19 April 2023 Morning Session Analysis

US dollar sank amid upbeat data from China and UK.

The dollar index, which is traded against a basket of six major currencies, lost its ground after hitting the highest level in one week as a series of upbeat economic data from the outside of the US weakened the appeal of the Greenback. Yesterday, the National Bureau of Statistics of China released its first quarter of GDP at 4.5%, far better than the consensus forecast of 4.0%. Prior to that, the China economy was experiencing a growth of just 2.9% in the last quarter of 2022. The stronger-than-expected GDP was mainly attributed to the strong recovery of economic activity across all different sectors after the end of zero-Covid measures late last year. On the other side, the rebound in the pound market also drove the dollar index lower during the pre-trading session of the UK market. Although there was an unexpected rise in the number of unemployed within the UK, the pay growth remained strong, which has been shown by the Average Earnings Index + Bonus data. With such a backdrop, the outstanding performance of the other region diminished the market demand for the dollar index. As of writing, the dollar index dropped -0.37% to 101.70.

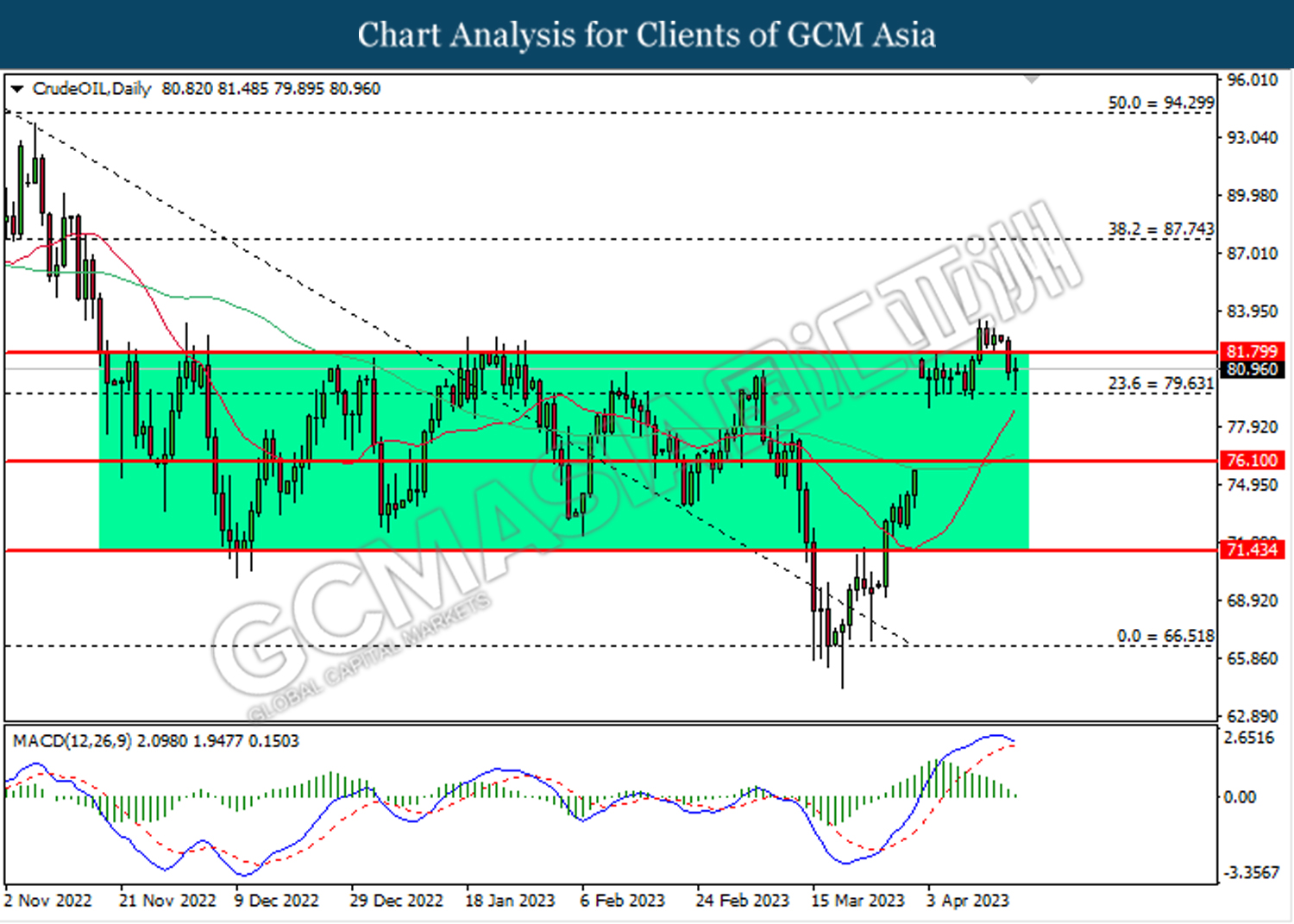

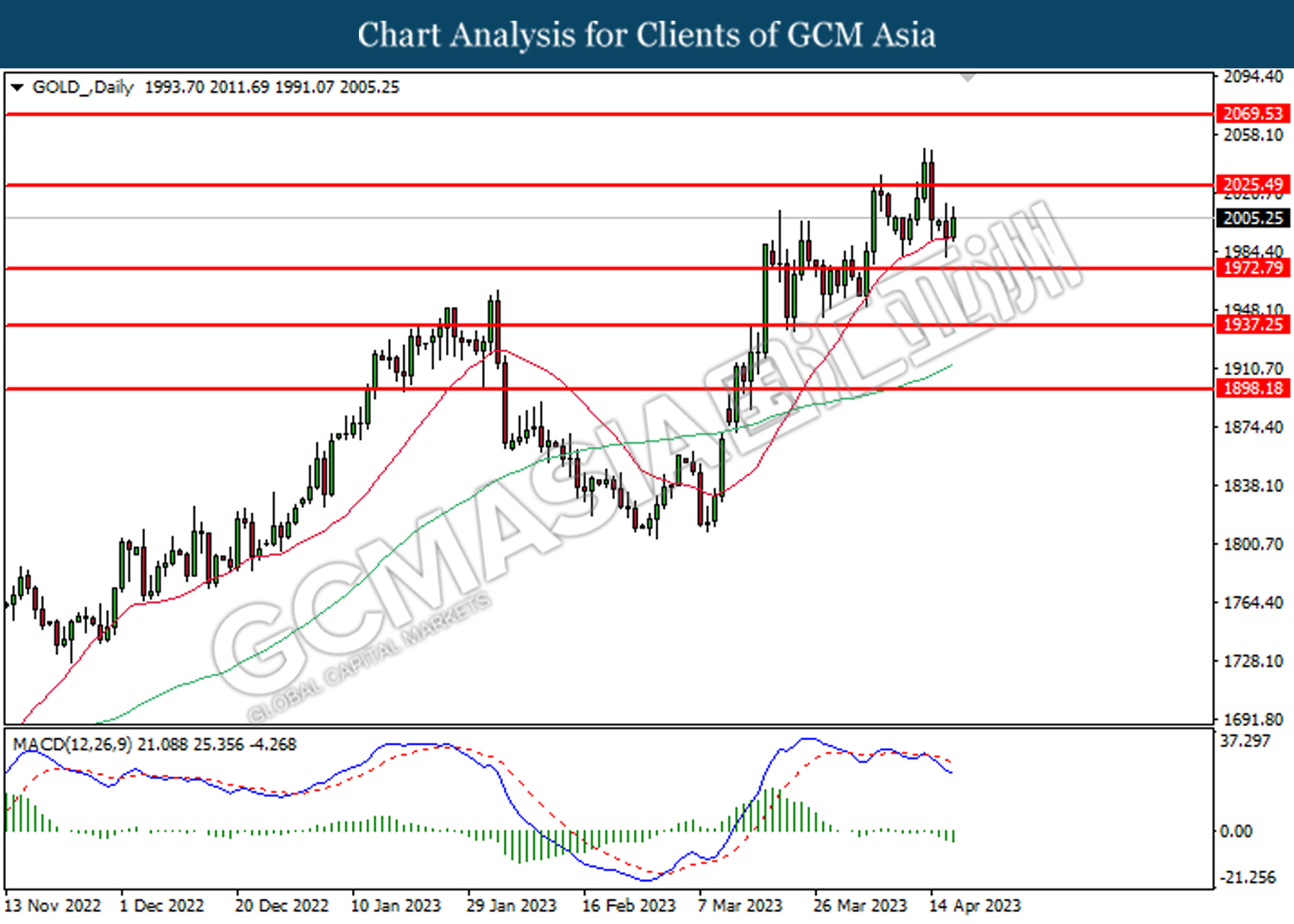

In the commodities market, crude oil prices edged up by 0.07% to $81.05 per barrel as the API weekly oil inventories data showed a larger-than-expected draw last week. Besides, gold prices were traded up by 0.01% to $2005.50 per troy ounce amid the weakening of the dollar index.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 14:00 | GBP – CPI (YoY) (Mar) | 10.4% | 9.8% | – |

