19 November 2021 Afternoon Session Analysis

New Zealand Kiwi rose following expectation of rate hike.

The New Zealand Kiwi which traded against the dollar and other currency pairs have rose following increasing expectation of rate hike in the upcoming monetary policy meeting from RBNZ. According to the latest survey conducted by RBNZ, two-year inflation expectations have rose to 2.96% from 2.27% last. The central bank announced that the country’s inflation expectation had also jumped 3.7%, the highest since 2021 and added that interest rate expectations may continue to rise in short and medium term. Following the situation, experts believe that the coming week is likely to bring some good news for the investors in the form of another rate hike, targeting to limit the country’s inflation between 1-3%, with a central target of 2%. At the time of writing, NZD/USD rose 0.08% to 0.7037.

In the commodities market, crude oil price rebounds 0.03% to $79.24 per barrel at the time of writing as market takes a breather are now wondering how much crude major economies would release from their strategic reserves. Recently, Reuters report that the United States had asked China, Japan and other big buyers to join a release of crude stocks from Strategic Petroleum Reserves. On the other hand, gold price remains supported and edge higher 0.05% to $1862.50 a troy ounce at the time of writing following dollar weakness.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

16:30 EUR ECB President Lagarde Speaks

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 15:00 | GBP – Retail Sales (MoM) (Oct) | -0.2% | 0.5% | – |

| 21:30 | CAD – Core Retail Sales (MoM) (Sep) | 2.8% | -1.0% | – |

Technical Analysis

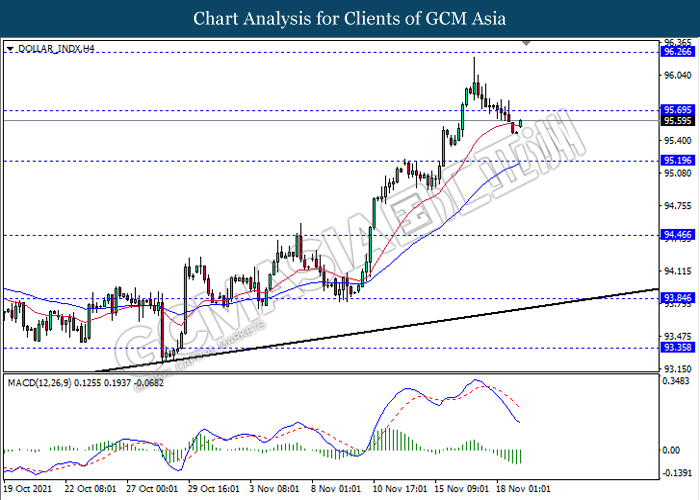

DOLLAR_INDX, H4: Dollar index was traded lower following recent breakout below the previous support level 95.70. MACD which illustrate bearish bias signal suggest the dollar to extend its losses towards the support level 95.20.

Resistance level: 95.70, 96.25

Support level: 95.20, 94.45

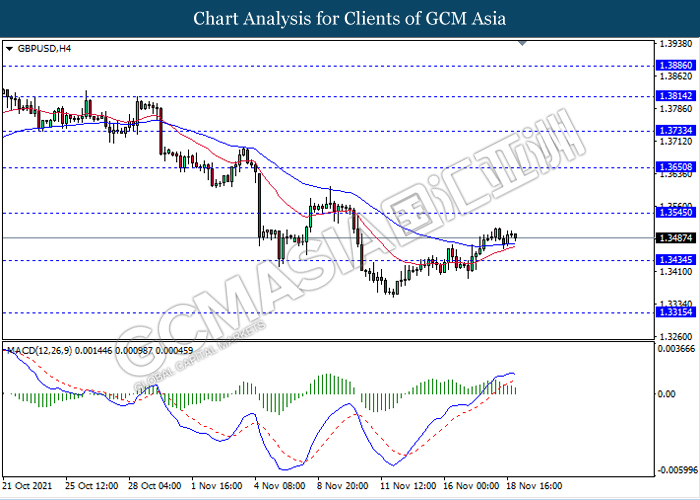

GBPUSD, H4: GBPUSD was traded higher following recent breakout above the previous resistance level 1.3435. However, MACD which illustrate diminishing bullish momentum signal suggest the pair to be traded lower as a short term technical correction back towards the level 1.3435.

