19 May 2023 Morning Session Analysis

US dollar spiked amid a series of upbeat economic data.

The dollar index, which was traded against a basket of six major currencies, extended its gains during the yesterday’s trading session as a new round of solid economic data reignited the market confidence toward the currency. According to the Department of Labor, the number of American filed for unemployment claims in the past week fell more than expected, suggesting the labor market remains tight. The initial claims for unemployment benefits dropped from the prior reading’s 264K to 242K this week, lower than the consensus forecast at 254K. With this figure, it pared back the bet of further easing monetary policy as the ongoing labor market situation provided some room for Federal Reserve to hike its rate again if necessary. Besides, the Federal Reserve Bank of Philadelphia posted the manufacturing index for the month of May at -10.4, slightly better than the consensus forecast at -19.8, indicating some improvement in the manufacturing activity although it is still continued to decline in overall. With the backdrop of strong economic data and “constructive progress” in the talks of debt ceiling, the appeal of US dollar jumped and it hit the highest level in two months. As of writing, the dollar index rose 0.62% to 103.50.

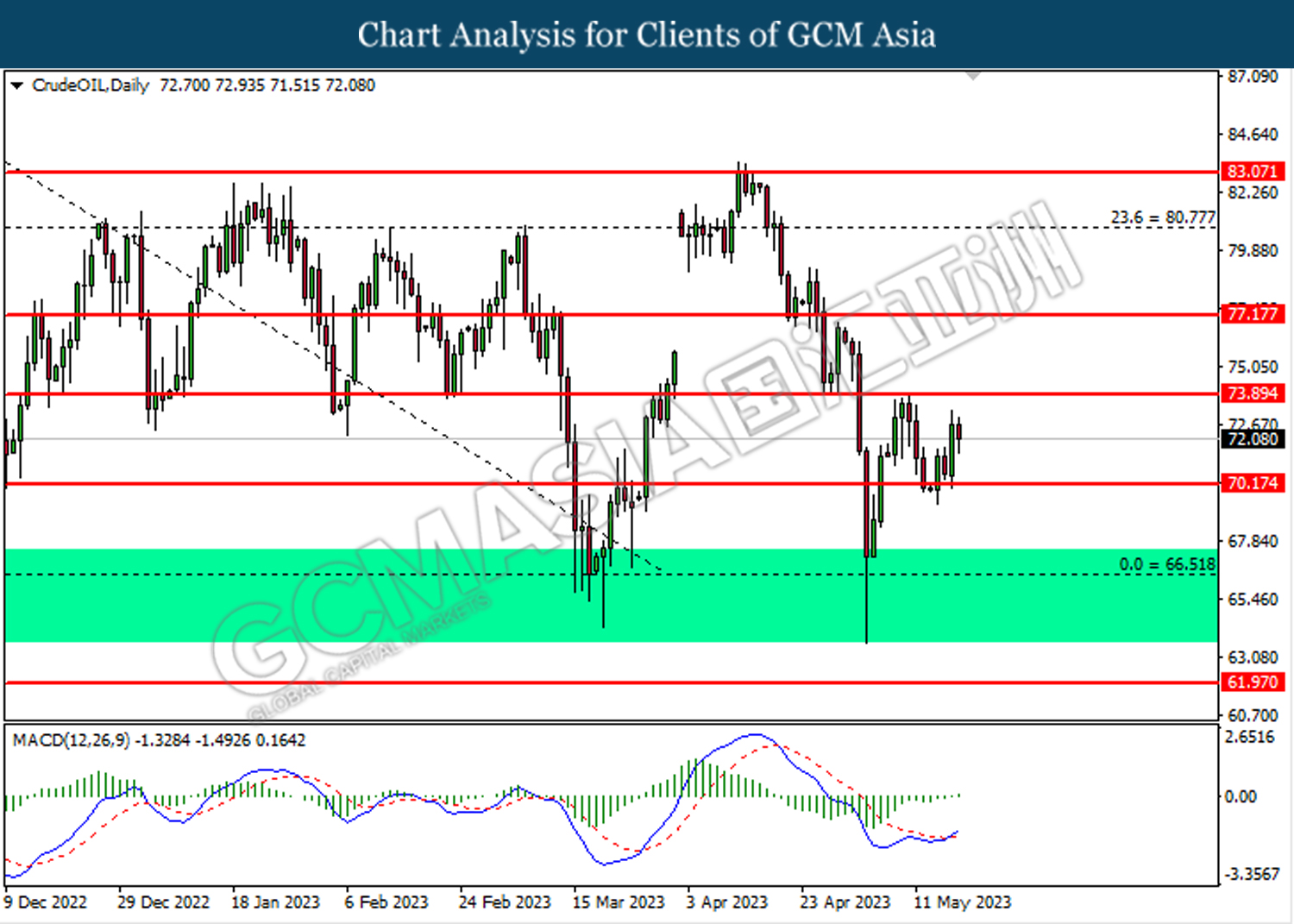

In the commodities market, crude oil prices edged down by -0.78% to $72.15 per barrel as the solid US economic data boosted the value of dollar and prompted the investors to shy away from oil market temporarily. Besides, gold prices edged down -0.06% to $1958.75 per troy ounce as the dollar strengthened.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

23:00 USD Fed Chair Powell Speaks

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 20:30 | CAD – Core Retail Sales (MoM) (Mar) | -0.7% | -0.8% | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded higher while currently testing the resistance level at 103.15. MACD which illustrated bullish bias momentum suggests the index to extend its gains after it successfully breakout above the resistance level.

