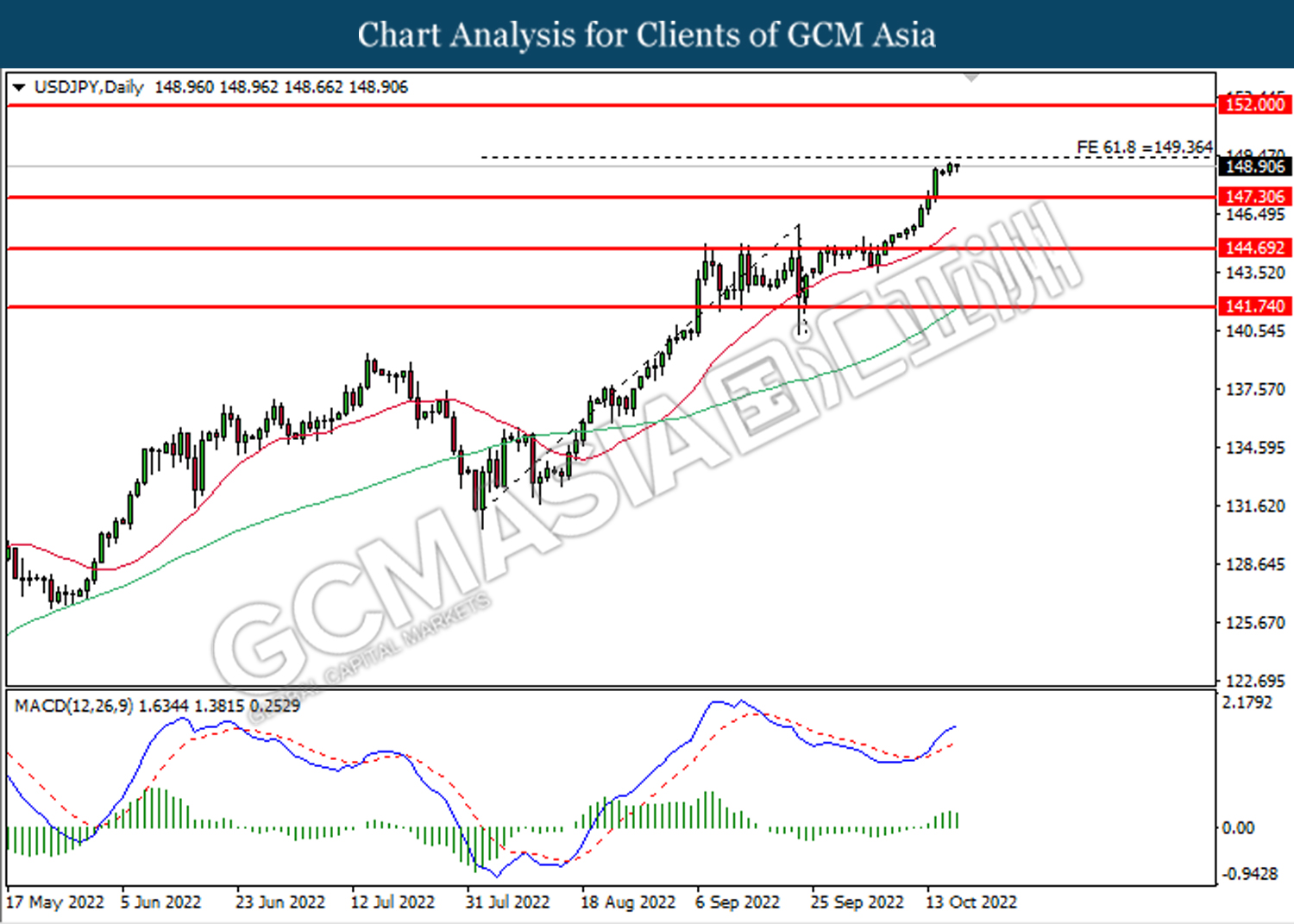

Japanese Yen sank despite high possibility of intervention by Japan government.

