19 December 2022 Afternoon Session Analysis

Pound lingered following the release of mixed economic data.

The Pound Sterling, which was majorly traded by the global investors, hovered near the recent lows after UK released a series of mixed economic data. According to the Office for National Statistics, the UK Retail Sales data came in at -0.4%, missing the consensus forecast at 0.3%, while recording a significant drop from the prior month reading at 0.9%. It reflected that the consumer spending in the nation dropped sharply, which could be mainly attributed to the rate-hike plan from the Bank of England (BoE). Besides, the UK Manufacturing PMI dropped from 46.5 to 44.7, weaker than the consensus forecast at 46.5, while the UK Services PMI achieved the level of 50.0. Nonetheless, the gains of Pound were not seen as the recent hawkish statement from the Federal Reserve Chairman Jerome Powell continued to spark bearish momentum on the pairing of GBP/USD. As of writing, the pair of GBP/USD rebounded 0.40% to 1.2190.

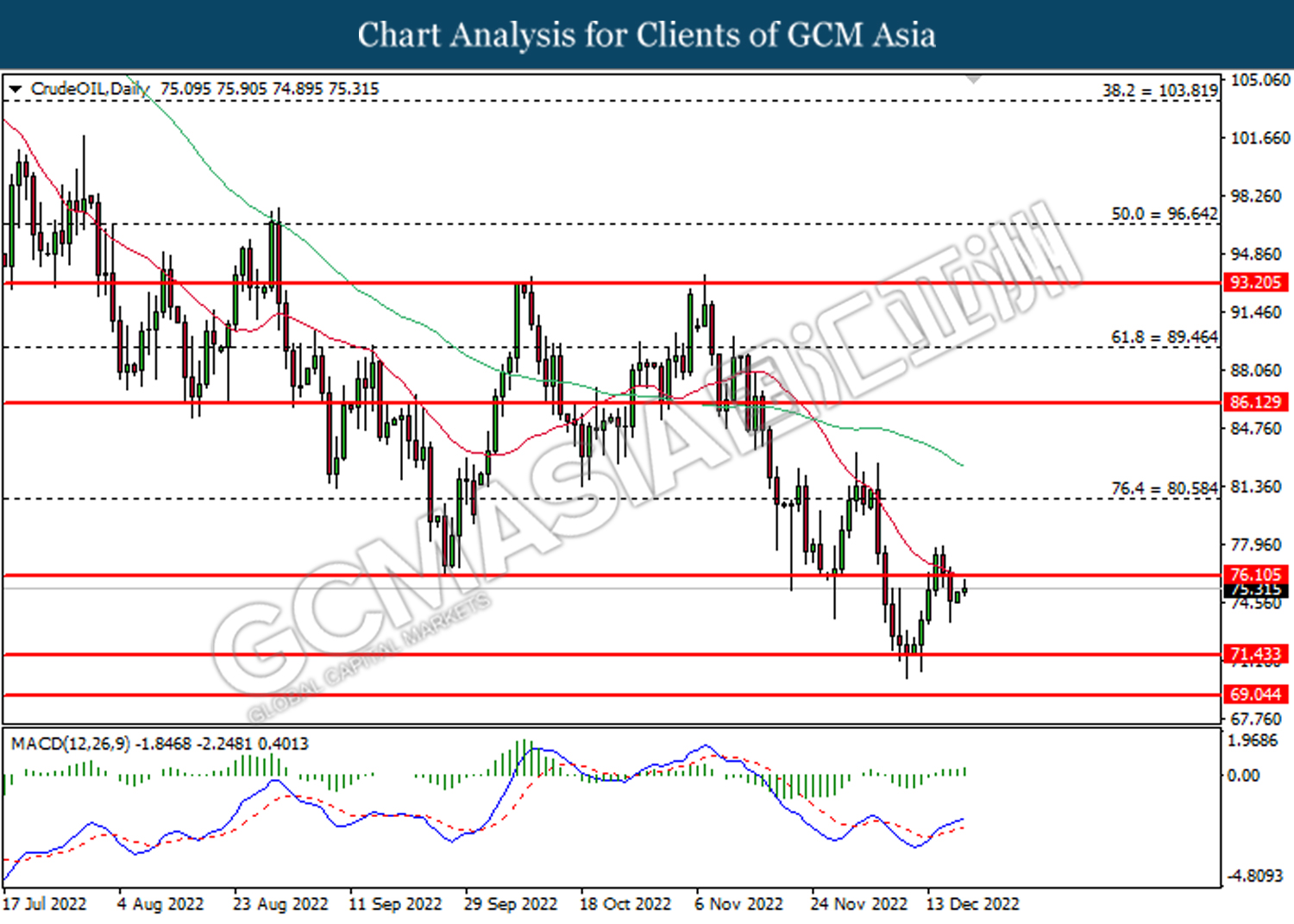

In the commodities market, the crude oil price rose by 1.11% to $75.55 per barrel after the US president Joe Biden decided to refill the Strategic Petroleum Reserve (SPR) in February 2023. Besides, the gold prices rose 0.09% to $1794.90 per troy ounce amid dollar weakened during Asian trading session.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 17:00 | EUR – German Ifo Business Climate Index (Dec) | 86.3 | 87.4 | – |

