19 July 2022 Afternoon Session Analysis

Australia Dollar surged amid hawkish expectation.

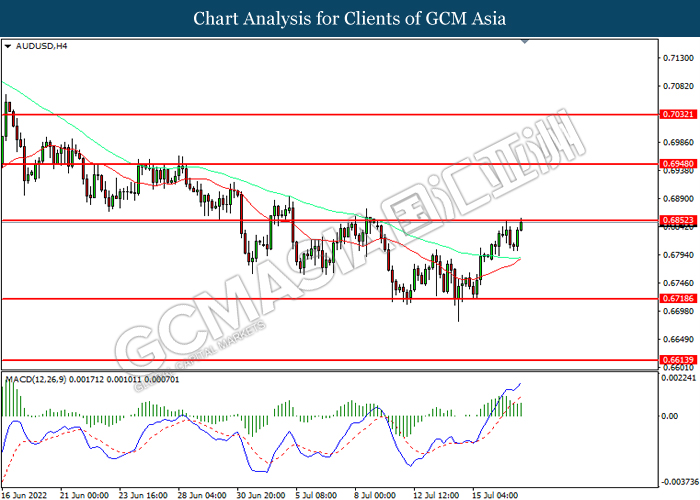

The Australia Dollar extends its gains following the Reserve Bank of Australia unleashed their hawkish tone toward the economic progression in the Australia region. According to the latest monetary policy meeting minutes, the Reserve Bank of Australia has signaled the need for higher rate hikes in order to combat the spiking inflation risk. Despite the recent rate hikes which adding further pressure toward the Australia economy, the unemployment drops to its lowest level in nearly 50 years. The Reserve Bank of Australia (RBA) also sees the current benchmark rate of 1.35% is still well below the neutral rate. Currently, if the Australia economy continue to its full recovery, market participants could expect the Reserve Bank of Australia would likely to increase further benchmark rate by 0.75% in August. Inflation figures are currently the most crucial indicator to determine the future monetary policy, hence investors would continue to scrutinize further data to gauge the likelihood movement for the currency. As of writing, AUD/USD appreciated by 0.56% to 0.6850.

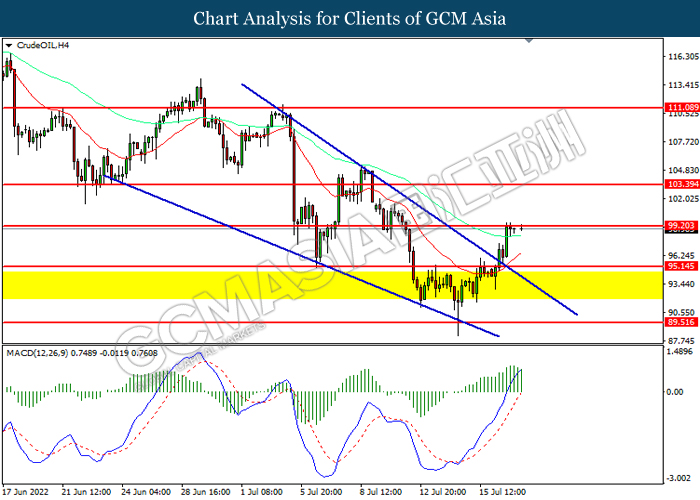

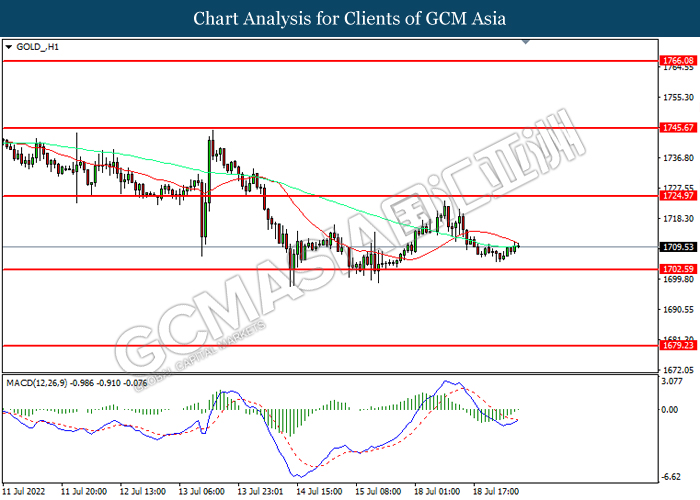

In the commodities market, the crude oil price surged 0.14% to $99.10 per barrel as of writing. The crude oil price was traded higher as the recent depreciation of US Dollar continue to spark further demand on this greenback-dominated oil. On the other hand, the gold price slumped 0.03% to $1709.70 per troy ounces as of writing amid weakening US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 14:00 | GBP – Average Earnings Index +Bonus (May) | 6.8% | 6.9% | – |

| 14:00 | GBP – Claimant Count Change (Jun) | -19.7K | – | – |

| 17:00 | EUR – CPI (YoY) (Jun) | 8.6% | 8.6% | – |

| 20:30 | USD – Building Permits (Jun) | 1.695M | 1.650M | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded lower following prior retracement from the resistance level. MACD which illustrated diminishing bullish momentum suggest the index to extend its losses toward support level.