Resistance level: 103.15, 104.95

Support level: 100.65, 99.40

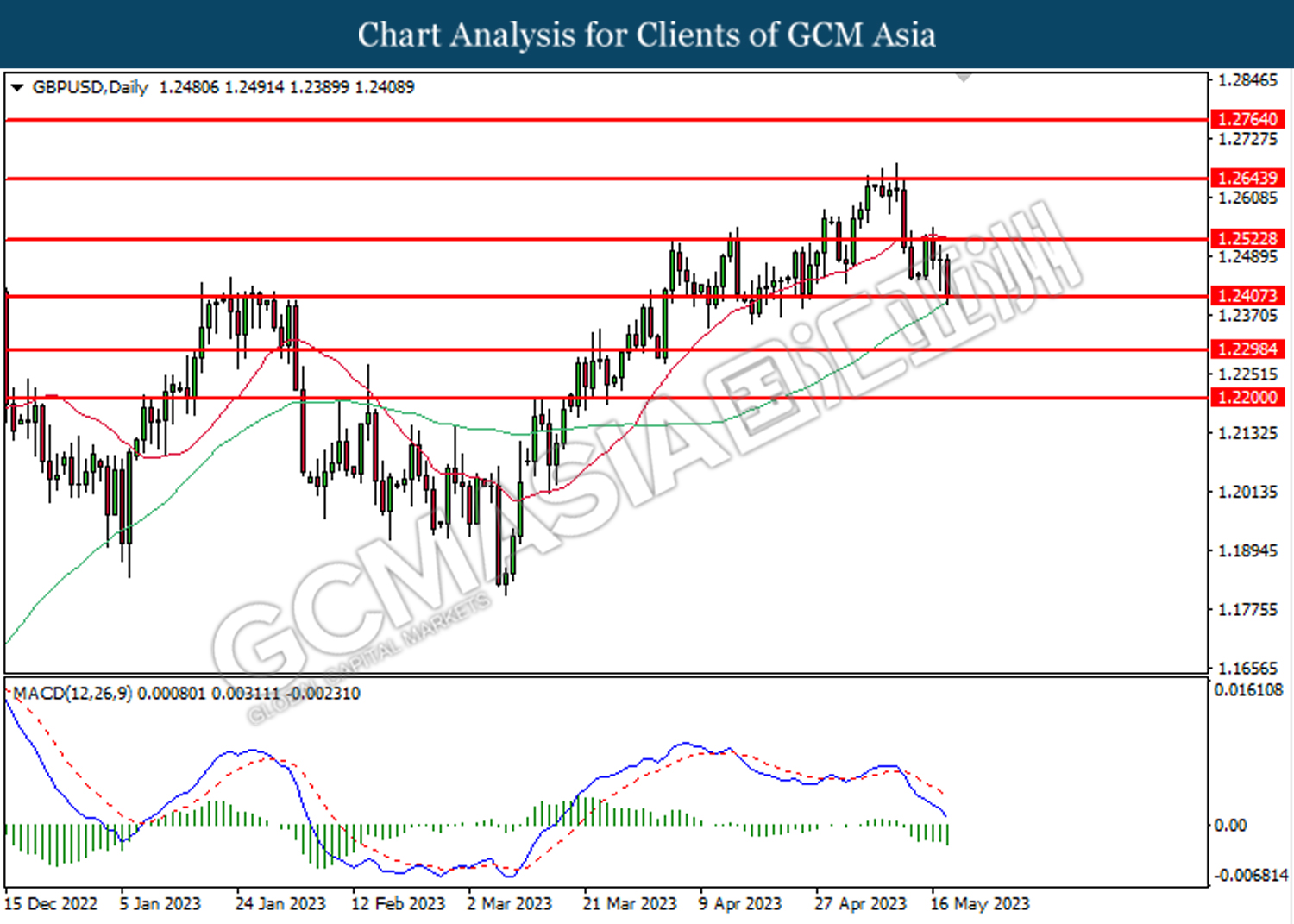

GBPUSD, Daily: GBPUSD was traded lower while currently testing the support level at 1.2405. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.2525, 1.2645