The Japanese Yen, which is majorly traded by the global investors, plunged as the Bank of Japan continues to maintain its ultra-loosening monetary policy despite the sky-high inflationary pressures in the nation. The Japan’s contradictory stance leaves yen at risk of further slide, whereby the other major central bank such as Federal Reserve, Bank of England and European Central Bank hiked their interest rate aggressively to calm down the overheating economy. After the Japanese Yen suffering a tremendous depreciation for quite some time, the Japan’s government vowed that they are closely watching the FX moves with a high sense of urgency and appropriate steps will be taken if necessary. Back to few weeks ago, Japan’s government intervened the FX market by selling the USD and buying the Japanese Yen concurrently. Such a move had pushed down the value of USD/JPY by roughly about 500 pips. Therefore, going forward, the market participants will continue to eyes on the further comment and action of the Bank of Japan to scrutinize the movement of Japanese Yen. As of writing, the pair of USD/JPY edged down by 0.06% to 148.95.

In the commodities market, the crude oil price dipped 0.41% to $85.50 per barrel amid the heightening of market fears over the rising covid-19 cases in China, which could deteriorate the oil demand in the future. Besides, the gold prices dropped 0.04% to $1649.95 per troy ounce as the dollar’s strengthened.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 17:00 | EUR – German ZEW Economic Sentiment (Oct) | -61.9 | -65.7 | – |