| 17:00 | EUR – CPI (YoY) (Mar) | 8.5% | 6.9% | – |

| 22:30 | CrudeOIL – Crude Oil Inventories | 0.597M | -1.088M | – |

Technical Analysis

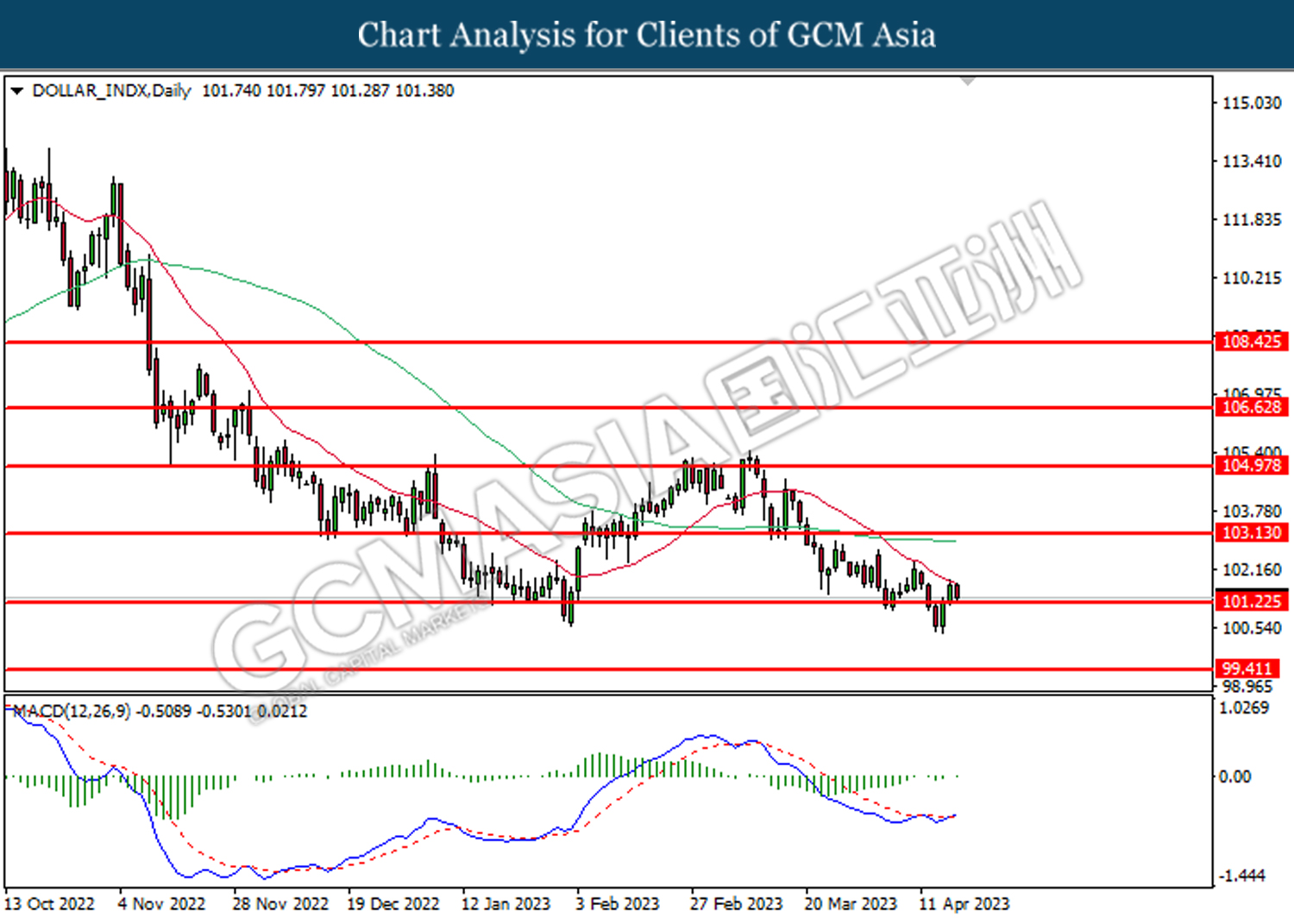

DOLLAR_INDX, Daily: Dollar index was traded lower while currently testing the support level at 101.25. However, MACD which illustrated diminishing bearish momentum suggests the index to undergo technical correction in short term.

