19 April 2023 Afternoon Session Analysis

Canadian Dollar dived, Fed’s views remained hawkish.

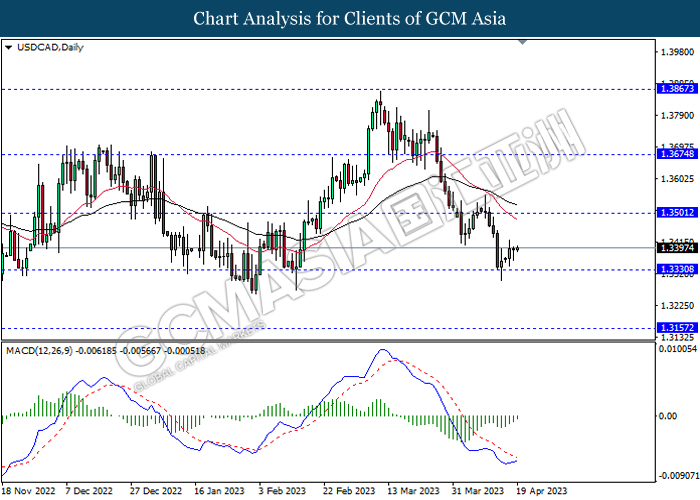

The USD/CAD, which traded by majority of global investors continued its upward movement on yesterday following the hawkish speech from Fed officials. According to Reuters, the St. Louis Federal Reserve President James Bullard reiterated on Tuesday that Fed should keep on its path on interest rate rise as the recent inflationary data had shown the risk of sky-high price remained persistent. Besides that, he expressed the view that the US labor market is still strong, which increasing the odds of further rate hike after the meeting on May. With that, he favors raising the rates to the range of 5.5% to 5.75%. Another Fed member had echoed the speech of Bullard. Federal Reserve Bank of Atlanta President Raphael Bostic claimed that the rate would likely to be hold above 5% in order to efficiently dampen the inflation. Nonetheless, the gains experienced by USD/CAD was limited over the rising inflation in Canada. The Canada Core Consumer Price Index (CPI) MoM in March had notched up from the previous reading of 0.5% to 0.6%, exceeding the market forecast of 0.4%. Thus, Bank of Canada (BoC) would likely to follow the step of Fed, which sparkling the appeal of Canadian Dollar. As of writing, the USD/CAD appreciated by 0.07% to 1.3396.

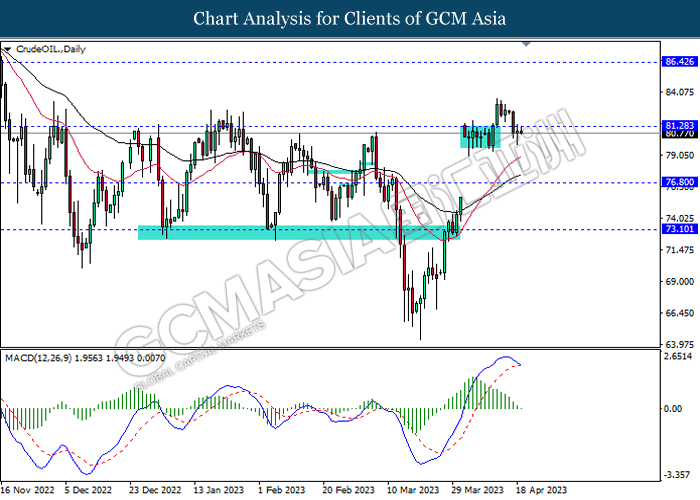

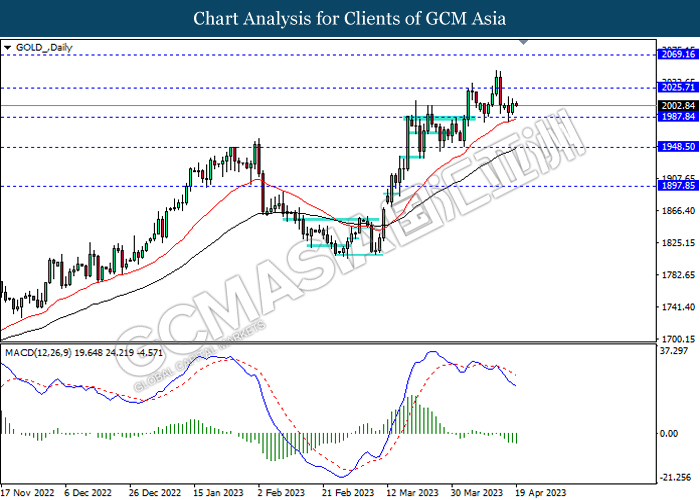

In the commodities market, the crude oil prices rose by 0.09% to $80.83 per barrel as of writing following the hawkish statement from Fed had led to the appreciation of US Dollar, prompting the oil price become more expensive. On the other hand, the gold price dropped by 0.04% to $2003.21 per troy ounce as of writing amid the strengthening of US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 14:00 | GBP – CPI (YoY) (Mar) | 10.4% | 9.8% | – |