Resistance level: 1.3545, 1.3650

Support level: 1.3435, 1.3300

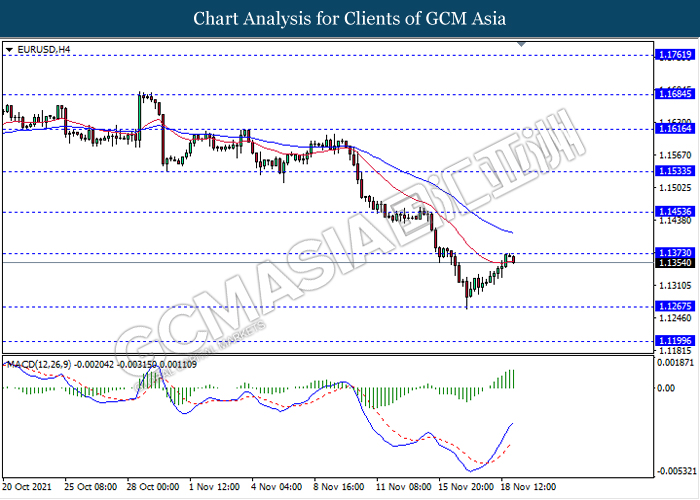

EURUSD, H4: EURUSD was traded higher while currently testing the resistance level 1.1375. However, MACD which illustrate diminishing bullish momentum signal suggest the pair to experience a technical correction towards the support level 1.1265.

Resistance level: 1.1375, 1.1455

Support level: 1.1265, 1.1200

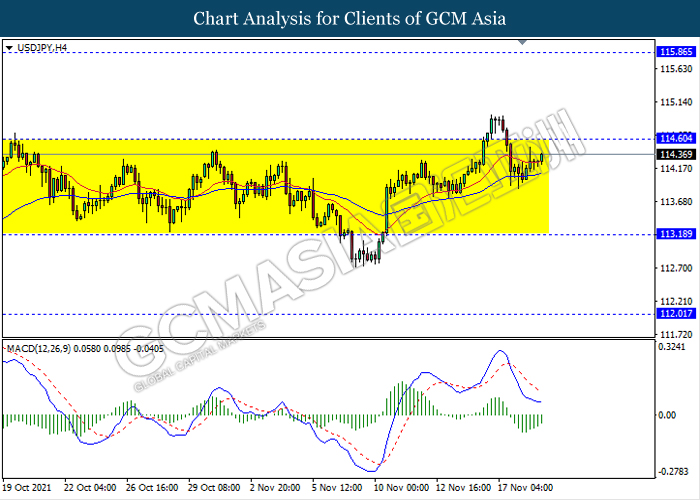

USDJPY, H4: USDJPY remain traded in a sideway channel while currently testing near the resistance level 114.60. However, MACD which illustrate diminishing bearish momentum signal suggest the pair to be traded higher after it breaks above the resistance level 114.60.

Resistance level: 114.60, 115.85

Support level: 113.20, 112.00

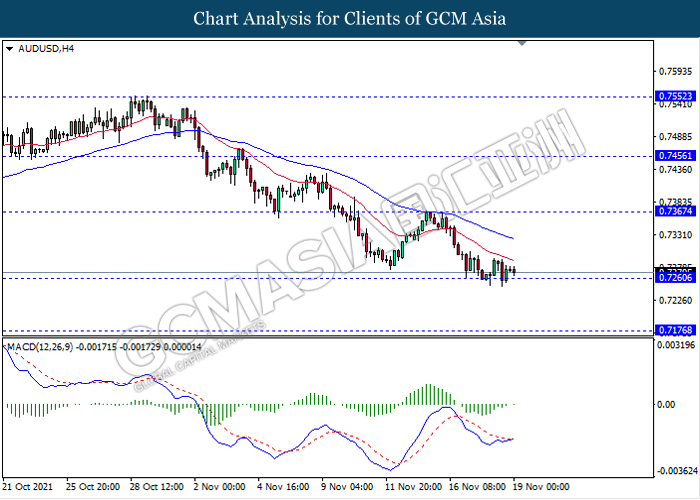

AUDUSD, H4: AUDUSD was traded lower while currently testing the support level 0.7260. MACD which illustrate bullish bias signal with the formation of golden cross suggest the pair to be traded higher as a technical correction towards the resistance level 0.7365.

Resistance level: 0.7365, 0.7455

Support level: 0.7260, 0.7175

NZDUSD, H4: NZDUSD was traded higher following prior rebound from the support level 0.6980. MACD which illustrate bullish momentum signal suggest the pair to extend its rebound towards the resistance level 0.7075.

Resistance level: 0.7075, 0.7145

Support level: 0.6980, 0.6910

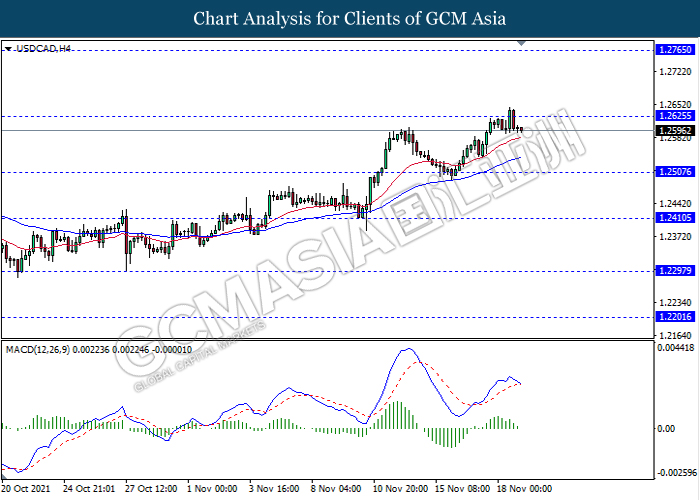

USDCAD, H4: USDCAD was traded lower following prior retracement from the resistance level 1.2625. MACD which illustrate diminishing bullish momentum signal suggest the pair to extend its retracement towards the support level 1.2505.

