19 October 2022 Morning Session Analysis

Risk-on sentiment following upbeat report, safe-haven Dollar retreated.

The Dollar Index which traded against a basket of six major currencies extend its losses following the revival of risk appetite in the global financial markets continue to prompt investors to shift their portfolio into another riskier asset. Yesterday, the US equity market surged significantly as the upbeat earnings and better-than-expected factory data, which spurring further positive prospect toward the upcoming financial reports. Nonetheless, the losses experienced by the US Dollar was limited over the backdrop of upbeat manufacturing data. According to Federal Reserve, US Industrial Production for last month came in at 0.4%, higher than the market forecast at 0.1%. Such upbeat production data in September led by output gains in both durable and nondurable goods, indicating the manufacturing sector in United States still remains solid despite the recent rate hike decision from Federal Reserve. As of writing, the Dollar Index depreciated by 0.04% to 112.00.

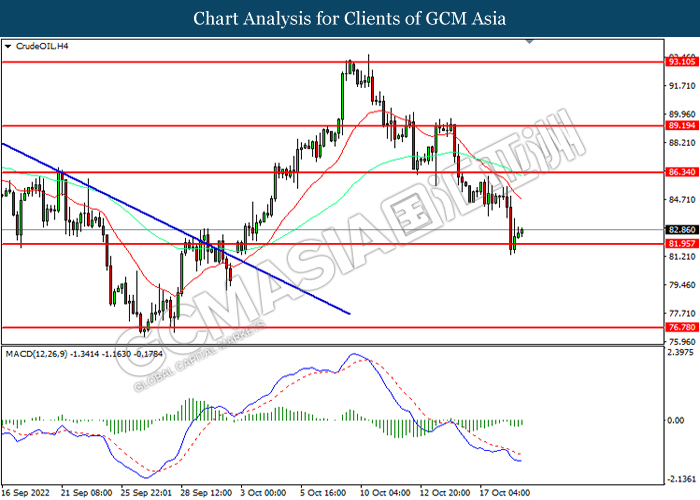

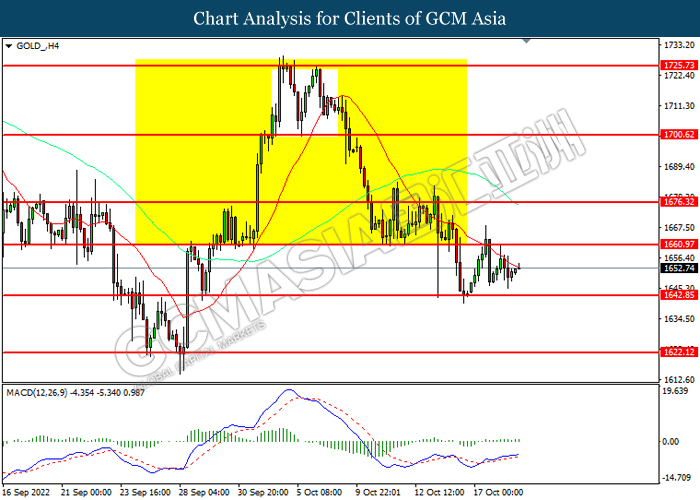

In the commodities market, the crude oil price extends its losses by 0.52% to 83.60 per barrel as of writing. The crude oil price was edged lower amid the speculation over the oil release from US government. According to Bloomberg, the Biden administration is planning to release of at least another 10 million to 15 million barrels of oil from Strategic Petroleum Reserve (SPR). On the other hand, the gold price surged by 0.10% to $1653.50 per troy ounces as of writing amid weakening US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 14:00 | GBP – CPI (YoY) (Sep) | 9.90% | 10.00% | – |

| 17:00 | GBP – CPI (YoY) (Sep) | 9.10% | 10.00% | – |

| 20:30 | USD – Building Permits (Sep) | 1.542M | 1.530M | – |

| 20:30 | CAD – Core CPI (MoM) (Sep) | 0.00% | – | – |

| 22:30 | USD – Crude Oil Inventories | 9.880M | – | – |

Technical Analysis

DOLLAR_INDX, H4: Dollar index was traded lower following prior breakout below the previous support level. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 112.20, 113.15

Support level: 111.35, 109.95

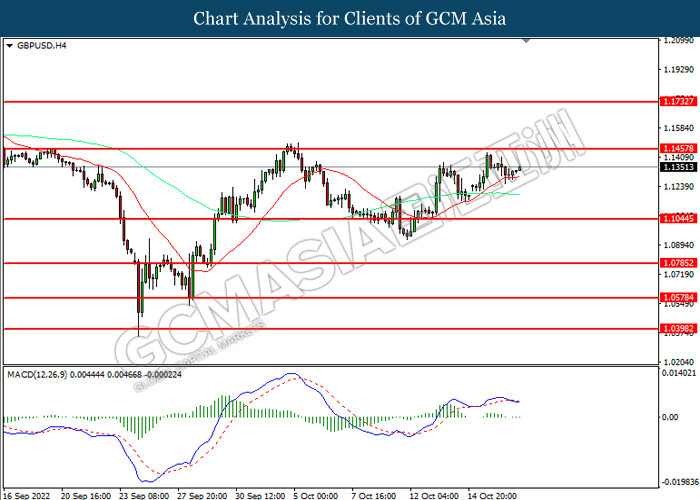

GBPUSD, H4: GBPUSD was traded higher while currently testing the resistance level. However, MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.1455, 1.1735

