18 November 2021 Afternoon Session Analysis

Pound sterling rose following upbeat CPI data.

The pound sterling which traded against the dollar and other currency pairs have rose following recent release of positive U.K CPI data. For October, the U.K CPI rose to 4.2%, much higher than the forecast of 3.9%. The increase in inflation was due to rising commodity prices such as gasoline, crude oil and natural gas which increased the costs of the manufacturing, industrial and transmission sectors. As inflation levels in the UK continue to rise, investors are speculating that the Bank of England is likely to implement an interest rate hike soon. According to economists, they expect the BoE to raise interest rates as early as next month. At the time of writing, GBP/USD rose 0.10% to 1.3491.

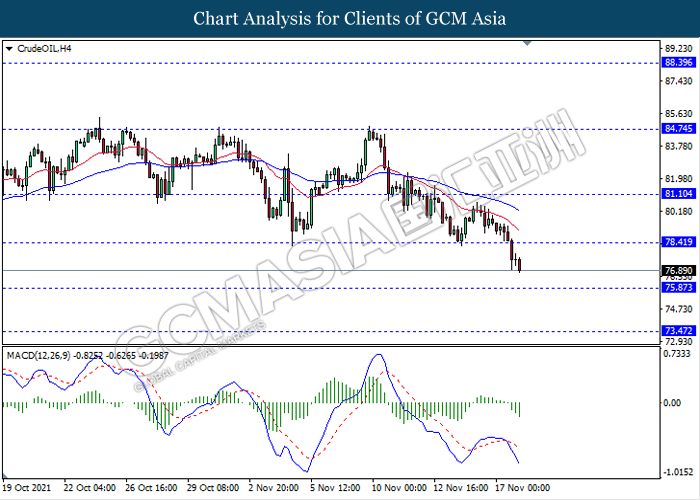

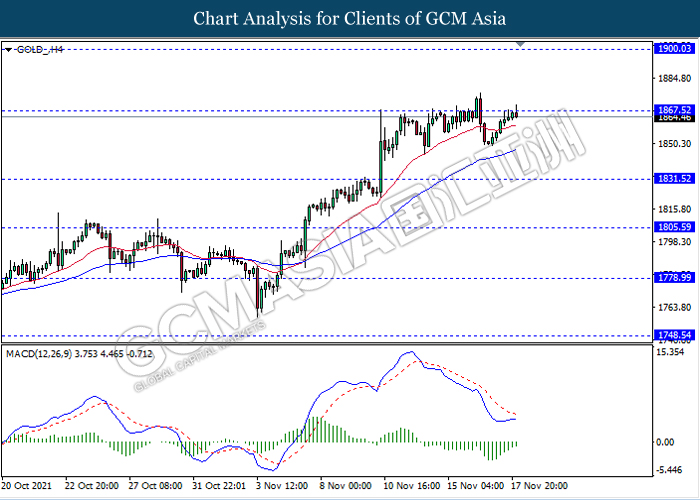

In the commodities market, crude oil price fell 0.78% to $76.85 per barrel as of writing following news of U.S and other countries to use oil reserves. According to reports from Reuters, the United States was asking major oil consumers like China and Japan to consider a coordinated release of oil reserves in order to lower prices. On the other hand, gold price edge higher 0.06% to $1865.89 a troy ounce at the time of writing following dollar retreat.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 21:30 | USD – Initial Jobless Claims | 267K | 260K | – |