Support level: 1.2405, 1.2300

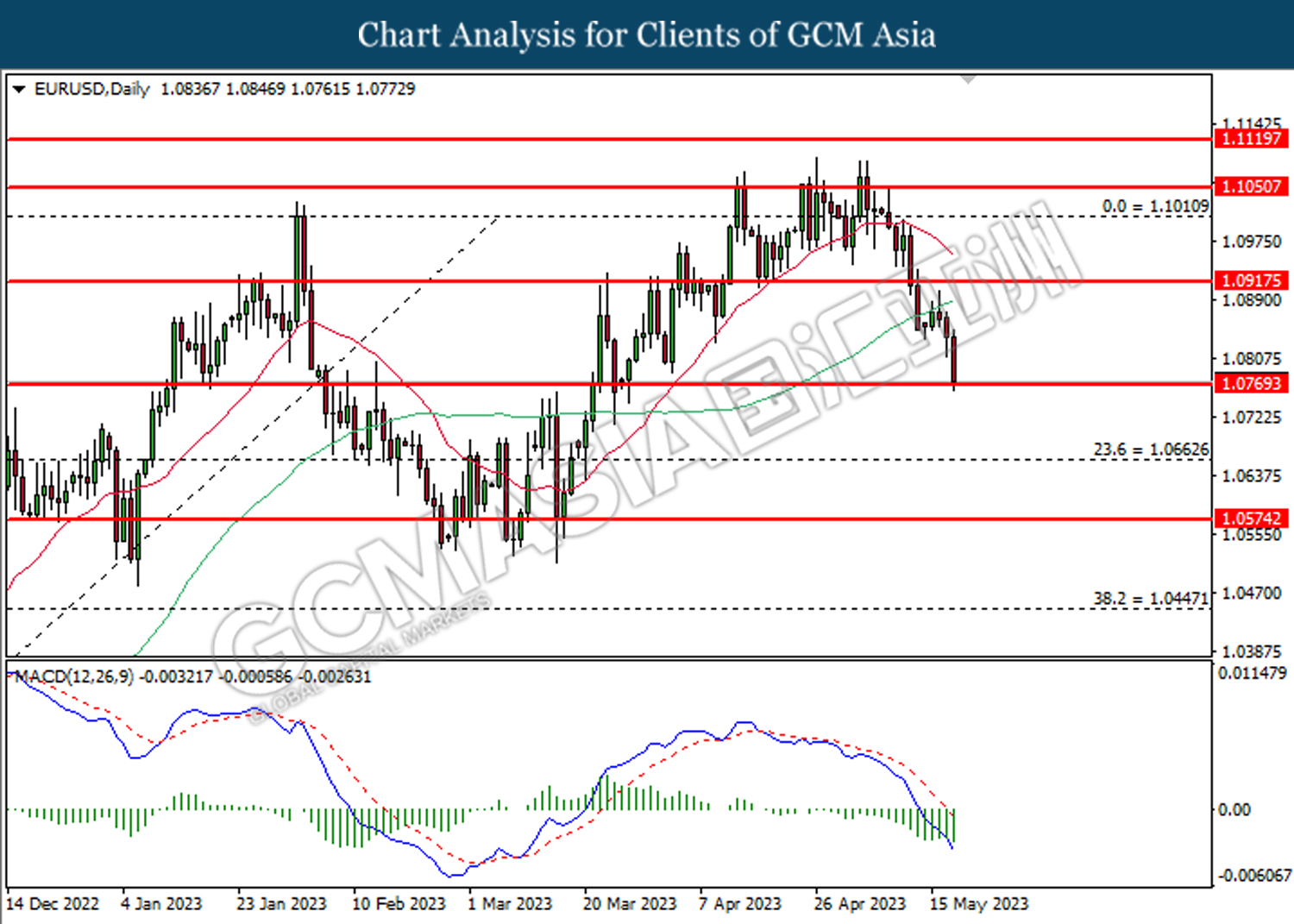

EURUSD, Daily: EURUSD was traded lower while currently testing the support level at 1.0770. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.0915, 1.1010