Technical Analysis

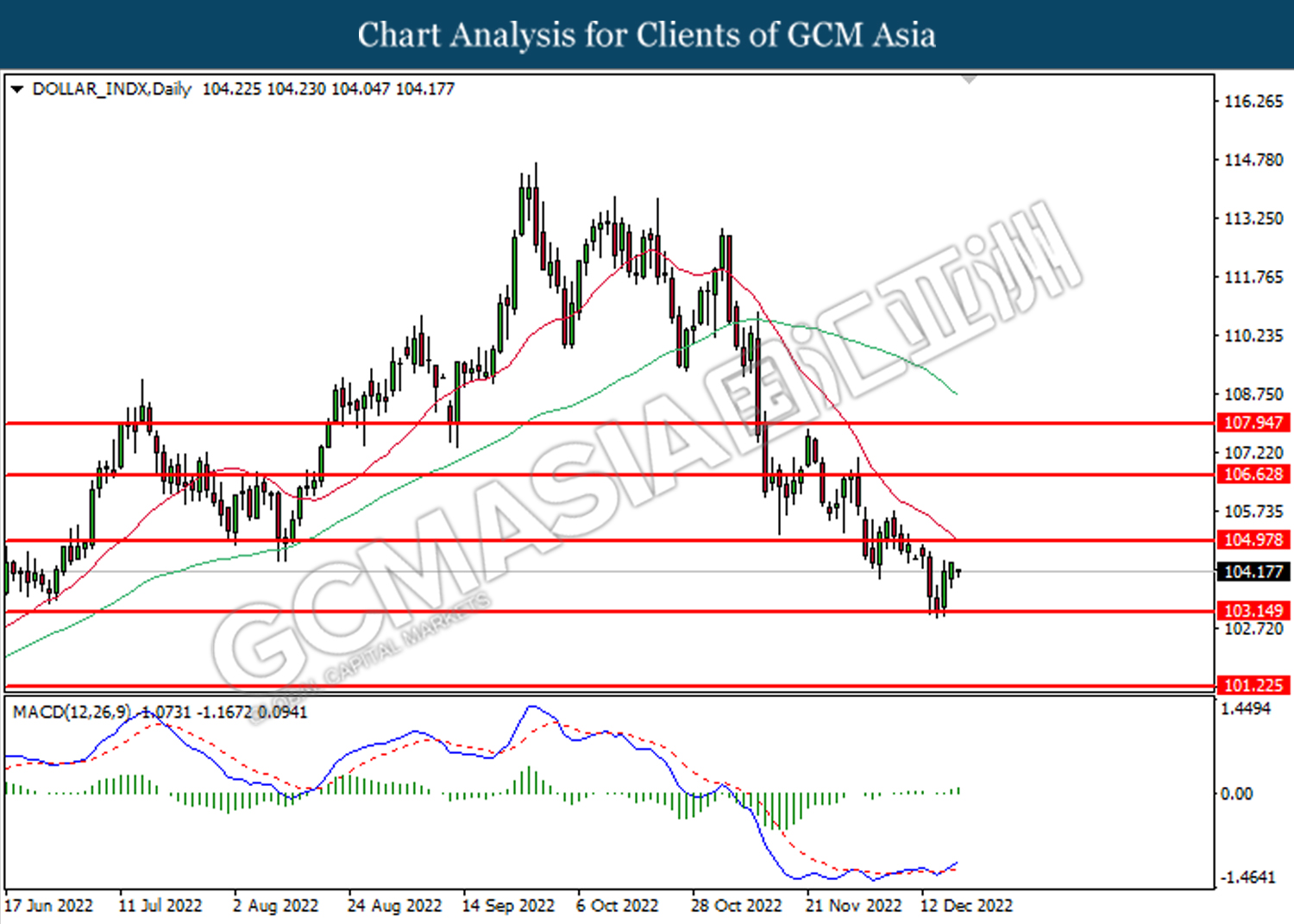

DOLLAR_INDX, Daily: Dollar index was traded higher following prior rebound from the support level at 103.15. MACD which illustrated bullish bias momentum suggests the index to extend its gains toward the resistance level at 105.00.

