19 December 2018 Afternoon Session Analysis

Dollar pressured amid expected dovish outlook.

note from Federal Reserve. According to reports, the Fed is expected to increase rate on Wednesday. However, due to increasing trade tensions between US and China and the slowdown in global growth, investors expected that the Federal Reserve will likely to adopt a dovish outlook on the monetary policy and could signaling ideas of fewer rate hikes for the upcoming year. Besides that, U.S President also criticized the Fed for even considering yet another interest rate hike despite current economy outlook. Dollar index was down 0.25% to 96.30 as of writing. Meanwhile, AUD/USD inched higher 0.22% to 0.7190 at the time of writing as strong commodity sentiment has provide boost for the Aussie. The Aussie has found support from the increasing strength from commodity such as safe-haven gold due to trade tensions fears. In addition, investors are also eyeing on dovish note from Fed monetary statement on U.S counterpart which could provide further boost for the Aussie.

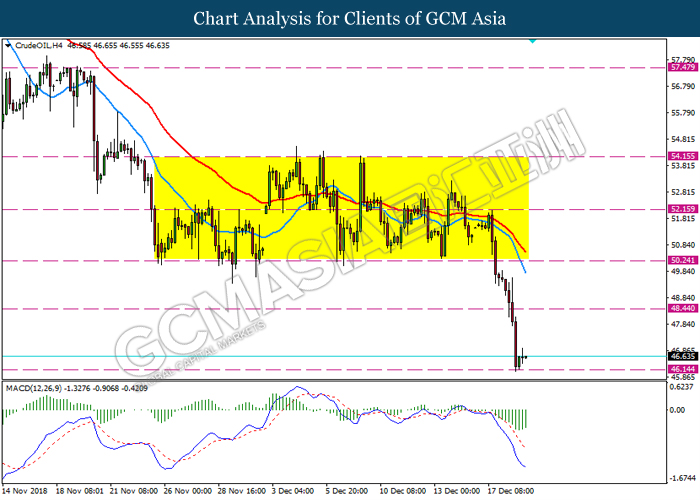

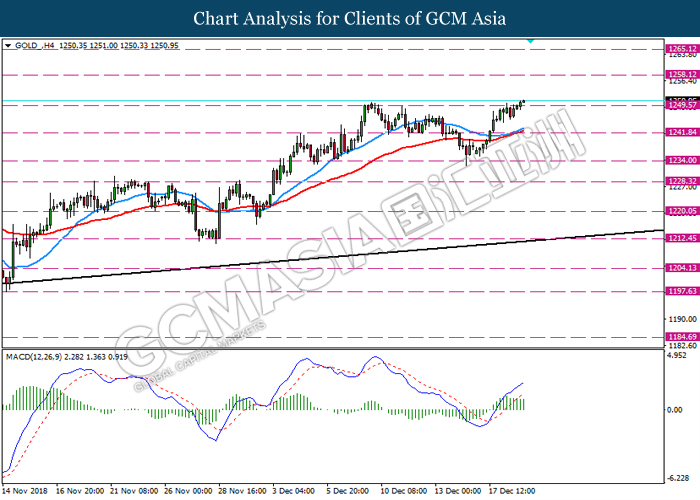

As for commodities market, crude oil price recovers 0.85% to $46.95 per barrel as of writing after a major tumble following the increasing worries of oversupply which continues to pressure the oil market. Based on American Petroleum Institute statement on Tuesday, U.S crude oil stocks rose unexpectedly last week while at the same time, U.S government also stated that shale production is expected to increase to over 8 million bpd for the first time by the end of December. Thus, it has increase further pressure for the already weak oil sentiment and causing another major selloff. On the other hand, gold price inched higher 0.11% to $1250.60 at the time of writing amid dollar weakness which dragged by expected dovish monetary policy from the Fed this week.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