Resistance level: 103.15, 104.95

Support level: 101.25, 99.40

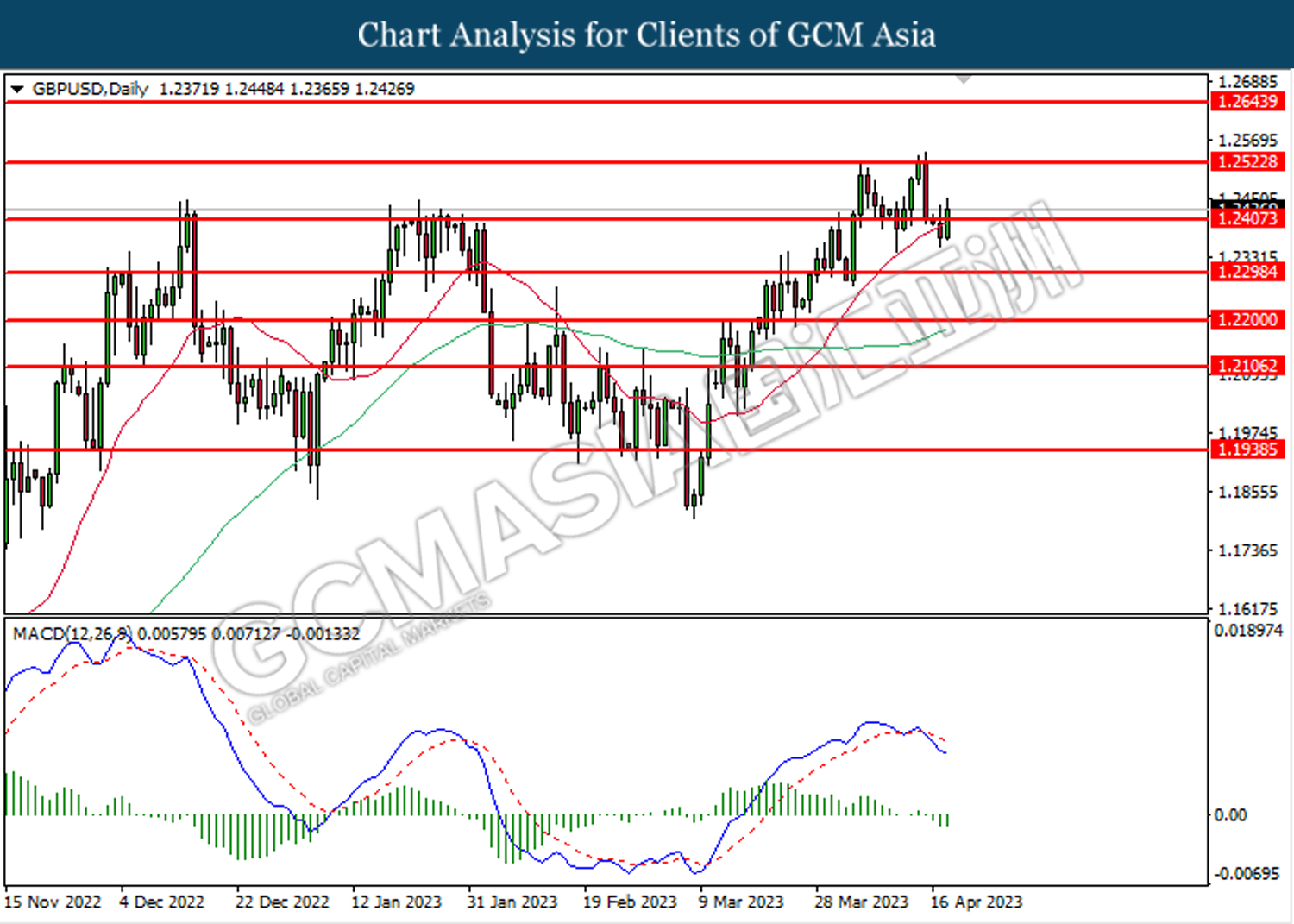

GBPUSD, Daily: GBPUSD was traded higher while currently testing the resistance level at 1.2405. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.2405, 1.2525

Support level: 1.2300, 1.2200

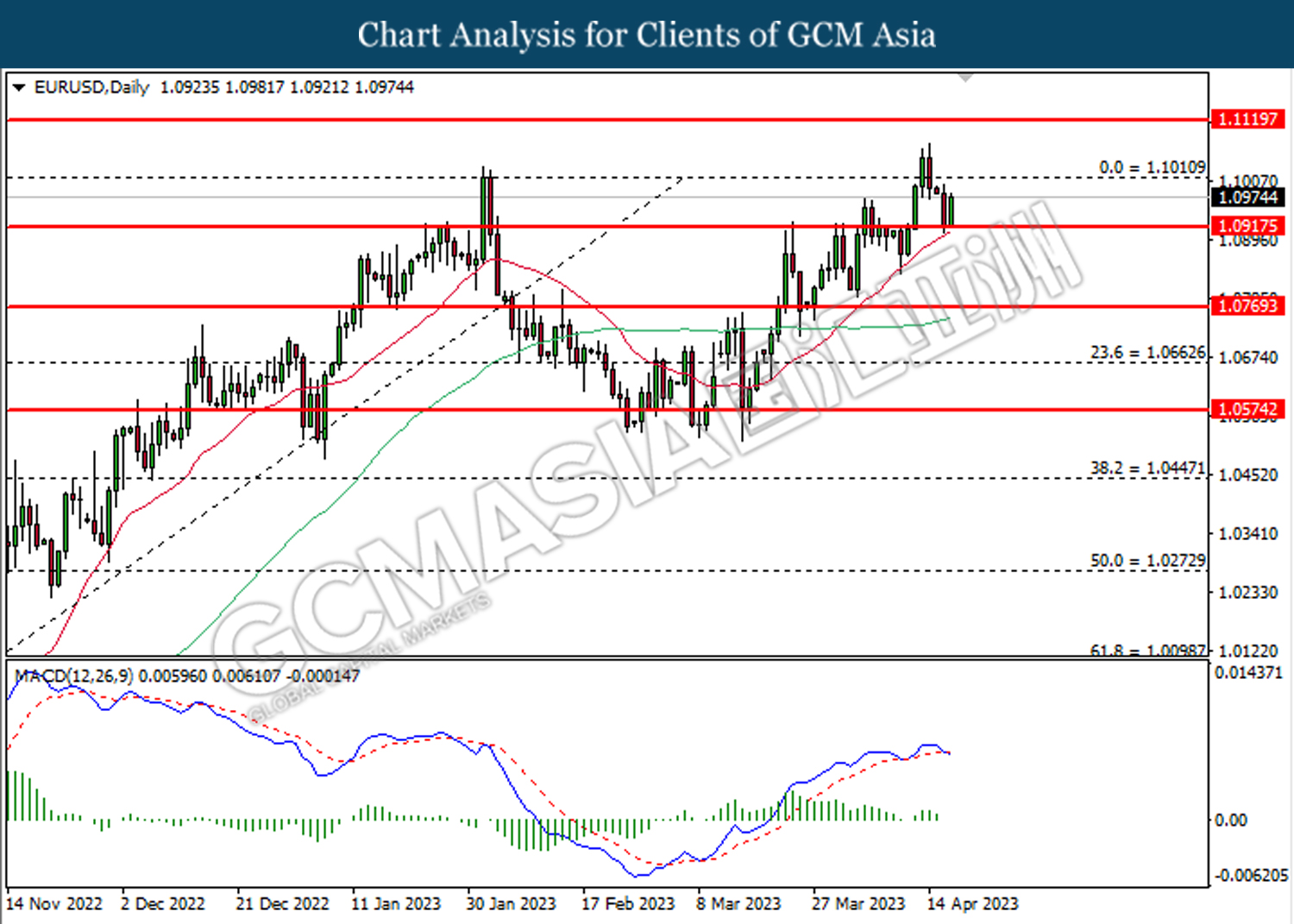

EURUSD, Daily: EURUSD was traded higher following the prior rebound from the support level at 1.0915. However, MACD which illustrated diminishing bullish momentum suggest the pair to undergo technical correction in short term.