Resistance level: 105.00, 106.65

Support level: 103.15, 101.25

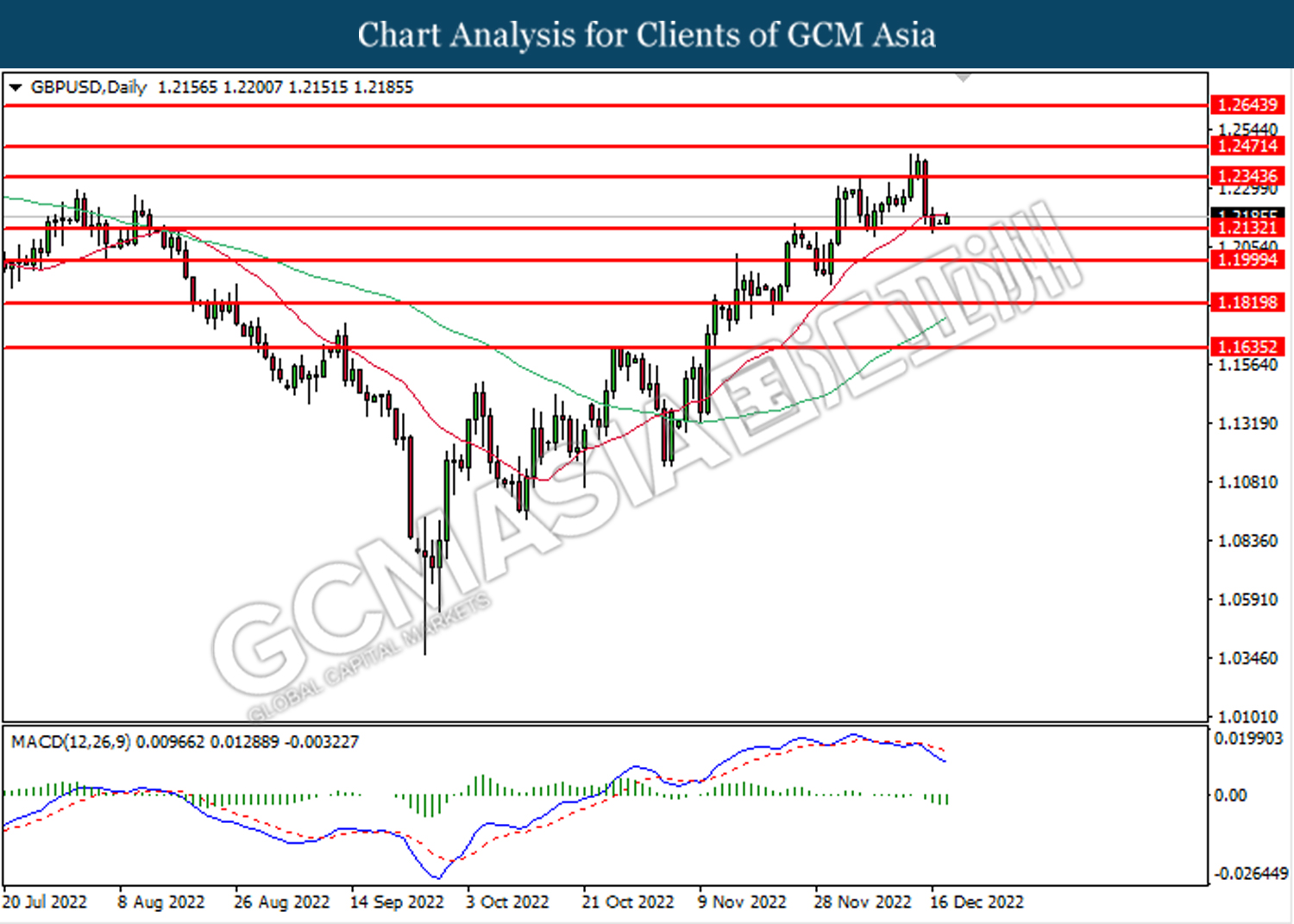

GBPUSD, Daily: GBPUSD was traded lower while currently testing the support level at 1.2130. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.2345, 1.2470

