19 July 2022 Morning Session Analysis

Bullish financial report announced, US Dollar slumped.

The Dollar Index which traded against a basket of six major currencies dropped significantly amid the backdrop of upbeat financial performance from banks. According to Reuters, Bank of America Corp beat analysts’ estimates for second-quarter profit on Monday, with healthy consumer spending and strong demand for loans limiting the hit from its investment banking business. On the other hand, Goldman Sachs Group Inc also beat expectations, its stock rising more than 4% after bond trading helped overcome weakness in M&A advisory. The greater-than-expected performance had dialed up the market optimism toward the company development, which stoked a shift in sentiment toward risk-appetite assets such as stocks market. However, the losses experienced by the Dollar Index was limited after the tech giant company released its financial report. Apple shares fell 2% after a report claimed that it would slow hiring and spending, becoming the latest tech giant to make such a move as fears of an economic downturn hit the sector. As of writing, the Dollar Index depreciated by 0.58% to 107.28.

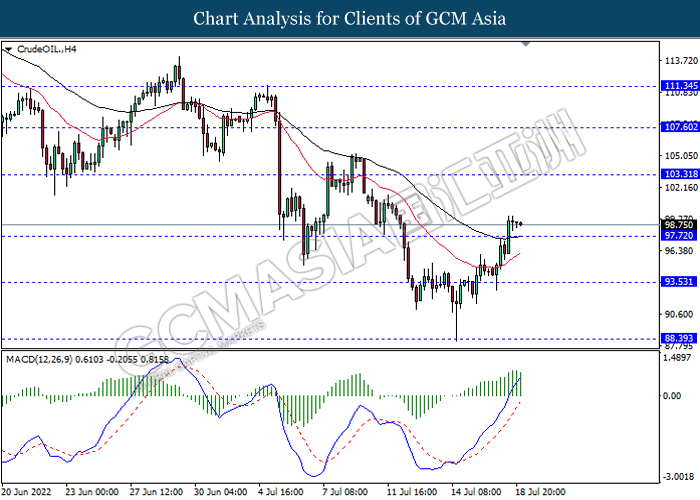

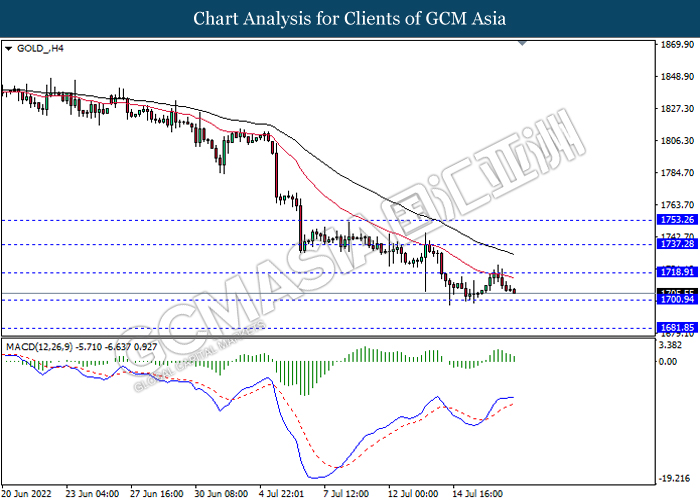

In the commodities market, crude oil price eased by 0.45% to $98.97 per barrel as of writing. Nonetheless, the oil price surged on yesterday as no announcements on increasing oil production by the Saudis. Besides, gold price depreciated by 0.29% to $1705.20 per troy ounce as of writing over the appreciation of US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 14:00 | GBP – Average Earnings Index +Bonus (May) | 6.8% | 6.9% | – |