Support level: 1.0770, 1.0665

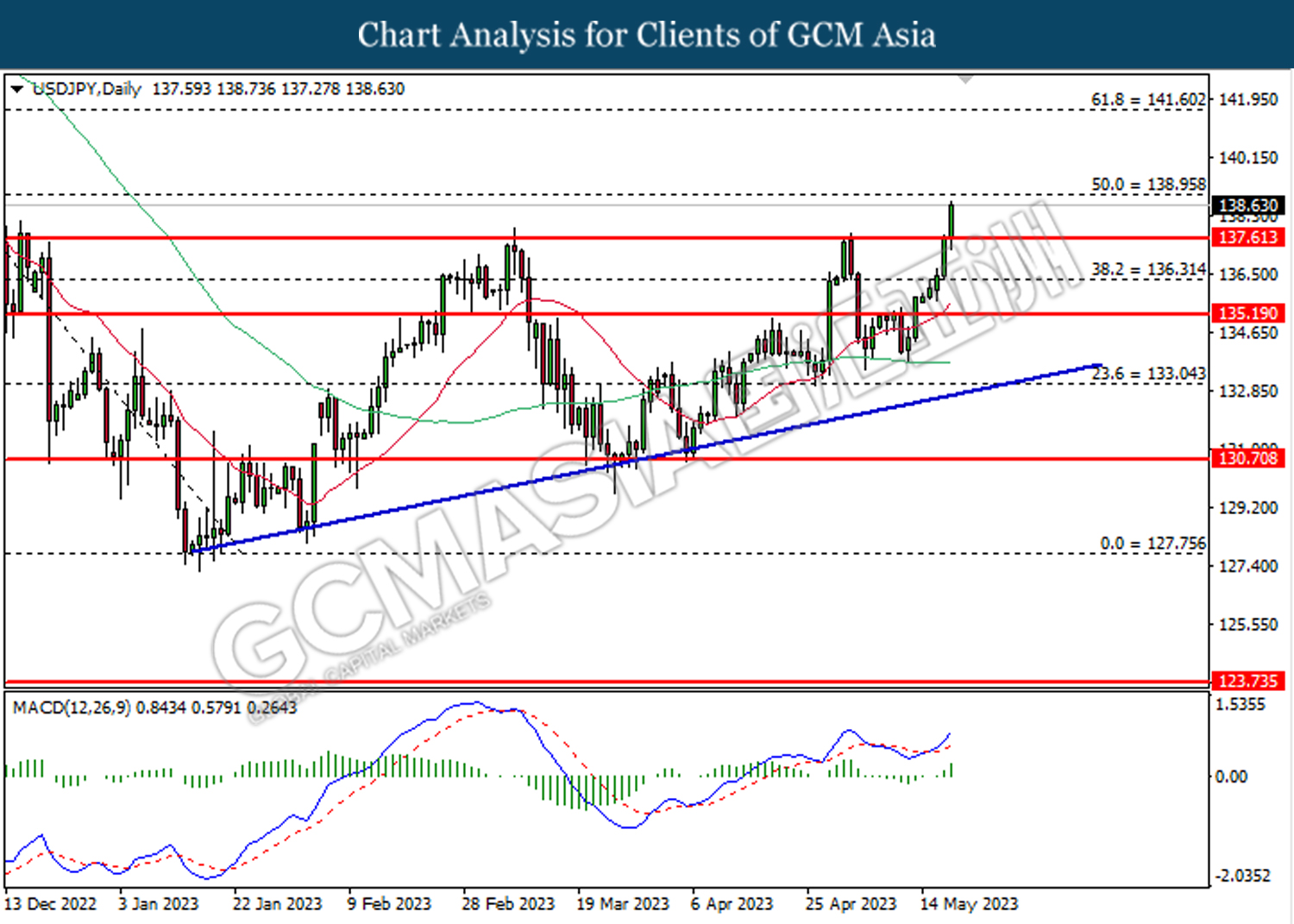

USDJPY, Daily: USDJPY was traded higher while currently testing the resistance level at 137.60. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 137.60, 138.95

