19 November 2018 Afternoon Session Analysis

Dollar under pressure amid global outlook concerns.

Dollar lower against its basket of six major pairs on Monday amid concerns from Fed officials regarding on the global economic outlook. On Friday, Fed’s new vice chairman has warned and cautioned about a slowdown in global growth, emphasize that “neutrality” in terms of monetary policy is going to be relevant for the future outlook for the US economy. Besides that, Federal Reserve Bank of Dallas Robert Kaplan also stated in an interview with Fox Business that he also saw a growth slowdown in Europe and China, prompting traders to reassess the pace of future U.S interest rate hike. Dollar index slumped 0.03% to 96.30 at the time of writing. On the other hand, GBPUSD was down 0.04% to 1.2831 as of writing amid fractured political backdrop within the UK where various cabinet minister has resigned and UK PM Theresa May could possibly face a vote of no confidence this week while the current Brexit draft agreement is unlikely to passed by the UK Parliament.

As for commodities market, crude oil price has rebound from lows by 0.58% to $57.32 per barrel amid traders have expected top exporter Saudi Arabia to urge OPEC to reduce supply about 1 million to 1.4 million bpd of supply to adjust global demand slowdown toward year-end. Moreover, gold price gains 0.05% to $1,220.15 a troy ounce following dollar’s weakness amid growth concerns.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

23:45 USD FOMC Member Williams Speaks

Today’s Highlight Economic Data

N/A

Technical Analysis

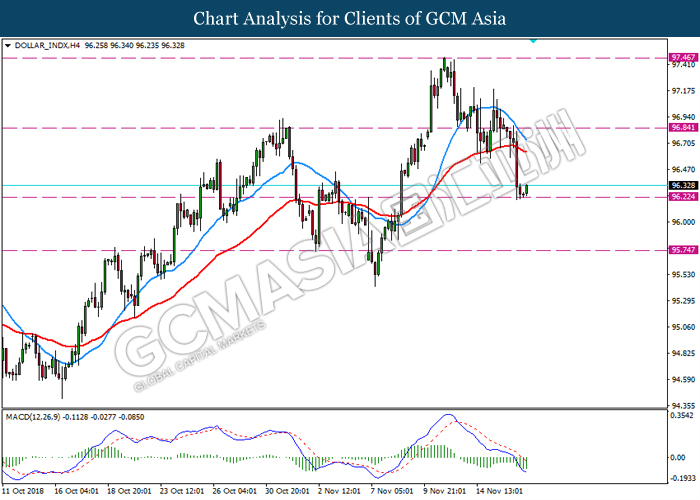

DOLLAR_INDX, H1: Dollar index was traded lower following a breakout below the previous support 95.75. MACD which illustrate bearish momentum signal with death cross suggest the dollar to extend its losses towards the support level 95.40.

Resistance level: 96.15, 96.35

Support level: 95.40, 95.15

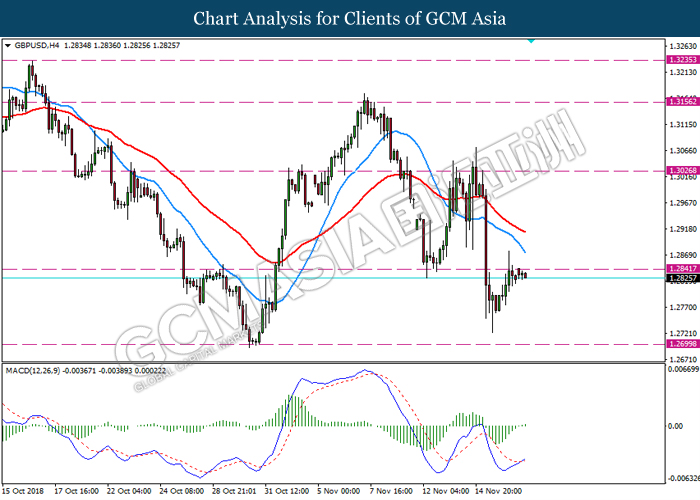

GBPUSD, H4: GBPUSD was traded lower following prior retracement from the resistance level 1.2840. Although MACD illustrate bullish momentum with the formation of golden cross, a breakout above the resistance level 1.2840 is required to attain further confirmation.