Technical Analysis

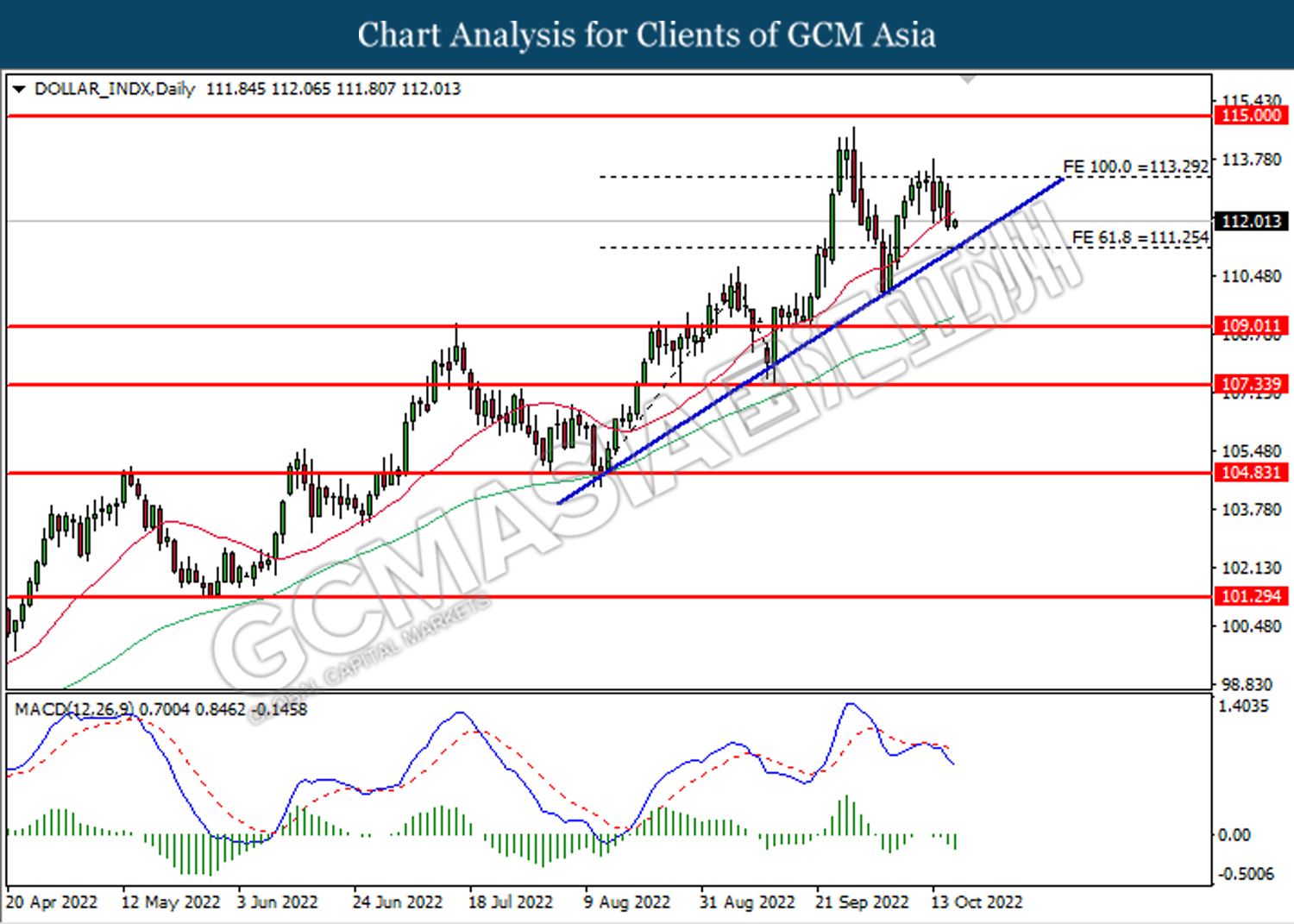

DOLLAR_INDX, Daily: Dollar index was traded lower following the retracement from the resistance level at 113.30. MACD which illustrated bearish bias momentum suggests the index to extend its losses toward the support level at 111.25.

Resistance level: 113.30, 115.00

Support level: 111.25, 109.00

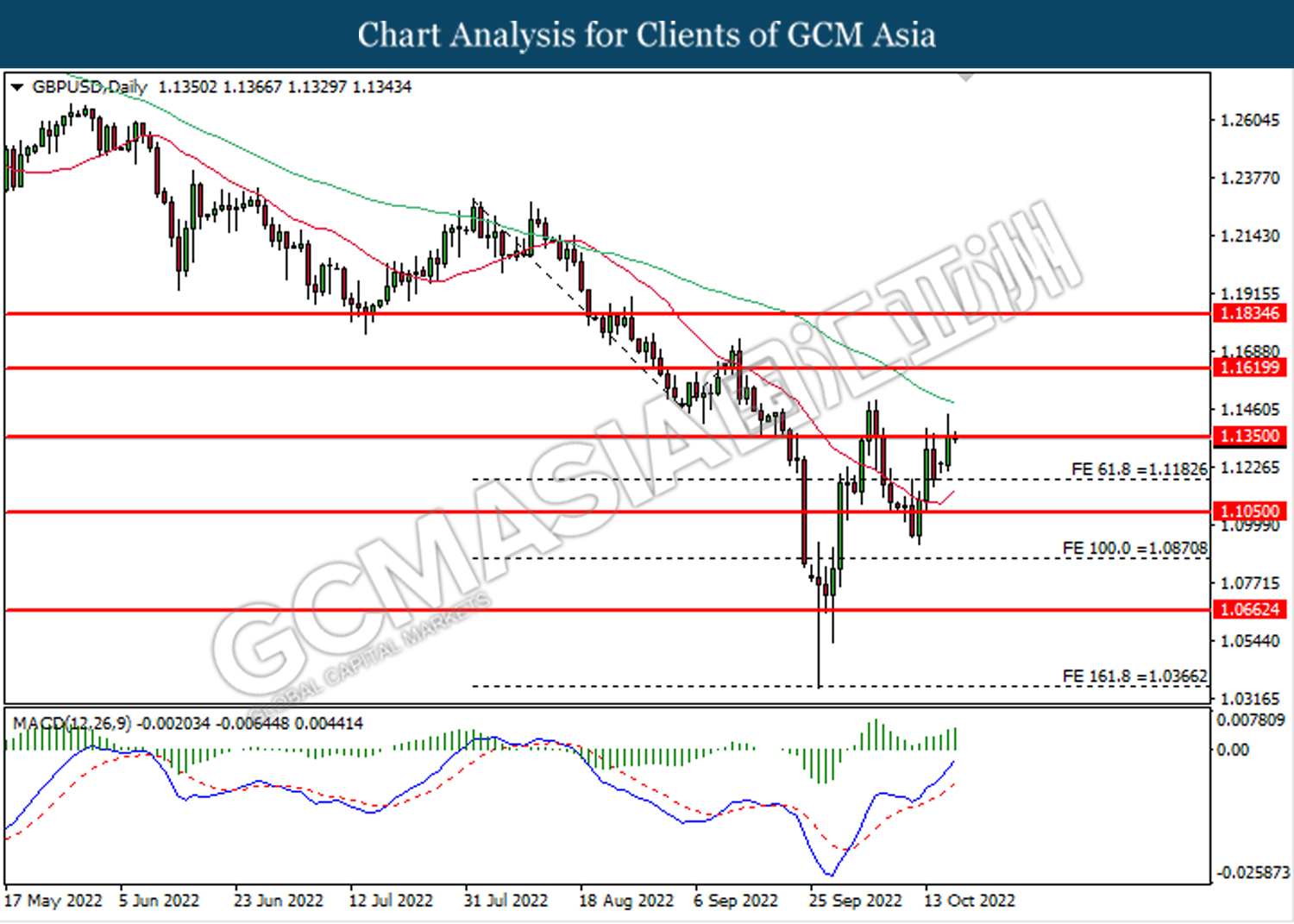

GBPUSD, Daily: GBPUSD was traded higher while currently testing the resistance level at 1.1350. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.1350, 1.1620