| 21:30 | USD – Philadelphia Fed Manufacturing Index (Nov) | 23.8 | 24.0 |

Technical Analysis

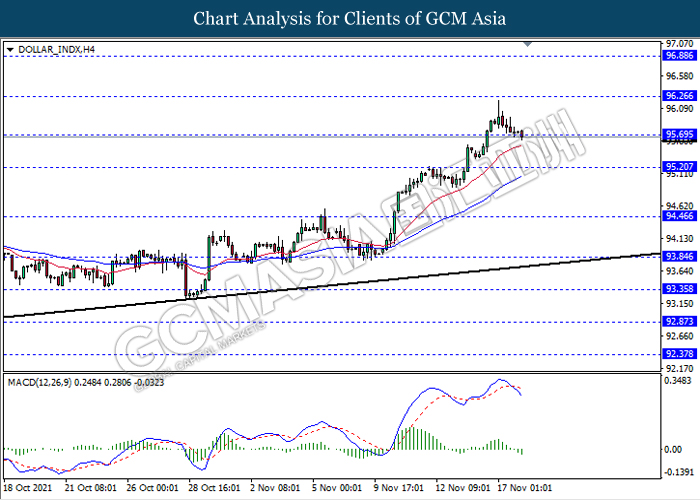

DOLLAR_INDX, H4: Dollar index was traded lower while currently testing the support level 95.70. MACD which illustrate bearish momentum signal with the formation of death cross suggest the dollar to extend its losses after it breaks below the support level.

Resistance level: 96.25, 96.90

Support level: 95.70, 95.20

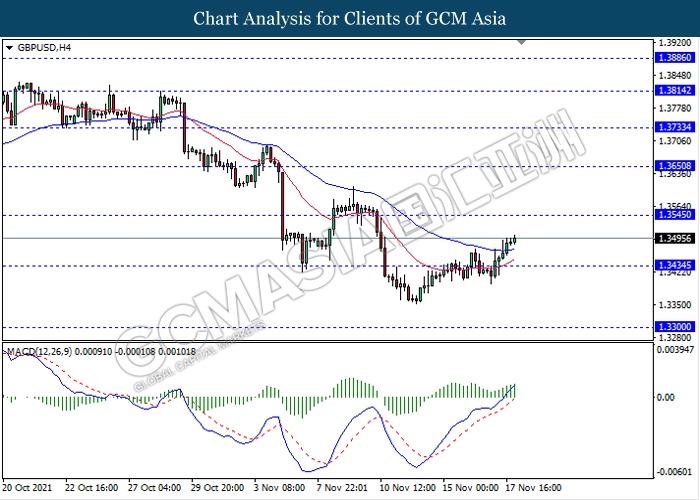

GBPUSD, H4: GBPUSD was traded higher following recent rebound from the support level 1.3435. MACD which illustrate bullish momentum signal suggest the pair to extend its rebound towards the resistance level 1.3545.

Resistance level: 1.3545, 1.3650

Support level: 1.3435, 1.3300

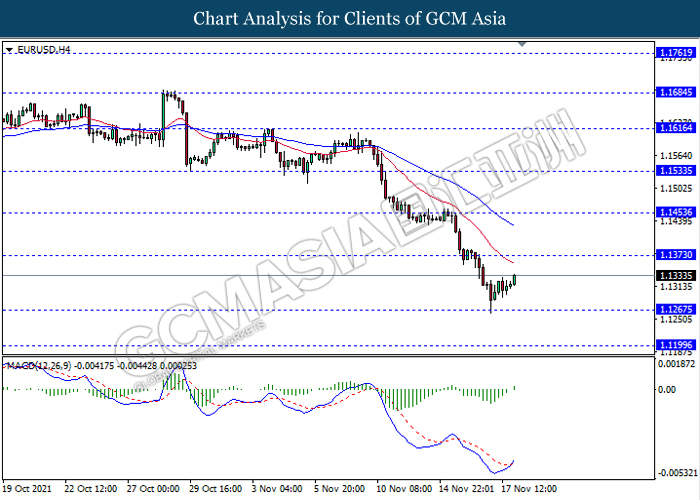

EURUSD, H4: EURUSD was traded higher following prior rebound from the support level 1.1265. MACD which illustrate bullish momentum signal with the formation of golden cross suggest the pair to extend its rebound towards the resistance level 1.1375.