03:00 (20th) USD FOMC Economic Projections

03:00 USD FOMC Statement

03:30 USD FOMC Press Conference

Today’s Highlight Economic Data

| Time | Market & Data | Previous | Forecast | Actual |

| 15:00 | EUR – German PPI (MoM) (Nov) | 0.3% | -0.1% | – |

| 17:30 | GBP – CPI (YoY) (Nov) | 2.4% | 2.3% | – |

| 21:30 | CAD – Core CPI (MoM) (Nov) | 0.4% | – | – |

| 23:00 | USD – Existing Home Sales (Nov) | 5.22M | 5.20M | – |

| 23:30 | CrudeOIL – EIA Crude Oil Inventories | -1.208M | -2.437M | – |

| 03:00

(20th) |

USD – Fed Interest Rate Decision | 2.25% | 2.50% | – |

Technical Analysis

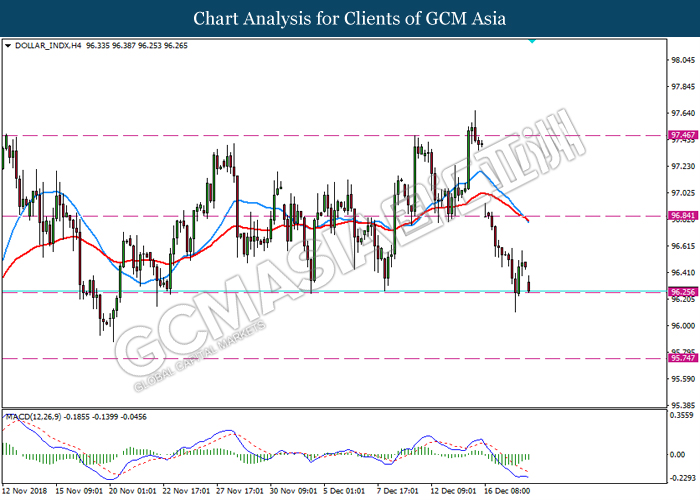

DOLLAR_INDX, H4: Dollar index was traded lower while currently retest the support level 96.25. MACD which illustrate diminishing bearish momentum suggest the pair to undergo a short-term technical correction towards the resistance level 96.85.

Resistance level: 96.85, 97.45

Support level: 96.25, 95.75

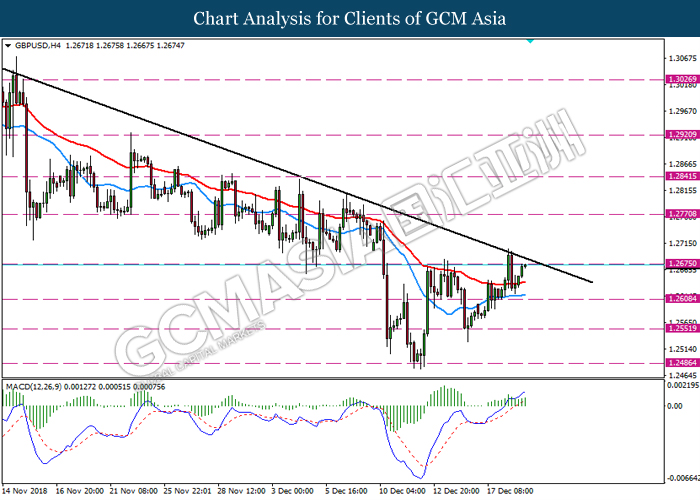

GBPUSD, H4: GBPUSD was traded higher while currently retest the resistance level 1.2675. MACD which illustrate diminishing bullish momentum suggest the pair to undergo a technical correction and retrace from the resistance level 1.2675.

Resistance level: 1.2675, 1.2770

Support level: 1.2610, 1.2550

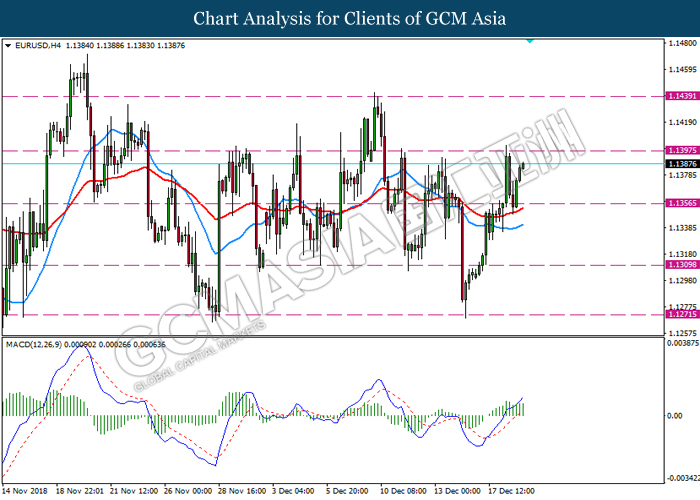

EURUSD, H4: EURUSD was trading higher following recent rebound from the support level 1.1355. MACD which illustrate diminishing bullish momentum suggest the pair to undergo technical correction in short term and retrace from the nearby resistance level 1.1395.