Support level: 1.1185, 1.1050

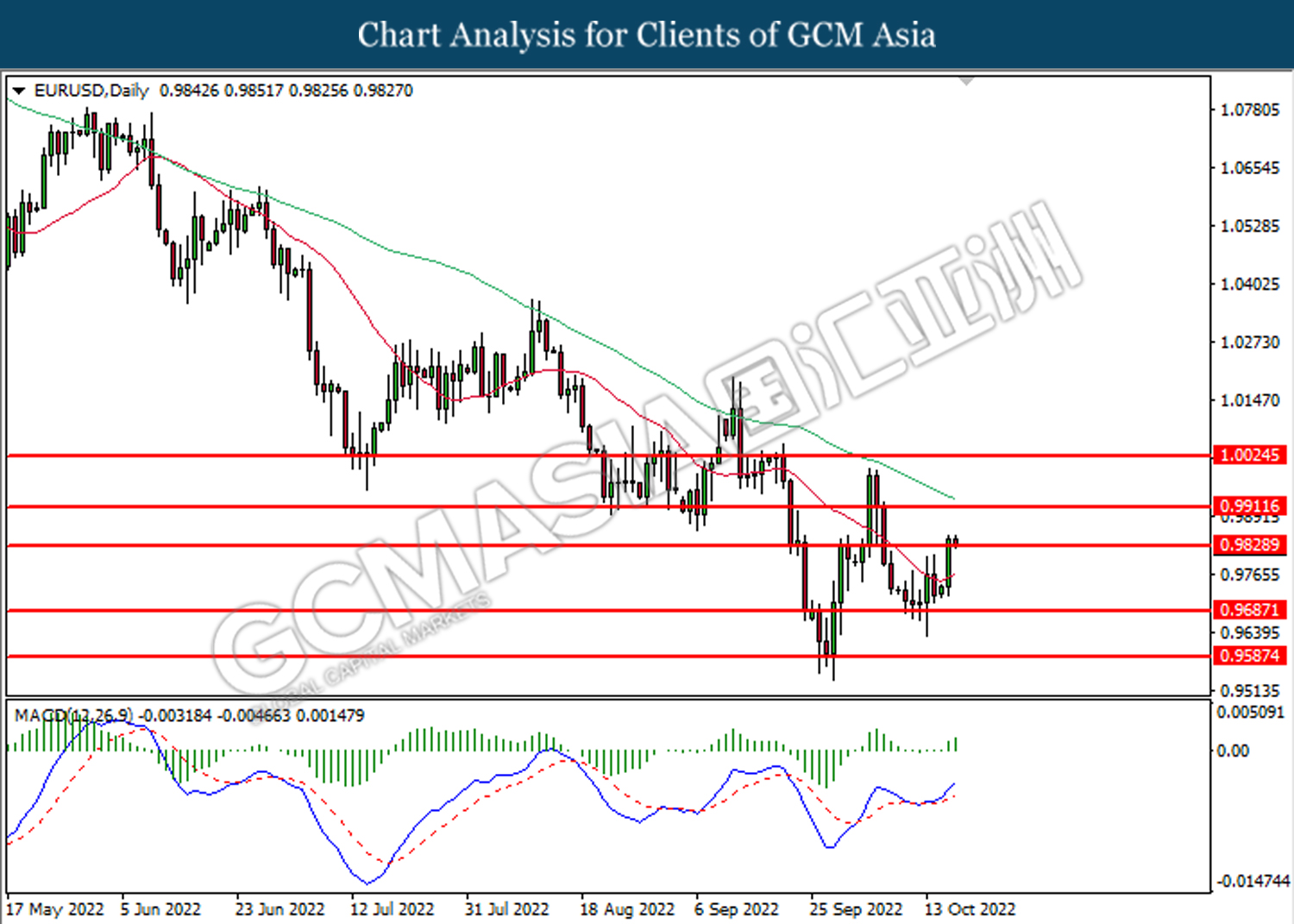

EURUSD, Daily: EURUSD was traded higher following prior breakout above the previous resistance level at 0.9830. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 0.9910.