Resistance level: 1.1010, 1.1120

Support level: 1.0915, 1.0770

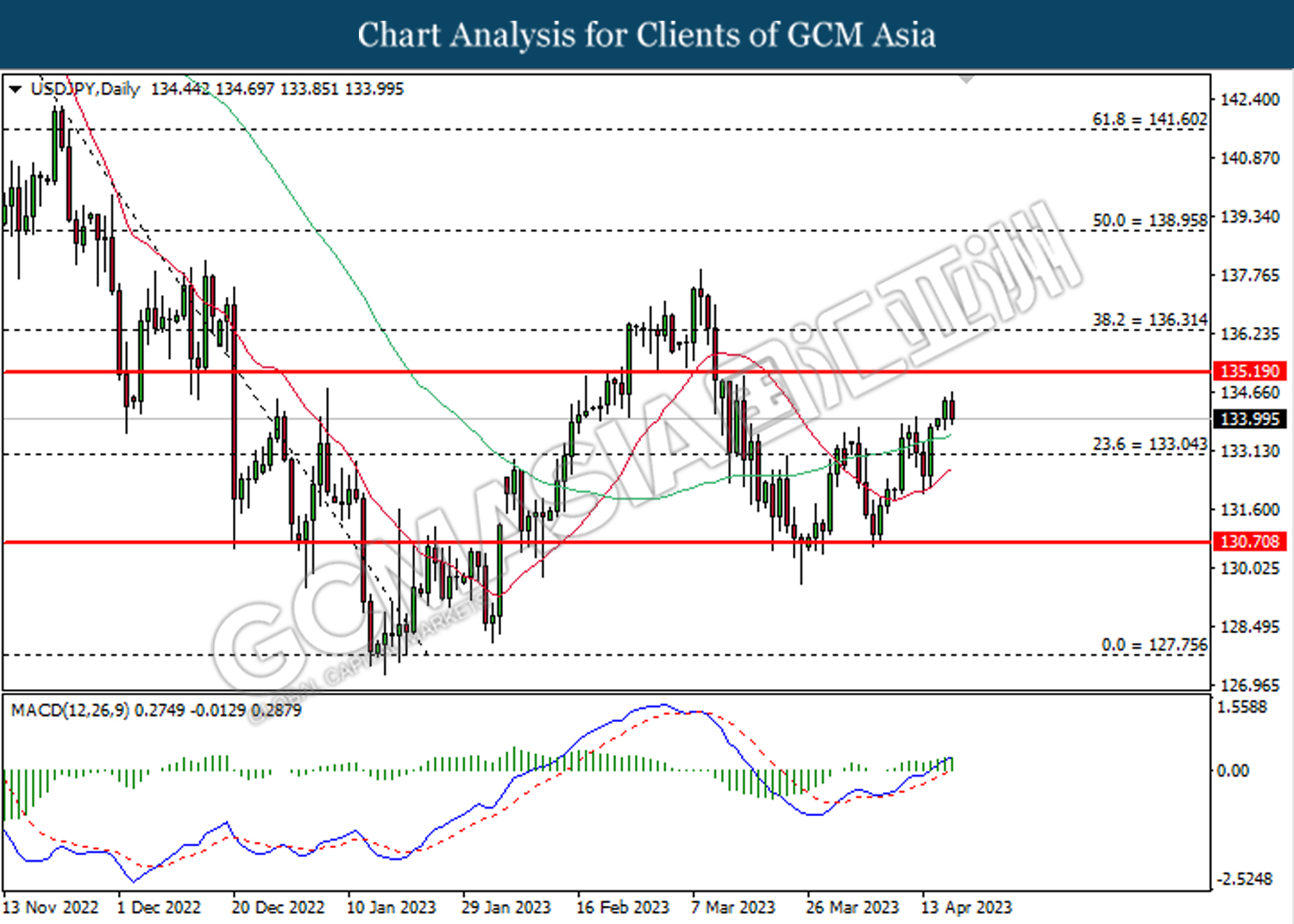

USDJPY, Daily: USDJPY was traded higher following the prior breakout above the previous resistance level at 133.05. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 135.20.

