19 January 2022 Afternoon Session Analysis

Pound slumped amid political uncertainty.

The Pound Sterling slumped amid rising political tensions in the United Kingdom, which dialing down the market optimism toward the economic progression. According to ABC News, U.K. Prime Minister Boris Johnson faced new calls for his resignation over a party he and his wife attended with Downing Street staff in May 2020, when the country was still under lockdown. Despite Boris Johnson had apologized for violating the Standard Operating Procedure (SOP) for the Covid-19 pandemic, the apology still did little to wave off calls to resign from opposition politician party. Nonetheless, the losses experienced by the Pound Sterling was limited amid positive sentiment around improving trends recently in Covid-19 infections rates and hospital admission. According to the latest NHS data, Covid-related hospital admission are failing in every region of England. As of writing, GBP/USD surged 0.10% to 1.3606.

In the commodities market, the crude oil price appreciated by 0.05% to $86.40 per barrel as of writing. The oil price extends its gains while reaching seven-year high amid an outage on a pipeline from Iraq to Turkey spurred concerns over the supply disruption for the crude oil commodity. According to Reuters, Turkey’s state pipeline operators Botas claimed on Tuesday that the explosion on the Kirkuk-Ceyhan pipeline had affected the oil export from Iraq to Turkish port. On the other hand, the gold price depreciated by 0.04% to $1813.10 per troy ounces as of writing amid strengthening US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

22:15 GBP BoE Gov Bailey Speaks

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 15:00 | GBP – CPI (YoY) (Dec) | 5.10% | 5.20% | – |

| 21:30 | USD – Building Permits (Dec) | 1.717M | 1.701M | – |

| 21:30 | CAD – Core CPI (MoM) (Dec) | 0.60% | – | – |

Technical Analysis

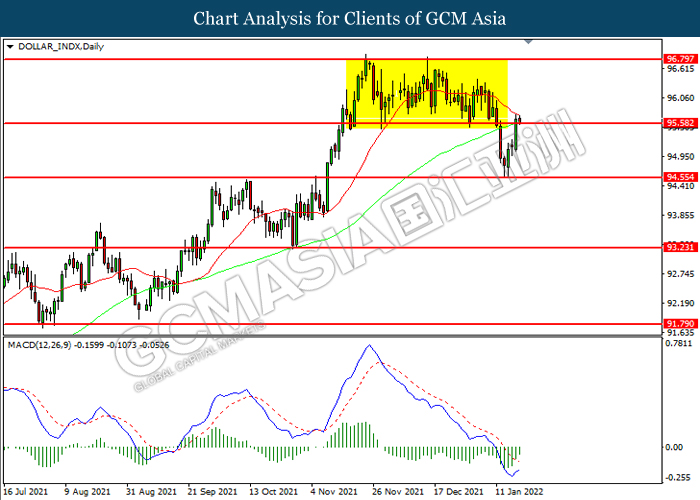

DOLLAR_INDX, Daily: Dollar index was traded higher while currently testing the resistance level at 95.60. MACD which illustrated diminishing bearish momentum suggest the index to extend its gains after it successfully breakout above the resistance level.

Resistance level: 95.60, 96.80

Support level: 94.55, 93.25

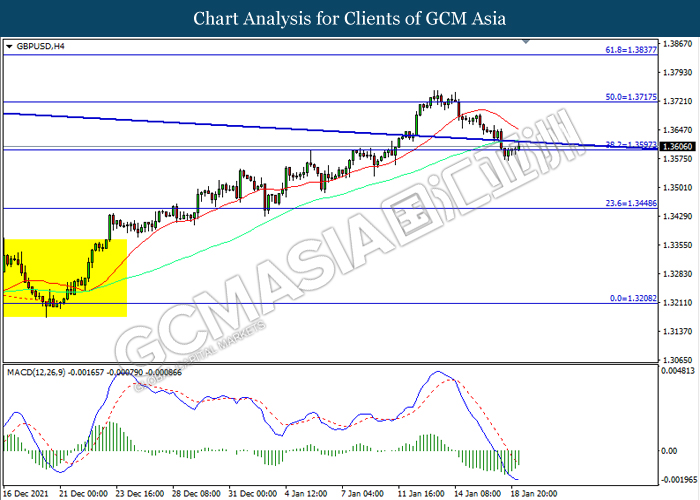

GBPUSD, H4: GBPUSD was traded lower while currently testing the support level at 1.3595. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher in short-term as technical correction.