Resistance level: 0.9910, 1.0025

Support level: 0.9830, 0.9685

USDJPY, Daily: USDJPY was traded higher following prior breakout above the previous resistance level at 147.30. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 149.35.

Resistance level: 149.35, 152.00

Support level: 147.30, 144.70

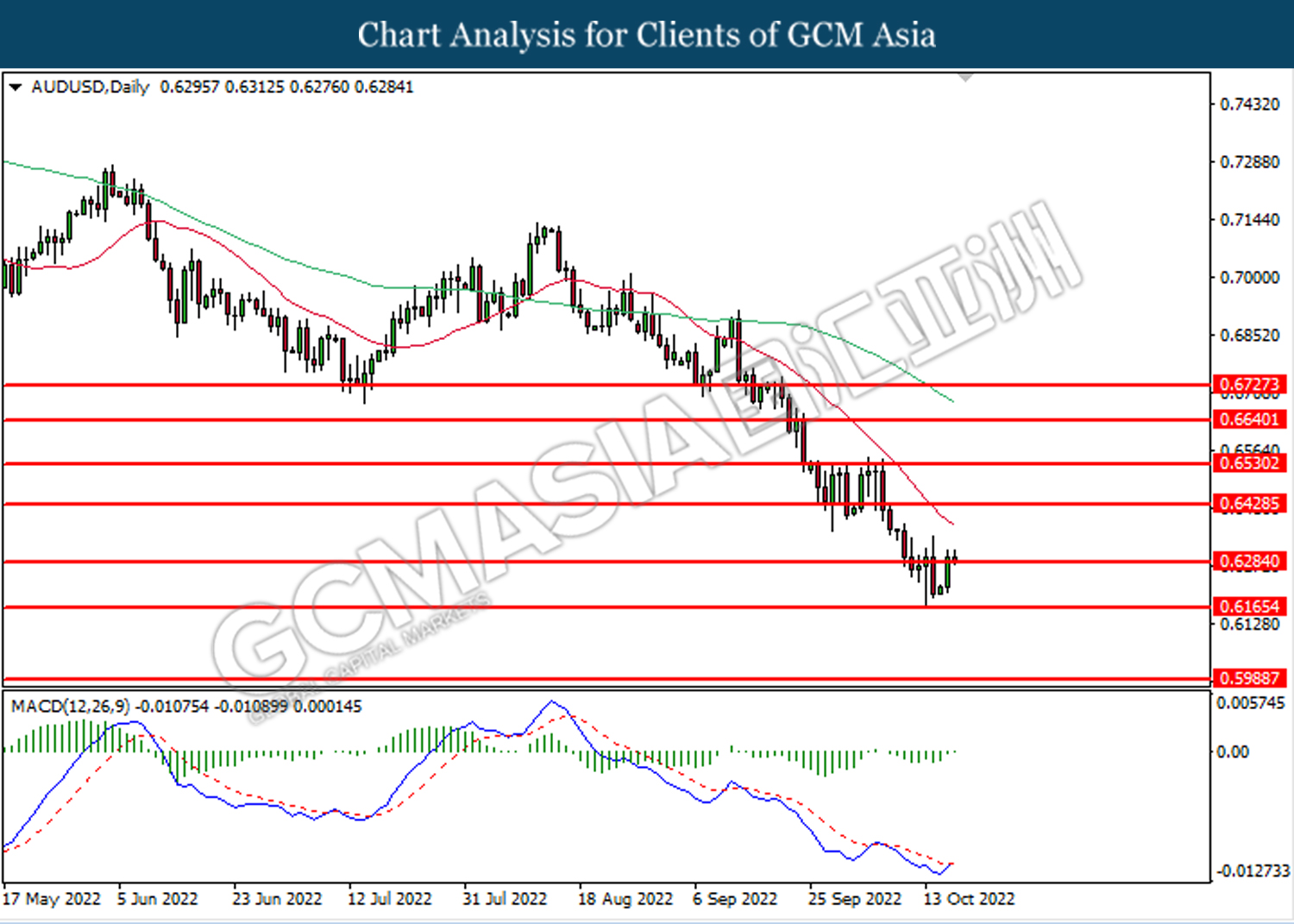

AUDUSD, Daily: AUDUSD was traded higher while currently testing the resistance level at 0.6285. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 0.6285, 0.6430

