18 October 2022 Morning Session Analysis

Pound surged as UK fiscal policy U-turned.

Pound Sterling rebounded from its lower level following the UK new Finance Minister announced a comprehensive retreat on the UK government’s tax and spending plans on Monday in order to calm the jittery markets and restore investor confident toward the government’s credibility. According to CNBC, the UK Finance Minister Jeremy Hunt announce that almost all of the controversial tax measures which announced earlier would be reversed. The major U-turn includes scrapping the cut for the lowest rate of income tax as well as reduction on dividend tax rates. The stunning reversal would likely to raise about $36 billion for the UK budget. The announcement had eased market concerns toward the financial capability for the UK government, increasing the appeal for the UK government bond. As of writing, GBP/USD depreciated by 0.01% to 1.1355.

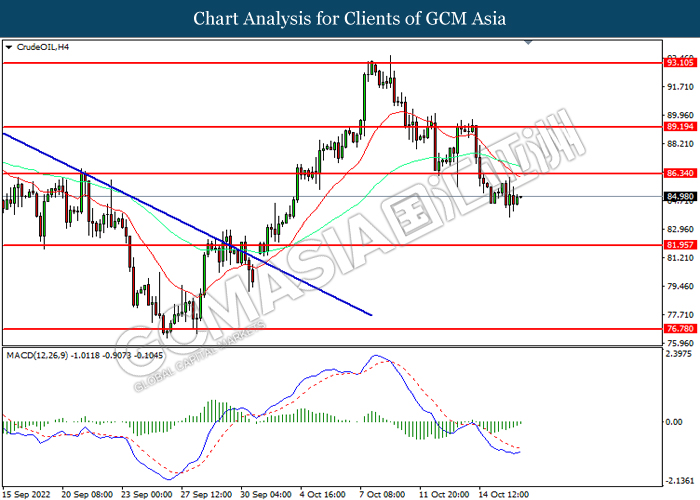

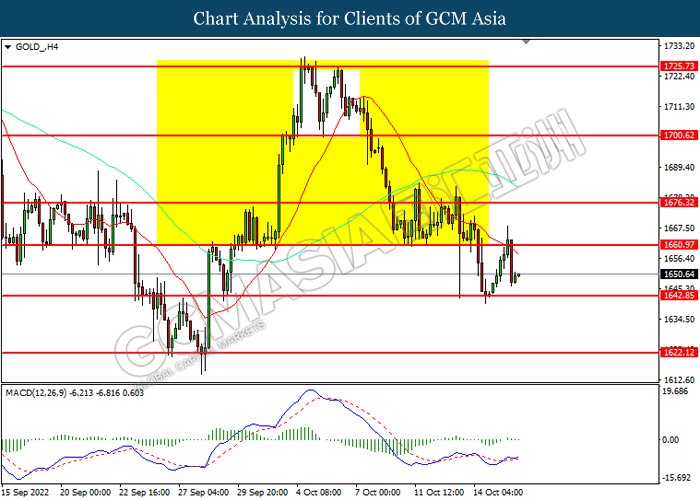

In the commodities market, the crude oil price appreciated by 0.23% to $84.95 per barrel as of writing. The oil market rebounded from its lower level as more OPEC+ members expressed their willingness to support for the recent production cut of over 2 million barrels per day. On the other hand, the gold market extends its losses by 0.01% to $1650.50 per troy ounces as of writing amid rate hike expectation from Federal Reserve continue to drag down the appeal for this safe-haven gold.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 17:00 | EUR – German ZEW Economic Sentiment (Oct) | -61.9 | -65.7 | – |

Technical Analysis

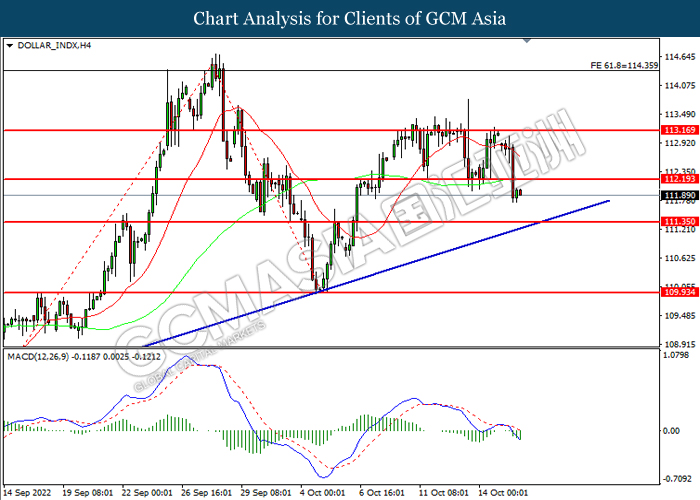

DOLLAR_INDX, H4: Dollar index was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the index to extend its losses toward support level.