Support level: 1.2130, 1.2000

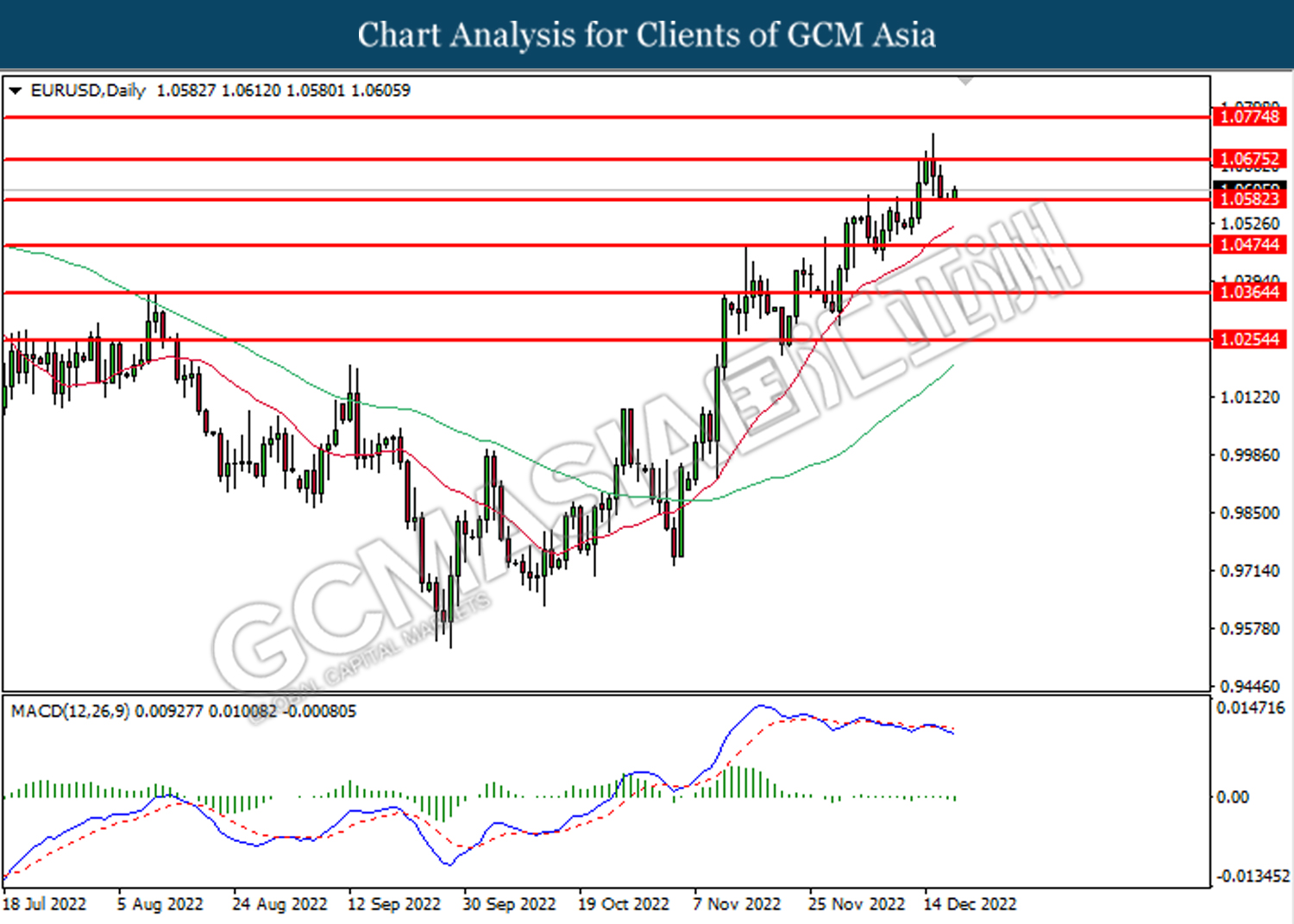

EURUSD, Daily: EURUSD was traded higher following prior rebound from the support level at 1.0585. However, MACD which illustrated bearish bias momentum suggest the pair to undergo technical correction in short term.