| 14:00 | GBP – Claimant Count Change (Jun) | -19.7K | – | – |

| 17:00 | EUR – CPI (YoY) (Jun) | 8.6% | 8.6% | – |

| 20:30 | USD – Building Permits (Jun) | 1.695M | 1.650M | – |

Technical Analysis

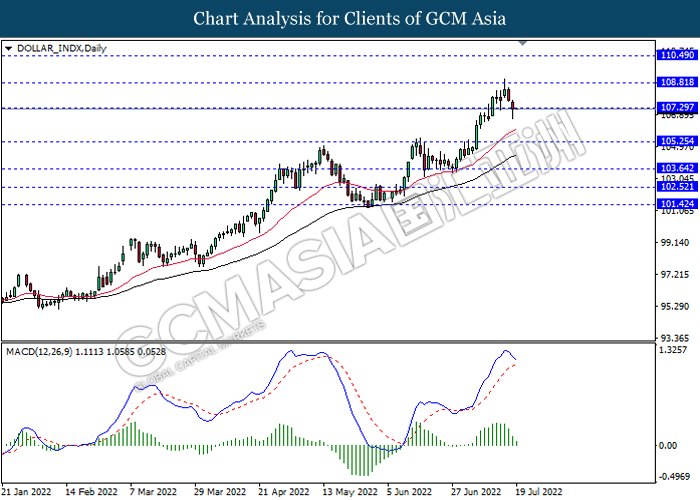

DOLLAR_INDX, Daily: Dollar index was traded lower while currently testing the support level. MACD which illustrated decreasing bullish momentum suggest the index to extend its losses id successfully breakout the support level.

Resistance level: 108.80, 110.50

Support level: 107.30, 105.25

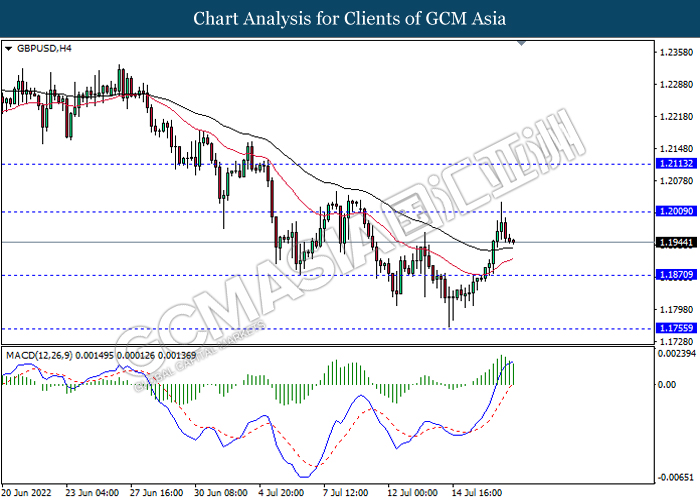

GBPUSD, H4: GBPUSD was traded lower following prior retracement from the resistance level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses.

Resistance level: 1.2010, 1.2115

Support level: 1.1870, 1.1755

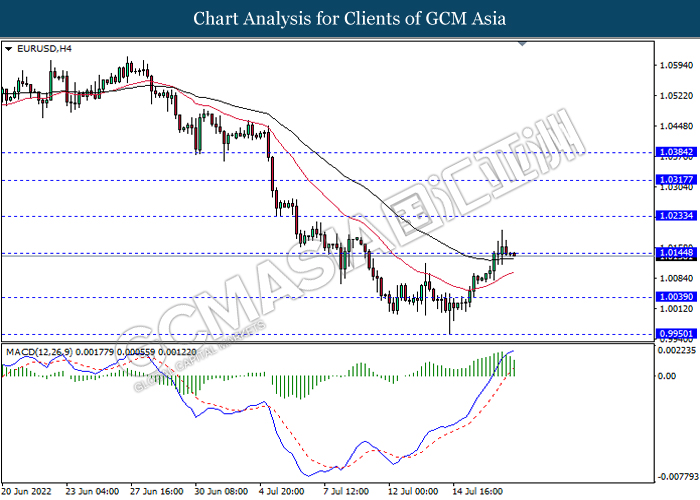

EURUSD, H4: EURUSD was traded lower following prior breakout below the previous support level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses.

Resistance level: 1.0145, 1.0235

Support level: 1.0040, 0.9950

USDJPY, H4: USDJPY was traded lower following prior breakout below the previous support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 138.60, 139.90

Support level: 137.35, 136.65

AUDUSD, H4: AUDUSD was traded lower following prior retracement from the resistance level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses.