| 17:00 | EUR – CPI (YoY) (Mar) | 8.5% | 6.9% | – |

| 22:30 | CrudeOIL – Crude Oil Inventories | 0.597M | -1.088M | – |

Technical Analysis

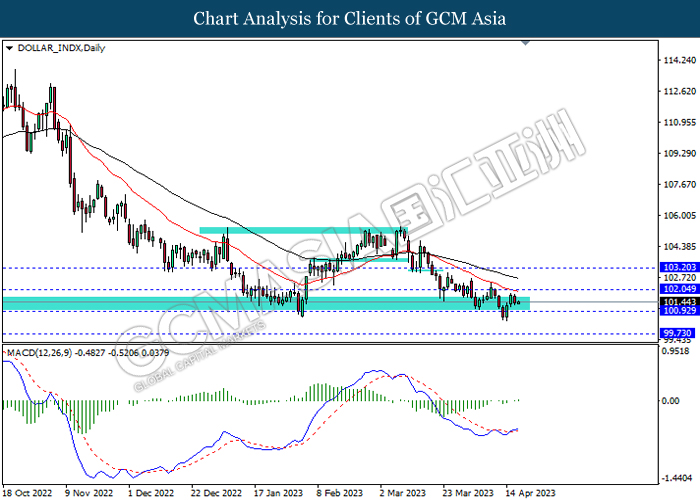

DOLLAR_INDX, Daily: Dollar index was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the index to extend its gains.

Resistance level: 102.05, 103.20

Support level: 100.90, 99.75

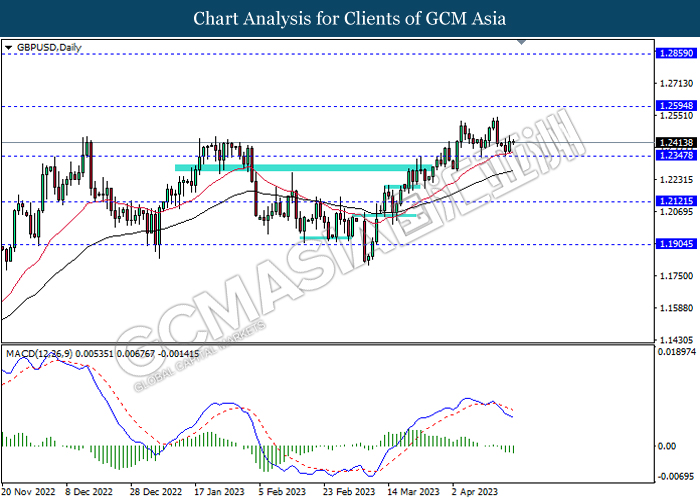

GBPUSD, Daily: GBPUSD was traded higher following prior rebound from the support level. However, MACD which illustrated increasing bearish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.2595, 1.2860

Support level: 1.2345, 1.2120

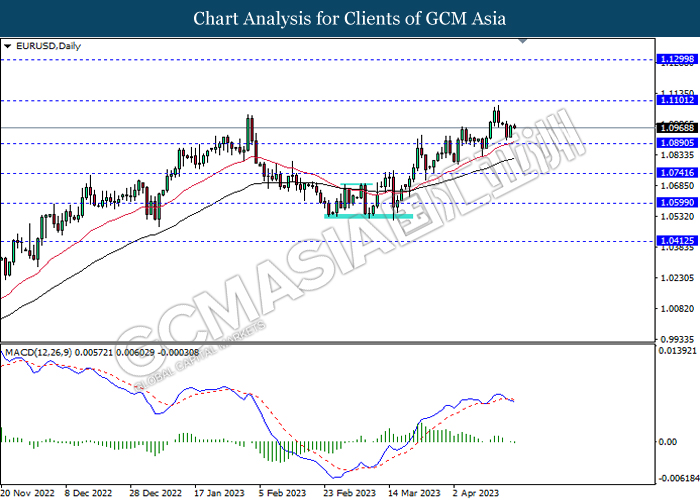

EURUSD, Daily: EURUSD was traded higher following prior rebound from the lower level. However, MACD which illustrated increasing bearish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.1100, 1.1300

Support level: 1.0890, 1.0740

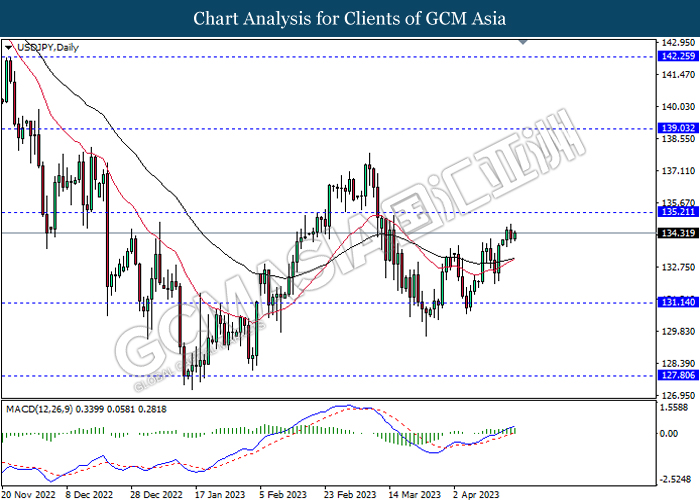

USDJPY, Daily: USDJPY was traded higher following prior rebound from the support level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 135.20, 139.05