Resistance level: 1.3715, 1.3840

Support level: 1.3595, 1.3450

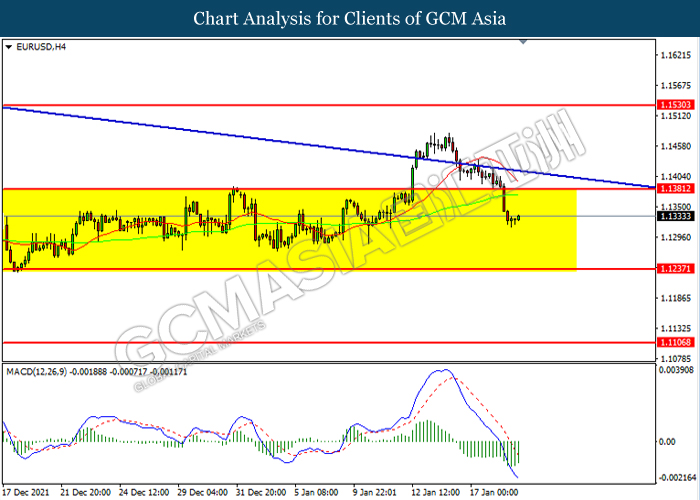

EURUSD, H4: EURUSD was traded lower following prior breakout below the previous support level at 1.1380. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses toward support level at 1.1235.

Resistance level: 1.1380, 1.1530

Support level: 1.1235, 1.1105

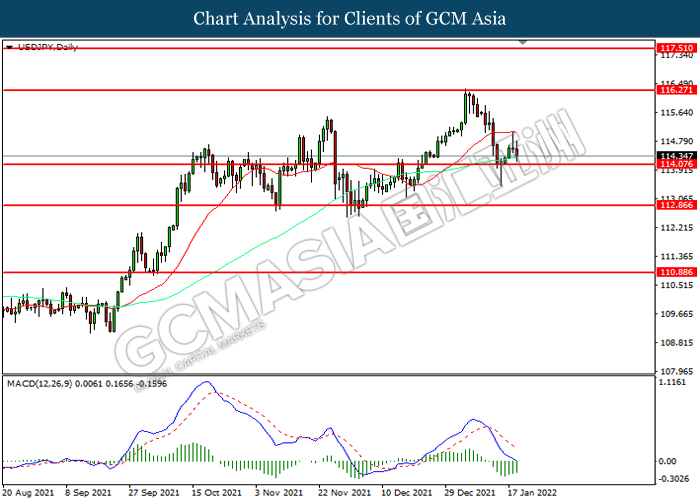

USDJPY, Daily: USDJPY was traded lower while currently testing the support level at 114.10. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher in short-term as technical correction.

Resistance level: 116.25, 117.50

Support level: 114.10, 112.85

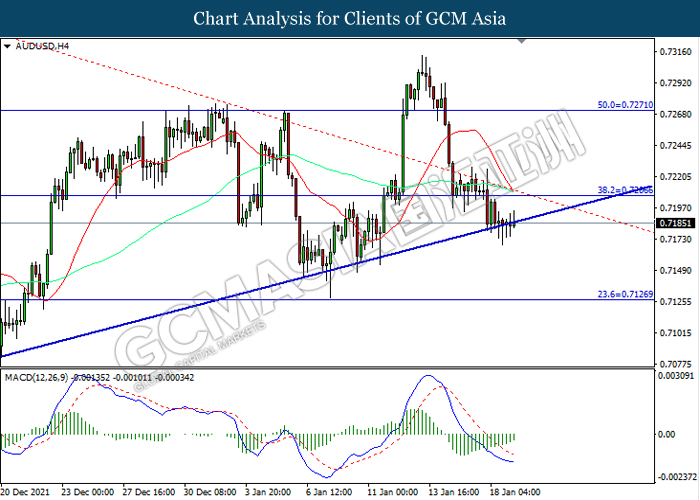

AUDUSD, H4: AUDUSD was traded lower following prior breakout below the previous support level at 0.7205. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher in short-term as technical correction.

Resistance level: 0.7205, 0.7270

Support level: 0.7125, 0.7000

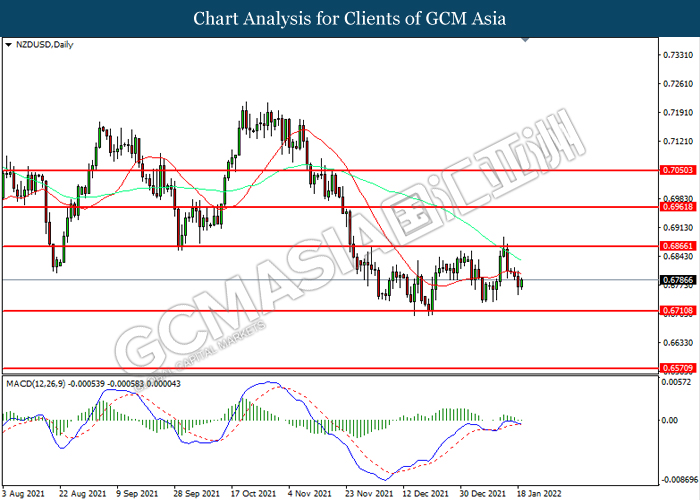

NZDUSD, Daily: NZDUSD was traded lower following prior retracement from the resistance level at 0.6865. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward support level at 0.6710.