Resistance level: 108.15, 112.45

Support level: 105.55, 101.30

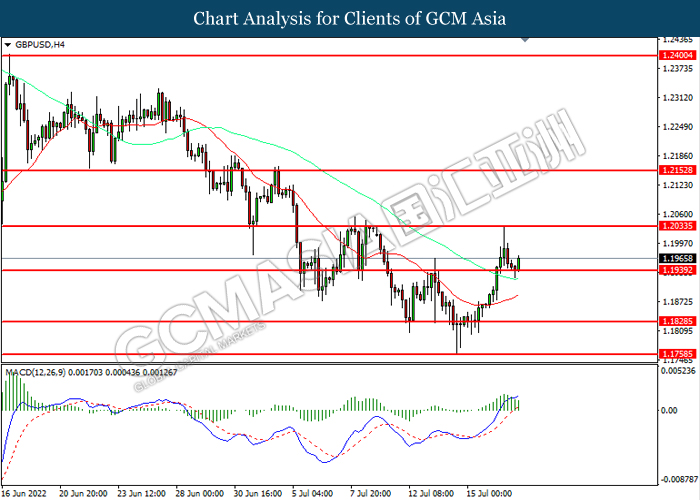

GBPUSD, H4: GBPUSD was traded higher following prior rebounded from the support level. MACD which illustrated increasing bullish momentum suggest the pair to extend tis gains toward resistance level.

Resistance level: 1.2035, 1.2155

Support level: 1.1940, 1.1830

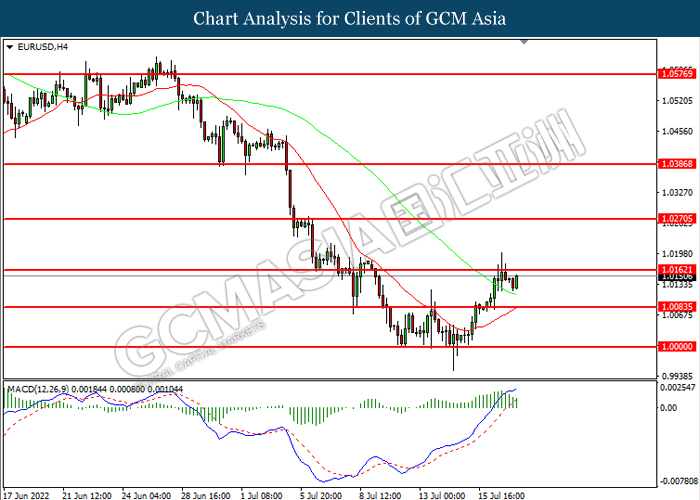

EURUSD, H4: EURUSD was traded higher while currently testing the resistance level. However, MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.0160, 1.0270

Support level: 1.0085, 1.0000

USDJPY, H4: USDJPY was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after breakout.

Resistance level: 139.65, 142.75

Support level: 137.75, 134.45

AUDUSD, H4: AUDUSD was traded higher while currently near the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains after breakout.

Resistance level: 0.6850, 0.6950

Support level: 0.6720, 0.6615

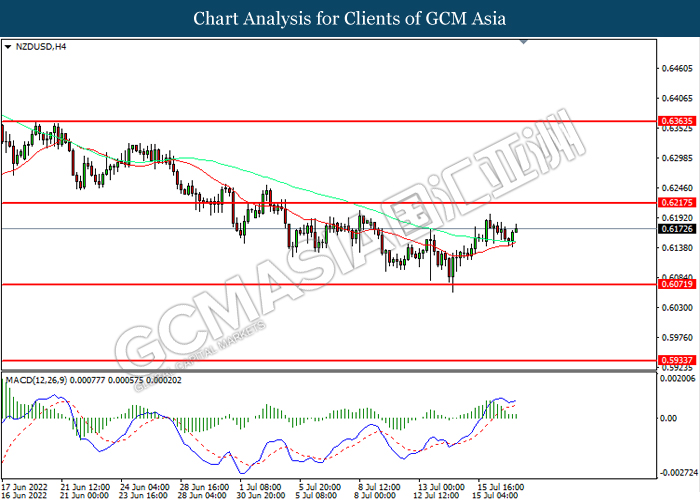

NZDUSD, H4: NZDUSD was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains after breakout.

Resistance level: 0.6215, 0.6365

Support level: 0.6070, 0.5935

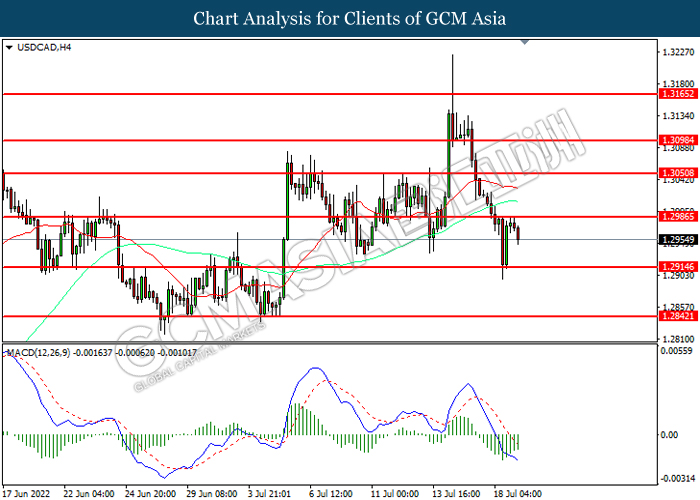

USDCAD, H4: USDCAD was traded lower following prior retracement from the resistance level. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.2985, 1.3050

Support level: 1.2915, 1.2840

USDCHF, H4: USDCHF was traded lower while currently testing the support level. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.9845, 0.9905

Support level: 0.9755, 0.9685

CrudeOIL, H4: Crude oil price was traded within a range while currently testing the resistance level. However, MACD which illustrated diminishing bullish momentum suggest the commodity to be traded lower as technical correction.

Resistance level: 95.20, 103.40

Support level: 95.15, 89.50

GOLD_, H1: Gold price was traded lower while currently testing the support level. However, MACD which illustrated diminishing bearish momentum suggest the commodity to be traded higher as technical correction.

Resistance level: 1724.95, 1745.65

Support level: 1702.60, 1679.25