Support level: 131.15, 127.80

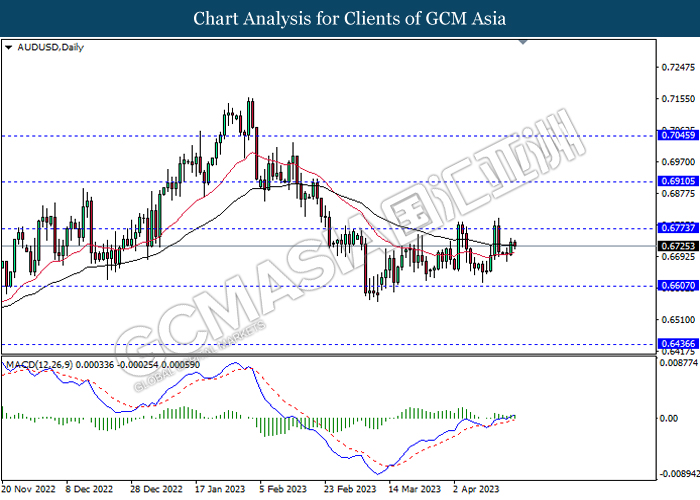

AUDUSD, Daily: AUDUSD was traded higher following prior rebound from the lower level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 0.6775, 0.6910

Support level: 0.6605, 0.6435

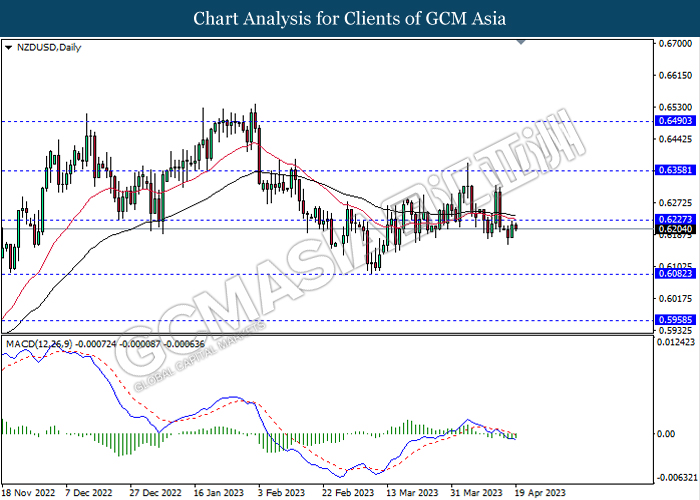

NZDUSD, Daily: NZDUSD was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 0.6225, 0.6360

Support level: 0.6080, 0.5960

USDCAD, Daily: USDCAD was traded higher following prior rebound from the support level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 1.3500, 1.3675

Support level: 1.3330, 1.3155

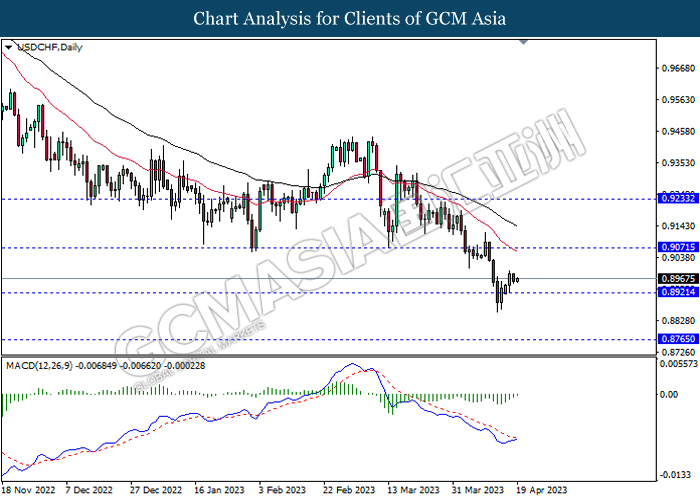

USDCHF, Daily: USDCHF was traded higher following prior breakout above the previous resistance level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 0.9070, 0.9235

Support level: 0.8920, 0.8765

CrudeOIL, Daily: Crude oil price was traded lower following prior breakout below the previous support level. MACD which illustrated decreasing bullish momentum suggest the commodity to extend its losses.

Resistance level: 81.30, 86.40

Support level: 76.80, 73.10

GOLD_, Daily: Gold price was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses.

Resistance level: 2025.70, 2069.15

Support level: 1987.85, 1948.50