Resistance level: 1.0675, 1.0775

Support level: 1.0580, 1.0475

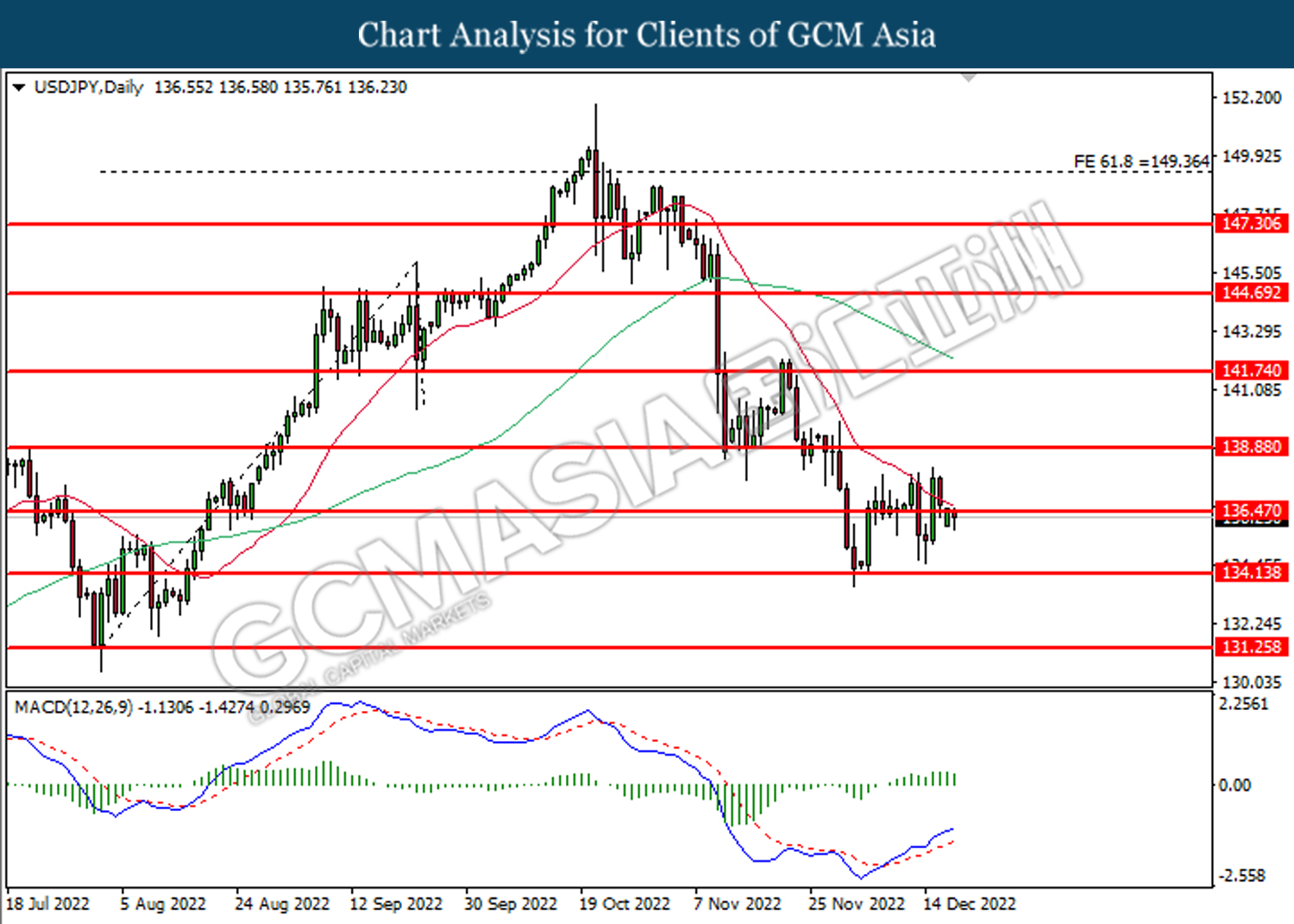

USDJPY, Daily: USDJPY was traded lower following prior retracement from the resistance level at 136.45. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward the support level at 134.15.