Resistance level: 1.2840, 1.3025

Support level: 1.2700, 1.2585

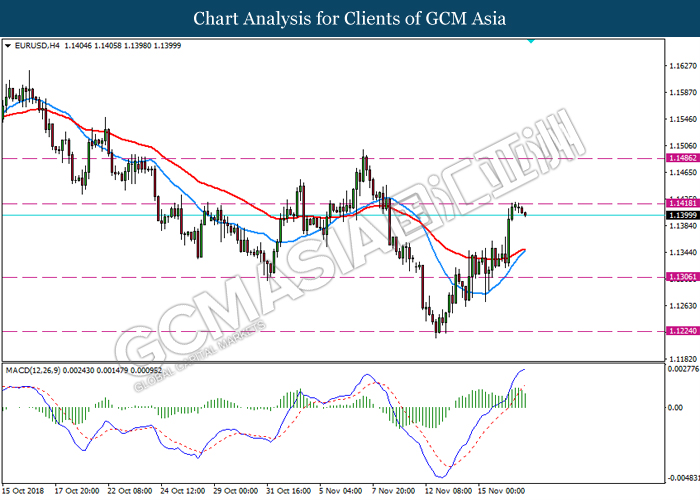

EURUSD, H4: EURUSD was traded lower following recent retracement from the resistance level 1.1420. MACD which display diminishing bullish momentum suggest the pair to extend its retracements towards the support level 1.1305.

Resistance level: 1.1420, 1.1485

Support level: 1.1305, 1.1225

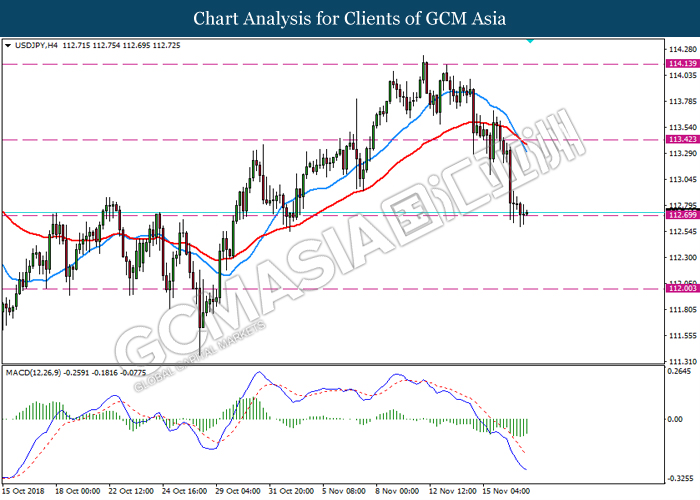

USDJPY, H4: USDJPY was traded lower while currently testing the support level 112.70. MACD which illustrate diminishing bearish momentum suggest the pair to be traded higher as a short-term technical correction towards the resistance level 113.40.

Resistance level: 113.40, 114.15

Support level: 112.70, 112.00

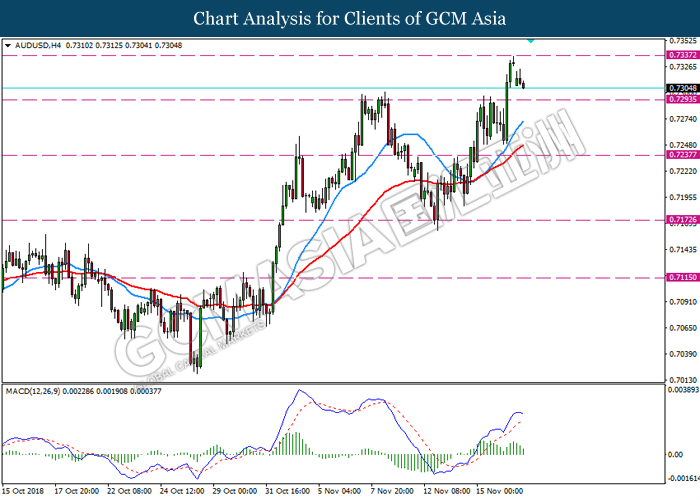

AUDUSD, H4: AUDUSD was traded lower following prior retracement from the resistance level 0.7335. MACD which display bearish momentum suggest the pair to extend its retracement towards the support level 0.7295.