Support level: 136.30, 135.20

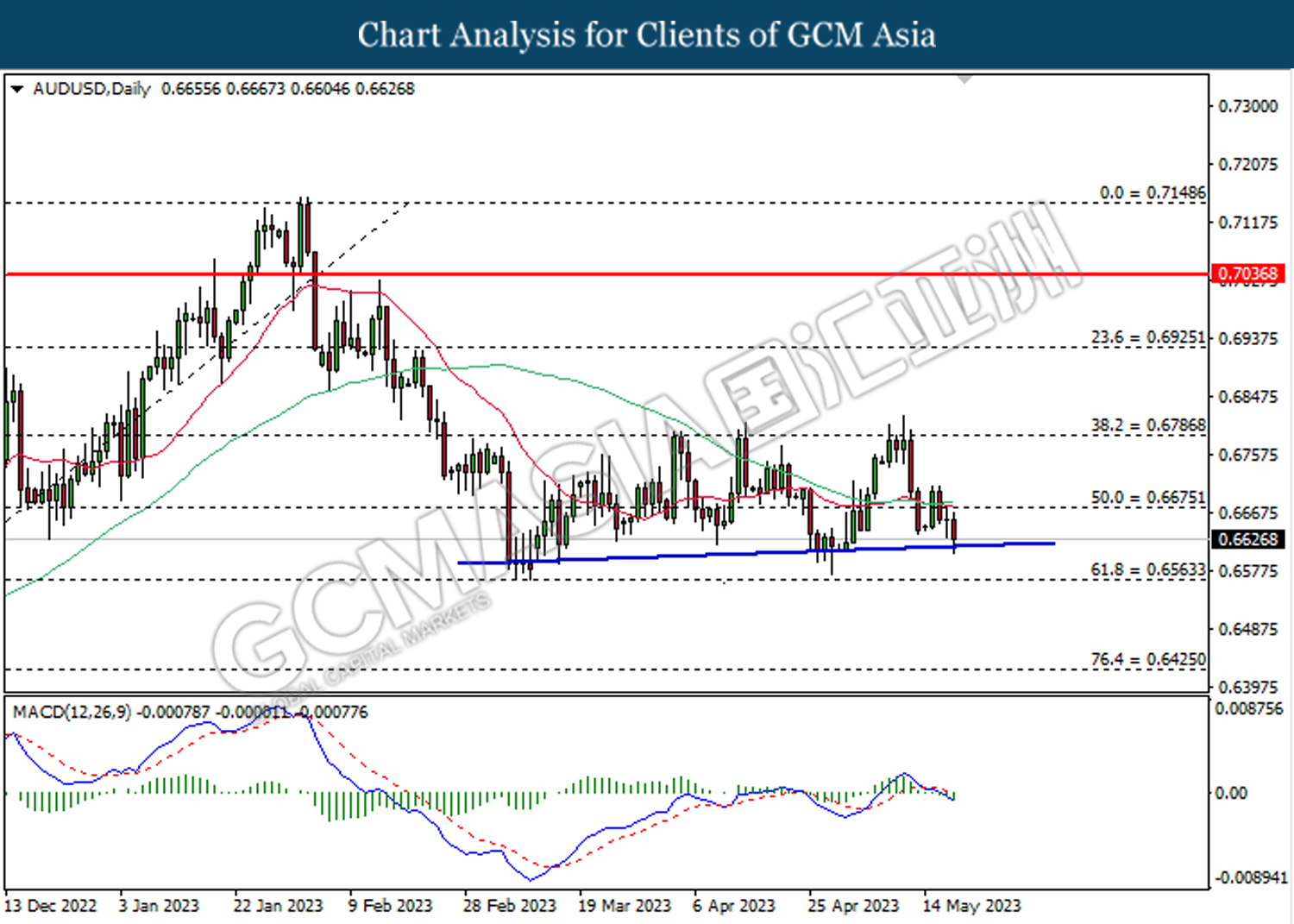

AUDUSD, Daily: AUDUSD was traded lower following the prior breakout below the previous support level at 0.6675. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 0.6565.