Resistance level: 136.45, 138.90

Support level: 134.15, 131.25

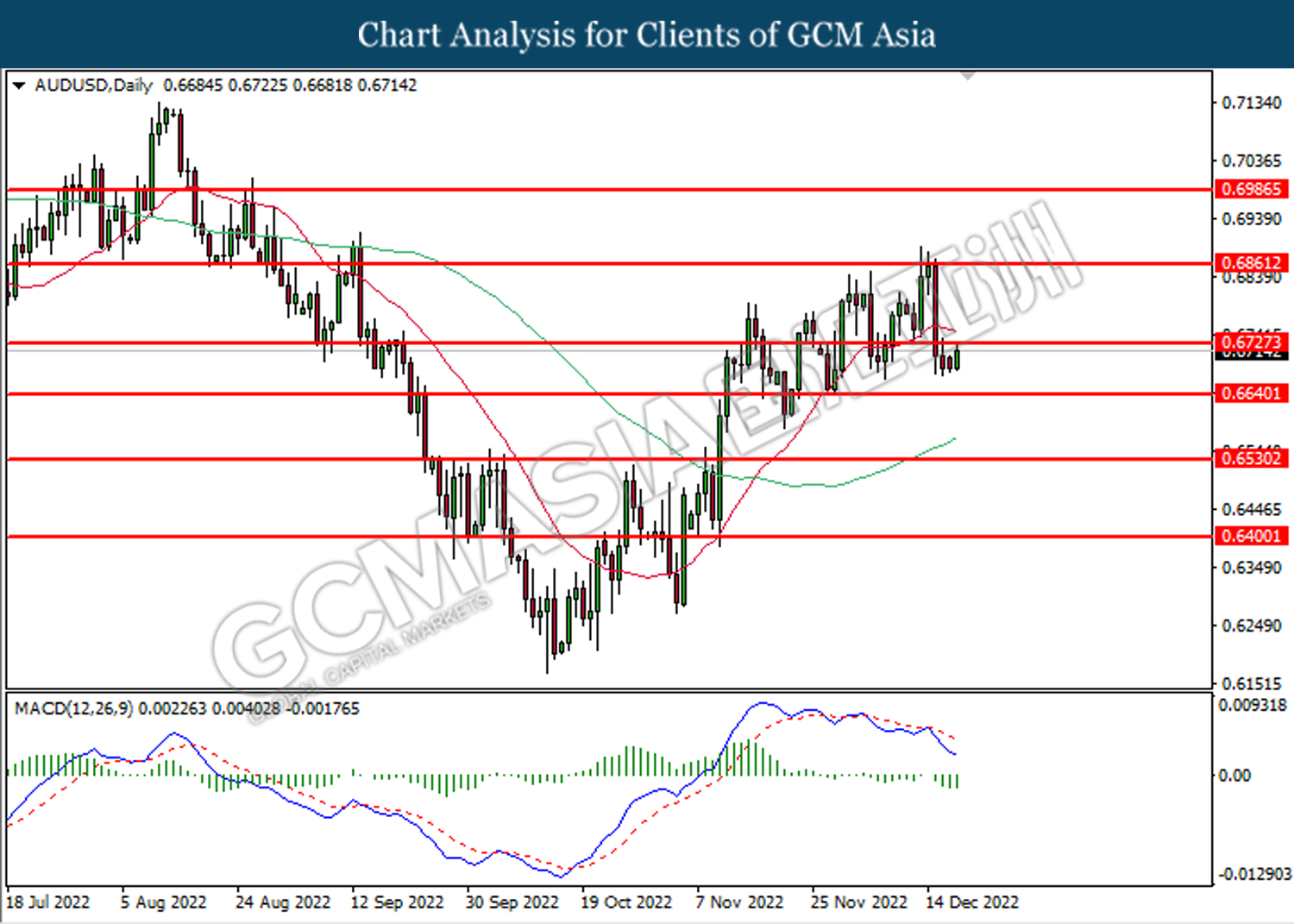

AUDUSD, Daily: AUDUSD was traded higher while currently testing the resistance level at 0.6725. However, MACD which illustrated bearish bias momentum suggest the pair to undergo technical correction in short term.