Support level: 0.6165, 0.5990

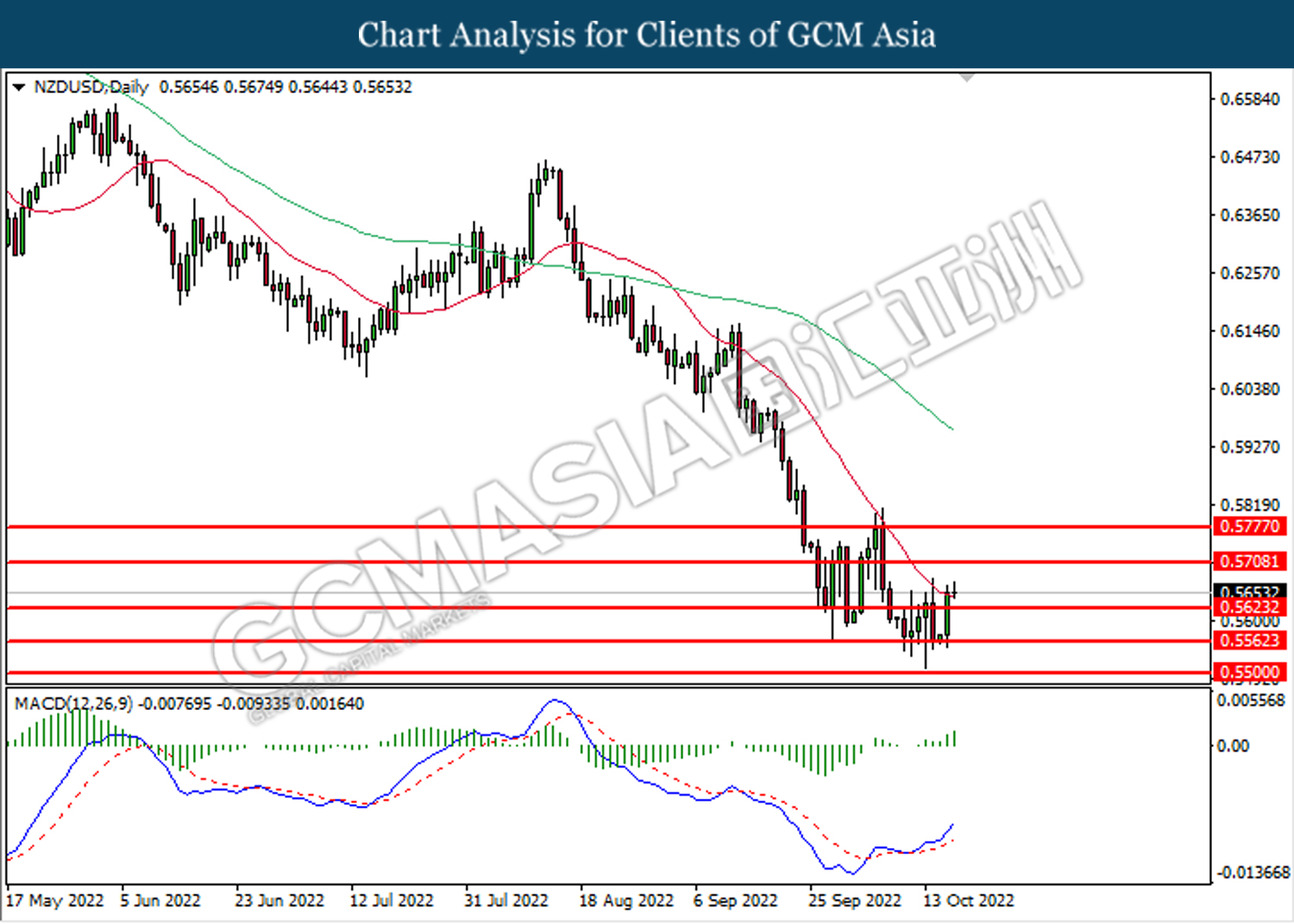

NZDUSD, Daily: NZDUSD was traded higher following prior breakout above the previous resistance level at 0.5625. MACD which illustrated bullish bias momentum suggest the pair to extend gains toward the resistance level at 0.5710.