Resistance level: 1.1395, 1.1440

Support level: 1.1355, 1.1310

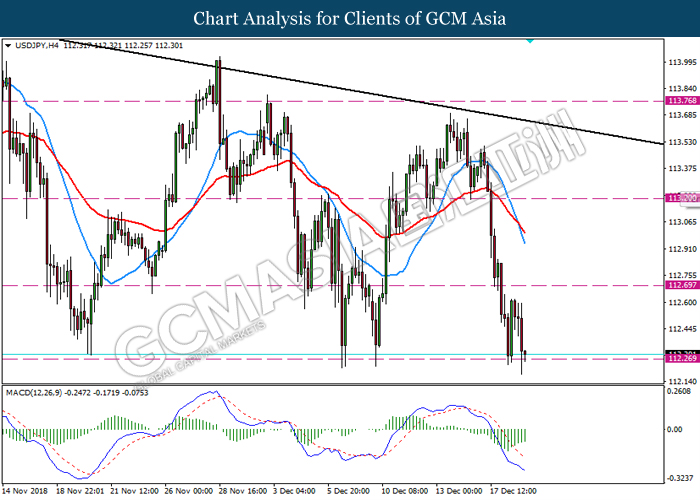

USDJPY, H4: USDJPY was traded lower while currently retest the support level 112.25. MACD which illustrate diminishing bearish momentum suggest the pair to undergo short term technical correction towards the resistance level 112.70.

Resistance level: 112.70, 113.20

Support level: 112.25, 111.60

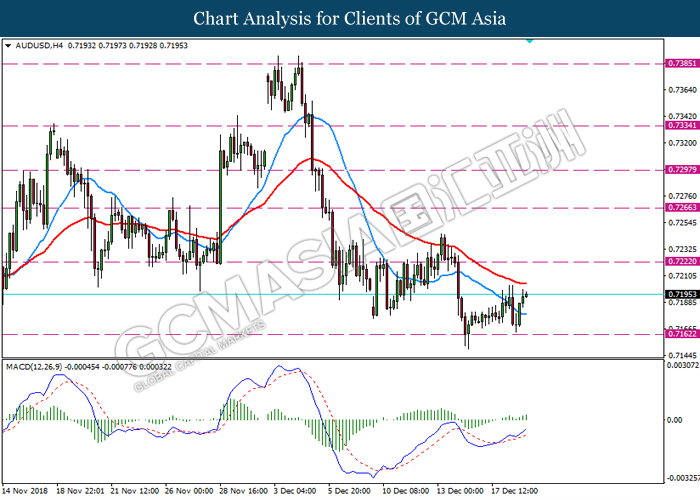

AUDUSD, H4: AUDUSD was traded higher following prior rebound from the support level 0.7160. MACD which display bullish momentum with the formation of golden cross suggest the pair to extend its gains after it breaks above the resistance level 0.7220.