Resistance level: 0.6725, 0.6860

Support level: 0.6640, 0.6530

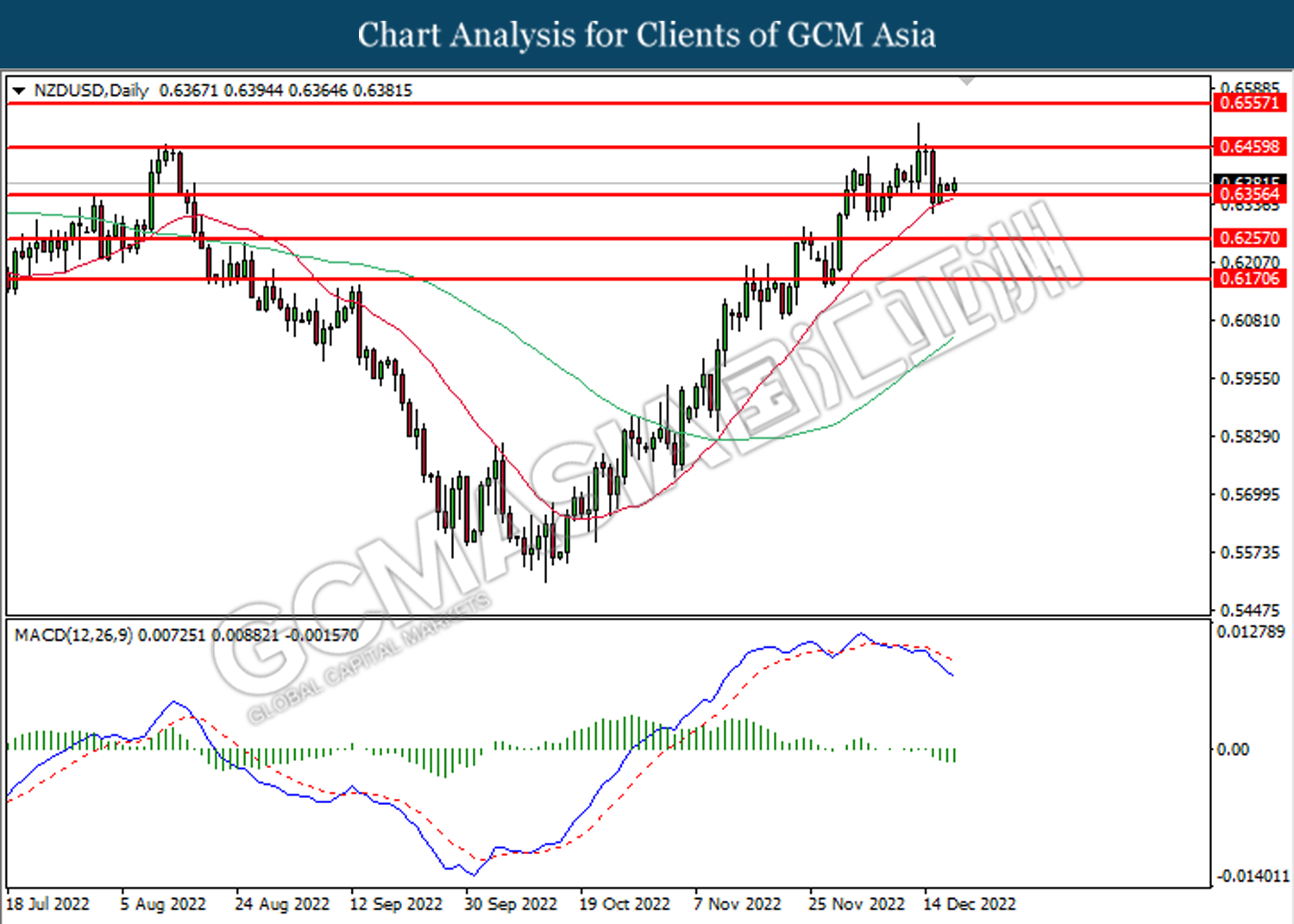

NZDUSD, Daily: NZDUSD was traded higher following prior breakout above the previous resistance level at 0.6355. However, MACD which illustrated bearish bias momentum suggest the pair to undergo technical correction in short term.

Resistance level: 0.6460, 0.6555

Support level: 0.6355, 0.6255

USDCAD, Daily: USDCAD was traded higher following prior breakout above the previous resistance level at 1.3600. MACD which illustrated bullish bias momentum suggests the pair to extend its gains toward the resistance level at 1.3740.

Resistance level: 1.3740, 1.3885

Support level: 1.3600, 1.3505

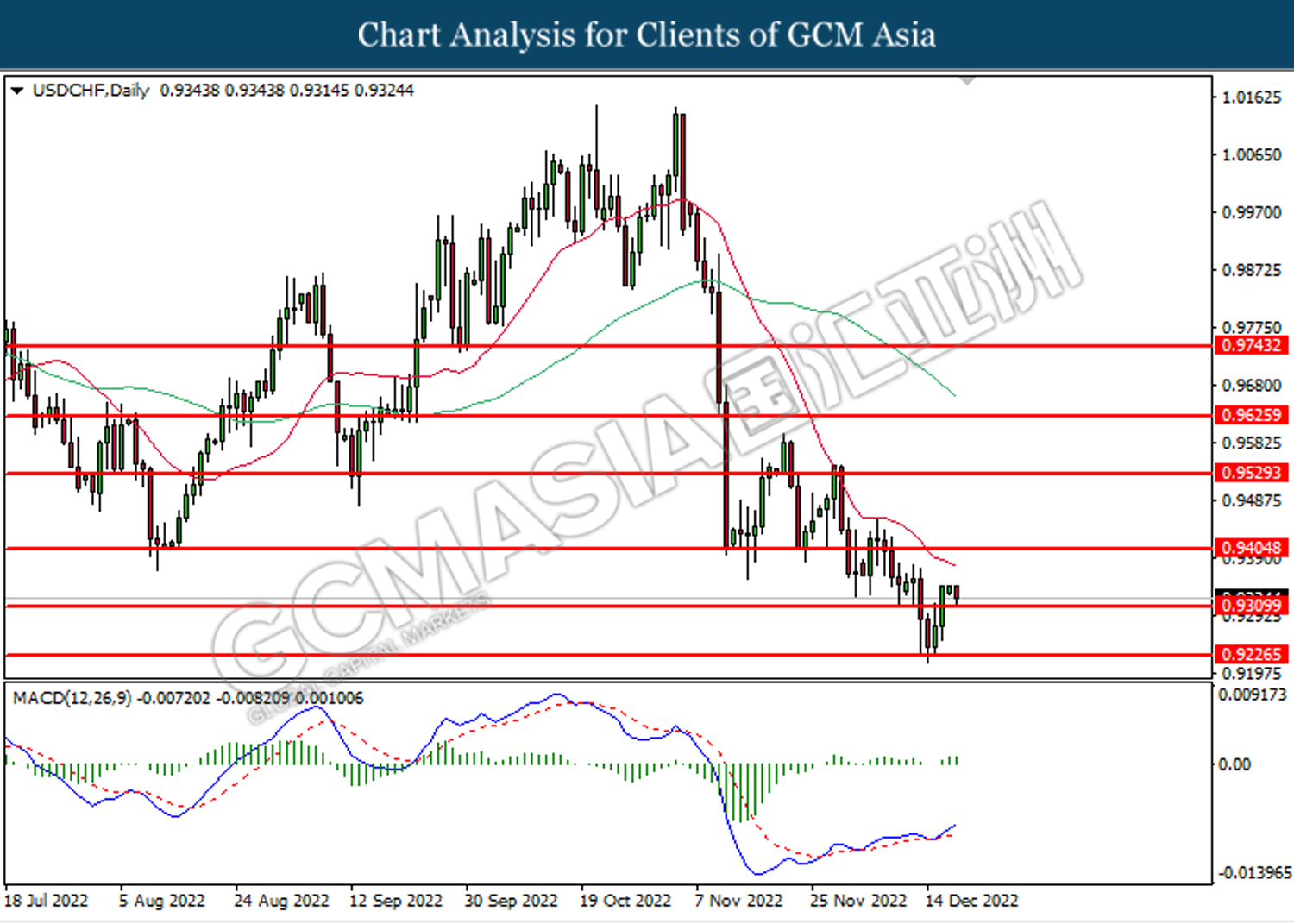

USDCHF, Daily: USDCHF was traded higher following prior rebound from the support level at 0.9310. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward resistance level at 0.9405.