Resistance level: 1.1375, 1.1455

Support level: 1.1265, 1.1200

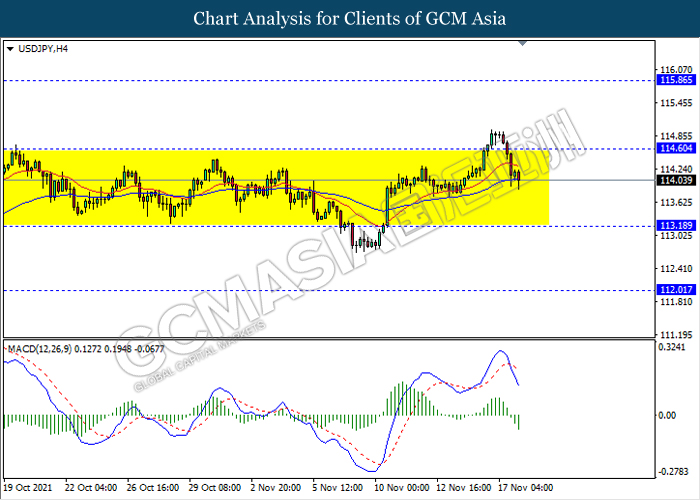

USDJPY, H4: USDJPY remain traded in a sideway channel following recent retracement from the resistance level 114.60. However, MACD which illustrate bearish bias signal with the formation of death cross suggest the pair to be traded lower in short term towards the support level 113.20.

Resistance level: 114.60, 115.85

Support level: 113.20, 112.00

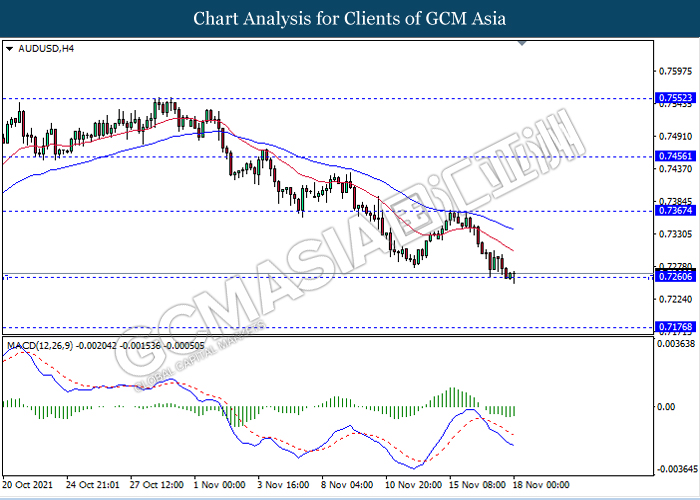

AUDUSD, H4: AUDUSD was traded lower while currently testing the support level 0.7260. MACD which illustrate ongoing bearish momentum signal suggest the pair to extend its losses after it breaks below the support level.

Resistance level: 0.7365, 0.7455

Support level: 0.7260, 0.7175

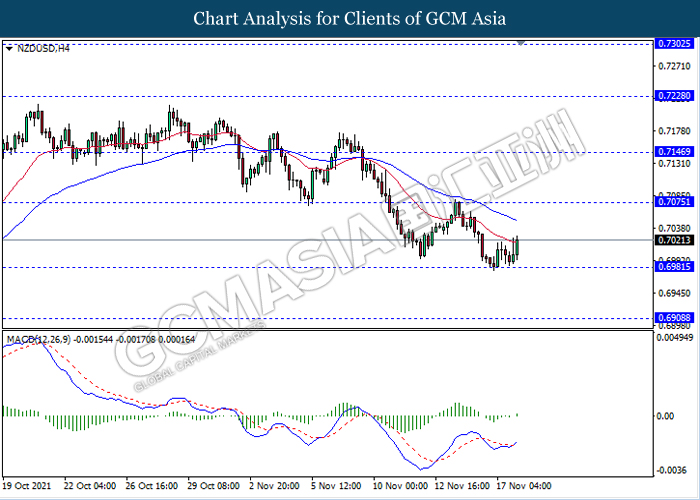

NZDUSD, H4: NZDUSD was traded higher following prior rebound from the support level 0.6980. MACD which illustrate bullish bias signal with the formation of golden cross suggest the pair to extend its rebound towards the resistance level 0.7075.