Support level: 1.1045, 1.0785

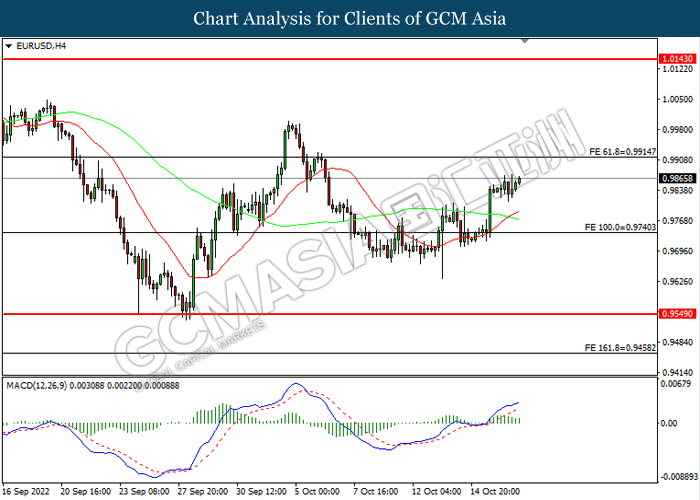

EURUSD, H4: EURUSD was traded higher following prior rebounded from the support level. However, MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 0.9915, 1.0145

Support level: 0.9740, 0.9550

USDJPY, Daily: USDJPY was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains toward resistance level.

Resistance level: 150.15, 155.70

Support level: 145.80, 141.15

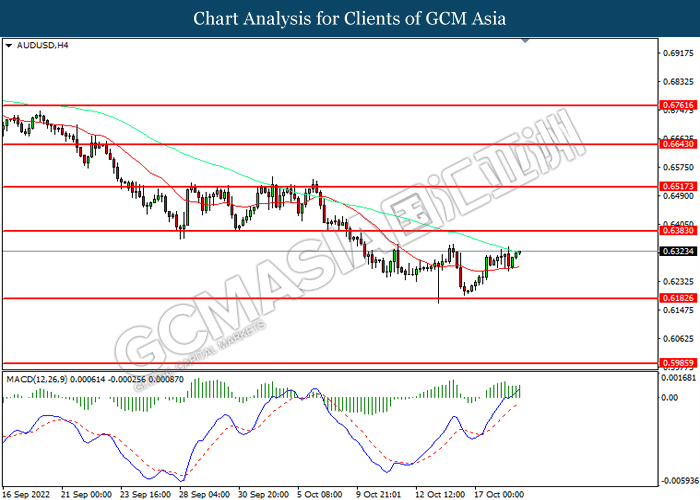

AUDUSD, H4: AUDUSD was traded higher following prior rebounded from the support level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 0.6385, 0.6515

Support level: 0.6185, 0.5985

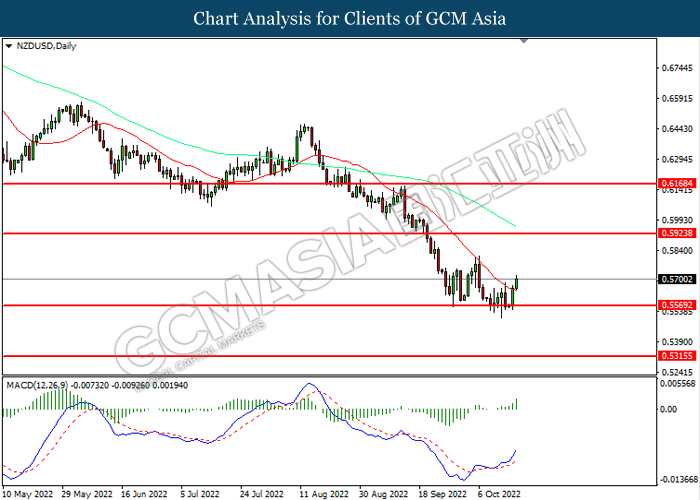

NZDUSD, Daily: NZDUSD was traded higher following prior rebounded from the support level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains toward resistance level.

Resistance level: 0.5925, 0.6170

Support level: 0.5570, 0.5315

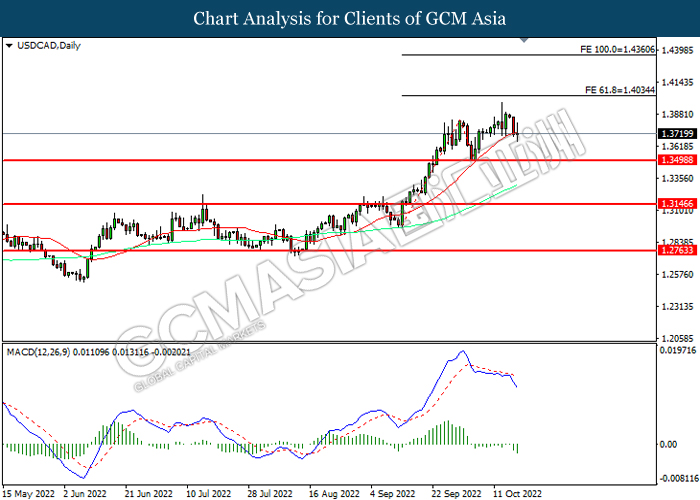

USDCAD, Daily: USDCAD was traded higher while currently near the resistance level. However, MACD which illustrated increasing bearish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.4035, 1.4360

Support level: 1.3500, 1.3145

USDCHF, H4: USDCHF was traded lower while currently testing the support level. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.0035, 1.0185

Support level: 0.9925, 0.9795

CrudeOIL, H4: Crude oil price was traded lower while currently testing the support level. However, MACD which illustrated diminishing bearish momentum suggest the commodity to be traded higher as technical correction.

Resistance level: 86.35, 89.20

Support level: 81.95, 76.80

GOLD_, H4: Gold price was traded lower following prior retracement from the resistance level. However, MACD which illustrated increasing bullish momentum suggest the commodity to be traded higher as technical correction.

Resistance level: 1660.95, 1676.30

Support level: 1642.85, 1622.10