Resistance level: 0.6850, 0.6930

Support level: 0.6770, 0.6665

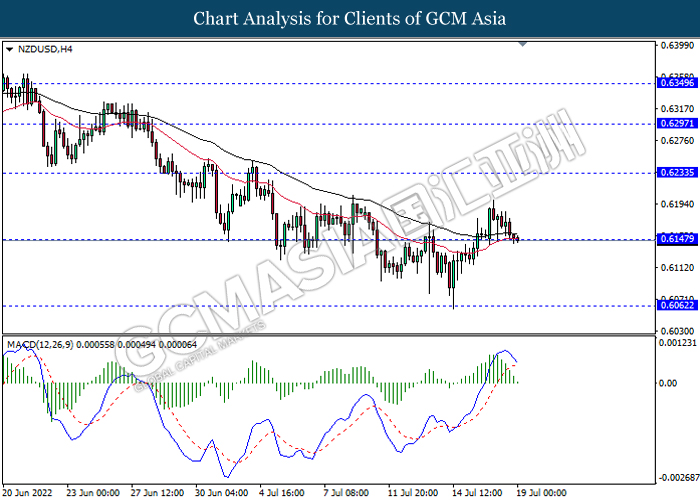

NZDUSD, H4: NZDUSD was traded lower while currently testing the support level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses if successfully breakout the support level.

Resistance level: 0.6235, 0.6295

Support level: 0.6145, 0.6060

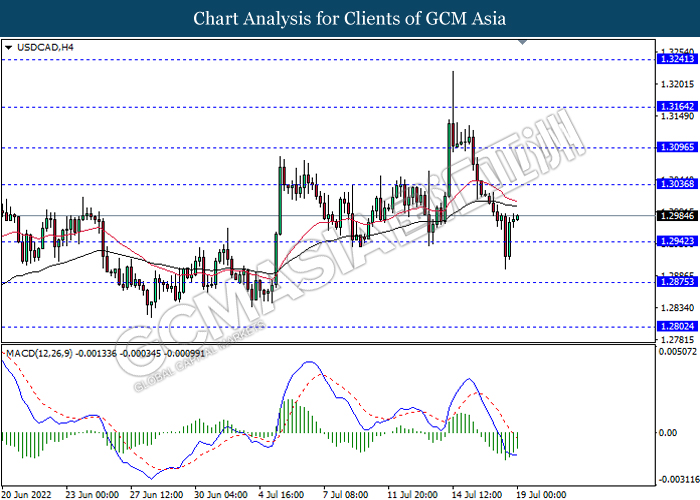

USDCAD, H4: USDCAD was traded higher following prior breakout above the previous resistance level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 1.3035, 1.3095

Support level: 1.2940, 1.2875

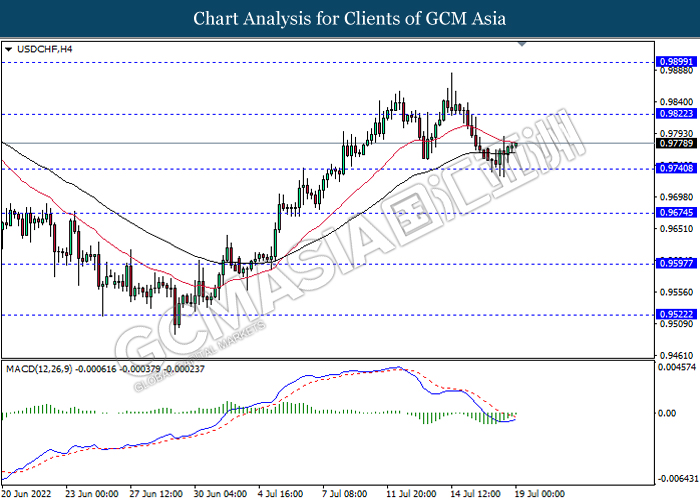

USDCHF, H4: USDCHF was traded higher following prior rebound from the support level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 0.9820, 0.9900

Support level: 0.9740, 0.9675

CrudeOIL, H4: Crude oil price was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the commodity to be traded lower as technical correction.

Resistance level: 103.30, 107.60

Support level: 97.70, 93.55

GOLD_, H4: Gold price was traded lower following prior retracement from the resistance level. MACD which illustrated decreasing bullish momentum suggest the commodity to extend its losses.

Resistance level: 1718.90, 1737.30

Support level: 1700.95, 1681.85