Resistance level: 0.5710, 0.5775

Support level: 0.5625, 0.5560

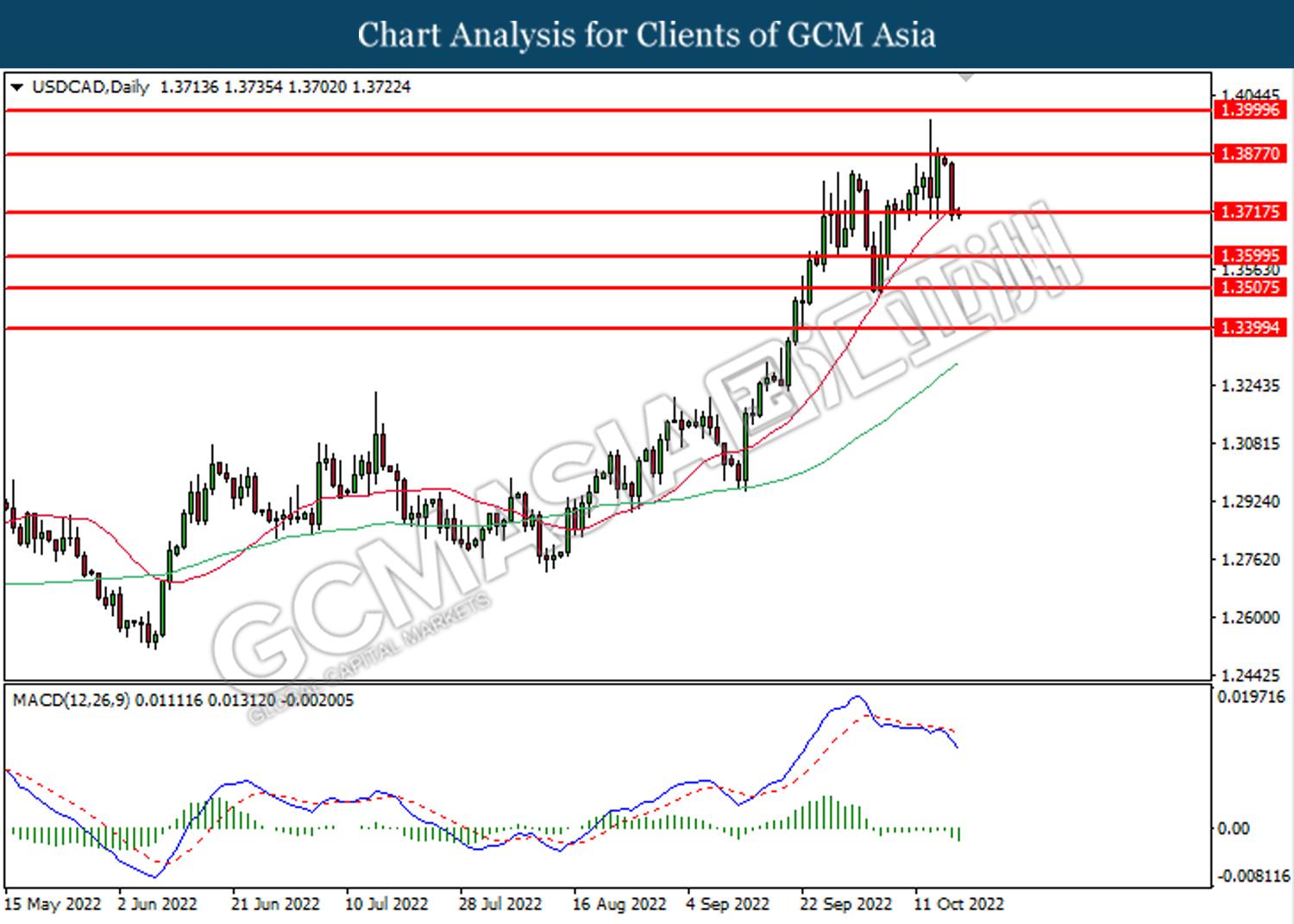

USDCAD, Daily: USDCAD was traded lower while currently testing the support level at 1.3715. MACD which illustrated bearish bias momentum suggests the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.3875, 1.4000