Resistance level: 0.7075, 0.7145

Support level: 0.6980, 0.6910

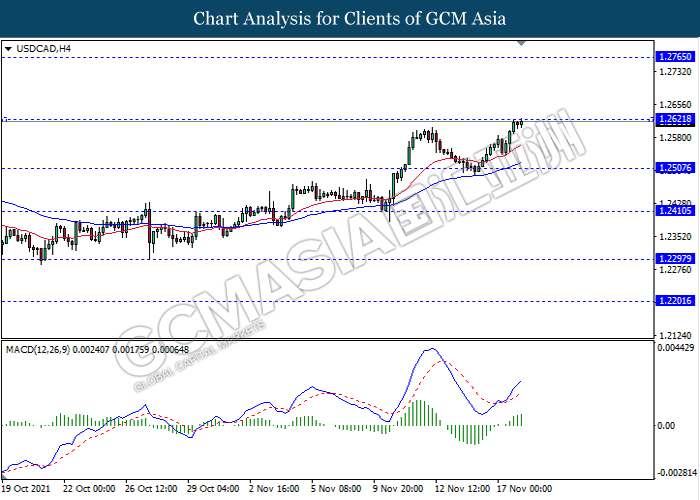

USDCAD, H4: USDCAD was traded higher while currently testing the resistance level 1.2620. MACD which illustrate bullish momentum signal suggest the pair to extend its gains after it breaks above the resistance level 1.2620.

Resistance level: 1.2620, 1.2765

Support level: 1.2505, 1.2410

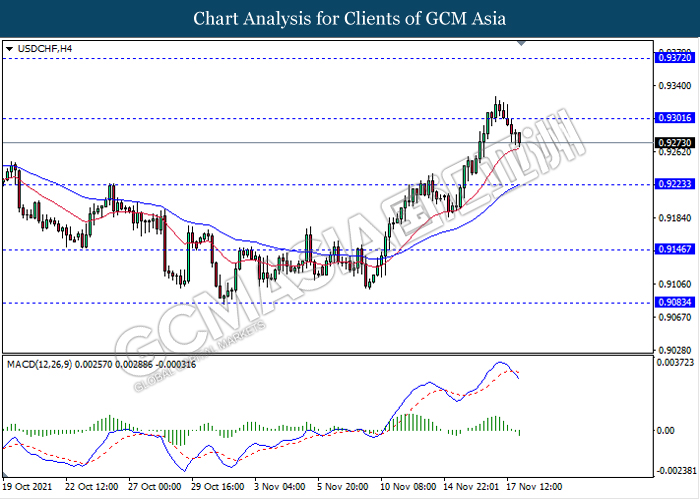

USDCHF, H4: USDCHF was traded lower following prior retracement from the resistance level 0.9300. MACD which illustrate bearish momentum signal with the formation of death cross suggest the pair to extend its retracement towards the support level 0.9225.

Resistance level: 0.9300, 0.9370

Support level: 0.9225, 0.9145

CrudeOIL, H4: Crude oil price was traded lower while currently testing near the support level 75.85. MACD which illustrate bearish momentum signal suggest the commodity to extend its losses after it breaks below the support level.

Resistance level: 78.40, 81.10

Support level: 75.85, 73.45

GOLD_, H4: Gold price was traded higher while currently testing the resistance level 1867.50. MACD which illustrate diminishing bearish momentum signal suggest the commodity to extend its gains after it breaks above the resistance level.

Resistance level: 1867.50, 1900.05

Support level: 1831.50, 1805.60