Resistance level: 112.20, 113.15

Support level: 111.35, 109.95

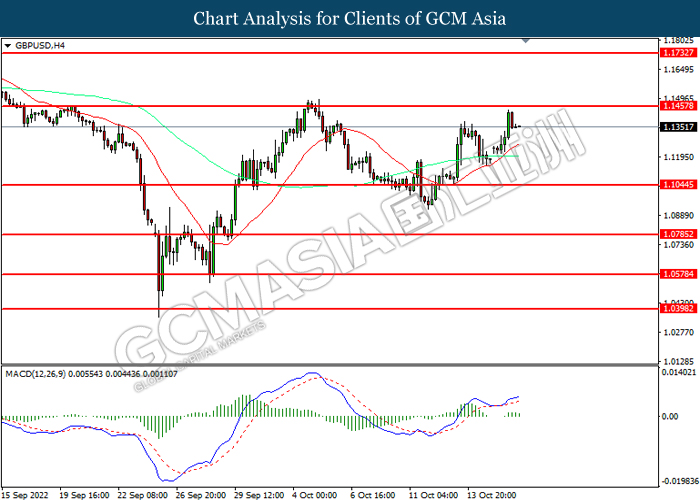

GBPUSD, H4: GBPUSD was traded higher while currently testing the resistance level. However, MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.1455, 1.1735

Support level: 1.1045, 1.0785

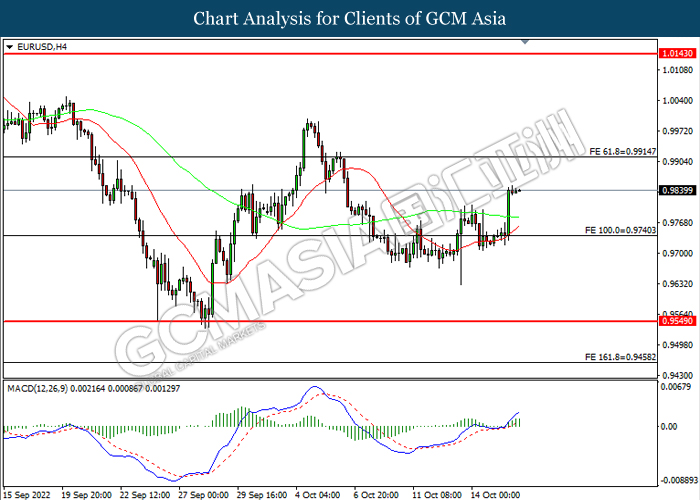

EURUSD, H4: EURUSD was traded higher following prior rebounded from the support level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 0.9915, 1.0145

Support level: 0.9740, 0.9550

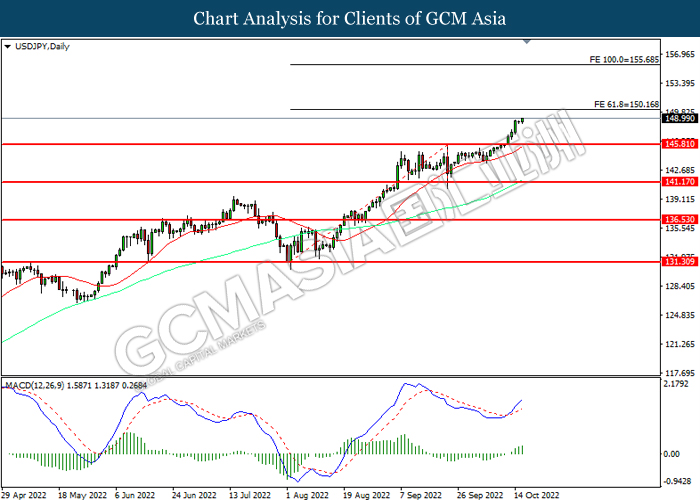

USDJPY, Daily: USDJPY was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains toward resistance level.

Resistance level: 150.15, 155.70

Support level: 145.80, 141.15

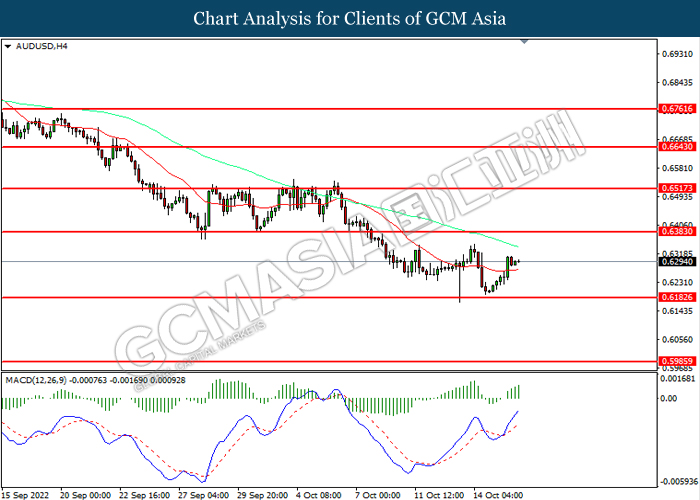

AUDUSD, H4: AUDUSD was traded higher following prior rebounded from the support level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 0.6385, 0.6515