Resistance level: 0.6675, 0.6785

Support level: 0.6565, 0.6425

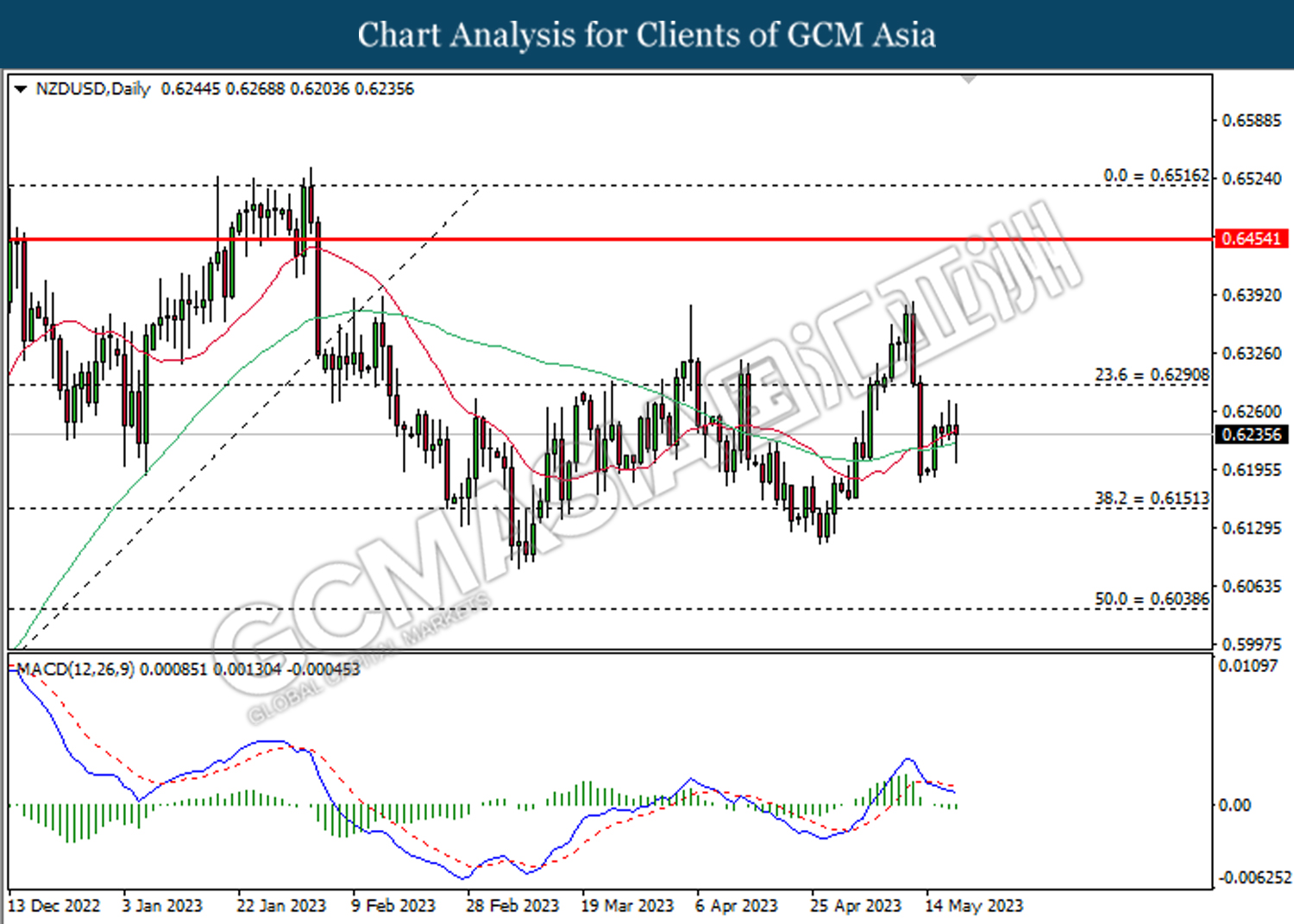

NZDUSD, Daily: NZDUSD was traded higher following the prior rebound from the lower level. However, MACD which illustrated bearish bias momentum suggest the pair to undergo technical correction in short term.