Resistance level: 0.7220, 0.7265

Support level: 0.7160, 0.7095

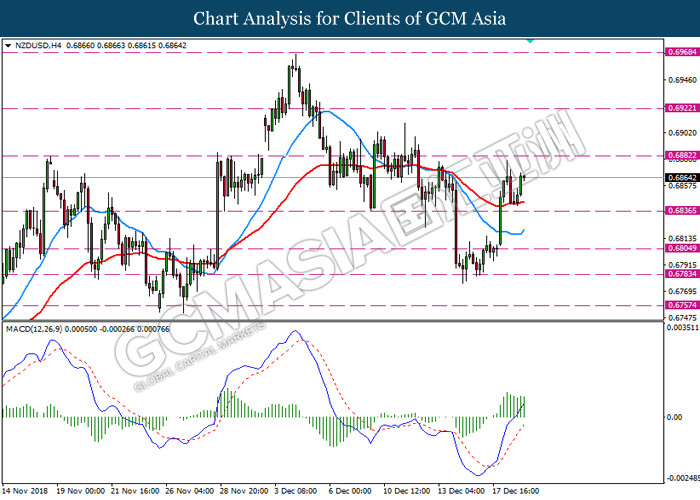

NZDUSD, H4: NZDUSD was traded higher following prior rebound from the support level 0.6835. MACD which illustrate diminishing bullish momentum suggest the pair may undergo short term technical correction and retrace towards the support level 0.6835

Resistance level: 0.6880, 0.6920

Support level: 0.6835, 0.6805

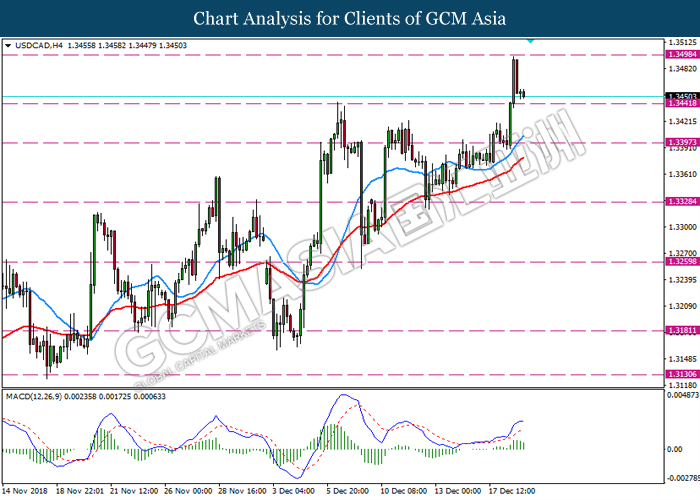

USDCAD, H4: USDCAD was traded lower following prior retracement from the resistance level 1.3500. MACD which illustrate bearish bias suggest the pair to extend its retracement towards the support level 1.3440.

Resistance level: 1.3500, 1.3565

Support level: 1.3440, 1.3395

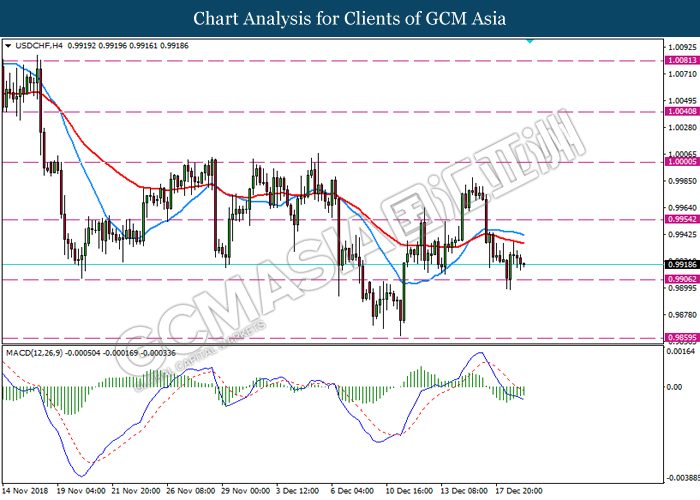

USDCHF, H4: USDCHF was traded higher following recent rebound from the support level 0.9905.MACD which illustrate bullish momentum suggest the pair to extend its rebound towards the resistance level 0.9955.

Resistance level: 0.9955, 1.0000

Support level: 0.9905, 0.9860

CrudeOIL, H4: Crude oil price was traded lower while currently testing the support level 46.15. MACD which illustrate diminishing bearish momentum suggest the commodity to undergo a technical correction and rebound from the support level 46.15.

Resistance level: 48.45, 50.25

Support level: 46.15, 44.00

GOLD_, H4: Gold was traded higher following recent breakout above the previous resistance level 1249.50. However, MACD which illustrate diminishing bearish momentum with the formation of bearish divergence suggest the commodity to be traded lower as a short-term technical correction towards back below previous resistance level 1249.50

Resistance level: 1258.00, 1265.00

Support level: 1249.50, 1241.80