Resistance level: 135.20, 136.30

Support level: 133.05, 130.70

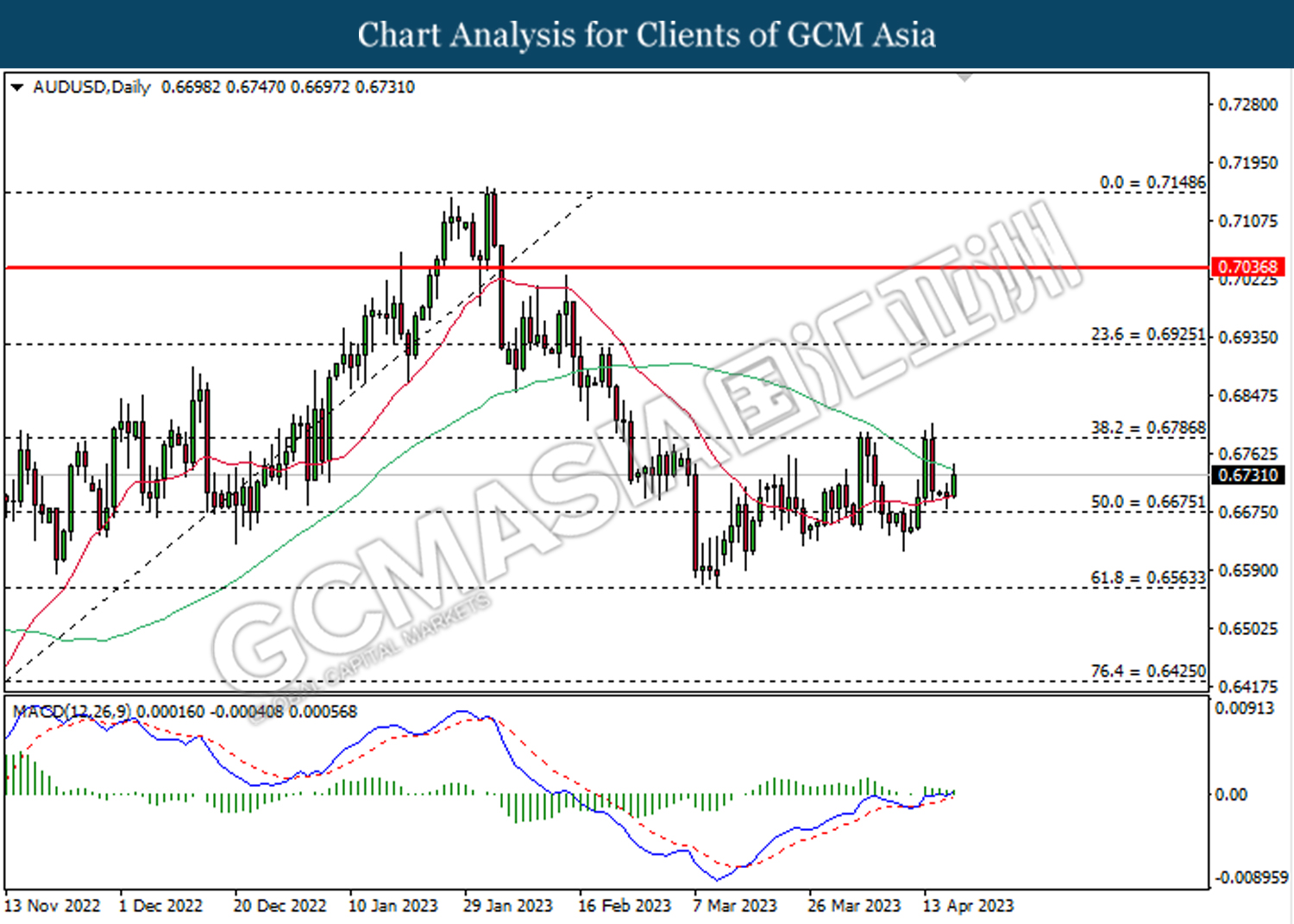

AUDUSD, Daily: AUDUSD was traded higher following the prior rebound from the support level at 0.6675. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 0.6785.