Resistance level: 0.6290. 0.6455

Support level: 0.6150, 0.6040

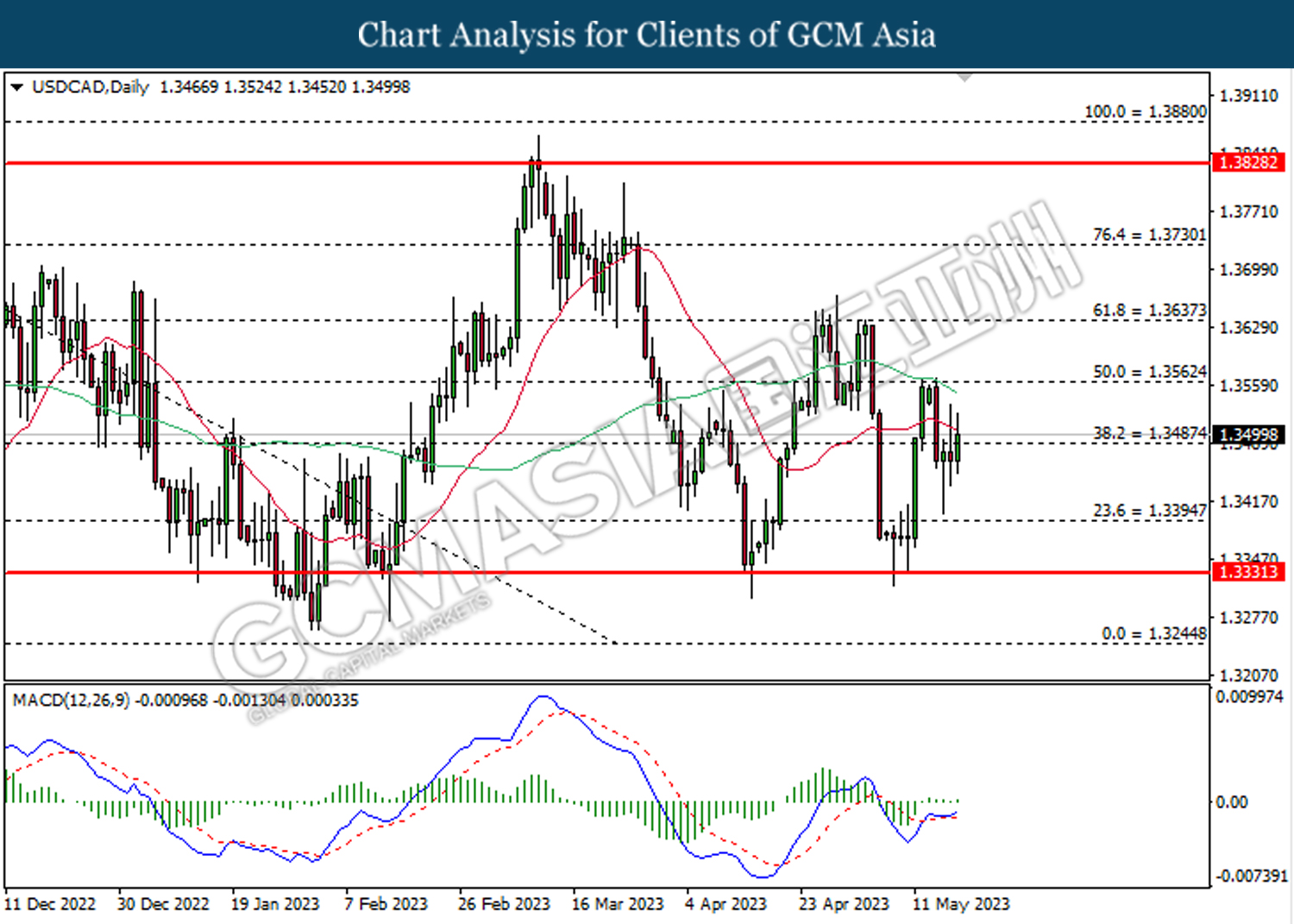

USDCAD, Daily: USDCAD was traded higher while currently testing the resistance level at 1.3485. MACD which illustrated bullish bias momentum suggests the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.3485, 1.3565

Support level: 1.3395, 1.3330

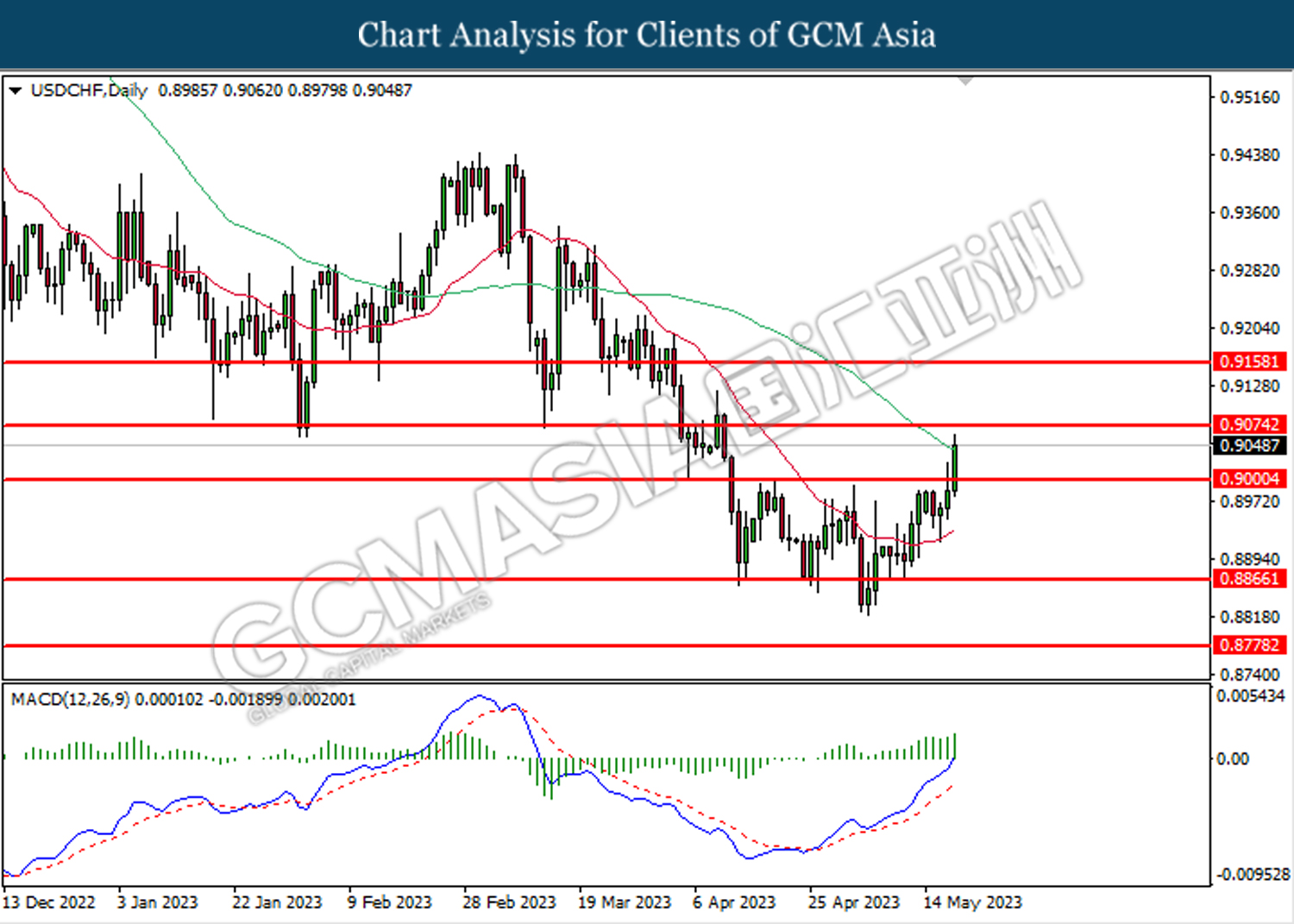

USDCHF, Daily: USDCHF was traded higher following the prior breakout above the previous resistance level at 0.9000. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 0.9075, 0.9160

Support level: 0.9000, 0.8865

CrudeOIL, Daily: Crude oil price was traded higher following the prior rebound from the support level at 70.15. MACD which illustrated diminishing bearish momentum suggest the commodity to extend its gains toward the resistance level at 73.90.