Support level: 0.6185, 0.5985

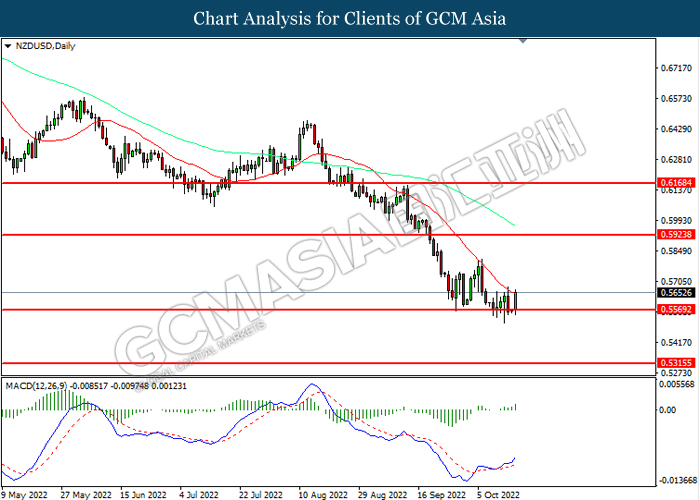

NZDUSD, Daily: NZDUSD was traded lower while currently testing the support level. However, MACD which illustrated increasing bullish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.5925, 0.6170

Support level: 0.5570, 0.5315

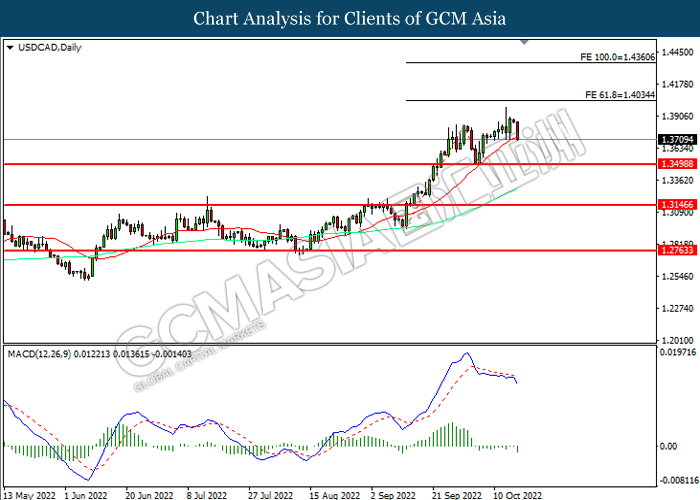

USDCAD, Daily: USDCAD was traded higher while currently near the resistance level. However, MACD which illustrated increasing bearish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.4035, 1.4360

Support level: 1.3500, 1.3145

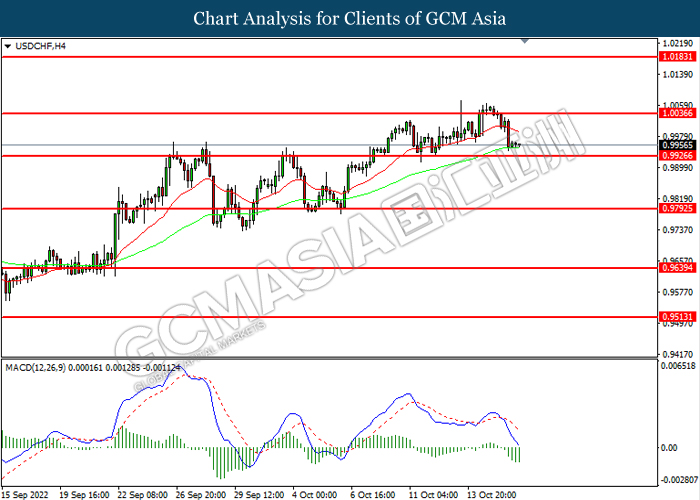

USDCHF, H4: USDCHF was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after breakout.

Resistance level: 1.0035, 1.0185

Support level: 0.9925, 0.9795

CrudeOIL, H4: Crude oil price was traded lower following prior breakout below the previous support level. However, MACD which illustrated diminishing bearish momentum suggest the commodity to be traded higher as technical correction.

Resistance level: 86.35, 89.20

Support level: 81.95, 76.80

GOLD_, H4: Gold price was traded lower while currently testing the support level. MACD which illustrated diminishing bullish momentum suggest the commodity to extend its lsoses.

Resistance level: 1660.95, 1676.30

Support level: 1642.85, 1622.10