Resistance level: 0.9405, 0.9530

Support level: 0.9310, 0.9225

CrudeOIL, Daily: Crude oil price was traded higher while currently testing the resistance level at 76.10. MACD which illustrated bullish bias momentum suggest the commodity to extend its gains after it successfully breakout above the resistance level.

Resistance level: 76.10, 80.60

Support level: 71.45, 69.05

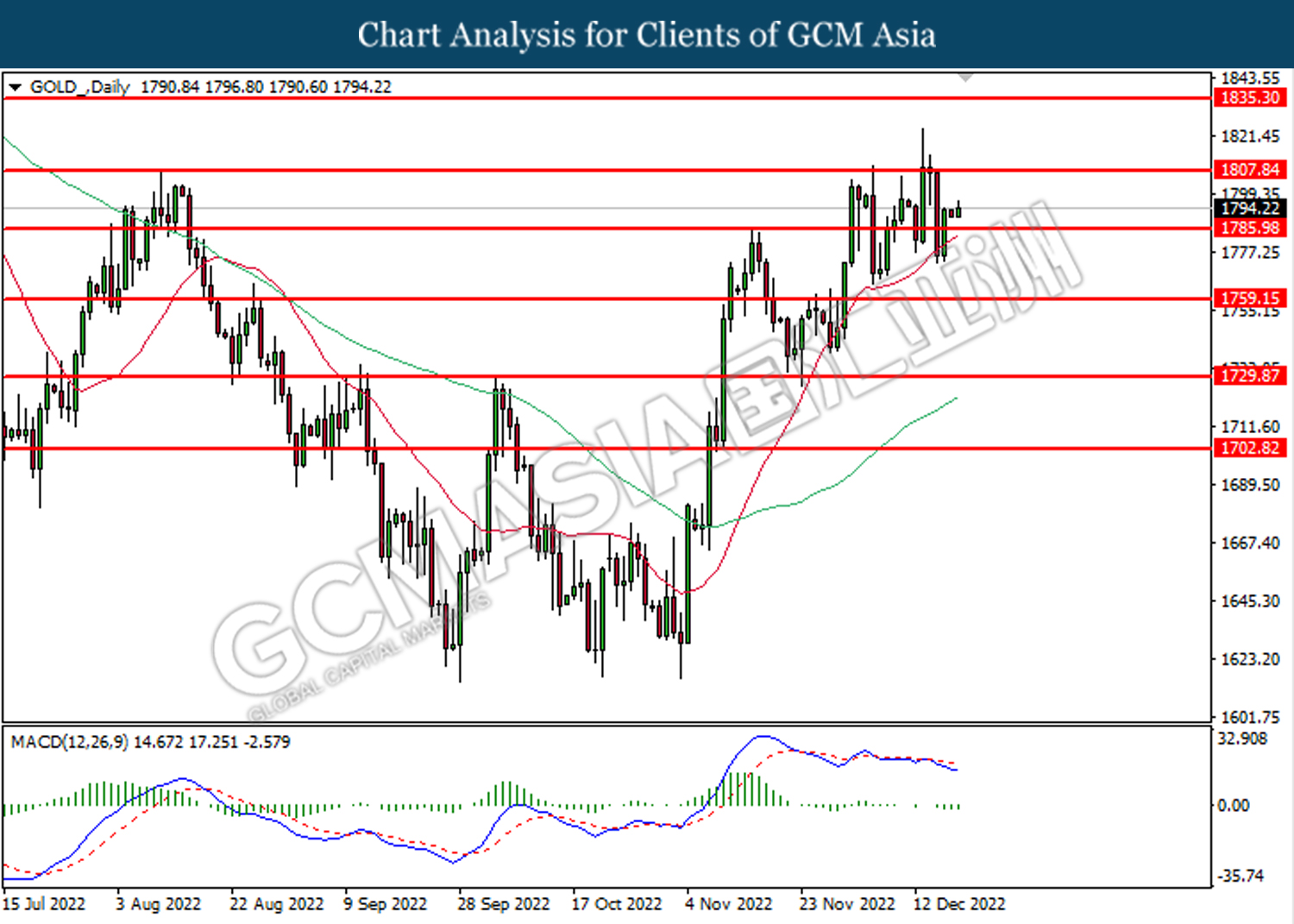

GOLD_, Daily: Gold price was traded higher following prior breakout above the previous resistance level at 1786.00. However, MACD which illustrated bearish bias momentum suggests the commodity to undergo technical correction in short term.

Resistance level: 1807.85, 1835.30

Support level: 1786.00, 1759.15