Resistance level: 73.90, 77.15

Support level: 70.15, 66.50

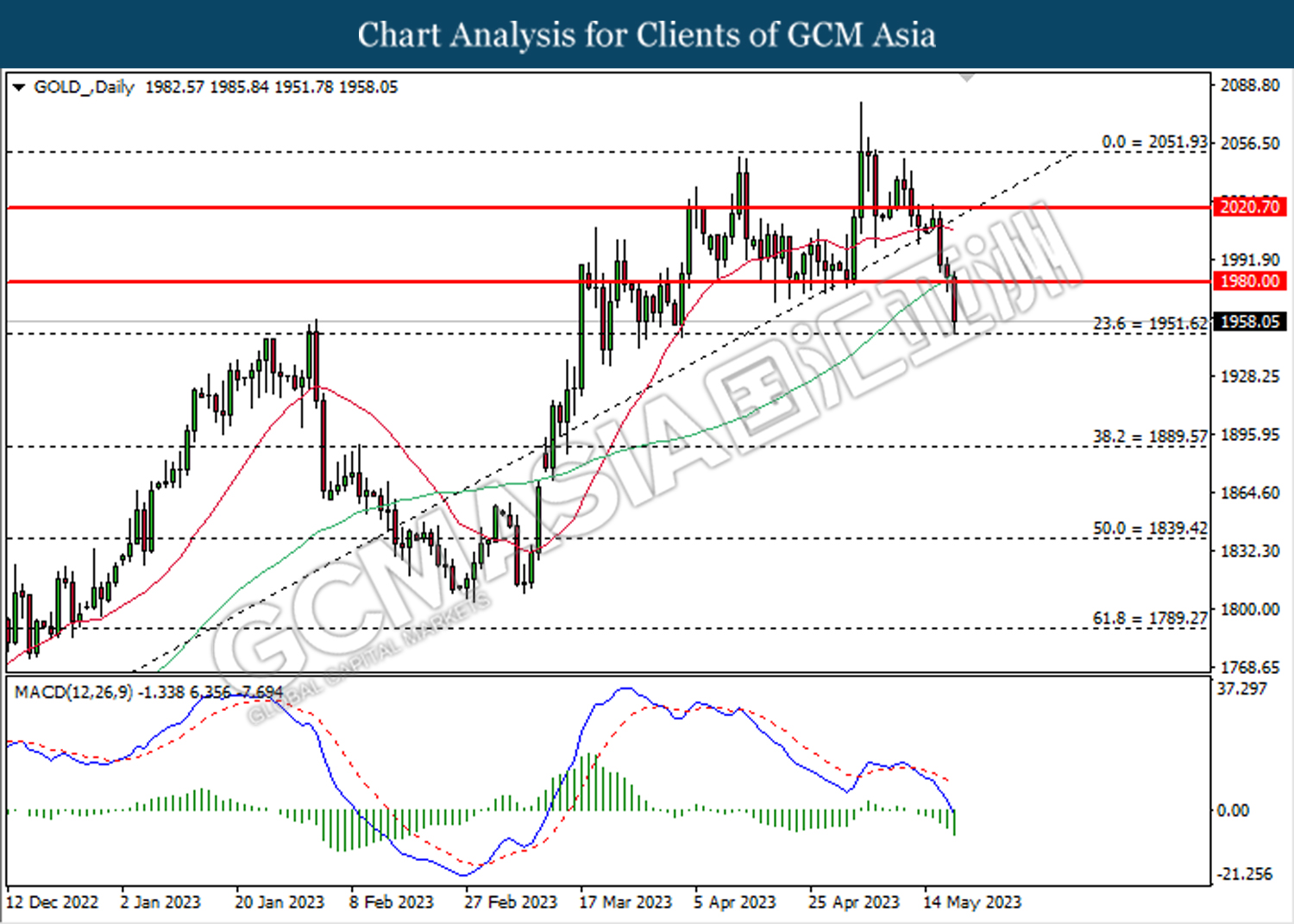

GOLD_, Daily: Gold price was traded lower while currently testing the support level at 1951.60. MACD which illustrated bearish bias momentum suggests the commodity to extend its losses after it successfully breakout below the support level.

Resistance level: 1980.00, 2020.70

Support level: 1951.60, 1889.55