Resistance level: 0.7335, 0.7435

Support level: 0.7295, 0.7235

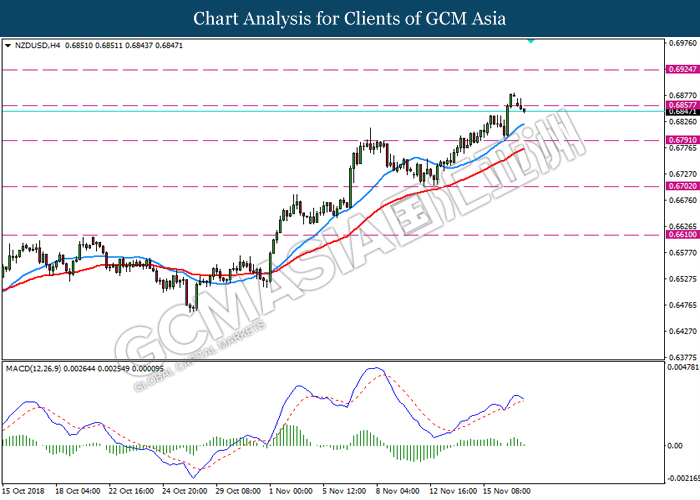

NZDUSD, H4: NZDUSD was traded lower following prior recent retracement from the resistance level 0.6855. MACD which illustrate bearish momentum with negative divergence suggest the pair to extend its retracement towards the support level 0.6790.

Resistance level: 0.6855, 0.6925

Support level: 0.6790, 0.6700

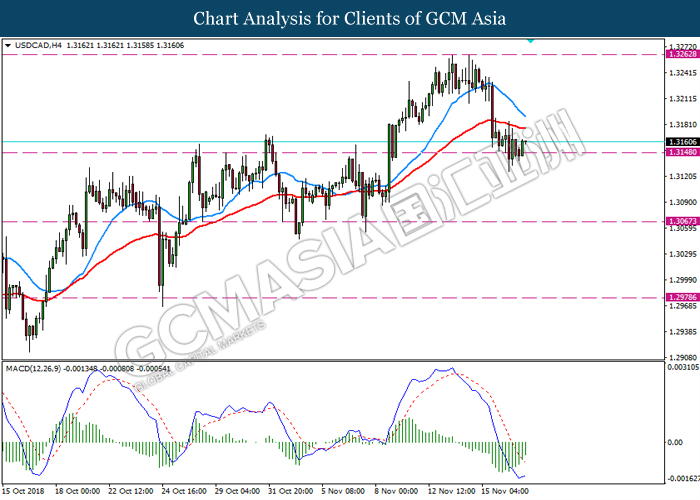

USDCAD, H4: USDCAD was traded higher following prior rebound from the support level 1.3150. MACD which illustrate bullish momentum suggest the pair to extend its gains towards the resistance level 1.3260.

Resistance level: 1.3260, 1.3360

Support level: 1.3150, 1.3065

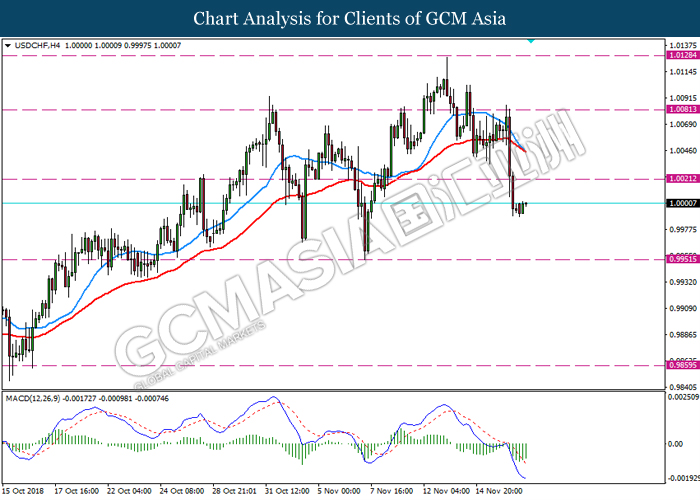

USDCHF, H4: USDCHF was traded lower following prior breakout below the previous support level 1.0020. MACD which illustrate diminishing bearish momentum suggest the pair to undergo a short-term technical correction towards the current resistance level 1.0020.