Resistance level: 1.2625, 1.2765

Support level: 1.2505, 1.2410

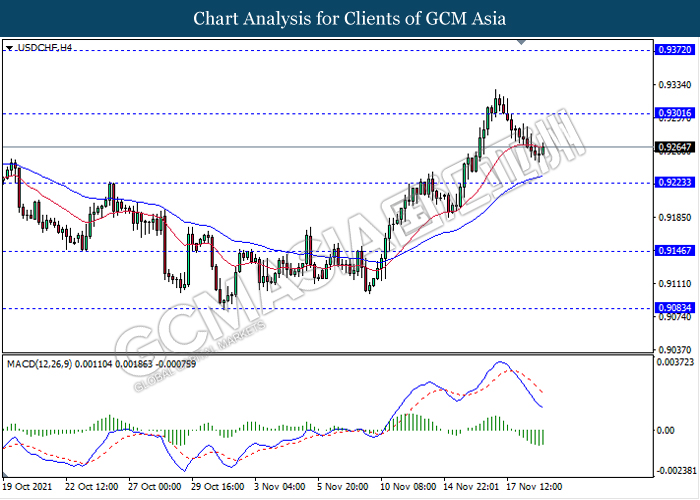

USDCHF, H4: USDCHF was traded lower following prior retracement from the resistance level 0.9300. MACD which illustrate bearish momentum signal suggest the pair to extend its retracement towards the support level 0.9225.

Resistance level: 0.9300, 0.9370

Support level: 0.9225, 0.9145

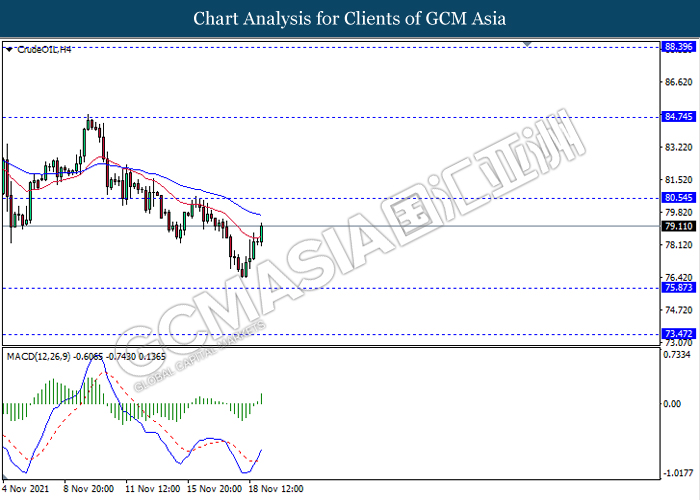

CrudeOIL, H4: Crude oil price was traded higher following recent rebound from the support level 75.85. MACD which illustrate bullish momentum signal with the formation of golden cross suggest the commodity to extend its rebound towards the resistance level 80.55.

Resistance level: 80.55, 84.75

Support level: 75.85, 73.45

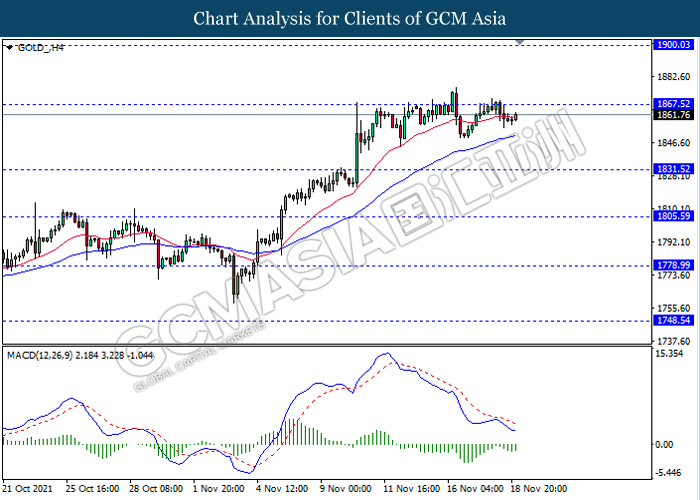

GOLD_, H4: Gold price remain traded flat near the resistance level 1867.50. However, MACD which illustrate bearish momentum signal suggest the commodity to be traded lower towards the support level 1831.50.

Resistance level: 1867.50, 1900.05

Support level: 1831.50, 1805.60