Resistance level: 0.6865, 0.6960

Support level: 0.6710, 0.6570

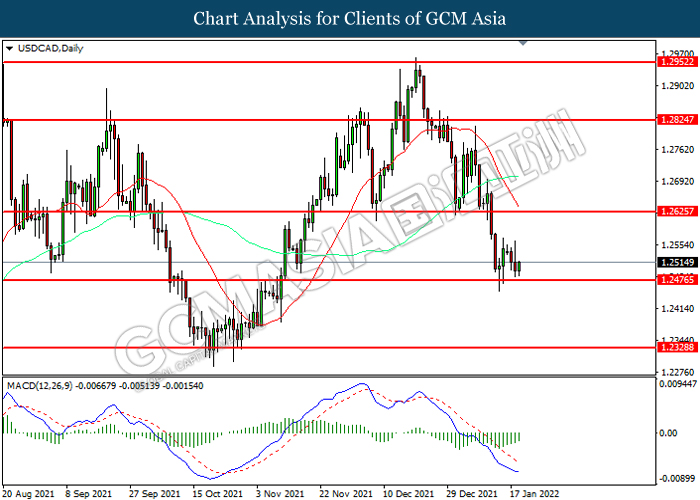

USDCAD, Daily: USDCAD was traded lower while currently testing the support level at 1.2475. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher in short-term as technical correction.

Resistance level: 1.2625, 1.2825

Support level: 1.2475, 1.2330

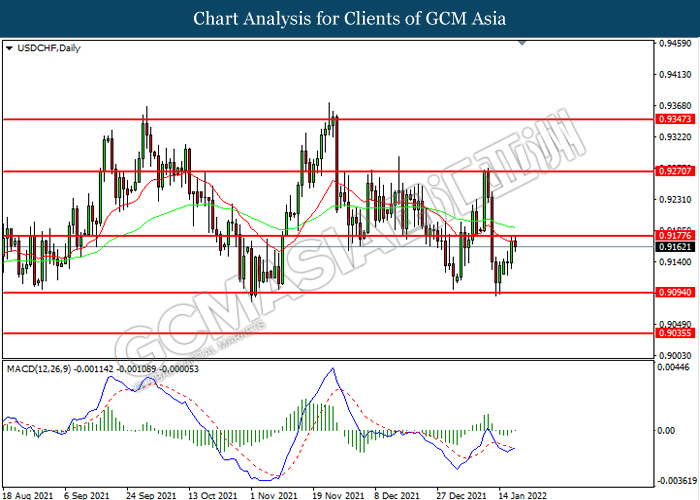

USDCHF, Daily: USDCHF was traded higher while currently testing the resistance level at 0.9180. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 0.9175, 0.9270

Support level: 0.9095, 0.9035

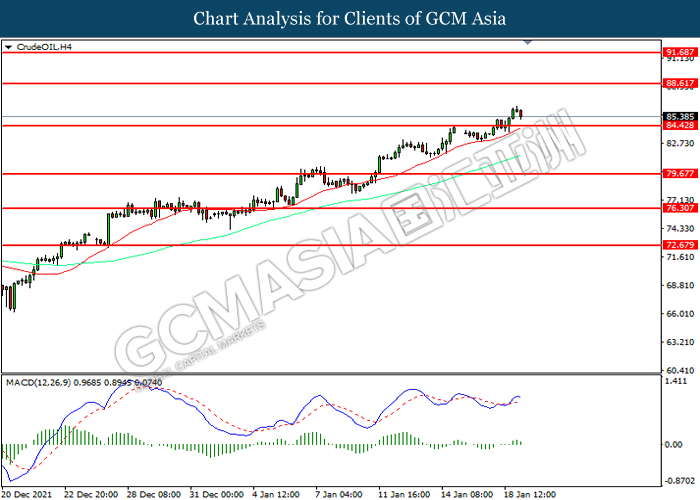

CrudeOIL, H4: Crude oil price was traded higher following prior breakout above the previous resistance level at 84.45. However, MACD which illustrated diminishing bullish momentum suggest the commodity to be traded lower in short-term as technical correction.

Resistance level: 88.60, 91.70

Support level: 84.45, 79.70

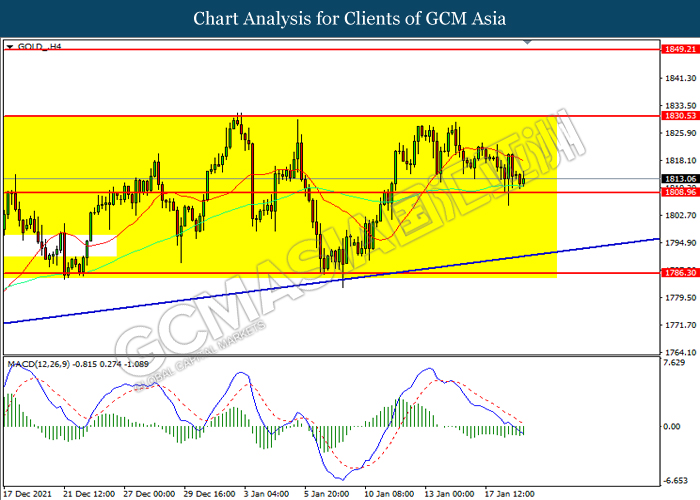

GOLD_, H4: Gold price was traded lower while currently testing the support level at 1808.95. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses after it successfully breakout below the support level.

Resistance level: 1830.55, 1849.20

Support level: 1808.95, 1786.30