Resistance level: 1.0020, 1.0080

Support level: 0.9950, 0.9860

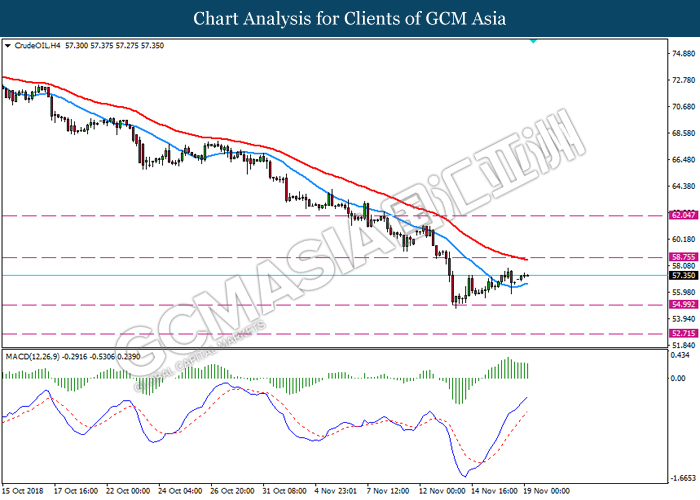

CrudeOIL, H4: Crude oil price was traded higher following recent rebound from the support level 55.00. MACD which display continuous bullish momentum suggest the pair to extend its gains towards the resistance level 58.75.

Resistance level: 58.75, 62.05

Support level: 55.00, 52.70

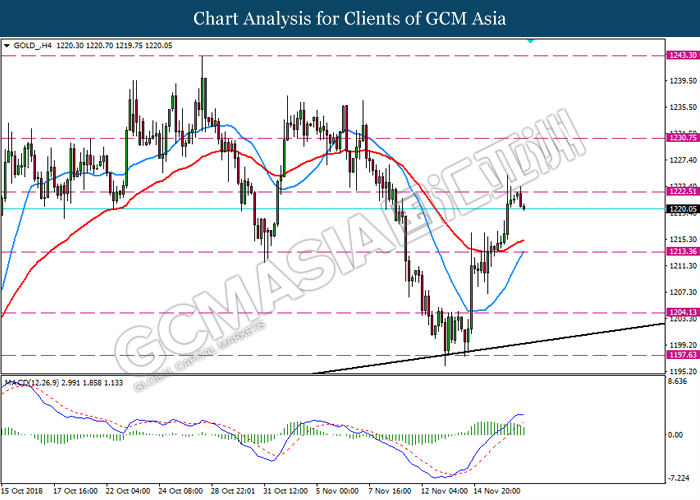

GOLD_, H4: Gold was traded lower following recent retracement from the resistance level 1222.50. MACD which illustrate bearish momentum suggest the pair to extend its retracement towards the support level 1213.50.

Resistance level: 1222.50, 1230.75

Support level: 1213.50, 1204.00

Highlighted economy data and events for the week: November 19 – 23

| Monday, November 19 |

Data N/A

Events USD – FOMC Member Williams Speaks

|

| Tuesday, November 20 |

Data USD – Building Permits (Oct)

Events AUD – RBA Meeting Minutes GBP – BoE Gov Carney Speaks GBP – Inflation Report Hearings |

| Wednesday, November 21 |

Data USD – Core Durable Goods Order (MoM) (Oct) USD – Existing Home Sales (Oct) CrudeOIL – API Weekly Crude Oil Stock CrudeOIL – Crude Oil Inventories

Events CAD – BoC Gov Council Member Wilkins Speaks

|

| Thursday, November 22 |

Data JPY – National Core CPI (YoY) (Oct)

Events EUR – ECB Publishes Account of Monetary Policy Meeting

|

|

Friday, November 23

|

Data EUR – German GDP (QoQ) (Q3) EUR – German Manufacturing PMI (Nov) CAD – Core CPI (MoM) (Oct) CAD – Core Retail Sales (MoM) (Sep)

Events GBP – BoE MPC Member Saunders Speaks

|