Resistance level: 0.6785, 0.6925

Support level: 0.6675, 0.6565

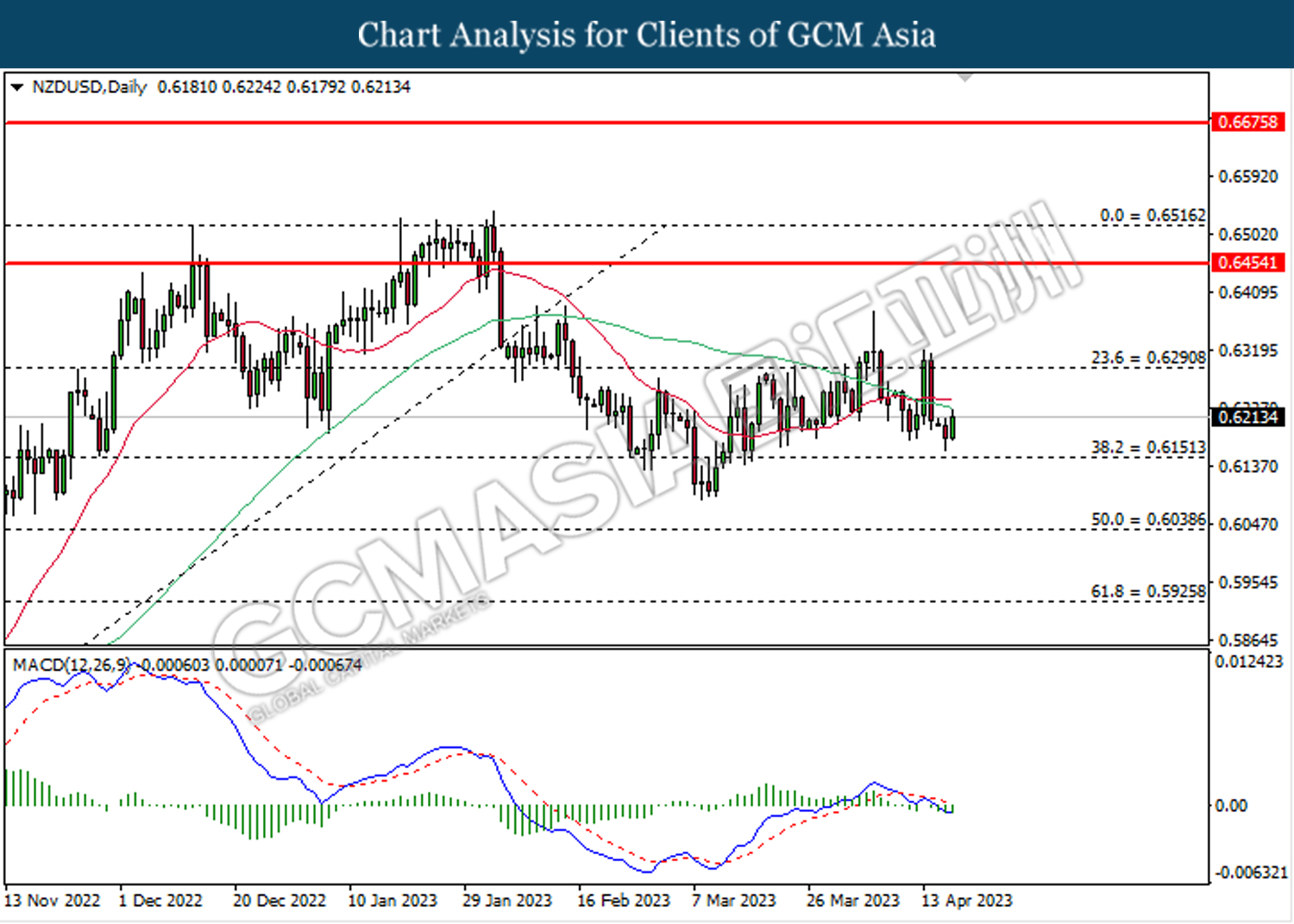

NZDUSD, Daily: NZDUSD was traded higher following the prior rebound from the support level at 0.6150. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward the resistance level at 0.6290.

Resistance level: 0.6290, 0.6455

Support level: 0.6150, 0.6040

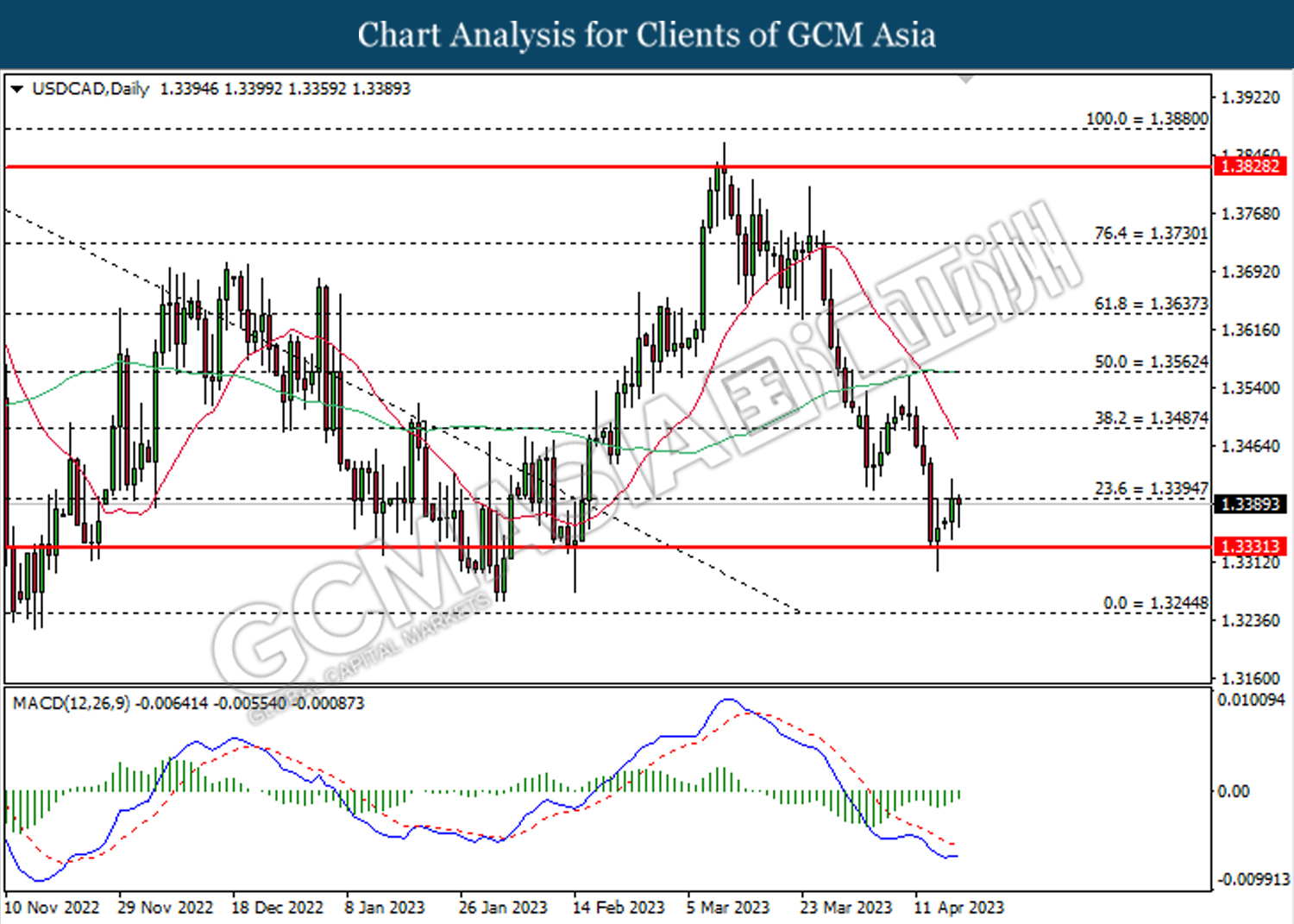

USDCAD, Daily: USDCAD was traded higher while currently testing the resistance level at 1.3395. MACD which illustrated diminishing bearish momentum suggests the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.3395, 1.3485