Support level: 1.3715, 1.3600

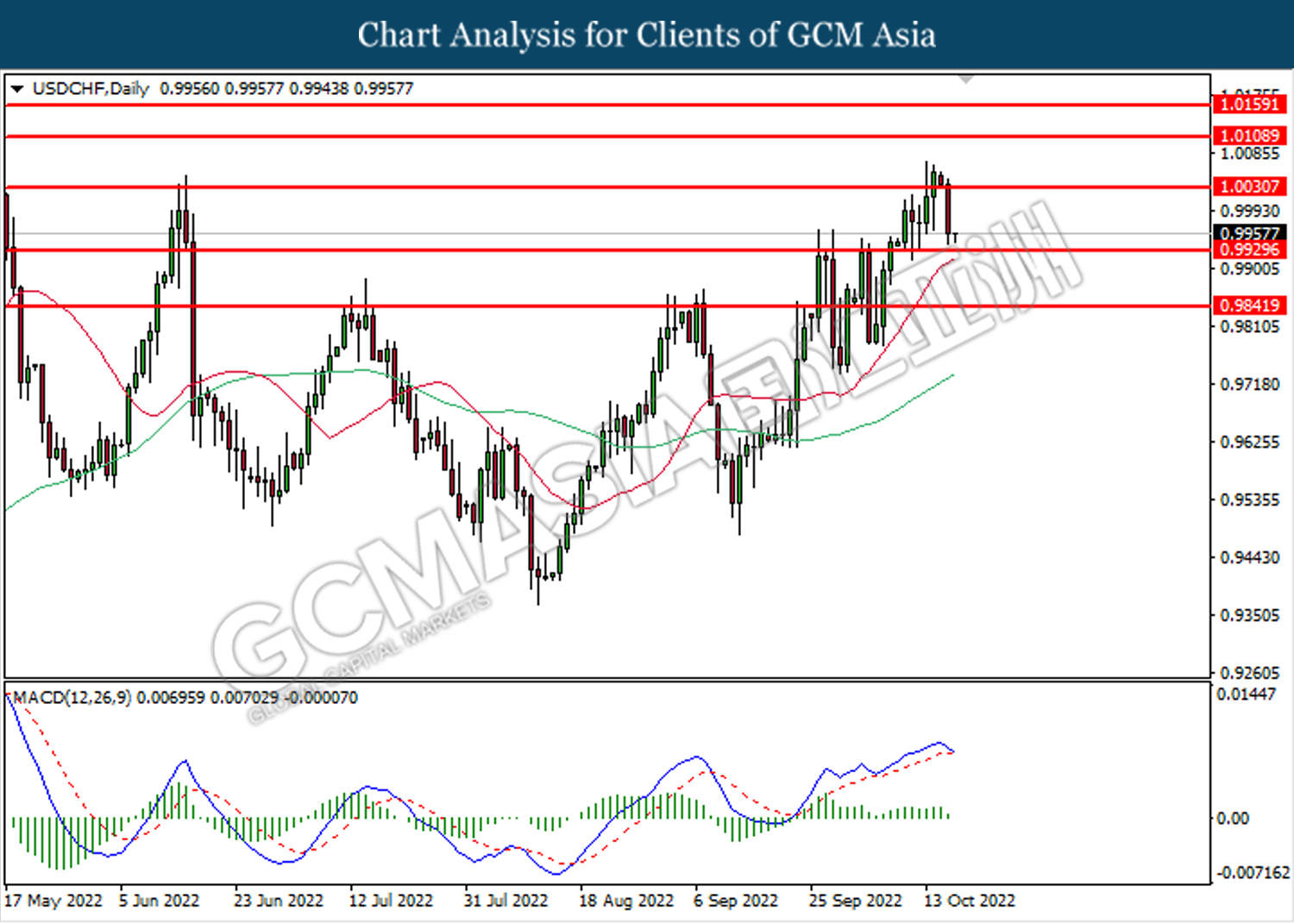

USDCHF, Daily: USDCHF was traded lower following prior breakout below the previous support level at 1.0030. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward the support level at 0.9930.

Resistance level: 1.0030, 1.0110

Support level: 0.9930, 0.9840

CrudeOIL, Daily: Crude oil price was traded lower following prior breakout below the previous support level at 86.15. MACD which illustrated bearish bias momentum suggests the commodity to extend its losses toward the support level at 80.60.

Resistance level: 86.15, 89.45

Support level: 80.60, 76.60

GOLD_, Daily: Gold price was traded higher following prior rebound from the lower level. MACD which illustrated diminishing bearish momentum suggest the commodity to extend its rebound toward the resistance level at 1661.40.

Resistance level: 1661.40, 1693.35

Support level: 1627.40, 1600.00