Support level: 1.3330, 1.3245

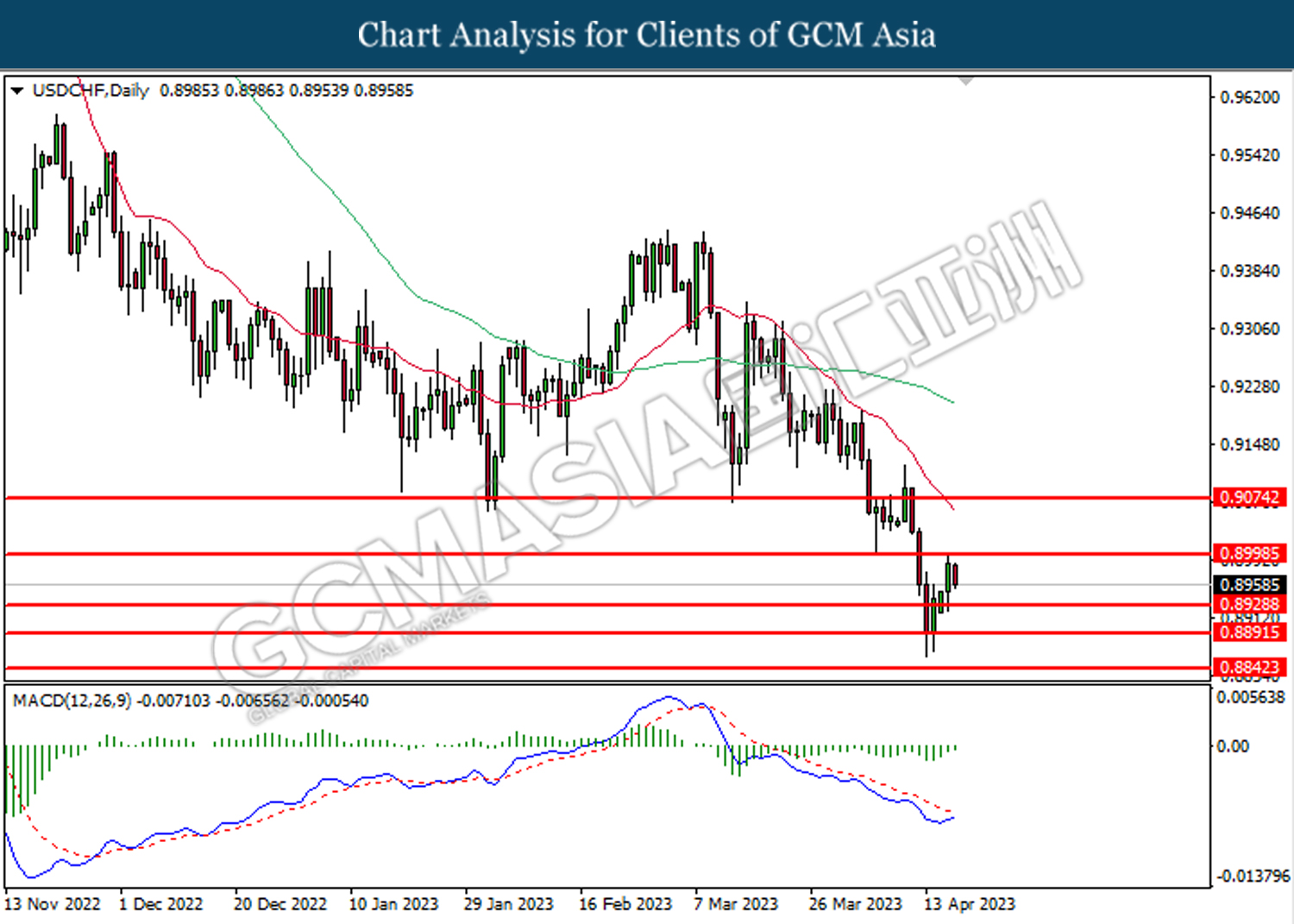

USDCHF, Daily: USDCHF was traded lower following the prior retracement from the resistance level at 0.9000. However, MACD which illustrated diminishing bearish momentum suggest the pair to undergo technical correction in short term.

Resistance level: 0.9000, 0.9075

Support level: 0.8930, 0.8890

CrudeOIL, Daily: Crude oil price was traded lower while currently testing the support level at 79.65. MACD which illustrated diminishing bullish momentum suggest the commodity to extend its losses after it successfully breakout below the support level.

Resistance level: 81.80, 87.75

Support level: 79.65, 76.10

GOLD_, Daily: Gold price was traded lower following the prior breakout below the previous support level at 2025.50. MACD which illustrated bearish bias momentum suggests the commodity to extend its losses toward the support level at 1972.80.

Resistance level: 2025.50, 2069.55

Support level: 1972.80, 1937.25